Why Should You Not Forget To Submit The Investigation Form

In the economic sense, the investment form is the key through which you can purchase the assets that are not used and consumed today but will be used in the future to create wealth and profit. And the forms contain the basic information about the investors that will be needed in the later process of investments. The forms are filled up and submitted to the organization that deals with the investments. And with the investment form, they can proceed to the next step as directed by the organization.

Representation Of Fund Sponsors

We help clients create and manage a full spectrum of private investment funds. Our team works with fund sponsors on nearly every continent and in all major markets including North America, Latin America, Europe, the Middle East, and Asia.

For each client, we advise on business, tax, and regulatory issues associated with fund management. We counsel sponsors on fund organization, domicile selection, and fee and compensation structures, assisting clients with investor negotiations and guiding them through the stages of fund investment. We also help clients structure the ownership of general partner entities and management companies, and their relationships with their funds.

Our team draws on the experience of our knowledgeable investment management, tax, and ERISA practitioners to counsel fund sponsor clients on legal and regulatory issues affecting investment companies, investment advisers, broker-dealers, and commodity traders.

The Capital Raising Process From Beginning To End

Once youve refined your pitch, the process of raising capital differs depending on the types of investors you target.

For example, if you pitch to a $10 billion endowment that only invests in funds with over $500 million AUM, it will be slower and more bureaucratic than pitching to a small family office.

With large institutional investors, you can expect the following:

- Introduction Get an introduction via other fund managers, trustees, your prime brokerage provider, or anyone else you know.

- Phone Interview Answer questions about your strategy, how you make decisions, and qualitative aspects of your fund.

- Informal Background Check Theyll ask about you in the community to figure out your reputation. No search results can be worse than negative findings!

- In-Person Pitch Day If they like your story and reputation, theyll invite you in to present for an entire day. Youll go through your slides, your story, your process, your risk management, your team, your performance, and more.

When youre presenting your past investments, you might use a structure like the following for each one:

The #1 mistake in day-long presentations is focusing too much on your successes and not enough on your mistakes.

You might be tempted to walk in and give them 10 case studies of investments where you earned 50%, 70%, or 100% within 12 months.

But no investor is perfect, and everyone loses money sometimes.

You May Like: Fisher Investments Camas Wa Reviews

What Is A Mutual Fund

A mutual fund rules that an instance where you can manage money at a professional level is used by the mutual fund advisors to buy securities and make those that gain value over time. You can start an investment fund with friends or an investment club for fun and profit, too, to start now! Call a financial advisor.

What Are Your Funds Objectives

Once youve assembled your team, the fun part begins. Whats your funds purpose? Among the questions youll want to answer as precisely as possible: What is your theory of change? What geographic area constitutes your community focus? Whats your economic mission? What kind of risks and rewards do you want to provide to investors?

The will help you craft a simple and straightforward statement that can and should be revisited on a regular basis.

Theory of Change

A theory of change is a comprehensive description and illustration of how and why a desired change is expected to happen in a particular context. It goes beyond what your fund does, and helps define how your actions will achieve your long-term goals. Figuring this out is a great team-building exercise and will help keep your priorities aligned and focused.

Geographic Focus

What are the appropriate geographic boundaries for your community investment fund? How local do you want your local fund to be? Define an area that fits well with your envisioned market of investors and businesses.

As your team works through this step, clarify whether your geographic boundary pertains solely to your target businesses, your target investors, or both. Do you want to allow investment from residents outside your region?

Your main goal is to have a positive impact on your local community, so you need to define your geographic boundaries. But building connections with other communities is also crucial to this work.

Economic Mission

Also Check: Do I Need A Stock Broker To Invest

How To Start Your Private

The best way to start this type of fund is to define the business strategy to be followed. Next, you need to select the most appropriate investment vehicle to raise funds. Also, and you have to consider how to be successful in attracting many clients. Next, you must establish a fee structure to know how much each person who is part of this fund will earn. You also need to define the management fees and different types of interest and performance rates, among others.

Raising Your Fund And Growing

a. Write Offering Documents

In order to attract investors to your hedge fund, you will need to create a set of documents that explain your funds goals and terms of investment. This generally takes the form of a prospectus or private placement memorandum . This document both protects the hedge fund, by assigning liability for losses to the investors, and the investors, by providing specific strategies that will be employed by the hedge fund.

These documents are required by securities regulators and must disclose specific information. Consult with professional legal counsel to ensure that you meet all of the necessary disclosure requirements.

b. Create an Online Presence

Despite regulations that prevent hedge funds from publicly advertising their funds, they are allowed to set up informational websites. These websites can display the experience and backgrounds of the funds partners and provide information on the partners investment strategies. Having a clean, professional, and informative website can help foster trust in potential investors.

c. Seek Anchor Capital to seed your Fund.

It is essential for you to approach banks, venture capital firms, and wealthy investors with whom you or your team have prior relations with. It may be useful to establish strategic partnerships with these institutions where possible. Friends and acquaintances are also potential sources to raise money.

d. Promote your Hedge Fund

e. Find a Prime-broker

Recommended Reading: Robo Investing Vs Financial Advisor

Alternative Investment Fund Managers

The alternative investment fund managers directive covers managers of alternative investment schemes designed for professional investors. Alternative investment funds are funds that are not regulated at EU level by the UCITS directive. They include hedge funds, private equity funds, real estate funds and a wide range of other types of institutional funds.

Since its adoption in 2011, the AIFMD has supported the creation of an efficient single market for alternative investment funds and built a strong regulatory and supervisory framework for AIFMs in the EU. As part of the capital markets union package of 25 of November 2021, the Commission adopted a legislative proposal that recommends amending the AIFMD framework to make the AIF market even more efficient, improve investor protection and enable better monitoring and managing of risks to financial stability by. A reviewed framework will directly contribute to the three key objectives of the CMU, as set out in the CMU communication.

The Blunt Truth About Starting A Hedge Fund

You might have a personal trading account with $100K, $200K, or even $1-5 million+.

Your average annualized returns over the past 5 years were 15%, beating the S& P 500, which only produced 9%.

As a result, you believe that youre a good candidate to start a hedge fund.

Wrong!

First of all, high returns on small amounts of capital do not mean that much.

Second, results from personal accounts, no matter the account size, are not taken seriously.

Third, you need to be part of an existing team at a hedge fund, asset management firm, or prop trading firm to have a good chance at starting a new fund.

To start a true, institutional-quality hedge fund that uses the LP / GP structure and has large external investors, such as endowments, pension funds, and funds of funds, youll need to raise hundreds of millions of USD.

The bare minimum to get noticed is $100 million, but realistically its more like $250 million+, and ideally more like $500 million $1 billion.

You have no chance of accomplishing that unless you have deep connections to potential Limited Partners and a great track record over many years at an existing fund.

Yes, you could start with much less capital, or go through a hedge fund incubator, or use a friends and family approach, or target only high-net-worth individuals.

But if you start with, say, $5 million, you will not have enough to pay yourself anything, hire others, or even cover administrative costs.

Don’t Miss: What Are Some Of The Investing Options Offered At Banks

Ways To Get The Legal Work Done

Once you’ve secured the capital, you have to work through the legalities of setting up the fund.

If you’re going to give out investment advice, first pass a test and register with the Securities and Exchange Commission . This is legally required under certain circumstances and it’s a good idea in any case as future investors will see this as a positive sign. You’ll also need to set yourself up with the Internal Revenue Service to get an employer identification number.

There are three possible ways to take it from there, depending on your budget and your need for professional hand-holding.

Internationally Recognised Collective Investments

- Exchange-traded funds an open-end fund traded by listed shares on major stock exchanges.

- Real Estate Investment Trusts a close-ended fund that invests in real estate.

Investment funds are regulated by the Investment Company Act of 1940, which broadly describes three major types: open-end funds, closed-end funds, and unit investment trusts.

Open-end funds called mutual funds and ETFs are common. As of 2019, the top 5 asset managers accounted for 55% of the 19.3 trillion in mutual fund and ETF investments. However, for active management, the top 5 account for 22% of the market, with the top 10 accounting for 30% and the top 25 accounting for 39%.BlackRock and Vanguard are the top two when including passive investments.

The top 5 active management funds in 2018 were Capital Group Companies , Fidelity Investments, Vanguard, T. Rowe Price, and Dimensional Fund Advisors in 2008, the list included PIMCO and Franklin Templeton.

Closed-end funds are less common, with around $277 billion in assets under management as of 2019, including about $107 billion in equities and $170 billion in bonds market leaders include Nuveen and BlackRock.

Unit investment trusts are the least common, with about $6.5 billion in assets as of 2019.

Don’t Miss: Investment Property Refinance Loan Rates

Balanced And Asset Allocation Funds

There are two types of balanced fund:

- Traditional balanced funds, which have a static portfolio comprising equities, bonds and cash

- Asset allocation funds , which follow a dynamic asset allocation strategy whereby the funds composition is fine-tuned at regular intervals.

In addition, asset allocation funds use two other asset classes to broaden diversification and improve performance: real estate and commodities.

How Do Private Funds Provide Capital To Early

A fund is an entity created to pool money from multiple investorsoften referred to as limited partners. Each investor makes an investment in the fund by purchasing an interest in the fund entity, and the adviser uses that money to make investments on behalf of the fund. Traditional venture funds typically invest in businesses in exchange for equity and some firms specialize in particular industries or in companies at a certain stage .

Don’t Miss: Fisher Investments Number Of Employees

Learn How To Legally Start Your Own Hedge Fund And What To Consider Before You Do

If you’ve come up with a market-beating strategy and have a good track record of outperforming the market, you may be thinking about starting a hedge fund. Hedge fund managers receive considerable compensation for their performance, and the tax benefits are great for high earners.

But a short track record of outperforming the market in your personal trading account isn’t enough to start a hedge fund. You’ll also need to assemble a team to make sure that you establish and operate legally and register with all the necessary parties. You’ll need to market your fund and raise money to invest. And you’ll need to run a business on top of managing the hedge fund’s investments.

If you think you’re up for the challenge, here’s how to start a hedge fund.

The Tax Implications Of Using An Llc For Investments

With all the talk surrounding the Trump Tax Cuts that went into effect in 2018, a lot of people have started wondering if using an LLC would potentially help them with taxes? I mean, who doesn’t want to save money in taxes?!?

Important note: I’m not an accountant or tax professional, and I’m definitely not your accountant or tax professional. You should seek the guidance for a tax professional if you have any questions surrounding the tax implications of your investments, business structure, etc.

Okay, with that being said, what are the tax implications of using an LLC for investments?

The IRS doesn’t recognize the LLC as an entity – it’s pass-through. What this means is, each member reports their share of “whatever” on their taxes as if the LLC doesn’t exist. So, if you have 2 people and your operating agreement specifies a 50/50 split, then each person reports their income, losses, dividends, whatever, 50/50.

So, most LLCs used for investing would have capital gains, losses, and dividends. Each would then be allocated to the members per the operating agreement. The members would, in turn, each report the amount on their taxes as if they had received them themselves. As such, each members tax implications would be different.

So, if you’re just investing within an LLC, you don’t get any type of special tax treatment. The IRS basically views everything as if the LLC doesn’t exist.

Read Also: Best Way To Invest Money In Cryptocurrency

Write Your Investment Agreement

Before you go out and market your new hedge fund, you’ll need a clear investment agreement to show prospective investors. The investment agreement will include details such as:

- Your fee structure: What’s the expense ratio? Do you have a performance fee? The industry standard is a 2% management fee and 20% performance fee, but there’s been pressure on lowering fees over the past decade.

- Minimum commitment: Is there a minimum amount of time or money an investor must commit? Many hedge funds require at least $1 million and a one-year commitment, sometimes more.

- Distributions: Will you have set periods where investors can request distributions, or will they be able to take distributions by providing notice 30, 60, or 90 days ahead?

Again, a good lawyer will be invaluable in making sure your investment agreement covers everything you need.

Lucid Appoints Faisal Sultan As Middle East Vp And Md

RIYADH: US-based electric vehicle manufacturer Lucid Group Inc., in which Saudi Arabia’s Public Investment Fund holds a 60 percent stake, has promoted Faisal Sultan to vice president and managing director in the Middle East.

According to a press release, Sultan will directly report to Lucids CEO and Chief Technology Officer Peter Rawlinson.

Sultan’s appointment comes as Lucid plans the construction of a plant in the Kingdom that will produce 150,000 electric vehicles per year.

Our mission is to inspire the adoption of sustainable energy by creating the most captivating electric vehicles in the world, and the Middle East is a strategic region in fulfilling that mission, for both manufacturing and retail, said Rawlinson.

He added: This requires deep knowledge of the area along with business acumen, and we are very fortunate to have Faisal leading our team here in the Middle East.

Sultan has 23 years of combined automotive experience with Lucid, Industrial Clusters, FCA, Magna, Ford, and GM, where he held leadership positions spanning industrial development, manufacturing, operations, engineering, and program management.

In August, Sultan, who was then the managing director of global operations at Lucid, said the PIF was supportive of Lucid when it faced a supply crunch.

During an interview with Bloomberg, Sultan noted that supply chain issues will be righted soon, and things will get back to normal by the end of this year.

Recommended Reading: Qualified Opportunity Zone Investment Funds

Ners In The Pamm Investment Funds

1. Money Manager: manages the investment fund and invests the money on behalf of the investors. He only has the power to buy and sell, he does not have access to movements or investors money

2. Investors: these are the managers clients. They deposit their capital in the investment fund to be managed and can access their funds to consult and withdraw their funds whenever there are no open positions.

3. Broker: the entity that makes the trading platform available and acts as an intermediary between the manager and the investors. It is in charge of making the withdrawal of commissions on profits

4. Technology provider: it is the one that provides the broker with the appropriate technological tools so that it can offer its services properly.

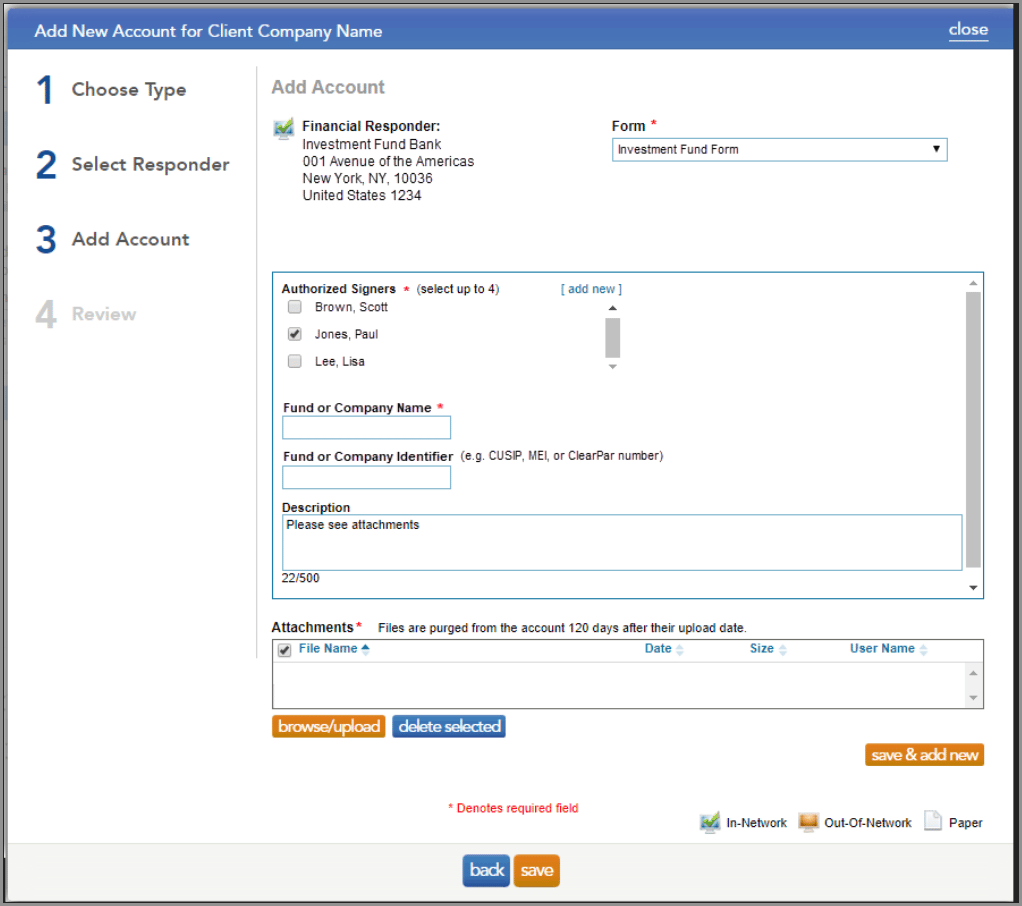

Reporting To The Sec As An Exempt Reporting Adviser

Q: I am planning to file reports with the SEC as an Exempt Reporting Adviser and want to know how to set up an IARD account.

A: You can find the IARD Entitlement Forms and related information under “How To Register/File Reports” on this website. You can also check FINRA’s webpage

Q: Which items in Form ADV must Exempt Reporting Advisers complete?

A: Exempt Reporting Advisers that are not also registering with any state securities authority must complete only the following Items of Part 1A: 1, 2, 3, 6, 7, 10, and 11, as well as corresponding schedules. Exempt Reporting Advisers that are registering with any state securities authority must complete all of Form ADV. See Form ADV’s General Instructions for more information. The IARD system will automatically include only the items of Form ADV that must be completed based upon the type of filing you chose to submit.

A: Yes, we would not recommend enforcement action if an SPE satisfies its reporting obligation under section 203 or 203 by including all information concerning the SPE on your firm’s Form ADV report, provided that the SPE: does not engage in any activities other than those described in your question above that would cause the SPE to be an investment adviser as defined in section 202 and acts as the SPE only for private funds or other pooled investment vehicles advised by you or your related persons .

You May Like: Are Shield Annuities A Good Investment