Deploying Significant Capital Into Privately Held Companies And Funds With High Growth Potential

Established in 1995, our $24.8 billion well diversified and high performing global portfolio contains privately-held companies through both direct investments and funds. Our activities are driven by our sector focus we invest in the industrial, healthcare, financial and business services, technology, and consumer/retail sectors.

In 2022, we opened our first international office for private equity in New York City. Having a team in the largest global investment hub enables BCI to foster new relationships while generating additional opportunities to invest capital through our direct and fund investment programs.

PRIVATE EQUITY PROGRAMPERFORMANCE

Annualized returns for the periods ended December 31, 202111Assets in the private equity program are valued annually at December 31. Returns for the program are calculated on an internal rate of return basis and benchmarks are presented on a time-weighted rate of return basis.

GLOBAL DISTRIBUTION OF PRIVATE EQUITY PROGRAM

As at December 31, 20211

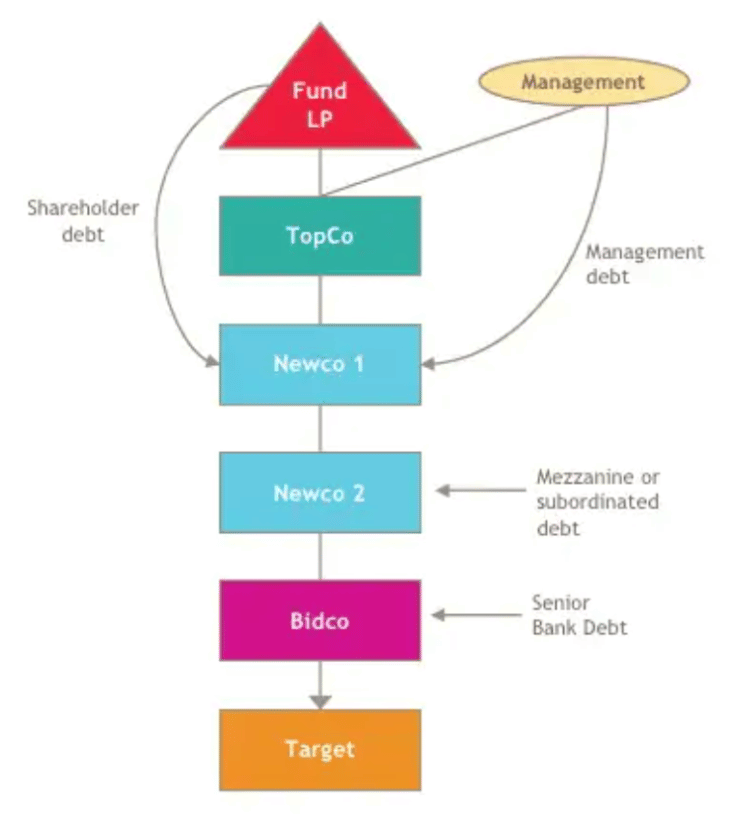

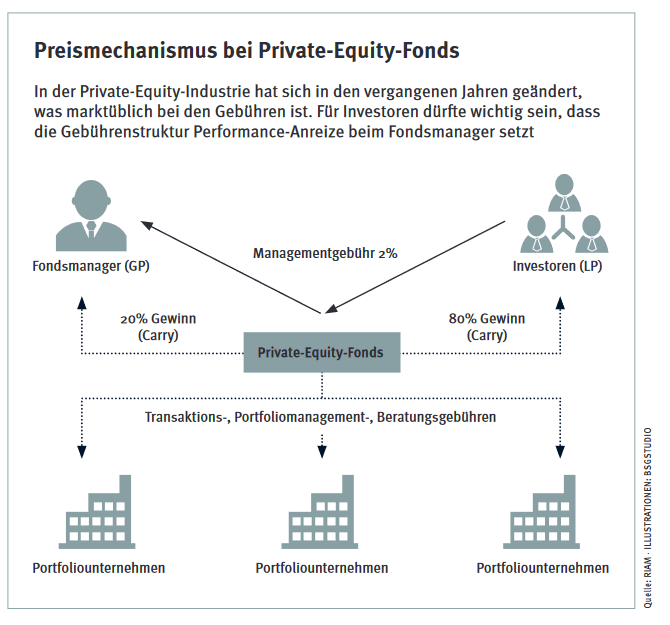

How Are Private Equity Funds Managed

A private equity fund is managed by a general partner , typically the private equity firm that established the fund. The GP makes all of the fund’s management decisions. It also contributes 1% to 3% of the fund’s capital to ensure it has skin in the game. In return, the GP earns a management fee often set at 2% of fund assets, and may be entitled to 20% of fund profits above a preset minimum as incentive compensation, known in private equity jargon as carried interest. Limited partners are clients of the private equity firm that invest in its fund they have limited liability.

You Can Invest In Unlisted Companies That May Become The Next Corporate Juggernauts But There’s A High Degree Of Risk

If youre looking to maximize your investment returns, you may want to consider private equity. Investing in private equity is a way to invest in companies that arent publicly listed.

In other words, you cant yet purchase their stocks. But they can prove to be thriving powerhouses in the future. As a private equity investor, youd get an early crack at their success.

Recommended Reading: Real Estate Investing Baltimore Md

Potential Risks Of Investing In Pe Firms

- Illiquidity. Unlike stocks, which are convertible to cash, private equity investments are typically illiquid. If an LP has a financial emergency and wants to liquidate funds, they usually canât touch private equity investments for five to 10 years.

- Opacity. Private equity investments donât have to comply with the same set of federal regulations as publicly traded companies, so there is limited transparency.

- Ethical impact. PE firms that do leveraged buyouts often cut costs in target companies in the drive for returns. This can result in job losses, inferior products, communities without local resources like newspapers or hospitals.

Who Should Consider Private Equity Investing

Private equity funds are out of reach for many investors because they tend to have substantial minimum contribution requirements.

How substantial? Let’s put it this way: Some private equity funds will allow you to buy in for as little as $250,000. Others have capital contribution requirements that reach up into the millions.

Many private equity funds are only available to institutional and accredited investors, who are thought to be more experienced and thus able to take on the risk of investing in securities not regulated by the SEC. An accredited investor is one with a net worth exceeding $1 million who’s earned an income above $200,000 or $300,000 if filing jointly for the past two years.

Don’t Miss: How To Fund Real Estate Investment

Isnt Private Equity Investing Associated With Illiquidity

TB: Yes, it can be. Liquidity is certainly not the same as when investing in more traditional asset classes. But what weve found is that investors often pay for liquidity which they dont use. So they might invest in a mutual fund because its more liquid than a private fund, but they land up staying invested for the long-term and not using that liquidity aspect. In the process, they could be missing out on the potential return opportunities historically associated with private equity investing.

It also depends on what the investor needs the liquidity for. Is it because the financial markets are stressed and they want to cash out quickly? Arguably, this is the worst time for a long-term investor to sell their assets but yes, it may be difficult to liquidate private investments in this scenario. That said, under normal market conditions, private equity can often be structured in funds that allow for periodic liquidity windows. These provide investors with the flexibility they need for personal situations .

Finally, technology is fueling an increasingly effective secondary market for private assets. In other words, its becoming easier for investors to find buyers and sellers of private assets, as opposed to being restricted to transacting through the manager holding their capital.

Are Private Equity Firms Regulated

While private equity funds are exempt from regulation by the Securities and Exchange Commission under the Investment Company Act of 1940 or the Securities Act of 1933, their managers remain subject to the Investment Advisers Act of 1940 as well as the anti-fraud provisions of federal securities laws. In February 2022, the SEC proposed extensive new reporting and client disclosure requirements for private fund advisers including private equity fund managers. The new rules would require private fund advisers registered with the SEC to provide clients with quarterly statements detailing fund performance, fees, and expenses, and to obtain annual fund audits. All fund advisors would be barred from providing preferential terms for one client in an investment vehicle without disclosing this to the other investors in the same fund.

Don’t Miss: How To Invest To Become A Millionaire In 10 Years

Why Companies Allow Private Equity Firms To Acquire Them

Understanding why a privately-owned business would want to sell to a private equity firm is key to defining how PE funds can create value.

A company may decide to sell itself to a private equity bidder for a variety of reasons. For example, a business may have reached a point where its entrepreneurial management style impedes growth, and a more professional approach is required.

Professional here may reference:

- Scaling growth processes

- Leveraging technologies

Business owners may also reach a stage in their career where they want to step back from the daily responsibilities of management.

Occasionally, strategically merging with another company in the same sector may stimulate growth and synergies. Finally, changes in the business value may prompt management to sell for cash.

Find Out How You Can Benefit When Wall Street’s Biggest Players Find Great Opportunities

Many investors see private equity investments as a gateway to the most lucrative opportunities in the financial markets. The professionals who run private equity companies raise substantial amounts of capital from investors, sometimes use the money as collateral to borrow more capital, and then go out to buy companies that are particularly attractive. Private equity typically purchases entire companies rather than taking a partial equity interest, and companies whose stock is publicly traded prior to a private equity buyout are typically no longer available in the public markets after the buyout. Therefore, to invest in private equity, you have to ask the following questions:

- Do you meet the Securities and Exchange Commission’s definition of an accredited investor who can invest in private equity funds?

- If so, is there a private equity fund accepting new money that will take you on as an investor?

- If not, are you willing to participate indirectly by investing in a private equity management company?

Recommended Reading: Is Yolo Etf A Good Investment

How Can I Get Into Private Equity With No Experience

If you can’t score an internship or a first job in private equity, try a related field like venture capital, investment banking, or asset management. These firms also have little interest in hiring inexperienced business school graduates, no matter how bright. Once again, this is a function of supply and demand.

What should I invest $1000 in?7 Best Ways to Invest $1,000

- Fixed interest.

How can I invest $200?

One of the best ways to invest $200 is to get involved with a dividend reinvestment program or a direct stock purchase program. With either one of these programs, you can buy stock directly from the company that issues it instead of having to work with a broker.

Are VC partners rich?

A successful VC for a top-tier firm can expect to earn somewhere between $10 million and $20 million a year. The very best make even more. Most everyone who has attained any kind of success in Silicon Valley seems to dream of becoming a venture capitalist.

Can individuals invest in Blackstone?

Hedge Funds SolutionsBlackstone invests in alternative investment strategies for leading institutional investors and sophisticated individuals, seeking attractive risk-adjusted returns.

Can I invest in Blackstone funds?What is private equity example?Where do private equity firms get their money?What happens when private equity buys a company?

Private Equity Real Estate Opportunities

Although most people associate private equity investments with the tech sector, real estate holds many private equity opportunities. The difference is that as opposed to investing in individual companies, youll be putting your money into specific real estate projects or developments that need investor capital.

Once your investment is made, you will typically become a limited partner in the particular real estate projects that are part of the offering. The general partner makes all the decisions, so you need to choose carefully.

Private equity real estate opportunities also usually have long hold periods where your investment capital is illiquid. Under most circumstances, profits come when the development is completed and sold.

Explore Benzinga’s favorite private equity real estate investment offerings.

You May Like: Is Buying Gold A Good Investment

What Is A Private Equity Firm

Private equity firms provide financing to non-public businesses. Some firms will focus on venture capital and search for relatively new companies for investment. Others may focus on leveraged buyouts. In some cases, they may even take a publicly-traded company private to enhance its profitability.

Depending on the size of the ownership stake, the firm may appoint new management and therefore have more control over the private companys day-to-day operations. A shift in the executive team can be significantly beneficial when the firm has expertise in the industry.

Some of the best firms raise capital by taking commitments from investors, often more prominent institutional investors, for a set amount of money. Given the scope of the investment, minimum investment amounts are typically quite high. The firm then takes that money and, in turn, provides capital to a private business it deems attractive. Each investment will have different parameters, and they are highly customizable based on the underlying companys needs.

A firm makes money from selling a business at a profit, plus a combination of management fees and performance fees that it charges its investors.

Sometimes, firms rely on loans or other forms of debt financing to supplement investor funds, or when they find an attractive investment but do not yet have capital from clients to invest. In this case, leverage will amplify the returns, whether positive or negative, of the investment.

Differences Between Investing In Private Equity And Public Stocks

- Private equity firms buy controlling stakes in the businesses they invest in, often paying a premium to acquire this control.

- A controlling stake enables owners and managers to have closer alignment, which may not exist in publicly traded companies.

- The management itself often selects the board of directors in a publicly-traded company, leading to poor oversight.

- PE firms do not have to report quarterly financial results to the public. Less frequent reporting allows companies to have a longer-term focus when making decisions.

- Private equity investments aggressively use leverage because the risk tolerance of the investor base is high. On the other hand, publicly traded companies operate with less debt, as investors are typically more averse to risk.

- Investments held in PE-backed businesses are more illiquid than publicly traded stocks, which are exchangeable for cash during market hours. By comparison, the liquidity for a private entity only happens when the entire business is sold, with a typical 5-year holding period.

Now that weve learned why its worth investing in private equity lets dive into the areas private equity funds can excel in, creating superior value and differentiating themselves.

Read Also: How Do I Invest In Foreign Stocks

What Is The History Of Private Equity Investments

In 1901, J.P. Morgan bought Carnegie Steel Corp. for $480 million and merged it with Federal Steel Company and National Tube to create U.S. Steel in one of the earliest corporate buyouts and one of the largest relative to the size of the market and the economy. In 1919, Henry Ford used mostly borrowed money to buy out his partners, who had sued when he slashed dividends to build a new auto plant. In 1989, KKR engineered what is still the largest leveraged buyout in history after adjusting for inflation, buying RJR Nabisco for $25 billion.

What Percentage Of Your Portfolio Should Be Allocated To Offshore Investments

IFSA has its own investment philosophy, but no two investors are ever the same. Percentages are very risk profile dependent. Fundamentally, a more aggressive strategy leans towards greater offshore exposure. You also have to consider your time strategy and where you are investing from.

When you look at South Africa, the reality is that the rand is very volatile. So you dont want to move around too much between different currencies. But, essentially, in my opinion, you should lean towards 40-45% in the offshore space.

Recommended Reading: Merrill Lynch Wealth Management Minimum Investment

What Public Companies Can Do

As private equity has gone from strength to strength, public companies have shifted their attention away from value-creation acquisitions of the sort private equity makes. They have concentrated instead on synergistic acquisitions. Conglomerates that buy unrelated businesses with potential for significant performance improvement, as ITT and Hanson did, have fallen out of fashion. As a result, private equity firms have faced few rivals for acquisitions in their sweet spot. Given the success of private equity, it is time for public companies to consider whether they might compete more directly in this space.

Conglomerates that acquire unrelated businesses with potential for significant improvement have fallen out of fashion. As a result, private equity firms have faced few rivals in their sweet spot.

We see two options. The first is to adopt the buy-to-sell model. The second is to take a more flexible approach to the ownership of businesses, in which a willingness to hold on to an acquisition for the long term is balanced by a commitment to sell as soon as corporate management feels that it can no longer add further value.

Why Do Investors Make Private Equity Investments

The simple reason why investors and funds make private equity investments is upside. Very few publicly traded stocks offer the profit potential that private equity offerings do. Once most companies have equity shares available on the stock market, its a free for all.

Buying private equity on the other hand is more like buying advance tickets to a rock show vs. buying them at the door. You get better seats for less money. On the day of the show, you can keep them or sell them at a profit. Except of course, the rewards for investors are much larger than getting good seats.

For example, before companies like Alphabet Inc. or Meta Platforms Inc. became household names and titans in the stock market, their operations were funded by private equity investors. Those early investors have made millions, if not hundreds of millions of dollars on their investments. Additionally, the cost of buying the kind of equity that original private equity investors have in those companies today would be prohibitive.

Even if you had enough money to buy that much of Google or Meta on the stock exchange, its highly unlikely you can get the kind of return on investment that the original private equity investors got. All this potential upside is why private equity is such a popular alternative investment.

Don’t Miss: Private Lenders For Investment Properties

Evaluate The Different Investment Strategies & Private Equity Firms

This step is probably the most important one so take your time to determine which investments are a good fit for your goals and abilities. This process is much like investing in other funds. Some considerations for investing can include current investment interests, previous investments, risk tolerance, and the funds options.

Investing in private companies can range from focusing on growth companies to traditional debt financing for long-tenured, family-run businesses.

In todays age, the private equity universe is massive. There is no one size fits all approach. Private equity firms come in all shapes and sizes so you need to find one that fits your needs.

See Related:How to Invest in Hydrogen

Investing In Private Equity Managers

Because of the uncertainty of investing in private equity funds, some investors prefer instead to buy shares of the companies that manage the funds. You can find some such companies, such as KKR and Blackstone Group , publicly listed on major exchanges.

When times are good for private equity funds, their managers also participate by taking a cut of their profits, and that benefits shareholders. However, investing in a manager doesn’t let you drill down on particular fund focus areas, leaving you exposed to the success or failure of the management company as a whole. That can lead to a better diversified portfolio, but it makes it impossible to generate the truly massive returns that a well-focused private equity fund can produce when its investment philosophy proves to be fortuitous.

Private equity has a reputation for high-end treatment and wealth generation, and it’s an exclusive area into which many investors can’t go. Even if you qualify, take a close look at private equity to ensure that the funds you pick fit well with your expectations and financial needs.

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool recommends KKR. The Motley Fool has a disclosure policy.

Recommended Reading: Investment Banking Valuation Lbos M& a And Ipos