Tax Considerations Of Oil & Gas Investing The Basics

Congressional Incentives

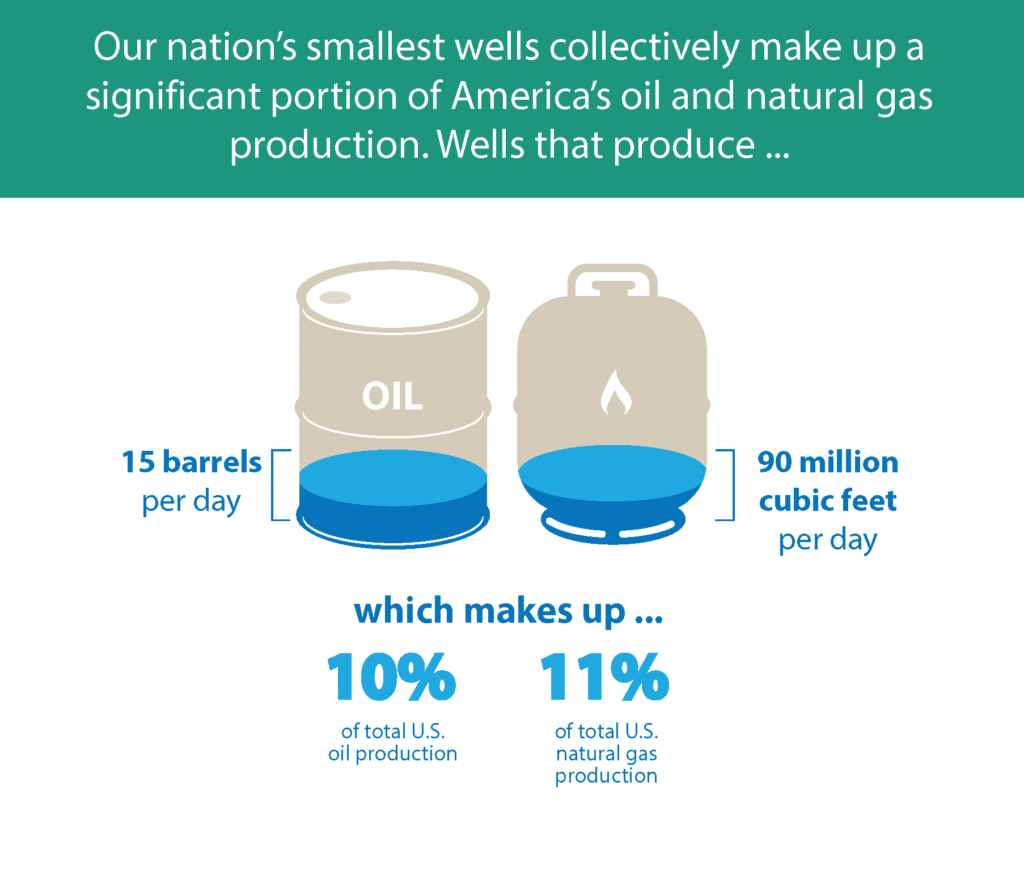

Natural gas and oil development from domestic reserves helps to make our country more energy self-sufficient by reducing our dependence on foreign imports. In light of this, Congress has provided tax incentives to stimulate domestic natural gas and oil production financed by private sources. Natural gas and oil drilling projects offer numerous tax advantages. These tax benefits enhance the economics of natural gas and oil projects.

Intangible Drilling Cost Tax Deduction

Oil and gas projects are labor, services, and non-salvageable materials intensive, so a significant portion of the expenditure is considered Intangible Drilling Cost , which is 100% deductible during the first year. For example, a capital expenditure of $100,000 could result in approximately $70,000 in tax deductions for IDC even if the well does not start drilling until March 31 of the year following the contribution of capital. The remaining $30,000 of tangible costs may be deducted as depreciation over a 7-year period. .

Depreciation Tax Deduction

Small Producers Tax Exemption- Depletion Allowance

This tax benefit is not available to large oil companies, or taxpayers who sell oil or natural gas through retail outlets, or those who engage in refining crude oil with runs of more than 50,000 barrels per day. It is also not available for entities owning more than 1,000 barrels of oil average daily production.

Active, or Non-passive vs. Passive Income

Intangible Drilling And Completion Costs

IDCs include all the expenses incurred by the operator of the well related to the drilling and preparing the well for production. Such expenses may include the cost of the drilling contractor, wages paid to employees to oversee the project, survey work, site preparation, fuel, etc. IDC also includes the cost of casing and tubing in addition to certain other tangible items, so the term intangible can be a bit misleading. The costs of pumping equipment, flow lines, storage tanks, separators, salt water disposal equipment, and other production facilities or equipment is not classified as IDC and is required to be capitalized and depreciated.

With the exception of integrated oil companies and drilling projects situated outside of the United States, IDC can be fully deducted in the year in which they occurred. You must make the election to deduct IDC on the first return in which IDC is incurred by either deducting or affirmatively electing.

- For cash basis taxpayers, if the contract with the operator requires the costs to be prepaid, IDC is fully deductible when paid, even if the actual costs are incurred by the operator in the following year.

- Taxpayers can elect to capitalize and amortize over 60 months straight line .

- Assume AMT income before any IDC preference add back is $500,000 and Excess IDC is $400,000 AMTI including Excess IDC = $900,000 x 40% = $360,000 amount deductible from AMT

- $40,000 is the preference IDC add back, thus, taxable AMT is $540,000

Oil: A Big Investment With Big Tax Breaks

When it comes to tax-advantaged investments for wealthy or sophisticated investors, one commodity continues to stand alone above all others: oil. With the U.S. government’s backing, domestic energy production has created a litany of tax incentives for both investors and small producers, and oil is no exception.

Also Check: Home Loan Investment Bank Customer Service

Why Choose Viper Capital Partners

For over five decades, our team at Viper Capital Partners has been facilitating capital formation and management within the energy industry.

As one of the leading oil and gas companies in Texas, were committed to offering investment opportunities to help you generate cash flow, provide beneficial tax deductions, and encourage multiple returns on investment.

Other advantages to choosing us as your oil exploration investment company are:

- Mineral ownership and package opportunities: Viper Capital Partners elite team has access to some of the most compelling mineral tracts in the business.

- Excellent leasehold program opportunities: Our team has gathered years of know-how when it comes to energy leasehold value and inefficient markets.

- Direct participation oil and gas well working interests: Our team partners with operators that are well-known for using the latest drilling technology for maximum yields.

Reasons To Invest In Oil And Gas

Here are just a few of the reasons to invest in oil and gas wells

- Unique Tax Benefits

Oil and gas investing offers some of the most exceptional tax breaks available anywhere in the tax code. This enables you to reduce your tax burden while generating a monthly income stream at the same time.

- Monthly Income

Free time is an extremely valuable commodity to accredited investors. Oil and gas investing gives you the opportunity to achieve significant monthly income, while allowing you to maintain focus on your own businesses.

- Simple Process

The API Resources team will carefully walk you throughout the entire process, from ownership assignments to revenue distributions. Were with you every step of the way so that you can have confidence and peace of mind.

- Diversified Portfolio

Are all of your eggs in one basket? Take advantage of the benefits that oil and gas commodities provide and help your portfolio to flourish.

- Low Oil Prices

Pricing is back on the rise! Well development costs have decreased significantly over the past two years. Lower well costs and the API Resources approach have created a rare opportunity that has not been available in almost 10 years.

Read below for some additional tax breaks from oil and gas well ownership

Recommended Reading: How To Invest In Gold Stock Market

How Do Oil Tax Benefits Work

Oil and gas investors are entitled to several major tax benefits that are not available anywhere else in the tax code. In the following paragraphs, we will explain the tax advantages of oil investments and how you can use them to energize your portfolio. These tax benefits of oil investments include Intangible drilling costs, tangible drilling costs, lease costs, etc.

Investing In Oil And Gas: How Tax Deductions Can Help You

There are a lot of reasons why qualified investors choose to diversify their portfolios by investing in oil and gas. One compelling reason is the substantial tax deductions afforded by this unique opportunity. In fact, when were talking about investments rich in tax benefits, a single commodity stands out above all others oil and gas.

The United States domestic energy production comes with a litany of major tax breaks, which complement any investment strategy. DW Energy, participating as a non-operating working interest partner with some of the most reliable, successful, and proven exploration and production firms in the country, can help any qualified investor take advantage of these tax benefits to protect the investors portfolio, build wealth, and reduce overall tax liabilities.

Some of the chief tax benefits that are available to qualified investors who partner with DW Energy include:

Don’t Miss: Opportunity Zone Investment Funds Vanguard

Have Questions Or Comments We Want To Hear From You

Ranken Energy Corporation offers direct oil and gas investment opportunities that enable investors to participate in the potential cash flow and the unique tax benefits associated with oil and gas investments. Investing in oil and gas is highly speculative and could result in substantial losses. The information contained in this website is for informational purposes only and is not a solicitation to buy or sell any securities. Information on this site is not intended to be used as investment or tax advice. Consult your investment advisor or tax advisor concerning the current tax laws and effects on your personal tax situation.

Tax Benefits On Investing In Oil And Gas The Basics

Depreciation Tax Deduction

The development of natural gas and oil from national reserves helps make our country more energy self-sufficient by reducing our dependence on foreign imports. In light of this, Congress has provided tax incentives to encourage privately funded domestic oil and natural gas production. Oil and natural gas extraction projects have numerous tax advantages. These tax benefits add to the economics of natural gas and oil projects.

Compared to services and materials that offer no salvage value equipment and other tangible materials used to complete and produce a well are generally salvageable. Such items are depreciated over a 7 year period using either the Straight Line Method or the Accelerated Cost Restoration System. Equipment in this category would include casing, tanks, wellhead and mast, pumping units, etc. Tangible and completion equipment costs are typically between 20 and 40% of the total cost of the well.

Don’t Miss: Boussard & Gavaudan Investment Management Llp

Tax Considerations: A Small Producers Perspective

Investing in the oil and gas industry provides very significant tax benefits to Small Producers. Although the Tax Reform Act of 1986 eliminated many traditional tax havens. The tax benefits of participating in national drilling programs remained. A properly structured program can provide a great way to stretch your investment dollar.

Cefms Practice Concerning Partners K

CEFM as Managing General Partner has always made it a practice to distribute the Partners K-1s and supporting documentation usually by mid-February. We have found that this provides enough time for the partner to process the information and file his/her tax return by April 15.

Along with the 1065 K-1 there are up to three supporting documents, or reports that are provided. Some of the information provided:

- Distributed Well Revenue & Depletion Allowance The Partners share of Gross WI income, the Net Income Received, and the 15% Depletion Allowance calculations for all wells in the Energy Partner Fund portfolio are provided.

- 1st Year IDC & Depreciation Deductions This document summarizes the Partners share of all capital that was paid out during tax year. Shown is the total amount of intangible expenses from each Partnership well investment that the partner may deduct for the tax year. In addition, the first-year allowable depreciation for each well is calculated in this spreadsheet. A 7-year straight-line depreciation schedule is used.

- Business Capital Activities Worksheet The Partners share of operational capital expenses and retained earnings of the Partnership. Also shown are the specific, proportioned dollar amounts that apply to their account for such things as the Total Re-invested Capital Contributed, Previous Years Allowable Depreciation Expenses, and Interest Income

Recommended Reading: How Do I Invest In Tiktok

Deductions For The Costs Of Oil Shale Exploration And Development

Location in tax code: 26 U.S.C. § 617

Amount saved by repealing: The U.S. Treasury would save $768 million between 2016 and 2026 by repealing this tax preference for certain mining exploration expenditures, including expenditures for oil shale. The amount applying to oil shale alone is unknown.

This tax preference allows oil and gas companies to deduct the costs of exploring and developing new domestic oil shale fields in the same tax year that the costs were incurred, rather than when those expenditures actually generate income. This means that companies engaged in oil shale production can incur costs exploring for deposits and deduct those costs from other income, whether or not they ever generate income on the property. This transfers the risk from the company to the taxpayer.

What A Miracle Technological Age We Live In Thanks To Recent Advances In The Oil And Gas Industry Oil And Gas Can Profitably Be Extracted From Areas That Previously Had Little Economic Promise

According to a recent article in Forbes Magazine, oil and gas production has more than doubled in Texas alone in the last two years and Texas recently surpassed Venezuela in total oil production. All of this activity depends on investors willing to pony up the capital to fund this expansion, and that can lead to some complicated tax issues.

Every tax season, we prepare tax returns for many partnerships that own oil and gas interests and have hundreds of investors. Inevitably, after preparing and mailing the K1s to the investors, we receive phone calls from all across the nation because the investors had been told by investment advisors or other investment professionals – who might have the best intentions, but lack the appropriate tax knowledge – that they can deduct the Intangible Drilling Costs passed through to them by the partnership even though they are a passive investor. The phone call leads to the question, Where is that in the Internal Revenue Code? After responding to so many of these calls, we have prepared a brief overview that outlines some of the key points for the average oil and gas investor.

Also Check: Alternative Investments For Accredited Investors

Reevaluating Your Investment Portfolio Today May Help Reduce Your Overall Tax Burden In The Spring

As the end of 2021 looms, many high net worth individuals find that now is the perfect time to reevaluate their investment portfolio strategiesspecifically from a tax perspective. Direct oil and gas investments right now in 2021 in an oil and gas drilling partnership can be a smart move to reduce ones overall tax burden this year. Instead of paying more to Uncle Sam, money that was slated for the 2021 tax bill can be put to work instead, providing significant write-offs while also providing the added benefit of consistent cash flow and return on investment potential.

Todays Tax Incentives Arent Loop Holes

Congress has enacted several tax incentives in previous years to encourage private investors to participate in the exploration and development of oil and natural gas within the United States. These incentives are not loop holes in the tax code. They are specific statutes designed to help stimulate domestic production with the goal of making our country more energy self-sufficient. Every barrel of oil produced helps reduce our dependence on foreign imports. The U.S. Tax Code is currently structured to help support aggressive production, making direct oil and gas ventures one of the best tax advantaged investments available.

What Are The Tax Benefits

Tax Considerations of investing in Oil and Gas Working Interest Drilling Programs:

Oil and Gas Investments offer substantial Tax Deductions. Although it is everyones civic duty to pay income tax to help fund our government, the government provides tax deductions for situations that contribute overall to the countrys wellbeing. You may have heard oil and gas working interest drilling programs can help reduce your tax bill. It is true, so lets look into this further.

What you will learn here is an introduction into the tax benefits oil and gas working interest drilling programs provide. After reading it, you should have a basic understanding of these deductions that can reduce your tax bill. We are among the first to agree that tax forms and instructions require a bit of study to get the numbers right. So at tax time, you might need to contact an accountant for additional information. But for now, please read further

The U.S. government would like our country to become less dependent on foreign resources. So in order to encourage domestic oil and gas production, direct investments in oil and gas offer larger tax breaks than any other type of investment.

Also Check: Best App For Stock Market Investing

Tax Benefits Of Oil Investment

Tax benefits of oil investment as well as gas investment are plentiful and can be written off as a loss in the year the investment was made. Taxpayers, who are engaged in oil and gas production or transportation through pipelines, can deduct their operating expenses as business deductions. Taxpayers who sell refined products such as gasoline and diesel fuel can deduct their expenses as well as their gross income from those sales.

This makes investing in oil a lucrative endeavor with many tax benefits. Learn more about the tax benefits of investing in oil.

Active Vs Passive Income

The tax code specifies that a working interest in an oil and gas well is not considered to be a passive activity. This means that all net losses are active income incurred in conjunction with well-head production and can be offset against other forms of income such as wages, interest and capital gains.

You May Like: Apply For Investment Property Loan

What Limits A Taxpayers Liability

This one is fairly easy. For the purposes of this rule, an entity limits the liability of the taxpayer for purposes of this rule if the interest in the entity is in the form of:

- a limited partnership interest in a partnership in which the taxpayer isn’t a general partner

- stock in a corporation or

- an interest in any other entity that, under applicable state law, limits the potential liability of the holder of interest for all obligations to a determinable fixed amount – generally this would be an LLC or similar entity type.

An important note is that there are arrangements that can be put into place that do not violate this rule. Some of these arrangements are:

- an indemnification agreement

Request More Info By Filling Out The Form > >

Lease Operating Expense Oil and Gas Tax Deductible in the year they are incurred without AMT consequences

Lease Operating Expenses cover the day-to-day costs involved with the operation of a well. The expense also covers the costs of re-entry or re-work of an existing producing well.

Lastly, the tax benefits from oil and natural gas production have historically triggered potential taxation under the Alternative Minimum Tax . However, Congress provided some tax relief in the early 1990s for independent producers. An independent producer was defined as an individual or company with production of 1,000 barrels per day or less. Although there is still the potential for AMT taxation for excess IDCs, percentage or statutory depletion is no longer considered a preference item.

Hydrocarbon Demand is Not Going Away

Despite the push for green energy and electric cars, the global demand of hydrocarbons is not going away. Did you know that hydrocarbons are used in the production of everyday items such as shampoo and lipstick? As a matter of fact, green energy would not even be possible without hydrocarbons. They are necessary for the manufacturing of solar panels as well as in the production and operation of wind turbines. The oil and gas industry will undoubtedly be a source of tax deductible investments for a very long time.

Disclaimer

Don’t Miss: Different Ways To Invest In Oil