Real Estate Investment Trust In Canada

- REITs allow you to invest in real estate without needing to manage a property.

- Investors receive the rental income as a dividend.

- There are different categories, such as residential, commercial, industrial, and more.

- They are normally publically traded on the Toronto Stock Exchange but can be private investments.

REITs allow you to invest in real estate without the hassle of owning a home. There are many variations, including stocks, ETFs and mutual funds. These options allow you to invest for as little as one dollar, with no upkeep of a physical property required.

Bmo Equal Weight Reits Index Etf

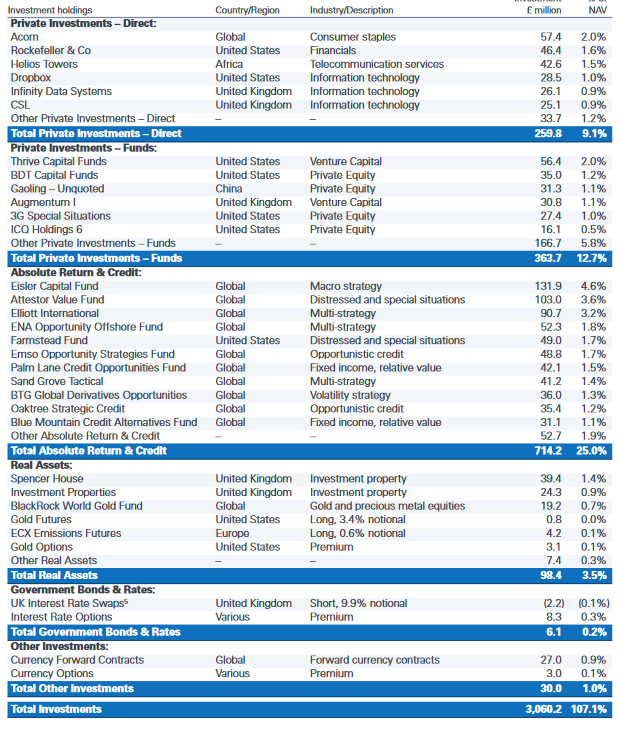

BMOs REIT ETFfollows the Solactive Equal Weight Canada REIT Index. This index puts equal weight on 22 REITs. For example, WPT Industrial REIT makes up 5.80% of the index, Boardwalk REIT makes up 4.76% of the index, and Choice Properties makes up 4.42% of the index. Over the past five years, BMOs REIT ETF had a return of 36.5%, with a dividend yield of 3.716% annually. BMO charges a maximum annual management fee of 0.55%, for a management expense ratio of 0.61%

How Does A Company Qualify As A Reit

To qualify as a REIT, a company has to meet specific requirements as mentioned below.

Don’t Miss: E Commerce Companies To Invest In

Reit Etfs You Need To Be Looking At For September 2022

Real estate is a wonderful asset class that has made countless investors rich over the years. Much like a diversified portfolio of Canadian dividend stocks, its an easy no-brainer addition to your portfolio.

Some people take this a step further and create their own real estate empire, consisting of a few rentals in their city. This is not an ideal way to get your real estate exposure.

If you’re looking for broader exposure to the market, you’ve come to the right spot. There’s an easier way to get exposure to the real estate sector. And that is through REITs.

In this article, I’m going to be going over some of the best Canadian REIT ETFs for 2022 and beyond. But first, lets look at why owning these REITs is a better idea than becoming a landlord.

How To Invest In Real Estate Investment Trusts

Like popular public stock, investors may decide to buy shares in a particular REIT that is enlisted on the major stock exchanges. They may do so in the following three ways.

- Exchange-traded funds: With this particular investment option, investors would avail indirect ownership of properties, and would further benefit from its diversification.

Notably, REIT as an investment option tends to resemble mutual funds, the only difference being that REIT holds properties instead of bonds or stock options. Additionally, REIT investors are entitled to avail the assistance of financial advisors to make more informed decisions in terms of investing in an appropriate REIT option.

Read Also: How Start Investing In Real Estate

Consider Taking Advantage Of The Motley Fools Real Estate Winners Service

The Motley Fool offers some of the most trusted investing services online today, and if you want to get serious about real estate investing, its worth looking into the companys Millionacres Real Estate Winners service.

With the service, youll gain access to monthly investing alerts that cover REIT and real estate stock investing opportunities. Youll also receive a quarterly top 10 report and access to the firms real estate investment research center, a platform with all the tools youll need to make wise decisions in the world of real estate.

For just $249 per year, youll have everything you need to learn to become a profitable real estate investor and build real wealth.

Vanguard Ftse Canadian Capped Reit Index Etf

Vanguards REIT ETFfollows the FTSE Canada All Cap Real Estate Capped 25% Index, which is mainly composed of REITs, with 25% being stocks of real estate companies. For example, FirstService Corporation makes up 13%, and Colliers International Group makes up 7.5%. This allows the index to follow small-cap, mid-cap, and large-cap real estate stocks and REITs.Over the past five years, VRE had a return of 45%, with a dividend yield of 2.89%. Vanguard charges an MER of 0.38%.

Don’t Miss: How To Start Investing In Canada

Are Reits Safe During A Recession

Investing in certain types of REITs, such as those that invest in hotel properties, is not a great choice during an economic downturn. Investing in other types of real estate such as healthcare facilities or retail is a great way to hedge against a recession. They have longer lease structures and thus are much less cyclical,

Are Dividend History Growth And Yield

We will look at Alexandria Real Estates dividend history, growth, and yield. We will then determine if its still a good buy at current prices.

Alexandria Real Estate is considered a Dividend Contender, a company that has increased its dividend for more than ten years. In this case, Alexandria Real Estate has increased its dividend for 12 consecutive years and the most recent dividend increase was 3%, announced in May 2022.

Don’t Miss: High Quality Fixed Income Investments

What Are The Three Types Of Reits

- Equity REIT commonly used REITs that invest in properties. Income is generated in the form of rent, mainly from leasing office space, warehouses, and hotels, and is eventually distributed as dividends to shareholders.

- Mortgage REIT earnings are generated from mortgages, via lending money to real estate owners or buying existing mortgage-backed securities. The margin between the interest earned on mortgage loans and the cost of funding these loans is the income derived from this investing activity.

- Hybrid REIT combination of investments in properties and mortgages by owning properties while also extending loans to real estate investors. Revenue comes from both rent and interest income.

Alexandria Real Estate: Undervalued Reit

Alexandria Real Estate : Undervalued REIT. The overall Real Estate Investment Trust sector has been down a lot year to date. For example, the office REIT category has been down 21.9% since the start of 2022. In addition, the REIT Industrial category is down 18% year to date. This decline provides long-term investors with some opportunities in the Real Estate sector.

For example, Alexandria Real Estate Equities, Inc. is one company I have had my eye on, and it looks like an excellent area to pick up some shares as it is near a support level at around $140 per share. The chart below shows that the $130 $140 level was once a support level at four different times. In addition, the stock is trading at $145 per share. Thus, the REIT looks like it is in an excellent range to pick up shares. Next, we will determine if Alexandria Real Estate is an undervalued REIT and deserving of our hard earned money.

Read Also: How Can I Invest In Foreign Stocks

Overview Of Alexandria Real Estate Equities

Alexandria Real Estate Equities is an S& P 500 Index urban office REIT. The company is the first, longest-tenured, and pioneering owner, operator, and developer uniquely focused on collaborative life science, agricultural tech, and technology campuses in innovation cluster locations. The REIT has a total market capitalization of about $24.3 billion and an asset base in North America of 74.1 million square feet as of June 30, 2022.

Alexandria Real Estate was founded in 1994. The REIT pioneered this niche and has since established a significant market presence in major clusters, including Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland Life Science Corridor, and the Research Triangle. Alexandria Real Estate has a longstanding and proven track record of developing Class A properties clustered in urban life science, agricultural tech, and technology campuses that provide its tenants with highly dynamic and collaborative environments that enhances their ability to successfully recruit and retain world-class talent and inspire productivity, efficiency, creativity, and success.

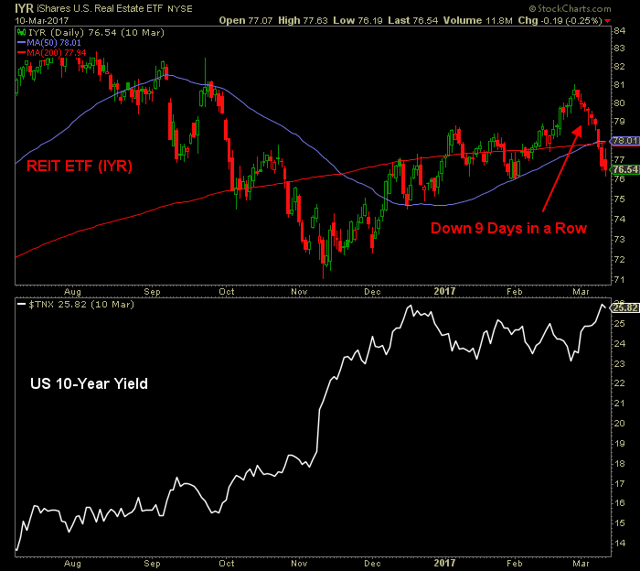

Alexandria Real Estate is down ~36% since its all-time high in January 2022. The primary driver of the stock price decrease has nothing to do with the company itself, as earnings are expected to grow about 12% in 2022 and are expected to grow roughly 8% in 2023. Instead, it has to do with the increase in interest rates, as this affected all REIT stocks in the markets.

What Types Of Reits Are There

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs . This is one of the most important distinctions among the various kinds of REITs. Before investing in a REIT, you should understand whether or not it is publicly traded, and how this could affect the benefits and risks to you.

Also Check: How Do I Invest In Something

Invesco S& p/tsx Reit Income Index Etf

TheInvesco REIT Income Indexis an ETF that follows the S& P/TSX Capped REIT Income Index. This index tracks 19 Canadian REITs that pay dividends and rebalances twice a year in January and July. The index’s holdings are based on the REIT’s risk-adjusted dividend yield. The higher the REIT’s dividend yield, the more weight is placed on that REIT. Over the past three years, Invesco REIT ETF returned 24%. The ETFs dividend yield is 3.847%.

Who Should Invest In Reits

Since REITs own and manage high-value real estate properties, they are one of the most expensive avenues of investments. Consequently, investors who park their funds in REITs are those who have substantial capital at their disposal. For example, big institutional investors like insurance companies, endowments, bank trust departments, pension funds, etc. can suitably invest in these financial tools.

Role of REITs in a Retirement Portfolio

Including REITs in ones retirement portfolio tends to prove beneficial for investments in several ways. The following pointers help gain valuable insight into the same.

Exposes portfolio to a diverse mix of properties

Opportunity to generate earnings

When the value of REIT appreciates, investors tend to earn substantial returns. Also, these companies are required to distribute as much as 90% of their taxable earnings to their shareholders, serving as an avenue to generate steady income.

Suitable for the long run

Unlike stocks and bonds which follow a business cycle of 6 years, REITs are more in sync with the movement of the real estate market. Notably, such movement tends to last for over a decade and hence further suitable for investors who are looking for a long-term investment horizon. In turn, it proves to be a profitable investment avenue for retirement planning.

Helps hedge inflation

You May Like: Bloomberg Where To Invest 10000

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Real Estate Investment Trust : How They Work And How To Invest

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Investopedia / Eliana Rodgers

Don’t Miss: Cash Out Refinance And Invest

A Stable Portfolio Management Team

Something that also applies to most investment strategies is the importance of a stable portfolio management team.

Portfolio managers that manage a strategy over a long period of time with great results are important to consider. A REIT ETF that experiences a lot of turnover with its portfolio managers should generally be avoided.

Economic Hardship On Lower Classes

The Link was called a “bloodsucker” by housing estate residents after the company acquired the Housing Authority shopping centres, renovated them, and raised rents. This has led to local shops being pushed out, higher prices, and the dominance of chain stores within the estates. This trend has reduced entrepreneurship opportunities for lower income people in Hong Kong’s public housing estates and new towns, diminishing their chances to achieve social mobility, and has increased the cost of living.

A 2012 campaign by The Link to promote “nostalgic restaurants” in its shopping centres was widely derided on social media as hypocritical. Users on Golden Forum and Facebook wrote that the company “first killed the shops, then makes money from their death” and criticised the company for only allowing chain stores in their properties.In 2006, The Link cut thousands of staff, a move “fiercely criticised by unionists, who said Link Management had dishonoured a pledge to protect the welfare of its frontline workers when it took over the operation from the Housing Authority”. The Link replied that “the job cuts were in line with private practice”.

By mid 2015, NGO Link Watch published a report that showed big chains made up 76 per cent of the 2,075 shops in 22 shopping centres run by the firm, but the Link’s CEO claimed, “We continue to maintain roughly 60 per cent of our shops leased to smaller operators.”

Read Also: How Does Betterment Investing Work

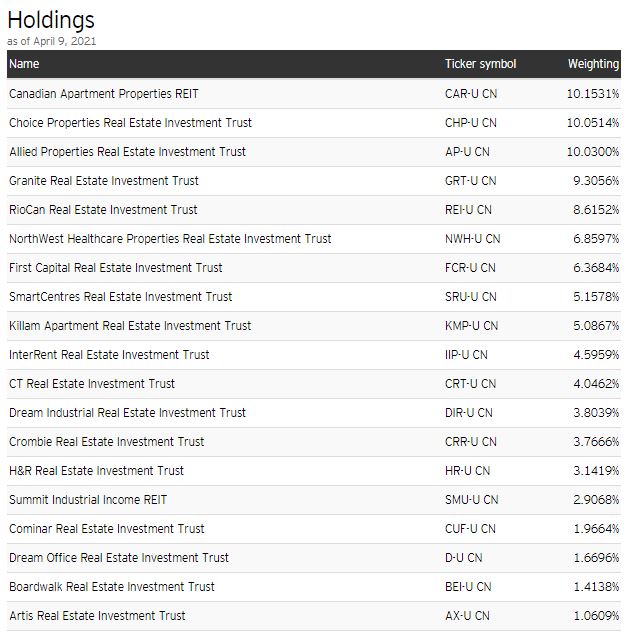

Ishares S& p/tsx Capped Reit Index Etf

iShares Capped REIT ETFfollows the iShares S& P/TSX Capped REIT Index ETF, which limits any individual REIT to a maximum of 25% of the ETFs portfolio. The largest holding is Canadian Apartment Properties REIT, which makes up 15%, followed by RioCan at 10%. Over the past five years, XRE had a return of 23%, with a dividend yield of 2.775%. Including dividend distributions, the total 5-year return was 46%. iShares charges an MER of 0.61%.

Understanding Fees And Taxes

Publicly traded REITs can be purchased through a broker. Generally, you can purchase the common stock, preferred stock, or debt security of a publicly traded REIT. Brokerage fees will apply.

Non-traded REITs are typically sold by a broker or financial adviser. Non-traded REITs generally have high up-front fees. Sales commissions and upfront offering fees usually total approximately 9 to 10 percent of the investment. These costs lower the value of the investment by a significant amount.

Special Tax Considerations

Most REITS pay out at least 100 percent of their taxable income to their shareholders. The shareholders of a REIT are responsible for paying taxes on the dividends and any capital gains they receive in connection with their investment in the REIT. Dividends paid by REITs generally are treated as ordinary income and are not entitled to the reduced tax rates on other types of corporate dividends. Consider consulting your tax adviser before investing in REITs.

You May Like: Private Money For Real Estate Investing

Revenue And Earnings Growth / Balance Sheet Strength

We will now look at how well the REIT performed and grew its FFO and revenue throughout the years. When valuing a company, these two metrics are at the top of my list to study. Without revenue growth, a company cant have sustainable FFO growth and continue paying a growing dividend.

Alexandria Real Estate revenues have been growing modestly at a compound annual growth rate of about 15.2% for the past ten years. Net income, however, did much better with a CAGR of ~21.1% over the same ten-year period. However, FFO has grown 4.5% annually over the past ten years and has a CAGR of 8.1% over the past five years.

Source: Portfolio Insight*

Since revenue, net income, and FFO did have good growth over the years, we will determine if this stock is attractive based on its valuation and dividend yield. We will talk about the companys valuation later in this article. In the meantime, analysts predict that the company will grow FFO at a 5% rate over the next five years.

Last years FFO increased from $7.53 per share in FY2020 to $7.50 per share for FY2021, a decrease of 0.4% considering the challenging two years because of the COVID-19 pandemic. Additionally, analysts expect Alexandria Real Estate to make an FFO of $8.41 per share for the fiscal year 2022, which would be a ~12% increase compared to FY2021. This growth is something I like to see that future earnings continue to grow.

Harvest Global Reit Leaders Income Etf

For exposure outside of Canada,Harvest Global REIT ETFcomprises REITs and REOCs from around the world. The most significant geographic allocation is the United States, with 65.6% weighting, Australia at 10.6%, the United Kingdom at 5.5%, and Singapore at 5.4%. HGR invests in various REITs, including hotel and resort REITs, mortgage REITs, and specialized REITs, such as telecommunications infrastructure. Mortgage REITs purchase mortgages and mortgage-backed securities . Highermortgage rates, a trend seen throughout Canada in 2022, will increase the yield of mortgage REITs. The ETF aims to also generate income by using a covered call strategy. The ETF will write covered call options to generate income, which helps to boost the ETF’s dividend yield. Over the past five years, HGR returned just 0.3%, with a dividend yield of 5.61%. HGRs total 5-year return was 22% when accounting for dividend distributions. HGR charges an MER of 1.36%.

Also Check: What Are Some Of The Investing Options Offered At Banks