Digital Assets And Cryptocurrency

Cryptocurrency is the most common method of investing in blockchain and its fairly simple. It is enough to set up an account on a cryptocurrency exchange like Coinbase or Gemini and start trading. Investments in cryptocurrency are at high risk due to speculation based volatility.

Digital asset investment is a broader area. Anything from gold to art to real estate can become a digital asset through the tokenization process. Tokenization allows the conversion of anything that has value into a digital token that exists on the blockchain.

For example, imagine that you are an art investor but do not have enough funds to buy an artwork that costs $1 million. An art dealer tokenizes this artwork into one hundred token and values each token at $10,000. By buying two of those tokens, you can now own 2% of the artwork. All the while blockchain guarantees proof of ownership, and that your investment is safe.

Top 5 Blockchain Stocks To Buy In 2022

If youre interested in learning how to capitalise on the revolutionary technology behind the Bitcoin network called blockchain, then you are in the right place!

In this article, we go through what the technology is, some of the best blockchain companies you need to know about and five top blockchain stocks to invest in this year.

Is Blockchain A Good Investment

In many cases, absolutely. But as with all investments, you need to do your research and due diligence before deciding on the best blockchain projects to invest in after all, not all projects are built equal.

Whether youre looking at how to invest in the best gaming cryptos , utility tokens, yield farms, mining, web3 or something else, your success will always boil down to how well you manage your risk and consistently pick winners.

Luckily, there are a handful of strategies you can employ to outperform the market, these include:

Recommended Reading: Is A Roth Ira An Investment Account

Invest In Companies Implementing Blockchain

If youre relatively risk-averse, investing in companies that dont specialize in blockchain but still implement the technology could be a great option. Because these businesses dont live or die on the success of blockchain technology, they provide a much safer investment option. Surprisingly , there are already numerous, publicly-traded companies that have added blockchain technology to their business ecosystem.

In choosing this route, you generally have two categories of companies to pick from integrators and providers. But nothing is stopping you from putting both types in your portfolio.

Blockchain integrators, such as Walmart, apply blockchain technology to improve aspects of their operations. Many companies are incorporating blockchain into everything from supply chains and the Internet of Things to remittances and data storage. Other than Walmart, Facebook, Goldman Sachs, Nestle, Pfizer, and Bank of America represent just a few of the notable names involved with blockchain tech.

Blockchain providers, on the other hand, sell blockchain-as-a-service solutions to other businesses. IBM, for instance, has a suite of enterprise blockchain offerings, containing technology regarding identity, food, finance, and worldwide payments, among several other industries.

Outside of IBM, you may want to look into investing in Oracle, Amazon, Samsung, and Microsoft. They all provide blockchain solutions as well.

How To Invest In Blockchain Top Methods

- Enter into Cryptocurrency Presales like IMPT Join a Carbon Nuetral Platform that will Fight Climate Change

- Invest in Utility Tokens like Tamadoge Invest in some of the most exciting play-to-earn crypto games

- Speculate on Blockchain Stocks Hold stocks in blockchain-centric companies

- Play Blockchain-Enabled Games Take part in the growing play-to-earn economy

- Invest in NFTs Leverage NFT marketplaces to invest in promising collections

- Stake Your Cryptocurrencies Help keep blockchains secure and earn rewards

- Earn Interest on Your Crypto Holdings Take advantage of crypto savings accounts

- Participate in Yield Farms Earn a yield on your idle cryptocurrencies

- Start Mining Earn rewards by helping to keep cryptocurrencies secure

- Take Part in IDOs Access early-stage projects at the best possible price

- Become a Liquidity Provider Provide liquidity to decentralized exchanges

Recommended Reading: Oil Well Investment Tax Deduction

Earn Interest On Your Crypto Holdings

If you are planning on holding cryptocurrencies long term. This one is for you.

Cryptocurrency savings accounts allow you to deposit your cryptocurrencies in return for a transparent and reliable yield typically paid out in the same crypto you deposited, e.g. ETH yields more ETH, whereas USDC yields more USDC.

They generally work similar to the savings accounts offered by most banks in that you deposit your funds in return for a transparent interest rate. In some cases, you may be required to commit your deposit for a fixed length of time to earn interest or benefit from a higher rate.

These platforms are generally completely hands-off. After depositing your funds, simply sit back and wait for the interest to roll in.

As you might expect, these platforms generally leverage your deposits as part of their business strategy to earn a return most of which is passed on to you. This might include facilitating collateralized loans, providing liquidity, market making, volatility trading, and various other income streams.

Unlike most traditional savings accounts, several crypto staking and savings providers feature auto-compounding, allowing your yields to stack up even faster. Quint is one such provider.

As always, consider shopping around to find the best rates and providers these can change regularly!

Is Blockchain Traded On The Stock Market

Maybe the best way for you to invest in blockchain technology isn’t through a single stock but through an exchange-traded fund . The GlobalX Blockchain ETF was formed in mid-2021 and is designed to allow investors to gain exposure to an entire basket of blockchain stocks with a single investment…. see details

Recommended Reading: Short Term And Long Term Investments Examples

How To Invest In Blockchain In 2022

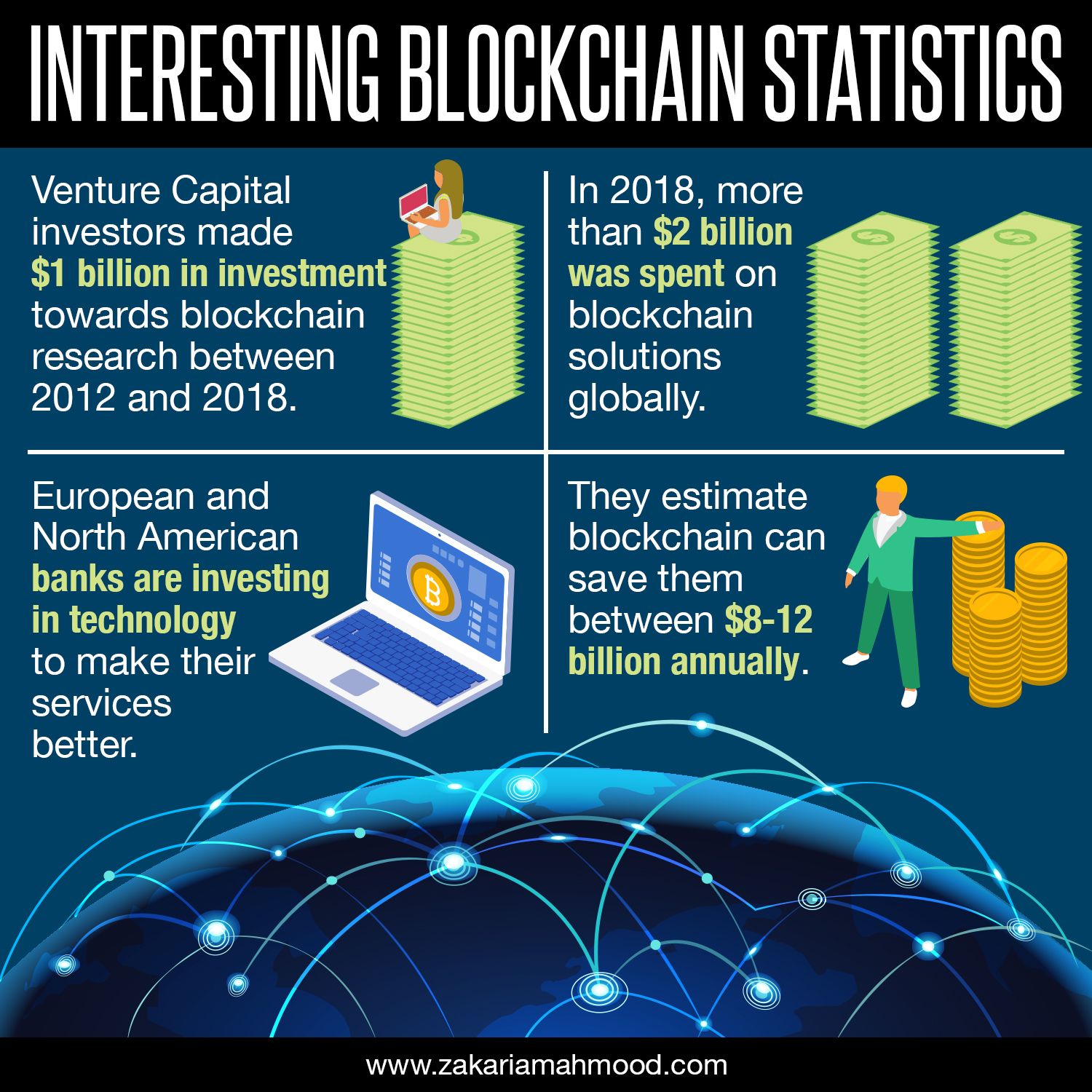

Widely regarded as a potentially disruptive technology, blockchain is often top of the list for investors looking to secure a stake in future-proof industries.

If youre wondering how to invest in blockchain technology as a beginner, this ones for you. Well dive into the ten most popular ways to invest in the blockchain niche, providing options for investors of all experience levels and risk appetites.

Risks Associated With Emerging Technologies

Similar to other thematic investments like electric vehicles or artificial intelligence, blockchain ETFs tend to come with additional sources of volatility. These risks can be market-related, such as pricing valuations or sudden changes in investors sentiment. Or they can be macro risks, such as additional government regulation.

Consider Bitcoin, which uses blockchain technology to store every transaction ever made. The digital currency has been in existence since 2009, but the popular crypto is not without its share of skepticism from authorities and investors. That uncertainty translates to greater volatility.

For sophisticated and retail investors alike, assessing the value of Bitcoin and other cryptocurrencies like Ethereum, XRP and Cardano remains a challenge. Most traders appear unsure of what these cryptocurrencies might be worth now or in the future.

Nevertheless, it seems the trend in cryptocurrency trading is not going anywhere. If anything, it appears to have gained steam and so has the adoption of blockchain.

Don’t Miss: Bitcoin Funds To Invest In

The Future Of Blockchain

Just like any other technology, blockchain technology is thought to shape up the world by 2030. By this year, its thought that most governments will have adopted some forms of virtual currencies. This is because cryptocurrency is more efficient compared to traditional fiat alternative.

Blockchain technology is also thought to bring trillion-dollar protocols. Today, theres a race among top valued companies as to who will reach a market stock valuation of one trillion dollars.

Some of these top companies include Amazon, Apple, Google and Microsoft. All these companies represent the new economy whereby theyre showing that its easy to have a transition of physical businesses to digital businesses through online connections. Blockchain technology will shape and change this equation. This will reduce the cost of transactions.

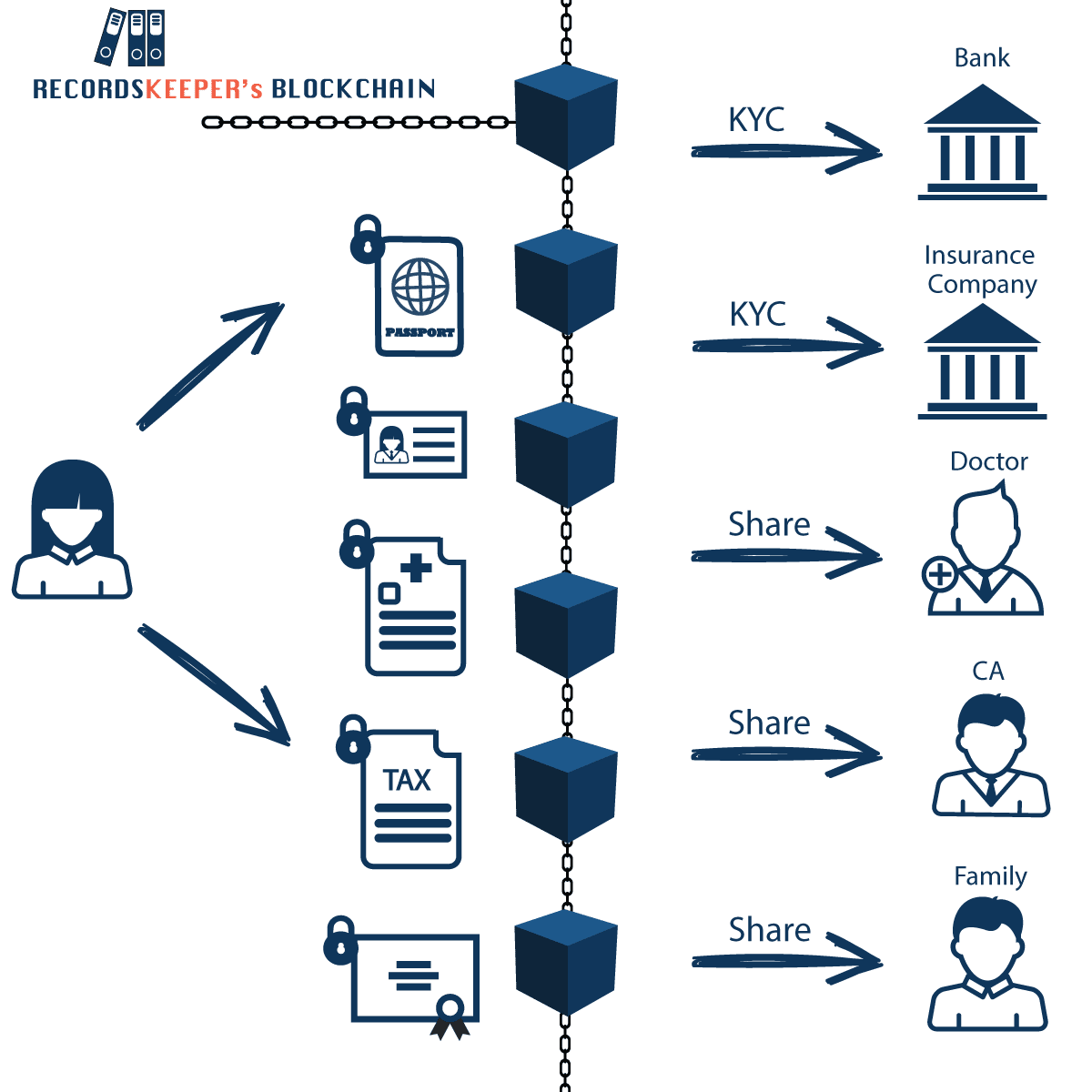

Finally, blockchain is thought to identify solutions to different systems threats and problems. This will reduce the risk of security breaches, increase efficiency, reliability and self-sovereignty. Also, the asset identity platform in blockchain technology will collect, store and share data for virtual and physical assets.

From time to time we refer third-party products or services to you. We may receive compensation from those third parties whose products or services we refer, however, our reviews and recommendations are independent of any compensation we may receive. There is no obligation for you to interact or transact with these third parties.

Why Start Investing In Blockchain

As a new technology with potential game-changing effects on the business world, blockchain is naturally garnering interest from the investment community. Here are a few factors that make it attractive:

- Blockchain could help an organization become more efficient, unlocking higher profitability over time.

- Blockchain is getting some high-profile attention from big tech firms, such as Amazon and Salesforce.com .

- Because of COVID-19, the world is making a rapid shift to digital. Blockchain goes hand in hand with other adjacent technologies, such as cloud computing, e-commerce, and AI.

There are also risks to consider, particularly for blockchain investments involving cryptocurrency:

- A lot of new cryptocurrencies are out there with underlying blockchain projects, and many of them don’t pan out.

- Cryptocurrency prices can be highly volatile, and purchasing them may lead to loss of principal.

Also Check: Questions To Ask Before Investing In Stocks

Volatility Is A Double

Volatility is another factor in the crypto market that has affected how people invest their money. Since cryptocurrencies are much more volatile than traditional assets, investors can expect much higher returns. For example, the average return in the stock market is 10% annually.

Conversely, cryptocurrency investors have seen anywhere from 50% in a month with blue-chip coins like Ether to 100% in a day with memecoins like Dogecoin . However, increased volatility brings a possibility of a higher downside, too. For example, this year alone, many cryptocurrencies, including 72 of the top 100 coins, dropped over 90% during the recent market downturn.

While the cause of this high volatility may not be known, experts have speculated that it could be due to factors such as lack of regulation and a low amount of institutional money in the space.

Regardless of the reason for the high volatility, many investors have tried to capitalize on it. For example, many investors in the United Kingdom tend to see cryptocurrency as a get rich quick scheme, according to a study covered by Cointelegraph in 2019. Many of the respondents in the study lacked an understanding of cryptocurrencies and were more likely to invest without any due diligence.

Ellie Le Rest, CEO of Colony an Avalanche ecosystem accelerator spoke to Cointelegraph about volatility in the crypto space, stating:

Ways To Start Investing In Blockchain

Besides investing directly in stocks of companies making use of blockchain, there are other ways to get in on the action.

As with all technology, it starts with semiconductors. Graphics processing unit chips designed by NVIDIA and AMD are a key ingredient in digital currencies. Even old stalwart Intel has a division to partner with companies developing blockchain to help foster innovation and development. IBM is another old tech company trying to evolve in a fast-changing world, and its blockchain segment has already partnered with numerous companies to help them put the new tech into real-world practice.

Buying shares of companies that are taking their time to fully understand and deploy blockchain could be a great long-term investment strategy if you want to bet on blockchain’s further development.

Read Also: How Do I Invest In Neuralink

What Is Blockchain Technology

Blockchain is a digital ledger of transaction. It is not stored in one central location, but instead, replicated across many different nodes. Transactions are compiled into blocks, and these blocks are linked together to form a data chain that cannot be altered. Because information stored in blockchain is decentralized, if there is an error in the record, it will be corrected by referring to other identical nodal points within the blockchain. Because of this, blockchain is pretty much incorruptible and extremely secure.

This is in contrast to the old method of storing information on a database. A traditional database tends to be located in one central location, like a server. If the server is compromised in a cyber attack or physical disaster , then the data is at riskwhatever that data might be banking information, medical records, or supply chain logistics.

Additionally, in a traditional database, the data itself can be changed. This is not true in blockchain solutions, as finished blocks cannot be altered.

As you can imagine, blockchain technology presents an attractively more secure option for organizations that need to store information. And in todays world, that pretty much means every organization. Data has become a critical element in a world where businesses offer tailored solutions to their customersfrom a retailer recommending store items they might like to an investment firm giving advice to a banking customer.

Amplify Transformational Data Sharing Etf

BLOK is the most prominent blockchain ETF on the market. This actively managed fund selects global companies to develop and apply blockchain technologies.

Top holdings: NVIDIA , Coinbase Global , SBI Holdings, CME Group and Silvergate Capital

Expense ratio: 0.71 percent

Assets under management: $968 million

You May Like: Best Investment For 5000 Dollars

How Does Blockchain Work

The purpose of the blockchain is to record all of the exchanges of data. This record is known as the ledger. The exchanges of data recorded on the ledger are known as transactions.

Verified transactions are added to the ledger as a block. Each block has three elements:

Miners can create new blocks on the chain through mining. While every block has its own nonce and hash, it also references the hash of the previous block in the chain.

This means that miners need to use specialised software to solve the complex math problem of finding a nonce that generates an accepted hash of which there are around four billion combinations that need to be mined before finding the right one.

This process makes it extremely difficult to manipulate the blockchain. Once a block is successfully mined and is accepted by the nodes on the network the miner receives a financial reward. Nodes are electronic devices that keep a copy of the blockchain and keeps the network running.

How Does Blockchain Technology Work

One of the most prominent features of blockchain is that it is decentralized. That means the database is not stored in one area, but rather, it is located within many different servers and computers worldwide.

These computers run a blockchain peer-to-peer program, and each location of these blockchains is called a node. So, anytime the blockchain is altered, the majority of nodes have to unanimously agree on the change. The blocks in the blockchain maintain accuracy by being connected and agreeing on changes as a team.

You May Like: Benefits Of Investing Through An Llc

Reasons To Invest In Blockchain Stocks

Making money in blockchain stocks isnt something you can do overnight it requires both time and effort. Although every investment has its own risks, investing in blockchain stocks has some advantages as follows:

1. The blockchain ledger technology provides an excellent platform where stocks, currencies, commodities and bonds will be tokenized.

2. The use of blockchain technology speeds up the entire process of settling transactions.

3. Blockchain addresses the problems of data security and privacy. When theres increased transaction security, the whole trading environment becomes efficient.

4. Blockchain technology can solve the issue of inside trading. To fix the insider trading problem is a huge deal. Fixing this problem creates a fair playground for all investors.

How Investors Are Making Money In The Crypto Space

Cryptocurrency isnt just easier for investors to access, it also provides multiple avenues for investors to make money. There are different subsectors within the crypto market, including token sales and decentralized finance .

Token sales were one of the first subsectors to increase in popularity within the crypto space. Token sales are fundraising rounds where investors can buy a crypto projects native tokens before they hit the open market. The idea is that investors can get in early and make a profit once the tokens are listed. This is based on the expectation that a tokens price will increase after a listing due to speculation and increased liquidity.

Token sales come in different forms, including:

- Initial coin offerings : Projects sell tokens directly to investors through their site via smart contracts.

- Initial decentralized exchange offerings : Projects sell tokens to investors through decentralized exchanges .

- Initial game offerings : Projects sell in-game assets, tokens and nonfungible tokens to investors.

The ICO market first peaked in popularity, surpassing the $1 billion mark in 2017. ICOs and the newer iterations were attractive to investors since they were initially very easy to get into, with users needing only a crypto wallet to participate. Now, however, there are additional requirements such as KYC , whitelists and limits on how much investors can contribute to a crowdsale.

Read Also: Invest In Online Real Estate