Vanguard Automatic Investing Wins The Race Slow And Steady

Even if you only set up a small monthly investment, slow and steady always wins the race. Vanguard automatic investing ensures that you always invest, whether its to maximize your IRA contributions for the year or to invest in a taxable account. Regularly putting money away ensures that you get closer to your financial goals every month.

New to investing? Check out our article on How to Invest Money: A Beginners Guide!

How Do You Stop Vanguard Auto Investing

If you want to stop your Vanguard automatic investments, its easy to do. They allow you to stop your automated investments at any time.

Follow these steps to cancel auto investments in your IRA or individual broker account:

Once you delete the automatic contributions, youre back to manual investments.

How Can I Buy Etf Shares On A Monthly Savings Plan

By Dan Bortolotti on June 11, 2017

Are there ETF-buying plans available that keep share-buying low?

Q. Does anyone offer a way to buy ETF shares on a regular basis, like a savings plan designed to add a small amount each month? Or is the only option to wait until you have saved enough cash to make an order worthwhile?

Peter, Cambridge, Ont.

A. ETFs offer a long list of benefits, but one of their drawbacks is that they dont make it easy to invest small amounts. Thats because almost all brokerages charge a commission to buy and sell ETFs: usually $7 to $10 per trade. If youre contributing $200 per month, a $10 commission is 5% of every purchase. That will quickly erode any benefit you might get from the ETFs lower management fees.

If youre looking to invest small amounts with ETFs, you have a few options:

Use a robo-advisor. There are now many online platforms that allow you to build an ETF portfolio with small amounts of money and regular contributions, including Wealthsimple and Modern Advisor. Every time you add money, its used to buy new shares, and youre not charged any trading commissions: instead, you pay a small percentage of your account or a flat monthly fee. This makes it cost-efficient for investors adding small amounts each month.

You May Like: What Type Of Real Estate To Invest In

Get Answers To Our Frequently Asked Questions

Why do I need to rebalance?

Rebalancing helps you maintain your investments so you can stay on track with your short-term or long-term investing plan.

Is linking my account with Passiv secure?

Yes. Your account and the trading activities you execute on Passiv all go through Questrade. Our security, privacy and guarantees are all in place.

How do I sign up for Passiv?

Its easy. Sign up at getpassiv.com then link your Questrade account and start creating your target portfolio.

Questrade Wealth Management Inc. and Questrade, Inc. are members of the Questrade Group of Companies. Questrade Group of Companies means Questrade Financial Group and its affiliates that provide deposit, investment, loan, securities, mortgagesand other products or services.

Questrade, Inc. is a registered investment dealer, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to the activities undertakenby Questrade, Inc. QWM is not a member of IIROC or the CIPF.

Questrade Wealth Management Inc. is a registered Portfolio Manager, Investment Fund Manager, and Exempt Market Dealer.

Questrade, Inc. provides administrative, trade execution, custodial, and reporting services for all Questwealth accounts.

©2020, Questrade, Inc. All Rights Reserved.

What Does That Mean

Automatic investing is the practice of contributing money to your investment accounts on a regular basis through direct deposit from your paycheck or recurring bank transfers. The idea is to establish this routine of saving and investing regularly with no extra effort on your part.

Making it automatic can help keep your savings plan on track no matter what else is going on in your life. Not only can you make saving automatic, you may be able to make investing automatic as well.

Video: How to make investing a habit

Benefits

- Reduces the temptation to spend

- Reduces the likelihood that you will overreact to market ups and downs

- Avoids spending time on an activity you may not enjoy that saps your brain power

- Eliminates the temptation to try to time the market

- Helps your saving and investing stay on track while you live your life

Read Also: Jp Morgan Investment Banking Reviews

Consider Your Etf Exit Strategy

Investing for the long term is wise, but even with the longest of long-term goals, eventually you reach the point where youâll need to sell your ETF shares and make use of their investment gains.

When you sell an investment at a profit, youâre doing whatâs called realizing a capital gain. This means your initial investment, your capital, has increased in value over what you paid for it. Because that increase in value has never been taxed before, itâs taxable as income. The rate you pay depends on how long youâve held the investment, with long-term investors who hold an investment for at least a year being rewarded with slightly lower capital gains tax rates.

If your long-term goal is retirement, you can effectively avoid these capital gains taxes while investments are within your tax-advantaged retirement account, like a traditional IRA or a Roth IRA. With a Roth IRA, your investment gains will never be taxed as long as you donât touch them before age 59 ½. And with a traditional IRA, you wonât be taxed until you start making withdrawals from the account in retirement. Then your tax payments will be based on your current income, not short-term capital gains rates, regardless of how long youâve held an investment.

How To Buy An Etf

Step 1: Decide your ETF investing strategy

In advance to making an investment, it makes sense to ask the following questions, as they will guide you in making the right decision when it comes to your personal investment strategy. If you can answer the following questions with a yes, choosing ETFs might be a good way to invest for you:

- Am I looking to invest for the longer term?

- Do I want to invest in a diversified portfolio?

- Do I want to invest in a collection of assets rather than individual stocks, bonds or financial assets?

Additional questions are:

- What sort of sector do I want to invest in?

- What sort of asset class am I looking at?

- How much risk am I comfortable taking?

If an investor is looking for a low volatility and low risk investment, then a bond ETF might be the right choice. If he is willing to take on some more risk, stocks ETFs do the job just fine. Even greater risk but also greater potential returns are offered by crypto or commodity ETFs. With these ETFs it might make sense to allocate a couple percent of my portfolio at the most. If an investor is focused on the short-term, leveraged ETFs might be an option. If he is bearish on a particular asset class, one can express my view investing into an inverse ETF.

Step 2: Open Brokerage account

Step 3: Choose ETFs

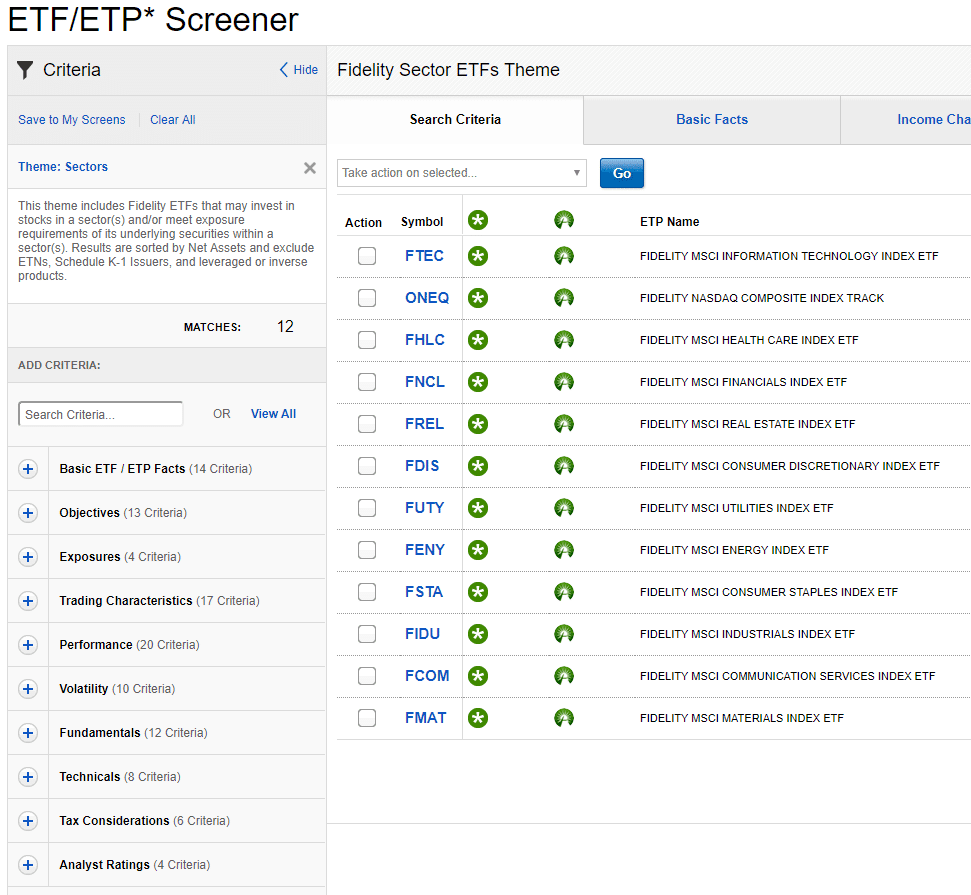

Here is a list of the most popular ETFs. These ETFs represent no financial advice but have been listed for educational purposes only:

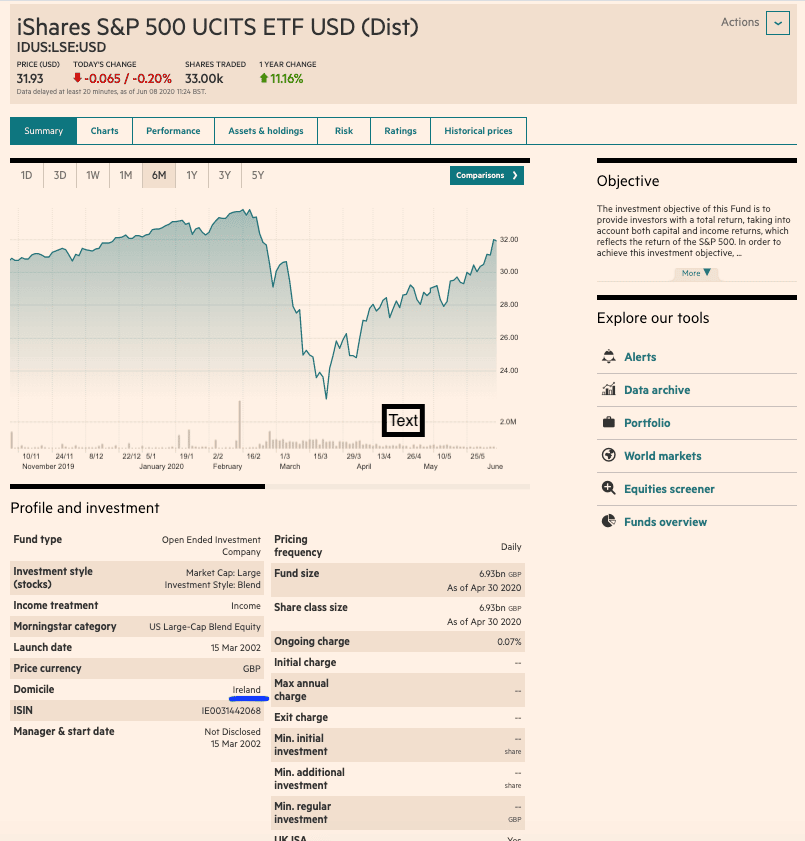

- An ETFs trading prices

Step 5: Invest

Also Check: Broker Dealer For Independent Investment Bankers

Open An Investment Account To Purchase Etfs

To invest in ETFs, you need to open a brokerage account or another form of investment account. You have many options to choose from, depending on your goals:

Most major brokerages offer these accounts for ETF investing. Each broker has its own account registration process and requirements. Before opening a brokerage account, look up the firmâs investment minimums, ETF options and fees to ensure they meet your goals.

Consistent Investing In Action

BUILDING YOUR SHARES. REDUCING YOUR COST.

Over the long term, consistently investing a constant dollar amount through all different market conditionsan investment strategy commonly called dollar cost averagingmay help lower your overall average cost.

Plus, accumulating more shares when the price is lower means benefiting when the market and the price of the investment go up.

BUILDING YOUR SHARES. REDUCING YOUR COST.

Investing a consistent amount cannot assure a profit or protect against loss in a declining market. Since such a plan involves continuous investment in securities regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of low and high price levels. This is a hypothetical example and is for illustrative purposes only. Number of shares are rounded to whole numbers and may not equal total shares due to rounding.

You May Like: Can Financial Advisors Invest Their Own Money

Work With A Jp Morgan Advisor

Personalized financial strategies built for you and your goals.

Check out our FAQs to learn more about pricing and funding options.

LEARN MORE ABOUT OUR FIRM AND INVESTMENT PROFESSIONALS AT FINRA BROKERCHECK.

To learn more about J. P. Morgans investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products.

JPMorgan Chase and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your personal tax, legal and accounting advisors for advice before engaging in any transaction.

Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Past performance is not a guarantee of future results.

Asset allocation/diversification does not guarantee a profit or protect against a loss.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

INVESTMENT AND INSURANCE PRODUCTS ARE:

Fully Automated Trading And Investing Systems: Robo

Robo-advisors arecomputer programs that are programmed to advise investors according to theirfinancial needs and goals. Some firms that use robo-advisors replace humanadvisors with them. Others may offer robo-advisory services along with humanadvisors.

Robo trading has increased in popularity, and the assetsunder management at robo-advisor firms are expected to grow at a compoundannual growth rate of 18.7percent through 2023. These programs rely on customized algorithmsto provide advice to investors.

Read Also: Chinese Investment In Us Real Estate

The Benefits Offered By Auto

M1 Finance uses smart robo-advising programming to helpinvestors achieve their financial goals. It does not charge any commissions ormanagement fees so that your savings can grow even more.

When you invest with M1 Finance, you can enjoy personalization of your portfolio. The site also offers great accessibility and cutting-edge expertise. M1 Finance offers many different securities from which you can choose and different types of accounts.

Check the background of M1 Finance LLC on FINRA’s BrokerCheck

How Do I Set Up Automatic Investment With Vanguard

Vanguard automatic investing is easy to set up. Once you have a Vanguard account, follow these simple steps:

Pay close attention in this section this is where you set up the automatic investments. Your bank account information and amount to invest are pretty straightforward. A few other factors youll need to know include:

Don’t Miss: Is Gold A Bad Investment

Investing In Mutual Funds

On the other hand, if youre the kind of investor who wants less control and a simpler, more hands-off experience, combined with the advice of an advisor, maybe its mutual funds youre after.

They suit people wanting their portfolio to be professionally managed. You can also easily set up automatic investments in fixed amounts towards your mutual funds so you dont have to remember to contribute each month.

As well, mutual funds offer other series and structures that arent available in ETFs. These can provide you with regular cashflow or invest your money more tax efficiently.

- Footnote 1

Research Potential Etf Investments

Even within the categories weâve outlined above, there are thousands of ETFs to choose from. That makes researching potential ETF investments crucial to make sure youâre picking the best investment for your goals. Hereâs what to consider as youâre examining and comparing ETFs within particular categories:

To research ETFs, look to sites like Morningstar and ETF.com to compare the benchmarks, fees and constituent investments of different funds.

Read Also: Where Can I Invest 100 Dollars

Why Consider Automatic Investing

Automating your regular investments can help reduce risks and keep some of the emotions of financial decision-making at bay.

This investment strategy has the advantage of dollar-cost averaging. When you plan regular periodic contributions to your portfolio, you are less likely to mistime the market with reactionary investment choices. When you set the frequency of your investments, other factors like an asset’s price won’t influence your investing decisions. The result is that the dollar-cost averaging strategies of AIPs tend to minimize the effect of market volatility on your portfolio.

Automatic investing is a great tool to help you stick to a budget because you’re planning for investment decisions in advance. So, you are less likely to be tempted to use money budgeted for long-term investing in other ways, like spending it on a vacation. On the flip side: Dont fall into the set-it-and-forget-it trap. While AIPs allow you to put much of your investing on autopilot, you dont want to be caught off-guard when unexpected expenses arise . Check in on your investing plan if your budget is thrown off kilter and make adjustments if necessary.

Automating routine investing decisions can also help with your investment goals. You can check in on your portfolio periodically and make changes instead of constantly monitoring the market and assessing your financial situation each time you want to invest.

Youll Have The Option To Select Our Premium Robo

What do you dream about? A bucket-list vacation? Your first house? Retirement? Whatever your goals are, we can help you reach them, with a tailored portfolio of ETFs plus a comprehensive financial plan and unlimited 1:1 advice from a CERTIFIED FINANCIAL PLANNER professional.

What is a CERTIFIED FINANCIAL PLANNER professional?

A CFP® professional has completed the CFP Boards rigorous certification requirements and understands how to bring all the pieces of your financial life together.

How does this work?

Use our online planning tool to create your no-obligation plan. Then meet with a CFP® professional to fine-tune your plan and then select your portfolio. If you decide to go ahead, youll get an automated portfolio of ETFs and unlimited 1:1 advice from a financial planner to help evolve your plan.

What is the advisory fee?

Pay a one-time planning fee of $300, and just a $30/month advisory fee after that. Get started with a $25,000 minimum.

Read Also: Using Va Loan For Investment Property

Recurring Investments For Stocks And Etfs

Recurring investment orders will typically start to be processed between 11 AM ET and market close on the scheduled date. If your recurring investment order falls on a day that the market is closed, like a weekend or holiday, it will be scheduled for the next trading day.

To fill recurring investment orders, we group them in batch market orders. Typically, we create one batch order for each security but sometimes we need to create multiple batch orders.

Each batch order is converted into one or more share-based orders that are routed to the market for execution. To figure out how many shares youll receive for a recurring investment, we divide your investment amount by the weighted average price per share for each batch order. You may end up with fractional shares.

Recurring investment orders are typically filled during regular market hours .

Lets say you have a weekly investment of $50 for MEOW and the batch order was executed at a weighted average price per share of $5. Then youll get 10 shares of MEOW that week.

Your recurring investment might get paused automatically for a number of reasons, including:

- The bank transfer for your order was reversedthis sometimes happens if the bank account has insufficient funds

- The bank account you chose for your primary payment method was unlinked

- The stock or ETF at the time the order wouldve been placed had a trade restriction

- Your account was set to position-closing only, meaning you werent able to place buy orders

Fund Your Brokerage Account

In this case, lets say youre using M1 Finance to buy ETFs. Below are the steps youll follow to fund your M1 Finance account via your bank account:

Read Also: How To Invest Your 401k In Gold

How Automatic Investing In Stocks Works With M1 Finance

M1 Finance is an investmentplatform that makes learning how to start investing in stockssimple. You can decide how much you would like to invest and easily open youraccount. After you have provided your information, you can set up an automaticinvestment schedule so that funds automatically flow into your account.

M1 Finance allows you to choose your own securities or to opt to choose a portfolio that has been expertly created for you according to your goals and risk tolerance. M1 helps your money to grow through automatic re-balancing so that your portfolio continues to meet your target allocations.