You Dont Need A Lot Of Money To Get Started

This one ties into my above example.

Because youre starting early, the amount you need to put aside towards investments could be tiny.

In fact, you can get started with as little as £1.

Yes, thats right. As you can see in the example I showed you above, £50 per month can make a difference over time!

So even if youre starting with a tight budget, theres no excuse not to start investing. You can always increase your contributions as your income goes up over time.

The sooner you get started, the easier it will be to make a dent in your overall savings.

Remember: the key is to start investing early and then add to it regularly! Tweet this.

Why Investing In Memorial Lots Is Important To Start At A Young Age

Nowadays, most young adults find opportunities to start or operate a business which is a good idea for them to earn money and sustain their needs. But did you know that investing in memorial lots is also another way to earn a lot more money especially at a young age? I highly recommend that you start considering investing in memorial lots as early as now, while you still have plenty of time, and the price is still flexible. Just like any other real property investment, memorial lots increase its market value every year.

RELATED: Millennials Income Opportunity in Online Selling

In case you need an emergency fund, you can consider selling your memorial lot at a higher price. If a loved one passed away, you can also let them use the memorial lot, instead of buying a new one. Unfortunately, there are still people who find or feel uncomfortable whenever they talk about death. That is why people chose not to invest in memorial lots but the fact is you can always plan when it comes to the financial preparations that it may require.

If you have already invested in a memorial lot, thats one thing less to worry about in case something unforeseen happens. You will have more time to accomplish other requirements and of course, your grieving process can be more reassuring.

This article will point out the main reasons why investing in memorial lots and planning your life is a good choice.

Your Quality Of Life Will Improve

Military members who invest in retirement plans such as a Thrift Savings Plan, 401 or Roth IRA are taking steps toward an improved quality of life. Early investment will reduce the risk that youll be forced to make reckless choices to secure a stable retirement.

When it comes to investing in a new home, military buyers should also be aware of their mortgage options and make decisions based off of their unique financial situations. Check out this helpful guide to the VA home loan process.

The Veterans United Network is your source for military news, veterans issues, and VA benefit information.

More than 1 million people follow our interactive community on Facebook.

Also Check: Pictet Wealth Management Minimum Investment

Start Investing As Young As You Can

I wish I knew more about the stock market when I was in high school or college. That way I could have had 5 or 6 additional years of experience under my belt. I think everyone should learn to invest young and figure out how the stock market works.

Of course, many young folks dont have any money to invest. These days, new graduates have a ton of student loans to deal with, too. I still think it is very important to start investing even if you have debt. The easiest thing to do when starting out is to contribute to your 401 at least enough to get all the company matching. Thats a 100% gain. You dont want to leave it on the table.

Anyway, Im trying to teach my son about investing while hes young. He has an investment account and it did very well in 2020. It dropped in March but came back to hit a new high recently. He can see his money growing passively and he loves that. I think it is a great lesson. He can learn more about index investing as he grows up. For now, hes happy that his account is growing. Thats a seed, right?

When did you start investing in the stock market? Do you think you could have done better if you started earlier?

Starting To Invest With Established Stocks Can Lead To More Income

If starting to invest early, trusted tech stocks are a strong option. Lindsey Bell, chief investment strategist at Ally Invest, advises people who start investing early to pick stocks that theyre familiar with, like Google .

If youve never invested in the market before, you should ease into it. Youll need to get used to it before you feel comfortable with the up and down swings the market can make. Invest in something you understand, said Bell.

Citis main U.S. equity strategist Tobias Levkovich noted that many young investors are buying tech stocks that they know. They have been purchasing the stocks since the quarantine.

We have heard anecdotally about younger individuals with less market experience viewing the March plunge as a unique time to start portfolios and often crowding into the tech arena, purchasing the stocks whose services or products they know and use, said Levkovich.

Read Also: The Best Way To Invest In Real Estate

Why Does Early Childhood Development Matter

Early childhood is a period of rapid physical and mental growth and change. Children learn to move, communicate, and interact with the world, and develop a sense of personal and cultural identity. This period offers the greatest opportunities for positive human development, but it is also a time when children are most at risk. Negative influences on a childs development during early childhood can be irreversible.

Young children growing up in especially difficult circumstancessevere poverty, malnutrition, wars, and diseaserequire particular attention. Discrimination based on ethnicity, gender, disability, HIV and AIDS status, class or caste, or political and religious beliefs all adversely affect early childhood. Discrimination can exclude children from full participation in society, reduce survival rates and quality of life, and undermine feelings of well-being and self-esteem.

Why Is It Important To Start Investing Early Here Are Why You Should Start Now

When is the right time to start investing? Easy question, but difficult for most people to answer. Actually investing can be done at any time, no need to wait old. Even more profitable if done early, at a young age. However, often limited funds become a barrier to starting investing.

In principle, the earlier you start investing, the greater the potential return that can be obtained from that investment. It is undeniable that investment requires funds, but it does not have to wait for large amounts of funds to be collected. Because, currently, many investments can be started with limited funds.

Investing from an early age has benefits for future financial independence. There are many reasons why you should start investing early. You can see the several reason below.

You May Like: Using Investments To Pay Off Debt

Do All Early Childhood Programs Provide The Same Benefits And Returns

No, there is a range. A landmark study of early childhood programs found that five out of seven programs for which they calculated costs and benefits had a positive cost-benefit ratio, but there was variance both in the benefits tracked and in returns among the five.2

There is also a school of thought that argues that investing earlier in a childs life yields higher returns on investment. Nobel Prize-winning economist James Heckman has written extensively on investments and early childhood, arguing that returns on unit dollar invested are at least theoretically higher earliest in a childs life .3

While earlier programs may generate the highest potential returns, donors that support children beyond age three nonetheless play an important role in sustaining and extending benefits, and there is good evidence that programs that target older age groups can also generate positive returns.

% Of Ceos Indicate That Their Companies Suffer From Skills Shortages

Business Roundtable . Workforce Skills Surve

In Arizona, as in most of the United States, we dont have enough workers with the skills that employers need. Nearly half the American workforce lacks the basic education and communication skills required to get a job and advance. In addition, one quarter of Arizonas students dont graduate from high school. Thats the bad news. The good news, however, is that we know how to solve this problem.

Don’t Miss: Start Investing In Stocks With Little Money

Acorns Lets People Use Spare Change To Start Investing Early

In addition to stock trading apps like Robinhood, Acorn is another app that lets people start investing early. In contrast to Robinhood offering stocks to trade in a volatile stock market, Acorns takes a more subtle approach. For people who want to start investing early, they can take as much little as a dollar a month to micro-invest in ETFs. New investors can even take spare change from purchases to invest in the stock market.

Noah Kerner, CEO of Acorns, noted that its important for young people to start investing early and to learn from the current economic downturn.

Take in whats happening right now, and dont forget it. When the dot-com bubble happened and when the Great Recession happened in 2008, everybody felt it. And everybody said the same things: This is unprecedented. Im never going to forget this moment. And then time passes and people forget, said Kerner.

Kerner also wants new investors to buy stocks while theyre at affordable prices.

When theres a sale in fashion, people go and buy things. When the market is on sale for 30% to 35%, thats when you get in, said Kerner.

Kerner also advises people who start investing early to set aside money consistently.

Invest regularly. No matter what, even if its a very small amount, try to keep going. Thats why we focus on spare change. Just try to do a little bit so that you can keep the momentum going and you can keep benefiting from compounding, said Kerner.

Starting To Invest Early Can Lead To Early Retirement

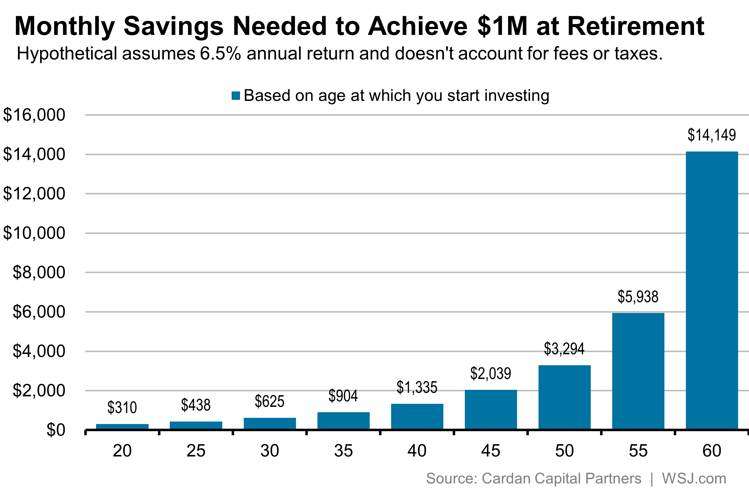

Investing early can have another benefit in a shorter time-an early retirement. With estimates saying that people need $1 million to retire, investing early can help people have more financial freedom.

For some young people, the FIRE movement is an enticement to start investing early. Many people have found success by making wise investments to retire early.

While the FIRE movement may not a realistic goal of every investor, if investors put extra money into their portfolios sooner, retiring comfortably could be a result.

Also Check: What Does Fisher Investments Invest In

What Are The Best Ways To Improve A Childs Early Development

Positive interventions in early childhood work best when they bring together a variety of sectors including nutrition, health, education, and support for parents. Research conclusively demonstrates the impact of well-planned interventions.

Children who live in the most adverse circumstances can make the biggest gains in their intellectual, social, emotional, and physical progress if they have good nutrition, interaction, and relationships early in their lives and have access to high-quality early childhood development services.

These children are healthy and ready for school, finish more years of education, get better jobs, and live longer than their parents. Investing in early childhood programs for the most disadvantaged can break the intergenerational transmission of poverty.

Recognizing the importance of early childhood is also about respecting the rights of every young child, as enshrined in the United Nations Convention on the Rights of the Child. The convention requires families, communities, and states to provide appropriate support for young childrens development, while recognizing the diversity of cultural beliefs and practices that shape childhood. A positive early childhood is both every childs entitlement and an investment in theirand ourfuture.

Number : Starting Investment Early Improves Your Spending Habit:

If you make the habit of saving/investing early on it will automatically improve your spending habit. We will explain how.

When you want to save a fixed amount from your fixed salary, you will have to put a restriction on your spending by creating a monthly budget for yourself. And having a budget is the best way to improve your spending habits as it helps you track your monthly expenditure on food, utilities, rent, leisurely activities, etc. And with years of practice, this simple task becomes a habit.

Now, to make saving a habit, put away the amount you want to save every month first. And then create a monthly budget with the amount that you have left. For example, if you earn Rs 25,000 every month and want to save Rs 5,000. Then as soon as you receive your salary, first put away the Rs 5,000, then maintain your expenditure with the rest of the amount.

Also Check: The Investment Company Of America Class A

Be A Step Ahead Of Everyone Else

The early bird gets the worm is an idiom worth adhering to. The earlier you begin investing, the better your personal financial situation will be down the line.

Compared to your counterparts, who may have chosen to invest later in life, over time you will be able to afford things that others cant.

Additionally, at some point your finances may become unstable, but by investing early youll be prepared to face such hardships.

Habits Take Time To Build

In the early stages of your career, you may have the desire to begin investing, but you may feel that you lack the liquidity. However, even if you, like most of your peers, are living pay-cheque to pay-cheque, you should look to be putting away a small sum each month.

Aim to put away at least 5% of your pay-cheque each month into a savings/investment account that is not directly linked to your current account. Fund this account every month as soon as you get paid and leave it alone. Developing the habit at this stage of your life is far more important than the size of the sum youre saving. However, despite the fact the amount will often seem small, over time this amount can grow significantly, which leads us nicely onto the next point

You May Like: Best Way To Invest For Income

Diversified Portfolio Pivotal To Start Investing Early

In addition to investing in stocks, financial experts advocate having a diversified portfolio. When starting to invest early, people should choose a wide variety of stocks to build their portfolios. Rob Cavallero, chief product officer at RobustWealth, said young investors should invest in a variety of stocks.

One big mistake to avoid as a 20-something investor is holding concentrated positions in trendy investments. During the dot-com bubble, investors chased expensive internet stocks, and a lot of people got hurt. Stick with a diversified portfolio of low-cost funds invested in conventional asset classes, at least initially, said Cavallero.

Amin Dabit is a certified financial planner. He advocates people who start investing early have a mixture of stocks and bonds in different industries. Dabit says a diversified portfolio will help shield new investors from large losses.

During a bull market, it can be easy to forget that the market delights in surprises. The best safeguard against market cycles, while still benefiting from the upside, is through committing to a well-diversified portfolio and long-term focus, said Dabit.

Reasons Why You Should Start Investing Young

Being a young investor might be the smartest move youll ever make.

The Alaska USA Financial Planning & Investment Services program is offered through CUNA Brokerage Services, Inc.*, a broker/dealer focused on serving credit union members. CUNA Brokerage Services, Inc. is an affiliate of CUNA Mutual Group. For more information about CUNA Brokerage Services, Inc., please visit cunabrokerage.com

Also Check: Can I Invest In Ripple

The Power Of Compounding

Lets go over compound interest quickly first. Compound interest is awesome. Everyone loves compound interest and its easy to see why. If you invest $1,000 and gain 10% per year, youll have $1,100 after one year. Your investment gains $100 in interest. The following year is even better because youll earn $110 in interest. You earn the interest on your initial principle AND any interest accrued. Every year you will earn more and more interest. See, whats not to love?

You can easily see that the earlier you start investing, the more time your portfolio has to grow. Time is the secret ingredient in compounding. The more time you have to invest, the wealthier you will be.

What Are The Open Society Foundations Doing To Support Early Childhood Development

Through our Early Childhood Program, we aim to improve the quality and availability of early childhood services, including home-based initiatives and community programs as well as preschools. The goal is to both empower and hold accountable government, donors, professionals, civil society organizations, parents, and communities to fulfil their respective roles to guarantee the right of each child to develop to his or her full potential.

We support a variety of groups and individuals working in Early Childhood services in Africa, Europe, Eurasia, the Middle East and Latin America. These include:

Don’t Miss: Best Investment Plan For Nri In India 2020

This Is Why You Should Start Investing As Early As Possible

Investing is a scary proposition, especially at a young age. While the allure of investing brings with it financial returns and early retirement, it can also mean financial loss and confusion. At the same time, investing your money means holding off on spending it today on something that could bring immediate happiness. But, if you play your cards right and invest early, your likelihood of lifetime financial success increases immensely.