A Quality Equity Decision

We believe the onshore Chinese equity market is becoming increasingly hard to ignore for investors. With more than 3,500 listed companies,3 A-shares, which are listed in Shanghai and Shenzhen, give investors access to what has been relatively isolated market, historically. Eased restrictions and continuing market liberalisation now mean international investors can trade A-shares and manage liquidity through the Stock Connect program, launched by the Hong Kong, Shanghai and Shenzhen exchanges to facilitate more streamlined trading of their listed securities.

Supporting the transition of China A-shares to a more international asset class is their inclusion in major indices by key global providers. In 2018, MSCI started including A-shares in their indices. FTSE is set to follow suit and MSCI has announced a significant increase in their indices exposure to weights of A-shares for later this year. In many cases, A-shares are the only option for investors to gain exposure to quality Chinese companies with a durable business model, low sensitivity to policy cycle, and high growth potential from the upgrade to China’s consumption market and technology advancement.

1 Wind, March 20202 Bloomberg Barclays, June 20203 Wind, June 2020

How Can I Invest In Asia But Avoid China

I have long held the view that investing in emerging markets and in particular Asia will pay off over the long term and hold some funds and trusts that have so far delivered good performance.

I am becoming increasingly concerned about investing in China though, both from a risk perspective due to the increased interference with private enterprise and also for ethical considerations, as I feel China is becoming increasingly authoritarian and I am worried about human rights.

I would like to continue investing in Asian markets through active funds and investment trusts but would like to find some that have lesser or minimal exposure to China. Are there any that do this?

Alleged human rights abuses and increased regulation in China have pushed some investors to limit their exposure to Chinese companies

Angharad Carrick, of This Is Money, says: More investors may be contemplating reducing their exposure to China, whether it be because of regulation, geopolitics or human rights abuses like you mention.

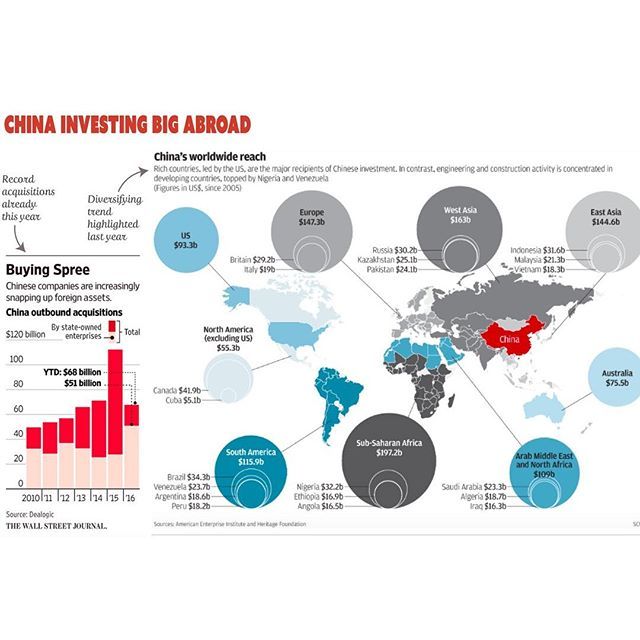

China has the lions share of the emerging market index currently. It has doubled its share of the MSCI emerging market index over the past five years.

This index captures large and mid cap representation across 25 emerging countries.

Goldman Sachs predicts it could rise further to well above 40 per cent over the next five years.

Our experts look at some of the active funds and trusts with little to no exposure to China.

Opic And Other Investment Insurance Programs

In the aftermath of the Chinese crackdown on Tiananmen Square demonstrations in June 1989, the United States suspended Overseas Private Investment Corporation programs in China. OPIC honors outstanding political risk insurance contracts. The Multilateral Investment Guarantee Agency, an organization affiliated with the World Bank, provides political risk insurance for investors in China. Some foreign commercial insurance companies also offer political risk insurance, as does the Peoples Insurance Company of China.

You May Like: How To Invest In The Stock Market Under 18

Decide What Type Of Security You Want To Purchase

Once your account is open, think about what type of security you want to purchase: stocks, mutual funds, or exchange-traded funds.

If you want to buy shares of individual companies, you want to purchase stocks.

If you want diversification and to be more passive, you want to purchase either mutual funds or ETFs that track an index.

Mutual funds can only be traded once per day after the market closes, while ETFs can be traded throughout the day.

Can You Invest In Chinese Stocks

Invest in Chinese stocks through a broker that provides access to Hong Kong-listed and mainland Chinese-listed stocks. To access the myriad of Chinese companies that do not have ADRs, sign up for a broker that provides access to shares listed on stock exchanges in Hong Kong or mainland China .

Is it illegal to invest in Chinese companies?

The reason is that under Chinese law, foreign ownership in certain Chinese industries is prohibited. As a result, it is illegal for Chinese companies like JD.com and Alibaba to have non-Chinese shareholders. But Chinese law prevented them both from doing so.

Can I buy stocks from China?

You can also buy A shares, meaning shares from mainland Chinese companies listed on the Shanghai and Shenzhen stock exchanges. To invest in these companies, you can buy shares in ADRs through a US broker.

Recommended Reading: How Soon Can You Refinance An Investment Property

How To Invest In Chinese Stocks: 5 Ways To Begin In 2022

Henry ChiaMay 11, 2022

Do you see potential in a Chinese company, but dont know how to invest? At first, investing in Chinese stocks might seem confusing, but it doesnt have to be.

This guide breaks down the five easiest ways for anyone wanting to invest in Chinese stocks from the U.S, or other parts of the world.

Youll be able to gain exposure to the fastest growing region on the planet, very quickly .

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Can You Invest In Individual Stocks In A 401k

How To Invest In Chinese Stocks

1) Invest in Chinese stocks via listed American Depository Receipts 2) Use a broker that offers access to Hong Kong-listed and Chinese mainland-listed stocks3) Invest in a U.S.-listed China Exchange Traded Fund 4) Invest in an unlisted China Mutual Fund5) Invest in Chinese stock CFDs

Here, we examine each of these five options in detail.

# 4 Investing In Companies That Have Significant China Exposure

Finally, one other method we can use to gain China exposure is to invest in companies that may not be based in China, but have significant business exposure in China. This means that when China grows, these companies also grow. At the same time, they are also regulated in a country that we are familiar with such as in the U.S. or even Singapore.

This is different from investing in a Chinese company that is listed in an overseas exchange.

Some examples of companies in Singapore with significant China exposure would include CapitaLand Limited, which derived 41.4% of its revenue from China and Wilmar International, which derived 56.2% of its revenue from China.

Our options are not limited to just Singapore stocks either. In the US, companies such as Apple and Starbucks, to name a few, derived 16.8% and close to 26.8% of their revenue from China and China / Asia Pacific respectively. So if we want to invest in China through a non-China based company, we can choose to invest in the stocks of some of these companies.

Read Also: How Can I Invest 2000

Bnp Paribas For Your China Investments

- Comprehensive China access solutions:

- QFI, Bond Connect, CIBM Direct, Shanghai and Shenzhen-Hong Kong Stock Connect and Shanghai-London Stock Connect

- Clients benefit from a streamlined process

Protection Of Foreign Investment

- Bilateral Investment Conventions Signed By China

- China has signed bilateral agreements for investments with several countries. To see the list of the countries, consult UNCTAD website.

- International Controversies Registered By UNCTAD

- The ISDS Navigator contains information about known international arbitration cases initiated by investors against States pursuant to international investment agreements. China is involved in 6 cases as Home State of claimant and in 3 cases as Respondent State.

- Organizations Offering Their Assistance in Case of Disagreement

- ICSID, International Center for settlement of Investment Disputes

- Member of the Multilateral Investment Guarantee Agency

- China is a signatory of the Convention of MIGA.

| 5.0 |

Note: *The Greater the Index, the More Transparent the Conditions of Transactions. **The Greater the Index, the More the Manager is Personally Responsible. *** The Greater the Index, the Easier it Will Be For Shareholders to Take Legal Action.

Recommended Reading: 20 Percent Down Investment Property

Invest In An Unlisted China

The fourth option for anyone asking how to invest in Chinese stocks, is Mutual Funds.

Mutual Funds are unlisted investment products, which you can purchase units in via some online investment platforms, your financial adviser, or directly via an application with the fund manager.

Like ETFs, Mutual Funds offer investors exposure to an underlying professionally managed portfolio of stocks. Some also use derivatives to take short positions. Most are designed to meet the specific needs or objectives of certain investors and aim to outperform an index or benchmark.

There are a number of Mutual Fund in the U.S. which specialise in Chinese stocks. Matthews Asia is one established China-focussed investment manager which offers a range of Mutual Funds composed of H-Shares and A-Shares.

Many large global asset managers also offer China-focussed U.S. Mutual Funds such as Aberdeen Asset Management, Fidelity and Goldman Sachs.

What are the pros and cons of investing in a China-focussed Mutual Fund

Because Mutual Funds are usually managed by highly experienced specialist investors, they can provide a safer option as opposed to direct investing, especially for individual investors who arent experienced in investing in a region such as China. Mutual Funds are also highly regulated, meaning investor funds have a high level of protection and many fund managers have stringent risk management and stock selection processes.

The Shenzhen Stock Exchange

The Shenzhen Stock Exchange was established on December 1, 1990, and it is located in Shenzhen, a city in southeastern China. Although it is only about 30 years old, the SZSE is the worlds eighth-largest stock exchange by market capitalization. The products trading on the SZSE include the A-shares, B-shares, indices, mutual funds, fixed income products, and diversified derivative financial products. As on the SSE, foreigners can trade the B-shares, but can only trade the A-shares via the QFII program.

The QFII, acronym for the Qualified Foreign Institutional Investor, is a program that allows specified licensed international investors to invest in stocks listed on the stock exchanges on mainland China. The program was introduced by the Peoples Republic of China in 2002 to provide foreign institutional investors with the right to trade on stock exchanges in Shanghai and Shenzhen. Prior to the establishment of the QFII program, investors from other nations were not allowed to buy or sell stocks on Chinese exchanges because of the way the country tightly controls capital flows.

Read Also: How To Get A Loan To Buy Investment Property

Political And Security Environment

The risk of political violence directed at foreign companies operating in China remains low. Each year, government watchdog organizations report tens of thousands of protests throughout China. The government is adept at handling protests without violence, but given the volume of protests annually, the potential for violent flare-ups is real. Violent protests, while rare, have generally involved ethnic tensions, local residents protesting corrupt officials, environmental and food safety concerns, confiscated property, and disputes over unpaid wages.

There have also been some cases of foreign businesspeople that were refused permission to leave China over pending commercial contract disputes. Chinese authorities have broad authority to prohibit travelers from leaving China and have imposed exit bans to compel U.S. citizens to resolve business disputes, force settlement of court orders, or facilitate government investigations. Individuals not directly involved in legal proceedings or suspected of wrongdoing have also been subject to lengthy exit bans in order to compel family members or colleagues to cooperate with Chinese courts or investigations. Exit bans are often issued without notification to the foreign citizen or without a clear legal recourse to appeal the exit ban decision.

Leadership Reshuffle And Xi Jinpings Reelection

The political regime in China may prove a threat to the stability and growth of its domestic equity market as Xi Jinping who has been reelected as president for a third term in late October continues to grab more political power.

According to Lilian Co, portfolio manager of the Strategic China Panda Fund at Eric Sturdza Investments:

You May Like: Can Indians Invest In Us Stock Market

Office Real Estate And Land Ownership

- Possible Temporary Solutions

- Rental and Business center.

- The Possibility of Buying Land and Industrial and Commercial Buildings

- Foreigners are allowed to buy their property only after having worked or studied in China for at least one year. They are only entitled to own one property in China and it must only be used for residential purposes. Commercial or industrial property can only be purchased after a company has been incorporated in China.

- Risk of Expropriation

- The risk of expropriation is high. Article 20 of the Foreign Investment Law of the People’s Republic of China stipulates that the government shall not expropriate investments made by foreign investors. Only in special circumstances , the State may expropriate or requisition an investment made by foreign investors for public interest in accordance with the law. Such expropriation or requisition shall be carried out in accordance with the procedures of law and fair and reasonable compensation shall be given in a timely manner.

China Companies Are Everywhere

If you’re living in Singapore, realize that Chinese companies are EVERYWHERE. You just got to look closely!

For instance, I noticed my new flat was built by China Construction .

You would also see many tunnelling and MRT projects have more Chinese companies involved, vying for market share from Singapore, Korean and Japanese companies.

You have companies like Shanghai Tunnel Engineering

Even Jewel and Terminal 1 uses air conditioning from Chinese home appliance company, Midea!

There is little excuse not invest because we are unfamiliar with Chinese companies. It just takes a little more observation and reading to get comfortable with them!

Recommended Reading: Best Bank For Investment Mortgage

A Portfolio In 2021 Isnt Global Without China

The teachings of finance since at least the middle of the 20th century have recommended that investors hold thoroughly diversified portfolios of stocks and bonds, reflecting the entire financial universe, in an appropriate asset allocation. And in the 21st century, China is a vital part of global financial markets.

To exclude Chinese securities from global portfolios at this stage strikes me as roughly equivalent to insisting that the earth is flat.

That said, Chinese markets and companies are much more opaque and subject to political control than those in places like Europe, Japan and the United States. China is still a developing country an unusual one, in financial terms. While capitalism flourishes, the Communist Party rules.

As Jason Hsu, founder of Rayliant Global Advisors in China and an adjunct professor of finance at the University of California, Los Angeles, told me on video chat from Shanghai: In China, the invisible hand of capitalism wears a red glove, and regulations can be very heavy-handed. Yet its still an important place to invest.

The Hong Kong Stock Exchange

The Hong Kong Stock Exchange was founded in 1891, but it first started listing the largest Chinese state-owned enterprises in the mid-1990s as Hong Kong operates as a politically autonomous region from mainland China. The mainland Chinese companies are listed as H-shares and can be traded by foreign investors. All shares trading on the Hong Kong Stock Exchange are denominated in Hong Kong dollars .

Recommended Reading: How Do I Invest In An Ira

# 1 Investing Directly In Chinese Companies Through Offshore Exchanges

The simplest way we can increase our exposure to China is by investing in Chinese companies. While foreigners can invest directly in China-listed shares , there may be some limitations such as having to do so through a broker offering access to the Hong Kong Exchange Stock Connect, and even then, there may be a limited number of securities we trade as well as a daily trading volume quota in the system.

Nevertheless, we can still gain exposure to some of the largest and most well-known Chinese companies are listed in the U.S and other offshore exchanges.

On the New York Stock Exchange , we can invest in Alibaba Group, an e-commerce behemoth, which also owns complementary businesses in cloud computing and logistics, and China Mobile, one of the largest telecom companies in the world. On NASDAQ, we can invest in Baidu, Chinas largest search engine, JD.com, the biggest online retailer in China, and Pinduoduo, a fast-growing social commerce platform.

We can also invest in bluechip Chinese companies listed in Hong Kong, including Tencent, a social media and online gaming giant, and phonemaker, Xiaomi. The Hong Kong Exchange is also home to many other traditional Chinese companies in the property and financial sector. Some household names include, Country Garden and China Evergrande, as well as Bank of China, China Construction Bank and Ping An Insurance.