How Does Platinum Investing Differ From Other Metals

Many clients own a mix of gold and silver. While the percentages of a balanced metals portfolio may change, it is rare that a portfolio would be exclusively invested in one or the other. Some may hold large gold positions and a small amount of silver, others the opposite, but few limit their metals portfolio to one or the other. The investment strategy for platinum and palladium is quite different. It is rare you would ever want to own both at the same time. Due to changing market conditions and relative pricing, the strategy employed with platinum and palladium leans towards owning one or the other, and exchanging one for the other at key times.

As market conditions change, the relative price between platinum and palladium, meaning how many ounces of one it takes to purchase an ounce of the other, varies dramatically. Over the last 20 years platinum has been as much as 6 times the price of palladium, and as little as 10% less. These substantial discrepancies in price offer a unique investment opportunity. Our knowledgeable advisors will work with you to position a portion of your metals portfolio into the appropriate metal at the right time, and recommend when to swap one for the other, dramatically increasing your total ounces owned at no additional cost.

The Us Dollars Depreciation

Palladium is sold in the global arena, just like other precious metals. This signifies that if the US currency depreciates, the value of palladium will rise since manufacturers will stop mining. Inflation has caused the US currency to decline in 2021. So, if you want to protect yourself against inflation, investing in palladium is a good idea.

Why Traders Need To Watch Palladium And Platinum Stocks Right Now

Zinger Key Points

- Thirty-nine percent of the global refined supply of palladium comes from Russia, according to Kitco. The country also accounts for around 11% of global platinum supply.

- Palladium hit an all-time high of $3,017 an ounce in May 2021 before falling on production cuts from the auto industry.

Russia’s invasion of Ukraine and resulting sanctions on Russia are putting pressure on several sectors including commodities. Two precious metals that could be affected by the global crisis are palladium and platinum.

What Happened: The U.S. and other countries are imposing sanctions on Russia, which could impact exports out of the country across varying sectors.

Russia is the largest global producer of palladium and the No. 2 producer of platinum, two metals that could be impacted by the Eastern European conflict.

Thirty-nine percent of the global refined supply of palladium comes from Russia, according to Kitco. The country also accounts for around 11% of global platinum supply.

Palladium is used by automotive manufacturers, in electronics and in jewelry. Platinum is the third most-traded precious metal in the world behind gold and silver and is also used for automotive and jewelry applications along with industrial and medical items.

Palladium was up nearly 7% to $2,648 per ounce on Thursday. The metal started the year trading around $1,905 and is now up over 30% year-to-date.

Platinum was down more than 1% at $1,094 and is up around 15% year-to-date.

Read Also: Where To Open An Investment Account

If You Are Familiar With Precious Metals Then You Probably Know About Gold And Silver However There Are Many Investors Who Dont Know Much About Platinum And Palladium

In fact, it would surprise many investors to know that palladium is actually more valuable than gold while platinum is many times more valuable than silver. So what makes platinum and palladium so valuable? The best way to get educated on these precious metals is by contacting an executive at Allegiance Gold. They will be able to help you better understand the value of diversifying your financial portfolio with any precious metal. Here are a few facts about platinum and palladium.

Invest Carefully In Platinum Stocks

Investing in precious metal producers such as platinum mining stocks is appealing given the inflationary forces ravaging the global economy. However, bear in mind that mining investments are cyclical, and stocks can be incredibly volatile. Their fortunes are highly dependent on the supply and demand of materials they produce. Invest accordingly.

Nevertheless, with the demand for precious metals and other basic materials on the rise, platinum mining stocks are worth a look.

Don’t Miss: Best Way To Invest In Stocks Online

How Do Platinum And Palladium Differ

- These two metals look very similar to each other and one can be easily mistaken for the other to an untrained eye. They also react similarly as catalysts to the same elements and chemicals which means, among other things, they will not tarnish and will tend to keep their color and brightness with time.

- Aside from differing in price, platinum is much denser and thus weighs more than palladium which is 12.0g/cm3.

- The global supply of palladium in 2021 was forecast to be 6.74 million ounces this is compared to the early figures for 2022 indicating a global platinum supply of around 5.2 million ounces.

- Both Palladium and Platinum have similar properties. They are soft, ductile, malleable, and resistant to corrosion. They can withstand high temperatures. Both are good conductors of electricity and also excellent electrical insulators.

- Palladium is harder than platinum, and has a hardness of ~4.75 on the Mohs scale, whereas platinum has a hardness of ~4.25, meaning that platinum can thus be scratched by palladium.

- Palladium melts at a lower temperature, 2,826 °F, compared to the 3,215 °F melting point for Platinum.

- Palladium currently trades at a higher price as compared to platinum .

- Palladium is more difficult to refine than platinum. Palladium can be purified using mercury or sodium cyanide, but platinum must be purified using hydrochloric acid.

Investment Opportunities And Availability

At this point, you could be wondering if you should start investing in platinum or palladium. Or even both, for that matter. Prices for platinum and palladium are usually more volatile than gold and tend to perform well in the long run. Therefore, most experts suggest that these precious metals could be a good long-term investment. Especially for those who are looking to diversify their portfolios even further from fiat currency devaluation and inflation.

The fact is that most platinum and palladium mining comes from three specific countries: South Africa, Russia, and Zimbabwe. In other words, any political instability in any of these three countries can cause a shortage in supplies and an increase in prices.

In addition, increased regulations for catalytic converters on automobiles run by fossil fuels have pushed demand for both these metals as they are essential to reduce the emission of harmful pollutants into the environment.

The spot palladium price has increased from $136 in January of 1990, to $2,742 in May of 2021, an increase of almost 2,000%, as shown on the chart below. The first spike happened around Y2K and, during the last decade alone, it increased 256%, from $770 in May of 2011 to current prices.

Palladium spot price from January of 1990 to May of 2021.

The spot Platinum price started in the 90s just under $500. It spiked in February of 2008 slightly above $2,100 and has been fluctuating around $1,200 during the first half of 2021.

Recommended Reading: How Much Money Do You Need To Invest In Gold

Where Is Platinum Found

Platinum was discovered in South America independently by Antonio de Ulloa in 1735 and by N. Wood in 1741, but it had been in use by pre-Columbian Indians. Platinum appears in thin sulphide layers in certain mafic igneous bodies and is mined in Canada, Russia, South Africa, the USA, Zimbabwe and Australia. Some platinum is acquired as a by-product of copper and nickel processing.

There are extensive platinum mining operations in Russia and South Africa, with these two countries being the worlds leaders in production. Some of the most significant projects include the Russian Nornickel Kola MMC mine located in Murmansk Oblast, and the Impala Platinum Holdings Impala Mine located in the Northwest of South Africa.

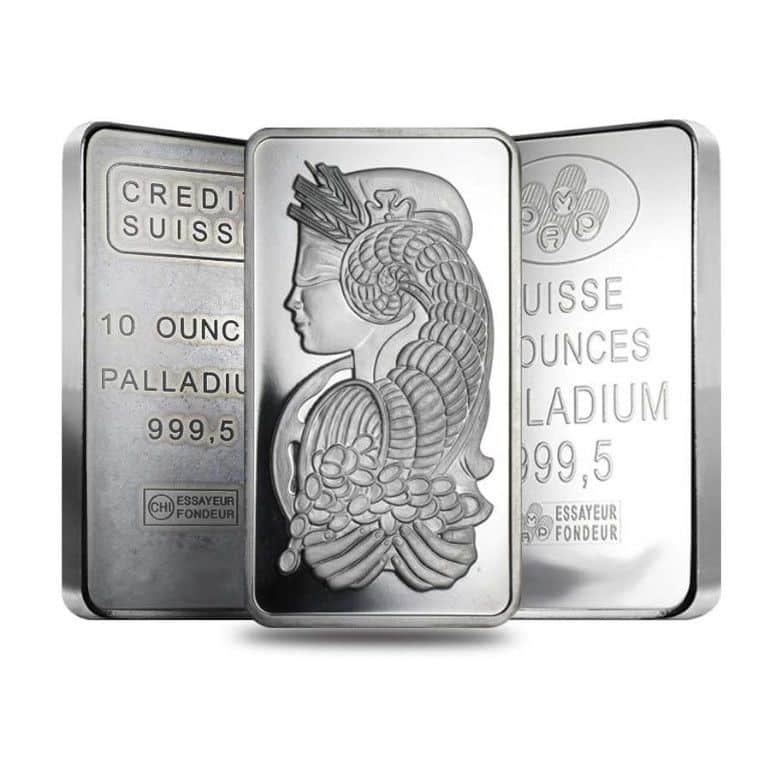

Investing In Precious Metals: Platinum Vs Palladium

Youre likely fairly familiar with silver and gold since so much of our lives involves these two well-loved precious metals, but platinum and palladium are two other precious metals that you probably could use a brief lesson on. If youre considering coin or bar investments in either of these, knowledge is key.

Both platinum and palladium actually have a lot in common. They are more durable and resistant to scratching than other precious metals, which can be especially great if you are thinking of having your wedding bands made from either. They also have very high melting points, which historically has meant that not much could be done with either until the early 1800s when a proper purification process was discovered.

Often both of these precious metals are mined in association with other minerals such as copper and nickel in various locations around the world, which tend to be primarily in South Africa and Russia with some mining operations also in U.S.A. and Canada.

Now lets break down the differences between the two.

Read Also: Investing In Multiple Target Date Funds

Pros And Cons Of Platinum

Platinum, on the other hand, is a reasonably rare asset in comparison to palladium. Its rarer than gold, silver, bronze, and the like. However, it is significantly more common than palladium. This ease of access makes platinum a much more appealing asset to manufacturers and other parties who need either metal.

Similar to palladium, platinum is non-corrosive and valuable even in smaller densities. But platinum is expected to keep increasing in demand, which would likely raise its price a bit, assuming supply can keep up. Unfortunately, supply is limited in platinum no matter what. It is much easier to find than palladium, though.

Thanks to the assets volatility, its used similar to gold as an economic hedge. Keep in mind this volatility is much more manageable than palladium, which is ideal for platinum investors. Its also a popular metal in similar industries to palladium like jewelry and cars.

That said, platinum faces the same issue in palladium in that manufacturers are attempting to find an alternative source. If this happens, the price of platinum may plummet. Take note, though, that platinum is a much more popular metal for this application than palladium.

Its also worth mentioning that platinum bars and coins are much more common than palladium ones. As a result, investors might lean toward platinum over palladium. This will especially be the case if they prefer physical holdings.

Palladium As An Investment

November 21, 2022 If you don’t want to keep a stack of palladium coins hidden under your bed, there are other ways to gain exposure to the palladium price. There are, for instance, many retail brokers available online that offer palladium derivative trading. Among day traders, contracts for difference based on palladium are popular, partly because CFDs are available for pretty much any bankroll size. They also make it easy to speculate on both upward and downward price movements.

Another option is to invest in an exchange-traded fund with exposure to palladium or the palladium metal group. There is, for instance, the WisdomTree Physical Palladium fund which is traded on the London Stock Exchange . This fund, one of the pioneers in the field of palladium ETFs, is backed by allocated palladium bullion. If you prefer NYSE-listed funds, you can, for instance, take a look at NYSE:PALL.

A more indirect way of investing in palladium is to invest in palladium mining companies. However, that gives a less straightforward exposure to the palladium market price as there are other factors to consider, e.g. company management and geographical risk. Finding a mining company exclusively focused on palladium is also difficult, so you will likely gain exposure to other metals alongside palladium.

Here are a few examples of public palladium mining companies:

You May Like: How To Invest In Gta Stocks

Where To Find Palladium

Originally discovered in 1803 in a South African crude platinum ore by William Hyde Wollaston, palladium can now be found in Australia, Brazil, Russia, Ethiopia, and North and South America. Palladium is also recovered commercially from nickel and copper deposits in South Africa and Canada.

Russia and South Africa are two of the worlds largest producers of the rare precious metal, with the significant Nornickel mine located in the Norilsk-Talnakh area of Siberia, and the Anglo American Mogalakwena platinum open pit mine located in the Limpopo Province.

Palladium Can Provide Portfolio Diversification

Investing in palladium is a great way to add to your portfolios diversification. Adding palladium to your investment portfolio allows investors to diversify among precious metals and achieve the unique benefits of palladium.

The broader market has been on a downward trajectory since the start of the year. Stocks have been falling and investors are removing risky assets from their portfolio. Thus its important to diversify among different asset classes like palladium.

Precious metals like palladium, gold, and silver have a history of strong, consistent performance during tough economic times. This is an added benefit for investors looking to manage the tough market environment that were in today.

You May Like: Best Stock Market Index To Invest In

A Hedge Against Inflation

Precious metals have been seen as a hedge of inflation for hundreds of years. As the United States continues to add billions of dollars of fiat to the money supply, the price of platinum and palladium continues to rise. Also, some investors believe that the current inflation in fiat supply could lead to hyperinflation. These hyperinflation fears have created a floor on the price of platinum and palladium.

What Is The Price Outlook For Palladium And Platinum

Frederic Panizzutti, leading expert on precious metals and managing director at MKS Dubai, says:

Platinum: We expect investment demand to increase throughout the year as platinum is almost half the price of gold and far behind palladium, and will remain an attractive and relatively inexpensive alternative. All parameters are pointing towards a perfect storm for platinum.

Palladium: The automotive sector shall further recover and the catalytic demand for palladium is set to further increase especially with the ongoing tightening of emissions standards Some speculative sporadic short-lived interest could result in sharp rallies followed by corrections. We expect 2021 to be another very volatile year for palladium.

Recommended Reading: Are Shield Annuities A Good Investment

Palladium Is A Store Of Wealth

Just like gold, silver, and platinum, palladium is often held as an investment. It holds several benefits when used as a store of wealth, just like other precious metals. A store of value refers to an asset or commodity that maintains its value over a period of time. Palladium is a store of wealth whose value moves at a similar pace like that of gold.

Moreover, palladium is a rarer precious metal that gold, which means its value can increase in the future. Keep in mind that palladium is more volatile compared with other precious metals. This means its price may fluctuate due to changes in supply and demand.

How Did Palladium Become So Valuable

The demand for palladium is stronger than the gold and silver markets because of the limited supply and growing need for environmental solutions. As global warming becomes a pressing threat, hybrid vehicles are a major goal for many car manufacturers. Palladium can help achieve this.

Aside from this goal, companies have shifted toward palladium catalytic converters because of their unique ability to separate and convert nitrogen oxide molecules into harmless gases. Asian car manufacturers have embraced this opportunity to reduce carbon emissions, increasing the demand for the limited palladium supply.

Palladium is valuable not only because of its rising demand but also because of its low supply. Currently, most of the worlds palladium supply comes from South Africa and Russia, which both have potential concerns. With labor rights issues, poor working conditions, and strikes in South Africa and declining output from Russia, palladium production could halt at any time.

As physical palladium becomes rarer, palladium prices increase. If you buy palladium today and the supply tightens even more in the next 10 years, you could enjoy substantial investment success.

Read Also: How Do I Invest In Nike Stock

Should Investors Choose Palladium Or Platinum

Thanks to their rarity, increasing industrial demand, and price growth potential, both metals could make an interesting choice depending on ones investment strategy and risk tolerance:

Investors looking for price stability and eager to avoid large dipscould choose platinum, as the metal is more stable than palladium.

However, those ready to ride the price wave and potentially benefit from price rallies could buy palladium.

Finally, those looking to really diversify their portfolio while improving their exposure to precious metals could choose to invest in both.

What Is The Better Investment For 2021

Both palladium and platinum are good investment options. Each metal is valuable, has a high degree of versatility, and are prized by bullion collectors for their beauty and collectability. Deciding on what metal to choose largely comes down to an investors risk tolerance.

Those who want to avoid price swings and large dips should choose platinum, as the metal is more stable than palladium.

However, investors eager to ride the price waves of a rarer metal should invest in palladium. Palladium, due to its exclusive rarity and use in industrial endeavors, looks to be the best metal to invest in for 2021 and beyond for those looking for the highest return on investment.

You May Like: How Do I Invest In Something

Where To Find The Best Deals For Precious Metals

To learn about existing sales that are ongoing, you should visit our website at lpm.hk. Here you can find coins which are on sale by clicking on the “On Sale” button at the top of the page, where you will be taken to the page which will show a list of coins and their current live prices. LPM has one of the largest inventories of precious metals that you’ll find anywhere in Asia, which means we hold sales regularly, so you will want to visit this page frequently to see what deals are available.