More Details About Acorns’ Ratings

Account minimum: 5 out of 5 stars

Theres no minimum to open an account, but the service requires a $5 balance to start investing.

Account management fee: 5 out of 5 stars

Editors note: Acorns previously had a $1 tier that was discontinued in September 2021. All $1 tier customers will be migrated to the $3 tier automatically, unless they indicate economic hardship and would be unable to continue investing without the $1 tier.

Acorns charges $3 a month for a taxable brokerage account, Acorns Later and Acorns Spend , or $5 a month to include those benefits plus Acorns Early, investment accounts for kids.

Whether Acorns’ fee is a pro or a con depends entirely on your account balance. Flat fees like this are less common among robo-advisors, which typically charge a percentage of your assets under management per year. A fee of only $3 or $5 a month sounds cheap, but it can be a high percentage of assets for investors with small balances. If you only contribute by rounding up your spare change, one of Acorns signature features, your fee relative to your account balance will be fairly high.

|

Account balance |

|

|---|---|

|

0.36% |

0.60% |

Investment expense ratios: 4 out of 5 stars

Account fees: 3 out of 5 stars

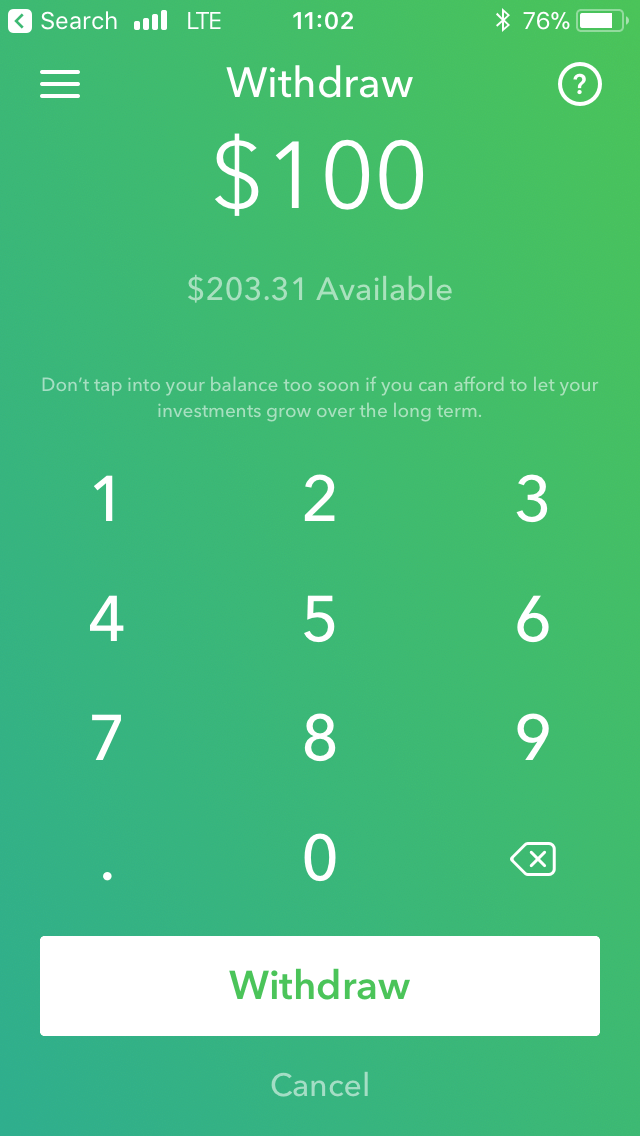

Still, you can always choose instead to sell your investments and transfer your cash to a bank account. There’s no charge for that.

Portfolio mix: 3.5 out of 5 stars

Socially responsible portfolio options: 4 out of 5 stars

Accounts supported: 2.5 out of 5 stars

Tax strategy: 1 out of 5 stars

How Much To Invest In Stocks

Remember that investing is for the long haul. So you should only invest money you wont need within the next five years or so. That should give you enough time to recover from any short-term losses and reap the potential long-term rewards.

The specific amount you invest depends on your budget. If you go by the 50-30-20 guideline touted by many experts, 20 percent of your budget should be reserved for future goals, while 50 percent goes toward essential spending and the remaining 30 percent covers everything else. Of that 20 percent, you should invest whatever money you dont expect to need anytime soon. So, if your monthly budget starts with $10,000, youd aim to set aside $2,000 a month for the futureand thats the maximum youd want to invest, depending on your goals.

Of course, not all of us fit into model sizes. Perhaps you can afford to invest more than 20 percent. . Maybe 20 percent feels like too lofty a goal for now. Whats most important is that you get started as soon as possible. Even if you have just a small amount to invest, the sooner you start investing, the more time your money has to grow.

Acorns Review Conclusion: Is It Right For You

Acorns target audience is the younger generations of investors. College students that can waive the monthly fee will be able to benefit from this app the most.

The platform is also a great micro-savings option for any investor.

Acorns is inexpensive, encourages good saving habits, simplifies investing, and gives you the tools needed to be a successful investor.

Many people scoff at the $1/mo. fee for being too high and this is the biggest knock we uncovered for Acorns.

However, you can afford $1/mo. and the saving and educational features offered in the app provide value that exceeds the monthly fee.

Additionally, Found Money can also compensate for the monthly fee because you are getting cash-back to invest that you could not get otherwise.

Saving and investing is an area that people do not partake in due to the time-consuming process involved.

If you would skip saving without the help of Acorns

it is definitely worth the fee.

People that are in their peak-earning years should probably find another investment solution.

p.s. if you are a college student make sure to use this link and get Acorns for FREE.

If you are not a college student, I do still think Acorns is a good option, but you might want to also look at these:

Wealthsimple – First $5,000 free

$5,000

Also Check: Best Investment Companies For Beginners

When Is Acorns A Bad Idea

Here are some reasons Acorns may not be right for you.

If you only rely on spare changeIf you only use the spare change roundups, you’re not going to be accumulating much. Investing micro amounts will also only get you micro returns. To really build wealth, you’ll need also contribute larger amounts regularly.

High fees for small balances$3 a month or $36 per year doesn’t sound like a lot. But the percentage can be steep for small balances. If you only have $10 in your account, that’s a 30% monthly fee.

In comparison, Betterment, another robo-advisor, charges 0.25% of the assets under management for accounts under $100,000.

No tax benefitsAcorns does not offer tax loss harvesting or any type of tax assistance, for that matter. Some robo-investing apps, like Wealthfront provide tax loss harvesting for all users.

Limited Investment optionsYou only have approximately 7 asset classes to choose from. While, some investing services, like Betterment, offer 10+ asset classes.

Focused Exclusively In Aerospace Defense Intelligence And Space

Acorn Growth Companies is a middle-market private equity firm focused on aerospace, defense, intelligence, and space investments. Acorn invests in operating companies that strive to enhance global mobility, protect national interests, and develop next-generation intelligence gathering technology. Acorn works in tandem with management to build its portfolio companies into significant market leaders.

Don’t Miss: Is Austin Real Estate A Good Investment

Who Should Choose Acorns

The robo-advisor features of Acorns make the most sense for someone who is drawn to the platforms round-up savings claim-to-fame: Purchases made in linked accounts are rounded up to the nearest dollar, and the balance is saved in an investment account.

If you spent $4.50 on a latte on a linked credit card, for instance, an additional $0.50 would be charged to your card and added to your investment account. If youve experienced joy with this pro-savings gimmick, you may be inclined to save for retirement with Acorns as well.

Still, competing robo-advisors provide more robust services at a lower cost. Only users who think theyll be enticed to save more with Acorns need apply.

Key Features Of Acorns

Acorns most distinguishing feature is its round-ups. And while a round-up doesnt necessarily add a lot on a per transaction basis, all of that change adds up over time.

Found Money is a rewards program that adds bonus cash to your portfolio when you spend money with one of Acorns partners. There are currently two kinds of Found Money transactions. For Tap and Get offers you have to go through the Acorns app and then make a purchase through your mobile phone. For Simply Spend offers you just need to use your Acorns-linked card to make purchases with partner brands.

Unlike a cash back credit card that offers cash back on all purchases, Found Money offers only exist for companies that partner with Acorns. There are currently more than 250 partners, including Walmart, Expedia, Apple, Nike and Sephora.

Acorns also provides educational content through its website and app. This content explains important investment terms and concepts using simple language. You can also find useful financial advice to help you make the most of your savings and investments.

Available Features

- Human advisors

Don’t Miss: North Oak Real Estate Investments

Simple Plans To Get You Investing

Acorns ties spending to investing with some plans that get money into your accounts while youre out spending. One of its best known is what Acorns calls round-ups.

When you set up round-ups, Acorns can automatically round up any purchase to the next dollar and move that extra amount from your linked bank account into your investing account. When youve accumulated at least $5 in round-ups, Acorns invests that amount in your target portfolio. If you dont want to invest it every time, you can set up a manual transfer process, too.

In addition, you can have extra money deposited into your account through a program called Acorn Earns. Refer friends and receive a small bonus or receive a deposit when you spend at one of the more than 350 brands partnered up with Acorns, part of its Found Money program.

Of course, you can also use a recurring transfer to get money into your investing account. Thats a smart way to keep your portfolio growing relentlessly. And youll also be able to use the smart deposit feature to squirrel away funds from your direct deposits .

What Types Of Bonds Can You Invest In

Bonds typically pad the safe side of your portfolio. But how much padding they provide depends on the type of bonds. And just like with stocks, the risks and returns of bonds are correlated. Treasuries, issued by the federal government, provide the most safety and the lowest returns. Corporate bonds, issued by companies, tend to offer greater returns, but also greater risksthe degree of which depends on the stability of the particular company. Municipal bonds, issued by state and local governments, fall somewhere in between.

Bonds also vary by maturity. Thats how long it should take you to get back the face value of the bond. And the longer it takes, the greater the returnsand risksstand to be. Short-term bonds mature in five years or less, intermediate bonds mature between five and 12 years and anything beyond is considered long-term.

Also Check: How Can I Start Investing In Real Estate

Acorns Review: Invest Your Spare Change

Have you ever heard the expression a little goes a long way?

Everyone has heard of that expression because it is true.

Do you struggle time after time to build your savings?

If you struggle, that is because you are human.

Maybe you have tried everything but cannot seem to kick your bad spending habits.

We get it saving money is hard!

The thought of investing can paralyze people because it is

either too overwhelming or requires too much money.

After all, you will set aside time in the future to:

- Save money to invest

- Learn how to invest

you will do that, right?

Maybe you will but the fact is, many people plan to invest but never follow through.

And even if you do follow through, you will miss out on the benefits of getting started as soon as possible .

If only there were a way to remove the excuses and to start making great investments today.

Fortunately, there is one company that has promised to allow you to do just that.

That company is called Acorns, and they are committed to helping you.

Are you interested yet?

Did you know? Acorns is Absolutely FREE for college students. to get the offer today.

* this won’t last forever

For people that find saving money difficult, micro-investing can be a life-saving tool.

Investing small amounts can make a BIG difference over time.

So, instead of putting your spare change away or spending cash that you find

why not invest that money?

Most people do not even realize that the money is missing .

Acorns Investing Review 202: Is It Worth It

Question: What do you do with your spare change?

Chances are good you leave those excess pennies, dimes, nickels and quarters lying around your car. Maybe you empty your pockets into a jar on your dresser and vow to cash them in some time in the future. Or maybe you count out coins when you buy something

Now, theres Acorns, an investing and savings app that lets you put those pennies to good use.

You can literally open an Acorns account with less than a dollars worth of change.

Also Check: Morgan Stanley Access Investing Account

Do You Pay Taxes On Dividends

Yes, dividends count as income, so you have to pay taxes on them. Ordinary dividends, the most common type, are taxed at your normal tax rate. Each January or February, you should receive a Form 1099 from your investment firm that includes the total you earned in dividends during the previous tax year. You should include that amount with your taxable income when you file your tax return.

If the dividends are qualified dividends, they are taxed at the lower capital gains tax rate. However, its safe to assume that most dividends you earn are ordinary unless your investment information says otherwise.

Investmentnews Wants To Hear From You Please Take A Minute To Complete This Form So We Can Better Understand And Serve Our Readers

Our customers are growing money in small amounts for the long run, he said. Our vision definitely is getting into more holistic money management for the individual and the family, so nothings off the table. Automated advice is great, but sometimes people need an actual live contact.

Bloomberg News first confirmed the launch Thursday.

While investing in single stocks can involve more volatility, the company said the feature lets customers stay diversified but also allows them to participate in individual trading, and could eventually support cryptocurrency and other investments.

Acorns plans to recommend that users invest 90% of their money in the Acorns offerings and 10% in stocks, according to images of the product shared with InvestmentNews.

The new feature, called Customizable Portfolios, is designed to drive user engagement on the platform, Kerner said.

He also said his firm is developing a portal to educate investors about diversification. I always stress that education is such an important part about what Acorns provides, Kerner told Bloomberg.

Acorns, already backed by celebrities like Jennifer Lopez and asset management giant BlackRock Inc., announced plans in May to go public in the second half of 2022 via a merger with a blank-check company, which could value the company at $2.2 billion.

For reprint and licensing requests for this article,

Recommended Reading: Joint Investment Account With Child

How To Start Trading Stocks

Before you invest in anything, you first have to think about what your financial goals are, along with your timeline for achieving them. Then you can build a well-diversified portfolio designed specifically to meet those goals. And don’t forget that there are also different types of accounts for different goals.

‘separate Your Politics From Your Investing’

A quarter of consumers in the MagnifyMoney survey said the top thing they wish they knew about investing is why the stock market can be so high when average Americans are struggling financially.

The short answer, says Neal Solomon, a certified financial planner and the managing director of WealthPro in Gloversville, New York, is that “the stock market and the economy are different animals. They do have a relationship, but it’s not always what people think. The stock market is forward looking it anticipates the future. The market is betting that there will be an ‘after Covid-19’ next year sometime.”

Berger notes that the coronavirus crisis has exacerbated this view. “There have been wild fluctuations in the market” during the pandemic, she says. “People don’t understand why some people are doing well and some are doing badly. Unemployment is high, but the stock market is rising. This leads to overall confusion.”

Indeed, the pandemic has led a third of consumers to trust the stock market even less, the survey found. And about a quarter of the respondents who mistrust the market say their main reason is that”it favors the interests of the wealthy.”

Don’t Miss: Cash Investments Accounts Receivable And Inventory Are

Another Roboadvisor In Canada That Will Invest Round Ups

Just because Acorns isnt currently available in Canada doesnt mean there isnt a roboadvisor that will happily round up and invest spare change from credit and debit card transactions.

In 2018, Canadian automated investing service Wealthsimple announced its new roundup feature that would allow all Wealthsimple clients to link a credit and/or debit account to their accounts and invest those quarters, nickles, and pennies left over every time you buy your groceries, your coffee, or your shirtless Nick Cage pillow case.

Even if youre not quite ready to invest, anyone with five spare minutes can go to Wealthsimples two-time Webby-winning website and .

Wealthsimple is anything but a fly-by-night startup its Canadas largest automated investing service. Its received$265 million in investment from some of the worlds largest financial institutions in Canada and Europe. Our brokerage Canadian ShareOwner Investments Inc., which handles all client trades, is a member of the Canadian Investor Protection Fund . CIPF is a program that insures all accounts up to one million dollars against member firms bankruptcy.

Wealthsimple may be the best thing to happen to spare change since the invention of the sofa. All Wealthsimple clients, regardless of how many quarters theyve got invested, receive state-of-the-art technology, unlimited human support and remarkably reasonable management fees.

Article Contents3 min read

How Do We Review Robo

NerdWallets comprehensive review process evaluates and ranks the largest U.S. robo-advisors. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

Read Also: What Can You Invest In With A 401k

How Do Similar Companies Perform

It’s impossible to predict how any stock will perform and IPOs can be particularly volatile. But evaluating the performance of companies like Acorns can be useful in determining how the market is performing and whether now is a good time to invest in this industry.Select a company to learn more about what they do and how their stock performs, including market capitalization, the price-to-earnings ratio, price/earnings-to-growth ratio and dividend yield. While this list includes a selection of the most well-known and popular stocks, it doesn’t include every stock available.

-

Coinbase Global

Company summary

Coinbase Global, Inc. provides financial infrastructure and technology for the cryptoeconomy. It offers the primary financial account in the cryptoeconomy for retail users a marketplace with a pool of liquidity for transacting in crypto assets for institutions and technology and services that enable ecosystem partners to build crypto-based applications and securely accept crypto assets as payment. The company was founded in 2012 and is based in Wilmington, Delaware.

Historical performance