How A 401 Works

The contributions that you make to your 401 are excluded from your taxable income, which is why this is called a tax-deferred account. So if you earn $40,000 annually and contribute $3,000 to your 401 for the year, the IRS will consider your taxable income to be $37,000 . In some cases, reducing your taxable income could mean less of your income is in a higher tax bracket and save you even more money come tax season.

For the 2022 tax year, you can contribute up to $20,500 to your 401 account. If you are 50 years old or older, some 401 plans will let you add “catch-up contributions” of up to $6,500, allowing for a total of $27,000 in contributions for 2022. Each year, these contribution limits change, so be sure to check the latest IRS publications for updates.

When you invest through your 401 account, your earnings grow tax-free. But once you start withdrawing your 401 account balance, at age 59½ or later, the distributions are taxed as ordinary income. This has benefits if your income is lower in retirement, since you should expect to get taxed at a lower rate. Withdrawing money from your 401 before you’re 59½ years old results in a 20% tax withholding and carries an additional 10% penalty, so it is not advisable.

Your Company May Offer A Roth Option

Many companies have added a Roth option to their 401 plans. After-tax money goes into the Roth, so you wont see the immediate tax savings you get from contributing pretax money to a traditional plan. But your money will grow tax-free. account.)

For 2021, you can stash up to $19,500 a year, plus an extra $6,500 a year if youre 50 or older, into a Roth 401. For 2022, workers can save $20,500 while those who are 50 and old can still contribute an extra $6,500. Contributions must be made by December 31 to count for the current tax year, and the limit applies to the total of your traditional and Roth 401 contributions. A Roth 401 is a good option if your earnings are too high to contribute to a Roth IRA.

Is Income Tax Withholding Required On In

There is no income tax withholding required on an in-plan Roth direct rollover. However, if you receive a distribution from your plan, the plan must withhold 20% federal income tax on the untaxed amount even if you later roll over the distribution to a designated Roth account within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

You May Like: How To Invest In Share Market Online

Choosing Between A Roth 401k And A Roth Ira

As with anything financial planning, theres really no one-size-fits-all answer to this question. The best way to figure out which account makes more sense for you is to talk to your financial advisor about your specific situation, but here are a few scenarios to help guide your conversation.

A Roth 401k might be the better choice if you:

- Earn too much money to open and contribute to a Roth IRA.

- Want to take advantage of an employer match.

- Want to contribute as much money as possible.

- Appreciate the ease of signing up at work and having contributions automatically deducted from your pay each pay period.

A Roth IRA might be the better choice if you:

- Want access to a wider range of investment options.

- Want to be able to withdraw contributions tax- and penalty-free before you turn 59½ without making a plan loan.

- Have no inclination toward taking RMDs when you turn 70½.

K Rollover To Roth Ira

When you switch jobs or retire, you need to decide what to do with your previous 401 plan. One option is transferring your money from your employers retirement plan by doing a 401 rollover to a Roth IRA.

Many people decide to rollover, or transfer, their former employers retirement plan to a Roth IRA due to the flexibility these accounts provide. Often, as with a Traditional IRA, a Roth IRA gives you more investment choices and can have lower fees than a 401. A Roth IRA rollover also provides you with a convenient option to consolidate other retirement accounts in one place, helping keep track of your retirement savings as your career progresses.

However, a rollover from a 401 to a Roth IRA may not make sense for everyone. Your financial situation and personal goals play a large part in determining whether a rollover is the right move. Next, well explore how the rollover process works and key financial considerations so you can decide whether this is right for you.

You May Like: How Can I Find Out If I Have 401k Money

Read Also: Why Is It Important To Invest At An Early Age

Potential For Higher Taxes

As with Roth IRAs, the potential tax benefits of 401s are not guaranteed. While pretax contributions can save you money in the short term, its possible youll be in a higher tax bracket when you withdraw funds after retirement age, which may ultimately result in you paying higher taxes on your contributions and earnings.

Benefits Of Contributing To Both A 401 And Roth Ira

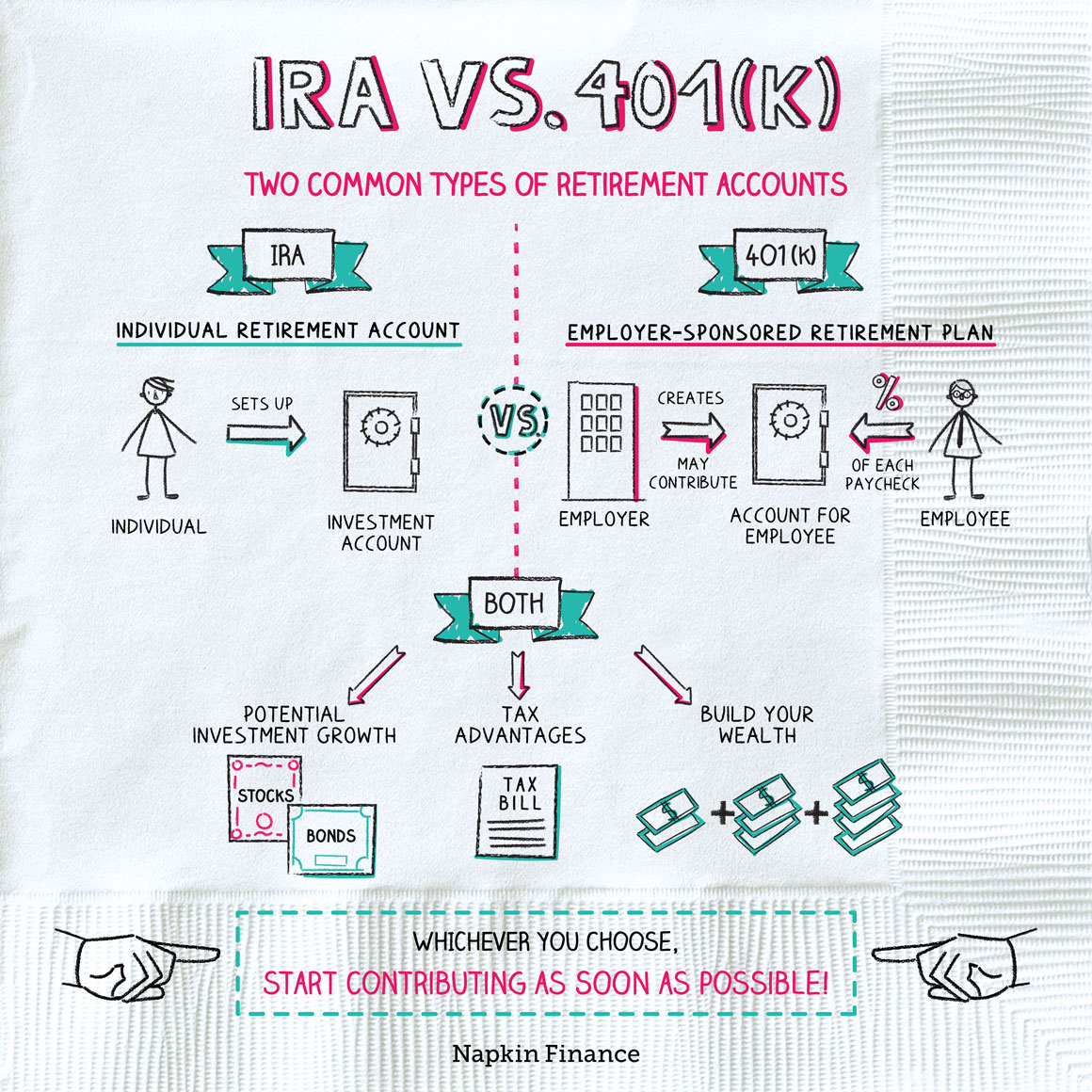

Contributing to both a 401 and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. With a 401 account, you’ll contribute money you haven’t yet paid taxes on. Your employer may also match contributions up to a certain percentage of your annual income.

With your Roth IRA, contributions are made after you’ve paid taxes, but qualified distributions, or withdrawals, are not taxed. Additionally, contributing to these accounts may make you eligible for a tax credit known as the Saver’s Credit, which could be up to 50% of your contributions. When you combine these accounts, you can stack your tax benefits while saving for retirement.

Also Check: Should I Create An Llc For My Investments

The Best Mutual Funds For Roth Iras

Mutual funds offer simplicity, diversification, low expenses , and professional management. They are the darlings of retirement investment accounts in general, and of Roth IRAs in particular. An estimated 18% of Roth IRAs are held at mutual fund companies.

When opting for mutual funds, the key is to go with actively managed funds, as opposed to those that just track an index . The rationale: Because these funds make frequent trades, they are apt to generate short-term capital gains.

These are taxed at a higher rate than long-term capital gains. Keeping them in a Roth IRA effectively shelters them, since earnings grow tax-free.

At What Age Does A Roth Ira Make Sense

A Roth IRA makes sense at any ageearly or even late in your careerso consider your retirement savings options and, if appropriate for your income and financial goals, open one as soon as possible. Think about whether you want to pay taxes when you’re no longer working and may need all the income you can get.

Recommended Reading: How To Invest Socially Responsible

Vs Roth Ira: An Overview

Both 401s and Roth IRAs are popular tax-advantaged retirement savings accounts that differ in tax treatment, investment options, and employer contributions. Both accounts allow your savings to grow tax-free.

Contributions to a 401 are pre-tax, meaning they are deposited before your income taxes are deducted from your paycheck. However, when in retirement, withdrawals are taxed at your then-current income tax rate. Conversely, there is no tax savings or deduction for contributions to a Roth IRA. However, the contributions can be withdrawn tax-free when in retirement.

In a perfect scenario, youd have both in which to put aside funds for retirement. However, before you decide, there are several rules, income limits, and contribution limits that investors should be aware of before deciding which retirement account works best for them.

Roth Ira Vs : What Are The Major Differences

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Heres the tale of the tape showing how the Roth IRA and the 401 stack up against each other:

|

Feature |

|

|

Penalties for withdrawals before 59 1/2. |

Penalties for withdrawals before 59 1/2. |

Don’t Miss: Oil And Gas Investment Banking Jobs

Can I Contribute To A Roth Ira And A 401

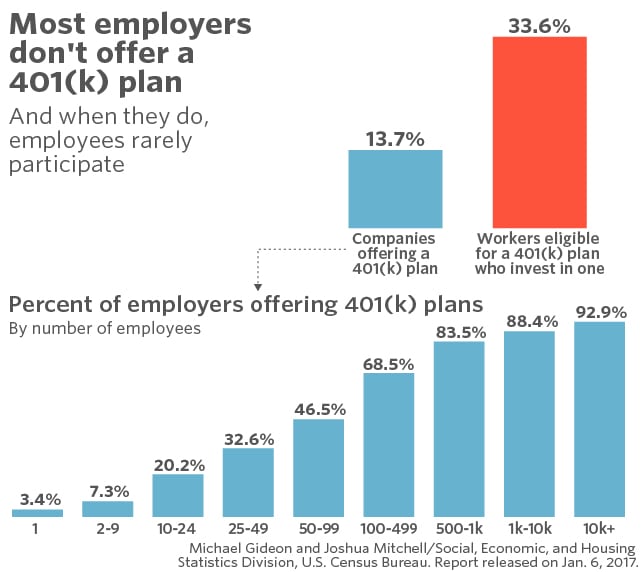

Most retirement savings are made through employer-sponsored 401 plans. If your employer offers to match a percentage of your contributions, it’s a great way to increase your retirement savings with free money.

In addition to your 401 contributions, you can contribute to a Roth IRA. A Roth IRA will be held outside of your employer-sponsored plan but is just as easy to set up.

Adhere to the contribution limits bothâ$19,500 and $6,000 respectivelyâand you can grow your retirement savings by $25,500 annually plus any employer contributions.

A good strategy would be to contribute to your 401 up to the amount your employer matches. Then, contribute as much as you can towards your Roth IRA until you reach the limit. This way, you’ll maximize the free money you’ll receive from your employer and increase the amount of tax-free distributions you’ll have during retirement.

Disadvantages Of A Roth Ira

The Roth IRA sounds pretty awesome, doesnt it? Unfortunately, the Roth IRA does have some limitations that you need to be aware of:

- Lower contribution limits. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 When you compare that with the contribution limits for a 401, you might be thinking, Thats it? Thats why 401s and Roth IRAs work better together.

- Income limits. As amazing as the Roth IRA is, theres a chance you might not even be eligible to put money into one. Gasp! If your modified adjusted gross income is higher than $144,000 as a single person or more than $214,000 as a married couple filing jointly, then you wont be able to contribute to a Roth IRA in 2022.4 But dont worry, the traditional IRA is still an optionits better than nothing!

- The five-year rule. This wont be an issue for most folks, but the five-year rule says you cant take money out of your Roth IRA until its been at least five years since you first contributed to the account. Youll get hit with taxes and penalties if you break that rule . And remember: Just like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 .

You May Like: Ark Investment Management Trading Information

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Am I Eligible To Invest In A Roth

To contribute to either a traditional or Roth IRA, you must have taxable compensation for that year. And Roths have additional restrictions on who can contribute: Single filers with a modified adjusted gross income less than $124,000 can contribute up to the maximum amount allowed for the year. If your MAGI is $139,000 or more , you cannot contribute to a Roth. Anything in between, you can contribute a reduced amount.

You can contribute to a traditional IRA, no matter what your MAGI is. But how much of your contributions are deductible depends on your MAGI and whether youre able to contribute to a retirement plan through your employer. If you do have a retirement plan at work, you can deduct the full amount up to the contribution limit, if your MAGI is $65,000 or less as a single filer, or $104,000 or less if youre married and filing jointly. Without an employer-sponsored option available to you, single filers have no income limits on how much they can deduct while joint filers with a MAGI of $206,000 or more get no deduction.

Dont Miss: How Can I Use My 401k To Buy A House

Read Also: How Can I Invest In China

Weighing The Pros And Cons

Roth IRAs and Roth 401ks are both good options for retirement savers. The answer to which account is the better option will really depend on your unique situation. Its always a good idea to talk to your financial advisor to weigh the pros and cons and come up with what the best choice is for your situation.

Read More:What is a Fiduciary? Heres Why It Matters in Money Management

Which Is Better For Taxes A Roth Ira Or 401

Weve talked briefly about the different tax implications of a 401 and Roth IRA, but lets dive a bit further into them here. As we mentioned, a 401 and a Roth IRA have different tax advantages.

In most cases, 401 contributions are made pre-tax, meaning they reduce your taxable income and, therefore, your tax burden in the current year. The money grows tax-deferred while its in your account, and youll pay taxes on your 401 withdrawals at your ordinary income tax rate at retirement.

A Roth IRA, on the other hand, allows you to make your contributions after taxes. While theres no tax advantage in the current year, your money grows tax-free in the account and you can withdraw both your contributions and earnings tax-free during retirement.

So which tax advantage is better? Traditional 401 contributions are generally more beneficial for taxpayers with a high income today who expect to have a lower income during retirement. In other words, you can get a tax break today if your tax rate is high, and then defer those taxes until youre in a lower tax rate. And vice versa.

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

Read Also: Harsch Investment Properties Las Vegas

Can I Contribute To A Traditional Ira And A 401

If you prefer contributing pre-tax money towards your retirement accounts, the two options you have are a traditional IRA and an employer-sponsored 401.

Like a Roth IRA, a traditional IRA is set up through an outside institution, like Fidelity. However, instead of allocating after-tax dollars like a Roth IRA, a traditional IRA uses money before taxes are taken out.

This means you can contribute more to your traditional IRA and have less tax burden during your working years. However, like a 401, the distributions you take during retirement will be taxed.

You can contribute up to $6,000 towards your traditional IRA while still contributing towards your 401. Like the previous scenario, you can contribute a total of $25,500 towards retirement, $33,000 if you’re 50 and older.

Additionally, you can rollover old 401s into an IRA. Rather than transferring old 401s into your current 401, you can consolidate them into an IRA and take advantage of the increased investing options.

When Can I Withdraw From My Roth Ira

You can withdraw anytime from a Roth IRA, but there may be some penalties.To avoid a potential 10% early withdrawal penalty, you should withdraw after the age of 59½ or once your Roth IRA account has been open for five years. You can withdraw early and avoid penalties if you are buying a home for the first time, have college expenses to pay for, or need to cover birth or adoption expenses.

Dont Miss: How To Find Old 401k Money

Also Check: Bank Of America Investment Banking Groups

Comparing Contribution Limits: Roth 401 Vs Roth Ira

You know, of course, what a 401 is and what an IRA is. But ever since the Roth versions of these tax-advantaged vehicles came on to the scene , allocating retirement-planning dollars has gotten more complicated. Here’s the lowdown on both Roths. The good news is that, unlike the Roth IRA/traditional IRA relationship, the Roth 401 functions nearly identically to the traditional 401 as far as contributions go.

Whats The Difference Between A Roth Ira And A Traditional Ira

Both types of IRAs allow you to save for retirement. A Roth IRA allows you to save after-tax funds, and you must meet income requirements to continue to one. You can withdraw those funds tax-free in retirement. A traditional IRA allows you to save pre-tax funds, and you may be able to deduct your contributions depending on your income and whether you and/or your spouse have retirement plans at work. You pay taxes on withdrawals in retirements.

Recommended Reading: Creating A Real Estate Investment Trust