What Else Do I Need To Know About My Vanguard Brokerage Account/settlement Fund Before I Enroll

Your eligibility screening will determine whether you have the types of investments that Digital Advisor can manage. In some cases, you’ll need to sell all or a portion of certain investments as part of the enrollment process so we can manage them for you.

For each brokerage account you wish to enroll, the entire balance must be in certain investment types and/or the brokerage account’s settlement fund. If your brokerage accounts include Vanguard index funds or Vanguard ETFs®, you may be able to keep those investments in your Digital Advisor account. However, we may recommend you sell down those or other investments before enrolling. Since there may be costs and tax consequences associated with selling your existing investments, we use a breakeven cost analysis to weigh the costs of transitioning the investments you hold before enrolling in Digital Advisor . We estimate the capital gains tax impacts compared to the expense ratio benefits from selling investments that aren’t our lead recommendation , but that still align with your recommended asset allocation. So depending on the outcome of the breakeven analysis, we may recommend that you continue to hold certain investments subject to our portfolio construction guidelinesor we may determine it’s in your interest to sell down a particular investment during enrollment.

For eligible 401 retirement accounts, Digital Advisor doesn’t require a money market or stable value fund minimum balance.7

Who Should Use The Vanguard Group

Because of Vanguards unique structure, lets first discuss who shouldnt use Vanguard.

Its not for you if you cant meet Vanguards minimum investment requirements.

Its also not for you if you want to be an active trader, as Vanguard doesnt cater well to the needs of investors who trade in individual stocks.

If you want a modern app and strong customer service, youll probably need to look elsewhere.

However, if you subscribe to a diversified, low-cost, long-term style of investing as many smart people do its an excellent brokerage choice. Here are some examples of the types of investors that Vanguard serves well:

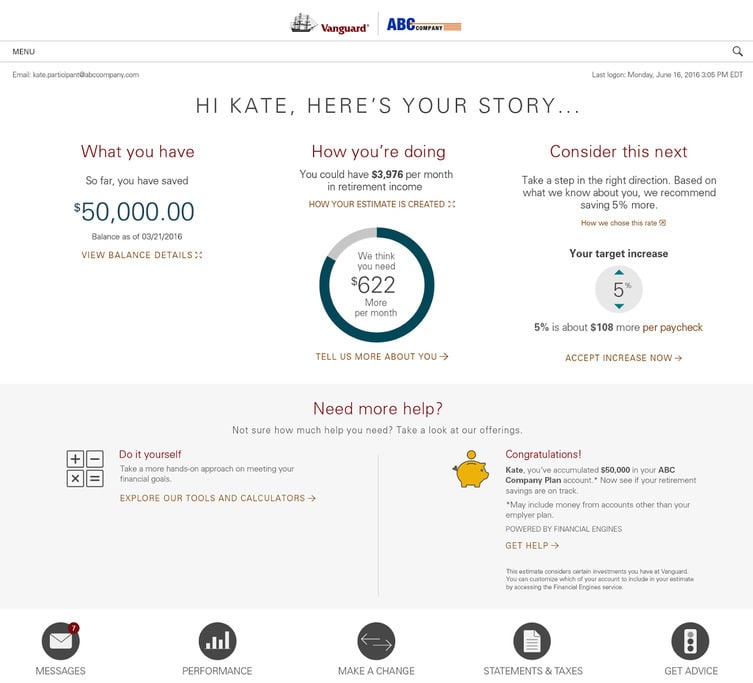

Put Digital Advisor To Work For You

Digital Advisor is an easy-to-use, online professional money manager thats tailored to your retirement goalno matter where you are on your investing journey.

Well create a long-term savings plan based on your unique inputs. Then well invest your savings in broadly diversified Vanguard ETFs® and manage them day-to-day for youproviding ongoing expertise that optimizes your chances for investment success, even during market fluctuations.

And if debt is standing in your way of saving, our debt payoff calculator offers scenarios to help you become debt-free faster.

Digital Advisor is always on, so when your life circumstances change, you can return to your personal online dashboard, make updates, and get a real-time adjustment to your plan.

Don’t Miss: High Net Worth Investment Advisors

Buying Your First Stocks: Do It The Smart Way

Once youve chosen one of our top-rated brokers, you need to make sure youre buying the right stocks. We think theres no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. Youll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisors average stock pick has seen a 356% return more than 3x that of the S& P 500! . Learn more and get started today with a special new member discount.

About Vanguard Personal Advisor Services

| Minimum Investment | |

| Current Promotions | N/A |

Vanguard provides a premium financial robo-advisor service. The minimum buy-in for a Vanguard Personal Advisor Services account is $50,000. While this will be a deterrent for entry-level investors, Vanguard has chosen this route because their investment portfolios are developed by real live human financial advisors and not just by some computer algorithm. It is also assuring to know the financial advisors are paid a salary rather than commission on sales, thus can provide objective advice.

New customers are required to fill in Vanguards detailed questionnaire, which is designed to get a comprehensive snapshot of their financial position and needs. A human financial advisor then examines this information and uses it to make an investment portfolio tailor-made to meet the individual clients needs.

In fact, one of the greatest features of Vanguards robo-advisor service is the provision of comprehensive financial advice suited to each clients investment goals. So, while Vanguard does not offer 401K plans, 529 plans, or college savings plans, their financial advisors will take these matters, as well as accounts held with other providers, into consideration when designing the best portfolio mix and account development strategy to suit each clients financial goals.

Also Check: Short Term Fixed Income Investments

How Do I Open An Account

Vanguard excels in helping people open new accounts. In particular, rolling over a retirement or after tax brokerage account is a pain-free process.

The whole account opening/rollover process involves a series of questions written in plain English. Once Vanguard figures out what you need to do, they give you the appropriate forms, and complete the account rollover for you.

If youre opening an account with funds from your bank account, you can log in to Vanguards personal investor page, and choose the type of account you want to open.

From there, youll connect to your bank account, and transfer funds. The whole process takes about 10-15 minutes. After that, it takes 2-3 business days for your funds to settle.

Vanguard makes it easy to open any type of investing account you can imagine. This feature came in handy when I decided to open a SEP-IRA at the last minute one year. I managed to open the account the day before taxes were due.

Disadvantages Of Vanguard Digital Advisor

Vanguard Digital Advisors downsides include a high minimum investment requirement and important omissions like no socially responsible investing or tax-loss harvesting.

- High Minimum Investment. Vanguard Digital Advisor requires a minimum opening investment of $3,000. Thats more than many novice investors can afford.

- Limited Investment Options. Although its able to achieve impressive diversification with a limited fund lineup, Vanguard Digital Advisor doesnt offer enough breadth for sophisticated investors. You cant buy individual stocks, non-Vanguard ETFs, or even mutual funds here, to say nothing of alternative investments like forex and cryptocurrencies.

- No Socially Responsible Investing Option. Vanguard Digital Advisor doesnt offer any socially responsible investment options here. When you invest in its total market ETFs, youre investing in oil companies and tobacco firms alongside green energy companies and plant-based food manufacturers.

- No Tax-Loss Harvesting. Vanguard Digital Advisor doesnt do tax-loss harvesting, which is when a human or automated advisor sells assets for a loss that offsets taxable gains and drives down net investment costs. This is a feature of other popular robo-advisors like Wealthfront.

- No Access to Human Financial Advisors. With Vanguard Digital Advisor, you dont have access to a human financial advisor. Youll need to upgrade to Vanguard Personal Advisor Services for that.

Also Check: Best Investment For 5000 Dollars

Who Is Vanguard Personal Advisor Services Best For

We understand that Vanguards service wont be the best choice for everyone. You have unique financial needs and investment goals.

Vanguard Personal Advisor Services is an excellent choice for those with significant assets. Some people dont yet have the $50,000 to meet the account minimum. Vanguard recommends considering its Digital Advisor service if youre in that boat.

Vanguard Personal Advisor Services is also a good choice for investors with long-term goals. Vanguard is investor-owned, which means the fund shareholders own the funds, which in turn own Vanguard. Before investing, you will discuss your financial planning goals with an advisor.

With that said, day traders or those looking for a quick turnaround might want to look elsewhere. Instead, PAS focuses on your retirement goals, college savings, and long-term growth.

Does Vanguard Offer Robo Investing

Vanguard holds $5.3 trillion in assets. … It offers a hybrid robo-advisor product called Vanguard Personal Advisor Services that competes with Betterment and Wealthsimple. This service gives you access to both a human advisor and an automated investment product. Vanguard charges a 0.30% fee for accounts up to $5 million.

Recommended Reading: Best Retirement Investments For Retirees

How Do I Open A Robo

To open a robo-advisor account, visit the robo-advisors website or download its app. Robos all have their own unique registration process, but in general youll need to provide the following information:

Name

Investment goals

Risk tolerance

You have to inform robo-advisors of this information so they can comply with federal regulations and place you in investments matching your goals and ability to tolerate risk.

Is Vanguard A Robo Advisor

Vanguard is not inherently a robo advisor. The company is a provider of affordable mutual funds and index funds first and foremost and is a digital provider second.

In other words, Vanguard is more well known for its affordable rates than for offering cutting-edge digital services. If youre looking for a more comprehensive mobile experience, consider using a service like Wealthfront.

Don’t Miss: How To Start Investing In Oil

Who Do I Contact If I Have Questions About Invest If You Have Any Additional Questions On Invest You Can Call The Number On The Back Of Your Card American Express Will Direct Any Investment Advisory Questions To Vanguard

Terms and Conditions for INVEST Offer

1. INVESTs advisory services and financial planning tools are provided solely by VAI, a registered investment adviser. Please review VAIs Form CRS and the INVEST brochure for important information about VAIs services, including its asset-based service levels. INVESTs financial planning tools provide projections and goal forecasts, which are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. All investing is subject to risk, including the possible loss of the money you invest.

Amex does not guarantee the services of VAI and makes no claim or promise of any result or success by retaining VAI. Your use of INVEST, including your decision to retain the services of VAI, is at your sole discretion and risk.

All costs associated with fund expense ratios still apply at all times. You should also consult your brokerage account commission and fee schedule for other charges that apply to your account.

Membership Rewards points received through INVEST may be considered taxable income to you and may be reported on an IRS Form 1099. You are responsible for any resulting federal or state taxes. Please consult your tax advisor if you have questions about the tax treatment of Membership Rewards points.

Is Vanguard Digital Advisor Trustworthy

Personal Finance Insider evaluates company trustworthiness by reviewing each company’s Better Business Bureau profile. Vanguard Digital Advisor is affiliated with Vanguard Advisers, Inc., which doesn’t currently have a BBB profile.

However, Vanguard Marketing Corporation, Vanguard’s affiliated broker-dealer, has an A+ rating with the Better Business Bureau.

But as mentioned on the BBB website, the bureau’s ratings don’t ensure a company will be reliable or perform well. This is why it’s always important to do your own due diligence.

Also Check: How Can I Invest In A Private Company

Vanguard Personal Advisor Services Assets

Vanguards methodology follows traditional Modern Portfolio Theory principles, emphasizing the benefits of low-cost securities, diversification, and indexing, driven by long-term financial goals. Stock and bond methodologies increase diversification by including equity funds at different capitalization and volatility levels as well as bond funds with different geographical, timing, and capital risks.

Vanguard Personal Advisor Services Review

We work hard to find the best offers. Most, but not all, products in our articles are from partners who may provide us with compensation, but this doesnt change our opinions. See our advertiser disclosure.

Contents

Vanguard, a leader in the low-cost index funds market, offers a hybrid investment advisory service known as Vanguard Personal Advisor Services®. This hybrid service combines unlimited human financial advisors with automated portfolio management, better known as robo-advising.

Robo-advisors have become a popular service for both small and large investors looking to build a diversified portfolio to maximize their investment returns while minimizing their risks. With the success of robo-advisors like Wealthfront and Betterment, all of the biggest investment firms and brokerages are starting to roll out their own automated investing services.

| Wellington Fund | |

| Total Assets | About $6.2 trillion in global assets under management, as of January 31, 2020 |

| Number Of Funds | About 190 U.S. funds and about 230 additional funds in markets outside the United States, as of January 31, 2020 |

| Number Of Investors | More than 30 million investors, in about 170 countries, as of January 31, 2020 |

| Average Expense Ratio | 0.10% |

| Chairman and CEO | |

| About 17,600 in the United States and abroad, as of January 31, 2020 | |

| Core Purpose | To take a stand for all investors, to treat them fairly, and to give them the best chance for investment success |

Don’t Miss: Best Platform To Start Investing

Vanguard Robo Advisor Promotions

As of right now, Vanguard is not offering any promotions that are specific to their robo advisory services.

That said, Vanguard offers tiered benefits for all investors, depending on the amount they invest with the company. For example, benefits tend to vary depending on whether you invest up to $50,000, between $50,000 and $500,000, and between $500,000 and $1 million.

Check out Vanguards website for a complete benefits breakdown.

Does Vanguard Pay Interest On Uninvested Cash

Vanguard doesnt offer a cash management account. So its customers cant earn interest on uninvested cash. As such, Vanguard also cant act as a replacement for a traditional bank, unlike some of its biggest competitors.

However, Vanguard offers money market accounts, CDs and short-term bond funds. All of those are designed to preserve your savings and perhaps earn more on your money than a typical savings account.

Also Check: Using Heloc For Investment Property

Vanguard Personal Advisor Services Vs Fidelity Personalized Planning & Advice

| Vanguard |

| Open account |

Vanguard and Fidelity both offer an array of brokerage services in addition to portfolio management for higher-net-worth individuals . Both account types offer ongoing, one-on-one support from a financial advisor.

You’ll need more to get started with Vanguard, but you’ll pay less in annual advisory fees. While you’ll need half of Vanguard’s minimum to use Fidelity’s advisor-guided account, you’ll be responsible for a higher advisory fee .

However, Fidelity makes up for this by offering expense ratio-free mutual funds as its primary investment choice. Vanguard’s ETFs and mutual funds have expense ratios.

Investment Options And Asset Allocation

Vanguard Digital Advisor builds your portfolio using just four Vanguard ETFs:

- The Vanguard Total Stock Market ETF

- The Vanguard Total International Stock ETF

- The Vanguard Total Bond Market ETF

- The Vanguard Total International Bond ETF

Based on your investing time horizon, objectives, and risk tolerance, Vanguard allocates your initial investment and future contributions to these funds.

If youre relatively young, investing for retirement, and OK with significant market risk, Vanguard puts most of your money into the Total Stock Market and Total International Stock ETFs. If youre older or cant tolerate as much risk, your portfolio favors the two bond ETFs. If youre somewhere in the middle, your portfolio reflects that.

As your investing objectives change with age and life events, you can adjust your asset allocation preferences as needed.

Recommended Reading: How To Invest My 401k Money

Is A Robo Advisor Right For Me

Everyones financial circumstances are different. As such, only you can determine whether a robo advisor is right for you.

Some people like being in full control over their investments, and dont want anyone else bot or human calling the shots. Yet others understand that they generally dont know what theyre doing in the market and are willing to take a gamble on a robo advisor.

Spend some time researching how robo advisors work and determine the level of support and guidance that you need. If you have the capital, Vanguards Personal Advisor service offers the best of both worlds an automated strategy, backed by live human support.

How Do We Review Robo

NerdWallets comprehensive review process evaluates and ranks the largest U.S. robo-advisors. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

Read Vanguard disclosures below:

Vanguard Digital Advisor’s services are provided by Vanguard Advisers, Inc. , a federally registered investment advisor. VAI is a subsidiary of VGI and an affiliate of VMC. Neither VAI, Digital Advisor, VGI, nor VMC guarantees profits or protection from losses.

Also Check: Is It A Good Idea To Invest In Gold

Who Should Choose Vanguard Digital Advisor

One of the main jobs of a robo-advisor is to direct your savings into a diversified portfolio of securities to help you reach your financial goals. You might not really need anything fancy to accomplish this task. In fact, you could open an online brokerage account right now and build a diversified portfolio much like a robo-advisor would provide for you.

But that would take time and a certain amount of expertise. People lead busy lives, and many, if not most, are willing to pay a company to do the job for them. Hence, the proliferation of robo-advisor platforms over the past decade or so.

For new investors who are looking at robo-advisors for the first time, choosing a platform with the lowest fees possible should be one of the most important criterion. Young investors, then, should take a good, long look at Vanguard Digital Advisor, which meets nearly all of their needs while charging less than nearly any other competitor.

At the same time, Vanguard Digital Advisor isnt for everyone. Those looking for tax-loss harvesting or ESG funds will be disappointed, as will anyone who wants to chat with an actual human advisor about their financial situation. If youre in the market for those kinds of features, check out Vanguard Personal Advisor Services.