How To Become A Multimillionaire

Once you reach millionaire status you might be wandering how to become a multimillionaire.

Really, the answer is quite simple, keep doing what you did to become a millionaire in the first place.

For example, if you were able to become a millionaire by investing in real estate keep investing your money to grow it even more.

There are no right or wrong answers when it comes to investing your money it’s all about getting started and giving it the most time to grow.

However, there are a few methods that will make you more likely to become a multimillionaire.

These are: owning a business, investing in stocks and real estate, and becoming an executive at a large company.

Take Advantage Of 401s And Iras

The government has given us some great tools to defer the taxes we must pay on our investments. This makes saving for retirement even easier.

If you invest in taxable accounts, you know just how significant taxes can be. Depending on the tax policy of the federal government, taxes on capital gains could be changing substantially at any given time. So, it is important to shelter as much of our investments from tax as we can.

Enter 401 and IRA retirement accounts.

In addition to the tax deferral, many employers match employee contributions to their 401 accounts. If your employer offers a match, it would be very wise to take advantage of it — otherwise, youre just leaving free money on the table.

If the match is in company stock, I would diversify my investments as quickly as company policy allowed. When I worked at a public company, my rule of thumb was never to hold more than 10% of my investments in my company’s stock.

Michelle Singletary On Retirement And Personal Finance

Early retirement: Want in on the great retirement boom? Early retirement sounds tempting, but the math can be a major reality check. Here are the five things you should know.

New retirement rules: As the pandemic upends the economy, theres never been a better time to examine the conventional wisdom about retirement.

Move over, crypto: A record number of workers are becoming millionaires with their boring 401s and IRAs. Many never earned six-figure salaries. Meet the newly minted millionaires next door.

Questionable sources: There is so much you need to do to manage your money that its a good thing to get recommendations. But you need to consider the source and whether the advice is in your best interest, biased or appropriate given your personal circumstances and money style.

In hindsight: If you could, what retirement planning advice would you give to your younger self based on what you know now? Heres what some retirees say are their biggest regrets.

Read more personal finance and retirement perspectives by Michelle Singletary.

You May Like: Structured Asset Mortgage Investments Ii Inc

Diligently Keep Track Of Your Progress

How much you keep is even more important than how much you make. There are people who make millions of dollars and end up broke years later. The simple reason is because they had no idea where their money went. Perhaps they made some ill-timed investments.

Maybe their risk exposure didnt align well with their risk tolerance. Or maybe they simply just spend too much. Everybody should leverage Personal Capital, the best free financial tool online. With Personal Capital, you can track your cash flow, analyze their investment portfolios, and calculate their financial needs in retirement.

Set Aside All Windfalls

If you’re having trouble saving 10% or more of your income, or maxing out your tax-advantaged retirement savings, reaching millionaire status can take even longer. Or perhaps you want to speed the process along and meet your goal even sooner.

This is where capitalizing on any financial windfalls comes into play.

Does your company give a holiday bonus each year? Perhaps your Great-Uncle Tim passed away and left you a nice little sum. No matter the source, it would be wise to set aside any cash windfalls that come your way, and invest them right away.

This will boost your portfolio substantially, and you won’t even feel the pinch since that is “extra” money anyway. However, over time, that extra money can make a serious dent in your millionaire goal.

Don’t Miss: Joint Investment Account With Child

Aggressive Investing Is A Matter Of Perception Like Anything You Will Get Back What You Put In

Skill up in understanding how the property market behaves and reading market movements. Know a selection of different strategies. Get in touch with leading property-related service providers and other investors. Brush up on tax and legal structuring knowledge, as well as negotiation tactics, he advises.

With the right support and activity, $1m in equity is possible to achieve much sooner than 10 years. Such a target is an aggressive one and does require a more active approach by the investor.

In the end, investment is not a race, and it wont matter how long it actually takes you to get to a million. Making a firm commitment to learning and growing as an investor is the key. Even if it takes you 20 years, youll reach your goal by following a clear plan and being persistent, even through the tough early stages!

How Can I Save $10 A Day

Small savings each day can add up over time. Saving $10 a day over a 50-year period amounts to $180,000, not counting interest. Add a 7% annual return, and that amount jumps to $791,335 in the same amount of time! While saving $10 a day may not sound too important, it’s actually a good way to set up your retirement.

Also Check: Best Short Term Crypto Investments

Find Ways To Earn More Money

Sabatier says that you can’t just save your way to becoming a millionaire. Certainly not in this economy. That’s why you should focus on increasing your income potential.

Yes, this is definitely easier said than done, but there are multiple ways of doing this. You could look for a higher-paying job, take on a side hustle, or even start your own business.

So What Level Of Income Does Someone Need To Get To A Million Over A 15

Remember, youre not just saving the money youre using it to buy assets that theoretically go up in value. Maybe not every day, or every month, or even every year but over that 15-year period, the money youre investing is growing on its own and supercharging your timeline. Without the power of investing, youd have to save $66,666 per year to have $1,000,000 after 15 years and by then, $1,000,000 doesnt buy what $1,000,000 buys today, thanks to inflation.

But in order to be a millionaire via investing in 15 years, youd only have to invest $43,000 per year . I know, I know only $43,000 per year. No big deal.

*From this point forward, the average real rate of return well be assuming is 6%. A real rate of return is lower than the rate of return youll see on the stock ticker, because were shaving off 2-3% of our return since our money loses purchasing power every year as the price of goods rises.

Another way to think about this is $3,583/mo. and how much money youd have to be making in order to be able to afford to invest $3,583 *really* depends on the person, and highlights why keeping your spending in check is crucial.

Don’t Miss: Companies Similar To Fisher Investments

Invest In Ways That Work For You

You dont need a lot of money to start investing. Open an account with a mutual fund company that has no-load funds and low expense ratios.

You can also invest your money in the stock market by using an online broker like TD Ameritrade or E-Trade, which charge zero commissions for online stock trades.

If you have the cash to buy property, consider investing in real estate. You can create an additional income stream by leasing a rental property and benefit from the appreciation in property value.

Its best not to invest all your money in one thing. Diversification, or owning many different types of investments, is less risky and will smooth out the ride.

Stick with the basics and not what your friends are doing. Everyones situation is different, says Dana Twight, CFP, founder of Twight Financial Education in Seattle.

Your employer retirement plan is often a good place to begin, says Twight. It has automatic contributions, allowing you to invest without being concerned about todays news.

If you want to increase your investments or diversify further, look into passive income opportunities, such as rental property or peer-to-peer lending.

Investing in different asset classes helps you weather all the storms, floods and calm moments in between, Twight says.

Build a diversified stock portfolio, and you can reasonably expect to earn 10 percent annually on your equity investments over the long haul.

Focus Will Help You Become A Millionaire

The truth is, the only one that can decide what to do is you. What is driving you to be a millionaire by age 25? Instead of focusing on becoming a millionaire by age 25 or any other arbitrary number, you might want to just focus on making good financial decisions, like spending less and earning more.

Or, making a million dollars by 25 may not be that important to you. Instead, youd rather focus on traveling and adventures. Thats okay. But if you do want to be a young millionaire, it is possible. It will take a lot of hard work and sacrifice, but the rewards may be worth it for you.

And even if you miss the goal of 25, I’d venture you’d be on a great track financially.

What are your thoughts on the possibility of becoming a millionaire by 25? Possible or not?

Don’t Miss: Short Term Investment Mutual Fund

Save 15% Of Your Incomeor More

The personal savings rate is the percentage of income left over after people spend money and pay taxes. That rate dropped to 7.3% in October 2021, according to data from the Bureau of Economic Analysis . According to experts, that’s not enough to save for retirement, let alone for anyone trying to become a millionaire.

The Boring Way To Become A Millionaire

Im not an advocate of get rich quick ideas. There are tons of gurus who will promise to teach you their way to get rich quick. It may work for some but to me, the best way to build wealth and keep wealth is a slow, boring process that requires discipline through good times and bad.

Also Check: Morgan Stanley Los Angeles Investment Banking

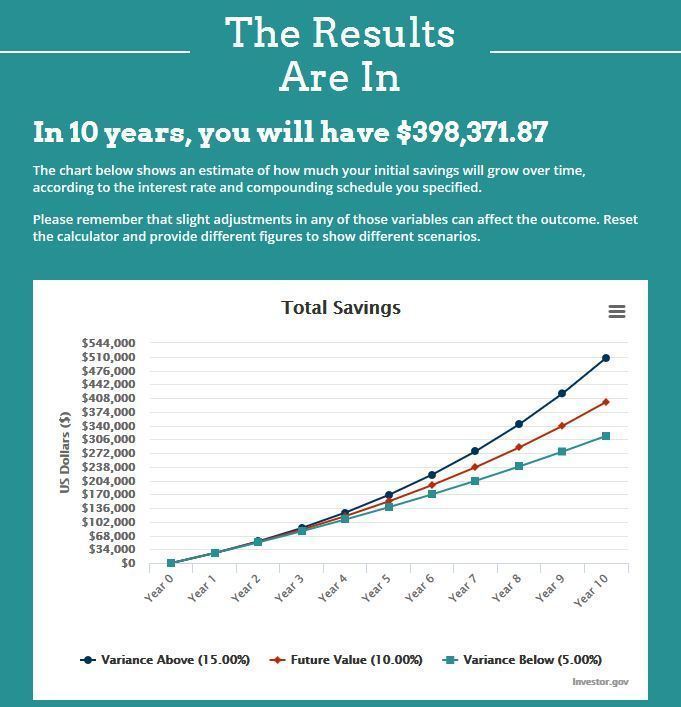

How Much Money Would It Take To Be A Millionaire In 10 Years

At a 10% return on investment, investing $5,000 per month would make you a millionaire in 10 years. Your total contribution would be $600,000 with an estimated growth of $400,000. However, you can find a higher return on investments and invest less money or invest more money with less return on investment.

Finding $5,000 per month to invest can be very difficult. The most likely scenario is having a couple who both have high-income jobs. For example, a couple of engineers each making $100k per year.

Alternatively, you can start a side hustle to help make up the difference. Some side hustles are easier to start than others, but some have the potential to make 5K per month.

Regardless, you will need to find the cash if you want to become a millionaire in 10 years.

Earn Just A Little More Each Month With A Side Hustle

I know no one wants to grab a side hustle, but it doesnt even need to be that much.

- Just go deliver food for Doordash for a few hours each weekend . Just enough to earn $100 and then invest it.

- Create Facebook ads for some businesses this might sound intimidating, but we millennials and Gen Zers have a huge advantage over some of the Boomers who are still trying using Yahoo to search for Google . So even if you know nothing about Facebook ads, a buddy of mine has a course teaching exactly how to do this its a great simple way to earn some extra cash or could honestly become a lucrative career if you wanted.

- Pet sit for others at a site like Rover you can earn $15/hour to literally play with a dog. Simply by watching a dog for one weekend a month you could fund your $1 million nest egg.

- There are a million ideas here, but these are just a few to get you started. I have another video with a bunch more side hustle ideas if you need more

Read Also: National Association Of Investment Clubs

Start Young And 2 More Valuable Investing Lessons

Five years can change your life.

Each of these three investment moves has an amazing lifetime payoff, especially if you can start in their 20s. Do them all, and you could be set for a very comfortable retirement.

1. Start early

You can turn yourself into a multi-millionaire by saving for retirement for just five years. Start at 25, and you will be giving yourself the greatest gift an investor can have: time.

Sure, luck is important. But time is more important.

To see why, lets assume that youre 25 years old and youve decided that when youre 30, you will start a long-term savings plan for your retirement. Further, well assume that you will retire at age 70 Thats not a bad plan. But it could be better.

If you start now, at 25, five years of modest investments can leave you with millions when its time to retire, no matter what you do after youre 30.

Heres the setup: Youre 25 and you have a decent job. You dont have tons of money to spare, but you figure out how to save $500 a month for your long-term future. That adds up to $6,000 a year, which you can put into an IRA, either a Roth or a traditional one .

Do that for five years and youll have invested $30,000.

During this five years, your investments are earning a return, though its impossible to know how much.

If we assume you receive the very-long-term compound annual growth rate of the S& P 500 index SPX, 10.7% your $30,000 would grow to $37,144 when youre 30.

Good luck, bad luck

Becoming A Millionaire From Stocks Means Keeping Investment Costs Low

Get investment fees wrong and your million-dollar investment portfolio can be eaten up by fees.

So, to become an investment millionaire, focus on low-cost funds or individual securities. And, keep trading to a minimum to avoid transaction fees.

Because zero-cost, zero-commission stockbrokers are easy to find. This is exactly what a millionaire investor does.

More on this topic in a moment. But next, strategy number 5.

Recommended Reading: Non Discretionary Investment Advisory Services

Understand The Power Of Compound Interest

Albert Einstein once called compound interest the eighth wonder of the world. When interest is compounded, the amount of interest you earned during a given time period is added to your balance, and that new total becomes your new interest-earning balance.

For example, this is what it would look like if you started with $1,000 and earned 10% interest per year , compounded annually:

| Balance | |

| $146 | $611 |

At the end of five years, you’ll have earned $611 in interest. As you can see, the interest that you earn continues to grow because the interest you’ve earned in prior years is now also earning interest.

Watch Out For Inflation

As you can see above, it is actually quite possible for you to become a millionaire through stocks. One thing that you need to remember is that your purchasing power will decrease every year by 2-3%. This is due to inflation . In certain years, inflation may be higher. However, inflation has been relatively stable during the last few years and is expected to stay that way.

You may also have noticed that it will take an adept investor over 25 years to become a millionaire if he/she starts with $25,000. This proves that the more capital that you have, the easier it is for you to make money off of it. Once you take inflation into account, stocks are definitely among the best long-term investment. As such, you should try to start with as much capital as you can possibly amass.

Don’t Miss: Best Franklin Mutual Fund To Invest

Build Multiple Income Streams

While you should definitely strive to make as much money as possible at your day job, you should also build additional sources of income outside of it.

According to an article by CNBC, 65% of self-made millionaires have three streams of income, 45% have four, and 29% have five or more.

While having several sources of income has helped them reach millionaire status, they also act as a safety net.

For example, if one of their income streams gets hit, they can rely on the others and dont necessarily have to downgrade their lifestyle.

On the other hand, if someone only has one source of income their nine-to-five they could lose everything if they lose their job.

Millionaire By 30 Money Mindset

If you want to become a millionaire by 30, you must adopt a strong money mindset. Know that there is money everywhere for the taking. Youve got to believe you deserve to be rich.

Further, becoming a millionaire by 30 is becoming more common rather than the exception thanks to inflation. After all, $3 million is the new $1 million today.

There are so many standard ways to become a millionaire. If you dont become a millionaire by 30, you will eventually get there with enough time.

If you work for 40 years and save and invest just 20% of your after-tax paycheck a year, there is no doubt in my mind you will amass at least one million dollars. Compounding is a powerful force.

Maxing out your 401K for 30+ years will also most likely lead to over $1 million dollars as well. Historical stock and bond market returns plus company match are on your side.

Weve got financial planners, personal finance blogs, television, books and even free financial tools to help you build and track your wealth. So many resources make building wealth much easier now than in the past. Lets look at three reasons why becoming a millionaire by 30 is easier than ever before.

You May Like: Private Equity Investments For Small Investors