Best Real Estate Crowdfunding Sites

Given a recent boom and interest and publicity around real estate crowdfunding sites, many firms are now competing for your investment dollars, including many new startups and market entrants. No two platforms are created equal either, with any given individual site offering its own feature set, opportunities, potential return on investment, and suite of tools for maintaining and keeping track of your investments.

As a general rule, noting that real estate crowdfunding also remains a relatively new practice, it pays to do your research here, look at user commentary and feedback, and consider the pros and cons associated with each online vendor before committing to an investment. Following though, youll find a list of several of the most popular and/or well-established sites that offer access to real estate crowdfunding opportunities.

RealtyMogul: RealtyMogul offers both nonaccredited and accredited investors access to commercial real estate investments and individual properties, including a variety of REITs that allow financiers to spread their investment dollars across a range of different real estate holdings. At the same time, investment minimums hover around the $5,000 mark, and fees can vary greatly among individual investment vehicles. If youre looking for high rates of return though, the real estate crowdfunding giant aims to deliver. It also offers accredited investors access to 1031 exchanges .

A Beginners Guide To Crowdfunding In Real Estate

If youve ever donated money through a GoFundMe or Kickstarter campaign, youve participated in a phenomenon known as crowdfunding. Crowdfunding, which has been around for several years now, uses online technology to raise large amounts of money from thousands of individual donors who contribute small amounts.

While crowdfunding has commonly been used to raise money for charitable or creative ventures, its becoming more and more popular in the world of real estate investing. In this real estate crowdfunding guide, Ill explain what it is, how it works, and how you can get involved.

What Is Robert Kiyosakis Approach To Using Opm To Buy Real Estate

Robert Kiyosaki teaches that the idea that a property is an asset is a myth. He states that cash flow is the key element to real estate investing, and property appreciation is not something to rely on. Kiyosaki teaches that investors should make money on the purchase of a property, instead of the sale of it. They can do this by choosing a deal that will provide a positive cash flow for the future.

Kiyosaki refers to using OPM in real estate as good debt. His theory is that bad debt is anything that is costing you money out of pocket. For example, a mortgage on a primary residence or a credit card. Whereas good debt can put money back into your pocket. As such, his teachings state that investors should use as little of their own money as possible, and instead rely on OPM.

Kiyosaki suggests the following options for OPM:

- Government tax credits

- Cash flow on operations

Kiyosaki believes that the best way for real estate investors to be successful is to spend their time finding great deals, and then find others to invest in the deals. Kiyosaki says that when the deal is structured correctly, this will allow investors to gain a profit generating asset for very little. He outlines the following process as a good example:

Step 1: Find a real estate deal that can provide good returns in the future, even if this means increasing the NOI somehow.

Step 2: Create a solid business plan and find investors who would like to fund the property purchase.

Also Check: Which Is The Best Blockchain To Invest

Final Thoughts On How To Invest In Real Estate Crowdfunding

Although many platforms restrict investment in crowdfunded real estate deals to only accredited investors, few platforms permit non-accredited investors. Real estate syndication provides the benefits of real estate without needing your day to day involvement.

There are several advantages to investing in a real estate crowdfunded deal. However, crowdfunded platforms have some bad deals that default, and you could lose money, just like I did. Since most of the investors are accredited investors, the defaults do not receive widespread mainstream media coverage. Follow my 10-point checklist to evaluate crowdfunded real estate deals.

Readers, have you tried lending on crowdfunded real estate platforms? How has your experience been so far? What steps would you add to the checklist to ensure your funds are protected?Do you prefer residential or commercial?

A Beginners Guide To Real Estate Crowdfunding

Crowdfunding is more than just a 21st-century buzzword its a new, exciting way for real estate investors to raise capital. But how does real estate crowdfunding work? What are the benefits of crowdfunding real estate deals? What do you need to know about looking for real estate investment loans from the masses? And what returns could you get by investing in another investors crowdfunding project?

Though real estate crowdfunding is not a traditional means of raising capital, investors need to understand this powerful form of real estate financing.

You May Like: Best Website For Investing News

Real Estate Crowdfunding: An Interested Tool To Diversify

After Parking lots and Boxes, it is now Real Estate Crowdfunding that appeals to Investors looking for high rental returns. Started as a niche Investment, Real Estate Crowdfunding is now attracting an ever increasing audience, and has set records in 2020, and retaining the status of the most profitable investment of the moment, with an average rate of return of 9.3% for savvy investors.

Real Estate Crowdfunding consists in raising funds from private investors, in order to finance a project in Real estate. And this type of Investment is attracting a lot of individuals or companies, since it is affordable to any kind of budget. With tokens available from 50 or 100 for smallest projects, it is becoming an investment for the general public, thus attracting Investors looking to diversify, along with savvy investors.

An opportunity that Grapen Invest is now pursuing by launching the First Real Estate Crowdfunding platform tied up with the Blockchain. Whats new then? The possible transfer of tokens on secondary markets and therefore a greater liquidity of the Investment, in addition to an average rental yield which is estimated between 6% and 10% on an annual basis for a 10 year duration.

No Need To Collect Rent

In the past, the easiest way to investment in real estate was to buy rental properties. While that can be a positive investment, it also means you are dealing with tenants and collecting rent. With a crowdfunded investment, you are removed from this laborious process.

The property management company or developer is the landlord and, in a real estate crowdfunded deal, it is they who collects the rent. You do not have to call tenants when they are late on paying rent or find quality tenants when someone moves out. You are strictly an investor which means that you dont deal with the day-to-day operations of collecting rent and managing income properties, but you still share in the proceeds when those projects are profitable.

Read Also: Max Cash Out On Investment Property

Here Are A Few Statistics:

- Jilliene Helman, online real estate investing expert, has predicted that the United States commercial real estate crowdfunding could grow to $10 billion in five years.

- By 2025, the crowdfunding industry as a whole is anticipated to be valued at more than $300 billion.

- Real estate crowdfunding grew 156 percent in 2014, just breaking the $1 billion mark. Campaigns ranged in size from less than $100,000 to over $25 million.

- In 2014, North America stood as the largest region by funding volume at 56 percent market share, compared with Europe at 42 percent.

- Real estate is one of the fastest growingsectors for crowdfunding. In 2016, real estate crowdfunding grew to a valuation of around $3.5 billion.

- A 2016 industry report estimated that years overall total US real estate crowdfunding activity at $3.5 billion.

- The World Bank predicts that by 2025 the crowdfunding industry as a whole will be worth $93 billion.

How To Invest In Real Estate Crowdfunding: 10 Point Checklist

Not making money sucks. But losing hard-earned money hurts even more. I recently lost over 45% of my capital in a real estate crowdfunded deal. This failed experience helped me develop a checklist on how to invest in real estate crowdfunding and avoid losing money.

As part of prudent asset allocation, I maintain a wide variety of income-producing assets as part of my portfolio. A few moonshots, some bitcoin, some SPACs, but most are vanilla.

While the bulk of my liquid net worth is concentrated in stocks and my primary residence, I also dabble in other non-traditional investments.

Today I want to talk about real estate crowdfunding investing, pros, and cons of it. I will also share details of my unsuccessful real estate crowdfunding investment. And how can you learn from my experience. And the checklist I created.

Recommended Reading: How To Invest In Darpa

You Can Diversify Your Investments

Youve heard the saying, Dont put all your eggs in one basket before, right?

Although its not usually phrased that way in financial circles, this bit of conventional wisdom often guides peoples investment strategies. After all, what happens if you invest all of your savings into a single building and the deal ends up going sideways? Suddenly everything is gone and youve lost a lot of money.

With crowdfunding, that $10,000 that may have gone towards a down payment on a single condo can be spread between two or three different projects. Suddenly, you can invest in a couple of different real estate sectors. Or perhaps youd like to get involved in luxury housing and commercial real estate at the same time. Crowdfunding makes it possible for you to have a stake in multiple real estate projects at once.

Its like owning shares in a mutual fund without having to go through a stock exchange.

Benefits Of Real Estate Crowdfunding

Whether youre just beginning your real estate investing journey or youre a seasoned pro, locking down the necessary financing to fund a deal can be a challenge. With its advent in the real estate sector, many investors have taken advantage of crowdfunding as an alternative way of funding their deals. Furthermore, crowdfunding has become associated with several other notable benefits, including:

Crowdfunding real estate increases your funding options while growing your investor network.

Direct marketing through crowdfunding also doubles as a tool to promote your business.

Successful projects will lead to positive word of mouth and client loyalty over time.

Save time and money by taking advantage of a user-friendly investment platform.

Gain access to valuable feedback from your online community so you may address any business flaws.

Also Check: How Do I Invest In Compound Interest

Real Estate Crowdfunding For Non

Most investorsare non-accredited investors because they dont have a highannual income or net worth. You fall into this category if you dontmeet one of these two requirements:

- Annualincome above $200,000 forthe last two years

- Net worthabove $1 million, with or without a spouses assets, excluding thevalue of your primary residence

The most common crowdfund real estate deals for non-accredited investors are private REITs. You will invest in a portfolio of properties the crowdfund platform owns. While you dont get to handpick which properties you invest in, this also make real estate investing easy.

Be aware that there are investment minimums with these real estate investing platforms.

You Can Lower Your Personal Financial Risk

Imagine having a diversified real estate portfolio like the one we just talked about. Except instead of crowdfunding, you opted to finance those projects yourself. Youve got one office building that you spent $5 million to buy. You bought an apartment building thats costing you just shy of $2 million. And then you decided to purchase a couple of single-family residential homes at a price of about $500,000 each.

If your city was hit with an economic downturn or you had the misfortune of renting to tenants who were out of work during the pandemic, you could easily find yourself struggling to get a return on that $8 million investment. When you opt to be a part of multiple projects, however, suddenly youre not out by several million dollars if things go belly up. Maybe instead youve lost a few thousand.

For investors who are particularly risk-averse, this matters a lot.

Read Also: Real Estate Agent Specializing In Investment Properties

What Is The Difference Between Real Estate Crowdfunding Vs Rental Property

This is a great topic to explore and it is important to know what these differences are if youre thinking about investing in real estate crowdfunding.

- The main differences for real estate crowdfunding and becoming a self-invested landlord have a lot to do with the tax advantages. When you invest in real estate crowdfunding, you become a shareholder. Its very similar to owning stock. The financial consequences of that are treated as 1099-DIV or a Schedule-K1 for your income taxes depending on which investment portfolio you choose.

When you own traditional real estate rental properties, thats not the case necessarily. There are a lot of tax advantages and deductions that your allowed to utilize when you are a landlord.

Aside from being able to eventually replace your full time income with real estate, you have other advantages as well.

When you are a landlord and own rental properties, you have things such as depreciation, and other allowable deductible costs that can affect your taxable income.

In other words, there are expenses that will offset your rental income gains.

It gets a little bit better too!

Additionally, if you have W-2 income and your real estate rentals show passive losses, those losses can also reduce your W-2 taxable income.

You can also roll over your potential capital gains and profits into a new investment property through a 1031 exchange.

Related Article: Want to Save Money on Taxes? Marry a Realtor

Can You Lose Money With Real Estate Crowdfunding

Yes. Every investment, from stocks and bonds to a crowdfunded real estate deal, carries the potential for loss. With that said, real estate investments are typically less unpredictable than stocks. Crowdfunding also allows you to invest a lot less money into a particular project than you would have to pledge to buy it outright. So, although there is certainly the potential to lose money on a crowdfunded real estate deal, you can spread the risk around while you avail yourself to investments with high upside.

Read Also: How To Invest With Leverage

What Is Crowdfunded Real Estate Investing

Real estate projects are capital intensive. Developers do not have all the funds to complete the project on their own. As a real estate developer, you can seek investors on real estate crowdfunding sites by sharing your project details. As an investor, you can evaluate various projects and decide which ones you would want to fund.

Real estate crowdfunding enables several investors to come together and invest smaller sums of money. The contributed pool of money is large enough to fund a real estate project. It is a win-win for both the investors and the developers.

Before the passage of the Jumpstart Our Business Startups Act, investment in large real estate projects was difficult. Borrowers or developers could not publicly solicit investment. You had to know someone to invest personally. After the JOBS Act was passed in 2012, developers can now directly market to investors.

Can You Get Rich From Real Estate Crowdfunding

Stocks, bonds, real estate have unique risk, return, and liquidity characteristics. Ideally, it would be best if you had a mix of different asset classes from a diversification standpoint.

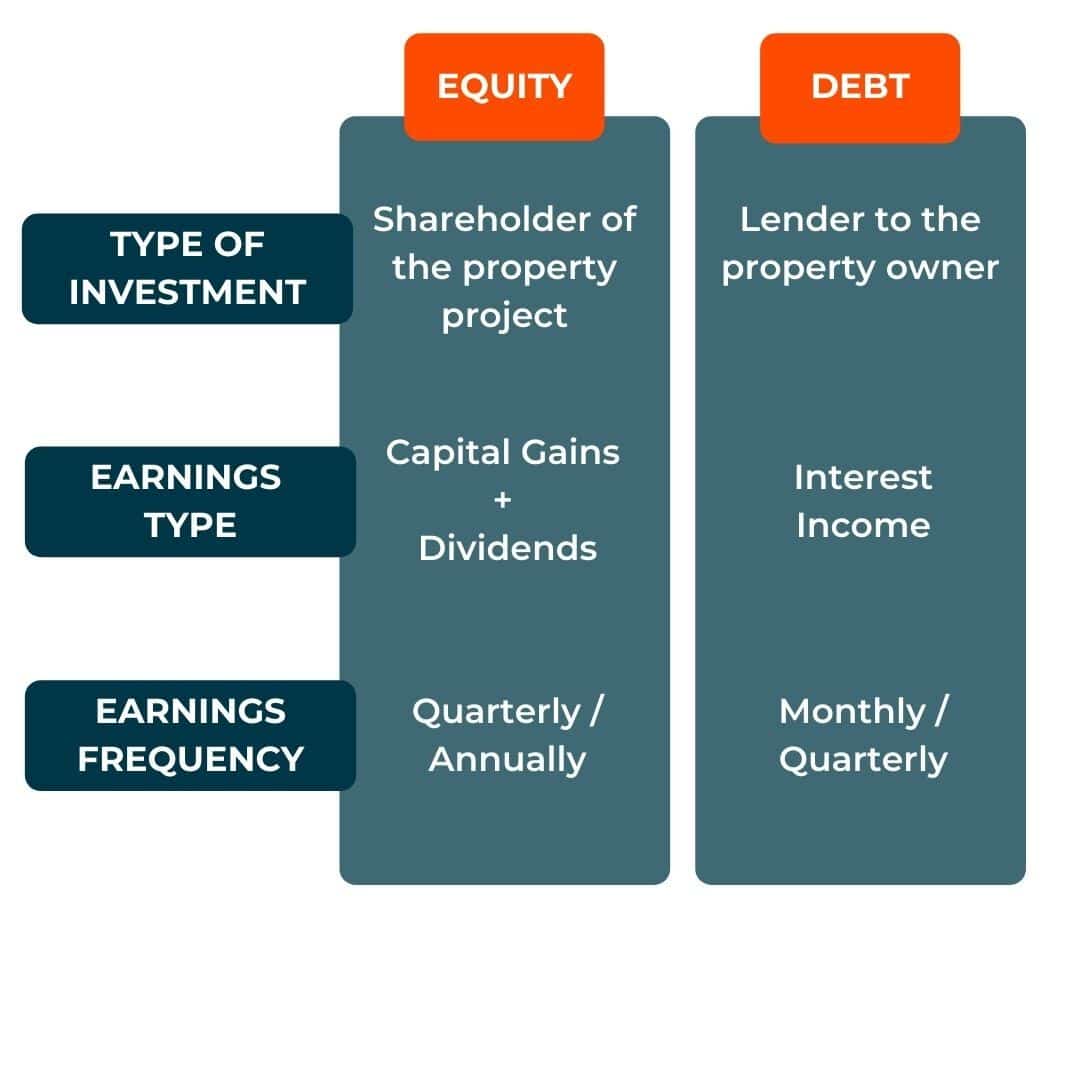

Crowdfunding investors make money based on the interest rate of the money they loan. Debt deals on crowdfunded real estate platforms provide a high return rate . Equity deals offer a higher return because they have a more extended hold period, and you get the extra return when the property is finally sold.

Real estate crowdfunding returns are higher than bonds and even index funds in some cases.

Risk and return are co-related. Any high return investment would involve high risk and vice-versa. The advantage of real estate crowdfunding is that your loan is backed by collateral.

You May Like: The Investment Company Of America Aivsx

Getting Started In Online Real Estate Investing

Prior to investing in real estate online, investors will need to set a few ground rules for themselves. For starters, no investor should buy assets without having at least some idea of why they are investing. A clear vision of what you hope to accomplish is instrumental in realizing success and even assessing progress.

Lets take a look at some of the most common reasons someone should consider investing in online real estate:

If investing in real estate online will help you realize your goals, proceed to establish a budget for yourself. How much capital you are able to allocate to individual online investments will dictate how you move forward. Accredited investors, for example, with more access to capital, will have a wider range of investments to choose from. It is not uncommon for capital to serve as a barrier to entry, with some crowdfunding platforms requiring a minimum investment. Those with limited funds, however, can invest in REITs for as little as a few dollars.

With a budget and a reason for investing lined up, investors should choose their preferred platform. For REITs, investors can sign up with todays most popular brokerages: TD Ameritrade, Fidelity, E-Trade, Interactive Brokers and a number of others. Once a member, investing in REITs is as simple as depositing funds and buying shares.

Can I Make Money With Real Estate Crowdfunding

It is possible to make money with real estate crowdfunding. The amount you can make depends on the projected Internal Rate of Return , a metric used by investors to estimate how much each invested dollar is expected to grow for the period of time it is invested.

You can typically expect to make 10% to 20% or more over your initial investment, but each project is different and the amount of return will vary. Since this type of investment takes time to pay off, you should expect your money to stay tied up for at least three to 10 years.

You May Like: Automated Real Estate Investing Systems