Active Vs Passive Investing

When we decide to invest our money, we have to make the decision of how to manage our portfolio.

Traditionally, there are two types of portfolio management – active and passive. These two types of management are very hotly debated in the investment community.

Personally, I employ both of these strategies. When making the decision of active vs passive investing, we must first define the management styles and get a deeper understanding of how these strategies work.

Index Etfs Vs Index Mutual Funds

You cannot invest directly in an index because it’s simply a measure of the performance of its constituent securities. What you can do is invest in an index through ETFs and index funds that try to replicate the performance of specific indexes.

ETFs focus on passive index replication, giving investors access to every security within a particular index. So an S& P 500 ETF exposes the investor to all of the stocks in that index. Index ETFs are generally low-cost and trade throughout the day just like stocks. Consequently, they are highly liquid and subject to intraday price fluctuations.

S& P 500 index funds tend to have slightly higher fees than ETFs because of higher operating expenses. Furthermore, because a mutual fund has a structure that differs slightly from that of an ETF, investors can only buy it at the days closing price, which is based on the fund’s net asset value .

The following are examples of index ETFs and mutual funds that are popular with investors:

- The largest S& P 500 ETF is State Street Global Advisors’ SPDR S& P 500 ETF , which has $346.6 billion in assets under management as of Oct. 4, 2022. SPY was launched in January 1993 and was the very first ETF listed in the U.S.

- Index investing pioneer Vanguard’s S& P 500 Index Fund was the first index mutual fund for individual investors. The Vanguard 500 Index Fund Admiral Shares is one of the largest index funds, with total assets of $754 billion as of Aug. 31, 2022.

Advantages Of Investing In An Index Fund

How to invest in index funds is easy enough to understand if you know about their advantages.

- The index funds promise good returns over a longer time horizon since the Nifty and the Sensex have performed very well over time. The Sensex had a base value of 100 in 1979 and over the last 39 years and it has given 35-fold returns. The Nifty had its base in 1995 and has given 11-fold returns over the last 23 years. What it means is that even if you had invested in an index fund, you would have still made good returns over the last many years. Index funds, it is important to note, have the ability to give you moderate to good returns over time as funds comprise stocks of leading companies. These are usually robust with a great financial history to back them.

- Index funds overcome the bias of human discretion. That is the big problem with most diversified equity funds. There is a very strong element of discretion that is given to the fund manager. Thus, the fund managers conditioning, biases and past experiences make a difference to the investment strategy of the fund. In an index fund, these are completely eliminated. The index fund, being a passive fund, overcomes the bias and just tries to track the index. You may think a fund manager is a benefit, but without any human error in the picture, you can make sure your investments are free from fault.

Recommended Reading: How Many Registered Investment Advisors Are There In The Us

What Is Considered A Good Expense Ratio

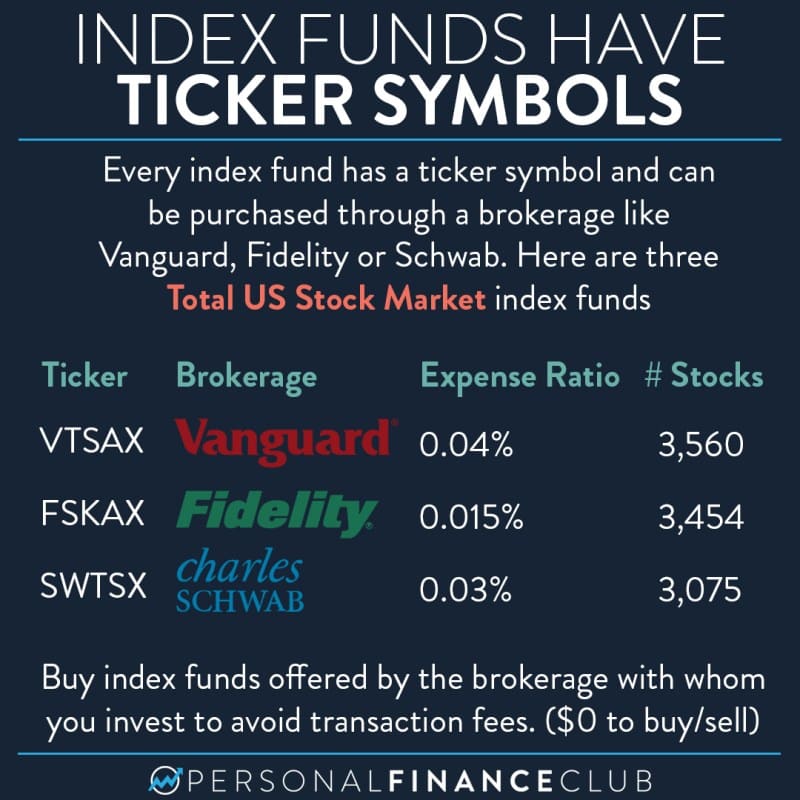

Mutual funds and ETFs have among the cheapest average expense ratios, and the figure also depends on whether theyre investing in bonds or stocks. In 2021, the average stock index mutual fund charged 0.06 percent , or $6 for every $10,000 invested. The average stock index ETF charged 0.16 percent , or $16 for every $10,000 invested.

Index funds tend to be much cheaper than average funds. Compare the numbers above with the average stock mutual fund , which charged 0.47 percent, or the average stock ETF, which charged 0.16 percent. While the ETF expense ratio is the same in each case, the cost for mutual funds generally is higher. Many mutual funds are not index funds, and they charge higher fees to pay the higher expenses of their investment management teams.

So anything below the average should be considered a good expense ratio. But its important to keep these costs in perspective and realize that the difference between an expense ratio of 0.10 percent and 0.05 percent is just $5 per year for every $10,000 invested. Still, theres no reason to pay more for an index fund tracking the same index.

How To Invest In Index Funds In The Uk

UK index funds are a popular way for beginners to invest in the stock market. Why? Because when you invest in an index fund, you get the opportunity to own a wide range of different companies at an extremely low cost.

The firm managing the index fund does all the hard work for you. Theyll work out how much to invest in each company, make any adjustments along the way as required, and collect all the dividends on your behalf.

In other words, it pretty much puts your investments on auto-pilot. And that allows you to sit back and hopefully just enjoy the long-term gains the stock market has historically delivered.

You May Like: Top Real Estate Investment Managers

Find Your S& P 500 Index Fund

Its actually easy to find an S& P 500 index fund, even if youre just starting to invest.

Part of the beauty of index funds is that an index fund will have exactly the same stocks and weightings as another fund based on the same index. In that sense, it would be like choosing among five McDonalds restaurants serving exactly the same food: which one would you go with? Youd probably select the restaurant with the lowest price, and its usually the same with index funds.

Here are two key criteria for selecting your fund:

- Expense ratio: To determine whether a fund is inexpensive, youll want to look at its expense ratio. Thats the cost that the fund manager will charge you over the course of the year to manage the fund.

- Sales load: If youre investing in mutual funds, youll also want to see if the fund manager charges you a sales load, which is a fancy name for a sales commission. Youll want to avoid this kind of expense entirely, particularly when buying an index fund. ETFs dont charge a sales load.

S& P 500 index funds have some of the lowest expense ratios on the market. Index investing is already less expensive than almost any other kind of investing, even if you dont select the cheapest fund. Many S& P 500 index funds charge less than 0.10 percent annually. In other words, at that rate youll pay only $10 annually for every $10,000 you have invested in the fund.

Select your fund and note its ticker symbol, an alphabetical code of three to five letters.

Other Considerations For Investing In The S& p 500

Dont get stuck on holding the S& P 500 as the majority of your portfolio. There are other areas of the market you need in order to build a diversified portfolio, such as small-caps, mid-caps and international stocks, says Favorito.

Building that diversified portfolio also means complementing an S& P 500 fund with bond holdings. Check out our listing of the best total market bond index funds to figure out how best to build your two- or three-fund portfolio.

Also Check: Why Are Investment Property Mortgage Rates Higher

Ask Us Your Questions

Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling Schwab at . Please read it carefully before investing.

Past performance does not guarantee future performance.

Indexes are unmanaged and you cannot invest in them directly.

Investment returns will fluctuate and are subject to market volatility, so that an investors shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or lower than the net asset value .

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

1. According to Morningstars Year End Active/Passive March 2021 Barometer, over the 10 year period ending December 2020 the average dollar invested in active funds underperformed the average dollar invested in similar index funds in the following Morningstar Categories: U.S. Large Blend, U.S. Large Value, U.S. Large Growth, U.S. Mid Blend, U.S. Mid Value, U.S. Mid Growth, U.S. Small Blend, U.S. Small Value, U.S. Small Growth, Foreign Small/Mid-blend, U.S. Real Estate.

2. Asset-weighted average expense ratio as of 4/30/2019 according to Morningstar data.

Buy Index Fund Shares

You can open a brokerage account that allows you to buy and sell shares of the index fund you’re interested in. Alternatively, you can typically open an account directly with the mutual fund company that offers the fund.

Again, in deciding which way is best for you to buy shares of your index fund, it pays to look at costs and features. Some brokers charge extra for their customers to buy index fund shares, making it cheaper to go directly through the index fund company to open a fund account. Yet many investors prefer to have all their investments held in a single brokerage account. If you anticipate investing in several different index funds offered by different fund managers, then the brokerage option can be your best way to combine all your investments under a single account.

Also Check: Hire Someone To Invest For You

Where To Buy Index Funds

Choosing a trustworthy broker with a large selection of commission-free ETFs is the first step before investing in index funds, as it will save you a lot of money. Many brokers offer free stock trades, but the selection of commission-free ETFs is important. Before choosing a broker, review their selection of ETFs and no-load mutual funds.

ETF Fund Fees: Firstrade vs. TDA vs. E-Trade

| Broker |

| $500 |

Table 2: Firstrade Commissions vs. Competitors

You can see that Firstrade has a substantial focus on having the best commissions in the industry. Even though T.D. Ameritrade, E-Trade & Schwab have now been forced to join the $0 Zero commissions bandwagon Firstrade still offers the best value across stocks, options, and mutual funds.

How To Invest In An Index Fund

You can make investments in mutual funds either through a direct plan or a regular plan. Lets first understand the difference between direct and regular plans.

Direct plans do not charge commission or distribution expenses therefore, they have a lower expense ratio. However, as you buy a regular plan through an intermediary such as a distributor, the mutual fund company pays a commission. Therefore, regular plans charge a higher expense ratio than direct plans.

Depending on which plan you choose, you can look to buy index funds both online or offline mode.

Following are some of your options.

Also Check: You Invested 2300 In A Stock

Buy Shares Of An Index Fund

Once you have picked your broker and chosen your fund, the hard work is done: all you have left to do is buy your shares. However, if you decide to invest in multiple funds, you still have to decide how much to invest in each fund type.

In general, younger investors planning for retirement should consider putting a larger allocation of their portfolio in higher-risk investments, such as stocks, since they have more time on their side before needing the money. The closer someone is to retirement, though, the more they may want to consider shifting a larger chunk of their holdings into bonds or other lower-risk assets since they are less likely to lose value in the short term.

Investing In Index Funds Taxes

How the government taxes a fund can determine how much money you can make. Choosing the wrong taxation method can lead to a high tax bill and conflicts with the IRS. Current tax law gives you three options for index fund investing, Traditional IRAs, Roth IRAs, and taxed investments.

Traditional IRAs

A traditional individual retirement account is tax-deferred. You do not pay taxes until you take money out of the account. The advantage of a traditional IRA is that the IRS will not tax funds in it, thus reducing your taxable income.

The disadvantage of a traditional IRA is that money is taxable when you withdraw it. Traditional IRAs can be a poor deal for younger and lower-income persons because early withdrawals could increase your income tax bill.

Traditional IRAs can also have tax implications for retirees. The Internal Revenue Service taxes traditional IRA withdrawals at the owners current tax rate after retirement. Drawbacks to traditional IRAs include strict contribution limits . The IRA contribution limit can change, so you must check it. The IRS can penalize you for contributing too much money to an IRA.

Current law requires minimum distributions from traditional IRAs after age 72. An IRA could increase a persons taxable income by making payments they do not need. Traditional IRAs are popular because they are easy to set up. Many people get traditional IRAs through their employers.

Roth IRAs

Taxable Index Fund Accounts

Recommended Reading: How To Invest In Gold Bullion

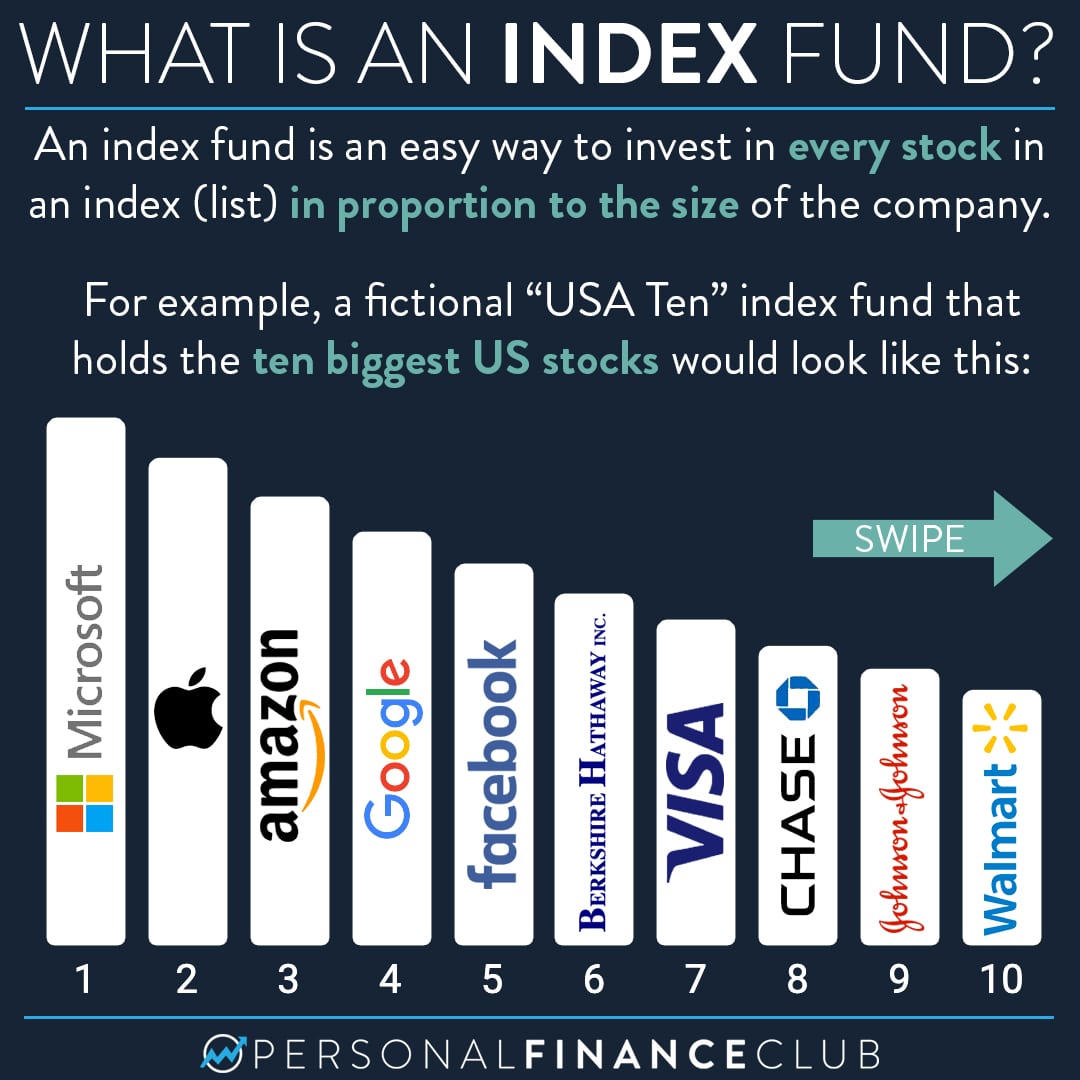

What Is An Index Fund

An index fund is a type of mutual fund or exchange-traded fund that holds all of the securities in a specific index, with the goal of matching the performance of that benchmark as closely as possible. The S& P 500 is perhaps the most well-known index, but there are indexesand index fundsfor nearly every market and investment strategy you can think of. You can buy index funds through your brokerage account or directly from an index-fund provider, such as Fidelity.

When you buy an index fund, you get a diversified selection of securities in one easy, low-cost investment. Some index funds provide exposure to thousands of securities in a single fund, which helps lower your overall risk through broad diversification. By investing in several index funds tracking different indexes you can built a portfolio that matches your desired asset allocation. For example, you might put 60% of your money in stock index funds and 40% in bond index funds.

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

| Compare the Best Online Brokers |

|---|

| Company |

| $0 for IBKR Lite, Maximum $0.005 per share for Pro platform or 1% of trade value |

How To Invest In Index Funds

An index fund is an investment that tracks a market index, typically made up of stocks or bonds. Index funds typically invest in all the components that are included in the index they track, and they have fund managers whose job it is to make sure that the index fund performs the same as the index does.

You May Like: Does Vanguard Offer Robo Investing

What Are The Risks Of Index Funds

Keep the following risks in mind when investing in index funds in Canada.

- Potential to lose money. You risk losing money if the investments across your index fund dont perform well simultaneously.

- Long-term strategy. Investing in index funds in Canada can take time to generate a profit, so you shouldnt expect to make a large return quickly.

- Not all assets are safe. Some index funds track volatile global markets such as the oil sector, so you could lose money even with a diversified portfolio.

Decide On Your Index Fund Investment Strategy

Your index fund investment strategy takes into account your overall financial goals, risk tolerance and timeline.

If youre working with a financial advisor, theyll help you determine the best mix of funds for your situation. If you open an account with a robo-advisor, the algorithm will suggest a strategy based on your answers to questions when you open the account.

If youre choosing an index fund allocation on your own, it may help to use an online tool to steer you in the right direction. Vanguard, for instance, offers an online questionnaire on your timeline, risk tolerance and investing preference to recommend an index fund asset mix for you. Fidelity offers investment tools you can use without creating an account, such as the ability to create an investment strategy.

In general, advisors recommend keeping more of your portfolio in stocks and less in fixed-income products like bonds when youre further from a goal. As you get closer to the goal, gradually adjust the mix away from stock and into bonds.

How aggressive you arereflected in the ratio of stock index funds to bond index fundsdepends on how much risk youre willing to take on. For shorter term goals less than three years away, you may be better off with high-yield savings accounts or certificates of deposit . For longer-term goals that are more than three to five years out, consider taking on more risk by investing in stock index funds.

You May Like: Llc Investing In Another Llc

Are Indexes Safe Investments

Investing in the capital markets always entails a degree of risk there are no guarantees, and no investment is 100% safe. That said, investing in an index fund can entail less risk than owning a handful of individual company stocks because index funds are diversified. That doesnt mean you cant lose money, but an index generally fluctuates a lot less than an individual stock. Index funds are only as stable as their underlying index.