Is Lithium The New Gold

Lithium is enjoying a huge rise in popularity due to its uses in our rapidly-evolving, technology-centered world. Lithium-ion batteries will be used well into the future, especially as the production of electric vehicles ramps up around the world. Because of this, its been called the new gold by a variety of investors and publications.

For example, the U.S. only has one lithium mine, located in Nevada. Despite that, its believed there are billions of dollars worth of lithium contained in the mine. While there may be environmental impacts to expanding lithium mining operations, it seems as though lithium stocks will continue to be a popular investment for now.

Strong Demand Growth For Lithium To Exceed Projected Supply

In a 2021 survey released in January 2022, Statista.com estimates that global demand for lithium is expected to increase by 703.8% from 263,000 metric tonnes of lithium carbonate equivalent in 2019 to more than 2.1 million tonnes by 2030.

Strong demand growth from electric vehicles and exponential growth in stationary energy battery storage systems is anticipated as green energy projects receive billions in funding globally, and as Europe tries to wean itself off Russian gas supplies.

In an August report, research firm BCG forecast a shortage of lithium by 2030: Lithium supply in 2030 is expected to fall around 4% short of projected demand . By 2035, that supply gap is projected to be acute. Supply could fall 24% short of projected demand of 4.6 million tonnes of LCE.

Anticipated scarcity has led EV manufacturing companies, including NIO, Ford, and Stellantis to scramble for long-term supplies and jostle to secure long-term supply contracts for battery systems.

The Chief Benefits Of A Lithium Investment

The most obvious benefit of an investment in lithium is future demand. Almost every industry that leans on lithium stands poised to break out in the futureelectrical vehicles biggest among them. While theres no shortage of lithium right now, there could be in the future. When that shortage occurs, prices will skyrocket.

Cross-sector reliance on lithium is also a positive for investors. Everyone from electronics manufacturers to automakers rely on lithium. This means that should demand wane in one area, its not likely to drag the market down. As new uses for lithium come to bear, demand is only going up.

Bottom line? Lithium is an important material thats slated to become virtually essential in several key industries. Investing today could be like staking your claim in an impending gold rush, so to speak.

You May Like: Different Types Of Loans For Investment Properties

$16372 Per Ton Is Still A Lot

If Goldman’s predictions come to pass and LCE is selling for $16,372 per ton in 2023, companies will still be raking in cash. Back in 2021, the price of lithium carbonate was solidly around 89000 CNY per ton for months . Nonetheless, lithium stocks were on the upswing and miners were profitable.

Lithium Carbonate Price Per Ton in Yuan

In fact, many companies made their projections for project feasibility based on prices per ton well below current prices, such as Lithium Americas, using $12,000 per ton to justify investment decisions. The truth is that the production costs for most lithium companies already producing, and even those in development stages, are low enough that even following a massive collapse in LCE prices they will still be profitable.

A few of these production-stage lithium companies are mentioned below, alongside the percent drop in their share prices from the market open on Tuesday after Memorial Day through Wednesday’s close.

Can I Invest In Lithium As A Commodity

No. At the time of writing, there is no way to buy lithium futures contracts like other commodities. However, the London Metal Exchange is set to launch the first-ever lithium future contact on June 14, 2021. For those unaware, a futures contract allows you to speculate on the direction of a security, commodity, or financial instrument. These are often by companies and production firms as a hedging tool.

Tom is an experienced financial analyst and a former grains derivatives day trader specializing in futures, commodities, forex, and cryptocurrency. He has over 10 years of experience in the Finance industry spanning across a day trader position at Futures First, and a web content editor and writer at FXEmpire.Tom is an expert in the areas of day trading and technical analysis as it applies to futures, cryptocurrencies, forex, and stocks. Toms primary interests include economics, trading, social-economic systems, technology, and politics.He has a B.A. in Economics and Management, a Journalism Feature Writing certificate from the London School of Journalism.Tom has written for various websites, such as FX Empire, The Motley Fool, InsideBitcoins, Yahoo Finance, and Learnbonds.

London

EC2N 1HN, UK

Also Check: Guaranteed 10 Percent Return Investment

Find Large And Small Lithium Producers

As is often the case in big industries, a handful of companies will account for the majority of the production. In America, these lithium mining companies include:

- Galaxy Resources

- Piedmont Lithium

These giant companies are expected to maintain their share of the lithium market space as it expands over the next ten years, so getting in on these as early as possible is ideal. Albemarle, for example, owns a mine in Nevada and Chile, and they are the largest supplier of lithium for electric vehicles in the world.

But it is smart to set aside some of your investment for smaller companies, including international companies. Some of the top smaller lithium mining companies include:

- Resources Ltd. of Australia

Smaller companies, by definition, carry a bigger risk, but their potential for radical growth also means that they occasionally bring you a huge return on investment.

Consider Buying Lithium Etfs

A good way to avoid the risks of owning individual lithium stocks is to consider buying exchange-traded funds . There are a range of lithium ETFs that build portfolios of the best lithium stocks available and charge reasonable expense ratio fees.

- Global X Lithium & Battery Tech ETF . This fund tracks the Solactive Global Lithium Index. Currently its top three holdings include Albemarle Corp, Tesla and SQM.

- Amplify Lithium & Battery Technology ETF . This fund tracks the EQM Lithium & Battery Technology Index. Its top three holdings are the materials stock leader BHP Group, SQM and Albemarle.

- VanEck Vectors Rare Earth/Strategic Metals ETF . The benchmark for this fund is the MVIS®Global Rare Earth/Strategic Metals Index, which tracks public companies active in producing a wide range of strategic materials, including lithium.

ETFs pool money from many investors to build a diversified portfolio of investments that track a benchmark index. They are less risky than buying individual stocks as they spread your investment dollars across a large portfolio of different stocks.

Featured Partner Offers

On WealthFront’s Website

You May Like: Stock Investment Short Term Balance Sheet

Can I Trade Lithium Etfs

As previously stated, it is not possible to invest directly into Lithium, and it is not traded as a commodity on any stock market exchange. It can, however, be invested in via an Exchange-Traded Fund .

Investing in the stocks of a Lithium producer via an ETF will give you broader exposure and diversification in what is a particularly volatile market.

Holding onto specific Lithium producer stocks is a risk that only ever pays off for those with a good familiarity with the Lithium market, and who are able to discern for themselves which companies are the strongest and most stable.

These are calculated risks, which can serve their portfolios extremely well. An EFT is more suitable for those who have a more vague knowledge of the industry as a whole.

Best Lithium Stocks: Standard Lithium

Standard Lithium is a top lithium development company with massive growth potential in the next few years. Its flagship project, Lanxess, is located in Southern Arkansas and has the potential to generate 20,900 tons of lithium carbonate annually. Moreover, it is estimated to have a project life of roughly 25 years with average annualized sales close to $283 million.

Additionally, SLI already has a direct lithium extraction plant facility in Southern Arkansas and plans to significantly ramp up investments to enter its commercialization stage. It has roughly $125 million in cash, while the total liabilities appear very small.

Hence, the company has the impetus to become a major lithium source down the road. However, it needs to effectively manage its liquidity positioning if it hopes to push on from here. But based on its incredible long-term outlook, SLI stock is worth investing in at current levels.

On the date of publication, Muslim Farooque did not have any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Muslim Farooque is a keen investor and an optimist at heart. A life-long gamer and tech enthusiast, he has a particular affinity for analyzing technology stocks. Muslim holds a bachelors of science degree in applied accounting from Oxford Brookes University.

Read Also: Starting An Investment Advisory Firm

Lithium Demand From Electric Vehicles

Right now, the car industry is moving towards all-electric cars at a rapid rate of knots. There are a number of models available now, but the future includes new models from Porsche, Skoda, Volkswagen and Audi, to name a few.

If the uptake in EVs goes according to plan, the majority of these cars will be using lithium-ion-battery cells. This will produce a huge increase in demand for lithium.

But with only around 773,000 EVs sold in 2016, theres a long way to go to get into the tens of millions. In 2016, there were over 76 million new car sales. That means just 1% of worldwide car sales were EVs.

Thats a big mountain to climb.

While theres no doubt that, in the long term, the car industry will move to all-electric, its going to take time. Well have fully-autonomous cars on the roads well before the world becomes 100% EV.

That also means the lithium boom, and opportunity to invest in lithium companies, will continue. But the reality is that it will also probably go through a series of ups and downs along the way.

If youre a short-term investor, buying lithium stocks now might prove to be too risky. But if youre in it for the long haul, then, with the right companies which means those with the right developments and agreements to sell their resource there could still be huge potential for investors to get in on this hot sector.

Cautious Considerations For Lithium Investing

The lithium market is very concentrated and controlled by a few producers. Thats a problem for retail investors, because its difficult to get a handle on the market value of this commodity. Lithium itself isnt publicly traded, which means theres no spot price to go on. Often, that leaves investors guessing blindly about true market value.

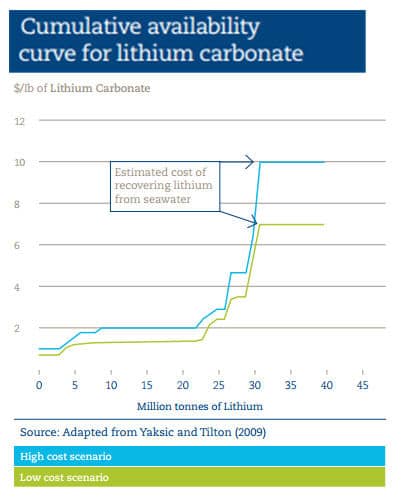

A low consolidation of ownership also means more volatility over time. Supply chains are fewer, which means disruptions could cause major downstream problems for a wide cross section of companies. Theres also questions about obfuscated inventory and supply. No one really knows how much lithium we have access to right now because producers dont disclose that information. We wont know theres a shortage until were right in the middle of it. This will also create volatility.

The big takeaway here is a general lack of transparency. We dont know enough about supply and availability to value lithium appropriately. While its an important material, its more important to establish its value as an investment.

You May Like: Which App Is Best For Mutual Fund Investment

Lithium Mining: Dirty Investment Or Sustainable Business

Can industries with big environmental footprints, like mining, operate sustainably? That’s the question at the heart of a host of new mineral and ore discoveries thatif extracted, applied, consumed and recycled wiselycan lead to sustainability achievements and allow us to set even loftier environmental goals.

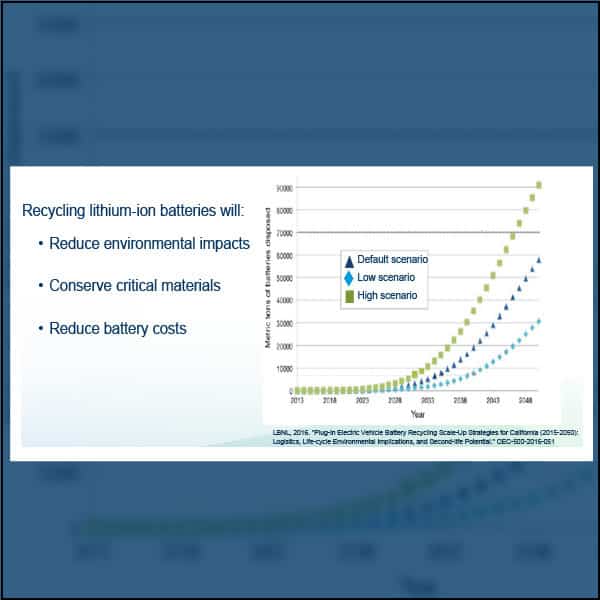

Take lithium, or the “white metal.” Lithiuma common geological commodityis difficult to extract due to its density. An alkali metal, lithium is used in the production of alloys and glass, in chemical synthesis, and in rechargeable storage batteries. These batteries, referred to as lithium-ion batteries, are used in everything from portable electronics to military vehicles and aerospace applications. Business intelligence firm Visiongain calculated that the global lithium-ion battery market would see a capital expenditure of $34.29 billion in 2018. The market for Li-ion batteries is clearly a significant percentage of the total battery revenue .

For an investor looking to exclude companies with a negative environmental impact or looking to invest in sustainable, “do-good” companies, where do lithium miners fall? Should an investment manager focus on the negative effects of mining or the positive effects of its applied output?

Is It Too Late To Buy Lithium

Most of the experts who understand the value of lithium production would say that its nowhere near too late to be investing in lithium as a resource.

In fact, some of the most exciting news in the industry revolves around new ways to acquire bigger amounts of lithium to feed not only the electric vehicle market, but burgeoning markets for all sorts of electric gear using lithium ion batteries, from power tools to communications devices.

Companies are hard at work looking at new ways to get lithium from materials like hard rock, brine and clay sediment, and investigating how to balance the activities of mining and extraction with new methodology. Some companies are even using another companys waste products to generate lithium, which is an interesting take on bringing new methods to market.

Although some detractors claim that high upfront capital costs will deter companies from this type of research and development, some of it clearly is underway and that could only be good for lithium stocks.

#1 Stock For The Next 7 Days

When Financhill publishes its #1 stock, listen up. After all, the #1 stock is the cream of the crop, even when markets crash.

Financhill just revealed its top stock for investors right now… so there’s no better time to claim your slice of the pie.

You May Like: Buying Investment Property In Another State

What Is The Outlook For Lithium

While lithium has a wide range of uses , the amount of demand from electric vehicles is expected to dwarf existing supply to traditional and established markets. This means the outlook for lithium will be largely dictated by the adoption of electric cars.

The sales of new electric vehicles grew significantly leading up to 2019, when the market experienced a temporary slowdown to 2.1 million vehicles. In 2020, however, existing policies and targeted stimulus responses to the Covid-19 pandemic again spurred demand EV sales increased by 40% to over 3 million vehicles. This figure represents an encouraging 4% market share of new car sales. By early 2021, estimates of passenger EVs on roads around the world exceeded the 10 million mark.

Additionally, forecasts for future growth are nothing short of astonishing. The International Energy Agency predicts that by 2030 this number may be 125 million. If governments adopt more aggressive policies to fight climate change and greenhouse gas emissions, the number of EVs could be around 220 million.

Lithium Disadvantages And Doubts

Improving efficiencies through innovation is present across the lithium industry. Many point to better li-ion battery performance and lower production costs on the horizon, arguing that, for the foreseeable future, this is likely the battery technology platform that will see the most development and deployment.

However, others argue that there’s no guarantee that li-ion batteries will be the battery of choice going forward. Instead, they focus on experimentation with other metals either through inclusion or substitution that can reduce or eliminate some of the lithium’s disadvantages, of which there are many. Li-ion batteries start degrading as soon as they leave the factory and only last two to three years from the date of manufacture used or not.

Lithium is also extremely sensitive to high temperatures. And if a li-ion battery is completely discharged, it’s ruined. Li-ion batteries require an onboard computer to manage the battery, making them more expensive. And finally, there is a small chance that if a li-ion battery pack fails, it will burst into flames.

Also Check: Goldman Sachs Real Estate Investing

Best Lithium And Battery Stocks To Buy

In this article, we discuss the 12 best lithium and battery stocks to buy. To skip the detailed analysis of the lithium and battery market, go to 5 Best Lithium and Battery Stocks To Buy.

The demand for lithium has been growing rapidly since the adoption of electric vehicles and grid-scale lithium-ion batteries for energy storage. According to GlobalData, the demand for lithium is expected to surpass 100 thousand tonnes in 2023. Currently, the top three lithium mining countries are Australia, Argentina, and Chile. These three countries produced 87% of the global lithium in 2021.

In 2021, the global lithium market was worth $3.83 billion, which is expected to reach $6.68 billion in 2028 at a CAGR of 8.1%. The main driving factor of lithium demand is the EVs. In , Chinas EV sales reached a record of 502,545 units, representing a YoY growth of 125%. During the same period, BMW delivered 97,000 electric cars, up by 29.6% year on year. Furthermore, due to the high EV demand, S& P expects the global production of lithium to grow by 55% at the end of 2022, compared to the 2020 levels.

Why Add Lithium Companies To Your Portfolio

Lithium stocks are the shares of companies that engage in the mining or processing of lithium. They can be separated into the following categories, which each provide benefits and drawbacks.

-

Lithium mining stocks, which are shares of companies that are involved in the mining of lithium.

-

Lithium battery stocks, reflecting companies that develop the batteries.

-

It is also possible to trade shares of companies that are involved in both activities, from major blue-chip to penny stocks.

As the science continues to develop, some traders may be concerned by possible volatility in the market, but the reliance on lithium by such huge tech firms as Tesla, Apple and Microsoft has led to a rapid rise in demand.

Don’t Miss: Wealth Management And Investment Services