Both Import And Export Prices Declined On A Year Over Year Basis

US Import Price Index by End Use All YoY NSA and US Export Price By End Use All Commodities YoY NSA . Monthly data as of 10/31/2022.

Finally, the Fed has also ramped up its quantitative tightening programthe process of allowing its balance sheet to shrink by up to $95 billion per month. The aim is to reduce it by about $2.5 to $3 trillion over the next few years, bringing it down to pre-pandemic levels relative to GDP. Quantitative tightening is designed to work through several different channels. The most powerful, in our view, is that it signals that money is getting tighter. When combined with higher interest rates, the signal leads investors to reduce risk.

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

Our High Yield Strategy

Our experienced, dedicated high yield teams employ a consistent investment process which has been tested over a range of market cycles and conditions. This process is centred on the philosophy that the key to superior long-term potential returns in the fixed income market is compounding current income and seeking to avoid principal loss through fundamental credit analysis and macroeconomic research.

Our robust bottom-up credit research process focuses on identifying companies with improving credit trends, while the top-down component seeks to identify risks and opportunities associated with the overall economy and market. In this way we aim to minimise default risk and manage volatility through active management, while pursuing high yielding opportunities and potentially generating capital growth.

AXA IM offers a range of high yield strategies investing within and across regions, sectors and maturities.

- 03 November 2022

- 03 November 2022

- 25 October 2022

Read Also: Wealth Management To Investment Banking

Example Of Fixed Income

To illustrate, let’s say PepsiCo issues fixed-rate bonds for a new bottling plant in Argentina. The issued 5% bond is available at face value of $1,000 each and is due to mature in five years. The company plans to use proceeds from the new plant to repay the debt.

You purchase 10 bonds costing a total of $10,000 and will receive $500 in interest payments each year for five years . The interest amount is fixed and gives you a steady income. The company receives the $10,000 and uses the funds to build the overseas plant. Upon maturity in five years, the company pays back the principal amount of $10,000 to the investor who earned a total of $2,500 in interest over the five years .

What Comprises Fixed Income Investment

It is important to understand that fixed income funds are not a different category of funds in the mutual funds domain. Their identity is defined by their investment style and expected returns. Some common fixed income generating products are:

Exchange Traded Funds

These are funds that are listed and traded on the stock exchanges. Nifty, S& P, BSE Sensex are some of the indexes these funds associate with. ETFs can be traded in the cash market on a day to day to basis with Gold ETF being one of the popular choices among its offerings.

Debt Funds

Debt funds invest in safer instruments like government bonds, corporate bonds and related securities. These are low risk, low return, stable investment platform that do not invest in volatile stock markets.

Money Market Funds

Investment in money market funds take the direct brunt of any increase in interest rates and are therefore best suited for short periods investment like upto 90 days. They generate a steady income and include commercial papers, short term certificates of deposits, bankers acceptance, etc.

You May Like: Short Term Rental Investment Property

Read Also: How To Invest On Angellist

Gaming And Leisure Properties Inc

Gaming and Leisure Properties Inc is a company that is focused on acquiring, financing, and owning real estate. But not just any real estate is looked at the company only cares for properties around tourist areas that could support a casino. More specifically, the focus is on the likes of Hollywood, Baton Rouge, and Nevada.

Gaming and Leisure Properties enjoys strong margins, which are more than double the industry average. As a result, shareholders have been rewarded with a with a quarterly dividend that has been growing alongside earnings.

There has also been the occasional special dividend when there is surplus cash. This is paid in addition to the quarterly payment and adds to the total return of the investment. One was in 2014 for $11.84 per share, compared to the normal $0.52 per share quarterly dividend at the time. In other words, Gaming and Leisure Properties is not shy about rewarding shareholders when the opportunity arises.

This is a great investment opportunity with a high yield, adding to an investors bottom line to help with their current or future income needs.

Analyst Ratings For Every High Yield Bonds Etf

This is a list of all US-traded ETFs that are currently included in the High Yield Bonds ETF Database Category by the ETF Database staff. Each ETF is placed in a single best fitETF Database Category if you want to browse ETFs with more flexible selection criteria, visit our screener. To see more information of the High Yield Bonds ETFs, click on one of the tabs above.* Assets in thousands of U.S. Dollars. Assets and Average Volume as of 2023-01-12 15:19:06 -0500

The following table displays sortable historical return data for all ETFs currently included in the High Yield Bonds ETF Database Category. For information on dividends, expenses, or technical indicators, click on one of the tabs above.

The table below includes fund flow data for all U.S. listed High Yield Bonds ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U.S. Dollars.

The following table displays sortable expense ratio and commission free trading information for all ETFs currently included in the High Yield Bonds ETF Database Category.

The following table includes ESG Scores and other descriptive information for all High Yield Bonds ETFs listed on U.S. exchanges that are currently tracked by ETF Database. Easily browse and evaluate ETFs by visiting our ESG Investing themes section and find ETFs that map to various environmental, social, governance and morality themes.

Also Check: Best Investment Plan For Kids

What Is Fixed Income

Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until their maturity date. At maturity, investors are repaid the principal amount they had invested. Government and corporate bonds are the most common types of fixed-income products.

Unlike equities that may pay out no cash flows to investors, or variable-income securities, where payments can change based on some underlying measuresuch as short-term interest ratesthe payments of a fixed-income security are known in advance and remain fixed throughout.

In addition to purchasing fixed-income securities directly, there are several fixed-income exchange-traded funds and mutual funds available to investors.

What Is The Difference Between Fixed

Fixed-income securities are debt instruments that pay interest to investors along with the return of the principal amount when the bond matures. Equity, on the other hand, is issued in the form of company stock and represents a residual ownership stake in the firm, and not a debt. Equity does not have a maturation date, and while it may pay a dividend makes no guaranteed payments to investors. In general, equity is a higher-risk/higher-return security than a company’s bonds.

Read Also: Use Heloc For Down Payment On Investment Property

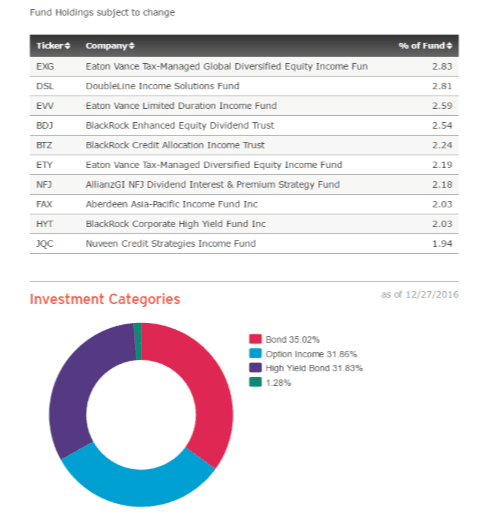

Graniteshares Hips Us High Income Etf

- Assets under management: $34.3 million

- Dividend yield: 9.2%

- Expenses: 3.19%*

The GraniteShares HIPS US High Income ETF , $14.76) is one of the most expensive income investments on this list at 3.19% in annual expenses. But it’s important to note that if you invested in each of its 61 holdings individually, you’d still be eating most of those same fees.

HIPS, which stands for “high-income pass-through securities,” seeks to track the performance of the TFMS HIPS Index, which invests in well, high-income securities with pass-through structures.

With HIPS, you leave the investment selection to the index provider. It selects the 15 securities with the highest yields and lowest volatility from all four high-income categories: MLPs, REITs, BDCs and CEFs. All of the securities are equally weighted. It then adjusts the weight of each sector to limit volatility. Each of the four must have at least a 15% weighting the MLPs cannot exceed 25%.

The index is reconstituted once a year. It rebalances if the MLP weighting at the end of a quarter exceeds 25%. Currently, CEFs account for slightly more than 55% of HIPS’s assets. BDCs, REITs and MLPs were each around 15%.

HIPS has maintained a 10.75-cent monthly distribution per unit since inception. And a nice bonus: the ETF doesn’t generate a K-1 tax form something you’d have to deal with if you individually owned any of the partnerships it holds.

* Includes acquired fund fees and other expenses

Fixed Income Pros & Cons

-

More stable returns than stocks

-

Higher claim to the assets in bankruptcies

-

Government and FDIC backing on some

-

Returns are lower than other investments

-

Susceptible to interest rate risk

-

Sensitive to Inflationary risk

Some government bonds like Treasury Inflation-Protected Securities are indexed to changes in the inflation rate and protect investors accordingly.

Read Also: How Do I Invest In A Specific Company

How Fixed Income Investments Work

Fixed income investments focus on providing a reliable stream of income. The most common fixed income investments are usually bonds, which are fixed term loans issued by companies and governments looking to raise money. UK government bonds are called Gilts, whilst in the US government bonds are known as Treasury Bills, or T-Bills, and German federal bonds are referred to as Bunds.

A bond issuer will pay investors a fixed rate of interest for a set period, at the end of which the loan is repaid. Investing in individual bonds can be particularly risky, as their fortunes rely on the specific issuer, whether a corporation or government, and therefore in case of insolvency they may fail to repay your investment and you could lose money.

As a result, many investors opt to put their money into funds that invest in bonds. This helps reduce the risk because rather than just buying bonds from a single issuer, your money is spread between range of different fixed income holdings. Some bond funds will invest solely in a basket of bonds issued by companies, while others will focus purely on government bonds, and some will invest in a combination of these. As with all investments the rule of thumb is that the higher the potential return on offer, the riskier the investment. Bonds which are rated from AAA down to BBB by credit ratings agencies such as Standard & Poors or Moodys are classified as investment grade and are deemed to be lower risk.

Performance Through Market Cycles

For high yield bonds, credit cycles tend to drive performance more than any other single factor, so a proper understanding of the stages of the economic cycleand their investment implicationsis critical. Below we highlight the key components of a typical market cycle and discuss how we would typically expect high yield bonds to perform in each phase.

Components of the Credit Cycle

For illustrative purposes only.

Recommended Reading: Aiv Apartment Investment And Management

Our Philosophy And Approach

The US High Yield Bond Strategy objective is total return, and secondarily, current income. It seeks to generate a total return in excess of that of the index by investing primarily in U.S. dollardenominated high yield corporate bonds and other fixed and floating-rate corporate securities. The strategy is designed to provide a concentrated yet balanced portfolio primarily focused on the traditional U.S. high yield bond investment opportunity set. We aim to actively deliver alpha in three primary ways:

- Experienced Team

Our strategy is managed by a seasoned team of experienced high yield professionals, the core of which has been together for over 15 years and has managed through multiple market cycles. Our team focuses exclusively on the high yield market and takes a collaborative approach to the portfolio, ensuring that every idea that makes it into the portfolio has been heavily vetted by the entire team and considered from multiple perspectives.

- Proprietary Fundamental Research

We rely on proprietary fundamental bottom-up research to uncover inefficiencies in the high yield market and identify high-conviction total return opportunities for our portfolio. We assign a proprietary credit rating, spread4 target, and ESG score5 to each name that we assess. These metrics force us to identify specific catalysts for future spread compression and total return, creating a natural sell discipline in our portfolio.

- Concentrated Portfolio of Best Ideas

Disinflation Is In The Pipeline

U.S. Producer Prices Index U.S. PPI Unprocessed Nonfood Materials Less Energy , U.S. Producer Prices Index Processed Goods For Intermediate Demand , U.S. Producer Prices Index Finished Goods , NSA , YoY%. Monthly data as of 10/31/2022. The U.S. Producer Price Index is a measure of the change in the price of goods as they leave their place of production. Shown in the chart is the year over year percent change for each index.

The steep inversion of the yield curve , which has historically been a reliable signal of recession in a year’s time, also suggests that credit availability is tightening which generally leads to slower growth.

Don’t Miss: Buy Multi Family Investment Property

Important Considerations For Canadian Taxpayers

With any investment, what you get to keep after taxes is more important than what you earn. Canada Revenue Agency has very specific rules governing the tax treatment of the interest paid to you on your fixed-income investments. All payments due to you are considered taxable in the year they are declared, regardless of whether you actually receive the income. Therefore, for investments like stripped bonds, which accrue interest that is not received until maturity, tax planning holds special challenges. Tax-sheltered funds like RRSPs and RRIFs are good vehicles to hold special types of fixed-income securities. You should consult your tax advisor with specific questions about the effects of taxation on your investments.

Make sure to speak with your CIBC Wood Gundy Investment Advisor to find out if fixed income investments are appropriate for you and your long-term financial plans.

Use our Find An AdvisorOpens a new window in your browser. tool to locate a CIBC Wood Gundy Investment Advisor near you and take the first step to achieving the financial future you want.

The information contained herein is considered accurate at the time of posting. CIBC and CIBC World Markets Inc. reserve the right to change any of it without prior notice. It is for general information purposes only.

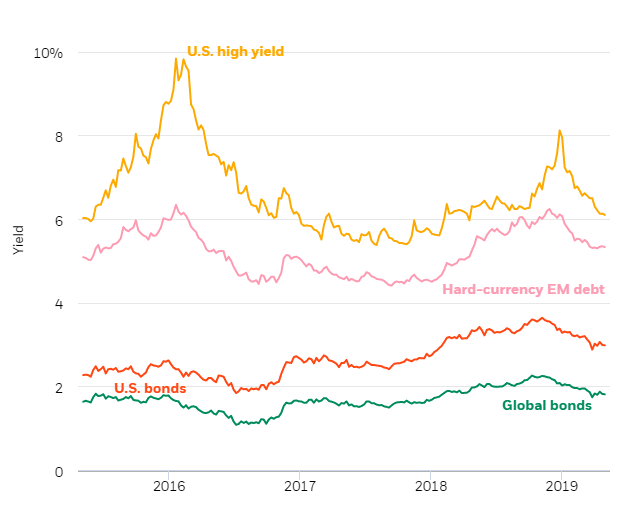

Reasons To Consider High Yield Bonds

What makes high yield corporate bonds different from investment grade corporate bonds?

Lower credit ratingsHigh Yield Bonds have lower ratings due to the potentially greater risk involved. This means that interest payments may not be made and even the principal may not be repaid.

Shorter maturitiesThese bonds are typically issued with shorter maturities. They are also less likely to have , which means that if a companys financial condition or credit rating improves, the issuer can call its outstanding bonds and take advantage of lower funding rates.

Emerging companiesWhile many high yield bonds are issued by former investment grade companies in decline, the high yield market also provides financing opportunities for emerging companies seeking working capital for expansion or to fund acquisitions.

High yield bonds hold the potential for higher returns for two reasons.

Higher coupon ratesIn general the issuers of high yield bonds are considered less likely to make interest payments than issuers of investment grade corporate debt. Because investors are being asked to assume this risk, high yield bonds tend to come with higher coupon rates, which can generate additional investment income.

Capital appreciation potentialCompanies issuing high yield bonds have the potential to turn around their financial standing, creating the opportunity for investors to realize capital gains as bond values increase, due to improving business conditions or improved credit ratings.

Also Check: Best Blockchain Technology To Invest In

Use Caution When Investing In High

High yield often translates to high risk. Keep in mind that high-yield funds often invest in bonds with low credit quality. These high-yield bonds also are called “.”

High yields are tempting for income purposes, but the market risk on these bonds is similar to that of stocks. High-yield bonds can fall in price even as conventional bonds are rising in price.

High-yield bond funds also might hold long-term bonds, which have higher interest-rate sensitivity than bonds with shorter maturities or lengths. When interest rates are rising, bond prices are often falling. The longer the maturity, the greater the sensitivity.

When interest rates are rising, long-term bonds often fall more in price than short- and intermediate-term bonds.

Spdr Bloomberg Barclays High

Another highly traded ETF that invests in high-yield bonds is JNK, which had an SEC Yield of 3.79% as of May 2021 and an expense ratio of 0.40%. As the ticker symbol suggests, JNK invests in bonds with credit quality below investment grade. The maturities average at intermediate term, which is generally between three and 10 years.

Read Also: How To Get Into Impact Investing