Investment Banking Vs Private Equity: The Differences

Just in case you havent already read the dozens of articles about this topic, the basic differences are:

- Investment Banking: You are like a real estate agent, but for businesses rather than properties. You represent companies and help them buy, sell, or raise capital, and you earn a commission when they do so.

- Private Equity: You are more like a real estate investor, buying homes and commercial properties, improving them, and then selling them again in a few years to earn a profit but you do this with largecompanies rather than properties.

You can earn a lot of money if youre successful in either field, but the ceiling is far higher in private equity for the same reason the ceiling is higher for real estate investors than it is for brokers: if an assets price increases by 2x, 5x, or 10x, the investors reap all the gains .

By contrast, if youre a broker or an investment banker, you earn commissions that are a small percentage of the selling price, no matter how well or poorly the deal performs afterward.

Undergraduates often start as investment banking analysts and then use the experience to move into other fields , such as private equity, hedge funds, and corporate development, after a few years.

Delicious Dining Wherever You Are

Whether theyre Michelin-starred or hidden gems, top restaurants often serve up sensational food alongside substantial waiting lists which is where we come in. What kind of thing can we do? It could be securing you a booking at the best table , ordering a complimentary glass of Champagne or perhaps even arranging a private kitchen tour with the chef5. Feeling creative? Well do everything we can to make a bespoke request happen.

What Is Investment Banking

Investment banking has to do with managing money from large companies. Investment banks do this by helping companies with mergers and acquisitions, manage capital, and or underwrite debt. Invest banks can also help companies do things like issue stock.

In short, investment banks operate as a way for large entitiesâwhether they be corporate or governmentalâto make big financial decisions.

These can include going public, making changes to management or the structure of the company, issuing new classes of stock, and the like.

Investment banks are also typically involved in helping companies with mergers and acquisitions.

For their part, investment bankers earn their commissions in a number of ways including via helping the companies they represent sell shares in public and or private capital markets.

Don’t Miss: Are Investment Advisory Fees Deductible

Private Equity Investment Vs Investment Banking

When it comes to investing your money, you want to understand as much as you can.

But there is a lot to know, things like: what’s the difference between private equity investment and investment banking?

We at DealRoom work a lot with both bankers and private equity firms by providing them a deal lifecycle management platform for deals executing and in this article, we will explore the answer to this and other pertinent financial aspects. As we have some expertise in this question.

Let’s start with explaining what is provate equity and investment banking. Btw if you need a quick answer – just scroll to the bottom.

Skills Required For Investment Banking & Private Equity

Lets take a closer look at the skillsets demanded of investment bankers and private equity associates.

Investment Banking Skills

As for the skills needed for investment banking, perhaps most important is the ability to think on your feet and make quick decisions. Investment bankers also need to be able to build strong relationships with clients and deal with difficult situations calmly and confidently. In addition, they must be highly analytical, have excellent mathematical skills, and be able to understand complex financial concepts. Finally, especially for analysts, excel modeling skills are critical. These are some of the most important investment banking skills you should focus on building if you are interested in breaking into this highly competitive field.

Private Equity Skills

As for private equity skills, professionals in this field similarly need to be highly analytical and have excellent mathematical skills. At the same time, they have a knack for quickly understanding the drivers of competitive advantage in an industry and why a companys business model is attractive or not. In addition, they need to have a deep understanding of the financial markets and be able to identify trends and opportunities. They also need to be able to negotiate deals effectively and build strong relationships with limited partners.

Also Check: Home Loan Investment Bank Warwick Ri

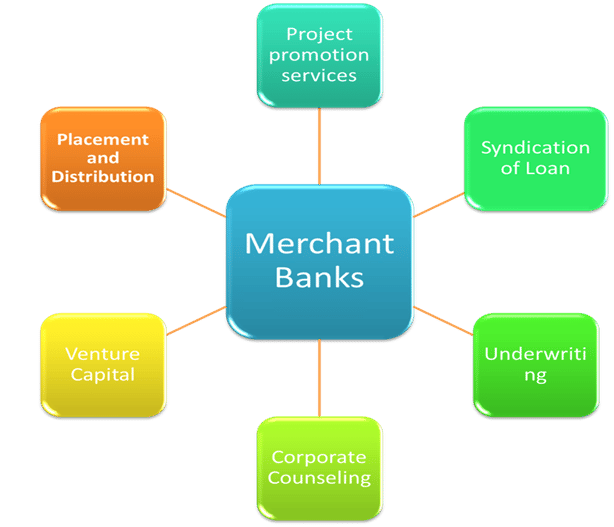

What Is The Definition Of Investment Banking

Investment banking is a form of financing given by a finance business or a banking unit to major multinational organizations. This entails assisting them with their investment strategies.

This service helps affluent people, governments, and significant firms and organizations generate or produce money. An investment banks essential responsibilities include underwriting new securities for various businesses and assisting in selling securities.

Youll also be in charge of mergers, purchases, and restructurings.

Large-scale organizations, enterprises, and governments use investment banks to make massive financial transactions. This is in addition to getting help with critical financial decisions.

To do this, investment banks often aid companies with their IPOs . Furthermore, these investment firms will sell the firms shares on the corporations behalf on the open market.

In a nutshell, investment banks act as financial advisors to large firms, organizations, and governments. These advisors help firms with sales and trade among buyers and sellers. This is in addition to assisting them with critical financial deals such as M& A transactions.

Companies often seek professional assistance to assess which investments will be beneficial in the long run and which may result in future losses.

Investment Banking Vs Private Equity: Should You Start On The Buy

All that glitters is not gold.

One of our most frequent queries is investment banking vs private equity perhaps in second place only to investment banking vs private equity vs hedge funds.

The key questions are usually:

We covered the second point in the article on investment banking exit opportunities, so we will focus on the first point here.

And well start by looking at how these fields differ and the usual arguments for and against starting out on the buy-side:

Don’t Miss: How To Invest In Crypto Exchanges

What Pursuits Can Do For You

When it comes to planning your own timewhether its a special vacation, a dinner out with friends or attending an eventit has to be right. With Pursuits, weve set the standards of service high. Attention to detail is a priority and we go beyond whats expected whenever we can. As seasoned world travelers themselves, our Lifestyle Managers add tremendous value with their expertise and insightful knowledge of specific locales and cities around the world.

What Does A Typical Day In The Life Of A Private Banker Look Like

Your position, location, company type, client emphasis, and seniority all impact your daily life.

A regular day in the life of a junior Relationship Manager would look like this:

Morning : Evaluate client accounts, profitability, and market activity with your senior RM and a few Investment Professionals. You scour corporate websites and Twitter for fresh prospects, issue some push emails, and make a few cold calls after the meeting.

Lunch : Meet with one of your groups MDs to talk about long-term career plans and the PB business

Afternoon : You attend a series of meetings with clients with your senior RM and annotate each clients objectives, key life/business developments, etc. You sometimes provide facts and data on investment, estate, and tax goods.

Closing : With your senior RM, you evaluate the days actions, plan the remainder of the week, and follow up with a few prospects you contacted the week before.

You May Like: How To Invest In Property With Little Money

Borrowing Can Be Strategic And Opportunistic

Some affluent investors borrow to invest as part of a comprehensive wealth management strategy. They use a customized line of credit to create liquidity against various wealth holdings, allowing them to act quickly to take advantage of opportunities.

Borrowing to invest is not for everyone and suitability is paramount as it can add risk. Any investment strategy should be discussed with your investment and tax advisors and should take into account your long-term and personal circumstances.

Small Business Loan Tips

Also Check: How To Transfer Money From Chase Investment Account

Understanding The Private Equity Due Diligence

Before deciding to invest in or buy a privately held company, there is an extensive private equity investment due diligence checklist to go through.

Here are some of the categories that need to be researched:

- âIntellectual Property: copyright, trademark, patents, and trade secret documentsâ

- Contracts and Agreements: copies of renewable supply/services, mortgages, joint venture projects, marketing projects, professional providers, retirement pension plans, and lease agreementsâ

- Corporate Documents: corporate by-laws, minute books, treasury shares, dividends plans, and stock books and ledgersâ

- Employee Benefits: copies of safety and hazards reports, non-government regulatory agencies, licenses, permits, and material safety data sheetsâ

- Financial Information: copies of current large contracts, projected financial information, sales reports, and yearly financial statements and more.

Investment Banking Vs Private Equity: Culture And Lifestyle

Lifestyle is one of the areas where PE is just clearly better. Investment banking is not for those looking for a great work-life balance. Getting out at 8-9 pm is considered a blessing. Also, investment banking is not an environment with hand-holding as you must be able to run with projects even when little direction is provided.

In private equity, youll work hard, but the hours are not nearly as bad. Generally, the lifestyle is comparable to banking when there is an active deal, but otherwise much more relaxed.

That said, there is some upside other than money and career prospects. You will definitely develop close friendships with your peers because you are all in the trenches together.

Many analysts and associates will tell you that some of their closest friends after college/business school are their investment banking peers that they grew close with while working such long hours.

In private equity, youll work hard, but the hours are not nearly as bad. Generally, the lifestyle is comparable to banking when there is an active deal, but otherwise much more relaxed. You usually get into the office around 9am and may leave between 7pm-9pm depending on what youre working on.

You may work some weekends depending on if you are on an active deal, but on average, weekends are your own personal time.

PE firms tend to be smaller in nature , so your entire fund may be only 15 people. As an Associate, you will have interaction with everyone including the most senior partners.

You May Like: Piggyback Loan For Investment Property

Private Banking Vs Investment Banking

Many students instinctively think of Investment Banking when they hear banking. They also often conjure up images of glitzy blockbusters like The Wolf of Wall Street or Wall Street. In truth, banking offers various divisions and responsibilities for brilliant graduates to pursue, each requiring different skills. Thus, we have made this post on private banking vs investment banking to aid you.

Private Equity Exit From Investment Banking

Private equity tends to be a common exit path for investment banking analysts and consultants. As a result, we get a lot of questions on both the functional and the actual day-to-day differences between investment banking analyst/associate and private equity associate roles, so we figured wed lay it out here.

Well compare the industry, roles, culture/lifestyle, compensation, and skills to compare and contrast both careers in detail accurately.

Read Also: Nri Property Investment In India

Private Banking Exit Opportunities

And now we arrive at the major downside of private banking careers: the exit opportunities are not so great.

If youre in a Relationship Manager role, your main options are to stay in that role, move to a different firm, or eventually start your own firm.

You might be able to go into something like investor relations or fundraising for private equity firms and hedge funds, but the experience doesnt translate 1:1 .

Institutional sales is another option, but again, its not necessarily an easy transition.

It would be virtually impossible to move from PB into a transaction-based role such as investment banking, private equity, or corporate development without deal experience.

If youre on the investing side, youll have more options, in theory, because of your experience doing analytical and markets-based work.

Asset management or mutual funds might sound like reasonable options, but the investing styles are somewhat different, and turnover in those industries tends to be quite low.

So, possible, but not likely.

You might stand a better chance at certain hedge funds, in macro research roles at funds, or even in something like investment consulting.

Certain sales & trading desks might be options, but it depends heavily on your product knowledge and experience.

If you know a lot about FX and swap products because youve helped foreign clients hedge their FX exposure, then the FX desk might be feasible.

Job Outlook For Investment Bankers

The national average salary of an investment banker is $67,712 per year. This number can vary depending on what bank you work for, how long you have worked there and your relevant experience in other financial roles. Many investment bankers also receive a large portion of their income from bonuses. The U.S. Bureau of Labor Statistics projects that jobs like this will grow by 4% from 2020 to 2030.

Read Also: Jp Morgan Alternative Investments Group

What Is An Investment Bank

When a company wants to sell stocks or issue bonds, it can utilize professionals that are in the investment banking industry. Investment banks specialize in helping companies raise or move capital. This is as opposed to a depository bank, the other main form of banking, which specializes in holding capital for companies and individuals. Investment banks do this in several different ways.

One of an investment banks most common services is to issue and sell shares of stock on the primary market. A company can either issue shares through an IPO when it sells equity to the public for the first time, or through a secondary issuance when a currently traded company releases additional shares. In both cases, an investment bank helps the company through the legal and financial process of creating those shares. Then it sells those shares on behalf of the company.

Investment banks also help companies raise money through debt. In this case, the bank helps the company prepare bonds to issue. It then sells those bonds on behalf of its client.

Investment banks tend to handle virtually any matter in which a corporate client wants to find or move capital. Most often, this includes handling mergers and acquisitions. For example, if a corporation wants to sell itself, it might approach an investment bank to find a buyer and structure the deal. Or if two companies want to merge, an investment bank will manage the process.

Private Banking Minimum Requirements

Not all private banking is equal. Banks like Chase, HSBC and Wells Fargo advertise enhanced service-based checking accounts using the terms âprivate clientâ or âpremier accounts.â However, these accounts are not true private banking.

Eligibility requirements for bona fide private banking vary from bank to bank. But the services are generally reserved for high-net-worth individuals, which, according to the Securities and Exchange Commission, means people with at least $750,000 in investable assets.

Investable assets include any liquid or nearly liquid assets you own, such as money in your checking and savings accounts, CDs, money market accounts, stocks, bonds, mutual funds, retirement accounts and trusts. Although the minimum amount for private banking eligibility varies, $1 million is a common benchmark requirement.

However, some private banks require investable assets of $5 million or $10 million for account consideration. And even within those banks, those assets will not grant you access to the most exclusive products from the bank.

Recommended Reading: Financing Commercial Real Estate Investments

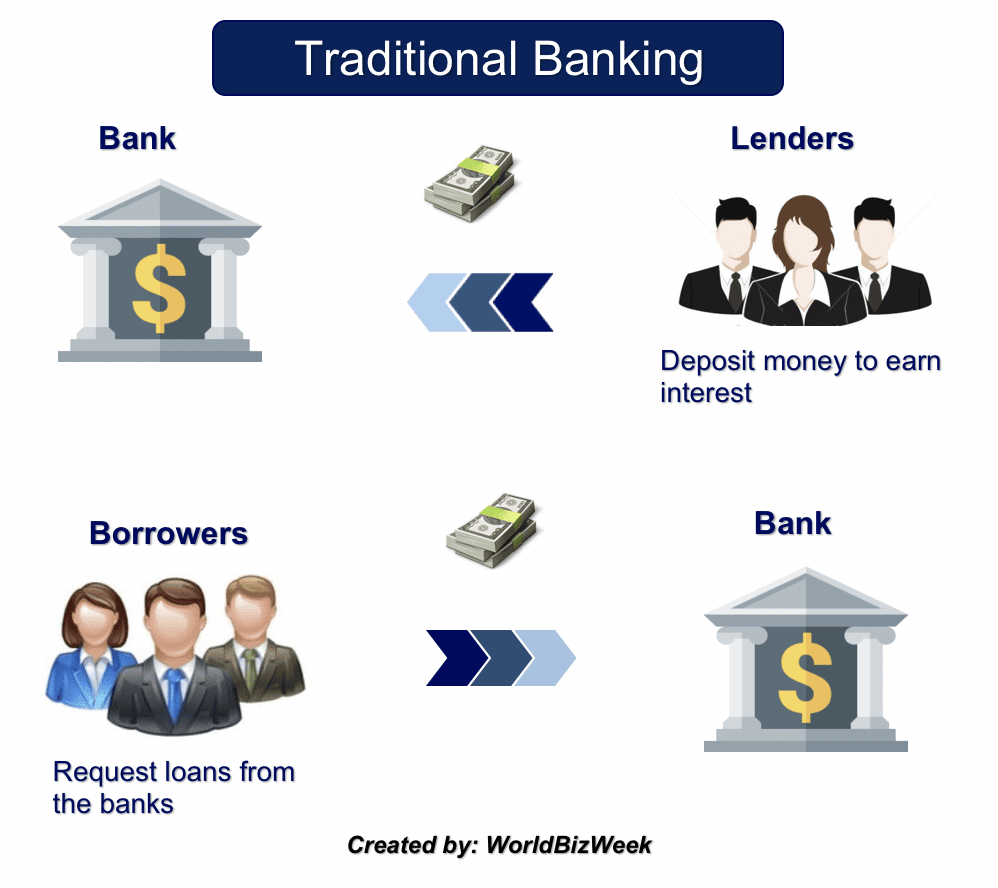

Investment Banking Vs Commercial Banking: An Overview

Though commercial banks and investment banks are both critical financial institutions in a modern economy, they perform very different functions and require different kinds of employees. Commercial banks are what most people think of when they hear the term “bank.” Commercial banks accept deposits, make loans, safeguard assets, and work with many different types of clients, including the general public and businesses.

Investment banks, on the other hand, provide services to large corporations and institutional investors. An investment bank may help in merger and acquisition transactions, issue securities, or provide financing for large-scale business projects.

How Do Wealth Managers Work

For Pillar, we provide a free Wealth Management Analysis for our clients, which you can schedule here.

Here, well use your lifestyle goals and dreams, financial needs, and current family and work circumstances to create a highly customized service. But please note: We only work with high net worth individuals with over $5 million in liquid assets.

Get more details here about the holistic wealth management services provided by Pillar, and how our process differs greatly from that of big private banks as well as most other wealth managers.

Recommended Reading: Investment Management Software For Individuals