Due Diligence: Public Vs Private Sellers

When the seller is a public company, the diligence can be thought of as a two-phase process:

When the seller is a private company, theres very little due diligence that can be performed until the seller willingly provides nonpublic information. Comprehensive due diligence can only begin once the CA is signed.

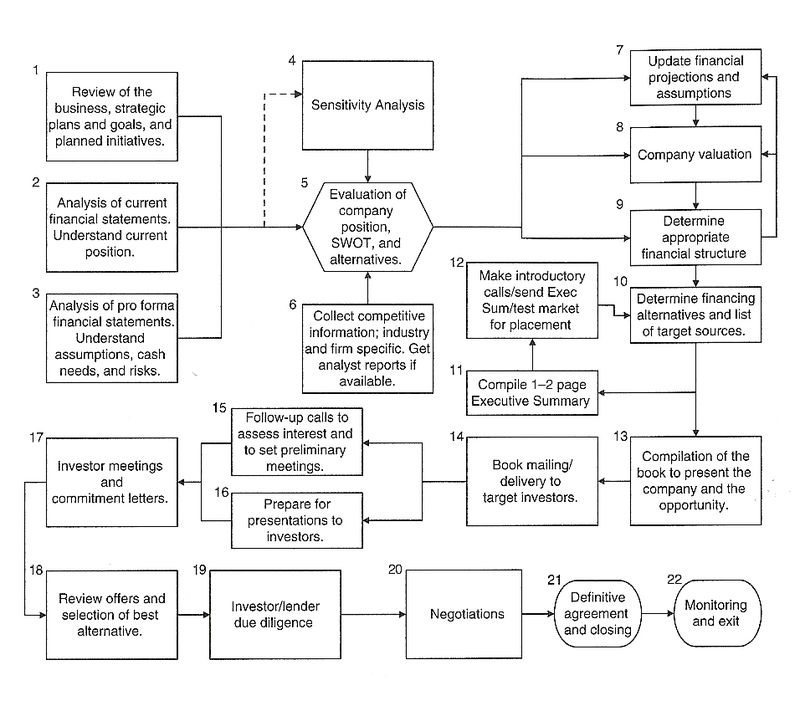

How The M& a Process Works

To complete a merger or an acquisition deal, both companies will follow this M& A process:

Careers In Investment Banking

With so much financial reward, it should come as no surprise that careers in investment banking are among the most coveted of all jobs, with top tier investment banks receiving several hundred applications for every job posted.

This also gives them considerable leverage in choosing from the highest achievers and hardest workers, and making them put in long hours when they do join the company. A typical investment banker can expect to work in excess of 60 hours per week in a regular week and more as deals demand it.

DealRoom conducted research into investment banking careers which can be found here.

You May Like: What Does A Chief Investment Officer Do

Phase : Due Diligence

With the period of exclusivity in effect, both parties conduct their final due diligence efforts. During this phase, you can expect the potential buyer to be far more meticulous in analyzing all aspects of your business including financial records, physical infrastructure, human capital, customer concentration, products and services, growth potential and competitive landscape. Your advisor monitors all progress, addresses any concerns and prepares final ad hoc information as may be requested. Meanwhile, your advisor also conducts due diligence on the buyer to confirm management fit and ability to close the deal. According to a recent Forbes article, Even a deal that makes strategic sense can come awry if those involved have not done proper due diligence including the increasingly important assessment of what divestments might need to be made to meet regulatory concerns or carried out the ground work required to get a deal done.

A Look At The Buy Side M& a Process

SEA provides investment banking services to entrepreneurial companies with EBITDA ranging from $1 million to $10 million, with an industry focus on Life Sciences, Business Services and Manufacturing & Distribution sectors. Our tailored process is the same investment banking process that bulge bracket Investment Banks use for large national and international companies.

Recommended Reading: How To Invest In Share Market Online

For Investment Bankers Representing The Buy

- Establishing the buying companyâs ultimate goals from a transaction, gaining insight into the kinds of companies that will allow them to achieve these goals.

- Advising the company on recent transactions and what they can expect to pay for a transaction in the market. This is a particularly important role for investment bankers in the case of cross-border deals.

- Contacting target firms and gauging their interest in a transaction of some form.

- Conducts valuation of the companies that express interest in being acquired or entering a merger.Like the sell-side process, this usually includes several industry contacts of the investment bank and other investment banks with sell-side mandates.

- Conducting negotiations on behalf of the buying company and potential sellers as they express interest in a transaction.

- Ensuring that deal diligence is conducted thoroughly for the buy-side.

- Facilitating deal closure through provision of documents such as the letter of intent, share purchase agreement, letters to regulators , etc.

Why The M& a Group Can Be Dramatically Different At Different Banks

Larger firms bulge brackets and elite boutiques tend to focus on targeted deals involving huge public companies.

For many of these companies, there are only a few plausible buyers and sellers due to their size.

That means that youll spend far more time on the following tasks:

- Creating many different operational cases and deal scenarios for each company .

- Building valuations and value creation analyses .

- Reconciling numbers, such as data in messy options tables, customer contracts, and adjusted financial statements.

These tasks may sound interesting, but by the 117th time youve done them, they can get quite repetitive.

You rarely get the time to learn an industry or company in-depth because you run the same analyses in Excel, make slight tweaks, and then re-run them with new companies or deal terms.

At smaller firms middle market banks and regional boutiques the process is more about learning a company, its strategy and industry, and positioning it for potential buyers.

Executives at smaller companies also tend to be less experienced with M& A, so you spend more time walking them through the process and explaining everything.

As an Analyst or Associate at a smaller bank, your tasks could vary wildly.

Ive seen cases where junior team members speak with the CEO or CFO to answer questions, but Ive also seen cases where they write the CIM, track buyers/sellers, manage the data room, and do little else.

Don’t Miss: 10 Down Payment Investment Property

Create A Preliminary List

An initial list of buyers is typically identified and researched by investment bank advisors. Once an initial list is presented, the Deal Team may also have suggestions for potential buyers that can be added to the list. A full preliminary list is then created and will require a more thorough review.

Once the preliminary list of potential buyers is created, the Deal Team may want to validate that the list considers a broad range of potential buyers to maximize value. Criteria for consideration may include, but are not limited to, cultural fit, geographical alignment, industry alignment, financial position, and operational metrics.

As part of reviewing the initial list of potential buyers, it is important to consider any companies that should be âblack-listedâ or removed.

Phase : Final Negotiations And Closing

Pending a successful due diligence phase, both parties and their respective legal teams resolve all price, structural and technical discrepancies in final negotiations. Concurrently, you and your advisor craft a communications plan to address employees, stakeholders and the outside community. Once all documentation and communications are in order, you and the buyer coordinate the closing and execute the wire transfer. This completes the extensive M& A process.

Don’t Miss: Which Cryptocurrency Is Best To Invest In 2020

Selling Or Buying A Business Is One Of The Most Important Financial Decisions You Will Make At National Transaction Advisors We Represent Both Buyers And Sellers

For The Buyer

- Business Identification and Pre-Qualification We actively search on your behalf to identify businesses in specific sectors or industries that match your search criteria.

- Business Acquisition Negotiations Often your acquisition target will have already engaged a business broker and having experienced representation on your side as well will level the playing field.

- Business Acquisition Financing We have access to a variety of funding sources and may be able to help you obtain financing for your next acquisition.

- Documentation and Due Diligence National Transaction Advisors will work with your legal and financial professionals to conduct sufficient due diligence, ensuring that all potential risks are identified and accounted for in the offer.

- Closing the Deal Many people think that once the Letter of Intent and/or Purchase Agreement is signed the deal is done, but our experience tells us that it is far from over at that point. That is really when the work begins. We will coordinate closing activities to ensure that all due diligence items have been addressed and the groundwork has been established for a smooth transfer of ownership.

For The Seller

Accrue And Open A Data Room

To conduct their diligence, buyers will need access to information beyond whats included in the CIP. A data room is an online portal for sharing information in a confidential manner so buyers can access the information they need to evaluate a company.

The investment banker will be responsible for setting up the data room, and may even start adding information during stage 2 as they gather information for the CIP. Some common items a banker will include in the data room are:

- Employee census and historical compensation data

- Organizational and reporting structure and documents

- Sales team and pipeline data

Also Check: Is Yolo Etf A Good Investment

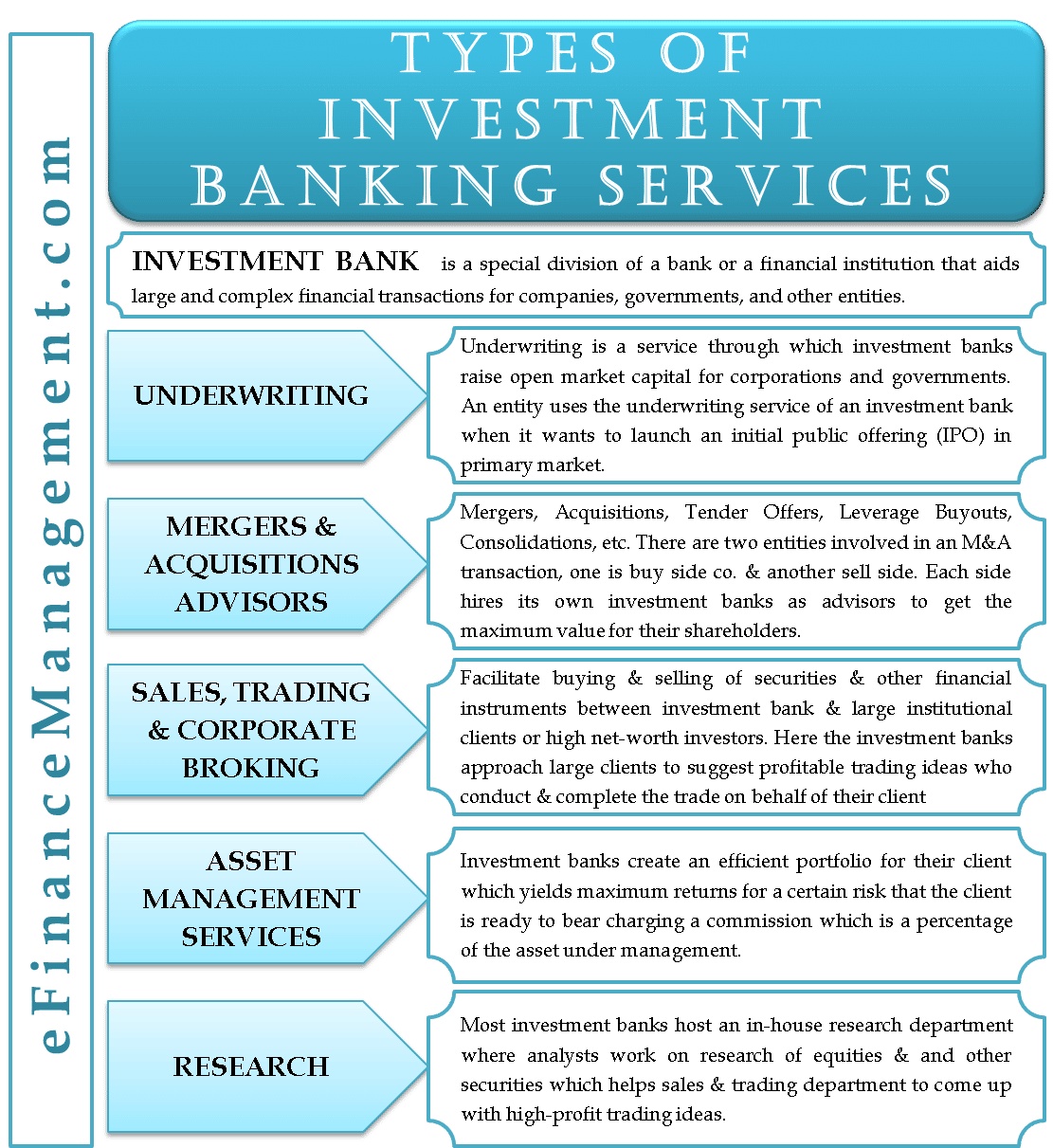

Underwriting Services In Investment Banking

Underwriting is the process of raising capital through selling stocks or bonds to investors on behalf of corporations or other entities. Businesses need money to operate and grow their businesses, and the bankers help them get that money by marketing the company to investors.

There are generally three types of underwriting:

- Firm Commitment The underwriter agrees to buy the entire issue and assume full financial responsibility for any unsold shares.

- Best Efforts Underwriter commits to selling as much of the issue as possible at the agreed-upon offering price but can return any unsold shares to the issuer without financial responsibility.

- All-or-None If the entire issue cannot be sold at the offering price, the deal is called off and the issuing company receives nothing.

Once the bank has started marketing the offering, the following book-building steps are taken to price and complete the deal.

Image: Free Intro to Corporate Finance Course.

Review The Proposed Purchase Agreement

While most of the terms of the agreement should be tied up by now, your banker will assist you in conducting final negotiations with the buyer to incrementally maximize your value in the transaction.

The banker will also assist in the preparation of the disclosure schedule, which discloses any additional and relevant information about the company that are too extensive to include directly in the purchase agreement, such as contracts, court injunctions, competitive agreements, etc. The selling companys legal counsel will take the lead on preparing the disclosure schedule.

Also Check: How Can You Invest In Oil

Make Initial Contact With Buyers

Either you or your investment banker will make initial contact with C-suite management and/or corporate development reps at the target buying company or private equity firm. Initial contact usually involves sharing the anonymous teaser, followed by an opportunity for the buyer to ask a few questions.

What Are The Typical Activities Investment Bankers Do Every Day

Investment bankers work long hours, often logging close to 100 hours a week, and while no two days may be the same, there are some common tasks these bankers engage in. The job requires strong organizational, analytical, and mathematical skills, as well as robust social skills.

Analysts assist senior level bankers with a variety of tasks, such as creating pitches, models and valuations. Additionally, investment bankers will participate in M& A transaction calls on both the buy-side and the sell-side.

Finally, when the deal moves along, the investment bankers help negotiate the terms of the deal.

Read also about The Current State Of Investment Banking Culture.

You May Like: Fidelity Cash Management Account Investment Options

Second Round Bids And The Definitive Agreements

After the list of buyers is pruned down to one or a few remaining candidates, another bid process letter is sent out to solicit definitive agreements.

Final bids are binding and finalists are brought in to negotiate their proposals. From there, a winning bidder is selected by the company guided by the investment bank and a Purchase and Sale Agreement is drafted a definitive agreement that outlines the terms of the acquisition.

Having A Thorough M& a Process Can Help Increase Your Chances Of Success And Elevate Shareholder Value

Whether youre looking to retire or start a new venture, you might be inching closer to selling your company. In theory, its simple: find a buyer and complete the deal. Unfortunately, its never that straightforward to launch a Mergers and Acquisitions process, with numerous factors to consider when deciding to sell your business. Common questions that weve received include:

- Is now the right time to sell my business?

- What type of buyer is the best for my company?

- How can we ensure maximum value for our shareholders?

- What does the M& A process even look like?

While the first three questions require an in-depth, personal conversation between you and your investment banking advisor, the final question is a bit more straightforward. Below is an outline of the complex 6-9 month M& A process that Capstone Partners Investment Banking Teams use to facilitate transactions and maximize the value of our clients companies.

Don’t Miss: Pictet Wealth Management Minimum Investment

M& a Performance Indicators Post

Hundreds of academic papers have used the event-based model to decide whether a deal is successful or not.

This is a spurious way to garner whether a deal was successful post-closing or not:Successful deals often show negative share price movements in the months after the transaction closed.

Likewise, the opposite can be true of deals that destroy value over the longer term.

Pay particular attention to the following:

Develop An M& a Strategy

The company decides on its overarching goals for the M& A process. Itâs important that thereâs a good motive for undertaking M& A as it underpins the whole process.

It also allows you to ask âwhy are we doing this?â any time doubts creep in .

Additionally, if you have ambitious growth plan for your company endeavours, check out our guide to developing an acquisition strategy.

Also Check: Morgan Stanley Investment Banking Division

Building The Sources & Uses Table

The section of an M& A Model contains the information regarding flow of funds in an M& A transactionâspecifically, where the money is coming from and where it is going.

An investment banker determines the amount of money raised through various equity and debt instruments, as well as from Cash on Hand to fund the purchase of the Target. This represents the . The Uses of Funds will show the cash that is going out to purchase the Target, as well as various fees needed to complete the transaction. Importantly, the total Sources of Funds must always balance with the total Uses of Funds.

Using the diagram from the previous section as an example, letâs start with the Sources of Funds side. Assume that Company X, the Buyer, will raise $30 million in New Senior Debt and $60 million in new Equity in order to raise money to purchase the Company Y, the Target company. This will trigger fees for the financing of this Debt and Equity, and these figures are located in the boxes on the left. On the Uses of Funds side, we see that the buyer will purchase the Equity of the target business, which is approximately $91.2 million. M& A transaction fees are 2.0% of the Purchase Price , or approximately $1.8 million. Financing fees include 4.0% of the $30 million in new Senior Debt raised and 6.0% of the $60 million in new Equity raised. These fees will total $1.2 million and $3.6 million, respectively.

Cash on Hand = Total Uses of Funds â Total Sources of Funds excluding Cash on Hand = â

Confirm That Information Is Up To Date During The Due Diligence Process

During M& A due diligence, you will be investigating intellectual property , legal issues, business processes, dependencies, critical roles within the company, and much more. Confirm that all information from both sides of the transaction is up-to-date before taking action.

A lot of this information can have legal ramifications if it is not properly handled, so both the M& A buyer and the seller will be digging deep into the documentation to find hidden issues. Making sure the information is current before this process starts can speed up the merger or acquisition.

Read Also: Best Investments For Accredited Investors

Distribute Process Letters For Next Steps

Following the presentations, the banker will share with interested buyers a process letter that outlines the information the buyer should provide in their first round bid in the form of an indication of interest , as well as timelines for when they should submit their bid. Some of the information a buyer should include in their IOI include:

- Basic details of a proposed transaction structure

- Diligence topics they would like to address in the next phase

Adjustments To The Pro Forma Balance Sheet

When Company X acquires Company Y, the Balance Sheet Items of Company Y will, for the most part, be added to those of Company X. There will be some adjustments to this, however, and these adjustments must be accounted for. Weâve already discussed one such adjustment: Goodwill. Besides Goodwill, there are additional adjustments that need to be made to the Buyerâs Balance Sheet to account for the transaction. Here is an example of all of the Balance Sheet adjustments that will occur using the adjustments made to the Pro Forma Balance Sheet that reflects the âTransactions Assumptionsâ illustration given above.

In the illustration above, the adjustments are as follows :

- Company X, the Buyer, issues $60 million and $30 million in capital. Net of the Equity and Debt financing fees, the Company receives $83,375 in Net Proceeds. Net Proceeds is a financing adjustment that is added to the historical Cash balance. Then the historical cash balance is adjusted for the transaction purchase price of $90,000 . Therefore, the cash balance is affected by the following calculation:

Pro Forma Cash & Equivalents = Company X and Company Y Current Cash & Equivalents of $2,072 and $1,241, respectively + $83,375 Financing Adjustment â $90,000 Transaction Adjustment

You May Like: Why Are Bonds Considered Fixed Income Investments