How Much To Invest In Bitcoin

How much to invest in Bitcoin will ultimately be up to you and your comfort level. The most common advice people receive when investing in anything, let alone first starting to invest in Bitcoin, is never to invest more than you can comfortably afford to lose.

In the future, Bitcoin could reach $500,000, or it could also go to zero. There is no way to know what will happen, but with such new technology comes a binary outcome. In other words, it will either be adopted or it will not. If it is adopted, the scarcity of Bitcoin could make it one of the hottest assets in the world.

It could be worthwhile to start small with just tiny Bitcoin increments before jumping in with a more considerable investment. Bitcoin can be purchased in any denomination, with the smallest amount being 0.00000001 BTC, also known as a Satoshi.

What Are The Risks And Drawbacks

As you might expect with a highly speculative investment, cryptocurrencies carry notable risks, including:

- Volatility: Cryptocurrency prices historically have been highly volatile, and fluctuations could result in significant financial losses.

- Fraud: According to the Federal Trade Commission, Many people have reported being lured to websites that look like opportunities for investing in or mining cryptocurrencies, but are bogus. And while login credentials are typically required to access a cryptocurrency exchange, these can be stolen or lost.

- Lack of recoverability: With conventional financial accounts, theres normally a recovery process if you forget or misplace your login credentials. If you lose your cryptocurrency key, however, you cannot retrieve your cryptocurrency. Similarly if you lose access to the place where you store your key, you will effectively lose possession of your cryptocurrency.

Buy Bitcoin To Diversify Your Portfolio

and even if youre a die hard skeptic, you still need some

Okay, How Much Should I Invest in Bitcoin?

Yales Recommendation on How Much Bitcoin to Buy

The Yale economist Aleh Tsyvinski recommends that Bitcoin should occupy 6% of every portfolio in order to achieve optimal construction. Even those who are strong bitcoin skeptics should maintain 4% BTC. The study indicates that even the staunchest opponents of the cryptocurrency world are best off investing 1% of their assets in this space, if only for diversification purposes.

However, before you act on this, please continue reading and finish the article. Below, I summarize eight authoritative recommendations in a nice chart for you.

On top of this, they practice what they preach. Because In 2018, Yale dipped its toes into the cryptocurrency space by investing in a $400M fund called Paradigm. You can read more about that here. Paradigm aims to invest in early cryptocurrencies, blockchain technology and exchange projects. Lets pause here for a moment, Yale not only started invest in crypto, but dove headfirst into deep end by allocating capital to the riskiest segment of Crypto!

Similar Recommendations from Arizona State University

Any Other Recommendations?

Industry Recommendations On How Much Bitcoin to Buy

For my Canadian readers, Ive arranged the following getting started with Bitcoin deals:

WealthSimple Crypto is secured and regulated

Easy to use mobile app.

No commissions

Recommended Reading: When Is The Best Time To Invest In Stock Market

Bitcoin Price Before Halving:

The above chart image is from GandoTrader.

Bitcoins first parabolic run happened in 2011 but then the price quickly crashed till the end of the year. Before halving in 2011 the price of Bitcoin was approximately $2.50 and then at the parabolic peak, it went up to $30.

But, before the halving Bitcoin price went down drastically and then started creeping up in 2012 till it reached the price of $12.35. This is exactly what is happening now in 2019.

At the moment Bitcoin price is following the same pattern. If history repeats itself then the price of Bitcoin should go up next year before the month of May.

If you want to earn a good profit within a period of six months, then you should start accumulating more Bitcoin. This is the right time to enter the market and take a position.

A Better Way To Invest

Bottom line? The road to building wealth is slow and steady, and there are still way too many unknowns when it comes to cryptocurrency. Could crypto become a more legit way to invest later on down the road? Sure. But as things stand today, just say no.

Get-rich-quick schemes are just thatschemes. Dont risk it and pour all your hopes, dreams and money into them. Instead, sit down with a SmartVestor who knows what theyre doing. Let them walk you through a solid strategy for investing that doesnt involve trying to build wealth through risky investments like crypto. And dont knock that 401, folks. Its the number 1 wealth-building tool of millionaires!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Recommended Reading: Errors And Omissions Insurance For Registered Investment Advisors

Whats The Minimum Bitcoin Investment You Can Make

There is no minimum amount of Bitcoin you need to buy to get started. The only minimum is the one set by the platform on which youll invest in your first pieces of Bitcoin. For example, Coinbase allows the minimum Bitcoin investment from $2.

However, I do not recommend buying such a small amount of Bitcoin because exchange platforms charge fees for buying, selling and transferring cryptocurrencies. These fees will kill your investment quickly if you decide to go for the minimum investment..

All in all, I recommend investing in a minimum of 50$, even if you can invest lower amounts that should be your Bitcoin minimum purchase.

What Are The Most Popular Venues For Buying Bitcoin

The most popular venues for buying bitcoins are cryptocurrency exchanges, brokerages, and payment services like PayPal. For indirect ownership of bitcoin, investors can choose to invest in companies that hold the cryptocurrency on their balance sheets, such as Tesla, Inc. or MicroStrategy Incorporated .

Recommended Reading: Should You Invest In Crypto

The Composition Of A Good Crypto Portfolio

Stillman says that your crypto portfolio should look just like any other part of your investment portfolio. It should be diversified and match your risk tolerance.

You should use cryptocurrencies that youve researched and feel comfortable investing in. Read the whitepapers on them to better understand how they work and their objective, she says. Dig into who is behind them and know their track record.

An important question is why youre buying crypto and your plans. Are you buying because your friends told you to? Is it for the short- or long-term gain? What are you planning on doing with any gains you earn? Some crypto is liquid, and some is not, Stillman points out. How important is that to you?

A good crypto portfolio lets you hold it through bear and bull markets without losing sleep at night. If the crypto portion of your portfolio is sized too large or concentrated in speculative altcoins, you risk having paper hands, a term used to describe investors who sell out of fear at the first sign of a downturn, Samsonoff says.

Inversely, if you are sized too small, you risk getting greedy as confirmation bias kicks in after crypto has been rallying, and you potentially buy into a top after feeling sidelined on the way up, he says.

Investing In Bitcoin In 202: Is It A Good Idea

A return on Investment of 100 million% over the last decade suggests that investing in Bitcoin is almost always a good idea. Timing when you will buy or sell is the tricky part of maximizing returns and profiting from the market and its high volatility.

As 2022 has shown, Bitcoin most certainly can fall quite drastically. However, history has shown us that every time the market drops like this, it is only a matter of time before it picks itself back up. The problems in the crypto world are just as much external as they are internal at the moment, and if crypto is something that you think will survive, Bitcoin will almost certainly remain at the forefront. With Bitcoin, its a bit of a binary question. The question is, Will crypto stick around?

Longer-term holders, also known as HODLers, will look at 2022 as another opportunity to pick up value in a market that will eventually reach $1 million. Whether or not that will be the case is an entirely different question, but right now, there is nothing that suggests we could not see yet another explosive move to the upside. It is worth noting that every time we collapsed like this, the market made higher highs.

You May Like: How To Invest In Lyft

Appendix: What Are In The Four Indices

Bitcoin: the OG of crypto markets deserves its own category and is in many ways the true benchmark for any other crypto market.

Smart contract platforms: after bitcoin, the big innovation was to have blockchains that were more programmable. These could host smart contracts or decentralised applications and have allowed the emergence of the metaverse and defi. Ethereum is the most popular version of a smart contract platform. As well as ethereum, we also include some key competitors. The constituents of this index are: Ethereum , Cardano , Avalanche , Solana , Fantom , VeChain , Terra , EOS , and Chainlink . We also include Polkadot which allows interoperability between blockchains and the use of smart contracts via parachains.

Metaverse: coins associated with the creation of a virtual space/digital world on the internet using a combination of augmented reality, virtual reality, and social networks. The constituents of this index are Axie Infinity , The Sandbox , Decentraland , Enjin Coin , Aavegotchi , Terra Virtua Kolect , Ultra , Phantasma , RedFOX Labs , and Gala .

financial services built on top of blockchain networks with no central intermediaries. This can be a broad category, so we narrow this down to platforms that focus on lending/borrowing, yield farming, automated market making and decentralised exchange tokens. The constituents of this index are: Aave , Compound , Uniswap , Yearn.finance , Loopring , PancakeSwap , Maker , 1inch , Thorchain , and Terra .

Does Schwab Recommend Investing In Cryptocurrencies

Bitcoin and other cryptocurrencies are speculative investments, in our view. We don’t believe that Bitcoin fits within traditional asset allocation models at this time, as it is neither a traditional commodity, such as gold, nor a traditional currency. Bitcoin’s dramatic volatility is driven primarily by supply and demand, not inherent value. Bitcoin doesn’t have earnings or revenues. It doesn’t have a price-to-earnings ratio, price-to-sales ratio, or book value. Traditional value metrics don’t apply, so there are no methods for assessing its value that we endorse or find persuasive.

Whether you should invest in cryptocurrencies depends on your goals and preferences as an investor, as it does with any asset or security. We suggest that clients approach it as a speculative investment and consider the high volatility and risks involved. For those who already have a diversified portfolio and a long-term investment plan, we see ownership of cryptocurrencies as outside the traditional portfolio.

1 Satoshi Nakamoto published the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” on Oct. 31, 2008.

Also Check: Best Investments Of The 1970s

Before You Buy Bitcoin

Privacy and security are important issues and investors who gain the private key to a public address on the Bitcoin blockchain can authorize transactions. Private keys should be secret and investors must be aware that the balance of a public address is visible.

Individuals can create multiple public addresses and distribute their collection of Bitcoin over many addresses. A good strategy is to keep significant investments at public addresses that are not directly connected to those used in transactions.

The history of transactions made on the blockchain is transparent but identifying user information is not. On the Bitcoin blockchain, only a user’s public key appears next to a transaction, making transactions confidential but not anonymous.

Is Day Trading Crypto Profitable

Day trading crypto markets can be extraordinarily profitable, assuming that your analysis and execution of trades are sound in principle. Those who traded bitcoin at the 2018 bottom and rode to the top before seeing the 2021 drop would have made a large sum of money. However, those who take advantage of the CFD market, and the ability to go both long and short with leverage, turned those profits into massive gains.

Read Also: How Do I Get Investors To Invest In My Business

Should I Invest In Cryptocurrency

Listen, you can try your hand at cryptocurrency if you want to. If you have some money youre willing to lose, money that you might have thrown away on a roulette wheel in Vegas instead, knock yourself out. Were not going to be mad at you for that. But we want you guys to win with money and secure your retirement futureand there is just no evidence that cryptocurrency is going to do that for you.

Plain and simpleinvesting in cryptocurrency is not a good way to build wealth for your future. Now, were not saying that cryptocurrency is going to go away. And were not saying it’s horrible. But we are saying that crypto doesnt have a proven track record of building wealth.

If you really want to invest in something with a solid track record, heres the better plan: If youre out of debt, have an emergency fund that will cover three to six months of expenses, and youre ready to invest, then focus on investing 15% of your income in growth stock mutual fundswhich are way more secure than crypto.

Dont give in to a craze just because theres a lot of hype. Weve talked to people who have taken out a mortgage or cashed out their entire 401 early to invest in cryptocurrencyheck no! Dont put it all on the line and risk your financial future, your retirement dreams and your familys well-being. If you cant afford to lose the money, dont invest it in something as unstable as crypto.

Amazon To Accept Bitcoin As Payment

If the rumours are true, the technology company could accept bitcoin payments which could drive the price of the cryptocurrency upwards.

This comes after Amazon posted a job advert looking to hire someone to develop its digital currency strategy.

Amazon isnt the only tech giant to be branching into cryptocurrency there are rumours circulating that Apple will use some of its large cash reserves to invest in bitcoin.

Given the huge volatility and that the use case of crypto currencies is far from proven, traders should only dabble with money they can afford to lose.

Susannah StreeterSenior Investment and Markets Analyst, Hargreaves Lansdown

Also Check: 20 Percent Down Investment Property

Is Bitcoin A Good Investment A Look Back At 2021 Performance

With such a substantial ROI in the past, investors will often wonder if Bitcoin is a good investment in the long term or if the best gains are in the past. 2020 was a very strong year for Bitcoin, as stimulus due to the pandemic had central-bank printing presses going full speed. Because of this, investors started to pile into Bitcoin as it has a limited supply.

As there will only be 21 million BTC, it creates scarcity, especially in the face of massive US dollar printing. Those who feared inflation and had cash reserves that were losing value started buying assets, with some of that flowing into the cryptocurrency markets. This was the beginning of a significant uptrend.

However, the market got far ahead of itself in 2021, breaking above the $60,000 level. At that point, the market has pulled back, and as we have seen in 2022, Bitcoin has fallen quite drastically. We have seen massive selloffs previously, and Bitcoin has always managed to turn itself around. Bitcoin is a bet on crypto being a disruptive technology.

With uncertainty, there is opportunity. This is a market that has been overbought, followed by oversold. If the Federal Reserve finds itself in a situation where it has to pivot its monetary policy due to a recession, that could be the catalyst for the next great bull run in Bitcoin.

How To Buy Bitcoin With Paypal

You can also buy bitcoin through a payment processor like PayPal Holdings, Inc. . There are two ways to purchase bitcoin using PayPal connecting your account to a debit card or bank account or using the balance of the PayPal account to purchase cryptocurrencies from a third-party provider.

Four cryptocurrencies, Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, can be purchased directly through PayPal. Except for those who live in Hawaii, residents of all states can either use their existing PayPal accounts or set up new ones. You can also use your cryptocurrencies to purchase products and services through the “Checkout With Crypto” feature.

When you buy bitcoin directly from PayPal, it earns money from the crypto spread or the difference between Bitcoin’s market price and its exchange rate with USD. The company also charges a transaction fee for each purchase. These fees depend on the dollar amount of the purchase.

A disadvantage of purchasing cryptocurrencies through PayPal is that an investor cannot transfer the crypto outside the payment processor’s platform to an external crypto wallet or personal wallet and few exchanges and online traders allow the use of the payment processor to purchase payment. eToro is among the few online traders that allow the use of PayPal to purchase bitcoin on its platform.

Don’t Miss: Can Illegal Immigrants Invest In Stock Market

Is Buy The Dip A Good Strategy

The principle of buy the dip is based on an assumption price drops are temporary aberrations that correct themselves over time. Dip buyers hope to exploit dips by buying at a relative discount and reaping the rewards when prices rise again.

Crypto markets are volatile, so buying cryptocurrencies at any price let alone a dip that might become a long-term trend is risky. While prices could return to previous levels, they could also fall even further, leaving your investment underwater.

If the past is prologue, then the current dip could bounce back as it did last year, when prices fell to similar levels before returning to pre-dip levels and even peaking in the autumn. But of course, they might not.

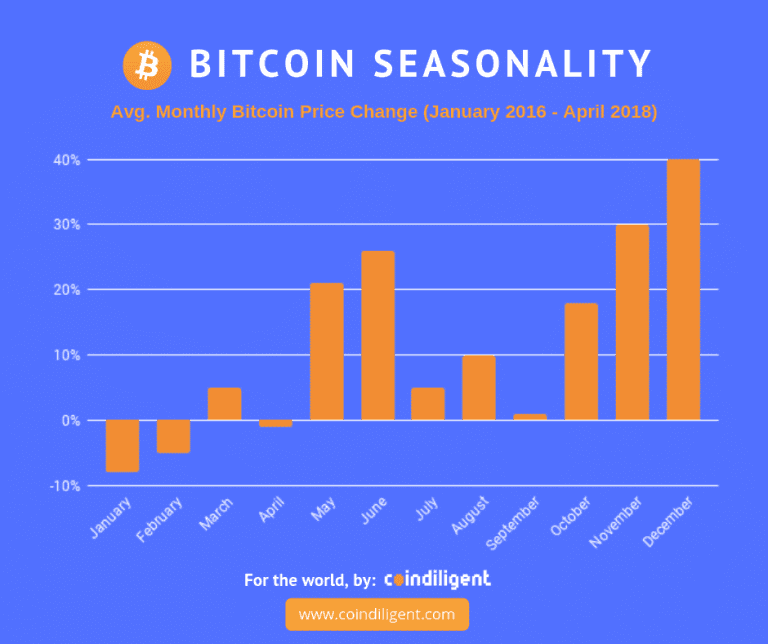

Bitcoin prices in particular have shown a degree of seasonality to date, appearing to fall in value to lesser or greater extents in the spring before bouncing back in early summer. However, as with every kind of investment, let alone the unpredictable world of cryptocurrencies, past performance is no guarantee of future results.

Oleg Giberstein said: Many a novice investor has been burned trying to catch falling knives.

He advises those committed to buying the dip to decide on a set amount of money theyre comfortable with using to buy BTC or ETH each month and not to worry too much about what happens to prices over the next two years.

*Correct at time of writing