What To Consider With A Real Estate Investment Trust

If you favor the latter, here are some things to keep in mind about real estate investment trusts:

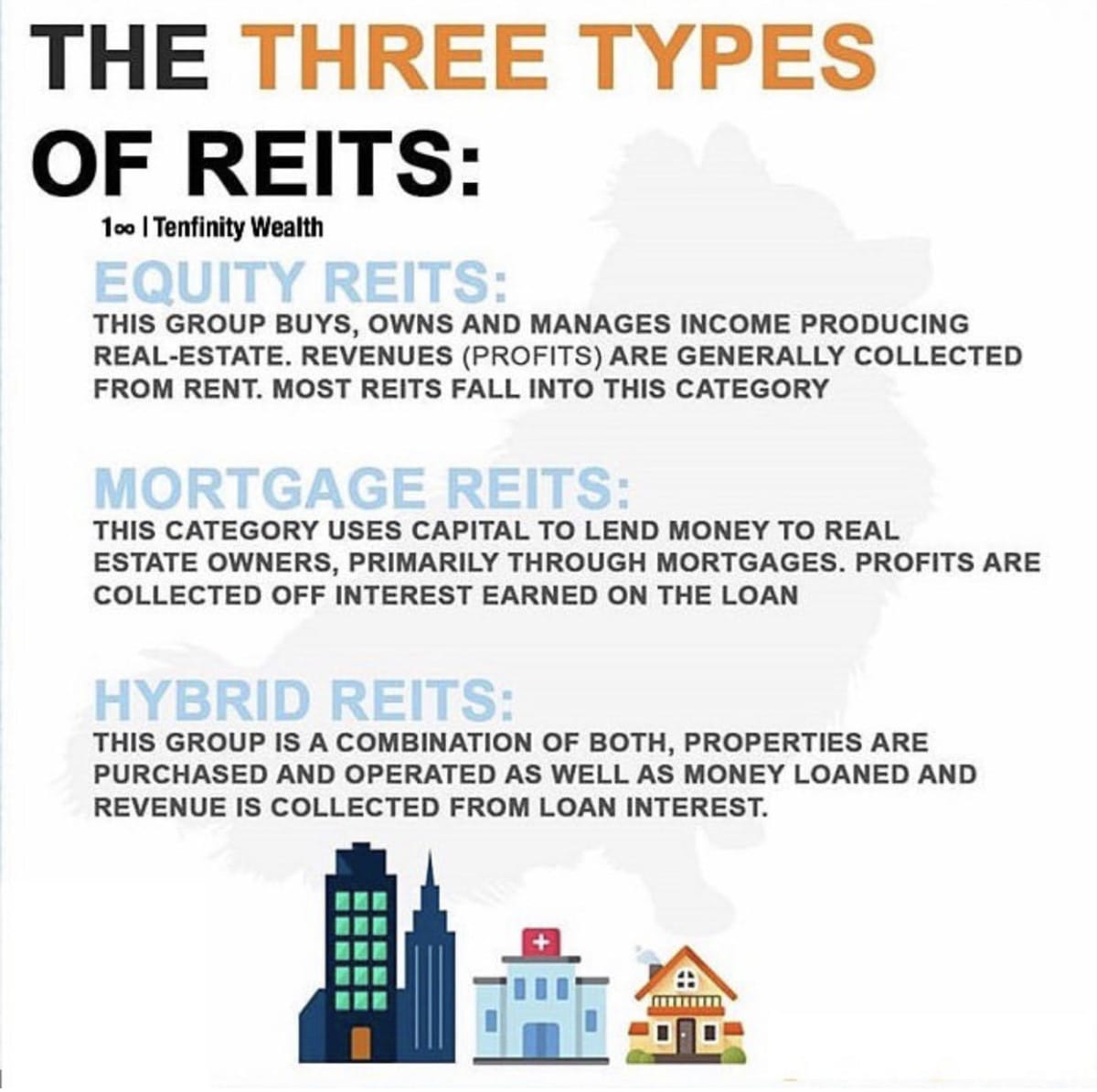

- There are several different kinds of REITs to choose from. These include Equity REITs and Mortgage REITs among others, offering regular income streams, diversification and long-term capital appreciation.

- REITs pay out dividends to shareholders, who then pay income taxes on those dividends.

- REITs are located in every state and internationally. You can potentially invest in REITs in over 30 countries around the world without having to actually go overseas to search for properties and endure the rigorous process of international real estate transactions.

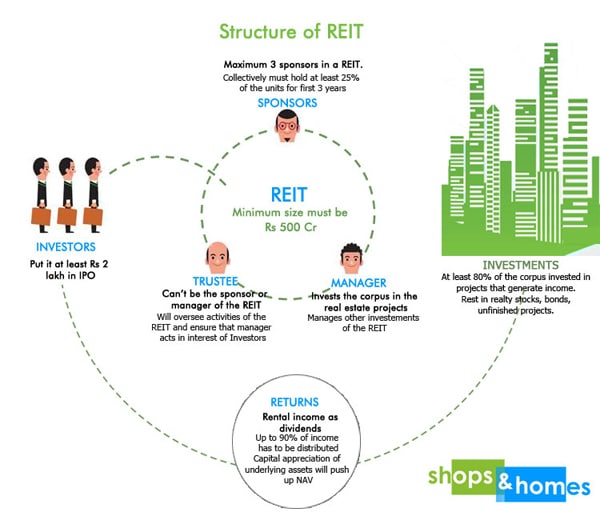

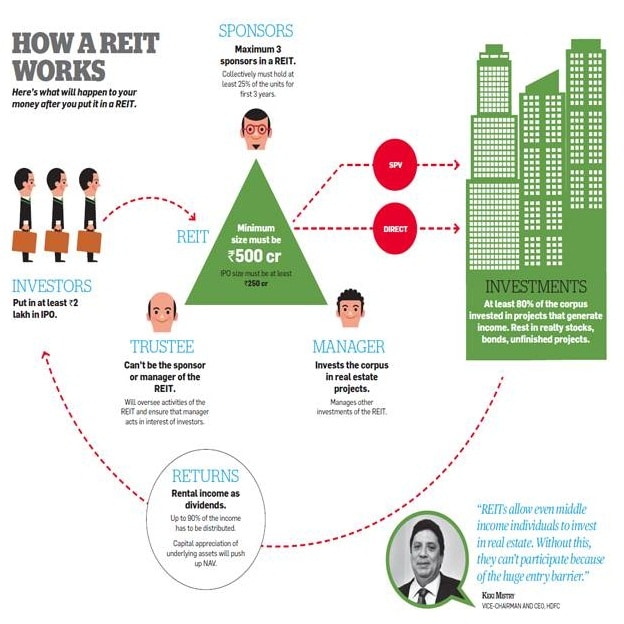

- A board of directors or trustees manage REITs and have a minimum of 100 shareholders. Some are stock exchange-listed REITs and some are private entities. Stock exchange-listed REITs operate under the same securities regulatory and financial reporting rules as other exchange-listed companies.

Those who have REITs included in their investments may diversify REIT types and may choose both domestic and international REITs. REITs give you plenty of options.

Here two informative podcasts to help guide you through your REIT vs. individual real estate purchase decision-making process. This includes a very important discussion about outright property purchases and the potential risk of winding up with a property thats worth less than what you invested if housing values or the market tank.

Rent Part Of Your Home

This might be an option if youre not quite up for the level of work involved in an Airbnb situation , and you have a large dwelling with unused space. Sanborn recommends renting out the other part either as short-term rentals or as a studio rental.

Take Our Poll: Do You Think Student Loan Debt Should Be Forgiven?

What Are The Benefits And Risks Of Reits

REITs offer a way to include real estate in ones investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments.

But there are some risks, especially with non-exchange traded REITs. Because they do not trade on a stock exchange, non-traded REITs involve special risks:

Recommended Reading: What Is Fundrise Real Estate Investment

How To Invest/buy Reits

A person can invest in REITs in a variety of ways. They can buy shares listed on major stock exchanges, just like Peloton or Tesla. They can purchase shares in a REIT mutual fundMutual FundA mutual fund is a professionally managed investment product in which a pool of money from a group of investors is invested across assets such as equities, bonds, etcread more or exchange-traded fund . A broker or financial planner can also help them analyze various REITs that suit their investment objectives.

As of today, the National Association of Real Estate Investment Trusts reports that up to 145 million Americans have funds invested in REITs through their direct investments or retirement savings. Beyond consumers investing with REITs, institutional investors like pension funds, endowments, and insurance companies also invest in REITs.

Sensitive To Interest Fluctuations

REITs tend to suffer in an environment of rising interest rates. Investors tend to switch to inflation-protected treasury bonds at those times, because they are backed by the full faith and credit of the U.S. government.

As interest rates on consumer credit rise across the board, your shares may become less valuable relative to shares that are just as low-risk but that offer a higher return because of rising mortgage rates.

Read Also: Best Investment Accounts For Young Investors

How Real Estate Investment Trusts Work

Since REITs return at least 90% of their taxable income to , they usually offer a higher yield relative to the rest of the market. REITs pay their shareholders through dividends, which are cash payments from corporations to their investors. Although many corporations also pay dividends to their shareholders, the dividend return from REITs exceeds that of most dividend-paying companies.

REITs have to pay out 90% of taxable income as shareholder dividends, so they typically pay more than most dividend-paying companies.

Some REITs specialize in a particular real estate sector while others are more diverse in their holdings. REITs can hold many different types of properties, including:

- Apartment complexes

- Self-storage facilities

- Retail centers, such as malls

REITs are attractive to investors because they offer the opportunity to earn dividend-based income from these properties while not owning any of the properties. In other words, investors dont have to invest the money and time in buying a property directly, which can lead to surprise expenses and endless headaches.

If a REIT has a good management team, a proven track record, and exposure to good properties, it’s tempting to think that investors can sit back and watch their investment grow. Unfortunately, there are some pitfalls and risks to REITs that investors need to know before making any investment decisions.

Cons Of Direct Real Estate Investing

One of the main disadvantages of direct investing is that it requires a significant amount of time and energy if you plan to be successful. You have to deal with tenant issues, maintenance emergencies, and your liability if there are any accidents on the property.

Financing can be another disadvantage. Many investors need to take on a mortgage or some other type of financing to pay for investments. If the market tanks or you have difficulty finding quality tenants, there’s the chance you could default on the loan.

Another negative is that real estate is not a liquid asset. That means you probably won’t be able to sell it quickly if you need cash in an emergency.

-

Positive cash flow and appreciation

Don’t Miss: How To Start A Business With Small Investment

Before You Invest: Things To Note

Do not assume that REITs are low risk and that the dividend income is recurring. Read your prospectus and research reports to understand the investment objective and strategy of the REIT.

Look for information under the following three key areas:

- Information on the REIT manager their experience and track record, and, if applicable, the REITs sponsor and pipeline of assets

- Information on properties to be put in the REIT in particular, whether you are familiar with the geographical and sector exposures of the REITs you intend to invest in

- Other investment information such as dividend policy and fees and charges

REITs can have different structures, geographical or sector focus, and some REITs may carry more risk, such as political and regulatory risk, than others. You should:

- Read the Investment Approach and Risks portions of your prospectus for information on the various risks of the specific REIT you intend to invest in. Note that the risk elements may differ greatly between REITs depending on their investment objective and strategy, geographical and sector focus, quality of the underlying real estate properties, land tenure of properties , experience of the REIT manager, and the income distribution policy.

- Consider if the REITs structure and risk profile suit your risk appetite and investment time horizon.

- Do not invest in a REIT if you do not understand or are not comfortable with its investment objective and strategy.

Are Reits Safe During A Recession

Investing in certain types of REITs, such as those that invest in hotel properties, is not a great choice during an economic downturn. Investing in other types of real estate such as healthcare facilities or retail is a great way to hedge against a recession. They have longer lease structures and thus are much less cyclical,

Read Also: Financial Advisor And Investment Advisor

Will Investing In Reits Diversify My Portfolio

Over the past few decades, assets have become increasingly correlated. This has challenged advisors to identify investments to better diversify their clients’ portfolios. Fortunately, REITs provide investors access to meaningful diversification opportunities.In fact, according to Chatham Partners’ research, the vast majority of advisors now invest their clients in REITs and the most frequently cited attribute as to why is “portfolio diversification.”

Following are illustrations of the low correlation REITs have with the broad stock market and how they can improve a portfolio’s risk-and-return profile.

Positions For Property Development Managers

Property development managers oversee a number of development initiatives. Each of them is engaged on tasks related to planning and building a brand new home.

Another choice to make the most of this expanding sector is to work as an actual estate developer.

All the construction-related documentation is handled by the true estate developers. They collaborate while looking over the buildings assets.

You May Like: Buying Investment Property In Chicago

What Are The Risks

A REIT is dependent on both the performance of its particular sector and the geographical region to which its exposed. If either of these suffers, so will your REIT.

As with any investment, its crucial you do your homework. Understanding which commercial sectors are on the up, as well as the economic landscape of a particular region and how the company itself is performing, are all key to knowing which ventures stand to do well.

And just like any other investment, some REITs offer higher risk in exchange for bigger potential gains, while others are much more suitable for those looking for safer, long-term returns.

Is A Reit A Good Investment

In short, yes. Because of the high yields and liquidity, a real estate investment trust is great for those who want to invest in real estate but dont have the capital to buy property. There is also less financial risk involved with owning shares in a REIT because its a mixed portfolio of various real estate properties instead of stock in one particular property.

Tip: Even if youre investing in real estate indirectly, the money you get back is based on an actual building. Property values depend highly on location, so research a REITs holdings before you invest.

Recommended Reading: How To Invest Without A Social Security Number

How Does A Company Qualify As A Reit

To qualify as a REIT, a company has to meet specific requirements as mentioned below.

Your Rights As A Reit Unit Holder

In general, these are limited to the right to:

- Require the REIT manager or trustee to administer the REIT in accordance with the provisions of the trust deed

- Remove a REIT manager

To remove a REIT manager, unit holders have to call for a general meeting to vote on a resolution to remove the REIT manager. The call for general meeting must be made in writing to the REIT manager or trustee by at least 50 unit holders or such number of unit holders that together hold at least 10% of the REITs issued units.

The resolution to remove the REIT manager must then be passed by a simple majority of unit holders present and voting at the general meeting, with no unit holders being disenfranchised.

You May Like: How To Invest In Dubai Real Estate

Pros Of Direct Real Estate Investing

One benefit of investing in physical properties is the potential to generate substantial cash flowas well as the ability to take advantage of numerous tax breaks to offset that income. For example, you can deduct the ordinary and necessary costs to manage, conserve, and maintain the property. Another large tax break is for depreciation, in which you deduct the costs of buying and improving a property over its useful life .

Of course, there’s also the prospect of price appreciation. While the real estate market fluctuates as the stock market does, property prices generally increase over time, so you may be able to sell later at a higher price.

Another perks of direct real estate is that you have more control over decision making than you would with REITs. For example, you can select only properties that match your preferences for location, property type, and financing structure. You can set rental prices, choose tenants, and decide how many properties to buy. You can also refinance your mortgage when interest rates drop, or tap into your home equity through loans or credit lines for other purposes.

Work With A Professional To Determine Your Investment Strategy

Anyone can invest in REITs, but it’s often a good idea to consult with a financial advisor before making big investment decisions. An advisor can help you by providing expert, personalized advice for your particular situation. They can even help manage your money for a fee if you don’t want to do it alone.

Whatever you do, avoid making investment decisions without first taking the time to research and understand what you’re investing in and how it might impact your financial future. Also, be sure to have your financial obligations covered before committing any money to an investment opportunity. Missing bill payments can lead to late payments and drag down your , which can make it harder to secure credit in the future.

Recommended Reading: How Do I Invest In Disney Stock

What Is Manufactured Housing

Manufactured housing is a home unit constructed primarily or entirely off-site at factories prior to being moved to a piece of property where it is set. The cost of construction per square foot is usually considerably less for manufactured housing than for traditional homes constructed on-site. Long known as mobile homes, manufactured housing has come a long way in terms of style, amenities, construction quality and public perception, though it still can take the basic forms of its roots.

A subset of manufactured housing is “modular homes,” or homes divided into multiple sections that are constructed off-site, then assembled like building blocks at the property. A manufactured housing unit can be as small as 500 square feet and as large as 3,000 square feet if built in a modular fashion.

What Are The Requisites For Managing A Reit

Like mutual funds, real estate investment trusts allow both small and big investors to acquire ownership in real estate ventures. It is governed by a law that intends to provide investment opportunities and strong income vehicles. In other words, it is similar to stocks traded in the market.

Reits have the following requirements:

- All REITs should at least have 100 shareholders or investors and none of them can hold more than 50% of the shares

- Must have at least 75% of its assets invested in real estate, cash, or treasuries

- 75% of its gross income must be obtained from real estate investments

- Must pay dividends equaling at least 90% of their taxable income to shareholders

- Must be managed by a Board of Directors or Trustees

Recommended Reading: Should I Invest Hsa Money

Who Invests In Reits

Currently approximately 145 million Americans live in households that are invested in REITs directly or access them through REIT mutual funds or exchange-traded funds .

- Institutional investors like pension funds, endowments, foundations, insurance companies and bank trust departments invest in REITs.

- There are millions of Thrift Savings Plan participants who have access to REITs in their stock choices.

- Nearly 100% of target date funds, which are prevalent in 401k plans, have REIT allocations.

What Makes A Company An Reit

Not all real estate-based companies are REITs. To qualify as an REIT, a company must use its real estate properties and or mortgages as income-generating investments. A company that builds and then sells housing developments, for instance, would not be considered an REIT.

To qualify as an REIT, a company must pay out at least 90% of its taxable income as dividends. REITs must also . . .

- be managed by a board of directors or trustees,

- derive at least 75 percent of its gross income from real estate related sources, including rents from real property and interest on mortgages financing real property,

- invest at least 75 percent of its total assets in real estate assets and cash,

- have a minimum of 100 shareholders after its first year as a REIT,

For an exhaustive list of requirements that must be met for a company to qualify, review the SECs investor bulletin about REITs.

You May Like: Invest In Penny Stocks Online

Vnq Vs Riet: What’s The Best Reit Etf

- Most often, I stay away from REIT ETFs.

- But there are a few exceptions that I like.

- RIET provides high yield and upside.

- I do much more than just articles at High Yield Landlord: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Feverpitched

Earlier this year, I explained in a separate article why I am staying away from real estate investment trust exchange-traded funds like the Vanguard Real Estate ETF .

There are three main reasons:

- Reason #1 – REIT ETFs are typically market cap weighted: This means that most of the capital will be invested in the largest and best-known REITs and little will be invested in the smaller and lesser-known REITs. Since the larger REITs typically trade at a large premium, you end up overpaying for your REIT exposure.

- Reason #2 – REIT ETFs pay a very low yield: I believe that real estate and by extension, REITs, should be an income-driven investment first and foremost. But REIT ETFs only pay a ~3% yield in most cases because they are mainly invested in expensive, large-cap REITs and higher-growth property sectors. A low yield in itself is not a bad thing, but it is not what I am looking for. At High Yield Landlord, we target a 6% dividend yield.

High Yield Landlord

But this does not mean that all REIT ETFs are bad.