Nowrxs Current Funding Round

NowRX is raising money on SeedInvest with a pre-money valuation of $275 million. The company requires a minimum investment of $998.

While year-over-year revenue growth from 2020 to 2021 was 90%, the company is still not profitable. As mentioned, NowRX is raising money to fund R& D, marketing, and sales, and to expand its U.S. footprint. Recently, the company announced expansion in Houston.

On the SeedInvest deal page, NowRX spells out the risk of making an investment with the company today, including the fact that the company is up against big, well capitalized market leaders.

On Feb. 8, the company announced it hired its first chief financial officer , Mark Marlow, who previously oversaw two company initial public offerings .

This leads us to believe the most likely exit for this privately held startup could be an IPO.

Like with any type of investment, investing in private companies carries risk. You shouldnt invest more money than you can afford to lose. Before acting, I recommend looking into the company yourself to see if it meets your personal investment criteria.

You can find the details of the deal, including how to invest, here.

On this date of publication, Jessica Zeller did not have any positions in the securities mentioned in this article.

1) Greater chance of failure

2) Risk of fraudulent activity

3) Lack of liquidity

5) Dearth of investor education

Read more: Private Investing Risks

©2022 InvestorPlace Media, LLC

The Amazon Of Pharmacy

Unlike many of the big pharmacy chains like Walgreens Boots Alliance Inc. or CVS Health Corp. , NowRX doesnt have a storefront. Instead, the company leases low-cost spaces near main roads that operate as fulfillment and distribution centers. Right now they have eight Drug Enforcement Administration -licensed pharmacies across the West Coast, including in the Los Angeles and San Francisco Bay areas.

Like most pharmacies, NowRX makes its money through reimbursement from insurance companies, patient copays, or cash pay.

leveraged technology and same-day shipping to disrupt the multi-trillion dollar retail market is leveraging technology and a same-day prescription delivery service to disrupt the several hundred billion dollar U.S. legacy pharmacy industry.

In this sense, I like to think of NowRx as the Amazon of Pharmacy.

CVS is the largest pharmacy in the United States, with 24% of the market share. But you wont get guranteed same-day delivery with CVS. The time greatly varies by the area you live in. And not only that its not free.

Through the NowRX plaform you can receive free same-day delivery of your medication or pay $5 for one-hour delivery.

A recent study valued the global online pharmacy market at $68.2 billion in 2020. Its expected to reach $202.3 billion by 2027, with a compound annual growth rate of 16.8% from 2021 to 2027.

If NowRX can grab even a small share of that growth, it could provide great returns for early investors

Equity Crowdfunding Does Not Hamstring You Operationallyif Done Correctly

One of the most consistent and understandable questions we hear from founders is How am I going to manage all those investors?. While we cant speak for other platforms, our answer is easy: You dont have to do anything. Well do the work for you. We were the first to develop a solution for consolidating smaller investors so they dont clutter your cap table, and most importantly, assist with ongoing shareholder management. Weve put mechanisms in place to ensure companies can maintain nimbleness and flexibility in exploring and executing future corporate events. As a case in point, nearly 1,000 investors participated in Heliogens offering on SeedInvest. The company received the requisite approvals for its upcoming public listing within 36 hours.

SeedInvest was founded on the belief that democratized access to capital and opportunity in venture capital when done responsibly can be fundamentally transformational for founders and investors both within and outside of the traditional VC sphere. While were proud of what we have accomplished so far, we know theres more work ahead of us than behind us.

With the backing and support of our parent company, Circle, which recently raised one of the largest fintech venture rounds in history and announced plans to list publicly later this year, to say were just getting started is quite the understatement.

Disclosure:

Read Also: Pacific Investment Management Company Llc Pimco

What Is Dogecoin Used For

Over time, Dogecoin has been primarily used for tipping Reddit and Twitter users. But weirdly, this meme coin is listed on most crypto exchanges.

It is also accepted by various vendors. You can use Doge to buy food, drinks, hosting, and other stuff from the internet.

Recently, the electronics retailer Newegg has implemented Dogecoin as a payment method in more than 70 countries.

And of course, besides being a tipping mechanism and a cheap means of exchange, Doge is also a little extra Litecoin miners get for securing the Dogecoin blockchain.

Is Aion A Good Investment

AION launched in 2017 as the native cryptocurrency for the Open Application Network. However, the networks CEO has since abandoned the project and given control to the community.

In volatile cryptocurrency markets, it is important to do your own research on a coin or token to determine if it is a good fit for your investment portfolio. Whether the AION token is a suitable investment for you depends on your risk tolerance and how much you intend to invest, among other factors. Keep in mind that past performance is no guarantee of future returns. Never invest money that you cannot afford to lose.

Recommended Reading: Heloc On Investment Property California

Invest In A Better Way To Get Your Meds With This Fast

Regardless of major world events, people will always need a reliable way to get their prescription medications. That’s why the retail pharmacy industry has continued to grow by leaps and boundsstanding at a staggering $534 billion in 2020 and expected to rise.

Yet despite this industry’s large size, its traditional business model continues to create frustration for everyday customers. Trips to the pharmacy can often involve long lines, wait times over the phone, insurance errors and sold-out inventory. These ongoing prescription fulfillment challenges create unnecessary obstacles for Americans who need their medications. But one Silicon Valley startup might have the right prescription to curb these obstacles.

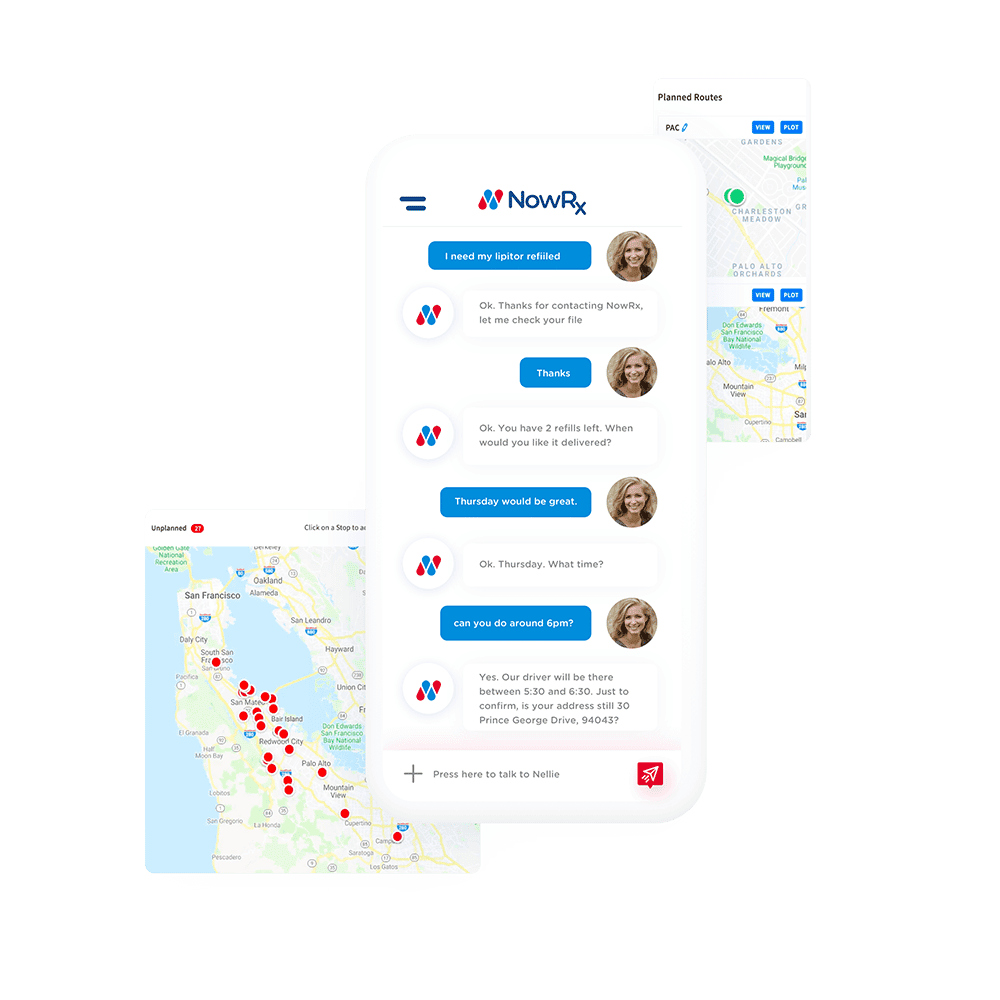

Meet NowRx, the tech-powered startup giving a large, long-established industry a major upgrade. Instead of customers picking up prescriptions at the pharmacy, NowRx’s robotics-powered brick-and-mortar microfulfillment centers fill prescriptions quickly and without errors. On-site employees then deliver these medications for free within two to four hours of the orders’ being placed. NowRx’s disruption of the traditional retail pharmacy status quo is attracting attention from investors across America. According to NowRx, over 10,000 people have purchased shares in the company, with more than $43 million raised since its launching on SeedInvest in 2016. The company also has five-star Yelp ratings across all eight of its pharmacy locations.

What Causes Crohns Disease

Doctors arent sure what exactly causes Crohns disease. However, researchers believe that it is likely an interaction between your genes, your immune system, and something in the environment.

In addition, although a specific cause may be unknown, there are factors that increase a persons risk of developing Crohns disease. These include a family history of Crohns disease, smoking, poor diet, and taking certain medications, including NSAIDs, such as ibuprofen and aspirin.

Also Check: How To Invest In Trulieve

Investors Can Earn Significant Returns By Purchasing Shares Of High

Buying a diversified index fund is a relatively low-risk approach to stock investing. Yet if you had bought a low-fee fund that tracks the benchmark S& P 500 index in September 2011, you still would have grown your money nearly fourfold over the last decade.

Buying individual stocks, though, would have offered you a shot at even greater returns. Shares of e-commerce giant Amazon , for instance, are up by 1,360% over the same period.

Both strategies reveal the benefits of focusing on the long term. Over time, the U.S. market has a history of rising, and specific innovative companies also need time to deliver on their outsized potential.

Image source: Getty Images.

For investors looking to beat the market, here are two high-growth companies that look set to deliver blistering performances over the next decade, conceivably quintupling your money by 2030.

Nowrx Breaks Equity Crowdfunding Record On Seedinvest With Four Days Left In Campaign

Tech-powered pharmacy surpasses SeedInvest record following record Q1 Revenue and Hyundai partnership announcement

MOUNTAIN VIEW, Calif.—-NowRx, a tech-powered pharmacy that provides same-day prescription delivery and telehealth services, today announced that its current Series C equity crowdfunding round on SeedInvest, the leading equity crowdfunding platform, has surpassed $22.5M, making it the largest Regulation A investment in SeedInvest history. The round is still open and has an anticipated close date of May 20th.

Since 2016, NowRx has steadily grown revenue from just shy of $700,000 to $22M in 2021. That represents an increase of more than 3,200% in five years. In 2020 alone, its revenue grew 90% compared to 2019 and its current annual revenue run rate, based on March 2022 revenue, is $32.3M. The tech-powered pharmacy has delivered more than 487,000 prescriptions so far to 64,000+ customers from 12 facilities in western states and will expand its reach and capacity as it opens five new facilities this year.

The JOBS Act democratized fundraising for startups. Thanks to equity crowdfunding, weve been able to raise the money we need to expand our business while giving ordinary people the ability to invest in the future of retail pharmacy, said NowRx CEO Cary Breese.

With the funds raised in this round, NowRx will expand into additional territories and accelerate the technology roadmap for its proprietary pharmacy-management software and logistics technology.

You May Like: Best Investment For 401k Plan

What Is Crohns Disease

Crohns disease is a type of chronic inflammatory bowel disease that causes inflammation in the gastrointestinal tract. It occurs when something, either in the environment or your genes, triggers your immune system to attack healthy bacteria throughout the GI tract resulting in inflammation.

The inflammation within the GI tract is what causes the common symptoms associated with Crohns disease. This includes but is not limited to cramps, abdominal pain, diarrhea, bloating, weight loss, and nutritional deficiencies.

Buy I Bonds Now To Lock In A Record 962% For 6 Months On Nov 1 The Rate Drops To 648%

There havent been many safe investments that could beat inflation except for the I bond, but even that safety net may soon not pack as heavy an inflation-fighting punch.

That’s because the record high 9.62% interest rate on I bonds issued through October will drop Nov. 1 to 6.48%, significantly lower but still one of the best investments out there, experts say.

The rate change is based on the change in the consumer price index from March to September. The new rate is below the 8.2% annual rate of inflation in September, which means when the rate is adjusted for inflation, youre looking at a negative interest rate.

Beating the market: I was 12 when I bought my first stock. My portfolio is beating my 401

Read Also: How To Start Investing In Oil

Can You Eat Potato Chips With Crohns

Processed carbohydrates, such as potato chips, can be well tolerated in people with Crohns disease.

However, fried, fatty foods, which can include non-baked potato chips, should be avoided during a flare-up. Additionally, processed foods like chips can contribute to other chronic diseases, such as heart disease and diabetes.

For these reasons, it may be best to just avoid them altogether.

Invest In The Future Of Pharmacy With Nowrx

Prescription delivery service sets out to disrupt the traditional pharmacy market

NowRX is a digital pharmacy platform that provides same-day delivery on your prescriptions and telehealth services. The company uses proprietary software and robotics technology.

NowRX is currently raising funds through SeedInvest that it plans to use for research and development , marketing and sales, and the expansion of its pharmacy operations.

Heres what you need to know

The goal of NowRX is simple. The company wants to make filling prescriptions accessible, convenient, and affordable. With its same-day prescription delivery as well as telehealth services, the company says it provides an end-to-end solution.

Read Also: Is It Worth To Invest In Cryptocurrency

Equity Crowdfunding And Traditional Venture Capital Arent Mutually Exclusive

Weve invested alongside a large number of traditional venture investors, and our portfolio companies have received follow-on funding from funds and strategic investors that include BlackRock, DCG, Great Oaks, Greycroft, John Hancock, Lerer Hippeau, Menlo Ventures, Revolution Ventures, RRE, Sound Ventures, Tiger Global, Vulcan Capital, and countless others. In fact, to date our portfolio companies have raised over $1.5B in aggregate. We are not here to replace traditional venture capital, were simply seeking the best companies and founders to back.

Is Now A Good Time To Invest In Real Estate

The recent performance of the U.S. real estate market has a lot of people asking, is now a good time to invest. After all, the U.S. real estate market has been nothing short of a sellers dream for the better part of a decade. Dating back to 2012, when the Great Recession caused home prices to bottom out, the median home value in the United States has appreciated for ten consecutive years. As a result, buyers have been forced to endure less-than-ideal circumstances for quite a long time.

Since the introduction of COVID-19 in the first quarter of 2020, the market has been even more difficult for buyers to navigate. In the time that has passed since the Coronavirus was officially declared a global emergency, insufficient inventory levels, low interest rates, and pent-up demand have increased the median home value in the United States by as much as 40.9% thats an average increase of $103,567 per house.

Home prices have become prohibitively expensive for the average buyer. That said, it would appear that the current cycle is starting to turn over. Not only are prices too high, but Fed-mandated interest rate hikes are starting to dissolve supply and demand. Having more than doubled year-to-date, mortgage rates are simultaneously preventing prospective buyers from buying and sellers from selling.

Don’t Miss: Grant Cardone Real Estate Investing

Raising A $20 Million Series B Online: The Nowrx Story

So far, SeedInvest and our investors have directly funded $350M into a portfolio of 250 companies across a range of industries, business models, and geographic locations.

Weve done so directly alongside VCs as well as by leading and filling rounds, too. Weve been one of the first investors to recognize a companys potential and support them financially and, for me personally, one of the most exciting developments has been our ability to help our portfolio companies scale by supporting them through multiple funding rounds across a broader range of their life cycles.

NowRx is a great example of how equity crowdfunding isnt just helping companies launch, its enabling them to scale. A Silicon Valley-based healthtech company thats grown into one of the nations leading on-demand pharmacies, SeedInvest contributed to the companys $750K Seed round in 2017 and led their $7M Series A in 2018 as well as their $20M Series B at the height of the COVID pandemic.

Along the way, NowRx leveraged press and brand awareness generated from their fundraise to help scale their business:

- From ~1,000 customers to 30,000+

- From ~$1M in revenue to $12M+

- From 5 employees to 50+

Stories like this show that the next era of equity crowdfunding is here, and its doing more than simply helping companies get off the ground.

You Can Raise Meaningful Amounts Of Venture Capital Through Equity Crowdfunding

Historically, online platforms could be optimistically counted on for a half million dollars or so. Maybe $1 to $2 million on occasion. But that threshold has completely changed, solidified further by recent changes to the JOBS Act regulations. Last year, the average crowdfunding raise on SeedInvest was in excess of $3M. Take portfolio company Virtuix, for whom SeedInvest led and filled an oversubscribed $15M Series A earlier this year. No stranger to crowdfunding, Virtuix received over $5M in commitments from existing investors before they even started their raise. The investor feedback was so strong that company management upped their raise beyond their original $10M goal.

Read Also: What Is The Best Small Investment App

Is An I Bond Still A Good Investment

Yes, because other similar quality investments, including savings accounts, Treasury bills and certificates of deposit , offer even lower returns.

Online savings accounts offer a little more than 3% interest and CDs offer around 4% interest, and those are the best ones, not the average ones, said Tumin. Treasury bill yields are below 5%.

Plus, remember, the current rate of 9.62% still applies for all bonds purchased through Oct. 31. Those bonds will earn 9.62% for six months, then switch to the 6.48% for the next six months. That would make the one-year return about 8.05%, still not bad.

Or maybe the next 6 months of inflation will be less than 9.62% and then the next 6 months below 6.5%, Tumin said. If that happens, you will have a real yield for the next year.

Also, they never lose money because the actual interest rate cant go below zero and the redemption value cant decline.

“Treasury will always exchange an I bond for its par value if the investor has owned that security for 12 months,” John Rekenthaler, Morningstar vice president of research, wrote in a note last month. “Effectively, I bonds possess whatever maturity date the investor desires.”

Likely recession: Economist explains why recession is likely unavoidable in the U.S.

Top Investment On Seedinvest Hits New Milestone: $826k In One Month

NowRx is excited to announce its latest record revenue milestone with $826k in prescription sales in one month , translating to an annual run rate of over $9.9mm. This is a 4% growth from the previous record in December and a 61% YoY growth from January 2019. These continual record-breaking months illustrate the increasing demand for NowRxs free, same-day delivery service. Since launching in 2016, the company has grown its customer base 1064%, filled over 150k prescriptions, served more than 22k customers, and launched five micro-fulfillment centers. NowRx has surpassed $5.28mm raised and is the company with the most investments currently on SeedInvest.

About NowRxNowRx is an on-demand pharmacy, founded with the goal of using software, artificial intelligence, robotics, and smart logistics to create the best retail pharmacy experience possible. Specializing in free same-day delivery of prescription and over the counter medications, NowRx hand-delivers medications right to your door in hours with its fleet of friendly HIPAA trained drivers. By removing the need to visit the pharmacy, NowRxs hopes to increase medication adherence and provide a more convenient pharmacy experience for millions of people. Learn more at

Also Check: Is Real Estate Investing Better Than Stocks