Bric Investment Property Analyzer

The BRIC Investment Property Analyzer will take the complex work out of evaluating the return on investment for any residential property investment. Just adjust the sliders as purchase price, costs, rental occupancy, interest rate, property and tax rate of any investment property and get back the expected monthly return on your cash invested. Use this tool to evaluate potential investment property options. This calculator is easy to use but can also be fine-tuned using option inputs to match your specific situation or any local variations.

The calculator keeps a running tally of the most common expenses of owning andproperty management fees. The calculator assumes that the profit you would have made would be taxed aslong-term capital gains and adjusts the bottom line accordingly. The calculator tabulates propertymanagement costs costs for all parts of the buying and renting situations. All figures are in currentdollars.

Initial costs are the costs you incur when you go to theclosing for the home you are purchasing. This includes the down payment and other fees.

Gross Rental Income is the amount of money you will receive from theestimated occupancy rate multiplied by the daily rental rate compounded yearly with the rent growth rate.

Property Management Fees are the expenses you will have to payto market your home, maintain it, and manage renters.

Roi For Financed Transactions

Calculating the ROI on financed transactions is more involved.

For example, assume you bought the same $100,000 rental property as above, but instead of paying cash, you took out a mortgage.

- The downpayment needed for the mortgage was 20% of the purchase price, or $20,000 .

- Closing costs were higher, which is typical for a mortgage, totaling $2,500 upfront.

- You paid $9,000 for remodeling.

- Your total out-of-pocket expenses were $31,500 .

There are also ongoing costs with a mortgage:

- Let’s assume you took out a 30-year loan with a fixed 4% interest rate. On the borrowed $80,000, the monthly principal and interest payment would be $381.93.

- Well add the same $200 per month to cover water, taxes, and insurance, making your total monthly payment $581.93.

- Rental income of $1,000 per month totals $12,000 for the year.

- Monthly cash flow is $418.07 .

One year later:

- You earned $12,000 in total rental income for the year at $1,000 per month.

- Your annual return was $5,016.84 .

To calculate the property’s ROI:

- Divide the annual return by your original out-of-pocket expenses to determine ROI.

- ROI = $5,016.84 ÷ $31,500 = 0.159.

- Your ROI is 15.9%.

Research The Market Carefully

The triple-location message is particularly true when it comes to considering short term investments in rental properties. The fundamental business metric to balance would be to shoot for a combination of a property that offers an appeal to short term renters and profitability.

Financial analyses can use rental comparisons and expected expenses using estimates for nightly rates in the area to determine if the projected Return on Investment meets the investors requirements.

Also Check: How To Invest In A Specific Company

How Do I Maximize My Roi In My Rental Property

The best way to maximize your ROI in your rental property is to use the proper tools to help create accurate calculations. Mashvisorâs Rental Property Calculator provides extremely accurate calculations so investors can be sure of their real estate investment decisions. This tool allows investors to use their own data to create the most precise calculations. Depending on how you financed your rental property, you will need to look at either cap rate or cash on cash return to know your ROI. The Rental Property Calculator makes these calculations for investors while also determining ROI on a property. This tool ensures investors will be making money in real estate.

What Cap Rate Is A Good Investment For Vacation Rentals

If the CAP rate is considered a good metric for your investment, then what is the golden number? As with most things in vacation rental investments: it depends.

A higher CAP rate, typically speaking, projects for a better investment, but it could also mean that its riskier. Good depends on how youd like to define it. Striking a balance between high investment and risk is what will really determine what a good CAP rate for your vacation rental is.

With that in mind, its advisable to hover between a 4-6% CAP rate. Low CAP rates around 1 to 2% could still be profitable, but theyre typically found in highly saturated areas like bigger cities with a well-established short-term rental market.

On the other hand, a high CAP rate could be a good investment, but its better suited for the gambler willing to take more of a risk.

Keep in mind too, that CAP rates can be very specific to neighborhoods, boroughs, and particular areas. Sometimes if you zoom too far out and look at an entire county or city, youre not going to get an accurate representation of what the CAP rate in your specific locality would be.

Take New York City, for example. Manhattans CAP rate came in at 3.9%, while just a stones throw away in Queens, the CAP rate is 5.03%. Your best investment should consider all these factors as no two CAP rates are created equal.

Read Also: Where To Find Stocks To Invest In

Outsource A Remote Management Agency Like Jetstream

Outsource cleaning management or a realtor to have boots-on-the-ground, but hire an agency like Jetstream to manage all remote responsibilities. Jetstream offers:

- 24/7 multilingual guest communications

- Timely payment of bills

- Guest screening

With Jetstream, there are no up-front payments required or hidden fees. Youll pay a percentage according to your occupancy rate, meaning you wont pay if you have zero guests. Since we help manage your property remotely, while you keep ownership of all your listings and reviews, its easy to scale your business and build your brand.

What Are The Pros And Cons Of Vacation Rentals

Owning a vacation rental property has benefits and pitfalls. The pros of buying a vacation rental property are:

- You get a monthly passive income

- You invest both for cash flow and asset appreciation

- It can become part of your retirement plan

- It has a higher cash flow, CoC, and ROI than long-term rentals

Cons to owning a vacation rental property include:

- The real estate market isnt 100% predictable

- You may need to pay for unexpected expenses

- It comes with higher taxes and liability than other types of investments

Don’t Miss: California Investment Adviser Registration Checklist

Calculate Expenses & Potential Monthly Income

After youve chosen a location and found a few properties that are feasible for your budget and meet your needs, calculate whether youll be able to make any money from your property. Remember that areas with high tourism tend to have higher property values but also higher rental income potential.

Ensure that you can afford the vacation rental property, and always examine the costs of nearby vacation rentals and compare them to your monthly financing and operational costs. It will be easier to calculate your rental property income if you can get the occupancy rates for a vacation rental in that area.

Here are the basic expenses vacation rental purchasers should consider as well as how to calculate your potential monthly income:

Digging Into The Deal

Republic is a marketplace that allows non-accredited investors to invest in highly vetted opportunities in start-ups, real estate, video games, and cryptocurrency. Republic’s real estate platform routinely offers the chance to invest in different types of real estate deals, including fix-and-flips, nontraded real estate investment trusts , and condos. I’ve participated in several deals, which have delivered decent returns overall.

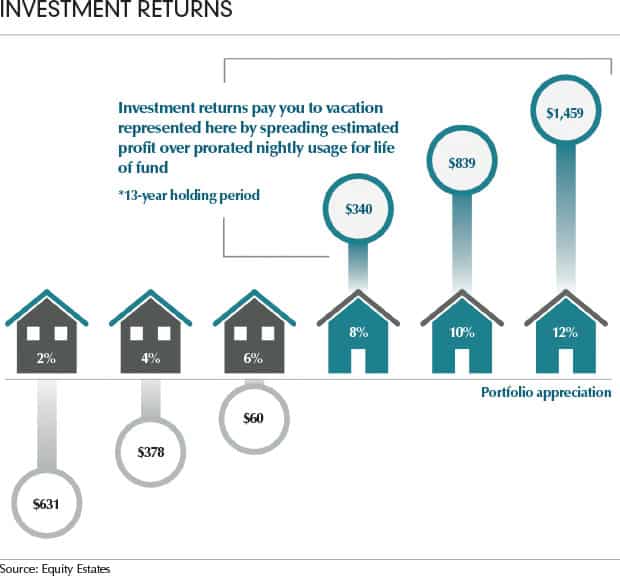

One of its latest offerings is a North Carolina Beach Rental Portfolio. The fund will focus exclusively on owning single-family beach vacation rentals in North Carolina. It enables anyone to own a piece of North Carolina beach real estate, no matter where they live, for as little as $250. Investors also don’t need to worry about managing the properties, since an experienced management team takes care of everything.

Investors in the fund can earn passive income from vacation rentals. They could also gain from home price appreciation upon an eventual sale of the portfolio. The fund expects to acquire and manage properties for three to five years and then liquidate the portfolio. It’s targeting to generate an internal rate of return in the 12% to 18% range. As a bonus, those who invest more than $10,000 into the fund can get free lodging at one of the properties.

Don’t Miss: How To Pull Equity Out Of Investment Property

Equip Your Vacation Rental With Useful Amenities

Stocking your vacation rentals with the right amenities determines how comfortable your guests stay will be. Having a mix of essentials and a few extras is the best way to create the perfect home away from home for your guests.

-

Provide the basics

Its best to get the basics right first, then think about what extras youd like to include. When it comes to the basic amenities you provide, your main goal is to ensure that your guests still have all the comforts that they have at their own homes.

To make sure you dont forget anything important, its good practice to follow a reliable hosting checklist when stocking your vacation home.

-

Add extras to impress your guests

It is always a good idea to go the extra mile and provide something on top of the basics. By upgrading your property with a few luxuries, you can take your rental to the next level. Popular extra amenities include hot tubs and free Wi-Fi.

Youve Taken The Plunge Now Get The Advertising Right

Even if youve done your due diligence on everything else, you dont want your vacation rental investment sitting empty. Potential guests need to know its out there and available.

How you market a vacation rental investment property can be the difference between low ratings and profit losses and a healthy ROI. But you need to know the channels that have the most reach and target the right audience, wherever your vacation property is located. Check out this report on multi-channel distribution for vacation rentals to help you maximize rental income and minimize vacancy.

Here are some channels you need to consider.

Online travel agencies

Lets take a look at the most popular distribution channels out there to help market your short-term rental property:

1. Airbnb: The most visited online rental agency in 2022 and a great option for getting your listing out there without paying annual feesespecially for hot-spot destinations or city rentals.

2. Vrbo: A popular platform for listing full-house rentals for families or travel groups. You can pay annually or use their pay-per-booking model.

3. Homeaway: A great place to list private rentals for families for a yearly fee, but with fewer global listings than Airbnb.

4. Booking.com: A comprehensive OTA for all-things travel including flights, car rentals, hotels, and short-term vacation rentals.

Direct bookings

Other ways you can get direct bookings include:

Also Check: Investing In Gold In South Africa

Pros & Cons Of Buying A Vacation Rental Property

Many investors will ask themselves is owning a vacation rental a good investment? While owning a vacation rental property is often a pleasurable experience, there are some drawbacks that you must consider, like maintenance and management costs. So, if youre considering investing in vacation rentals, here are the main benefits and disadvantages:

| PROS | CONS |

|---|---|

| A vacation property can provide an additional source of income | Whether the property is rented or not, you’ll be responsible for utilities, maintenance, taxes, and property management fees |

| Rental income can help to offset property and vacation expenses | You might have to pay a property manager to oversee daily operations |

| You will be able to take advantage of tax write-offs | Vacation rental properties are typically hit harder during economic downturns because people often pass or lessen their vacation trips to save money |

| The property’s value could skyrocket | Since vacation rental properties are seasonal and off-peak seasons generate lower per-night rent, cash flow can be inconsistent |

| You are free to use your vacation rental property whenever you want | Finding renters can be challenging, especially for new vacation rental property owners |

| Build your equity and wealth | Some cities and HOAs impose strict restrictions and regulations on short-term vacation rentals that you must adhere to |

What Is The 1% Rule

The 1 percent rule is a general rule of thumb for those investing in rental properties. Its used to determine how much you should pay to purchase a rental property.

The 1% rule is useful for any investor that has hundreds of opportunities to go through. Going in-depth on every opportunity would take months to complete. The 1% rule helps to minimize your choice and find the best investment quicker.

The rule is, when looking at rental property investment, ideally, you want to charge 1% of the purchase value as your monthly rent.

For example, you buy a rental property for $100,000. Using the 1% rule, you would need to ensure you could charge $1000 in rent per month.

This rule is not full-proof and is used as a general guide to help investors spot a good return among a huge list of potential investments and eliminate any bad deals.

Some critics will argue that the 1% rule isnt a great rule at all. This is because properties in bad areas will likely meet the 1% rule, and it doesnt take into account the age or damage of the property.

Therefore, critics say that investors using the 1% rule will end up with properties in poor condition in dodgy parts of towns. The 1% rule also does not consider operating expenses or cash flow.

Don’t Miss: App That Takes Change And Invests It

Easily Invest In Vacation Rentals

Vacation rentals can be an excellent real estate investment with low barriers to entry and many tax benefits. Given the high demand and prices for specific locations, youre likely to have a property that provides consistent year-on-year cash flow while appreciating considerably in value.

Our mission at Arrived is to give real estate investors opportunities to invest in homes and take advantage of property appreciation and rental income without the hassle of finding, maintaining, or managing a property. Our fractional real estate investing model helps to take advantage of higher rates in housing markets in the hottest locations with no significant down payment or upfront costs. Look through the properties available to get started with Arrived.

Occupancy Levels For Vacation Rental Units In Costa Ricas Southern Pacific Zone

Although Costa Ricas southern pacific receives less tourism than its central and north pacific regions, the competition is also much smaller.

Moreover, the south pacific Osa region and Costa Bahia Ballena, have been slowly gaining fame thanks to their relative proximity to San Jose and also to their greener year round environment.

Furthermore the growing expat community and also music festivals like Envision have helped peak interest and drive traffic to the region.

You May Like: Can You Buy An Investment Property With A Va Loan

Investment Info And Numbers On Vacation Property Investing In Costa Rica

Many vacationers to Costa Rica find themselves falling in love with this country. Not only are the locals, the Ticos, warm and gracious hosts, Costa Rican nature is powerful and overwhelming and very easy to fall in love with.

Coupled with low property prices, and multiple opportunities many make rash investments without knowing what to expect on expenditures or income. If you too are thinking of investing in Vacation Rentals in Costa Rica here are some numbers and tips for making a sound investment.

The Importance Of Location For Vacation Rental Properties

The location in which you buy your next vacation rental investment property will greatly impact its performance. Primary cities like San Diego and Miami, have proven to be great spots for savvy investors. However, their return on investment isnt without a significant caveat: availability. Primary cities have proven so lucrative for vacation rental investments that opportunities in these markets have lessened as their popularity grows. That means its time for investors to consider alternative cities or those that are less popular but share a similar earning potential.

According to the National Association Realtors , sales of investment homes increased 4.5 percent year-over-year, a figure that has risen steadily for the past seven years. Despite a smaller share of distressed properties coming onto the market, investment purchases reversed course after declining for four straight years, said Lawrence Yun, NARs chief economist.

Steadily increasing home prices and strong rental demand appear to be giving more individual investors assurance that purchasing real estate will diversify their portfolios and generate additional income if they decide to rent out the home.

Read on to learn exactly where to look when choosing the right investment property.

Want to learn how to get started investing in your local real estate market?

Read Also: Jackson Real Estate Investment Group

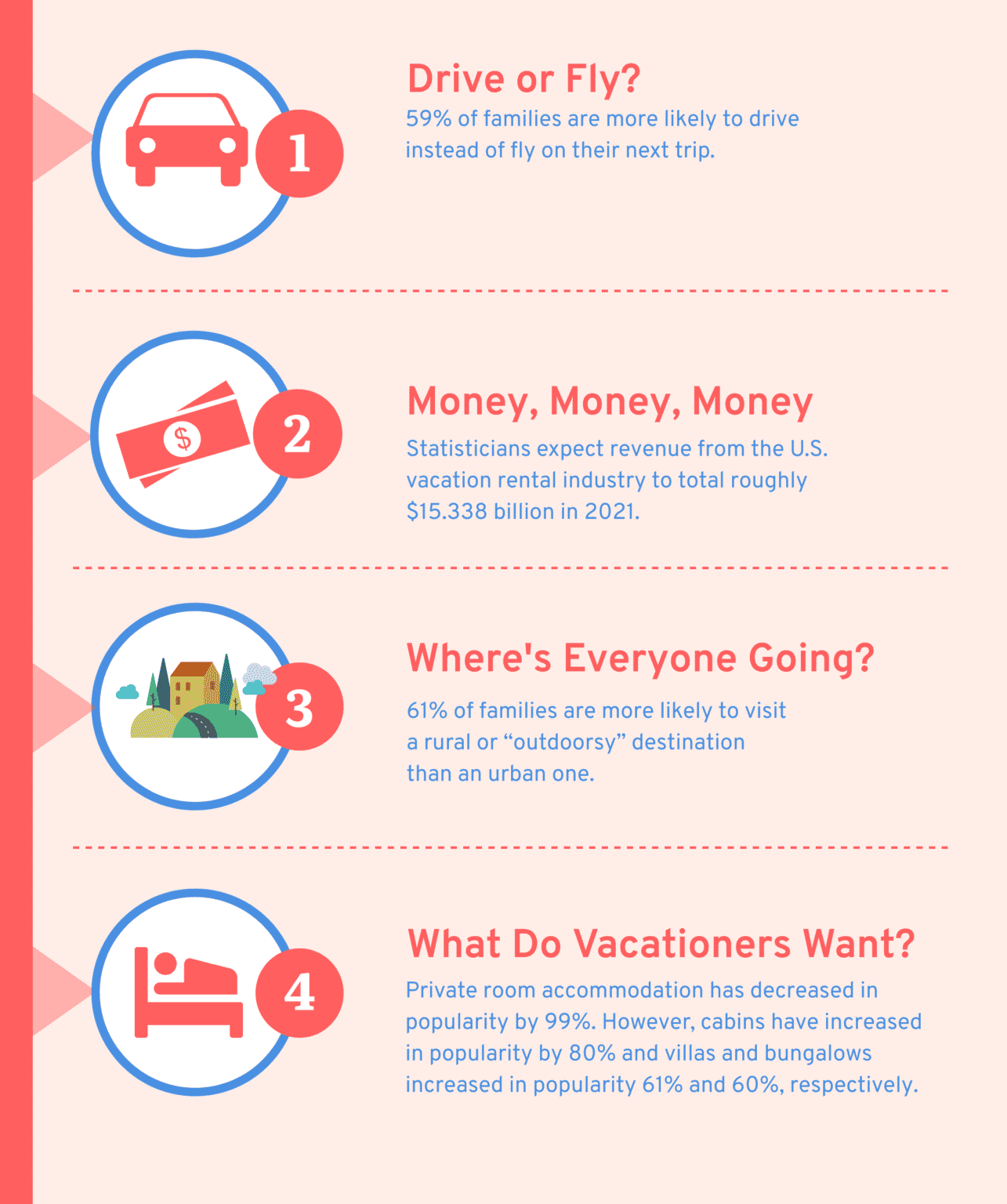

Why Invest In Vacation Rental Properties

First, lets review why vacation rental investment is currently such a hot topic. The market for vacation rentals is booming at a very fast rate. Plenty of homes are being rented as vacation rentals now more than ever before.

Renters come from all over the world seeking vacation rental properties in the United States. This trend continues to grow, which makes it an ideal time for investors to use this strategy to build their vacation rental portfolio growth.

Determine Your Buying Power

The first thing you should do is meet with a certified public accountant to get advice on your personal finances. This way youll know how much you can pay and how to make the most clever decision. During this meeting, you should be able to determine:

- The percentage of the downpayment that you need to make based on the purchase price and your savings

- The time you can afford to pay for the property yourself in case you cant rent it right away

- If you can afford closing costs along with other associated expenses

- If there are any tax benefits to buying this property, how much taxes are left to pay, and insurance costs

Becoming a homeowner comes with attained liability. A CPA and a lawyer can help you reduce risk levels.

Read Also: You Invest 10000 In A Complete Portfolio