Apartment Investment And Management Co’s Key Ratios

Apartment Investment and Management Cohas a market cap of$1.133billion, indicating a price to book ratio of1.6and a price to sales ratio of5.92.

In the last 12-monthsApartment Investment and Management Cosrevenue was$0.191billion with a gross profit of$0.103billion and an EBITDA of$0.066billion. The EBITDA ratio measures Apartment Investment and Management Co’s overall financial performance and is widely used to measure its profitability.

In the trailing 12-month period,Apartment Investment and Management Cosoperating margin was-11.1%while its return on assets stood at-0.56%with a return of equity of35.7%.

InQ2,Apartment Investment and Management Cosquarterly earnings growth was anegative-63.2%while revenue growth was apositive25.4%.

High Number Of New And Inexperienced Directors

There are 8 new directors who have joined the board in the last 3 years. The company’s board is composed of: 8 new directors. 1 experienced director. 1 highly experienced director. Independent Director Mike Stein is the most experienced director on the board, commencing their role in 2004. The following issues are considered to be risks according to the Simply Wall St Risk Model: Lack of board continuity. Lack of experienced directors.

Aimco Announces: The Realization Of $100m Of Value Creation From The Successful Development Of Four Properties Leased From Air Communities The Cancellation Of The Related $469m Lease Obligation And The Repayment Of $534m Debt Owed To Air

DENVER, June 21, 2022– – Apartment Investment and Management Company has executed definitive agreements with AIR Communities that will result in more than $100 million of realized value creation for Aimco shareholders, eliminate the $469 million obligation related to the four leased properties from AIR, and lead directly to the refinance or repayment of nearly $1 billion of debt.

Recommended Reading: Should I Invest In Shopify

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Air Communities Publishes 2021/2022 Corporate Responsibility Report

Denver, Oct. 03, 2022 — Apartment Income REIT Corp. today announced the publication of its 2021/2022 Corporate Responsibility Report. The annual report demonstrates AIRs commitment to being an outstanding corporate citizen and reinforces its dedication to ESG goal setting and reporting. This new report highlights our continued focus and progress on environmental, social, and governance initiatives, said Patti Shwayder, AIRs Chief Corp

Read Also: How To Pull Equity Out Of Investment Property

Air Communities Announces Quarterly Common Dividend Of $045 Per Share

DENVER, November 01, 2022–Apartment Income REIT Corp. announced today that its Board of Directors declared a quarterly cash dividend of $0.45 per share of Class A Common Stock for the quarter ended September 30, 2022. This dividend is payable on November 30, 2022, to stockholders of record on November 18, 2022. On an annualized basis, the dividend represents $1.80 per share, reflecting a dividend yield of approximately 4.7% based on AIRs closing share price on Tuesday, Nov

Aimco Files Definitive Proxy Materials And Mails Letter To Stockholders

DENVER, October 12, 2022–Apartment Investment and Management Company , today announced that it has filed its definitive proxy materials with the Securities and Exchange Commission in connection with its 2022 Annual Meeting of Stockholders scheduled to be held on December 16, 2022. Stockholders of record as of October 26, 2022, will be entitled to vote at the meeting. Aimcos Board of Directors strongly recommends that stockholders vote

Also Check: How Can I Invest In A Private Company

Aimco Recognized As 2022 Healthiest Employer By National Publication

DENVER, June 03, 2022– – Apartment Investment and Management Company, known as Aimco, has been selected as a 2022 Healthiest Employer by both The Denver and South Florida Business Journals. Aimco was ranked first in its category for South Florida and was a top scorer in Denvers medium sized employer category, receiving special recognition given the challenge of supporting employees with limited resources.

Balance Sheet And Cash Flow Metrics

- Total Assets

- Dividend Payout Ratio

- 0%

Apartment Investment and Management Coended1970with$0.000billion in total assets and$131.2billion in total liabilities. Its intangible assets were valued at$0.000billion while shareholder equity stood at $0.000 billion.

Apartment Investment and Management Coended1970with$0.000billion in deferred long-term liabilities,$0.000billion in other current liabilities,billion in common stock,$0.000billion in retained earnings and$0.000billion in goodwill. Its cash balance stood at$0.000billion and cash and short-term investments were$0.000billion. The companys total short-term debt was$0.000billion while long-term debt stood at$0.000billion.

Apartment Investment and Management Cos total current assets stands at$0.000billion while long-term investments were$0.000billion and short-term investments were$0.000million. Its net receivables were$0.000billion compared to accounts payable of$0.000billion and inventory worth$0.000billion.

In1970,Apartment Investment and Management Co’soperating cash flow was$0.000billion while its capital expenditure stood at$0.000billion.

Comparatively,Apartment Investment and Management Copaid$0billion in dividends in1970.

Don’t Miss: High Net Worth Investment Advisors

Air Communities Launches New Corporate Responsibility Website

AIR Communities Launches New Corporate Responsibility Website The site expands upon AIRs longstanding corporate citizenship efforts, highlighting initiatives and accomplishments related to environmental, social, and governance measures. Denver, CO, Aug. 23, 2022 — Apartment Income REIT Corp., known as AIR Communities, today announced the launch of a new corporate responsibility website. The site expands upon AIRs longstanding corporate citizenship efforts, highlighting initia

Insider Ownership Of Amazoncom

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

We can see that insiders own shares in Amazon.com, Inc.. The insiders have a meaningful stake worth US$92b. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

You May Like: Real Estate Investment Firms San Diego

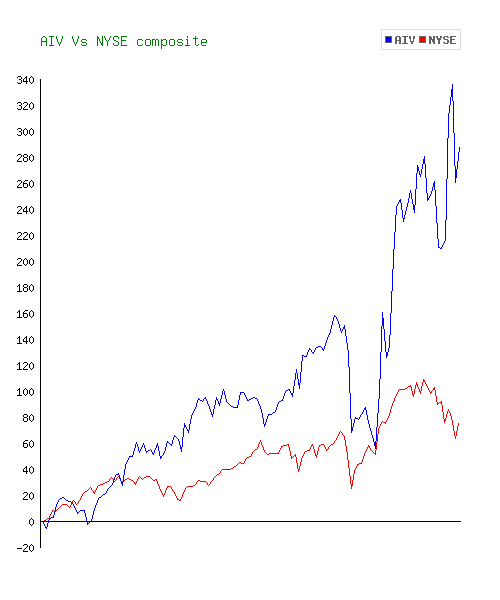

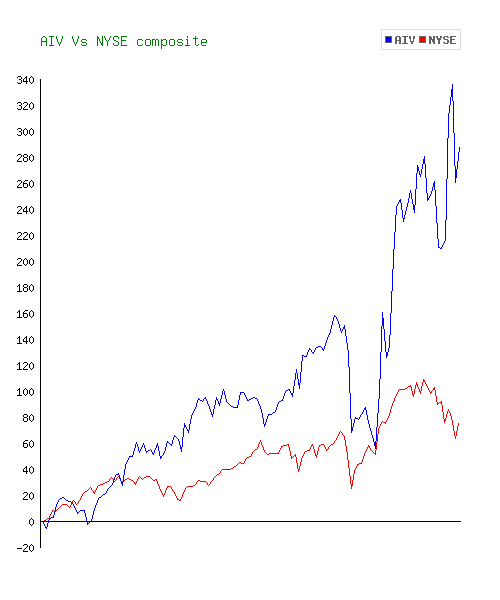

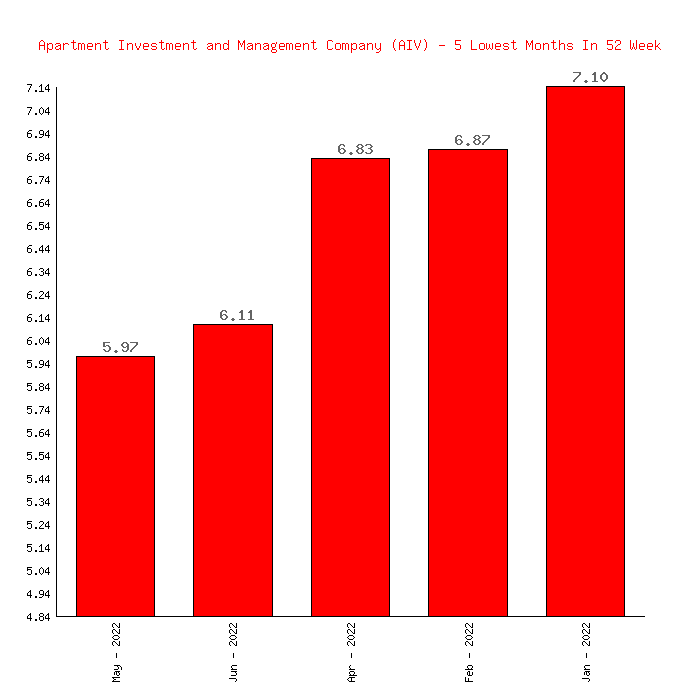

Apartment Investment And Management Trading Up 16 %

Shares of Apartment Investment and Management stock opened at $7.51 on Friday. Apartment Investment and Management has a 52-week low of $5.22 and a 52-week high of $9.79. The stocks 50-day simple moving average is $7.94 and its 200 day simple moving average is $7.31. The stock has a market capitalization of $1.14 billion, a P/E ratio of 4.75 and a beta of 1.12. The company has a debt-to-equity ratio of 1.21, a quick ratio of 1.00 and a current ratio of 1.00.

What Does The Institutional Ownership Tell Us About Amazoncom

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

Amazon.com already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It’s therefore worth looking at Amazon.com’s earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Hedge funds don’t have many shares in Amazon.com. Our data shows that Jeffrey Bezos is the largest shareholder with 9.8% of shares outstanding. In comparison, the second and third largest shareholders hold about 6.8% and 5.8% of the stock.

A deeper look at our ownership data shows that the top 25 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

Read Also: Why Is It Good To Invest

Apartment Investment And Management Shares Sold By Nisa Investment Advisors Llc

Nisa Investment Advisors LLC lessened its holdings in shares of Apartment Investment and Management by 13.8% during the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 45,312 shares of the real estate investment trusts stock after selling 7,284 shares during the quarter. Nisa Investment Advisors LLCs holdings in Apartment Investment and Management were worth $290,000 at the end of the most recent quarter.

Apartment Investment And Management Cos Pe And Peg Ratio

- Forward PE

- PEG

- 839.32

Its diluted EPS in the last 12-months stands at$1.6per share while it has a forward price to earnings multiple of714.29and a PEG multiple of839.32. A low price to earnings ratio can mean the stock is attractively valued while a high ratio suggests the stock may be overvalued.

The PEG on the other hand provides a broader view compared to the P/E ratio and gives greater insight into Apartment Investment and Management Cos profitability.

Apartment Investment and Management Costock is trading at a EV to sales ratio of12.49and a EV to EBITDA ratio of4.965. Its price to sales ratio in the trailing 12-months stood at 5.92.

Apartment Investment and Management Costock pays annual dividends of$0per share, indicating a yield of5.45%and a payout ratio of0%.

Read Also: Should You Invest In S& p 500

Land & Buildings Investment Delivers An Open Letter To Shareholders Of Apartment Investment And Management

On October 28, 2022, Land & Buildings Investment Management, LLC announced that it has delivered an open letter to the stockholders of Apartment Investment and Management Company expressing its view that the Company would continue to trade at a significant discount to net asset value until meaningful steps are taken to improve the Companys corporate governance and win the trust of stockholders, which Land & Buildings view can be achieved through the election of Land & Buildings nominees at the annual meeting. Land & Buildings also expressed its belief in the letter that a reconstituted Board is required to oversee urgent action at the Company, including a full exploration of strategic alternatives.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Recommended Reading: How To Choose An Investment Broker

Apartment Investment And Management Stock Performance

NYSE:AIV opened at $7.51 on Friday. The company has a debt-to-equity ratio of 1.21, a current ratio of 1.00 and a quick ratio of 1.00. Apartment Investment and Management has a 1 year low of $5.22 and a 1 year high of $9.79. The stocks 50 day simple moving average is $7.94 and its two-hundred day simple moving average is $7.31. The company has a market cap of $1.14 billion, a price-to-earnings ratio of 4.75 and a beta of 1.12.

Aimco Announces Second Quarter 2022 Earnings Date

DENVER, August 01, 2022–Apartment Investment and Management Company announced today that it plans to report second quarter results for 2022 on August 4, 2022, after the market closes. The Companys earnings release will be available in the Investor Relations section of its website at investors.aimco.com.

Recommended Reading: Heloc Rates On Investment Properties

Apartment Investment And Management Company Declares Special Cash Dividend Payable On September 30 2022

Apartment Investment and Management Company announced that its Board of Directors updated the existing share repurchase authorization and declared a special cash dividend of $0.02 per share. The special cash dividend of $0.02 per share complies with REIT distribution requirements and is payable on September 30, 2022, to shareholders of record at market close on September 14, 2022.

Aimco Announces Programmatic Joint Venture Agreement With Alaska Permanent Fund Corporation Targeting Up To $1 Billion Of Multifamily Development

DENVER, August 11, 2022–Apartment Investment and Management Company announced today that it and Alaska Permanent Fund Corporation have entered into an agreement to fund up to $1 billion of future Aimco-led multifamily developments. Pursuant to the agreement, APFC will fund up to $360 million of limited partner equity into projects meeting specific criteria, including, among other items, return thresholds and minimum project size. Aimco will act as the general part

DENVER, August 04, 2022–Apartment Investment and Management Company announced today second quarter results for 2022 and provided highlights on recent activities.

Read Also: Investing In Notes And Mortgages

This Metric Has Successfully Predicted Five Bear Markets As Well As Accurately Called Numerous Bottoms To Bear Markets And Stock

It doesn’t matter if you’ve been investing for the past couple of months, or five decades: This has been one of the roughest years for investors on record.

Since the ageless Dow Jones Industrial Average, widely followed S& P 500, and technology-focused Nasdaq Composite achieved their all-time highs less than a year ago, they’ve respectively tumbled by as much as 22%, 28%, and 38%. This places all three indexes in a bear market.

Although all bear-market declines are golden opportunities for investors to put their money to work , the heightened volatility and velocity of downside moves during bear markets has investors wondering when and where the bottom might be reached.

Image source: Getty Images.

Air Gives + Aimco Cares Charity Golf Classic Raises $430000 For Military And Educational Causes

AIR Gives + Aimco Cares Charity Golf Classic Raises $430,000 For Military and Educational Causes AIR Communities Executive Vice President Emeritus Miles Cortez joins Project Sanctuary and TAPS leadership at the AIR Gives + Aimco Cares Charity Golf Classic. Denver, Oct. 06, 2022 — With the help of many longstanding business partners, AIR Communities and Aimco secured $430,000 for beneficiaries of the AIR Gives + Aimco Cares Charity Golf Classic. The tournament, held at The Sanct

You May Like: Real Estate Investment Banking Firms

Wall Street Analysts Forecast Growth

AIV has been the topic of several analyst reports. StockNews.com initiated coverage on Apartment Investment and Management in a report on Wednesday, October 12th. They set a hold rating on the stock. TheStreet upgraded shares of Apartment Investment and Management from a d+ rating to a c+ rating in a report on Thursday, August 11th.

Air Issues $400 Million Of Senior Unsecured Notes

DENVER, July 05, 2022–Apartment Income REIT Corp. today announced the issuance of three tranches of guaranteed, senior unsecured notes, totaling $400 million at a weighted average effective interest rate of 4.3%, inclusive of a previously placed treasury lock, and a weighted average maturity of eight years. Specifically, AIR issued:

Don’t Miss: Return On Investment Digital Marketing

Apartment Investment And Management Co

- New York Mortgage Trust Inc

- Piedmont Office Realty Trust, Inc.

- Empire State Realty Trust Inc

- NexPoint Residential Trust Inc

- KBS Real Estate Investment Trust III Inc

- Resource Real Estate Opport REIT Inc

- Watermark Lodging Trust Inc

-

From Peter Morris, London N5, UK

- Aimco Confirms Completion of Lease Termination Transaction, Realizing $100 Million of Value CreationSep 07 2022

- AIV:NYQ price falls below 200-day moving average to 7.23 at 09:34 BSTNov 03 2022

- AIV:NYQ price moved over -1.13% to 7.85Nov 02 2022

- AIV:NYQ price rises above 15-day moving average to 7.50 at 10:41 BSTNov 04 2022

- AIV:NYQ price rises above 15-day moving average to 7.46 at 13:54 BSTNov 03 2022

- New York Mortgage Trust Inc

- Piedmont Office Realty Trust, Inc.

- Empire State Realty Trust Inc

- NexPoint Residential Trust Inc

- KBS Real Estate Investment Trust III Inc

- Resource Real Estate Opport REIT Inc

- Watermark Lodging Trust Inc

Apartment Investment And Management Company Acquired Property Adjacent To Hamilton On The Bay Asset Located In Miami For $19 Million

Apartment Investment and Management Company acquired Property adjacent to Hamilton on the Bay asset located in Miami for $19 million in second quarter 2021.Apartment Investment and Management Company completed the acquisition of Property adjacent to Hamilton on the Bay asset located in Miami in second quarter 2021.

Read Also: Tax Efficient Real Estate Investing

How We Use Your Personal Data

How we use your information depends on the product and service that you use and your relationship with us. We may use it to:

- Verify your identity, personalize the content you receive, or create and administer your account.

- Provide specific products and services to you, such as portfolio management or data aggregation.

- Develop and improve features of our offerings.

- Gear advertisements and other marketing efforts towards your interests.

To learn more about how we handle and protect your data, visit our privacy center.

Air Reports Second Quarter 2022 Results Raises Same Store Revenue And Noi Guidance Completes $640m In Acquisitions Makes $125m In Share Repurchases And Further Simplifies Balance Sheet

DENVER, July 28, 2022–Apartment Income REIT Corp. was formed to provide investors the most efficient and effective way to allocate capital to multi-family real estate. In only 18 months, or one-half the expected time, the establishment of AIR is complete. The balance sheet has been transformed with leverage reduced by $850 million, or 23%. The relationship with Apartment Investment & Management Company , approximately 14% of AIRs net asset value at year-en

DENVER, July 28, 2022– – Apartment Investment and Management Company today announced that its Board of Directors updated the existing share repurchase authorization and declared a special cash dividend of $0.02 per share.

Recommended Reading: Ultra High Net Worth Investment Strategies