Fractional Dividend Reinvestment Plan

Fidelity offers its customers the option to enroll in a dividend reinvestment plan that would automatically reinvest dividends into the company. If the dividend is less than what is required for a whole share, a fractional share will be added to the account rather than putting the payout into idle cash. If you choose to sell your holdings, you put the whole share amount in and any fractional shares will be liquidated on settlement.

Choose An Account Type

What you’re investing for can also help you pick an account to open. Chances are, you’ll want to start investing with one of these 3 main account types:

Brokerage account: When people talk about trading stocks, they’re typically talking about doing so in a brokerage account. You can think of a brokerage account as your standard-issue investment account. Here are the basics:

- ProsFlexibility. Anyone age 18 or older can open one.1 You can add as much money as you want to the account, whenever you want, and have access to a wide range of investment options. You can also generally withdraw any cash in the account whenever you want.

- ConsTaxes. While a brokerage account may be the simplest to open and start using, it’s typically the most expensive come tax time. That’s because you generally have to pay taxes on any investment profits every year .

- When to consider. If you’re investing for retirement, it generally makes more sense to first start with one of the next 2 account types. That said, as long as you choose an account with no fees or minimums, there’s no harm in going ahead and opening a brokerage account so you have it at the ready.

401: This is an employer-sponsored plan account for investing for retirement. You can generally only invest in one through work. If you’re not sure if you have access to one, check with your employer’s HR department. Some people may instead have access to a 403 or 457 account, which are similar. Here are the tradeoffs:

Exit Fees Terms And Conditions

In order to request exit fees re-imbursement you will be required to complete an exit fees re-imbursement form which you can download by , or request over the phone by calling us on 0333 300 3351.

Terms and conditions for re-imbursement of exit fees

This offer does not apply to any investments linked to an Adviser / Intermediary or third party.

Fidelity will reimburse the exit/redemption fees charged to a customer by their former provider/s when they move their investments to Fidelity Personal Investing, up to a maximum amount of £500 per customer.

An exit fee is an administration charge which is imposed by the former provider and arises directly as a result of processing the transfer or re-registration of the customers investments to Fidelity. Fidelity will not reimburse the customer for any loss of investment returns, loss of interest, dealing charges, penalties for transferring investments before their maturity dates or any other charges associated with your transfer or re-registration.

Where a re-registration or transfer is not possible and the customer chooses to sell their investments held through another provider and subsequently make new investment/s through Fidelity Personal Investing, Fidelity will cover any account closure fees charged by the customers former provider of up to £500 per customer. Fidelity will not cover any bid-offer spreads or any capital gains tax liability arising as a result of these transactions.

CSO9483/200420

Recommended Reading: How To Invest With Ally

How Do We Review Brokers

NerdWallets comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

*$0.00 commission applies to online U.S. equity trades and Exchange-Traded Funds in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee . Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Clearing & Custody Solutions® are subject to different commission schedules.

What Does Fidelity Offer

Fidelity is a full-service broker that can meet the needs of virtually every investor or trader. Here’s what they have to offer.

In 2022, Fidelity was also named our top pick for online brokerages in our annual reader survey, specifically because of their robust options and low pricing. See our full list of the best stock brokers here.

Also Check: How To Invest In Stocks With Etrade

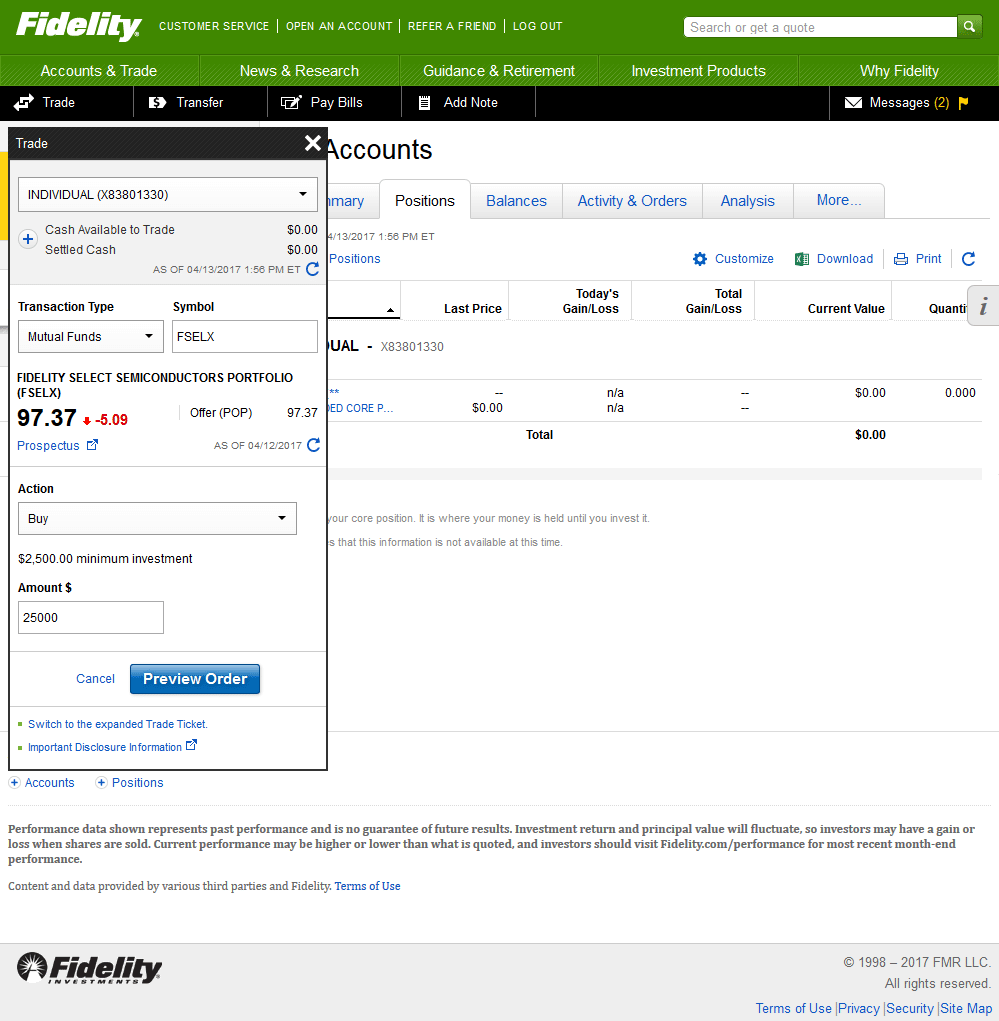

Buying Mutual Funds And Etfs

One of Fidelity’s major advantages is that it has one of the widest selections of funds, including its own line of Fidelity funds. Combined, Fidelity account holders can purchase over 3,400 mutual funds and exchange-traded funds without paying a transaction fee or commission.

| Total mutual funds | |

| No-transaction-fee mutual funds | More than 3,400 |

When it comes to mutual funds, Fidelity’s own funds are available in no-transaction-fee and no-load forms. Not only that, but some of Fidelity’s own index funds have no expense ratios whatsoever.

Customer Service And Support

Discount brokers may forgo sending you a holiday card every year, but that doesn’t mean they skimp on customer support. Fidelity has 24/7 phone support for brokerage accounts. Online chat service is open Monday through Friday from 8 a.m. ET to 10 p.m. ET.

If you’d like to speak to someone face to face, that’s as easy as visiting one of Fidelity’s 197 branch offices located all around the United States. One of the benefits of working with a large financial firm is that they have the scale to offer phone support around the clock and branch offices in virtually every metropolitan area.

Read Also: Charles River Investment Management System

Other Research Tools You May Enjoy

There are great and sophisticated screeners for stocks, ETFs and mutual funds. This is one of the best screener tools we have tested.

If you find that technical analysis can help your trading, you might find it useful that Fidelity gives access to Recognia and Trading Central’s tools, both of which offer chart pattern recognition.

You can contact Fidelity via:

The customer support is available in English.

When we tested it, Fidelity’s live chat was really slow. There were usually about a dozen clients in the queue before us, and it took up to 20 minutes to get in contact with an operator. The relevancy of the answers was mostly OK.

Fidelity claims the average wait time is only 5 minutes.

Phone support is great. The customer support team was very helpful and gave relevant answers. The response time was OK, as an agent was connected within a few minutes.

Email support works well, too. We received relevant answers within 1 business day.

On the negative side, not all support services are available 24/7. For example, live chat is only available between 8 a.m. – 10 p.m. .

- Quality educational articles

- Demo account, but only for desktop trading platform, called Active Trader Pro

The topics of the webinars range from beginner to advanced.There are approximately 5-10 new videos per month and you can also watch older materials.

We liked Fidelity’s FAQ, called the ‘Learning Center’: it collects a lot of relevant information in a well-structured and easily searchable manner.

Figure Out What You’re Investing For

You might be thinking, “But wait, shouldn’t my first step be to find some hot, secret stock picks that I can ride to the moon?” But in truth, successful investing generally starts with what you’re investing for, not what you’re investing in.

Lots of people start off by investing for retirement. In fact, we believe that for many people, investing something toward retirement should be pretty high up on your financial to-do list .

Although answering this question may not be as exciting as hunting down stock tips, it can help all the other pieces of your investing puzzle fall into place.

Don’t Miss: How To Invest In Adidas

How Do I Open A Fidelity Account

FESA FAQs: Download Here.

Buying Your First Stocks: Do It The Smart Way

Once youve chosen one of our top-rated brokers, you need to make sure youre buying the right stocks. We think theres no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. Youll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisors average stock pick has seen a 356% return more than 3x that of the S& P 500! . Learn more and get started today with a special new member discount.

You May Like: Umbrella Partnership Real Estate Investment Trust

How Long Should You Stay In Cash

Holding significant amounts of cash may provide reassurance during market volatility. But over the long term, leaving overly large amounts of cash uninvested in your portfolio can be a drawback. Historically, both stocks and bonds have delivered higher returns than cash and professional investors are careful to avoid over-allocating assets to cash. For this reason, investment management services such as those offered by Fidelity’s managed accounts do not allocate large amounts of money to cash, but instead stay invested.

While your Fidelity investment professional can help you plan for investing your cash for the long term, you also have a number of places to choose from in which to keep your cash in the short and medium term that seek to provide safety and flexibility, as well as opportunities to earn some interest. Here are some places to keep your cash with the goals of keeping it safe and accessible, and earning interest as well.

How To Open Your Account

The account opening is user-friendly and fully digital in most cases. There can be cases when you have to mail or fax the account opening form and the photocopy of the relevant ID card to Fidelity. It took 3 business days for us to open the account, which is a bit slow compared to other brokers.

Steps at Fidelity to open an account:

| 1 | 1 |

Why does this matter? For two reasons. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don’t have to pay a conversion fee.

A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. These usually offer bank accounts in several currencies with great currency exchange rates, as well as free or cheap international bank transfers. Opening an account only takes a few minutes on your phone.

Also Check: Is It Time To Invest In Gold

Fidelity Fees And Features Data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool.

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Could We Be Nearing An Upside Surprise

While the new fair-value P/E target of 13.5 is worrisome with its implications for the market, in my view it is too late to sell. That P/E model is a moving target. While so far this year we’ve only seen it move in one direction, it can move the other way too.

What could potentially cause such a move? A less-hawkish pivot from the Fed. Factoring in not only anticipated rate hikes but also the Fed’s quantitative tightening , the central bank is now on an extremely restrictive pathin the same range as previous major tightening cycles such as 1989, 1999, and 2006.

In my view, this creates a more favorable risk-reward balance than at any time during this cycle. It’s hard to imagine the Fed getting even more hawkish, but it’s easy to imagine it pivoting by getting less hawkish. Such a pivot would produce lower nominal and real yields, which I believe would lift the fair-value P/E ratio.

This valuation math can be just as powerful on the way up as it has been on the way down. If real interest rates were to fall to their historical equilibrium levels, which would happen if the Fed pivots, the stock market could reprice itself very quickly to a higher P/E ratio . I don’t want to be short as we get closer to that possibility.

Don’t Miss: How To Start A Real Estate Investment Llc

Representing The Owners Of Shares

Institutions often control huge shareholdings. In most cases, they are acting as fiduciary agents rather than principals . The owners of shares theoretically have great power to alter the companies via the voting rights the shares carry and the consequent ability to pressure managements, and if necessary out-vote them at annual and other meetings.

In practice, the ultimate owners of shares often do not exercise the power they collectively hold financial institutions sometimes do. There is a general belief that shareholders â in this case, the institutions acting as agentsâcould and should exercise more active influence over the companies in which they hold shares . Such action would add a to those overseeing management.

However, there is the problem of how the institution should exercise this power. One way is for the institution to decide, the other is for the institution to poll its beneficiaries. Assuming that the institution polls, should it then: Vote the entire holding as directed by the majority of votes cast? Split the vote according to the proportions of the vote? Or respect the abstainers and only vote the respondents’ holdings?

More Detail About Fidelity’s Ratings

Account minimum: 5 out of 5 stars

Fidelity’s account minimum is $0*, which has become the industry standard for brokers we review, as many no longer have a required minimum to open or maintain your account. Some investment choices, such as mutual funds, may require a minimum initial investment.

Stock trading costs: 5 out of 5 stars

Fidelity was already a leader for low-cost commissions, but the company eliminated commissions in 2019 for U.S. stock, ETFs and options trades.

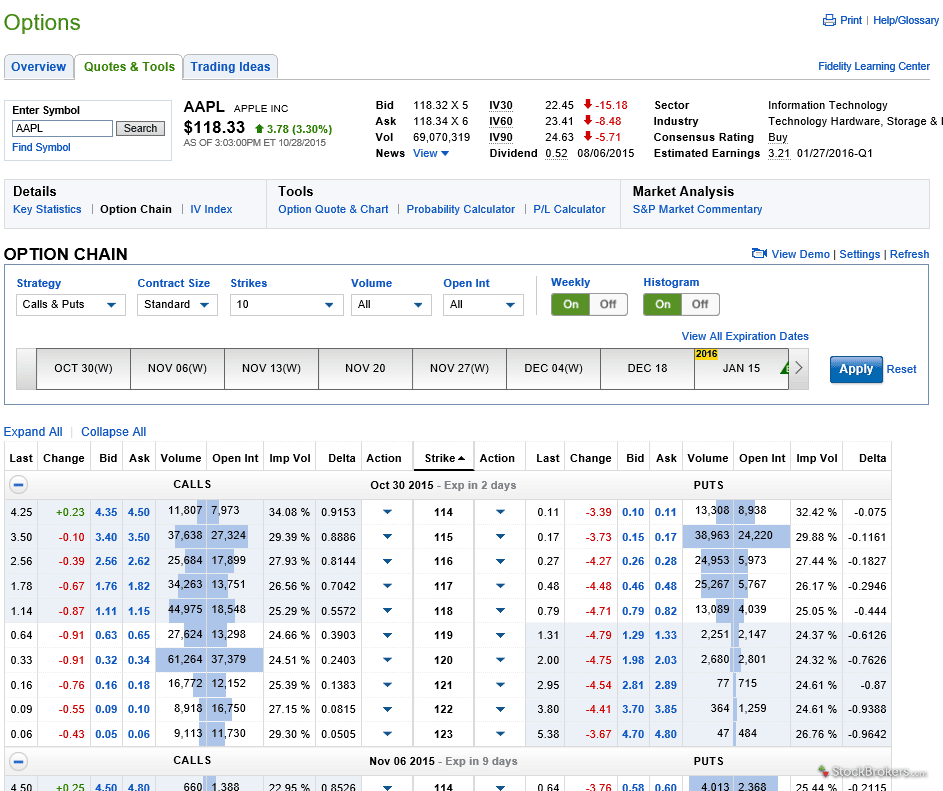

Options trades: 4 out of 5 stars

Options trades are commission-free, but they still carry a contract charge, which is $0.65. Fidelity doesnt offer volume discounts on options.

Account fees: 5 out of 5 stars

Fidelity has done away with nearly all account fees, including the transfer and account closure fees that are commonly charged by brokers.

Number of no-transaction-fee mutual funds: 4 out of 5 stars

The war among brokers to cut mutual fund fees has brought good changes to Fidelity: The company was the first broker to bring to market index funds with absolutely no expense ratio: the Fidelity Zero Total Market Index Fund, the Fidelity Zero International Index Fund, the Fidelity Zero Large Cap Index Fund and the Fidelity Zero Extended Market Index Fund.

Investors could build a balanced and virtually free retirement portfolio with these zero-expense-ratio funds alone, but even the Fidelity index funds that do charge an expense ratio undercut much of the competition on price.

You May Like: How To Start A Stock Investment Club

Other Fidelity Details You Should Know

Fidelity Youth Account: In 2021, Fidelity launched the Fidelity Youth Account, an investment account designed for teenagers **. The account, which allows a parent or guardian to monitor the teenager’s activity, offers access to stocks and ETFs, including fractional shares. Teenage account holders can also invest in select Fidelity mutual funds . Importantly, the account also puts some risky investments and investment strategies off limits, including options and margin trading.

Alongside the Fidelity Youth Account, Fidelity offers a customized mobile app experience, with in-app educational resources, articles on investing and online research tools. Once the account holder reaches 18, the account will be a standard brokerage account.

Is Fidelity A Safe Company To Invest With

Fidelity is one of the largest brokerages in the world, making it a safe company to invest with. Its fully regulated in the U.S. with the SEC and FINRA, is trusted by over 32 million investors and holds over $8.3 trillion in assets under administration.

Money held in an investment account with Fidelity is protected by SIPC insurance, which covers up to $500,000 in securities and up to $250,000 in cash . Funds held in Fidelitys cash management account are swept to partner banks and protected by FDIC insurance.

Finally, Fidelity provides additional coverage in excess of SIPC limits, for up to $1 billion across all customer accounts, and with up to $1.9 million per customer for cash and no limit for securities.

Don’t Miss: Different Coins To Invest In

Investment Accounts: Transfer On Death

An investment account can transfer fairly easily, as long as you designate a beneficiary and consider his or her ability to manage the account.

On a nonretirement account, designating a beneficiary or beneficiaries establishes a transfer on death registration for the account. For an individual account, a TOD registration generally allows ownership of the account to be transferred to the designated beneficiary upon your death.

Do investment accounts pass through probate?

NO, generally, as long as the TOD designation is in place. Keep in mind that if the will stipulates anything about such accounts, the named beneficiaries on the accounts take precedence over anything stated in the will and the assets will be distributed to the named beneficiaries.

YES, if there are no TOD beneficiaries named on the account or if there is a complication with the named beneficiary. For example, if the named beneficiary has passed away first and the designation was never updated, the account will be subject to probate.

For joint ownership with right of survivorship or tenants by entirety accounts, the joint registration transfers account ownership upon the first death, usually directly to the surviving accountholder. TOD becomes effective for joint accounts if both owners pass away simultaneously.

Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account.