Can Anyone Use Their 401 To Invest In Real Estate

First, a quick disclaimer: this post is not legal or tax advice. Before making significant financial decisions, consulting with these qualified professionals is always a good idea to ensure you get the desired results.

With that out of the way, can you invest your 401 balance into real estate? As alluded to in the introduction, the answer to this question is nuanced.

Typically, you cannot invest 401 money directly into real estate. For example, you cannot use your employers 401 plan to buy a house down the street and rent it out. There is only one exception to that rule. You can use a solo 401 to invest in real estate, much like a self-directed IRA . For qualifications and contribution requirements, along with a comparison between a traditional 401k versus a solo 401k, checkout this article.

You could also use your 401k funds to buy real estate investment trusts if you have a self-directed 401 . Those REITs trade on the open stock market. There are other ETFs and mutual funds that also invest in real estate. Again, purchasing those shouldnt be an issue if you have a self-directed account.

Using two methods, you can also leverage your 401 to buy specific real estate- which can be the most profitable way for you to invest in real estate!

Can I Use 401k For Real Estate Investment

If you are short of money and need to make a down payment urgently for your real estate property, you might be wondering if there is a cost-effective way to do this. Fortunately, there is one. You are allowed to combine the wealth-generating potential of your property with the tax benefits offered by 401k accounts.

Although you cannot directly buy a property through an employers 401k plan, there are still some ways to utilize the assets in your 401k account for buying property depending on your circumstances. However, it is not a recommended move since it takes a lot to collect savings for your retirement period. Once you have used them, it might take you a whole decade to make them up again.

What Are The Requirements To Buy A Property With A 401k

Whereas IRAs can be used to invest directly in real estate, tax laws prohibit people from using their 401k to invest directly in real estate. That said, there are still ways to purchase investment property by leveraging your 401k.

There are a few ways to do this.

The first way to invest in real estate using your 401k is by taking out a loan against it. Most plans will allow you to do so, so its important to check with your plan administrator before pursuing this route. Assuming its allowed, you are typically able to borrow half of the value of your 401k account, up to $50,000. The loan must be structured as a bona fide non-recourse loan, which is a type of loan that is secured by collateral in this case, it will usually be the rental property being purchased. This way, if the borrower defaults, the issuer of the loan can seize the collateral but cannot seek any additional compensation, even if the collateral does not cover the full value of the defaulted amount.

Most plans require you to repay the loan in full within five years, and youll be required to pay interest on that loan . That said, the interest payments are made back to the retirement account, so you are essentially just paying that interest back to yourself.

If the loan is not repaid by the deadline, the loan will be treated and taxed as though it was an early distribution resulting in a 10% penalty as well as income taxes owed based on your tax bracket.

Recommended Reading: How To Invest In Gold And Precious Metals

Have Questions About Investing Funds From Your Ira Or 401k Into Our Multifamily Fund Contact Us For The Pros And Cons

If youre reading this, you likely know that there is enormous value for investors in property investing. Real estate, particularly in multifamily and commercial properties, offers some of the highest ROI. But doing so takes a large investment of funds. What many prospective investors dont know is they may have those resources in their IRA and/or 401K. There are ways to use either of these to invest in multifamily and commercial properties.

With the stock market at record highs, many investors are looking to buy an investment property as a way of diversifying their portfolios. But with real estate also at record highs, it has created a dilemma for some investors: should they be saving for and investing in real estate, or should they stay the course and continue maxing out their retirement accounts?

Most people dont realize that it isnt an either-or situation.

In fact, it is possible to use both your 401k and individual retirement accounts to invest in real estate. And contrary to popular belief, it is possible to do so without suffering from steep withdrawal penalties.

There are some key differences between how to invest with either an IRA or 401k, which well cover in this article. This guide is intended to be an investors go-to resource for learning about how to leverage their retirement plans to buy an investment property, including the pros and cons of using this approach and alternative investment strategies to consider.

How To Use Your 401 For Real Estate Investing

Many American companies give their workers access to 401 plans, which let them save for retirement and get tax breaks at the same time. It takes its moniker from a subsection of the Internal Revenue Code in the United States . A 401 plan is a retirement savings program sponsored by your company and designed to help you prepare for your financial future after retirement.

Don’t Miss: How To Invest In Privately Held Companies

A 401 Loan Has Unbeatable Terms

If you choose a 401 loan to invest in real estate, it is worth noting that the interest rate youll pay on the 401 loan is probably less than any other borrowing option. And, theres no penalty per se if you dont pay it back. It gets treated as a distribution and is subject to a 10% IRS levy and ordinary income taxes, but it wont be a negative mark on your credit score and wont cause you to have problems obtaining a mortgage or something like that later.

Plus, any interest you pay yourself becomes part of your 401 balance, which will grow over time and be available to withdraw in retirement.

How Can Irar Help

Financial planning isnt as simple anymore as dumping a small portion of your income into a 401 account or an IRA. For nearly 30 years, our dedicated team of self-directed IRA experts have helped clients build wealth through alternative investments like real estate, at a lower cost.

We provide investors of all levels with resources that explain the regulations governing self-directed retirement accounts so they can make an empowered decision to put themselves in the best position financially.

Book a free self-directed IRA consultation with one of our experts today to learn more about how you can leverage a self-directed account to put yourself on the pathway to greater financial freedom.

Read Also: Best Investment Allocation For Retirees

How Can We Make Real Estate Investment Process Smooth For You

Capitalist Exploits promises you the best investment opportunities from all around the world with their professional guidance. We offer four valuable services to our customers who are into the investment world including Insider subscription, a weekly newsletter, Hedgies uncut, and market insights. Some of these services are free while others are premium and require minimal subscription fees.

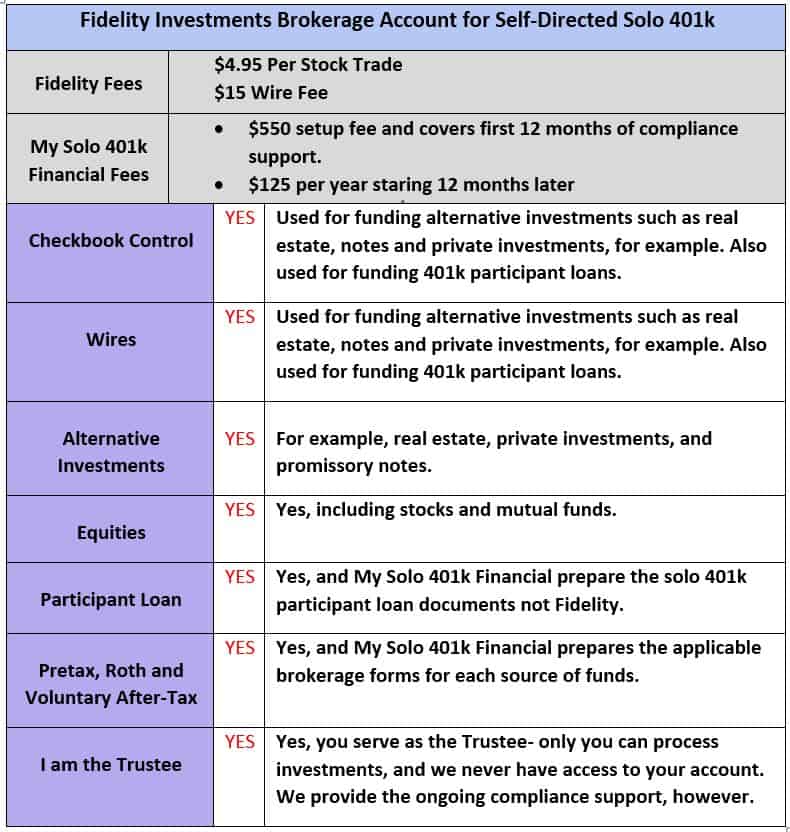

Ways To Fund A Real Estate Investment With Your Solo 401k

The Solo 401k is a retirement plan designed for self-employed individuals without any other full-time employees other than the business owner and his or her spouse. Many investors qualify for a Solo 401k plan by taking part in real estate activities, such as being a real estate agent, a contractor, or a property manager.With this self-directed retirement plan, participants have the unique flexibility to invest in real estate, among other alternative assets. Instead of having their retirement savings stuck in a stock portfolio, investors can now tap into this source of financing for their real estate ventures.Lets take a look at how a Solo 401k plan can fund a real estate investment:

Grow your retirement fund with real estate, not the stock market.

Read Also: What Is The Best Investment Website

Exceptions For Cashing Out A 401k

The IRS does allow a few exceptions to get at old or inactive 401k or IRAs before 59 ½ without a penalty. These include:

- Medical expenses

- Court-ordered withdrawals such as QDROs

- Qualified military withdrawals

- Substantially Equal Periodic Payments aka 72 or SEPP

- higher education and first time home

Sometimes , you want to leave the money in a 401k or 403b, but most of the time, you want to roll out the money into an IRA, so there is more flexibility.

I dont need to tell the real estate investor about self-directed IRAs and 401ks or QRPs, but what are the options to get a CURRENT 401k retirement plan funds? There are hardship withdrawals and 401k loans. Details for these withdrawals are in the summary plan description.

How about thisa new way to get at current or active 401k plans so you can invest in real estate? Have you heard of the QDRO?

Real Estate Is Often A Good Long

Lastly, suppose you use a self-directed IRA to invest in real estate. In that case, its worth noting that real estate is often a fantastic long-term investment with significant monthly income potential, which aligns very well with an account aimed at providing you with income in your retirement years.

While nothing is guaranteed, its not impossible to invest $50k in one syndication, have $100k in your IRA five years later, take that $100k and turn it into $200k, and so forth. When youre ready to exit the workforce, you might have thousands in passive income perfect for your retirement years!

You May Like: How To Invest In Sip Online

Using Your 401k For Real Estate Investing

A 401k is an investment savings account thats sponsored by the employer of the individual who holds the account. Workers are able to make contributions to a 401k account via automatic payroll withholding, which means that the money will automatically be taken out of your paycheck and sent to your 401k account. Depending on the account you have, your employer may match a portion or all of your contributions.

Any money thats placed into a standard 401k plan isnt taxed until you withdraw the money, which usually occurs after retirement. If you invest in a Roth 401k plan, your withdrawals could also be tax-free. There are a couple of different types of 401k plans that you should be aware of, which include Roth 401k plans and solo/self-employed plans. A Roth 401k plan is a special type of 401k account thats funded with your after-tax dollars up to a certain amount. Because the account is funded with after-tax dollars, eventual withdrawals dont need to be taxed, which is the opposite of how a traditional 401k works. Both account types have their advantages and disadvantages.

Real Estate Leverage With The Solo 401

Here is the primary reason to use the Solo 401 for all types of real estate investments: the use of leverage.

We are often reminded about the advantage of owning property, whether its a piece of land or a multi-family real estate property. However, the purchase of real estate requires large capital and as a result, many investors choose to purchase real estate with leverage. In the case of an IRA, when you purchase real estate using leverage this will be considered debt-financed property and will be subject to the Unrelated Business Taxable Income tax. If you use a nonrecourse loan with an IRA to purchase half of the real estate property, the income generated from the financed portion of the real estate property will be taxed at the UBTI tax rates, which can be as high as 37%.

Whereas the Solo 401k is not subject to the same UBTI rules as an IRA, which is the main advantage of using the Solo 401 to buy real estate. Internal Revenue Code Section 514 permits a few qualified organizations to be exempt from the UBTI tax, including qualified retirement plans. Thus, the plan will be removed from the UBTI tax. This is an attractive feature among real estate investors who do not have the finances to purchase the real estate property on their own, or prefer to use less of their retirement funds to make the real estate investment.

Recommended Reading: Invest Money And Get Monthly Income

Funding Your Solo 401

You cannot rollover your assets into a solo 401 from a current employer. You must be retired, have left the employer, or be eligible under IRS guidelines. You have several options when it comes to funding your solo 401:

- In-kind transfer: Non-cash assets are moved from the employer-backed 401 account to a solo account and not taxable.

- Cash transfer: Cash assets are moved from the employer 401 to the individual account. Partial or full investment may be processed and not taxable.

- In-kind direct rollover: Assets from an IRA are transferred to a solo 401 account, and theres no need for the liquidation of assets. This action must be reported for tax reasons and is not subject to tax withholding.

- 60-day cash rollover: This is the quickest way to fund your solo 401 from an IRA, but you have a 60-day period to deposit the check to avoid taxes and a 10% penalty for early distribution.

- Annual cash contribution: This is an option for self-employed individuals. Your solo 401 can be funded with annual cash contributions by your business tax return date. However, keep in mind that cash contributions have an annual limit. This number depends on your age and salary.

Dont Miss: Should You Move Your 401k To An Ira

Do I Qualify For An Early Distribution

Early distributions from 401s are set up on a strong-needs basis to provide immediate relief from financial hardship. Suffering a permanent disability permits 401 holders who havent turned 59 and a half yet to access their savings.

Preventing an underwater mortgage on a primary residence may count as an immediate, strong need for an early distribution. However, buying a second home is not considered an economic hardship to potentially qualify for an early distribution. For 401 holders under 59 and a half who are still enrolled in a 401 plan sponsored by their company, it’s impossible to take out your money to buy a second home, much less without penalties.

If you are experiencing a hardship, you may be eligible to borrow money as a loan from your 401. Typically, the repayment includes interest and specified length of repayment terms.

Lets say you do leave your company and decide to leverage your 401 to buy a second home. You should expect to absorb the early withdrawal penalty with the distribution received.

Unless you qualify for a different exception, the early withdrawal penalty is taxed at a rate of 10%. If you were to take out $100,000 from your 401 to purchase a second home, the penalty would be $10,000.

Also Check: Best Full Service Investment Firms

Reasons To Invest In Real Estate With Your Retirement Account

As noted above, the most popular way of leveraging retirement. There are many reasons for investors to consider using their retirement account to purchase an investment property. These reasons include:

- More control over investment decisions. As noted above, traditional 401k and IRA plans limit individuals to certain investment vehicles. In turn, many people find their retirement portfolios overwhelmingly concentrated in stocks and bonds. Rolling these accounts into an SDIRA gives investors more flexibility with how their retirement funds are allocated, in real estate and otherwise.

- Greater portfolio diversity. Most retirement advisors urge people to have the majority of their investments concentrated in some combination of stocks, bonds, equities and cash. Very few allocate any funds to alternative asset classes, like real estate, since these are considered riskier investments. In turn, an investor is putting their portfolio at risk to the stock markets daily ebbs and flows which can sometimes be dramatic. This is especially risky for investors looking to retire in the near future. If the stock market crashes, the value of their retirement accounts will plummet and these investors may not have the time to recover those losses ahead of their intended retirement date. Investing in real estate is a great way to diversify away from traditional stocks, bonds and equities.

How To Invest In Real Estate With A Solo 401

Unlike an employer-sponsored plan, a solo 401 is a self-directed retirement account and can be used to directly invest in real estate. In fact, buying real estate with a self-directed IRA is a tax strategy commonly used by investors.

The main benefit of using a solo 401 for real estate is that any income or gains from the investment are tax exempt. For example, if you bought a property for $150,000 and later sold it for $400,000, the $250,000 in profits are tax-free.

Investing in real estate with a solo 401 is a great way to avoid paying capital gains taxes and can help you grow your retirement nest egg a lot faster.

Property buyers who are exploring different ways to invest in real estate can discover that different cash flow options exist. It is now common to tap into a retirement account to help fund purchases for homes. While some regulations do exists, learning how to buy investment property with 401K or IRAs can be beneficial to any new investor.

There are strict IRS regulations that are enforced with real estate sales. There is no ownership of a rental property allowed with a standard 401K, but there are ways that this investment vehicle can be used to fund a real estate investment.

Also Check: Best Markets For Investment Property