Whats A Financial Advisor

A financial advisor refers to any individual who helps you manage your money. Within the broad financial advisory category there are many distinctions including level of expertise and credentials. Pricing varies among financial advisors as well. Financial advisors provide services from investment management, to tax and estate planning.

Like robo-advisors, there are many distinctions among financial advisors.

What’s A Robo Advisor

A robo advisor is an affordable digital financial service that uses technology to help automate investing based on information investors provide about themselves and their financial situation. “Robo” refers to these services being almost completely digital, and that computers, smartphones, or tablets are used to access and interact with your accounts. “Advisor” speaks to the investment advisors that offer digital advice and account management services, often for a lower fee than traditional investment advisory services.

hidden

Vanguard Personal Advisor Services Drilldown

Vanguard Personal Advisor Services uses a similar automated investment management style used by other robo advisors. But youll also have the benefit of regular consultations with live financial advisors who are available by phone or by email, Monday through Friday, from 8:00 AM to 8:00 PM, Eastern Time.Planning services include retirement and other financial goals, tax optimization, Social Security planning, Roth conversions, estate planning and trust services. They can accommodate individual and joint brokerage accounts traditional, Roth, rollover and SEP IRAs, trusts, and 401 plans held through Vanguard.One of the advantages to working with Vanguard is youll get the benefit of a portfolio constructed of Vanguard funds. With an average weighted expense ratio of just 0.09%, these funds offer some of the lowest expense ratios in the industry. Thats the reason why Vanguard funds are so widely used by the robo advisor industry.Vanguard Personal Advisor Services requires a minimum initial investment of $50,000. But the annual advisory fee is just 0.30% on portfolios up to $5 million. Above $5 million, the advisory fee stair steps down, going all the way down to 0.05% for balances over $25 million.

In addition to Vanguard Personal Advisor Services, Sofi Automated Investing also offers a hybrid option, with access to a team of financial advisors and career coaches at no additional cost.

Read Also: Best Investment Site For Small Investors

Lack Of Access To Other Services

Another downside to using a robo-advisor is that it will exclusively be an investment advisor, not offering any other form of advice.

Meanwhile, a dedicated financial advisor will likely offer a comprehensive range of financial planning services.

This could include everything from offering investment advice and asset allocation, to the most appropriate retirement accounts, all the way through to estate planning.

Whatever you want to achieve in your financial life, a traditional advisor will be able to help you with expert advice. Youll miss out on this service with a robo-advisor.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Recommended Reading: Merrill Edge Guided Investing Fees

What Is Diy Index Investing

Index investing is the formal term for using index funds to accumulate diversified holdings across one or more major equities benchmarks. Unlike managed funds, the composition of an index fund is derived from the underlying index the fund is mimicking.

This means that index funds do not require stock pickers or fund managers, leading to ultra-low-cost management fees and expense ratios.

To get started with DIY index investing, you can either purchase units in an index tracker mutual fund, or you can begin accumulating index-mimicking shares via an ETF. For example, an investment in VOO, Vanguards S& P 500 index ETF, would give you exposure to the same 500 publicly-owned companies that currently comprise the S& P 500 stock market index.

Remember, even though the S& P 500 is the most well-known index, DIY index investors can choose from a massive range of other index fund products. Thanks to the rampant financialization of the global economy, there is an equities indexand a corresponding index fundfor almost every financial market in the world.

Also Check: Rental Real Estate Investing For Beginners

Are Robo Investors Safe

Yes. Robo advisers that provide a Holder Identification Number ownership model are a safer and more transparent alternative for investors. Also, ensure your robo adviser has an AFSL.

HIN ownership means clients are not exposed to counterparty risk. Stockspot offers a full HIN ownership model. This simply means that a clients shares are owned by them and not by Stockspot. Shares are not pooled with other investors either. This also applies to a clients cash account.

If anything happened to Stockspot, it wouldnt impact a clients investments as those are owned by the client. Clients can simply transfer their investment in and out of Stockspot as needed. The client remains the legal owner.

Recommended Reading: Whats A Good Bond To Invest In

High Barriers To Entry

Traditionally, financial advisors require fairly significant assets to begin working with a client. A human advisor likely wont work with an individual who has less than $250,000 in assets. A robo-advisor doesnt judge you on the size of your balance sheet, in some places, like Acorns, you can start investing with just a couple of cents!

Are Robo Advisers Good For Beginners

Yes. Robo advisers are perfect for beginners.

For those new to investing, robo advisers take into account your goals, risk profile, and investing time frame. From there, a portfolio of shares is built for you to invest in. Robo advice frees up clients time too, so there is no need to track the ASX, no need to see what is happening on the stock market daily, and no need to follow meme stocks.

Read Also: Second Home Vs Investment Property Interest Rates

When You Should Use A Financial Advisor

Although robo-advisors have taken off tremendously well and are still in their early stages of development, lots of investors would still choose a traditional financial investor to take sweet care of their money. Here are some signs to look off for to help you decide if this is you.

You are not comfortable using technology or making business transactions online.

Younger generations who grew up with technology have more of an understanding and are more comfortable using it to make transactions online. But this might not be you. If not, theres no need to worry because thats what financial advisors are here for.

You value direct human contact. If speaking to someone one to one, and building a personal relationship is important to you then financial advisors are definitely your way forward. Not only do financial advisors play a portfolio management role, they also talk things out with you, and help keep you on track of your goals.

While robo-advisors do generally have customer support, they wont know all the ins and outs of your goals and needs. They can only usually help with more general questions about their tools and services. This exemplifies one of the risks of robo-advisors.

Human Advisors Trump Automated Coaching Abilities Especially In Market Downturns

Investing is often less about the numbers and more about a clients hopes for the future as they relate to family, friends, and lifestyle. A human advisor can explain not only the what but the why of each investment decision, and can coach clients through life changes like career moves, divorce, inheritance, and paying off a mortgage. By contrast, a robo advisor doesnt know the clients family, their history, their values, or their personal goals.

Perhaps the greatest value a human advisor can offer is advice when markets become volatile. Research shows that most investors make the wrong investment decisions during times of market turmoil.2 A human advisor can help clients plan for the possibility of a down market by making sure their investment plan is aligned with their tolerance for risk, and by suggesting ways to reduce or eliminate the risks that threaten their plan. He or she can offer perspective and judgment that might prevent bad choices, such as panicked selling in a down market.

2 The Proof that Most Investors Are Their Own Worst Enemy, Brian Portnoy, June 13, 2016, Forbes, https://www.forbes.com/sites/brianportnoy/2016/06/13/a-good-example-of-some-bad-decisions/?sh=12a750cc38c1.

Don’t Miss: Jp Morgan Investment Banking Internship

Should You Use A Robo

As you can see from this list, the options for low-cost, automated investment management have evolved and expanded since the U.S. leader in the space, Betterment, arrived on the scene in 2010. And the now meaningful track record of Canadian robo-advisors shows they can at least compete on a performance basis with higher-cost forms of portfolio management. The next decision is up to you.

Use the information here as a starting point in your search for the best service for your needs, then delve deeper check out the providers website and chat with a representative to determine whether its fee structure, choice of account options, investment offerings and, ultimately, performance to date satisfies your expectations and requirements.

Michael McCullough is an award-winning writer, editor and content strategist based in Vancouver. The former editor of Alberta Venture and managing editor of Canadian Business, he focuses on the subjects of business and investment.

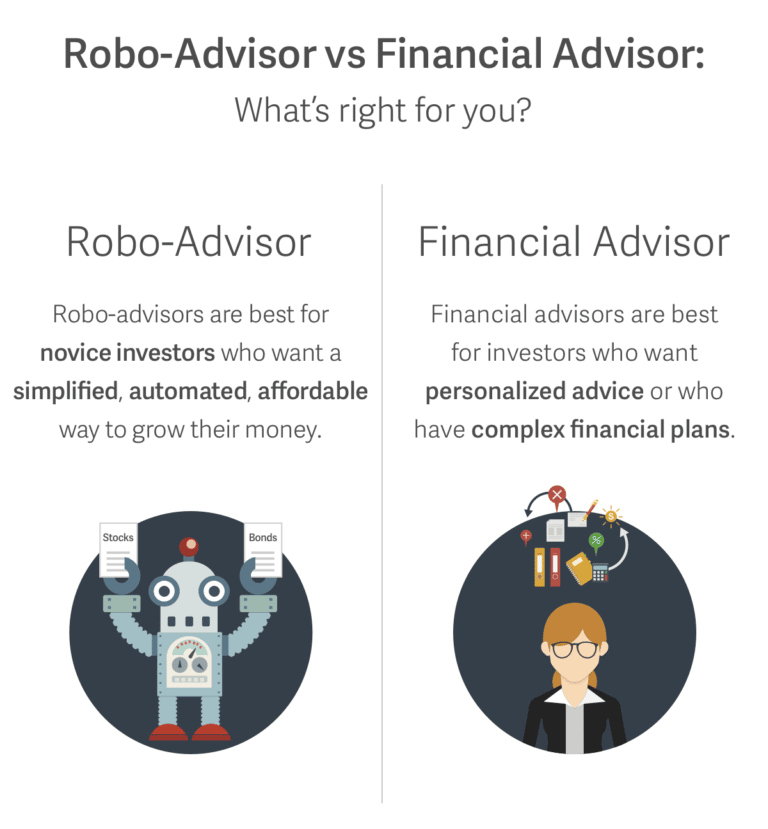

Are You A Beginner Or An Experienced Investor

Given the low cost and barrier to entry, robo-advisors are arguably better for beginners who have less capital and less confidence about investing.

That being said, you should still understand what youre getting into and not just blindly sign-up with a robo-advisor after reading this.

Alternatively, if youre more experienced, then you might need more options in order to fulfil your investment objectives.

As such, a financial advisor is probably a better idea.

Also Check: Wells Fargo Heloc On Investment Property

Who Wins The Battle Of Robo

So, who wins the battle for high returns? Should you trust a robo-advisor due to its objectivity and up-to-date theories? As you may have discovered by now, the answer is totally and utterly dependent on a plethora of factors.

Younger and newer investors who dont want to take out a loan to start investing, and would prefer to start slow, should take advantage of a robo-advisors low-fees.

Anyone who has grown up using technology for practically everything will not be phased by the lack of human contact, and might even feel slight relief by this.

Those with more experience, wealth, or who are not so trusting of, or familiar with technology, should go with a financial advisors personalized service, and begin building up a strong relationship with your assigned advisor.

Sure, financial advisors are more expensive, require a larger minimum account to work with, and of course, are prone to bias and human error, but nonetheless, these costs, and even downfalls could still bring more value, confidence, and peace of mind to your journey.

If you are still unsure but want to get started, we recommend you consider a robo-hybrid. This will give you a happy medium and at the least, help you figure out the next step.

How Can I Find Out More About Robo

Have questions about robo-advisors?

Want to learn more about the different types of robo-advisors in the market?

Well, youre in luck!

Well be having a special SeedlyTV episode, RoboWars 2: Choose Your Fighter, on 6 May 2020, 8pm!

Where therell be representatives from Autowealth, EndowUs, Kristal.Ai, StashAway, and Syfe who will be answering your questions LIVE.

Don’t Miss: Companies That Invest In Private Prisons

Robo Advisors Vs Index Funds: Key Differences

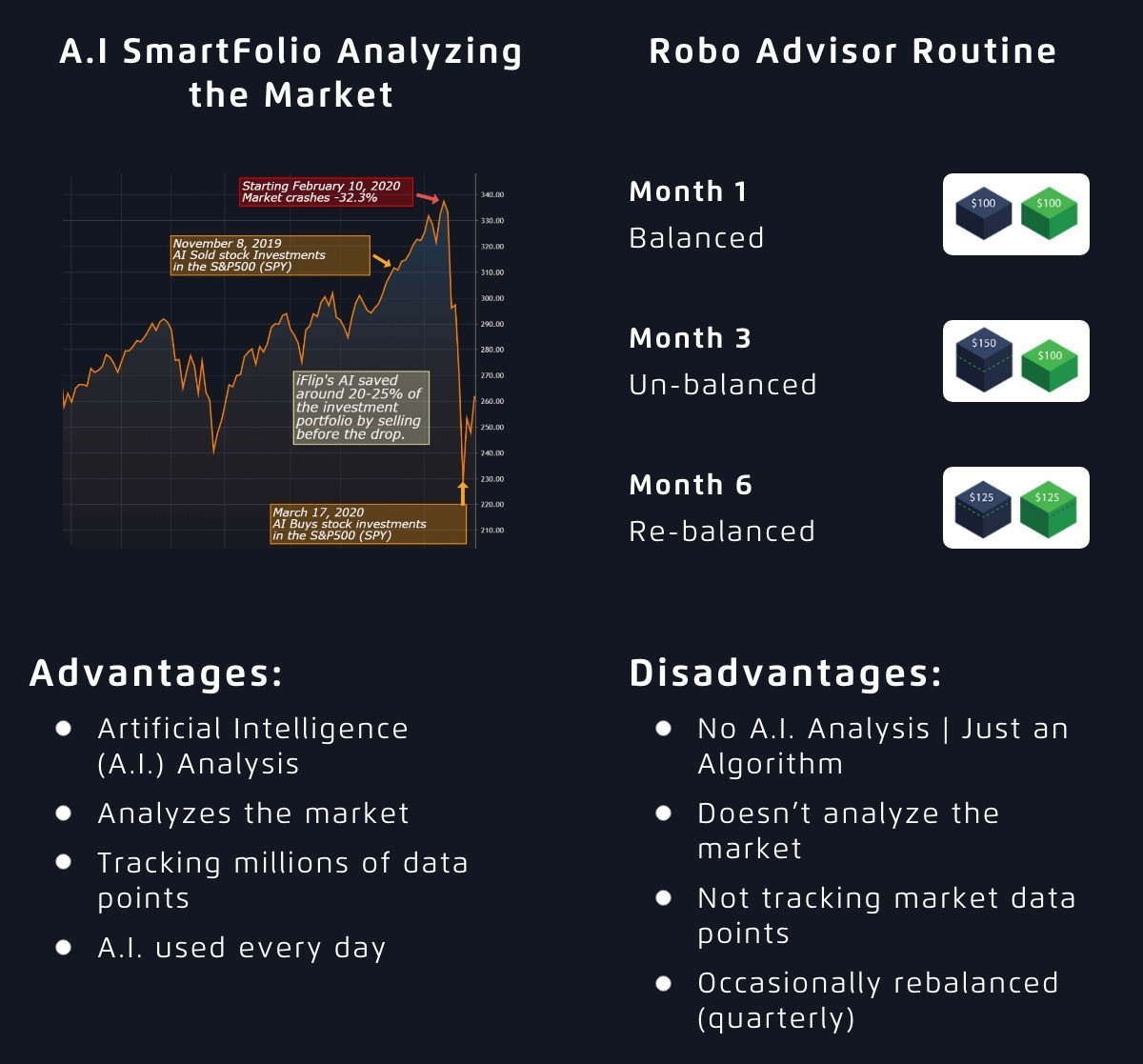

Robo-advisors and index funds both offer clients passive management-style investing. However, crucial differences might make one more suitable depending on your financial circumstances.

- Manual Input: Robo-advisors operate automatically once the client enters their financial goals and risk tolerance. Therefore, robo-advisors buy and sell stocks and bonds without manual input or oversight from a human manager or the client. Of course, clients can change their preferences and redirect a robo-advisors actions at any time. On the other hand, investors decide which index they want to buy or sell and can shift their money into a different index fund at will.

- Additional Services: Robo-advisors provide clients with services that help them define their financial goals and investment methods. Additionally, most robo-advisors can utilize tax-loss harvesting to minimize taxes owed on profitable investments. Index funds offer no additional services, only serving as investment vehicles that match specific portions of the stock market.

When Is Investing With A Financial Advisor Best

You have a complicated financial situation.

You need tax, estate planning and business succession advice.

You enjoy the comfort of having someone to call to discuss your financial situation.

You want someone to consult with about specific investment strategies.

Youre seeking guidance with more niche investing such as options trading or insurance strategies.

You want a fee for service or hourly pay model for your investment management.

You want a detailed and comprehensive financial plan.

Youre willing to pay a bit more for personalized service from an expert Certified Financial Planner.

Free: Financial Management Toolkit, Better Than Quicken

Read Also: How Do I Invest In An Opportunity Zone Fund

What Is A Financial Adviser

A financial adviser is a financial professional that offers financial advice to clients.

Financial advisers typically look at a clients income, taxation circumstances, and future financial needs.

Financial advisers help clients make financial decisions about what to do with their money. They look at investing in the share market, investing in property, tax minimisation strategies or other recommended courses of action.

Financial advisers usually service their clients face-to-face and online.

Questions To Ask A Financial Advisor

In your first meeting with a financial advisor, make sure you learn the answers to these questions and that youre comfortable with their responses.

- Are you a fiduciary?

- Are you always acting as a fiduciary?

- How do you make your money?

- What is your approach to financial planning?

- What financial planning services do you offer?

- What kind of clients do you normally work with?

- Do you have any account minimums?

- Do you have any conflicts of interest in managing my money?

- What information do I need to bring for you to look at when developing my financial plan?

- How many times and how often will we meet?

- Will you collaborate with my other advisors, like CPAs or attorneys?

Related:Find A Financial Advisor In 3 minutes

You May Like: Investing In Real Estate Through Lease Option

Your Finances Are Complex

As you grow your wealth, you may more help than a robo-advisor can offer. A financial advisor can work with your accountant to help mitigate your taxes and even an estate attorney to help with your will and other estate planning strategies. Your advisor may also give you advice on insurance to protect your wealth.

Decide How Much You Can Pay Your Financial Advisor

It used to be that financial advisors charged fees that were a percentage of the assets they managed for you. Today advisors offer a wide variety of fee structures, which helps make their services accessible to clients of all levels of financial means.

Commission-only advisors may seem free on paper, but they may receive a portion of what you invest or purchase as a payment. These free financial advisors typically are available through investment or insurance brokerages. Remember, these advisors may only be held to suitability standards, so they may end up costing what you would pay for a similar financial product suggested by a fiduciary financial advisoror more.

Fee-only and fee-based financial advisors may charge fees based on the total amount of assets they manage for you or they may charge by the hour, by the plan, through a retainer agreement, or via a subscription model. Common average financial advisor fee rates are listed in the table below:

| Financial Advisor Fee Type |

|---|

When evaluating advisors, be sure to consider their credentials as well as research their backgrounds and fee structures. You can view disciplinary actions and complaints filed against financial advisors using FINRAsBrokerCheck. And remember, just because someone is a part of a financial planning association, that doesnt mean theyre a fiduciary financial advisor.

Also Check: Using Home Equity To Invest In Real Estate

When Should You Use A Traditional Investment Advisor

While this writer personally trusts computers, that isn’t the case for everyone. If you are skeptical of robo advising or prefer the personal touch of working with a traditional advisor, the added costs could make sense for you.

You will likely have less in retirement, but you’ll also have the added option of being able to call someone for help with your money questions. And you could rest easier knowing someone is watching over your finances.

If you decide to work with a traditional investment advisor, it’s a good idea to work with an advisor who works in a fiduciary capacity, which means they must put your best interests ahead of their own.

Considerations When Choosing Which Is Best For You

Key considerations for choosing between a DIY approach or the hiring of a robo or financial advisor can be narrowed down to personal preference and the complexity of the portfolio.

- DIY: Investors who prefer to have control over their investments and portfolio management.

- Robo advisor: Generally suited for beginning investors or those with little or no need for financial planning beyond a simple investment portfolio.

- Human advisor: For investors who want personalized investment management and may need other financial planning services, such as estate planning or retirement planning

Don’t Miss: Best Investment For Regular Income