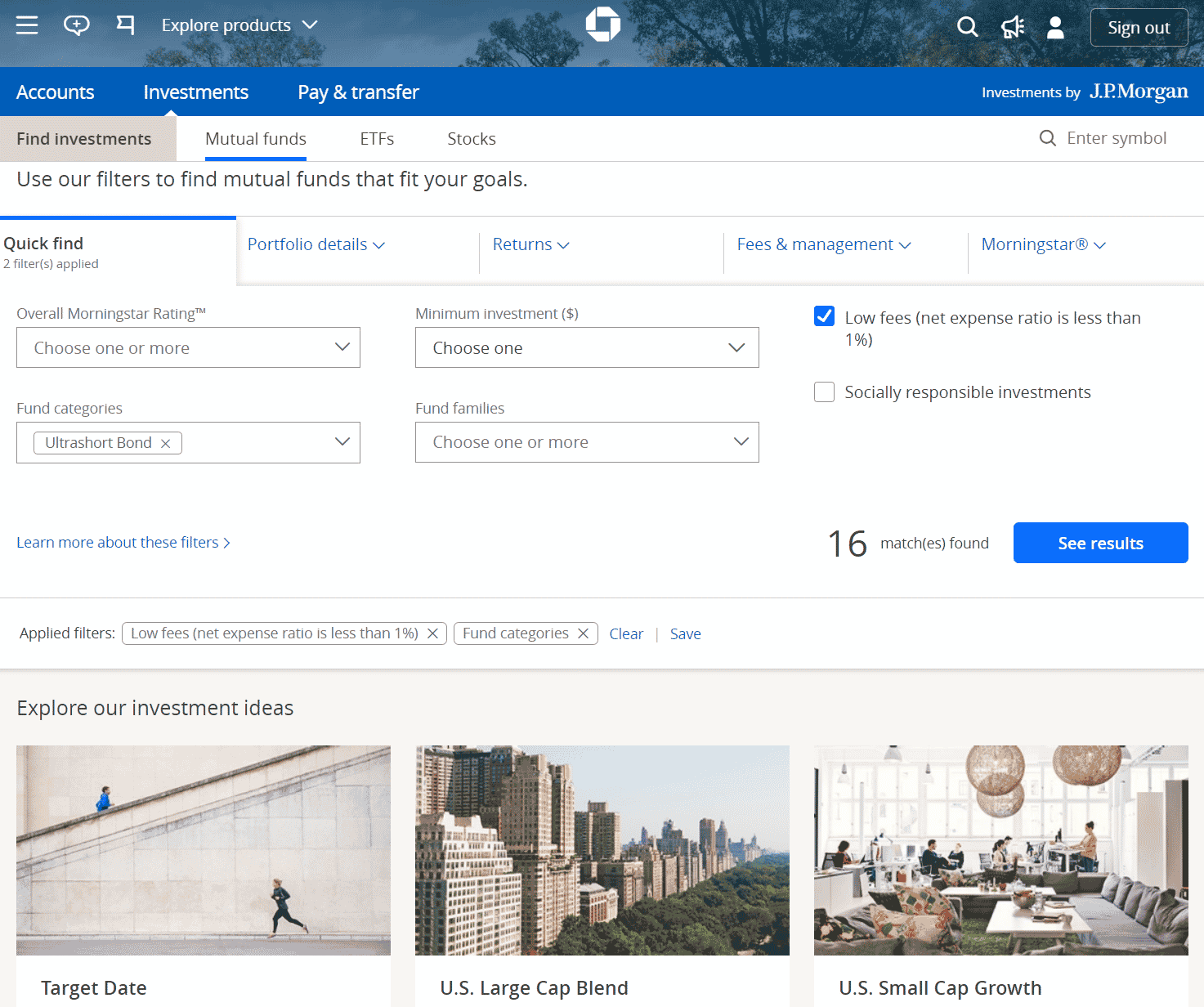

Access To Portfolio Builder Research

With a $2,500 minimum balance, investors gain access to the Portfolio Builder tool. This tool allows users to see how a certain stock or ETF would fit into their overall portfolio. The tool automates some of the best aspects of Modern Portfolio Theory to keep investors pursuing adequate diversification given their goals.Unfortunately, this is the primary mobile source for data and information. Users need to use the website to find articles about investment strategies. And users more or less need to leave the site to get detailed information about a stock or ETF.

Which Trading Platform Is Better: Jp Morgan Self

To compare the trading platforms of J.P. Morgan Self-Directed Investing and Vanguard, we tested each broker’s trading tools, research capabilities, and mobile apps. For trading tools, J.P. Morgan Self-Directed Investing offers a better experience. With research, J.P. Morgan Self-Directed Investing offers superior market research. Finally, we found J.P. Morgan Self-Directed Investing to provide better mobile trading apps.

Jp Morgan Frequently Asked Questions

You don’t need any money to start investing with the J.P. Morgan Self Directed Investing. Plus, you can exchange commission-free stocks, ETFs, options, and mutual funds.

Its automated account, however, requires a minimum deposit of $500, and you’ll need to maintain a minimum account balance of $250 to keep utilizing its services.

You May Like: Best Markets For Investment Property

Where Jp Morgan Self

Easy-to-use platform: With a single web trading platform, this is a straightforward way to get started investing in stocks and managing your portfolio.

App connects all Chase accounts: If youre already a Chase customer, the ability to view all of your Chase accounts, from checking to investments, in one location may be very appealing to you.

No account minimum: With no account minimum, you can start saving and investing with whatever amount works for you.

How Do We Review Brokers

NerdWallets comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

Disclosure: The author held no positions in the aforementioned securities at the original time of publication.

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

Read Also: Real Estate Investing In Denver Co

Online Investing Incidental Fees

| Late payment / Cash due interest | PRIME + 4.75% |

|---|---|

| Pre-payment advance before trade settles | PRIME + 4.75% |

| $250 per investment per year Does not apply to Managed Accounts | |

| Legal transfers | $25 per investment per year Does not apply to Managed Accounts |

| Safekeeping | $10 per position, per month Does not apply to Managed Accounts |

| Late payment / Cash due interest |

|---|

| PRIME + 4.75% |

| Pre-payment advance before trade settles |

| PRIME + 4.75% |

| $250 per investment per year Does not apply to Managed Accounts |

| Legal transfers |

| $25 per investment per year Does not apply to Managed Accounts |

| Safekeeping |

| $10 per position, per month Does not apply to Managed Accounts |

More Details About Jp Morgan Self

Account minimum: 5 out of 5 stars

J.P. Morgan Self-Directed Investing has a $0 account minimum, making any amount of money youve saved enough to start investing. According to J.P. Morgan, you can invest as little as $1 in no-load mutual funds with no transaction fees.

However, the Portfolio Builder tool is one of Self-Directed Investings bigger selling points, and you will need to have at least $2,500 in your account to use it.

Stock trading costs: 5 out of 5 stars

Like most online brokers today, J.P. Morgan Self-Directed Investing doesnt charge a commission for buying or selling stocks. Although this is a common practice now, it was only a few years ago that buying stocks meant paying a commission on every trade. The decline of stock commissions likely had a hand in the major increase in retail trading activity that started in 2020 and continues to this day.

Options trades: 4 out of 5 stars

J.P. Morgan Self-Directed Investings options pricing is pretty standard just like with stock trading, you wont pay a per-trade commission. However, you will pay $0.65 per contract.

Account fees: 3 out of 5 stars

Regardless of whether you’re performing a full account closure or just transferring a portion of the securities out of your account, youll pay a $75 account transfer fee. Some brokers, like Fidelity and Vanguard, don’t charge this fee, but among those that do, $50 to $75 is fairly standard.

Number of no-transaction-fee mutual funds: 4 out of 5 stars

Read Also: Merrill Edge Self Directed Investment Account

How Do I Open An Account

People who already have a Chase product can simply open an account through the Chase Mobile App. This involves answering a few questions and funding the account.Those who arent current account holders must either download Chase Mobile or visit the Chase.com website. Once users provide personal and employment information, they can choose the type of account to open. From there, it’s up to the investor to fund the account and start investing.

How This Broker Makes Money From You And For You

J.P. Morgan makes customers aware that they will have various types of costs and expenses that are associated with investing. Like many of their competitors, J.P. Morgan offers commission-free investments. However, the company must have another option to earn income by providing products and services.

- Interest on idle cash: J.P. Morgan investors can earn 0.01% on uninvested cash. Higher rates of interest are available through a money market fund sweep.

- Price improvement: J.P. Morgan discloses that they work to obtain the best execution of orders to meet customers’ guaranteed price orders. They also state that they are committed to providing transparency about their order execution process, which sometimes includes hedging to minimize their market risk. Sometimes, this process may impact the order execution price. To comply with regulations, J.P. Morgan is careful to determine which markets are best for investments and execute orders in those markets at the best price based on current market conditions. J.P. Morgan doesnt publish execution statistics in an easy-to-digest format.

- Payment for order flow : J.P. Morgan discloses that it may make money from receiving payments for order flow such as credits, rebates, discounts, and lower fees. J.P. Morgan discloses these payments in their quarterly Rule 606 reports. In the most recent filing, J.P. Morgan did not receive any payment for order flow.

Read Also: How To Invest In The Stock Market As A Teenager

How To Earn The Bonus

The J.P. Morgan Self-Directed Investing promotion requires you to deposit and maintain a minimum balance in order to earn the $625 bonus.

Full requirements to receive this bonus are:

Your Money Should Invest In Your Goals

Were giving you transparent pricingwhether you want to trade on your own or leave it up to our robo-advisor.

Sales of U.S. listed stocks and ETFs are subject to a transaction fee of between $0.01 and $0.03 per $1,000 principal. Please refer to your trade confirmation for the current fee.

Option trades are subject to a $0.65 per-contract fee. Sales are subject to a regulatory transaction fee of between $0.01 and $0.03 per $1,000 of principal. Offer terms and pricing are subject to change and/or termination.

There are costs associated with owning a mutual fund, such as annual operating fees and expenses. This and other important information is included in the prospectus.

Also Check: What Type Of Investment Is Acorns

Is It Safe And Secure

J.P. Morgan Securities is a member of FINRA and the SIPC. Its a well-known company, for a large bank, is remarkably free from scams and shady business. Investors should not expect some sort of bait and switch. I dont expect J.P. Morgan to raise rates on any of its investment products soon.The accounts are also protected through multi-factor authentication. Users are prompted for multiple factors even when logged in from known IP addresses. To me, this is an excellent example of consistent security.Investors’ accounts are also somewhat protected from theft as long as the fault is J.P. Morgans and not yours. That said, the investments in the account are not perfectly safe. Investments in any brokerage account can lose value and even go down to zero. Stock market investors need to be ready to risk money if they’re going to invest.

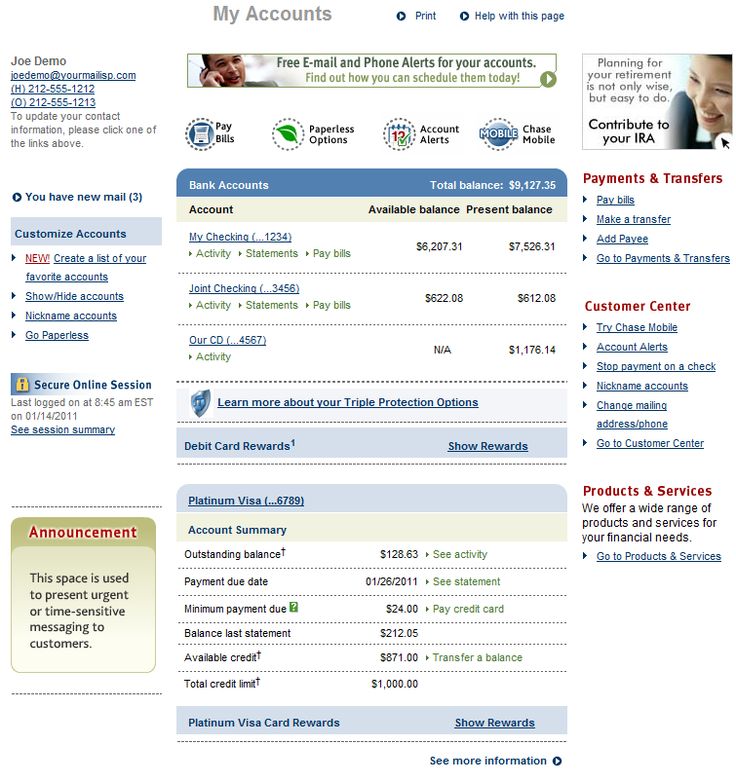

Integration With Chase Accounts

Like other brokers that are part of larger financial institutions , your Self-Directed Investing account appears on your Chase dashboard along with credit card accounts, bank accounts and any other account you have with Chase.

Thats an attractive feature if youre looking to consolidate accounts, one of the biggest appeals of the brokerage service here. Youll have quick transfers between brokerage and bank accounts, and you wont have to guess whether your money is in limbo.

If youre already familiar with the Chase dashboard, its simple to navigate and a generally clean interface, so you can get where you want to go easily. And if youre opening a J.P. Morgan Automated Investing account, the brokers robo-advisory, youll have that in the same place, too.

Also Check: Ways To Invest Money In Real Estate

How We Make Money

Bankrate is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate does not include all companies or all available products.

Commissions On Stocks Etfs And Options

J.P. Morgan hits the sweet spot on commissions for stocks, ETFs and options three of the most popular investment types. Heres how much it will cost you to trade them:

- Stock commissions: $0

- ETF commissions: $0

- Option commissions: $0.65 per contract

Those numbers are solidly good, but the industry is so competitive that the figures are also merely in line with most of the top players such as Fidelity Investments and Charles Schwab, though Robinhood and Webull both offer no-cost options trades, too. No matter, J.P. Morgan delivers on one of the most important areas for investors: cost.

If you need to make a broker-assisted trade, however, it will run you $25 a pop.

Recommended Reading: Purchase Investment Property With No Money Down

Stocks Dip After Jpmorgan Chase Ceo Jamie Dimon Warns Of Recession

So much for a sleepy Columbus Day on Wall Street. Stocks werent doing much Monday morning but took a turn lower in the afternoon following stark comments from JPMorgan Chase CEO Jamie Dimon, who warned that the United States is likely to enter a recession within the next six to nine months.

Dimon made the comments in an exclusive interview with CNBC that aired Monday.

You cant talk about the economy without talking about stuff in the futureand this is serious stuff, Dimon said in the CNBC interview. He added that he thinks Europe is in a recession already and that the US is probably next.

The Dow fell more than 200 points shortly after Dimons comments aired before rebounding to end the trading day down nearly 95 points, or 0.3%.

The S& P 500 and Nasdaq were each down sharply midday but also bounced off their lows. The S& P 500 closed with a 0.8% loss while the Nasdaq dropped 1%.

Shares of JPMorgan Chase, which is one of the 30 stocks in the Dow, were down nearly 1%. JPMorgan Chase is one of several big banks that will report earnings on Friday.

Stocks have tumbled this year due to worries about inflation and how the Federal Reserves aggressive interest rate hikes to fight surging prices may eventually lead to a recession. Stocks soared early last week, leading to hopes that the market had bottomed.

Are There Any Fees

Stocks, ETFs, options, and mutual funds trade commission-free with J.P Morgan Self-Directed Investing. The options contract fee is $0.65. If you want to buy bonds, youll pay $1 per bond . Fixed income also costs $1 per trade. Transaction fees you may face include:

|

Transaction |

|

|---|---|

|

Broker-assisted trade |

$25-$30 |

Free trades dont run out after an introductory period, making this the perfect app for people who want to buy and hold individual stocks along with ETFs or other assets.

Read Also: How Do I Invest In A Private Company

No Mutual Fund Commissions

When it comes to no commissions, J.P. Morgan takes it a step further than many brokers. The broker charges no commissions on mutual funds. And that pricing outdoes many rivals, some of whom offer no transaction fees on only the buy or sell, or minimize their commissions only on their in-house mutual funds or other no-transaction-fee funds.

The brokers pricing puts it squarely among the best brokers for mutual funds, and it should appeal to mutual-fund investors, including new investors and retirement investors. This is one place where J.P. Morgan competes well with apps such as Webull and Robinhood and even tastyworks none of which offers access to mutual funds, let alone no commissions on them.

Is It Worth It

J.P. Morgan is neither the first company to offer no-fee trades nor is it the most innovative company in the bunch. However, it offers a few unique selling points. The Portfolio Builder tool is an excellent option for people who want to own funds along with individual stock positions. The easy buy and sell buttons make the nuts and bolts of investing easy to manage.The only real drawback to the platform is that it only supports after-tax brokerages and traditional and Roth IRAs. Business owners or side hustlers will need to host their self-employed retirement plans elsewhere.Overall, I dont think I would move my money from another no-fee brokerage to J.P. Morgan Self-Directed Investing. However, it will make top apps for free trades for the foreseeable future. New investors are likely to find that its easy to use, even if it’s a little bit boring. I like that it encourages responsible investing in line with risk tolerances and time horizons.

INVESTMENT AND INSURANCE PRODUCTS ARE: NOT A DEPOSIT NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

You May Like: Investment Portfolio Asset Allocation Examples

How Much Does Jp Morgan Self

Like most modern trading platforms, J.P. Morgan Self-Directed Investing offers $0 commission trades you can buy and sell stocks all day without Chase taking a cut. $0 commission trades have become the industry standard, but you shouldnt take them for granted just ask anyone who yelled at their greedy Wall Street broker in the 80s!

The three fees youre most likely to run into are :

- $0.65 per options contract.

- $25 broker-assisted trades fee.

- $75 transfer fee between brokers .

Transfer fees suck, especially if you plan to take brokers for a test drive for a few months. That being said, its unfair to pick on Chase for charging $75 to close or move your account since companies like Robinhood and Webull do the same.

Overall, however, Chases fees are still lower and fewer than most, so its an overall win for the platform.

An Online Trading Experience That Puts You In Control

With unlimited commission-free online trades, you can take control of your own investments.

Choose from a wide range of stocks, ETFs, fixed income, mutual funds, and options.

From our Portfolio Builder to our screeners and watchlists, we make it easy to build diversified portfolios.

Access our secure, easy-to-use trading experience online or through the Chase Mobile® app.

Recommended Reading: Wealth Management Vs Investment Banking

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.