Are Cds A Good Hedge Against Inflation

A certificate of deposit is a short- to medium-term deposit in a financial institution at a specific fixed interest rate. Typical CDs are not protected against inflation. If you would like to reduce the impacts of inflation on your CD investments, consider buying a CD that is higher than the inflation rate so that you can get the most value for your money. The longer the term of the CD, the higher the interest rate will be.

Best Investments During Rising Inflation

greatwww.cnbc.com

greatwww.cnbc.com

best

bestbestinvestments

best

trend

How to Assemble a Flat Pack Wardrobe

AMBER ALERT IN DECATUR, IL Man Arrested MUST SEE VIDEO

How To Win A Street Fight WIth Head Movement, Learn…

Looking for apartments near USC? First Choice Housing

4609 Bougainvilla Dr Lauderdale by the Sea FL for rent…

Useful News

Chapel Hill project could complement Southern Village, meet housing needs, builders sayYour browser indicates if you’ve visited this link

mainsquareapartments

FHFA nominee pledges to address racial homeownership gapYour browser indicates if you’ve visited this link

Housing

San Antonio rents increase 30% amid hot housing market, study showsYour browser indicates if you’ve visited this link

Muchapartment

19 dead in NYC apartment blazeYour browser indicates if you’ve visited this link

apartmentapartment

Investors raising mobile home park rent in IowaYour browser indicates if you’ve visited this link

rentrents

Trending Search

See questions users ask most at Apartmentall via FAQs list

best investments during rising inflation, they are sourced from various reputable companies and bussinesses of providing apartments

“I have an article with the topic related to Best Investments During Rising Inflation”

How to search for Best Investments During Rising Inflation on your site?

Trending Searches

Stocks With High Pricing Power

As rising prices mean that the cost of raw materials used by companies to produce goods grow, the big risk for businesses during an inflationary period is shrinking profit margins. The key question is to what extent can a company pass increased costs to consumers.

In a note published in July 2021, UBS said that companies with higher pricing power would do better during an inflationary environment, as they would be able to raise prices for their products and services without losing revenues.

To identify companies with high pricing power, investors could search for firms with a dominant market position that offer high-quality products not easily substituted. Such companies tend to enjoy relatively more stable profit margins, according to UBS.

You May Like: Best Investment Banks For Private Equity

Bank Stocks During Inflation

Banks could be another type of stocks to buy during inflation, as an unexpected spike in prices introduces the possibility of an interest rate hike by central banks.

In 2022, the policy tightening cycle has already started, with central banks around the world, including the BoE, the Fed and the Swiss National Bank, responding to inflationary pressures by raising interest rates and tapering bond buying programmes.

Thats good news for banks and lenders, as higher interest rates mean borrowing is more expensive, resulting in higher profits from lending margins. In theory, banks should benefit from an inflationary environment.

XRP/USD

| 1.5 |

According to Khalaf, there are more competing factors at play. Bank stocks are plugged into the economy and an inflationary shock changes the economic dynamics.

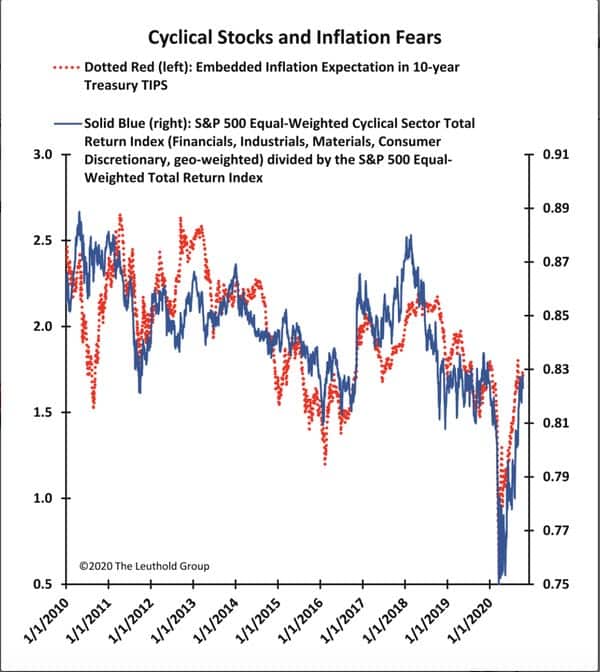

The 2021 research paper mentioned above also showed that from a historical perspective, financial stocks performed weakly during inflationary spikes, as default risks overshadowed the possibility of monetary tightening.

In the current context, the increasing risk of a recession in 2023 means that any impact of higher lending profits are likely to be offset by weaker demand.

The Best Mutual Funds And Etfs For High Inflation

Below are some of Morningstar analysts top mutual fund and exchange-traded fund picks in two areas that directly hedge against rising inflationTreasury Inflation-Protected Securities and commodities.

TIPS funds offer a straightforward hedge against inflation. The values of the underlying bonds adjust up and down as inflation rises and falls. TIPS typically yield 2% or less, lower than their I Bond peers. These low yields mean that TIPS face higher inflation risk than other bonds of similar maturity.

Commodities funds offer another inflation hedge. Commodities prices, which are sensitive to economic growth, make up an important part of inflation. Commodities funds can capture spikes in commodities prices that precede inflation increases. Still, Morningstars director of manager research Russ Kinnel recommends keeping commodities fund positions small because commodities prices are volatile and hard to predict.

Here are some of the best TIPS and commodities funds for inflation:

For additional commentary on Vanguard Short-Term Inflation-Protected Securities Index and Pimco Commodity Real Return Strategy, read Kinnels Grading the Inflation Hedges.

You May Like: Step By Step Guide To Investing

The Basics Of Inflation

Persistent deflation can increase unemployment and undermine the financial system as well as the broader economy by making it more difficult to service debt. The U.S. Federal Reserve is targeting a 2% average inflation rate over time as most consistent with its dual mandate to promote price stability and maximum employment.

Sharp deviations from a modest inflation rate in either direction present challenges for investors as well as consumers. That’s because they have the potential for significant economic disruption. They also have varying and often unpredictable effects on various asset classes.

In economics, inflation is a quantitative measureone of quantity over qualitytracking the rate of change in prices of a standardized basket of goods. Inflation is defined as an increase in prices over time, and the rate of that increase is expressed as a percentage.

Economic Indicators Point Toward A Slower Economy

The June 2022 CPI reading, which was reported on July 13, was extremely high at 9.1%. The July 2022 reading, which is scheduled for August 10, is likely to reflect falling gas prices, loosening supply bottlenecks, and a cooler housing market. Inflation will still be high in July but will almost certainly be lower than June.

Here’s an updated summary of points made in my recent article, The Case for Bonds Now, that point toward a slowing economy:

- Gas prices: The average price for one gallon of regular gas at the end of July was $4.21, down from its June 14 peak of $5.01.

- Manufacturers’ delivery time shortening: The was 53%, which was the lowest PMI reading since June 2020.

- Housing: Inventories were rising in June, which marked the largest monthly increase in the data’s history. July data will reflect this shift.

- Yield curve inversion: The 10-2 Treasury yield spread returned to negative in July. Every recession since WWII has been preceded by an inverted yield curve, by 6 to 18 months.

- GDP: Real gross domestic product decreased at an annual rate of 1.6 percent in the first quarter of 2022, followed by another decrease of 0.9% in Q2.

Don’t Miss: How Soon Can You Refinance An Investment Property

When Interest Rates Rise The Impact Trickles Through To More Than Just Borrowing And Lending

The Federal Reserve is finally recognizing just how entrenched inflation has become and looks like it might actually take some serious steps to at least start to address it. Key among those steps is raising interest rates.

Interest rates have been in a downward trend for around 40 years — since the last time inflation spiked this high — which makes a rising rates environment something many investors have not experienced. The investing roadmap is a little bit different when interest rates are going up, so knowing how to invest when interest rates rise is a skill that it makes sense to learn. These five strategies can help you navigate what could otherwise be a rocky patch in the market.

Image source: Getty Images.

These Are The Types Of Companies Warren Buffett Says You Should Invest In During Times Of Inflation

Warren Buffett

Consumer prices rose 8.5% in July, as compared to the same month in 2021, according to data from the Labor Department released in August. While this number is down slightly, it is no doubt leading many investors to wonder: How can I protect myself against inflation? In general, many experts recommend investing smartly to hedge against inflation. Suze Orman recently wrote on her site that you should keep investing in stocks to hedge against rising costs, and Ramit Sethi noted that: Investing is the single most effective way to get rich. Inflation can be bad for individuals when you just keep your money sitting in a bank account and do nothing else with it. But what kinds of companies should you be investing in? Heres what Warren Buffett has said over the decades.

The Chairman and CEO of Berkshire Hathaway, during a 2015 shareholder meeting, noted that: The best businesses during inflation are the businesses that you buy once and then you dont have to keep making capital investments subsequently, while you should avoid any business with heavy capital investment. He highlights real estate as good during inflation, which you may buy once and then also get the rise in value as well meanwhile he calls out businesses like utilities and railroads as not good investments during inflation.

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

Don’t Miss: Can You Cash Out Refinance An Investment Property

Let Social Security Help

People love to knock it, but Social Security is still a major part of most Americans retirementabout half of retirees rely on Social Security for more than 50% of their retirement income. It comes with a built-in cost of living increase based on the published inflation rate, and despite much being written about the potential drying up of the Social Security trust fund, its still estimated to provide at least 70% of expected benefits if or when it runs out of cashand thats without any legislative changes. All of that helps.

How To Profit From Inflation

For consumers, inflation means higher prices on goods and services, and a loss of purchasing power if their income fails to keep up. For investors, it means moving some of their money to assets that benefit from inflation or at least keep up with its pace.

The following investments tend to fare well during periods of inflation:

- Commodities like gold, oil, and even soybeans should increase in price along with the finished products that are made with them.

- Inflation-indexed bonds and Treasury Inflation-Protected Securities , tend to increase their returns with inflationary pressures.

- Consumer staples stocks mostly do well because price increases are passed on to consumers.

- Mortgage-backed securities and collateralized debt obligations are risky choices but tend to perform well under inflationary pressure.

- Investment real estate is traditionally a safe haven but should be approached cautiously in 2022 and 2023 given the unsettled state of the industry.

You May Like: Bb& t Investment Services Inc

What Investments Do Well During Times Of High Inflation

If you like the idea of investing in individual companies, the best stocks to choose during times of high inflation are businesses that can increase the price of their products to cover higher costs without losing customers. This is called pricing power.

Companies that have this often command brand loyalty, such as those that specialise in luxury goods like LVMH, the owner of Louis Vuitton, or big names such as the tech giant Apple and the sportswear maker Nike.

Firms that deliver essential products or services, such as healthcare, like the drug maker Pfizer, also find it easier to increase prices without affecting sales.

There are also investments designed to keep up with inflation. Inflation-linked bonds are loans to governments or companies that pay interest that rises with inflation.

Check the measure of inflation it tracks or your returns may be lower than you expect. RPI, is the retail prices index and tends to be highest.

If you want to know more about the different measures, check out our article: CPI vs RPI inflation: whats the difference?

These Stocks And Etfs Offer Protection Against Fast

Inflation continues to be one of the most pressing concerns on both Main Street and Wall Street. And with little relief expected in the short-term, people who havent already padded their portfolios with inflation investments still have time to don a little protection.

For context, Americas inflation rate was already red-hot by May 2021, when it surpassed 5.0%. By the end of the year, the consumer price indexs growth had reached 7%.

Consumers were punished still further in 2022 as Russia invaded Ukraine, sparking a massive run-up in crude oil prices that has domestic gasoline prices still rising to this day. CPI growth hit a 40-year high of 8.5% in March, it pulled back only slightly to 8.3% in April, and it could persist as a problem for many months more.

“By now, we are well aware of the supply chain issues and imbalances that caused goods inflation to rise over the last year,” says Liz Young, head of investment strategy at SoFi. “The big headline makers have been prices of used cars & trucks, household furnishings, and various food items, for example.”

But she notes that services data is becoming a larger driver of high inflation. “The reason this matters is that services inflation is a stickier component,” she says, and one that could prove more difficult to contain.

- Dividend yield: 4.1%

- Dividend yield: 4.3%

- Koyfin: Buy, 2/6/3/0/1, $46.45 PT

- Dividend yield: 1.8%

- Dividend yield: 2.0%

- Dividend yield: 0.7%

Read Also: Purchase Investment Property With No Money Down

What Stocks Do Well During Inflation

According to analysts, the following stocks may be considered excellent long-term investments in an inflationary environment:

- Berkshire Hathaway : a solid performer that flourishes in bad market conditions.

- Coca-Cola : a company with strong pricing power and a vast number of loyal customers.

- Devon Energy : the oil company that receives high returns due to the high cost of gas.

How To Find The Right Retirement Portfolio Allocation To Inflation Beaters

I like the idea of retirees “backing into” an appropriate stock allocation, using their anticipated spending from their portfolios to determine how much to hold in safer assets like cash and bonds and in turn how much to hold in stocks. Given that stocks have been reliably positive for holding periods of at least 10 years and more erratic for shorter periods than that, earmarking safe assets for the first 10 years of assets, then holding stocks for spending for years 11 and beyond, is an intuitively appealing setup. For retirees with high risk capacities and/or those who have a high risk of a shortfall, shrinking the allocation to safer assets may make sense.

Recommended Reading: Top Real Estate Investment Companies In Usa

Tips Are Designed To Beat Inflation

Treasury Inflation-Protected Securities are designed to protect your investment from rising prices. The U.S. Treasury adjusts the par value of TIPS each year to keep up with inflation. This boosts your interest payments, and it also may deliver some additional appreciation from inflation-adjustments.

While the inflation-hedging aspect of TIPS can make them an appealing way to preserve the purchasing power of your money, understand that they dont provide much in the way of growth. Over the past 10 years, the iShares TIPS Bond ETF, which tracks a TIPS index, posted average annual returns of just over 3%.

If you invest in TIPS, youll also need to watch out for deflation. Though youll never receive less than the original par value of a TIPS when it matures, its value can still decrease while youre getting interest payments.

The Banks Will Never Beat Inflation

The main reason I invest my savings, rather than putting them in a cash savings account, is because I know the banks will never increase their interest rates as fast as inflation. In the long term, Im confident investing will provide better returns, she says.

About 90% of her money is invested in a mixture of funds, with the remaining 10% in individual companies. Her funds include Baillie Gifford Positive Change, Baillie Gifford China, Liontrust Sustainable Future Global Growth and Vanguard Global Small-Cap Index.

Her individual stocks are Microsoft and OneSavings Bank.

Im holding my nerve and plan to invest my way through it. I have some cash savings equivalent to six months of outgoings to cover me for any emergencies, but I see no reason to have other cash savings. With investing, your money can fluctuate a lot but its better than losing value to inflation.

Don’t Miss: Best Podcasts For Investment Banking

How Individual Situations Can Affect Your Inflation Investments

While many investors find these inflation hedges valuable additions to portfolios during inflationary eras, they arent always right for every investor. Individual goals, time horizons and risk tolerance should be considered before making any investment decision.

For instance, during normal inflation investors at or nearing retirement are generally advised to shift most of their portfolios into cash and fixed-income investments. The fact that inflation is on a roll doesnt necessarily mean these risk-averse investors should go all in on equities, commodities and other relatively risky investments. Instead, they may put only modestly more of their portfolios into inflation hedges, while staying close to their asset allocation.

With interest rates still quite low, borrowing may be attractive for some investors. Thats especially true given that the Federal Reserve is likely to raise rates to combat inflation, making borrowing more expensive. With that in mind, taking out a mortgage now could be a smart move. This same is true of refinancing any existing high-interest rate loans. Keep in mind that inflation shrinks the balance due on a mortgage or other debt.