Mortgage Interest Rates & Covid

The economic fallout from COVID-19 has impacted the mortgage market in the form of stricter requirements from many lenders. Perhaps having learned from the financial crisis of 2008, many lenders have tightened their lending standards.

These more stringent requirements vary by lender, but some examples are:

- Some lenders have raised their minimum credit scores in general, or at least require to qualify for more preferential interest rates and mortgage terms.

- Some lenders have increased the down payment amount required to qualify for a loan.

- In some cases, mortgages that had previously been pre-approved are subject to a re-verification process prior to the finalization of the loan.

- Even government-backed loans through the FHA and VA have been impacted by some lenders stricter minimum requirements to obtain these loans.

The bottom line for home buyers is that these tougher requirements may require more shopping to obtain an affordable mortgage.

Dos And Donts When Borrowing To Buy Stocks

There are countless ways to invest borrowed money: in business ventures, purchasing income properties, home improvements that build future equity and private lending, to name a few. But given that most global stock indexes are now in correction mode, many are borrowing to buy equities.

History has shown time and again that the best time to buy stocks on leverage is when the market is down substantially. When good companies lose one-third to one-half of their value, if they were good companies before, theyre probably still good companies, Mr. Robinson says.

But before securing debt to your home to invest in stocks, know that there are rules you should not break. Never borrow to invest:

Read Also: Buy A Home Or Invest In Stock Market

Compare Our Top Lenders

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

You May Like: Invest Money Online And Earn Daily

If You Have A Home And A Mortgage And Invest You Are Already Borrowing Against It To Invest

Homeowners with a mortgage are already borrowing against their homes to invest.

Hows that, you say? Well, youre already using leverage to free up cash to do other things.

A mortgage allows a homeowner to make a big purchase and spread out the payments over time. The price to do this is the interest you pay.

If you borrowed more against your home in addition to the mortgage, its the same thing. The only difference is the bank obligation would increase.

Put another way, lets say someone owns a home with 30% of the homes value in equity, and 70% of value in a mortgage. They bought the home with a 20% down payment, and over time the equity increased through appreciation and principal payments.

If they were to borrow 10% against the present value of the home, the equity would go back to 20%, the same as when they bought the house. At todays rates, it may be possible to get a lower rate than the original mortgage.

A second payment increases overall risk, but not substantially so. The homeowner now has more money for profitable investments.

Next, Ill put on my conservative financial pundit hat

Is Using A Heloc A Good Idea

Short answer: It depends on what you are planning to use your loan for.

The cost of living is on the rise, with inflation hitting 7.7% in May. Even if you have a stable income, some expenses might be taking a toll on your savings or worsening your debt.

While you may be tempted to lean on credit cards or other expensive loans, homeowners also have access to a cheaper option: a home equity line of credit, or HELOC.

Using your home equity line of credit can help you take care of urgent expenses around the house or consolidate your other debts. But whatever youre using your HELOC for, there are some important factors to consider.

You May Like: How Much Money To Invest In Cryptocurrency

Heloc Vs Credit Cards

HELOC and credit cards are similar because theyre both revolving types of credit, but they have different structures.

While HELOC is a secured loan, a credit card isnt, which translates to higher interest rates. A HELOC comes with closing costs, while a credit card comes with abuse fees though not all of them.

The high interest rate attached to using credit cards makes it less ideal for real estate investment. Since its not tax beneficial like a HELOC, it might end up complicating your transaction in the future.

Its more advisable to use credit cards for personal purchases and expenses. Though conversely, you can use your credit card to pay off HELOC debt or use your HELOC to pay off credit card debt, it should be as a last resort.

Top 5 Benefits Of Using A Heloc For Investment Property

When it comes to financial stability, both homeowners and investors should be prepared with a plan. Using the equity in a home or investment property to pay for home upgrades or to cover unexpected expenses can be a great option for those who are financially healthy. Keep reading to discover more ways to use your home as a valuable tool.

You May Like: Real Estate Investing In Denver Co

Using A Heloc To Consolidate Debt

If you have multiple debts that youre paying off, consolidating them can simplify the process. Having one loan instead of multiple ensures your payments are going to the right lender at the right time.

And because a HELOC is secured by your mortgage, its interest rate is generally significantly lower than the rate on unsecured loans, like most credit cards.

For instance, even a low-interest might have an interest rate of 12.99%. Meanwhile, you might find a lender offering a HELOC for prime plus one that is, one percentage point more than the prime rate, which currently stands at 3.7%.

Before you take this step, remember that consolidating your debt this way would tie it to your home. If you fall behind in your payments, you could end up losing possession of your home, creating a worse situation than you had to begin with.

And while banks typically perform a stress test to ensure youre in a financial position to handle more debt, they will often grant you more than you might require. If youre already weighed down by debt, only borrow as much as you need to pay off your old balances.

Using A Heloc For Your Down Payment Can Be A Great Idea

Finding the funds to finance new real estate deals can be difficult. Outside-the-box options HELOCs can help you seize upon opportunities that were previously of of reach. Heres how they work.

Are you an investor or someone thatâs simply looking to move but havenât sold your home yet? Thatâs where using a HELOC for a down payment might be just what you ought to consider!

In a competitive real estate market, sellers arenât willing to wait around to see if buyers can obtain financing. There is simply too much risk for a buyer to do that unless they have to. Buyers want clean, low-risk transactions if thereâs a competitive bidding situation or multiple interested parties.

Don’t Miss: Stock Market Investing Jason Kelly

What Are The Requirements To Get A Heloc For An Investment Property

Unlike traditional mortgages, HELOCs are not as heavily regulated, so banks have some liberty when it comes to setting interest rates and terms.

Nonetheless, to be eligible for a HELOC, you still need to meet a number of criteria. Individual banks will have varying guidelines that determine how much they can lend you, based on the property value and your credit. It pays to shop around for your HELOC, to see what kind of deal you can get.

Some of the key considerations that banks look at when issuing HELOCs for investment properties are as follows:

- A maximum combined loan-to-value ratio of 80%

- At least 15% equity in the property

- A credit score of 620 or higher

- Ability to pay the loan back

- Healthy cash reserves

What Return Would I Need To Justify Investing My Home Equity In The Stock Market

Theoretically, investing in stocks with your home equity loan could be worth it if your returns exceed the interest rate on your loan. Interest rates on home equity loans average about 4% to 5%, and vary depending on your and other factors. There is no guarantee with how the stock market will perform, but historically has returned an average of 10% per year.

Recommended Reading: Invest In Ripple Company Stock

Using Heloc To Purchase First Investment Property

Hi everyone!

Im new to real estate investing and just wanted to get some advice, input, and constructive criticism on using aHELOC as a down payment to purchase my first investment property. Im currently in the process of getting approved for a $160,000 HELOC on my primary home. I plan to use this line of credit to put down 20% on a property for a DSCR loan , and I do have about $20,000 of reserves saved up. I plan to use this investment property as a self-managed short term rental to generate cash flow. As I am just starting up on real estate investing cash flow is my biggest focus at the time and will plan to diversify my portfolio in the future. Im curious on how I should be using the monthly cash on cash returns. I was originally planning to put all my monthly returns to pay down the HELOC as quickly as possible so that I can get into the next property but am worried about how to deal with paying the taxes if I dont allocate any of the returns to the side. Wanting to scale quickly Ive thought about doing a cash out refinance on the investment property after about a year and using that cash to pay off the HELOC then using the HELOC once again to get in the next property . However, there might be prepayment penalties when using a DSCR loan making a cash out refi not an option.

Today’s Current Mortgage Interest Rates

While mortgage lenders requirements have grown significantly stricter in recent years, the COVID-19 pandemic has led to extremely low-interest rates on mortgages. Even a fraction of a percentage point can lead to thousands or tens of thousands of dollars in savings over the term of a mortgage.

Mortgage rates can vary widely depending on various criteria, such as your credit history and the value of your new home, along with market conditions.

Also Check: How Do You Make Money Investing In Cryptocurrency

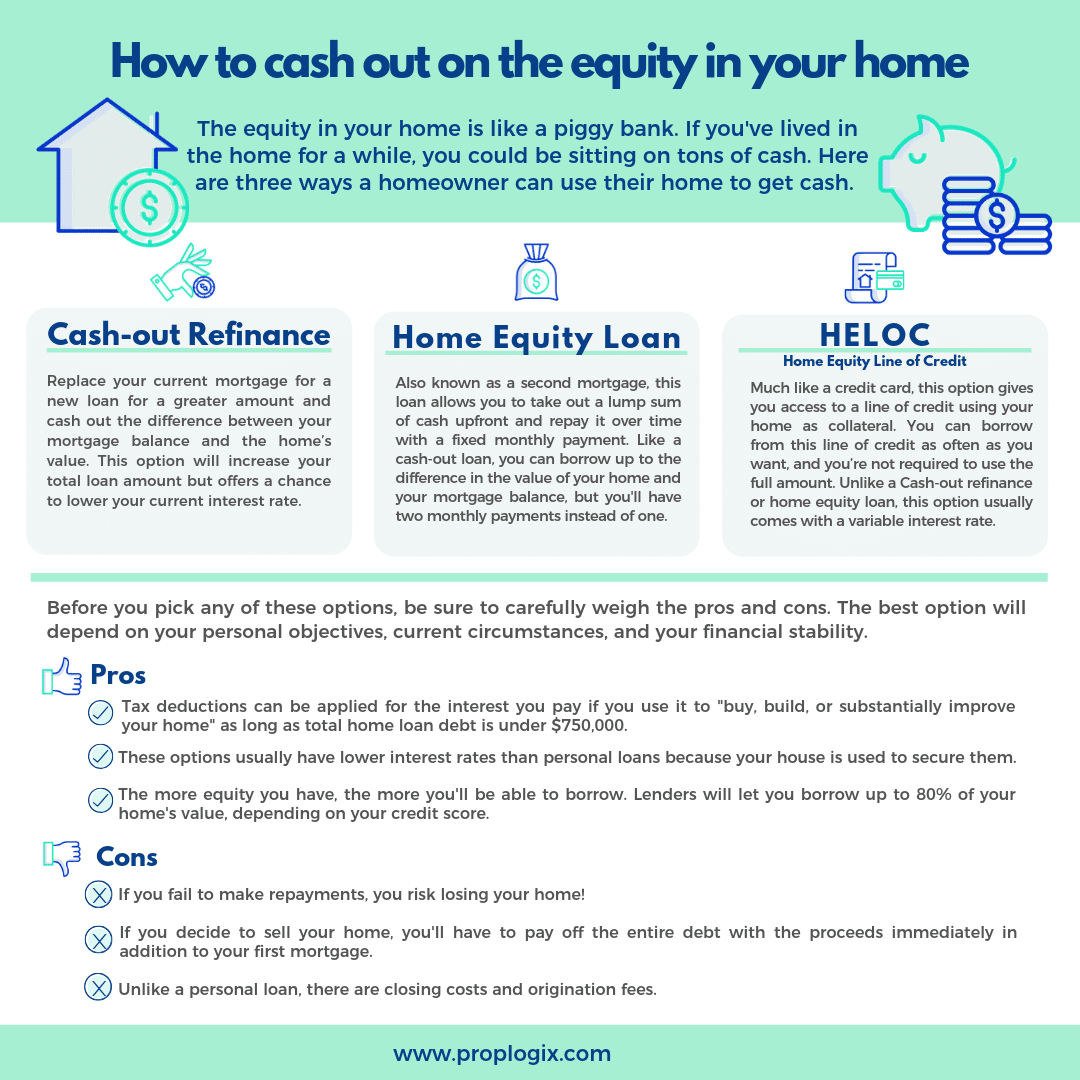

Best Uses Of Home Equity

If youve built up equity in your home over the years and are looking for a smart way to leverage it, there are a few ways to do it.

1. High-Value Home Improvements

One of the most common uses of home equity is to invest in home renovations and upgrades. The improvements that you make on the home will increase the value of your home and build more equity as a result, said Jared Weitz, founder and CEO of United Capital Source in Great Neck, New York. In some instances, home improvement projects such as adding insulation to your attic or installing solar panels can, over time, generate more value than the cost to complete.

Thats not always the case, however. Some home renovations actually contribute to a lower home value. So before you borrow against your equity for a fancy kitchen upgrade or new pool, be sure its going to help, not harm, the resale value.

2. High-Interest Debt Consolidation

If you have other types of debt that are accumulating interest at a much higher rate, using your home equity to consolidate it could be a smart move, according to Tony Matheson, a certified financial planner and founder of Matheson Financial Partners in Walnut Creek, California.

3. Emergency Fund

Ideally, you have about six months worth of expenses tucked away in an emergency fund with your bank or credit union. But, as we all know, things dont always work out ideally.

4. Real Estate Investing

Renting Out A Part Of Your House

If you have a spare bedroom or finished basement, you may be able to make some extra money by renting it out. You can use sites like Airbnb to list your space and set your own prices. Just be sure to check with your local laws first to make sure that this is allowed in the area.

Before you can rent out your house, you might need to renovate it and make it liveable. And if you have home equity, you may be able to use it to finance a home improvement project. This can also be a great way to add value to your home and make it more comfortable to live in. Plus, if you eventually sell your home, you may be able to recoup the cost of the improvements.

Read Also: Are Annuities A Good Investment For Seniors

Whats The Catch With A Heloc

There isnt one! If you ask me I think everyone should have a HELOC on their property if they are able to. You never have to use it and it doesnt count against you for having it. This is a great way to build out loan strategies for yourself and your investments.

All in all, I highly recommend you chat with a bank and look into securing a HELOC. Andif you need to buy a home first, before being able to secure a HELOC, you know where to find me!

Cheers!

Should You Invest In Stocks With A Home Equity Loan

One of the main benefits of home equity loans is that you can use the money for any purpose, including investing in stocks. However, just because you can use your home equity loan to buy stocks doesnt necessarily mean you should.

You may be tempted to use a home equity loan to buy stocks when theres a bull market and you believe youll make money quickly. But the stock market is unpredictable. During a bull market, stocks could correct, and you could lose some of your loan proceeds. If youre relying on the stock investments to repay your loan, you could be forced to sell at a loss.

One of the greatest risks of using a home equity loan to buy stocks is the potential of losing your home. A home equity loan, just like a mortgage, is secured by your home. As a result, if you fail to make your loan payments, the lender could foreclose on your home.

You May Like: Investments That Provide Monthly Income

Investing In The Stock Market

Investing in the stock market comes with no guarantees. However, watching the growth of the S& P 500 over the past 10 years may encourage some homeowners to use their home equity loan proceeds to invest in the markets, in hopes that theyll get a return larger than what theyll pay in interest.

Taking a loan out against a property to try to capture the next unicorn is incredibly risky, says John Mazza, president and CEO of Summerfield Wealth Advisors and former financial adviser with Southeast Financial Services in Greensboro, N.C. Everybody wants the unicorn, but slow and steady wins the race with the markets.

Pros And Cons Of Using Equity To Buy Another Home

Before you use a home equity loan for a second home, consider the pros and cons of taking equity out of your home to buy another house.

Pros

- Youll reserve your cash flow. Using home equity to buy a second home keeps cash in your pocket that you would otherwise use for the home purchase. This increased cash flow can result in a healthier emergency fund or go towards other investments.

- Youll increase your borrowing power. Buying a house with equity will allow you to make a larger down payment or even cover the entire cost making you the equivalent of a cash buyer.

- Youll borrow at a lower interest rate than with other forms of borrowing. Home equity products typically have lower interest rates than unsecured loans, such as personal loans. Using home equity to purchase a new home will be less expensive than borrowing without putting up collateral.

- Youll have better approval chances than with an additional mortgage. Home equity loans are less risky for lenders than mortgages on second homes because a borrower’s priority is typically with their primary residence. This may make it easier to get a home equity loan to buy another house than a new separate mortgage.

Cons

Recommended Reading: How To Invest 1 Dollar And Make Money

How To Use Heloc Loan On Rental Property

To effectively use HELOC on a rental property, youll need to engage the services of a HELOC lender who specializes in investment property line of credit. It typically comes with a higher interest rate than if it were for a primary residence.

Rental property HELOC is a valuable alternative financing source in real estate investing. If youre a savvy investor, you can get a HELOC on your primary residence to pay off an existing mortgage on your investment property. Likewise, you can get HELOC on an already existing rental property to finance the acquisition of new rental properties.

It is, however, essential to know that getting an investment property HELOC may prove difficult. Banks are more inclined to give HELOC to primary homeowners, and the default rate for owner occupied property is generally lower than investment property HELOC.