Primary And Secondary Education

Public primary and secondary schools in St. Petersburg are administered by . Public high schools within the city limits include:

- Keswick Christian School

- Northside Christian School

The non-profit educates more than 22,000 school children annually through field trip classes and offers winter, spring and summer workshops for 2,000 more.

Here’s One I Made Earlier

First, letâs look at why it might be easier to run your own ARK-inspired fund than mirroring other types of pooled portfolio.

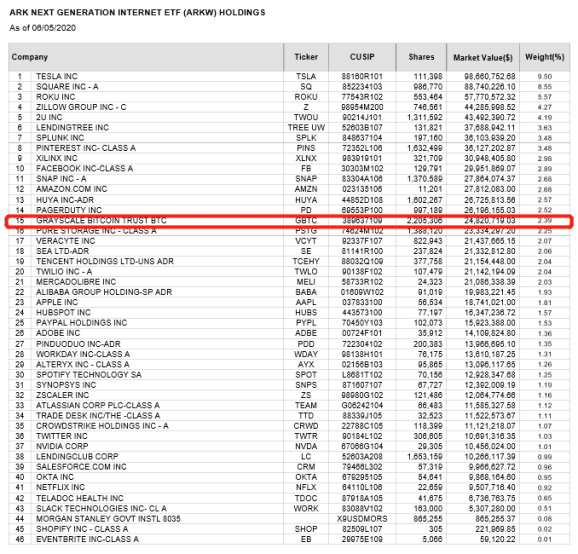

Whereas unit trust or open-ended investment company managers only have to reveal their top 10 holdings, ARK is very transparent about what its ETFs contain.

If you like the way they think and research there is nothing stopping you from using those holdings as a blueprint for your own investing.

A quick look at the top 10 names in the ARK Innovation portfolio as of 12 February 2021 shows Tesla, Roku, Teladoc, Zoom, Coinbase, Unity, Spotify, Twilio, Exact Sciences and Shopify. All available on Freetrade.

Thatâs another point – ARK is committed to public equity markets, so there arenât any private funds in there or invite-only investments that normal investors arenât allowed to access.

Whatâs more you can see the holdingsâ weightings and keep up with the portfolio as often as you like. So, you get to draw on the research and detailed allocations, and can then do it yourself.

And thereâs one key reason that might be attractive over the actual ARK instruments.

About Ark Investment Management

Your browser does not support this video. Please update your browser.

Founded in 2014, ARK Investment Management LLC is a New York based asset manager offering global thematic strategies that capitalize on the investment opportunities created by disruptive innovation. ARK believes that innovation is key to the long-term growth of company earnings, revenues and profits. By identifying and investing in public companies that are the leaders, enablers, and beneficiaries of disruptive innovation, ARK’s strategies aim to deliver superior long-term capital appreciation and outperformance with low correlation to traditional investment strategies. With the launch of The 30 Printing ETF , ARK’s ETF division now manages five equity ETFs, with focuses on Genomics Revolution, Industrial Innovation, Next Generation Internet, and Disruptive Innovation . Catherine D. Wood founded ARK with over 35 years of experience in thematic investing, including her previous 12 years as the CIO of Global Thematic Strategies for AllianceBernstein managing over $5 billion.

Read Also: Forming Llc For Real Estate Investing

How Can I Get An Edge Trading Ark Etfs

ARK publish their trades on a daily basis as it strives to be as transparent as possible to the public and its followers. The company send an email every day highlighting stocks that were purchased or sold by ARKâs ETFs. Cathie Wood has emphasised the importance that ARK places on educating people and that the transparency has warranted great feedback. A number of third party tools such as âARK watcherâ have popped up in an effort to better track and visualise the daily change in holdings of the ARK ETFs.

This makes it easier for traders to keep an eye on any big changes that can occur in the companyâs individual holdings. These big changes could signal interest in a specific stock and ARKâs intent to accumulate more over time, thus indicating that trading on that individual stock might be warranted.

You may find an edge by following ARK and its analysists on and other social media platforms. You may also look to get into a sector before the general public do by keeping abreast of new sectors and companies that ARK may find interest in creating new ETFs for.

Israel Innovative Technology Etf

The ARK Israel Innovative Technology ETF seeks to provide investment results that closely correspond to the performance of the ARK Israeli Innovation Index. The index tracks and follows the price movements of exchange-listed Israeli companies. The companies within the ETF are engaged in the disruptive innovation of specific areas including the sectors of IT, health care, genomics, and biotechnology. Amongst the top holdings in the IZRL ETF are companies such as Intercure, Camtek, and Inmode.

Don’t Miss: What Is The Best Free Investment App

How To Run Your Own Ark

Thankfully, no. We might not have access to the actual ARK portfolios but really what Wood is all about is a simple and effective approach to investment research.

The firm takes a birdâs eye view of the world, the broad shifts in social and cultural demographics, and how thatâs shaping the ways we live.

It then tries to identify the companies supporting and driving these changes, and who looks set to benefit.

And there might just be a few ways investors can adopt these guiding top-down and bottom-up principles, and miss out the negative aspects of ARKâs proposition too.

Where Does That Value Lie In Arks Strategies

Ultimately, while funds tend to judge themselves on exploring and meticulously delivering on an aim like investing in innovation, investors tend to associate value with how returns compare to fees. Does the gain justify the cost?

But itâs worth breaking down what those costs go towards. In ARKâs case, the company puts effort into creating and maintaining its proprietary indices, investment research and rebalancing the portfolio allocation in line with its aims.

The question for personal investors is whether they feel they can do some of that heavy lifting themselves and avoid the 0.75% fees. In the case of UK investors, it might even be the only way they can aim to replicate what ARK is trying to do.

Recommended Reading: Financing Commercial Real Estate Investments

How Online Trading Scams Work

One of the most prevalent online trading scams is to initially display profitable trades that give the investor a false sense of confidence, and get them hooked to the idea of easy money. Once this confidence is established, the investor will be marketed the idea of investing more money to earn greater returns. Additionally, other incentives may also be provided to encourage the investor to get their friends and family onboard the platform too.

Once the brokerage believes that they have extracted all available funds from an investor and his/her network, they will then proceed to suspend the account, and the investor will no longer be able to access the funds put in.

Many fraudulent firms will even claim to be domiciled in a regulated jurisdiction, and display fake regulatory licenses and addresses on their websites to try and improve their credibility with unsuspecting investors.Be careful and verify your information through multiple sources. Constant vigilance should be applied at all times when sending money online.

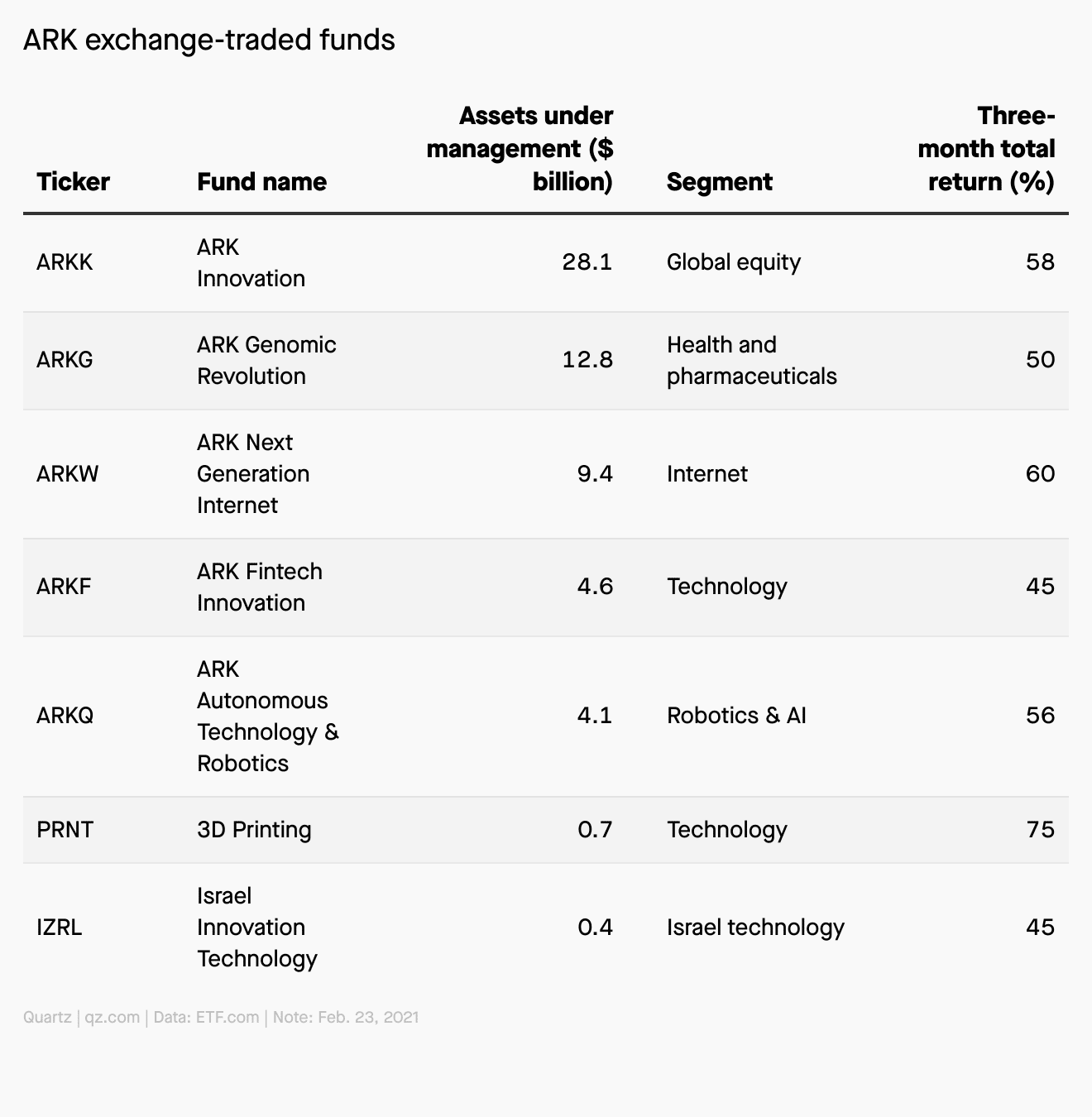

Which Is The Best Ark Etf

Identifying which ARK ETF is the âbestâ to trade would not be an accurate task. However, by reviewing the ETFsâ performances in 2020 & Q1 2021, we can gain an understanding of which are the top performing ETFs for that period, and maybe of interest for traders to keep an eye on.

ARK Genomic Revolution ETF led the pack in 2020 as it generated gains of 180%. Some of the other top performing ETFs in 2020 were the ARK Innovation ETF , the ARK Next Generation Internet ETF , and the ARK Fintech Innovation ETF .

After experiencing a difficult time in the 2020 bear market, the 3D Printing ETF has since gained just under 200% in the space of 10 months, resulting in it being one that is being closely watched by many traders in 2021.

You May Like: Investments With High Compound Interest

How To Trade On Ark Invest Etfs In The Uk

Traders of the CMC Markets Next Generation trading platform can trade on the full range of ETFs that ARK Invest offer. We offer you the ability to open buy/sell positions on ARK Invest ETFs with zero currency fees and extremely competitive spreads.

Here is how to trade on ARK Invest ETFs in the UK:

Chargeback Is Your Solution

The good news is that there is help available. The team at MyChargeBack a specialist group dedicated to helping consumers recover funds lost online is available 24/7 and has helped consumers all over the world recoup millions of dollars.

Using a trustworthy service such as MyChargeBack is critical in this endeavour as a typical chargeback process can often be complex and drawn out without the right guidance.

After , and validating your eligibility for their programs, MyChargeBack will help you build a solid case to regain your funds as soon as possible.

Recommended Reading: Is Buying Gold And Silver Coins A Good Investment

Who Is Cathie Wood

Cathie Wood is the founder and CEO of Ark Invest. Born in Los Angeles in 1955, she went on to graduate with a Bachelor of Science degree in finance and economics, from the University of Southern California. Woods worked for three years as an economist at Capital Group and, in 1980, she moved to New York City to take a job at Jennison Associates where she worked her way up to become managing director. In 1998, she co-founded a hedge fund, Tupelo Capital Management, and she then went on to join AllianceBernstein as a Chief Investment Officer of global thematic strategies. In 2014, she left AllianceBernstein to become the founder of Ark Invest.

Invest Like Arks Cathie Wood

How to be your own ETF manager.

More passive, less active.

Thatâs the crude trend weâve seen investors follow as we continue to question the ability of money managers to consistently beat their benchmark for us.

And itâs a theme ARKâs Cathie Wood has had an eye on for some time.

For the joint CIO and CEO, a steady shift into passive strategies since the dot.com bubble and 2008 financial crisis, coupled with large asset managers searching for innovative companies to invest in, created an opportunity.

Don’t Miss: Best Way To Invest 50

Is Ark Management Legit Or A Scam

When searching for brokers to conduct your trading activities with, the first and most important step should always be to learn about their certification. This will tell you whether they are regulated by a central authority or if ARK Management is an offshore and/or unregulated entity.

When a broker is unregulated or regulated by an entity outside of your jurisdiction, you have limited to no legal recourse in the event that your funds are compromised. In an event of theft, complaints can only be made if that broker is licensed by the regulator in your jurisdiction. Some examples of regulatory authorities that issue brokerage licenses are:

- The Cyprus Securities and Exchange Commission

- The Financial Conduct Authority

- The Australian Securities and Investments Commission

If a broker is not licensed by the regulatory authority in your jurisdiction, that likely means that they are unregulated and should be avoided. Even if the brokerage is regulated, it is best to avoid it if the regulator happens to be outside your jurisdiction.

What Is Ark Invest & How Did It Gain Success

ARK Investment Management was established in 2014, by Cathie Wood. The investment giant, whose name is an acronym for Active Research Knowledge and derived from the biblical Ark of the Covenant, concentrate on investing in disruptive technology. Amongst several next generation technology areas, ARK invest in energy storing, financial technology, and electric vehicles. In January 2021, it became one of the top 10 issuers of ETFs. ARK possess a risk-taking attitude and has a proactive culture of discovering and investing in innovative companies before they grow. Many attribute this as the foundations of the enormous success and growth the company has enjoyed.

ARKâs employees include scientists as it takes a proactive stance of understanding the impact of destructive technology. The majority of the companyâs analysist are millennials, with many of them not coming from a financial background. Many of them take to social media to discuss and defend their investment hypotheses. They create online content and produce podcast and webinars that are published across several social media channels, such as Twitter and YouTube.

Recommended Reading: Eb 5 Projects Return On Investment

Cathie Wood Sells Coinbase Shares Amid Insider Trading Allegations

Cathie Woods investment firm ARK Investment Management is the third-largest shareholder of Coinbase, reportedly holding nearly $9 million as of late June.

One of the largest stockholders of the Coinbase cryptocurrency exchange has dumped a massive amount of shares as regulators reportedly probe the firm for alleged insider trading.

Cathie Woods investment firm Ark Investment Management has sold a total of more than 1.4 million Coinbase shares, according to daily trade information from Ark on July 26.

The sale involved three Ark exchange-traded funds , including Ark Innovation ETF , which offloaded a total of 1,133,495 shares, or 0.6% of the ETFs total assets. Ark Next Generation Internet ETF and Ark Fintech Innovation ETF sold 174,611 and 110,218 COIN shares, respectively. Based on Tuesdays closing price, the value of the sold shares amounted to slightly more than $75 million.

Coinbase stock closed at $52.9 on Tuesday, losing 21% of value amid the sale. After showing some signs of revival in mid-July, Coinbase stock has been tanking as United States authorities arrested a former Coinbase Global executive on July 21 for alleged insider trading. Since reaching $77.3 on Friday, the Coinbase stock lost about 32% at the time of writing, according to data from TradingView.

COIN 30-day price chart. Source: TradingView

Price Is What You Pay Value Is What You Get

Fees are one of the key decision-drivers among personal investors and have been a big influence on the rise of passive investing.

When the shine started to come off the active industry we began looking at index-tracking OEICs and then simple ETFs in search of market-matching performance at low cost.

The trouble with active ETFs like ARKâs is they can bring those fees right back up. ARKK charges 0.75% per year which is vastly more expensive than some S& P 500 ETFs with expense ratios in the 0.03-0.07% range.

In terms of charges, it actually sits alongside a lot of the active OEICs investors tend to write off because of their apparent expense. But, choosing to look past the fees, investors pumped $19.6bn into the ARK suite of funds in 2020, with $17.7bn flowing into the tech story from June to December.

It turns out not to be cost, but value that investors are interested in.

Read Also: Where Can I Invest In Reits

A Few More Considerations

ARKâs popularity exploded in 2020, and for good reason. Performance was strong, thanks to its thematic approach to innovation taking off. But 2020 wasnât like other years. While innovation and ARKâs full range of forward-thinking investments had once thrust the company onto investorsâ YouTube recommendations, things don’t look so peachy at the tail end of 2021.