Q: How Do I Access Money In My Roth Ira

A: At any time, you can sign in to your account and withdraw your contributions to a Roth penalty-free. Its the earnings on your investments that you cant withdraw without getting hit with a 10% penalty.

The penalty on the investment earnings portion of your withdrawal will apply unless you are at least 59½ years old and have had the account for at least five years.

Vanguard: Best For Investing In Mutual Funds

- Advisory fee: 0.20%

- Minimum initial investment: $3,000

Vanguard is the largest mutual fund provider in the world, and the second largest provider of ETFs. Their funds are so popular and efficient that they are commonly used in robo-advisor platforms. The Vanguard 500 Index Fund Investor Shares , for example, is one of the most popular S& P 500 index funds in the world and is a common addition in managed portfolios.

Why Vanguard is so good for a Roth IRA is very similar to Betterment. Thanks to the Vanguard Digital Advisor, you can invest in either an ETF portfolio or an ESG portfolio and let Vanguard take it from there. Plus, theres no advisory fee for the first 90 days after opening your account.

Recommended Reading: How Can I Invest In Gold

The Best Roth Ira Investment Accounts Of 2022

Modified date: Aug. 30, 2022

Before I took a job at SmartMoney Magazine, terms like 401, Traditional IRA, and Roth IRA were all investor babble to me. I didnt know what they were and to be quite honest at 22 and with no financial smarts of my own, I didnt really care. I was in a ton of debt , so I didnt see retirement as a real priority.

Today, its a different story. Ive learned a lot and Ive since gotten out of debt and realized just how critical it is to get a jump on saving for the future. And the absolute best way to do that, in my opinion, is with a Roth IRA.

The Roth IRA is in many respects the best overall retirement plan available. Unlike other retirement plans, that provide tax-deferred income, the Roth IRA offers tax-free income. Once you reach 59 ½, and have been in the plan for five years, distributions taken from the plan are fully tax-free. Thats why the Roth IRA has become so popular.

If youre going to have a Roth IRA, youll need to have your money in the best Roth IRA investment accounts available. We selected six that we think are the best. Theyre not ranked in any specific order, but are based on how they stand out among the competition. Each is either a robo-advisor, or has a robo-advisor program available.

Whats Ahead:

Don’t Miss: What Is The Best Way To Invest In Gold

Does A Fidelity Roth Ira Have Fees

There is no cost to opening a Fidelity Roth IRA and no annual fee. However, a $50 fee may apply to close out an account. The investments held in the account may be subject to other fees, such as management, low balance, and short-term trading fees. Also, online U.S. stock, ETF, and option trades are commission free.

Read Also: Bank Of America Investment Banking Groups

Confirm A Few Key Details About Your Massmutual 401

First, get together any information you have on your MassMutual 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Don’t Miss: What Does Fisher Investments Invest In

What Could Be Improved

Tax strategies

Unlike some of its competitors, Fidelity doesnt offer tax-loss harvesting, a valuable strategy that can dramatically reduce investors capital gains. This is most significant for investors who have large account balances or are otherwise in high tax brackets, but if youre in one of those categories and plan to invest in a standard brokerage account, this is worth taking into consideration.

Human financial advisors

Most major brokerages with robo-advisor platforms dont offer access to human financial advisors, and Fidelity Go is no exception. There are some robo-advisors that do, however, so if getting financial advice beyond your automated investment portfolio is a priority, Fidelity Go might not be the best choice for you.

Few account types

Fidelity Go offers the standard account types that pretty much every robo-advisor has, including standard brokerage accounts , and individual retirement accounts, or IRAs. If you want to open a specialized account type, such as a UGMA/UTMA account or solo 401, you cant do it through Fidelity Go.

Fidelity Us Bond Index Fund

- Expense Ratio: 0.025%

- Assets Under Management: $57.7 billion

- One-Year Trailing Total Return: -2.0%

- 12-Month Trailing Yield: 1.86%

- Inception Date: March 8, 1990

FXNAX is a mutual fund that seeks to track the performance of the Bloomberg Barclays U.S. Aggregate Bond Index, which is composed of U.S. investment grade bonds and other debt securities. The fund, which invests at least 80% of its assets in the securities included in the index, is managed by Brandon C. Bettencourt and Richard Munclinger. Their tenure on the fund ranges from 1.3 to 7.7 years.

Of the funds 8,317 holdings, 39.5% are U.S. Treasurys, 26.7% are pass-through mortgage-backed securities , 25.2% are corporate bonds, and the remaining holdings include government-related, domestic and international debt securities, commercial MBS, and asset-backed securities . Essentially all of the funds holdings are rated investment grade with a BBB rating or higher.

Also Check: Best App To Start Investing

What Investment Account Does Dave Ramsey Recommend

Dave loves investing in real estate, but he recommends investing in paid real estate purchased with cash and not REITs.

Does Dave Ramsey recommend index funds?

Should Index Funds Be Part of Your Investment Strategy? We dont want to stand on average. Heres our advice: Invest 15% of your gross income in mutual funds of good-growth stocks that have a long, strong track record that beats the stock market index like the S& P 500 .

What fund does Dave Ramsey invest?

Dave Ramseys Recommended Vanguard Mutual Funds

- Fidelity Diversified International Commingled Pool

- Vanguard Emerging Markets Index Fund Institutional Plus Shares

- American Grants The Growth Fund of America® Class R-6

Dont Miss: Fisher Investments Camas Wa Reviews

How To Invest Roth Ira Fidelity

First, we want to register an account with Fidelity .

Select Open an Account.

Choose Open Now under Roth IRA.

Youre probably not a customer yet if youre reading this article

Enter your personal information here.

Employment Status. You may be asked about your Employment Status. This can be modified at any time, so dont worry too much about the specifics.

Core Position. You may also need to select your Core Position. This is where your money resides when its not being invested. For the most part, it doesnt matter which one you select. Your money should pretty much always be invested. All that being said, choose SPAXX.

Congratulations! Youve successfully registered an account with Fidelity. Verify that you received a confirmation email upon registration.

You should see a Dashboard when you log in. The Positions tab will tell you where your money is invested in all your investment accounts. Currently, you should have no investments.

Also Check: Is Fundrise A Good Way To Invest

Cons Of A Tsp Rollover

There may be a reason for this, as it is a large and diverse fund. The government is expected to do this.

This type of 401 plan offers more protections, which one should seriously consider.

It could be a difficult task to decide whether to roll over your TSP into an IRA or not. It is recommended that you should consult with a financial planner for guidance decisions for your circumstances.

What Is The Difference Between An Ira And A Roth Ira

An IRA and a Roth IRA have many differences, although they are both tax-advantaged accounts that help you save for retirement. Some of the key differences revolve around the specific tax benefits and which account works best in specific circumstances:

- In a traditional IRA, you contribute pre-tax income to your account, allowing you to deduct the contributions from your income Those contributions can grow tax-deferred until withdrawn during retirement, at which point they become taxable income.

- In a Roth IRA, you contribute after-tax income to your account and those contributions can grow tax-free inside the account. It will remain tax-free when withdrawn at retirement. You can take contributions from your Roth IRA at any time without creating a tax issue. The Roth IRA also offers other benefits and has income limitations.

Retirement experts often recommend the Roth IRA, but its not always the better option, depending on your financial situation.

The traditional IRA is a better choice when youre older or earning more, because you can avoid income taxes at higher rates on todays income. Its a good choice when you think tax rates are going to fall in the future, so that you pay lower rates on future withdrawals. However, traditional IRAs become non-deductible at relatively low income levels.

You May Like: Ishares Broad Usd Investment Grade Corporate Bond Etf

Fidelity Total Market Index Fund

- Expense Ratio: 0.015%

- Assets Under Management: $1.3 billion

- One-Year Trailing Total Return: 7.5%

- 12-Month Trailing Yield: 1.25%

- Inception Date: Nov. 5, 1997

FSKAX is a mutual fund that seeks to replicate the performance of a broad range of U.S. stocks, as represented by its index: the Dow Jones U.S. Total Stock Market Index. The fund, which invests at least 80% of its assets in common stocks included in the index, is managed by Deane Gyllenhaal, Louis Bottari, Peter Matthew, Robert Regan, and Payal Gupta. Their tenures on the fund range from 2.6 to 13.1 years. The funds 3,964 holdings include both value and growth stocks of large-cap companies based in the U.S.

A broad-based equity fund like FSKAX carries a certain degree of risk, but it also provides investors with fairly strong growth opportunities. For many investors, this mutual fund may act as the foundation of a well-diversified investment portfolio. However, for those with very low risk tolerance or who are approaching retirement, a more income-oriented portfolio may be a better option.

How Much Money Do You Have To Have To Open A Fidelity Roth Ira

There is no minimum investment required to open either a Fidelity retail Roth IRA or a professionally managed Fidelity Go Roth IRA. However, an investor needs to have an account balance of at least $10 in a Fidelity Go Roth IRA for Fidelity to invest money according to the investors chosen investment strategy. To be eligible for a Fidelity Personalized Planning & Advice Roth IRA, an investor must invest and maintain a minimum of $25,000 in aggregate across all such accounts.

Also Check: I Want To Invest My Money In Real Estate

View Important Information About Our Fees And Commissions

- View important information about our fees and commissions

-

3. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

Investors should consider carefully information contained in the prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Schwab ETFs are distributed by SEI Investments Distribution Co. . SIDCO is not affiliated with Charles Schwab & Co., Inc.

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the type of account you have, there are different rules for withdrawals, penalties, and distributions. Please understand these before opening your account.

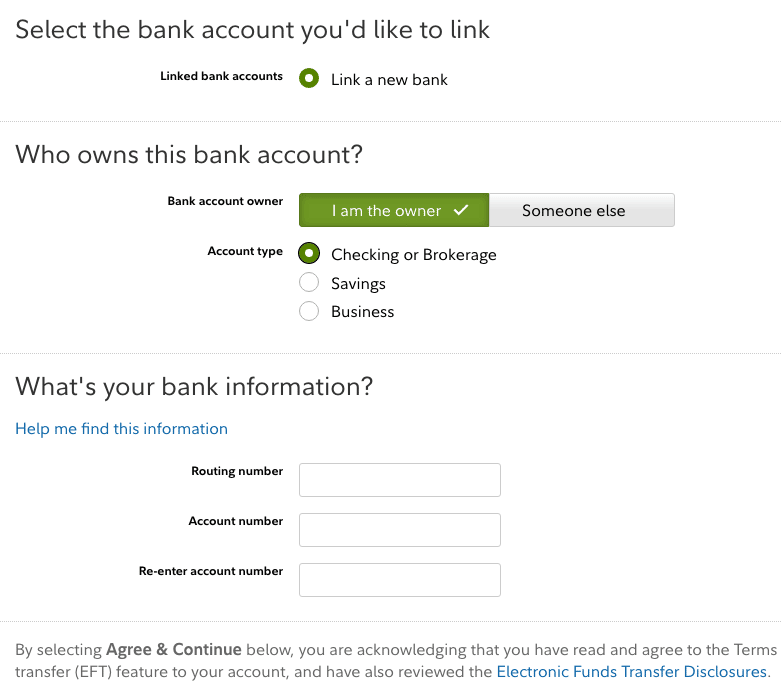

Initiate Your Rollover With Fidelity

Youre making great progress. Youve confirmed key details about your 401 plan and you have an IRA to transfer your money into. The next step is to initiate your rollover with Fidelity. Fidelity has two methods for requesting a rollover to another institution:

If you are rolling over your Fidelity 401 to an IRA at Fidelity, you can request a rollover online, through your NetBenefits account. For rollovers to another institution, youll have to call or use the form.

You May Like: Signature Estate & Investment Advisors Llc

Questions To Ask Before Opening Your Ira

- Is there a minimum initial investment to open an IRA?

- Are there minimum contributions?

- What types of fees are charged, and how much are they?

- Can fees be avoided with minimum account balances or by receiving electronic statements?

- Does the company offer the option to make automatic contributions?

- Which investment options are available? Stocks, Bonds, Mutual funds, ETFs, CDs, other?.

You should be able to get the answers to most of these questions online unless you are opening an account with an independent financial planner, who may or may not have this information online.

If the information is not readily available online, call the financial institution and ask for an information packet before opening an IRA.

Its a good idea to review the fees and other details before opening your IRA that way, you have a good idea of what kind of fees and other expenses you can expect to pay.

All things being equal, go with the company or broker you feel most comfortable with. And if you later decide that you dont prefer the financial institution where you opened your IRA, you can always transfer it to another financial institution.

The brokers there will be happy to help you fill out the paperwork.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: What To Know About Investing In Gold

Compare Fidelity’s Small Business Plans

We offer retirement plans for businesses of every shape and size. Visit the following product pages for more information. If you have a separate retirement plan established and would like to invest the assets in a Fidelity brokerage account, you may be interested in an Investment-Only Retirement account.1

If you have an existing 401K plan for your employees under another provider, learn more about the support and value we can deliver with a Fidelity 401.

no employeeswith only a few employees25 to 100 employees100 or fewer employeesWho contributesAccess to assets3Contribution featuresFees

Interested in a Fidelity HSA® for your small business? Learn more