More Freedom From A Regulatory Perspective

Need one more reason to invest in alternative assets?

Bitcoin, NFTs, real estate, and other alternative investments are subject to fewer regulations than stocks and bonds. That’s a double-edged sword, though.

On one hand, you’ll have more freedom from a regulatory perspective. The stock market is highly regulated and involves a lot of paperwork, posing challenges for investors and asset managers alike. Alternative investors have less red tape to deal with, which makes it easier to diversify your portfolio and experiment with different assets.

On another hand, the lack of regulation equals less transparency and a higher risk of fraud.

Why Alternative Investments Should Have A Place In Your Portfolio

Millions of people are putting their money into real estate, private equity, and other alternative assets despite the economic challenges related to the COVID-19 crisis, growing inflation, and other factors. Some are buying gold or artwork, while others are investing in cryptocurrencies.

But why do alternative investments matter and what makes them so appealing?

For starters, real estate and other alternative investments have a low correlation to the stock market. As a result, their performance is less sensitive to market movements.

What’s more, they allow for portfolio diversification and can generate high returns even in a low-yield world.

Investments in art, gold, and other hard assets may also protect against inflation and increase portfolio value. Although they’re subject to certain risks, they can act as counterweights to stock and other conventional assets.

Interested to find out more? Today, we’ll guide you through the different types of alternative investments, their pros and cons, and how they can fit in your portfolio.

Let’s dive in.

Get Better Every Day And Never Settle

Alternative-investment companies are standing out to workers for several reasons. Besides the breakneck growth in assets that they are experiencing, the firms are significantly smaller than their counterparts in banking or traditional asset management. Citadel has fewer than 3,000 team members and Blackstone employs about 4,000. The biggest banks several of which have persisted as top U.S. employers and even expanded their clout during the pandemic employ hundreds of thousands each.

The firms smaller size leads to several unique qualities for employees: tight-knit cultures driven by leaders who have spent much of their careers there clearly defined values, usually established by founders who either still run the companies or whose influence looms large ample opportunities for career growth that come with the firms perpetual expansion and a premium, uncompromising approach to hiring and fostering the best and brightest.

Inside this firm is an endless pursuit to find perfection, says Matt Jahansouz, Citadels chief people officer. We aim to get better every day and never settle. There is just no sense of complacency.

Below, watch Blackstone co-founder and CEO Steve Schwarzman speak with LinkedIn News about culture and hiring in 2019.

Don’t Miss: Can You Invest In Individual Stocks In A 401k

Deep Dive On Icapital Network: Alternative Investments Leader

Offices of iCapital Network

DEEP DIVE is a series of in-depth articles on FinTechtris that explores a particular fintech leader, discussing its history, products / services, and how it has grown to be an industry leader.

In the alternative investments sector, high-paced growth is fueling a new era of wealth management. These investments include private equity, hedge funds, real estate funds, and others that are traditionally outside public markets providing the potential for diversification and risk mitigation.

The problem with these investments was the high minimum investment amounts excluded most individuals. Even the top tier investors would refrain from locking in such a large portion of funds into a single deal. With regulatory changes in the last 8 years, individual investors are now able to participate at lower thresholds.

The boost of technology in this niche provided new and varied program structures that improved the delivery, timing, and user experience from alternative investment platforms. Being able to quickly structure transactions, onboard investors, aggregate investments, fund deals, and manage payouts has become tablestakes in the industry. The appetite from investors seeking higher yields beyond bank deposit rates is at an all-time high.

We saw the opportunity to build a tech-enabling platform that bridges the gap between institutional-quality alternative-investing opportunities and the high-net-worth community.

Lawrence Calcano , iCapital Network

Challenges Of Alternative Assets

Like traditional assets, alternative investments are still regulated by the Securities Exchange Commission. However, the securities do not have to be registered which reduces the transparency regarding the investments value. This lack of transparency and lower regulations can make pricing assets more difficult, meaning you might have to complete additional due diligence.

While many funds are only available to accredited investors, people getting into the alternative investment industry may also have access to these options. However, these investors must be wealthy and meet the Securities Exchange Commissions requirements. People are required to have at least a $1 million or more net worth which does not include their primary residence or have a $200,000-$300,000 annual income.

Another key challenge to consider is the longer lock-up periods of funds. Investments may take up to 5 to 10 years before they reach maturity. If a person is looking to access the funds before those time periods, they may find themselves unable to make their investments liquid. In these instances, reviewing the lock-in period and selecting other alternative investments with shorter time frames may be more suitable.

Also, keep in mind that many investments are complex and could require a financial advisor who is well versed in these possible vehicle options.

Recommended Reading: Mutual Funds Investing In Gold

Complementing Your Portfoliowith Alternative Investments

Having alternatives means having the options you need to fit your ever-evolving needs. We believe diversification across a broad spectrum of asset classes is the best way to help our clients meet their long-term objectives, balancing risk and return.

For those who appreciate the potential of alternative investments in a comprehensive portfolio, we offer diversification through investments such as hedge funds, managed futures, funds of funds, private equity, private real estate, and other alternative investment options.* Of course, alternatives arent for everyone, and well carefully consider the options that complement your existing financial objectives before thoughtfully moving forward.

The alternative investment vehicles we offer include, but are not limited to:

What Is An Alternative Investment

An alternative investment is a financial asset that doesnât fall into conventional asset categories, like stocks, bonds and cash.

Alternative investments include private equity, venture capital, hedge funds, managed futures and collectables like art and antiques. Commodities and real estate can also be classified as alternative investments.

Don’t Miss: Cash Out Refinance To Invest

Who Can Buy Alternative Investments

Buying many types of alternative assets has historically been limited to financially sophisticated investors like institutions or high-net-worth individuals deemed accredited investors by the Securities and Exchange Commission . This is because most alternative investments are not traded on public markets, and theyâre typically unregulated by the SEC.

If you wish to purchase alternative investments as an accredited investor, you can qualify in a few different ways: by having an annual income of $200,000â$300,000 for a coupleâfor the past two years by maintaining a net worth of $1 million dollars or more or by demonstrating âdefined measures of professional knowledge, experience, or certificationsâ in the SECâs eyes.

Analyze Alternative Investment Opportunities

Alternative investments are different from so-called traditional investments in a few ways. These differences can and should impact how you evaluate alternative investments you may be considering for your portfolio.

For example, one of the key differences between alternative investments and traditional investments is that alternatives are less liquid, or harder to sell or convert into cash. This is due to several reasons, including that most alternative investments arent traded in public markets.

With this in mind, most alternative investments have longer investment horizons or timelines than traditional investments. UBS notes, for example, that infrastructure funds, which invest in large capital projects, often have an investment horizon of 12 to 15 years. Private equity, meanwhile, typically has an investment horizon closer to 10 years.

Other factors that must be considered include the risk and return relationship for each investment, along with volatility.

Read Also: Amazon 10 Thousand Dollar Investment

What Are The Different Types Of Alternative Investments

Liquid Alternatives

The first thing to note about the range of investments on offer here is that they are liquid alternatives. Unlike private equity, for example, investors can access these strategies via more liquid investment vehicles, such as mutual funds, UCITS , and exchange-traded funds , which are funds that are traded on stock exchanges. And they usually invest in traditional assets, such as stocks, bonds and cash.

Leading Alternative Asset Classes: Performance And Opportunities

Alternative assets primarily can be segregated into 4 asset classes namely Private Equity, Hedge Funds, Real Estate and Private Debt. Infrastructure, energy and other exotic investments like art are some of the other alternative assets in play.

Table 1 represents the breakup of alternative asset classes, their performance, and the respective opportunities.

Understanding the components of alternative investment cycle and their fundamentals

Alternative Investments have a different trade cycle as compared to traditional asset classes. The investment cycle can last from as short as 1 year in the case of hedge funds to as long as 7-10 years for a PE fund.

Typical challenges in the alternative asset industry

Operational inefficiencies

Platforms handling traditional asset classes may not be well equipped to support multi-asset investing. Most buy side applications do not have adequate capabilities to support diverse portfolios. To solve this issue, firms create separate operating models which lead to hiring of additional resources, formation of siloed departments, and lot of interdependence amongst them, creating a complex structure. Also, it puts additional pressure of integration on already burdened IT departments.

Data quality and accessibility challenges

Data is the key for making important investment decisions. Figure 1 deals with the various concerns regarding usage and availability of data for alternative investments:

Figure 1: Data challenges for alternative investments

You May Like: What Does Fisher Investments Invest In

The Power Of A Leading Global Institution

Ideas Sourced Globally

Our reach is global, our relationships deep, and our connections long-standing. Our network spans 63 countries, covering the worlds leading CEOs, entrepreneurs, investors, policy makers and thought leaders. We source ideas and opportunities from this network of relationships, who recognize us as a committed partner, helping them advance ideas and grow their businesses.

Differentiated Insight

We live at the center of the worlds capital markets. We are able to synthesize insights across industries, geographies, securities, strategies, technologies, and public policies. Our informational breadth expands our thinking, our expansive data contributes context, and our long experience informs our judgment.

Value, Accelerated

We extend the global capabilities of our entire firm for the benefit of our portfolio companies.2 Whether empowered by our functional expertise, technology platform, or commercial relationships, we deploy considerable resources with the goal of helping our partners grow revenues, enhance margins, digitize processes, manage human capital, and evolve sustainability and impact.

How Have Managed Futures Grown In Popularity Over The Years

Managed Futures investments started with just a few wealthy people in the inner circles of Wall Street trading firms back in the 1970s. Over time, as more traders emerged and began to offer products, the investment opportunities became more prevalent and available to the general public. First more programs came to market, spreading across the wealthy as popularity grew during the 1980s and 1990s. Then program minimums and access points expanded to commodity pools and mutual funds in the 2000s where investments could be made for as little as $2,500 USD instead of previous levels of $100,000 USD or more to access.

Read Also: Is Buying Domain Names A Good Investment

Read Also: Second Home Vs Investment Property Mortgage Rates

What Questions Should An Individual Investor Ask When Selecting A Cta For Alternative Investing

Individual investors should have a proper due diligence process, including both investment due diligence and operational due diligence to select a CTA. Some common CTA vetting questions include:

- What type of strategy is used?

- What futures markets are traded?

- What is the minimum investment size?

- What are the fees?

Why Invest In Alternative Investments

In economics, hyperinflation is problematic, and a root cause of economic uncertainty. True hyperinflation, marked by unfettered price increases and severe currency devaluation generally occurs during times of turmoil or war. This is a rare occurrence in developed countries. Regardless, growing inflation rates are an important dynamic to observe, and investors can smooth the yield curve by employing alternative investment strategies.

Market inflation is the decline in purchasing power of a currency over time that results in rising prices for goods and services. In other words, the value of a currency decreases in times of high inflation. In the U.S., inflation is measured by the Consumer Price Index , which indicated a 5.4% annual inflation rate in 2021, an increase from 1.4% the previous year. The impact of inflation is consequential and far-reaching, affecting every aspect of the economy, including the investment world.

Conventional investments like stocks, bonds, and cash are less profitable in an inflated economy. That said, some types of alternative investments real assets that do not fall into a conventional investment category can do very well. This is especially true for alternative investments like real estate and Real Estate Investment Trusts .

Don’t Miss: Savings Ira Vs Investment Ira

The Current State And Way Ahead

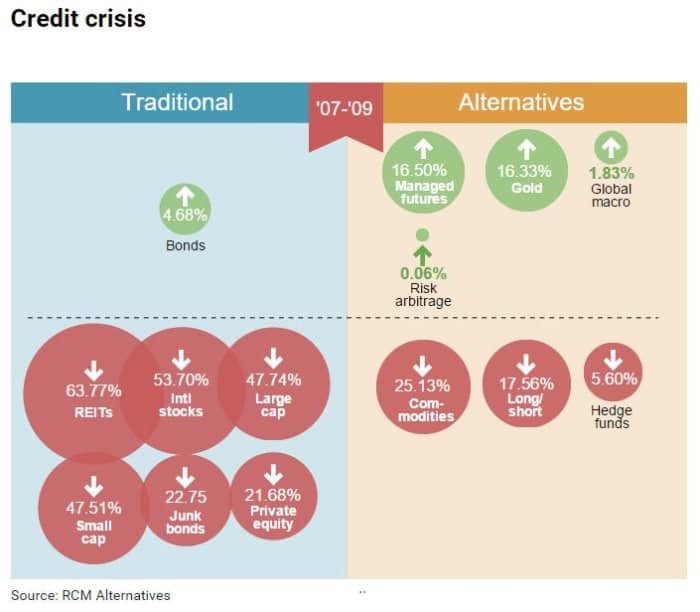

The 2007-09 financial crisis prompted traditional investors to make alternative assets a prominent part of their investment portfolio. The main reasons for this shift to alternate asset classes was due to low correlation with equities and bonds, diversification, greater alpha, and hedge against inflation.

Alternative assets have been on the growth path with only USD 3 trillion under management in 2003, the industry has grown by 400% over past 16 years to USD 15 trillion in 2019 and is expected to reach USD 18 trillion by 20241

Revenue from alternatives assets as percentage of revenue from all asset classes has grown from 29% in 2003 to 46% in 2019 . The projection for revenue for 2024 stands at USD 162 Bn1.

Q: Why Are There So Many Opportunities In Private Markets

A: The private markets can provide a lot of investing options since there are many more private companies than public ones. Also, private companies are often staying private for longer than before, so by the time a company finally does go public, much of the equity appreciation has sometimes already occurred. To capture those returns, you need exposure to private companies.

There are also many opportunities in private credit, which is lending to private companies. Many large institutions have become much more conservative in financing small- and medium-sized companies that make up the middle market. Individual investors are taking up the slack, providing capital to these companies through special lending funds. Weve noticed increased interest from clients in this strategy because it may provide a steady source of income and attractive total returns. Of course, there are risks with private equity investments, including loss of capital.

Don’t Miss: Stock Investment Short Term Balance Sheet

Traditional Vs Alternative Investments

What are the differences between alternative and traditional investments?

Risk. The Strategys investments may have low liquidity which often causes the value of these investments to be less predictable. In extreme cases, the Strategy may not be able to realise the investment at the latest market price or at a price considered fair.

Alternative Real Estate Investing

Why invest in alternative investments? Thank goodness there are alternatives. The alternative I chose requires much less or little management and is very appealing from a profit standpoint.

Rather than hundreds of employees, an alternative investment that you can do from your kitchen table or a small office using a computer and financial skills makes sense to many, especially if you can create passive income.

The alternative Im about to suggest is perfect for entrepreneurs. The business helps the local government, and most of all, it helps the entrepreneur.

This is not traditional real estate. However, this little-known but highly lucrative alternative real estate investment involves many opportunities in over 3,000 counties across the United States.

The majority of this alternative investment can be acquired, managed and profited from sitting at home working on your computer and following defined proven and tested processes.

Everything is legal and ethical and to your advantage and the advantage of the people you do business with.

Why Invest in Alternative Investments?

Becoming an Entrepreneur

Why are you interested in alternative assets? Or why should you be? Lets begin with this short encouraging statement. You dont know what you dont know. Thats where were going to start.

Its not difficult if youll learn from the extraordinary individuals that have created success and continue to succeed and practice.

Why Invest in Alternative Investments?

Buy Low and Sell Low

Also Check: How To Start Investing With 500 Dollars

Regulation Of Alternative Investments

Even when they don’t involve unique items like coins or art, alternative investments are prone to investment scams and fraud due to the lack of regulations.

Alternative investments are often subject to a less clear legal structure than conventional investments. They do fall under the purview of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and their practices are subject to examination by the U.S. Securities and Exchange Commission . However, they usually don’t have to register with the SEC. As such, they are not overseen or regulated by the SEC as are mutual funds and ETFs.

So, it is essential that investors conduct extensive due diligence when considering alternative investments. In some cases, only accredited investors may invest in alternative offerings. Accredited investors are those with a net worth exceeding $1 millionnot counting their primary residenceor with an annual income of at least $200,000 . Financial professionals who hold a FINRA Series 7, 65, or 82 license may also qualify as an accredited investor.

Some alternative investments are only available to accredited investorse.g., those with a net worth above $1 million, or an annual income of at least $200,000.