The Benefits Of Short And Long

Investing for the short-term is just as important as investing as the long-term, although each strategy can help you reach a different set of personal finance goals. For example, short-term investing can help you ensure your money keeps up with inflation, and it can help you save up for goals like buying your first home or starting a business.

In the meantime, long-term investing is usually for retirement, or for the purpose of building generational wealth. A diversified portfolio with varied investment options can bring these long-term goals to fruition, and the bottom line is that investment strategies in this realm tend to come with more risk since you have a longer investment horizon in general.

Five Principles For A Long

In addition to saving for your long-term goals, you should be investing, too. Remember these guidelines as you plan.

If you’re thinking about how to pay for goals that are seven or more years away, you should be saving and investing now. Consider these five key ways to help pursue your long-term investing goals.

Who Might Consider Short

People investing for savings goals that are less than three years away may think about exploring short-term investment strategies.

Short-term investment strategies might be considered by people who are saving for:

- Vacations: You might prefer to plan that big trip you’ve always wanted by funding it with money you’ve invested, rather than putting it on a credit card and accruing debt, for example.

- Weddings: You may have anywhere from a few months to a few years to save for all of the expenses related to a wedding. The right short-term saving strategy can help make your big day the best it can be.

- Gifts: Whether it’s for birthdays or major holidays, you may choose to keep money in an interest-bearing account for purchasing gifts for friends and family.

- Home Improvement: Rather than take money out of home equity, a short-term investing strategy may help you fund home improvement renovations or projects.

Don’t Miss: How To Angel Invest Without Being Accredited

Short Term Investing Vs Long Term Investing

Shutterstock/TheStreet

Have you invested for the next six months or the next six years? It makes a big difference.

There are two ways to understand the difference between short term and long term investments.

The definition is simple. A short term investment is any asset you hold for one year or less. Most investors hold short term investments for no more than a few months at a time, if not several weeks. A long term investment is any asset you hold for more than one year. Most investors hold long term investments for several years as part of an overall strategy for their portfolio.

Now for the long version.

Covering Of Losses In Case Of Short

Short-term investments do not provide enough time for investors to cover their losses in case their investments turn negative. Therefore, short-term investors have to suffer a loss whenever these investments see a decrease in value. And in case the investor has to liquidate their position and exit.

Long-term investments provide opportunities for investors to wait for the correct time to sell their investments and make profits. Even if an investment offers negative returns over a small period of time, the investor can wait and keep holding it. The temporary low may be due to business cycles, recessionary phase, or simply due to temporary poor performance of a company or sector. Investors can sell their investments whenever the investment rebounds and prices go up.

Don’t Miss: Starting Off In Real Estate Investing

Examples Of Short Term Assets

Various examples of short term assets are:

- Cash & Cash Equivalents: Cash & Cash equivalents include cash balance, bank balance, fixed deposits etc.

- Trade Receivables: Trade receivables include the amount that is owed to the company by the outsider. Basically, they are the companys debtors who have purchased the goods of the company on credit and are yet to pay to the company.

- Short Term Deposits: These deposits are security deposits with the government authorities like eLectricity Department Etc. and Are Recorded as Current Assets of The Company.

- Prepaid Expenses: Prepaid expenses refer to the expenses that are paid in advance by the company but the benefits from such cash outflows will be received in the future. For example, salary paid advance etc.

Example

Lets look at the practical example of the short term asset:

Mr. Nick started a business of trading of curtains by bringing capital $500,000 in the bank account from which he purchased an office building that cost him $ 63,000. He also purchased furniture for $25,000. The inventory purchased of $15,000 was purchased by him. Also during an accounting year, he sold inventory that costs him $2,500 for cash and inventory costing $3,500 for credit. So we need to calculate the short term assets of the business at the end of the period

Solution:

From the above transactions, office building and furniture are long-term assets so they are not to be calculated as are not included in short-term assets.

Risks And Rewards Of Bond Funds

Similar to stock ETFs, bond market funds are bundles of bond investments offering easy diversification and exposure to the bond market. Bond funds, like bonds, can have different maturities, risk and yield. Bond funds with longer maturities have higher yields and could be considered a long-term investment, but not for the same reason as stocks. Longer-term bonds pay higher yields because there’s a higher risk of inflation eating into your fixed interest payments.

However, the risk and reward profile of bonds with longer maturities might not stack up with the risks and rewards of investing in stocks:

We’re not interested in long term or high yield , because that offers an element of risk that you’re not necessarily rewarded for. Our attitude is if you’re going to take risk, you’ll be better rewarded for it on the equity side of the portfolio,” says Alexander.

Ultimately, having patience can lead to investing success over time, says Walnut Creek, California-based certified financial planner Mario Hernandez.

Not every asset is going to do well every year. Investments arent meant to. If you bail out and go into cash, youll realize that loss, and you wont be able to participate in the rebound in the market.

|

when you invest in a new Merrill Edge® Self-Directed account. |

Recommended Reading: Investing In A Brokerage Account

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How To Balance Long And Short Term Investments

As weve seen, there are big differences between long and short term investments. This means they can be combined in a portfolio.

A key rule to remember is that short term investments tend to be riskier and so should be done with the money that youre prepared to lose. Long term investing should be done with the money that youre saving for future plans, such as retirement or passing onto your children.

So plan to own a balance of both types of investments, but be sure to only allocate a portion of your money to short term investments with which youre willing to take some risk. With this in mind, the majority of your investments should be in long term investments.

Don’t Miss: Real Estate Funds To Invest In

Who Might Consider Long

Put simply, long-term investment strategies can be useful for anyone who has a savings goal that is at least several years away. In the world of personal finance, long-term goals are generally considered to be at least seven to 10 years away.

Long-term investment strategies might be considered by investors who want to:

- Save for Retirement: This is a common reason for a long-term investment strategy. This is because, for many, retirement can be the largest financial goal of a lifetime, as well as the longest to reach.

- Save for College: Higher education is expensive and the cost is rising. Long-term investment strategies can be an important means of paying for college.

- Build Wealth: Long-term investment strategies could help grow money over time.

It’s important to keep in mind that the typical long-term investment types are not appropriate for all investors. For example, stocks and stock mutual funds can potentially make useful long-term investments. However, the potentially higher relative performance of stock investments comes with greater market risk. Therefore, people with low tolerance for risk might consider other investment types to diversify their holdings with lower-risk investments.

Active And Passive Investors

Active investors usually invest in short-term investments since they are dedicated and can give sufficient time to take care of their investments.Passive investors usually prefer to invest in long-term investment avenues and hold them for a long duration of time. It is difficult for them to track their investments daily or very frequently, and hence, they prefer the passive approach.

Recommended Reading: Sustainable Funds To Invest In

Higher Holding Period Leads To Higher Profits

Investors tend to create a balance between the safety of their investments along with growth and good profits. And this is usually possible only with investments that the investors hold for the long term. These investments have the potential to provide a stable and good income for the later years in ones life and hence are a must-have in everyones portfolio.

Long-term investments such as shares and real estate come with some amount of risk, too, as no investments can be devoid of any risk element. However, since the goal is to grow our funds over the long term, some sort of risk is inevitable. As per the past performance, the chance of appreciation of capital is high, resulting in real wealth creation and accumulation. Investors can book profits in the short term by investing in the market and then exiting their position in less than a year. But the investments which they hold for several years often provide returns in double-digits. Thus, a high return along with capital appreciation multiplies the value of their investment portfolio several times in the long run. This is, however, not possible if the investments are not kept for a longer period.

Long Term Vs Short Term Investments For 2023

If you want to protect yourself from potential drops in the US dollar, here is the best long-term investment if the dollar crashes:

Editor’s Choice

We earn a commission if you make a purchase, at no additional cost to you.

- Gold And Silver For Your Self Directed IRA

- High Account minimum

- Invest In Gold By Doing Research

OUR RATING

Are you looking at different investing strategies and don’t know whether you should focus on long-term or short-term investing?

I know that all investments differ, and it cannot be easy to understand what investment types you should look into.

So this guide will give you an example of short and long-term goals for your new investment strategy.

TL DR: Summary

- Be careful of capital gains taxes

- Both have risky investments

- Choose financial goals that match your income

- Work With A Financial Professional

Also Check: I Want To Invest 1000 In The Stock Market

How Does Investing Work

Investing takes place when someone buys an asset at one price with the goal of selling it at a higher price. For example, investing can involve someone buying a particular stock, holding it for ten years, then selling it at a profit. However, many investors make money by buying and selling stocks and other investments over a much shorter period of time even within the same day.

Another example of investing is when a person uses their own money to buy real estate that they rent to someone else. In this case, the investor hopes the value of the property increases over time, yet theyre also receiving a return on their investment when their tenant pays rent each month.

What Are Long Term Investments & Short Term Investments

Before we start on this topic, let us explain what short-term investments are and what long-term investment is because many investors dont really understand this concept and to many, even 1 year seems to be long-term! The short-term investment is anywhere 1 year to 3 years. Period less than 1 year would come under Ultra Short Term. The investment horizon of more than 5 years should ideally fall under Long Term investments. Now a period between 3 to 5 years is a combination of long-term and short-term and we would classify as Medium Term Investments.

Read Also: Private Lenders For Investment Properties

Short Term Assets Vs Long Term Assets

Following are the major differences between short term and the long term assets.

- The long term assets are such assets that are used for long duration i.e. more than a year in the business to generate revenue whereas short term assets are those assets that are used for less than a year and generate revenue/income within one year period.

- The long term assets are not readily converted into cash as they are used for several years so they are not used to meet short term operational requirements of the business whereas short term assets are used to meet the short term operational requirements of the business as these assets are readily converted into cash.

- The depreciation is charged on Long term assets which divide the cost of such asset by booking it as an expense over the period of its useful life whereas no such depreciation is charged on the short term assets of the business.

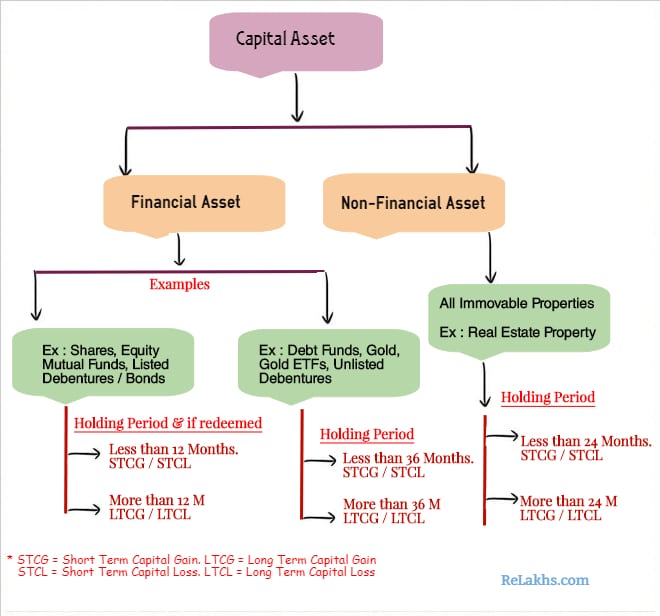

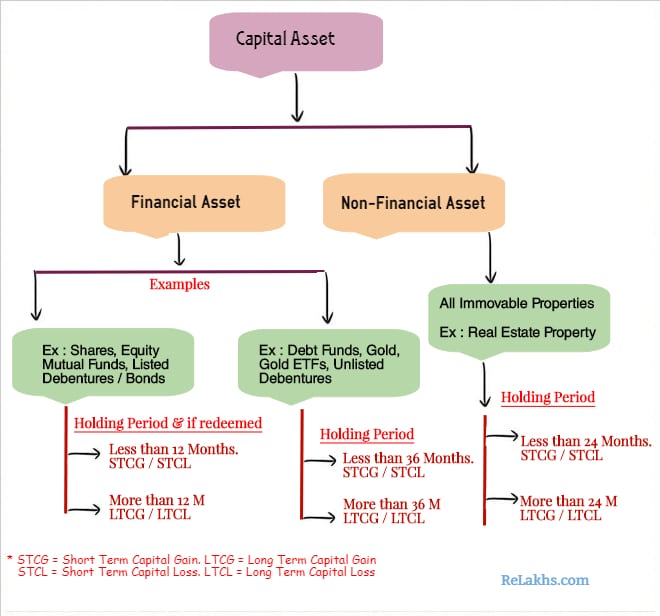

- On sale of long term assets the capital gain and loss earned and incurred respectively are referred to as long term capital gain/l loss whereas on the sale of short term asset, the gain/loss incurred is referred to as short term capital gain/loss.

Common Profile For A Short Term Investment

As noted above, short term investments are financial instruments that you hold for less than a year. Most traders will hold a short term investment for several months at the most, looking to profit off volatility and near-term gains.

While any asset can technically be a short term investment, most will share a few common features. They will typically be volatile assets, letting the price move quickly enough for investors to profit off the asset within a brief period. They will generally have relatively small price movements. Finally, a short term investment will also generally be highly liquid, allowing investors to sell the asset fairly quickly.

Common short term investments include products such as stocks, options and ETFs, all volatile assets with existing markets that allow rapid sale.

In particular, day traders and active traders often hold significant short term investments.

Don’t Miss: Ira Real Estate Investment Options

Common Profile For A Long Term Investment

Long term investments are financial instruments that you hold for more than a year. Most traders hold these investments for several years at a time, building them into portfolios with a specific strategy, such as 401s, college funds and long term savings accounts.

As with short term investments, any asset can be a long term investment. However common long term investments gain value slowly but predictably, making them better assets to hold over several years. Investors will also usually hold illiquid assets as long term investments.

The most common long term investment is real estate. Many people buy homes as an investment that they will hold for years, if not decades, allowing the property to accrue value. The process of buying and selling a house, which makes this investment very illiquid, would make this a difficult short term investment but is less of a problem over a period of years.

Other common long term investments include many mutual funds and bonds.

Long term investments are common for most retirement accounts and college funds, portfolios which tend to trade relatively rarely and count on long term growth.

Best Investments For Timelines Of Less Than 3 Years

When you know youll need access to your money in the next three years, you have to choose from low-risk investments that keep your cash liquid and easy to access. The best short-term investments for up to three years can help you do exactly that, although some offer more liquidity than others.

If your timeline is 3 years your #1 goal is to protect your savings.

You May Like: Fidelity Investments Life Insurance Company

How Can Sarwa Help

Sarwas platform gives you to access long term investments in a painless and affordable manner.

Our approach draws upon the work of top investors and academics to create a healthy balance of investments that minimizes portfolio risk, giving your money the greatest chance of growing over time. By investing with Sarwa, youre investing for your long term financial goals.

Want to know more? Get in touch to discuss any aspect of investing with one of our advisors.

Ready to invest in your future?

We Will Try To Understand It By Analogy

Just imagine a situation where you have to go to a nearby grocery shop. Would you take an Airplane for this purpose? Sound funny! Let us change the example, you have to go to Canada for a vacation. Would you go walking or take cycle for this purpose. Sound irritating!

Must Read Timing or Time in Equity Markets

Recommended Reading: No Doc Loans For Investment Property

Important Ingredients In Long