Risks Of Investing In Private Equity

There are plenty of risks you should be aware of before you invest in private equity.

- Access. Private equity funds are typically restricted to accredited investors as defined by the SEC. To qualify as one, you must meet at least one of the following requirements:

- Have an income of $200,000 in each of the prior two years

- Have a net worth over $1 million, either alone or together with a spouse

But just because you meet the SECs accredited investor criteria doesnt mean you can invest in any private equity fund. The companies that manage private equity funds may have their own requirements.

Private companies vs. public companies

Investing In Private Equity

Search current offerings based on your criteria with Benzinga’s New Alternative Investments Screener.

Private equity is one of the hottest sectors of alternative investing. It allows startups and early stage companies to raise capital by offering equity to investors who want to get in on the ground floor. As recently as 15 years ago, investing in private equity was almost exclusively the domain of the very wealthy.

However, new technological developments like online equity crowdfunding platforms are opening up the world of private equity investing to individual investors. Is private equity right for you? Keep reading to find out.

The Wealth Requirement Of Pe

It is often thought that one needs to be quite wealthy to invest in private equity. Although some laws establish minimum net worth requirements to become an investor in private equity, there are ways to circumvent that restriction to some degree.

One is by investing in publicly traded PE firms such as Apollo Global Management APO or in business development corporations such as Capitala CPTA TCAP , and about 20 more.

Thats because BDCs serve a useful role for investors: investing in small businesses that are often left out of speculative investment capital or even commercial banks. Small is a relative term, of course, and may mean companies with sales beyond $100 million each year. BDCs invest in well-known companies, too, such as Payless Shoes and the late Toys”R”Us.

For those wishing to directly invest in PE, yes, there is a requirement of net assets, which is defined by the U.S. Securities and Exchange Commissions Regulation D. This stipulates that investors must have shown themselves to be financially sophisticated enough to not require protection through filing regulatory disclosures and are therefore accredited investors who have proven themselves capable of assuming the financial risk.

If you are considering actively investing and choosing where your assets will be deployed, its important to think carefully in terms of risk.

You May Like: Easy Investing Apps For Beginners

The Downsides Of Private Equity

- Private equity funds carry a lot of fees. Since these investments are unregulated, there’s no limit to the amount that private equity firms can charge. Performance fees are paid to the general partners/fund managers for producing positive returns, and the “2 and 20” annual fee structure is common: a firm charges an annual management fee of 2% of the assets being managed and a 20% performance fee on profits generated.

- Private equity investments are illiquid. Private equity firms often require investors to keep their money in the fund for at least three to five years.

- Private equity investments can be high-risk. The companies are untried or troubled, and they may not live up to their potential.

Private Equity Investment Strategies

Our approaches span the private equity toolkit, offering investors exposure to private equity through direct, primary, secondary, and co-investment strategies. While the approaches differ, they share the strengths of a common platform as they seek to deliver top quartile performance across investment cycles.

Recommended Reading: Do Banks Invest In Life Insurance

Are You On Track For Retirement

Making sure you will be ready for retirement can be overwhelming. Funding your retirement accounts over the years is a critical part of your journey to the retirement of your dreams. An experienced Financial Advisor can help you navigate the complexities of investment management. Talk to a Financial Advisor>

Companies Likewise Benefit From Private Equity

Although the time horizon can be ten or more years, the first distribtions are generally paid to investors from the exit of investments after just a few years. This allows private investors to benefit from private equity too.

Private equity companies often hold a majority interest, meaning financial backers can influence corporate strategy up to and including a complete takeover of the company. In many cases, however, companies get back on the growth track and/or improve their market position under the leadership of private equity companies.

In contrast, venture capital is used to finance newly created startups and young companies.

Read Also: How To Begin In Real Estate Investing

What Are The Risks Involved With Private Equity Investments

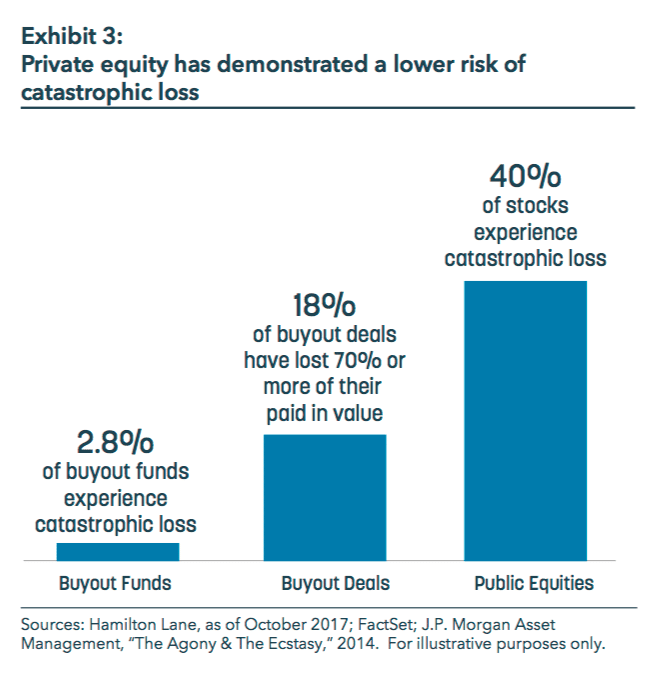

Private equity investments are popular because of the upside they offer. Its possible for one successful private equity investment to make you rich beyond your wildest dreams and set up generational wealth for your family. However, all that upside translates to increased risk.

In almost all cases, the companies seeking to raise private equity have no track record of success, and that kind of risk is enough to scare off institutional lenders like banks. If you want to play the private equity game, you need to be prepared for the likelihood of losing money.

In addition to the risk of loss, private equity investors must be able to withstand having their investment capital be illiquid for an extended period of time. Unlike stocks, no public exchange or market exists where private equity shares can be liquidated, so you must be prepared to give up access to your investment capital for years at a time.

If youve invested into a private equity ETF, venture capital fund or real estate venture, you have an ownership stake without a voice. You, and your investment capital, are completely in the hands of the fund manager or general partner. Youve got to be really certain of their ability to deliver on their stated goals.

How Private Equity Affects Portfolio Returns

The effect of adding private equity into a portfolio is – as always – dependent on the portfolio itself. However, a Pantheon study from 2015âµ suggested that including private equity in a portfolio of pure public equity can unlock 3.16% of annualised excess returns .

We will look into constructing a private equity portfolio How to build a diversified portfolio?. But – to get a simplified idea of how including private equity might affect overall returns – we can take a look at models of various sample portfolios. The chart below illustrates how introducing private equity to a portfolio affects the risk-return profile, starting from a portfolio of only public assets.

Read Also: Start Investing In Real Estate

Investments In Private Equity

Although the capital for private equity originally came from individual investors or corporations, in the 1970s, private equity became an asset class in which various institutional investors allocated capital in the hopes of achieving risk-adjusted returns that exceed those possible in the public equity markets. In the 1980s, insurers were major private-equity investors. Later, public pension funds and university and other endowments became more significant sources of capital. For most institutional investors, private-equity investments are made as part of a broad asset allocation that includes traditional assets ” rel=”nofollow”> bonds) and other alternative assets .

Choose The Investment Structure: Independent Sponsors Versus Committed Funds

Two types of investment structures common in the private equity industry are: independent sponsors and committed funds.

Independent Sponsors

Independent sponsors generally do not have committed funds and, instead, have networked relationships with investors. These firms initially identify investment opportunities and then seek financing to fund their purchases on a deal-by-deal basis.

Investors benefit because they retain discretion and freedom to choose which investments to make. They also avoid the investment timing uncertainty of when capital calls are made. Finally, the fee arrangements for these investments could be friendlier than committed funds.

Committed Funds

Investors in these funds have ceded choice over acquisition targets to the private equity managers. As a result, when the PE manager issues a capital call, investors must finance their commitments, regardless of their views of the merits of a particular deal.

These funds are also known as commingled vehicles because it includes an investors capital with other investors in the same pool. The advantage of this structure is that it is more hands-off for the investor. Once they have built confidence in the private equity fund, they can spend less time completing their due diligence on each deal.

Recommended Reading: Td Bank Heloc Investment Property

Why Companies Allow Private Equity Firms To Acquire Them

Understanding why a privately-owned business would want to sell to a private equity firm is key to defining how PE funds can create value.

A company may decide to sell itself to a private equity bidder for a variety of reasons. For example, a business may have reached a point where its entrepreneurial management style impedes growth, and a more professional approach is required.

Professional here may reference:

- Scaling growth processes

- Leveraging technologies

Business owners may also reach a stage in their career where they want to step back from the daily responsibilities of management.

Occasionally, strategically merging with another company in the same sector may stimulate growth and synergies. Finally, changes in the business value may prompt management to sell for cash.

Who Can Invest In Private Equity

Traditional private equity funds have very high minimum investment requirements, potentially ranging from a few hundred thousand to several million dollars. As such, most private equity investing is reserved for institutional investors or high-net-worth individuals.

In addition to meeting the minimum investment requirements of private equity funds, youll also need to be an accredited investor, meaning your net worth alone or combined with a spouse is over $1 million or your annual income was higher than $200,000 in each of the last two years.

You May Like: Fidelity Cash Management Account Investment Options

High Barriers To Entry

The large dollar amounts required to invest in private equity are one of the biggest negatives. At a minimum, investors must meet accredited investor requirements, which generally require annual income of at least $200,000 for the two previous years as well the expectation that income will reach the same level in the current year. Investors can also be considered accredited investors if they have a net worth of at least $1 million or have certain roles with the company issuing unregistered securities that is, a private equity firm. Some private equity vehicles may require investors to meet qualified investor requirements, which require investment assets of at least $5 million.

Even for investors meeting these requirements, investment costs are far higher than those for publicly available investment vehicles. Private equity funds typically charge a 2% management fee as well as additional performance fees equal to 20% of profits.

Funds of funds offer more diversified exposure to private equity, but they also involve an additional layer of fees. The typical private equity fund of funds collects 1% in management fees and 5% in incentive compensation, which might seem low for private equity exposure, but those costs are in addition to the fees on the underlying funds.

Liquidity In The Private

The private-equity secondary market refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Sellers of private-equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private-equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors. For the vast majority of private-equity investments, there is no listed public market however, there is a robust and maturing secondary market available for sellers of private-equity assets.

Increasingly, secondaries are considered a distinct asset class with a cash flow profile that is not correlated with other private-equity investments. As a result, investors are allocating capital to secondary investments to diversify their private-equity programs. Driven by strong demand for private-equity exposure, a significant amount of capital has been committed to secondary investments from investors looking to increase and diversify their private-equity exposure.

Investors seeking access to private equity have been restricted to investments with structural impediments such as long lock-up periods, lack of transparency, unlimited leverage, concentrated holdings of illiquid securities and high investment minimums.

Secondary transactions can be generally split into two basic categories:

Read Also: Deal Machine For Real Estate Investing

Reasons To Invest In Private Equity

Why should you consider investing in private equity? Lets point out some noteworthy factors.

- Returns in private equity depend on absolutely different factors than in public equity markets, which makes private equity investments a great diversification instrument,

- Instead of focusing on quarterly earnings as we usually do in public markets, private equity ownership provides the possibility to focus on long-term performance results. Eventually, it may help to generate larger returns.

How Private Equity Works

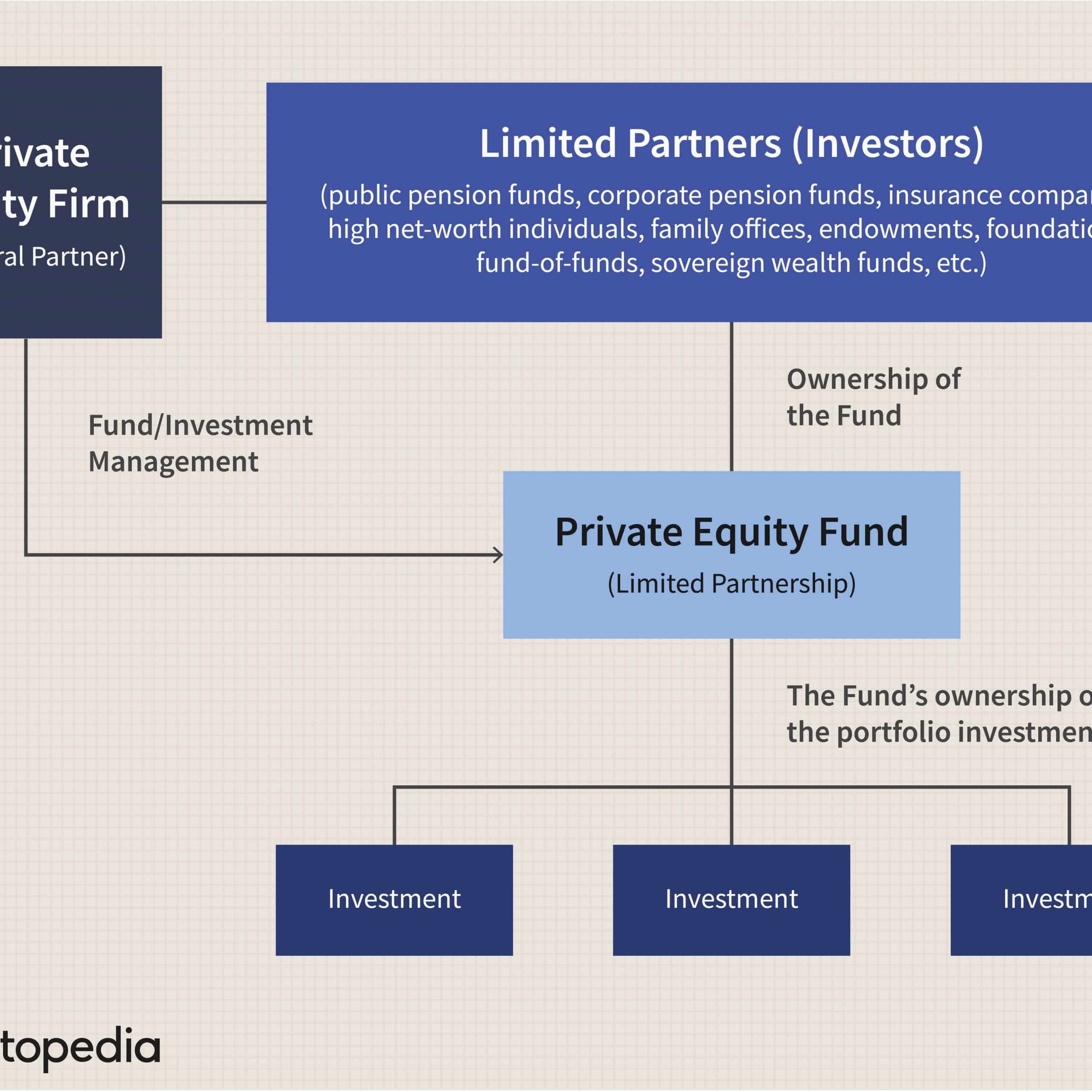

Lets say you invest $1 million through a private equity firm . The private equity firm would put your money in a private equity fund along with money from other investors and invest the pool of money in various private equity instruments, such as buyouts or venture capital .

» Looking for accredited investor opportunities? Learn how to become an angel investor

Recommended Reading: Barclays Investment Bank New York Ny

Direct Investment In Private Equity

Direct investment in private equity means that you seek out a private equity firm and invest your money with them.

Per our example above, structurally this is not dissimilar to investing in any other fund-based asset. You buy shares of a private equity firms portfolios based on their options, your interests, and your risk tolerances. The firm will then pool your money with the rest of that portfolio and use that capital to make investments. The portfolio will generate returns based on the performance of its underlying investments, and you will receive a percentage of those returns based on your share in the portfolio.

The main difference is that, with private equity, the fund directly invests in other companies rather than publicly traded assets.

The rewards of private equity can be high . However the risks are equally high . As a result, direct investment in private equity is restricted to accredited investors. This is generally defined as an investor with more than $1 million in assets or a minimum household income of $200,000 for single people and $300,000 for a married couple.

In addition, because of the scope at which private equity works, most firms require very high initial investments. It is common for private equity firms to require a minimum investment of between $10 million and $25 million up front.

Although, if you have $25 million lying around with which to invest, its unlikely you need us to tell you about money management.

How Private Equity Firms Exit Their Investments

PE funds always have an exit plan whenever they invest, as the value realized from a sale is a crucial driver of performance.

Typically, at the end of a typical 5-year hold period, private equity managers seek to exit their investments to create liquidity for their investors. These exits typically happen by:

- Sale to another private equity buyer

- Sale to a strategic buyer

- Going public via an initial public offering

- Performing a dividend recapitalization or

- Liquidity through a SPAC structure.

Sale to Another Private Equity Buyer

When the PE firm implements its strategies for growth, it may seek to sell to another buyer. Selling allows the private equity firm to recycle its investment and maximize value for its investors.

The purchasing private equity firm may have a different set of capabilities and prove to be a better business owner at this stage.

Some of these capabilities include having relevant operating partners, infrastructure to take a company to the next level, or investors with a different return expectation than the first private equity firm.

Sale to a Strategic Buyer

A buyer that operates in the same industry as the business owned by the private firm is called a strategic buyer.

Strategic buyers can typically pay the highest price because they can achieve the post-deal synergies. Cost synergies are cost savings from eliminating duplicate overhead and infrastructure. Revenue synergies are those from a better-combined product or service.

Don’t Miss: Investment Home Equity Line Of Credit

Similarities Between Investing In Private Equity And Public Stocks

- Generally, businesses are pro-cyclical. Thus, as the economy grows, the profitability of a business grows as well. This factor affects both private and public equity ownership stakes.

- Most industries that private equity firms buy have public-equity counterparts.

- Large PE firms may take public companies private or seek to exit their investment by selling their stakes through an initial public offering .

Want To View Our Funds

Create your free Moonfare account now to view our funds, get proprietary investment insights, performance data and more.

Important Information: Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are not guaranteed and may not reflect actual future performance. Your capital is at risk. Please see .

You May Like: Best Investment To Get Monthly Income