What Isreg D 506

Regulation D allows companies to sell securities that are not registered with the SEC, thereby reducing issuance costs. Reg. D also defines the term accredited investor. Reg. Ds Rule 506 allows real estate funds and developers to raise capital from an unlimited number of accredited investors and up to 35 non-accredited investors. Non-accredited investors must still be sophisticated investors who are knowledgeable about investing in general, and are familiar with the type of investment being offered.

Companies issuing securities under Rule 506 are not required to make disclosures to accredited investors, but anything they disclose must also be provided to non-accredited investors. Companies must make certain disclosures to their non-accredited investors. Importantly, entities offering securities under Rule 506 can only sell to investors with whom they have had a substantive relationship prior to the offering.

What Is A Real Estate Investment Fund

Prior to the 1990s, investing in real estate required large sums of capital. This limited the number of people who could participate to those who had enough money to buy and hold real property.

But along came real estate investment funds. These provide a way for the average investor to access lucrative real estate sectors by owning shares of an established fund that invests in a variety of real estate sectors.

What Are The Best Types Of Real Estate Funds To Invest In

For accredited investors, private equity real estate funds provide a number of important benefits that are not available from other types of real estate investment vehicles, including preferred returns and tax advantages. For individuals who are seeking exposure to real estate and have at least $50,000+ to invest, this is quite often the preferred approach to investing in real estate. Private equity real estate funds often specialize in particular types of real estate projects, so investors can compare various funds to find one that meets their goals and preferences.

For investors with less capital to invest that do not meet the accreditation standards, there are approximately 225 REITs traded on stock exchanges in North America, hundreds of real estate mutual funds and over 30 real estate ETFs. Some hold U.S. properties only, and others are international. Some specialize in a particular category of real estate while others invest in a broad range of property types. In choosing a REIT or fund, focusing on recent performance is not informative, as returns vary over time and real estate is cyclical in nature while one sector may have done well in the past year, another will be stronger the following year. We offer these criteria to consider when evaluating publicly traded real estate investment vehicles.

Key Criteria:

You May Like: Best Blockchain Technology To Invest In

Incentive / Performance Fees

This category is where the fee structure can get a bit tricky, but it is also where the general partner can make the bulk of their income. Incentive or performance fees are fees that are charged based on certain deal milestones or return benchmarks. They are designed to incentivize the GP for performance and typically follow a distribution waterfall pattern. While this term can seem intimidating, it really just means that the GP gets a larger share of the cash flow produced by the property when they meet certain rate of return milestones. To explain how this works, an example is helpful.

Suppose that a private equity firm finds a $10MM property in New York. To finance its purchase, they get a $7MM loan and raise $3MM in equity. Of the $3MM, the private equity firm invests 10% of their own money and the limited partners provide the remaining 90% .

At the beginning of the real estate investment period, any cash produced by the property is usually split according to the percentage that each group put in, 10% for the GP and 90% for the LP. But, if the propertys return reaches a certain threshold, say 10% annually , that split may change. It could change to 20% for the GP and 80% for the LP. This extra 10% for the GP is the incentive or performance fee for producing strong returns.

Navigating The World Of Private Real Estate Fees

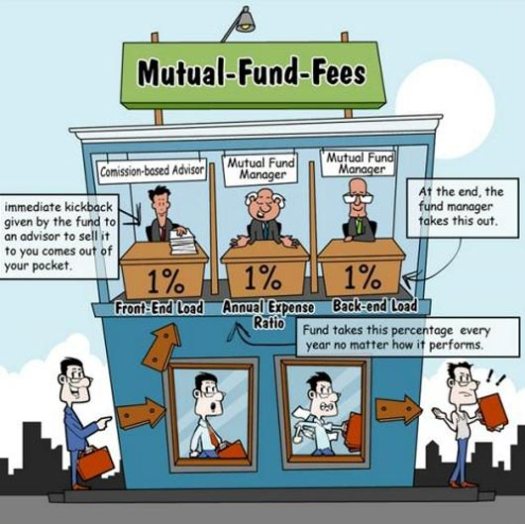

When considering any investment opportunity, prospective investors should take the time to review documents to understand fees and expenses that may impact long term potential for returns. Fees may be charged for a variety of services and can also be structured to incentivize performance so that sponsors earn more when the investment achieves return hurdles. No matter the size of the investment, its important to understand how fees compare with other similar investment opportunities and how they might impact returns over the hold period.

For example, imagine you were to invest $50,000 across two investments with the same risk profile, and one of the investments contains an extra 1% annual fee. Your total return would be eroded by roughly $7,000 over a 10-year term, assuming an 8% annual return for each investment. Fees can have a significant impact over time.

In this article, we will highlight a few different types of private real estate fees that Managers may charge on a particular offering.

Don’t Miss: Jp Morgan Investment Banking Recent Deals

What Are Affiliate Fees

In instances where the sponsor controls other entities that service the business needs of the real estate investment, investors should be aware of fees they may be paying through sponsor affiliates. The most obvious and prevalent instance of this is for property management services, but it can take the form of title companies, construction companies, consultancies, vending machine operators, laundry service companies, architects, engineers, or any number of other service types that take place within real estate operations. The amount and recurrence of these fees will vary with the nature of the underlying service performed, but astute investors should be sure to understand to what extent affiliates will play a role in the execution of an investment.

How Are Private Real Estate Investment Deals Structured

Private real estate investment deals are structured in different ways. Theres the Single LLC structure, where the sponsor contributes equity as a class A member along with all other LPs. The next structure is similar, but the sponsor contributes as a class B member, keeping his equity separate from the other LPs. Theres the JV LLC model where sponsors and LPs invest in different entities, and the Delaware Statutory Trust, which is rising to prominence as a structure to take advantage of 1031 Exchanges.

Don’t Miss: How To Invest In Real Estate With Little Capital

What Are The Common Fee Structures Adopted By Sponsors Of Private Real Estate Deals

Common fee structures used by real estate deal sponsors include the acquisition fee, management fee, asset management fee, and disposition fee.

Deal structuring is the organizational hierarchy in which a deal is acquired, funded, managed, and eventually, held. Most importantly, it determines how profits are divided and how cash flows are allocated. A defined deal structure and outline of fees are the foundation of any successful real estate private equity deal.

When deciding what structure is best, sponsors must address the four following questions: Who will contribute to the capital stack? What preferred returns are expected? How will distributions be allocated? And, what level of control will be sought? Once the GP, perhaps with some input from the LPs, has addressed these questions, the appropriate deal structure and accompanying deal fees reveal themselves. For the purpose of this article, it is vital to understand the relationships between sponsor and investor, GP and LP, as well as Class A and Class B members. Based on the designated structure, the roles, responsibilities, and expectations of each member or entity may be affected.

As we continue on, we will outline four common structures sponsors use and how they differ from one another.

Can Hedge Funds Invest In Real Estate

Some hedge funds do invest in real estate, and may do so through REITs. While investors can buy REITs directly, hedge funds often use leverage and may actively trade their REIT holdings. Some real estate hedge funds invest directly in real estate, often focusing on distressed properties where valuations have declined significantly and the hedge fund sees an opportunity for a strong recovery.

You May Like: Most Lucrative Real Estate Investments

Summary Of Real Estate Asset Management Fees

In a typical private equity commercial real estate transaction, there are two groups of participants: the sponsor and the investors.

The sponsor, sometimes called the asset manager or general partner, is responsible for all of the heavy lifting associated with finding, financing, and managing the property. The investor role is passive. They provide equity capital only and have no say in the day to day property management decisions.

To finance their efforts, asset managers charge fees to investors. In some cases, it may be a flat rate. In others it is a percentage of invested equity.

There is a material difference between the responsibilities of a property manager and those of an asset manager.

Asset manager responsibilities include creating and managing the budget, collaborating with lenders, managing cash flows, and managing the entire portfolio if multiple properties are owned.

Property managers are responsible for the day to day operations of the property. For example, they manage repairs, leasing, maintenance, and resident requests.

Our Company Mission Is To Exceed Expectations

- can identify solutions and execute strategies that will help our client make informed, competitive investment decisions allowing them to maximize their financial returns.

- funding has practical, streamlined processes and techniques that we follow to ensure financing success for our clients in a timely and responsive manner.

- Our expertise spans all major financial markets providing us with access to all qualified investments and capital sources. By working in conjunction with international, national, regional and community lending entities in addition to major life and REIT trusts, Primestone is able to put its national network to work for you. Our goal is simple we partner with our clients to understand their financial objectives and create innovative ways through transaction management to optimize their asset in a timely manner.

Meet The Team

Read Also: App To Invest Small Amounts Of Money

Can You Explain The Disposition Fee

At the time of a property sale, investment managers may charge a disposition fee to the investors. Similar to acquisition fees, disposition fees are levied to compensate for the time and effort associated with marketing and closing on a sale. This can also be very labor intensive, often requiring coordination among large teams and many third parties. Disposition fees are also paid at closing as a percentage of the purchase price, and their range tends to be comparable to that of acquisition fees.

Take An Educated Approach To Private Real Estate Fees

When you add all of them up, you may face more fees than you realize. Thats why its essential to be aware of the costs and transparency when choosing any investment Manager, particularly in real estate.

Jamestown Invest aims to be open and transparent with its investors on exactly what fees they are paying. and whether Jamestown Invest may be the right fit for your investment goals.

Don’t Miss: Are Investment Advisory Fees Deductible

What Goes Into The Administrative Fee

Managing dozens of portfolio properties and thousands of investors to the standard that we expect of ourselves is expensive. It requires a highly trained staff in fields such as legal, accounting, marketing, property management, and property acquisition. Because there are specialized disciplines with high demand for workers, the salaries and costs needed to support our talented team creates a certain level of overhead cost.

In addition, we continue to invest significant sums in technology tools and platforms designed to bring a high degree of efficiency to our own operations and to provide a superior and transparent experience for our investment partners.

In short, the administrative fee is used to create, maintain, and improve the infrastructure required to support our investment programs.

Real Estate Transaction Fees

Transaction fees are guaranteed. The manager gets paid these fees regardless of how the deal performs. Below are the most common transactional fees:

Acquisition Fee: This fee is most common amongst managers syndicating individual deals. The acquisition fee is usually between 1% and 2% of the total deal size and is generally on a sliding scale. The bigger the deal, the lower the fee. This is a market rate fee and is justified because the manager probably looked at 50 deals to find this one. The manager already paid all of the dead deal and personnel costs out of their own pocket.

Acquisition fees are paid on the total deal size, as opposed to equity invested. This is a significant difference because a 1% acquisition fee on a $30 million property comes out to $300,000. Most properties are typically leveraged using two-thirds debt, so the required equity may only be $10 million, meaning that $300,000 fee equates to a 3% cost of equity invested.

Committed Capital Fee: This fee is typically charged by called capital real estate funds and ranges from 1% and 2% on committed equity. The manager receives this fee even if the capital is not invested. If a committed capital fee is charged, an acquisition fee should not also be collected, as this is what the industry calls double-dipping. Unfortunately, many managers try to get away with double-dipping when serving individual investors, so be careful.

Read Also: Creative Financing For Real Estate Investing

We Represent Private Real Estate Investment Funds And Their Sponsors

Real estate investment funds provide investors with the ability to invest in large, diversified portfolios that typically hold, improve, manage, and develop illiquid real estate assets. Real estate funds are generally sponsored by experienced real estate developers, property managers, brokers, or investment advisers and can be structured according to specific investment strategies or asset types. These funds typically begin with an investment strategy that fits within one of four categories Opportunistic, which is likely to be a development or rehabilitation strategy Value-add, which generally takes an existing use and improves it in a significant manner to collect rents or sell when the property reaches a market-maturity level for profitability Core-plus, which is similar to the value-add strategy, but requires less work to improve the property and usually has fewer landlord responsibilities and Core, which is to purchase and hold existing, leased space until the point of maturity – usually with long-term, triple-net or absolute net leases in place.

Many successful real estate funds tend to have a focused strategy in one particular asset class with which the sponsor has previous experience.

Can Ira Funds Be Invested In Real Estate

Investors can hold real estate property in a self-directed IRA, i.e., an IRA that is not associated with any brokerage firm, bank, or investment company. The IRA custodian, or other entity responsible for record-keeping and IRS reporting, must accept alternative investments. The property must be held for investment purposes only the investor/investors family members cannot use it. The investor must pay cash for the property, and all ownership expenses must be paid out of the IRA.

You May Like: How To Invest In Stocks Without Fees

What To Look For In Private Equity Real Estate Fund Fees

This article was originally posted on Origin Investments blog.

Its well documented that private equity real estate funds offer investors a good way to generate excess returns over public equities. Real estate investing is an actively managed business, which means that it is labor intensive, and success in this industry is highly correlated to the quality of the team. In real estate, the difference between a good manager and a bad manager can mean the difference between doubling your capital and a total loss.

A great team does not come cheap, and fees help managers attract and retain high-quality employees. However, there is a difference between fees that are used to create investment value and exorbitant fees that simply make the managers of private equity real estate funds wealthy at the expense of investors.

We believe that fees should always align with investment objectives and provide real value to the customer. In other words, transaction fees should be fair and help keep the lights on, but the real payday for a manager should be when the investor wins. Thats how Origin is set up.

At the extreme, investors should be wary of fees that are too low. On the other end of the spectrum, managers that charge fees for every service also should be avoided.

There are two questions to consider when evaluating fees:

Real Estate Private Equity Funds:

Private equity real estate funds provide accredited investors with a number of important benefits that are not readily available through other types of real estate funds, including preferred returns as well as tax advantages. For individuals who are seeking exposure to real estate and have at least $50,000+ to invest, this approach is compelling.

Here, we describe how private equity real estate funds are structured, the key benefits of investing in these funds and a summary of Regulation D Rule 506 that governs the types of investors that can participate in a private equity real estate fund. We then describe the different phases of developing properties a fund may undertake and provide a high-level summary of The Kona Estates Fund I, LLC, a private equity real estate fund available to accredited investors.

Read Also: Can A Non Profit Invest In Stocks

Private Equity Fund Structure Vs Deal Structure In Cre

When working with a private equity firm, there are two common structures funds and deals.

In a fund structure, a private equity firm raises capital for a broad purpose of real estate investment. At the time fund investors make an allocation of capital, they likely dont know which properties it will be used to purchase.

In a deal structure, capital is raised for a very specific deal so real estate investors know exactly which property they are investing in.

This distinction is important because fees can be charged at the deal level or at the fund level, depending on the structure of the investment. For example, a fund manager could charge an annual management fee for all of the assets in the fund. On the flip side, a single deal manager would charge fees based on the single property being purchased.

Potential investors should be aware of whether their real estate investment is in a fund or a deal, and if the fees are charged at the fund level or the deal level.