Lower The Refinanced Interest Rate

You might be surprised by the difference between an investment property and a primary propertys interest rate. Typically, the interest rate for an investment property runs at least 0.5% 0.75% higher than what the same borrower might pay for a mortgage on their primary residence, but may be higher. It all depends on your situation.

Investment properties represent a larger risk for lenders. Banks and online lenders know that if you run into financial hardship and can only afford a single mortgage payment, youll always choose your personal home.

To account for this risk, lenders charge more in interest on investment properties. Two mortgage payments can be unsustainable, so you might want to search for a lower rate by refinancing.

Refinancing can give you access to lower rates if you can show that you are successfully managing your rental property. Compare your current interest rate with offers from lenders before you refinance.

Read Also: Il& fs Investment Managers Ltd Share Price

Active Risk Mitigation Strategy

Our primary focus is on capital preservation through a comprehensive risk mitigation strategy. To do this, we focus on:

- Stable, high-growth residential real estate markets across Canada.

- Maintaining a diversified pool of mortgages, with no single mortgage exceeding 10% of the book value of the fund.

- Strict mortgage origination guidelines backed by our experienced underwriters, who carefully assess each propertys liquidity, equity growth projections and the ability of the borrower to service the debt.

- Conservative residential property valuations provided by an experienced team of third-party professional appraisers. This helps to lower the volatility in property values.

- Retaining an appropriate amount of cash within each fund to service investor redemptions.

What Kind Of Loan Can I Get On A Primary Property

You could be eligible for many types of mortgage loans on a primary property. This will depend on your individual needs and qualifications. Types of mortgage loans include:

- 30-year and 15-year fixed-rate loansThese are mortgages where the interest rate is fixed and the principal and interest payment stay the same over the life of the loan.

- Adjustable-Rate MortgageThis is a loan where the initial interest rate is fixed for a period of time, then adjusts at regular intervals.

- FHA loanFHA loans may be ideal for people with lower credit scores and who are looking for a loan with a lower down payment.

- VA loanVA loans offer low or no down payment options for active-duty service members and veterans.

Read Also: Seeking Real Estate Investment Partners

What Are The Loan Options For Purchasing A Rental Property

With investment property financing for rentals, borrowers have various loan options, including:

As an alternative, some creditors offer commercial residential property loans that can be used for housing and apartment buildings when other options are unavailable. Commercial loans are more complex to establish but still an option as long as the rental income exceeds the mortgage expenses.

What Rates Can You Get On An Investment Loan

As with owner-occupier mortgages, you can choose an investment loan with:

- a variable interest rate, which may rise or fall over time, making your loan repayments cost more or less

- a fixed rate, which lets you enjoy consistent repayments during the fixed rate period, or

- a split rate, where you pay a mix of variable and fixed interest on your mortgage.

Its important to remember that the best investment loan for you may not be the one with the lowest interest rate. If you compare different loan products, you may find a fixed rate home loan or variable rate home loan with features and benefits that offer you extra value, as well as affordable home loan interest rates.

Don’t Miss: How To Invest In A Roth Ira Account

Change The Mortgage Term

Have you thought about changing your investment propertys loan terms so you own your investment property free and clear sooner? You pay more each month, but you accrue less interest over time when you shorten your loans term.

You may also want to consider lengthening your term if you have trouble keeping up with your monthly premiums. Lengthening your mortgage term means you pay less each month, but you spread your payments out over time and accrue more interest. Refinancing by changing the length of your mortgage may or may not change your interest rate.

You may also be able to refinance from an adjustable-rate mortgage to a fixed-rate mortgage. Investment property owners often choose to switch to a fixed interest rate because their rates dont change on a month-to-month basis, which gives you a more consistent set of monthly expenses.

The Complete Guide To Investment Property Mortgages In 2021

If the road to real estate riches were an easy one, everyone would be a millionaire landlord or house-flipper.

Making big money from investment property is rarely as simple as buy low, sell high. It requires careful research, planning, hard work and a dollop of good luck.

But as long as you make real estate investing decisions with your eyes wide open, the financial rewards could surprise and delight you.

In 2019, the average gross return of house flipping purchasing, renovating and quickly reselling homes was 39.9%.

In other words, the average house flipper earned $39,900 for every $100,000 invested.

The average return on rental properties in 2019 was 15%. This means the average buyer of a $500,000 apartment building earned $75,000 in a single year!

By contrast, the average stock market return over the past 50 years was about 8% while the average investors return on mutual funds was between 4-5% over the last 30 years.

In this article:

Before examining the benefits of buying investment property, lets bust two persistent myths:

Myth 1: Buying a primary residence is the same as purchasing an investment property.

Fact: Although many people think of their homes as investments, a home is not an investment property unless you buy it for the express purpose of generating rental income or a profit upon resale.

Myth 2: Home values have always risen, so a primary residence will end up being an investment property if you own it long enough.

Recommended Reading: Recast Mortgage Chase

You May Like: Investing In Commercial Real Estate With No Money

Take Control Of The Situation

If expenses are truly unmanageable, McFadyen advises that clients consider consolidating debts with a loan, such as the possibility of taking out a second mortgage or home equity line of credit to get it under control. He predicts consolidation will be a massive trend in the next 12 months.

I ask my clients, are you able to sleep at night right now? If someone isnt able to effectively get out of debt, what is the downside of setting yourself up with a second mortgage or HELOC to help things?

McFayden has a client who owes nearly $75,000, which caused their to go down to the low 500s . By consolidating their debt, it became a more manageable single payment instead of several payments that were only covering the interest owed. The key thing is to do it before youre drowning in debt.

Option : Hard Money Loans

A hard money loan is a short-term loan that is most suited to flipping an investment property as opposed to buying and holding it, renting it out, or developing on it.

While it is possible to use a hard money loan to purchase a property and then immediately pay off the hard money loan with a conventional loan, private money loan, or home equity loan, starting out with one of the other options is more convenient and cost effective if you are not intending to flip your property.

The upside of using a hard money loan to finance a house flip is that it may be easier to qualify for compared to a conventional loan. While lenders still consider things like credit and income, the primary focus is on the propertyâs profitability.

The homeâs estimated after-repair value is used to gauge whether youâll be able to repay the loan. Itâs also possible to get loan funding in a matter of days, rather than waiting weeks or months for a conventional mortgage closing.

The biggest drawback of using a fix-and-flip hard money loan is that it wonât come cheap. Interest rates for this kind of loan can go as high as 18%, depending on the lender, and your time frame for paying it back may be short. It is not uncommon for hard money loans to have terms lasting less than a year. Origination fees and closing costs may also be higher compared to conventional financing, which could chip away at returns.

Don’t Miss: Where To Learn About Real Estate Investing

Other Ways To Finance An Investment Property

Many investment property buyers use one of the three mainstream mortgage programs listed above. But other options include:

- Home equity: A home equity loan or home equity line of credit on your current home

- Private loans: Real estate investors will sometimes fund a purchase of rental property

- Seller financing: Occasionally, a seller who owns a home outright may trade the lump sum she would normally receive for a continuing income stream

- Hard money loans: These short-term loans can sometimes work well for house flippers

But most buying investment properties turn to mainstream mortgage lenders, including banks. You can find some through our website using the Request a Quote service. Youll soon find a question that asks whether you want the loan for investment purposes.

Finance Other Real Estate Investments

You may want to use your home equity to finance a down payment if you see a real estate investment that you need to snatch up quickly. As your home grows in value over time, your equity increases in value beyond what you pay on your principal.

You can even parlay this built equity into more profit by using it to put money down on another investment. You might even have bigger goals, such as using the money you get from your refinance to invest in a different type of real estate venture, like a commercial property.

You May Like: Easiest Investment Banks To Get Into

Interest Rates On Primary Residences

Your primary residence is where you hang your hat at night. It can be a one-bedroom apartment in Tulsa, a midtown condominium in Houston, or a luxurious single-family residence in the foothills of the Santa Monica mountains. Since its the place you call home, youll typically get the best interest rate on a primary residence when borrowing money for a mortgage. Thats because lenders view loans for primary residences as less risky than other types of loans since homeowners are less likely to forgo making their loan payments if they happen to fall upon rocky financial times.

Your primary residence must be the place where you spend most of your nights. It also must be the address you use when filing your tax returns, or whats listed on your drivers license.

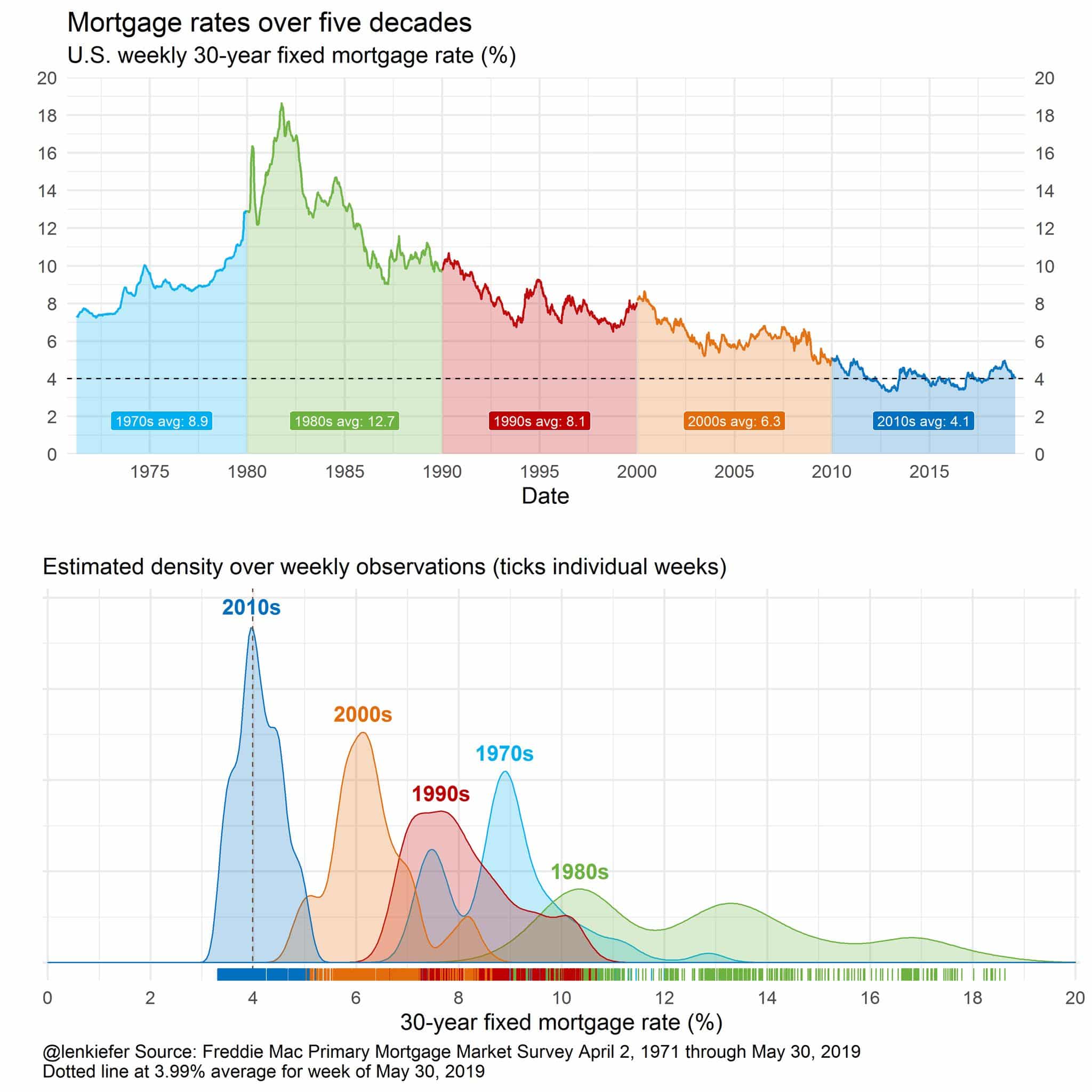

Last year was a good time for borrowing for primary residences interest rates for 30-year conventional loans hit an all-time low of 2.65 percent in early 2021. Rates have steadily begun creeping up, though, and as of mid-February, 2022, interest rates for 30-year conventional loans were nearing 4 percent.¹ Interest rates on 15-year loans, meanwhile, were just over 3 percent.

Note: The rates highlighted above are for prime creditworthy borrowers. Many different factors affect individual borrowing costs. Well cover those requirements a bit later.

How Can I Apply For A Mortgage

When applying for a mortgage for a primary residence, second home or investment property, here are some common steps:

Choose a mortgage lender and apply: When you first start looking for mortgages, you may see offers from lots of lenders. Compare rates and services before choosing the one that’s right for you.

Recommended Reading: Best Way To Invest Home Equity

What Is A Primary Property

A primary property is a home you’ll use as your primary residence. When you apply for a mortgage on a primary property or residence, youre confirming youll be living there.

Lenders may feel more confident lending to buyers who are using their home as a primary residence since they will be working directly with the people who are going to be living in, and caring for, the home.

Remember Real Estate Is A Long Game

Big real estate investors, such as developers, buy properties to hold for years, through many up and down cycles.

My views are that if you are going to invest you should be a long-term holder, says developer Gino Nonni of Nonni Property Group.

I dont know how often you can buy something and then turn around and make a substantial profit in a short period of time. At minimum, mom and pop investors pay their mortgage down and typically the value of the asset will go up.

He believes the shortage of land will always constrain supply and put pressure on prices. The result is a secure, long-term investment.

Thats the way I view it, and thats what I tell my friends when they ask. I tell them to always hold.

Also Check: Mutual Fund Investing In Startups

What Are Todays Investment Property Rates

Mortgage rates for investment properties are higher than those for primary residences because they are viewed as higher risk.

Still, rental properties are usually a great investment in the long run, and a slightly higher rate might not matter much when compared to the returns youll see on the property.

Every applicant is different. The best way to get your current investment property mortgage rate is to get quotes from multiple lenders and make them compete.

Rates change all the time, so contacting lenders online is the quickest way to get a fist full of rates to compare.

Will Investment Property Interest Rates Drop In 2020

Average mortgage rates fluctuate daily and are influenced by economic trends including the inflation rate, the job market and the overall rate of economic growth. Unpredictable events, from natural disasters to election outcomes, can impact all of those factors. See NerdWallets mortgage interest rates forecast to get our current take.

Read Also: How To Invest In Oil Wells

How Do I Compare Investment Loans

Property investors should consider the following when finding the ideal mortgage:

- Interest rate. For any borrower, a lower interest rate means lower repayments, which makes your investment property less expensive. But interest on investment loans is a tax-deductible investment expense, so getting the absolute lowest rate is less important than getting the right loan to suit your investment purpose.

- Fees and charges. Avoiding fees where possible can also help make your loan cheaper, but again, mortgage fees for investors are generally tax-deductible.

- Loan features. Mortgage features like an offset account can be very helpful, not to mention financially rewarding, if you know how to take advantage of them. It all depends on your investment strategy.

- LVR. Loan to value ratio is the amount you can borrow relative to the value of your investment property. An 80% maximum LVR means you need a 20% deposit. The smaller your deposit, the more you have to borrow, and the higher your costs will be.

- Borrowing capacity. Every lender will offer you a different amount of money, depending on their own policies, criteria and risk profile. Some may lend a lot more than others. It’s worth looking at multiple lenders to get an estimate of your borrowing power before deciding on one particular loan or lender.

Factors That Affect Interest Rates On Primary Residences And Investment Properties

Loans arent cookie-cutter Borrower A might get totally different loan terms than Borrower B even if they apply for the same amount at the same place on the same day.

Both types of lending are based on the following criteria:

- Debt-to-income ratio

- Loan-to-value ratio

After the subprime mortgage meltdown that led to the Great Recession, borrowers must demonstrate solid numbers in each of these categories to qualify for a home loan and the requirements are even stricter for investment property loans.

Don’t Miss: Is It Better To Invest In Gold Or Diamonds

Wowa Tip: Should You Pay Off The Rental Property Mortgage

If your property generates cash flow – meaning profits, you should keep your mortgage. However, paying off the mortgage could be a good idea if your property is losing money. In general, mortgage debt enhances your return on investment because you only need a small down payment to receive the total property appreciation and rental income. There are also the tax benefits of mortgage debt, such as deductions.

If your property generates profits, your money would be better spent as a down payment for another rental property. Instead of one fully paid off property, you could have two that appreciate in value and still provide you with rental income.

Each year, you will receive a T5013 slip from your mortgage lender showing the amount of interest paid. You must fill outLine 8710with the appropriate amount to claim the mortgage interest payments. Additionally, you may claim the costs directly associated with receiving the mortgage, such as:

- Mortgage broker fees

- Application & processing fees

With the deduction, you will lower the total amount of tax you need to pay. Some otherpopular rental expenses you can deduct in Canadainclude:

Increase Your Rental Income

Are you getting the most rent possible out of your investment property? Refinancing to make a few improvements or repairs might allow you to rent the property out for more money. Some of the most common upgrades you can make to increase your cash flow include:

- Adding an additional segment to the home to increase living space

- Finishing a basement and renting it out as a separate apartment

- Replacing the roof and missing tiles

- Upgrading the major appliances, cabinets and floors

- Repainting the interior rooms to make the property look nicer

- Finishing or maintaining an outdoor structure like a pool or fence

- Upgrading the furnace or central cooling system

Improving the livability of your space builds goodwill with your current tenants and increases the market value of your home. This means that you can charge more in rent in the short-term and make your money back by selling the property for more money later on.

Recommended Reading: Investing In Opportunity Zone Funds