What Are The Advantages Of Buying A House With An Llc

You can tap into a few great advantages when you buy a house with an LLC. These advantages include increased privacy, limited liability, tax benefits and partnership opportunities. Buying a house with an LLC also allows you to keep your business separate from your personal life. Let’s dive into the details of these advantages one by one.

Keep Up With Annual Expenses

If there is a change in the registered agent, this will have to be notified to the state. Youll have to send in your registration certificate. Or you may have to send in your annual report that states who the agent is, whos still at the company, where the company is located, and a feeof course.

Remember, if youre not the registered agent youll be paying an annual fee to the registered agent service.

Should I Create An Investment Llc

Investment LLCs are most common for families, groups of friends, or partners, who want to pool their money for investment purposes. It is also possible for an individual to create an investment LLC.

Some typical types of investments made under an LLC include:

- Stocks, ETFs, and mutual funds

- Bonds, CDs, and fixed-income instruments

- Ownership of businesses

The LLC will protect each partys investment and personal assets and provide each party with tax benefits. If you choose to create an Investment LLC, one of the most critical formation documents is theLLC Operating Agreement .

Also Check: How Can I Invest 2000

Create A Real Estate Llc Operating Agreement

An LLC operating agreement is a legal document that outlines the ownership and member duties of your real estate LLC. Five states require LLCs to maintain an operating agreement , but every LLC should have one.

Even single-member LLCs can benefit from having an operating agreement.

Your operating agreement should outline the following:

- Each members responsibilities

- How new members will be admitted

- How existing members may transfer or terminate their membership

- How profits and dividends will be distributed

- How and when capital calls will be made

- Manager indemnification regarding mistakes made in good faith

- Tax and reporting timing

- Interest transfer and first right of refusal to members if property is to be sold

You can add provisions to your real estate LLC operating agreement, as long as they don’t conflict with your states law.

Recommended: Download a template or create a custom free operating agreement using our tool.

A Guide To Buying A House With An Llc

You may wonder, “Can an LLC buy a house?”

The short answer: Yes.

You may want to explore the idea of buying a house with an LLC to enable your business to own property or to have your LLC make your next real estate purchase.

No matter your newest venture, you have possibilities but it can get tricky. We’ll go over the details of how to buy a house with an LLC and the possible pitfalls involved.

Although Rocket Mortgage® doesnt do lending to LLCs, this article will give you an idea of what you need to know if you considering buying a home this way.

Don’t Miss: Relative Strength Strategies For Investing

Real Estate Llc Vs Liability Insurance

If investors decide that the process of forming an LLC is not worth the protection it will provide if they were to face a lawsuit, they can choose to rely on liability insurance instead. Liability insurance is an affordable option, but these policies can be risky as they will include exceptions and limits to the protection they offer. Overall, LLCs are becoming increasingly popular due to the benefits they offer real estate investors.

Limitation To One State

LLCs can only buy property in the state they are registered. Meaning, if you want to purchase property through a Georgia LLC, your company needs to be incorporated in the said state.

If youre going to build a portfolio of assets across the country, youll have to set up a separate LLC in every state you intend to buy. It increases the operating costs due to state registration fees, annual filing requirements, and minimum franchise taxes previously discussed.

Also Check: How To Get A Second Mortgage For An Investment Property

What Is A Legal Structure

When it comes to the legal and financial side of real estate investments, you cant afford to expose yourself to lots of liability and heavy taxation. While you have the option to run your venture as a simple proprietorshipfiling income and expenses on your personal tax returnthis is far from the best approach.

There needs to be some layer of protection between your business and your personal assets. A failure to establish legal safeguards in the form of a documented business structure could put your own personal assetshome, car, savings, etc.at risk if you were to be sued or fall behind on debts.

A legal structure is simply some legal documentation that you wrap around your business to protect it. Assuming that you choose the proper one, you still have all of the freedoms to run your business as you see fit.

Create Your Llc Operating Agreement

An operating agreement is a written document that outlines operating procedures for your LLC.

The operating agreement is not filed with the state and does not need to be submitted when you register your company.

Still, it’s important because it allows each LLC member to understand their rights and responsibilities within the group.

You May Like: Charles River Investment Management System

What Are The Disadvantages Of Buying A House With An Llc

You should also remember that there are significant disadvantages to buying a property through an LLC before you take this route. Consider the initial and ongoing costs, difficulty getting a mortgage, lack of preferential capital gains treatment and a few other disadvantages, which we’ll go over in detail.

Fast Access To Good Credit History

LLCs can take out loans like an individual investor. Depending on the down payment, property performance, and creditworthiness of the LLC, banks will determine the amount of credit they can extend.

Banks can offer non-recourse loans for companies with a good credit history. A non-recourse loan is not personally guaranteed by LLC members.

That limits your personal exposure to liabilities. LLCs can also use one property to secure a loan for a second property.

Another investment strategy is to purchase an existing real estate holding with good credit history to secure more competitive offers.

Recommended Reading: Best Investment Site For Small Investors

The Perks Of Setting Up An Llc

In addition to protecting you and your personal assets from liability, LLCs have other benefits. These additional benefits may come into play as you decide on the right timing.

Pass-Through Taxation for Single & Multi-Member LLCs

- If you are considering LLCs versus a C corporation or S corporation, LLCs offer several advantages. Youll avoid the double taxation incurred by owners of C corporations. In addition, LLCs have less complex legal filings and regulatory requirements compared to a C-corp or S-corp when it comes to real estate investing.

Simplified Business Administration

Related: 3 Reasons NOT to Buy an LLC Online

Frequently Asked Questions About Setting Up An Llc For Real Estate Investing

Why start an LLC instead of opening a joint brokerage account?

The main issue with a joint brokerage account is the lack of liability protection. If you use a joint bank or brokerage account to fund real estate investing, you may be personally liable for any problems that arise, such as previous outstanding property taxes, lawsuits from renters, and so on. When handled correctly, an LLC or limited liability company offers much better personal protection. You can even open a joint brokerage account in the name of an LLC to get liability protection for your investment account.

Can you be personally liable in an LLC?

Yes, there are plenty of situations where a court may hold owners or members of an LLC personally liable for business debt or liability. You limit your exposure to liability by properly managing the LLC and associated business accounts. For more information on ways to limit your liability correctly, consider consulting with a professional advisor for relevant legal advice.

What are the benefits of an LLC?

Do you need a lawyer to set up an LLC?

What are the basic requirements for setting up an LLC?

Don’t Miss: Best Investment High Interest Rates

Fundamental Mistakes To Avoid When Starting An Llc For Real Estate

While forming a real estate LLC is immensely important for protection, the beginning stages of setting it up can also be massively intimidating for beginners. Also, there are several common mistakes that investors make along the way. To better assist in understanding the complexity of a real estate LLC, the following outlines the biggest mistakes people need to avoid when forming an LLC:

Not starting the process of forming your LLC before pursuing new deals.

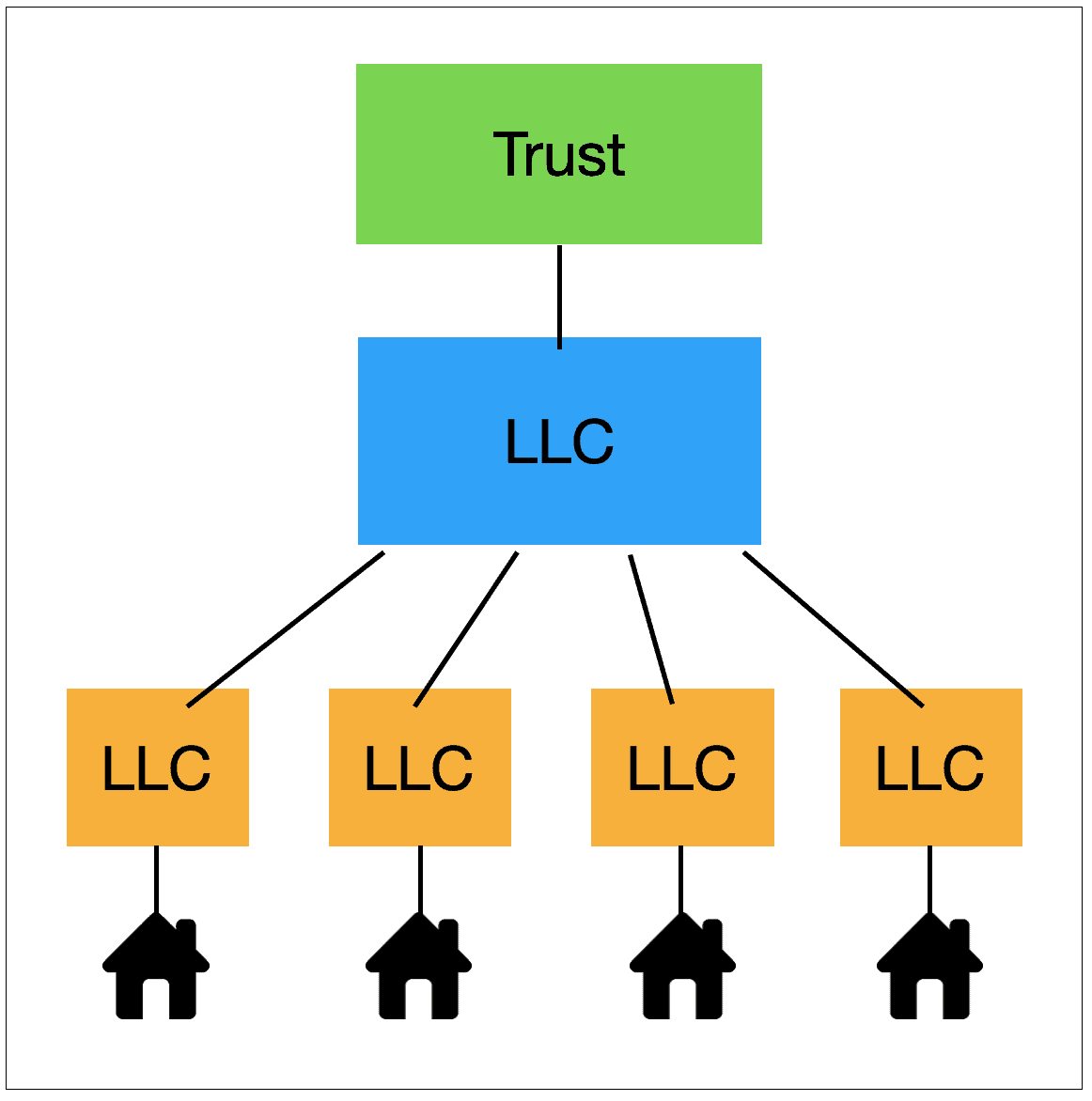

Selecting the wrong LLC structure for your business.

Commingling personal and business funds, or engaging in unethical practices.

Not consulting a professional on the best corporate and tax structures for your business.

Omitting the proper steps and due diligence recommended when forming an LLC.

Underestimating ongoing costs and maintenance to keep the LLC up and running.

Do You Have To Live In The Same State As Your Llc

Real estate companies are pretty much free to set up an LLC in any state they choose, with a few exceptions. It is common for business owners to file in the state they currently work in to avoid confusing tax requirements, but sometimes it may be worth it to file in a different state. Take the states tax laws into consideration when deciding for yourself.

Read Also: Is Fundrise A Good Investment

Use The Articles Of Organization Form On The Secretary Of States Website To Formalize Your Business

An l.l.c.s Articles of Organization are essentially its business license. It should include the company name, primary address, founding date, members, and a brief description of what the company does. Before submitting your Articles of Organization to the Secretary of State, ensure you have completed all the required sections. This is also the time when business owners must pay any formation fees to the Secretary of States Office. Their office may take a few weeks to respond, but youll receive notification once your documents are approved.

Why Do People Buy Land With An Llc

People buy land through an LLC because of additional asset protection and limited liability. Owning property through an LLC limits the individuals exposure should there be lawsuits or issues on the property.

Likewise, selling an interest in your company to use or lease the purchased land is simpler than selling it as a private person.

Read Also: Self Directed 401k Investment Options

Starting A Real Estate Investment Llc

To form a Delaware LLC, there is some basic information you need to provide.

While Harvard Business Services specializes in Delaware formations, we will also help you form your LLC in any state. You can view our Delaware formation packages on our website or contact us for help getting started.

All we need to know in order to file your limited liability company or corporation in Delaware is:

- Type of company

- Communications contact person

- Street address , which can be anywhere in the world

- Telephone number, landline or mobile

- Initial LLC member or corporation director/shareholder

- Shipping and billing address

- Method of payment

What Can You Invest In With An Llc

LLCs can invest in numerous types of securities, physical and digital assets. The only difference is that you cant invest using retirement accounts such as a 401K or Roth IRA.

Instead, youll have to open a separate business bank account and then a trading/investment account.

Heres what an LLC company can invest in:

Recommended Reading: Private Real Estate Investment Company

What Can You Find On Globalrentalsite

In order to support the information searching and scanning of customers, we do provide several useful tools to assist on our platform. On the main page, you can find different areas where we set up recommended searching forms like Top Trending Rental Searches, Recently Searched, Rental Categories and so on. For faster and more convenient service experience, we suggest our clients use those functions. We also release our own Blogs Post section specialized for distributing tips, advice and reviews on different rental services so that customers can make their rental choices better.If you have any trouble using our service, please refer to the Contact us section for a quick response. We also love to receive feedback, suggestions, etc. to improve our service in a better way. View more

Also Check: Can I Get A Loan For An Investment Property

Verify That The Name You Want To Use For Your Llc Is Not Already Taken

Having the right company name is more important than most people think. The companys name must be unique. Prepare a list of possible options before checking for their availability online. Remember, your l.l.c.s name is what will represent you in the public, so pick a name with promise. Problems with business names are the most typical reason LLC applications are rejected.

Don’t Miss: Can Illegal Immigrants Invest In Stock Market

Setting Up An Investment Llc

Setting up an Investment LLC is relatively simple, and although each state has its own laws governing LLC formation and requirements, the process is similar in most states.

Do you need more information about setting up an investment LLC?Follow this guide.

An Llc Offers Personal Liability Protection

Undoubtedly, the most important benefit of setting up an LLC is that it offers personal liability protection. This means that you as the founder or owner of the LLC cannot be held liable for debts, damages, or legal action against the company. If your property loses money or someone sues your LLC, your personal assets cannot be exposed.

You May Like: Chief Investment Strategist Alexander Green

Ability To Add Foreign Investors

Investing through a real estate LLC allows you to pool money from multiple members to purchase assets.

Even better you can add foreign national as LLC members. Doing so is an easy way to help your foreign family or clients purchase property in the US.

However, if thats the route you take, ensure that youre compliant with the rules and regulations provided by the Securities and Exchange Commission for real estate securities and exemptions.

Difference Between A Real Estate Llc And Sole Proprietorship

With a sole proprietorship, you dont have to file any legal paperwork or create a formal business structure. Youre the only person involved in the business, so youll be in charge of purchasing and managing all of your properties.

While that may sound simple enough, the tradeoff is sole proprietorships dont offer anywhere near the liability protection of an LLC. There is no separation of your personal and business assets like with an LLC, meaning you could run into big trouble if someone makes a claim against your property.

Also Check: Alternative Investment Partners Absolute Return Fund

How To Open An Llc

Opening an LLC is not difficult. Regardless of your state, these are the fundamental steps to take to open an LLC:

- Pick a name for your LLC .

- Create articles of organization and operating agreement. Some people do this with a lawyer, while others use online options which generate articles of organization and operating agreement and let you pay for a registered agent or other necessary parties/services.

- Register your LLC with your state.

- Apply for an Employer Identification Number through the IRS website. You can do this quickly and get an EIN number almost immediately.

- Work with an accountant to ensure you understand your tax requirements as an LLC, and that you are filing what you need to/when.

As you open an LLC for your real estate investing business, youll want two professionals on deck: a lawyer and an accountant. Ongoing operations will require some coordination between these two individuals or teams to ensure you remain in compliance.

How To Set Up A Real Estate Llc In 6 Steps

Starting a real estate investment LLC has risen in popularity in the past decade, namely due to the unique benefits that cannot be ignored. Forming a real estate LLC is not difficult rather, it is a matter of doing your research and getting organized. The following is a brief overview of the required steps, which can vary by state.

Research your states regulations on forming a LLC.

Pick out a business name and run a search to make sure it doesnt already exist.

File an Articles of Organization document that can be found on your Secretary of State homepage.

Create an Operating Agreement for your LLC, which outlines how your entity will be organized and run.

Find out whether your state requires you to publish an intent to file through your local newspaper.

Obtain any necessary business licenses and permits, as well as apply for a tax identification number through the IRS.

You May Like: Real Estate Investment Houston Texas