How To Record A Stock Transaction Through Journal Entries In Quickbooks

Here are the steps to record a stock transaction through journal entry in QuickBooks:

Step 1: Press on the plus button and then press the option for Journal Entry.Step 2: Select the Expense account. Now add the amount in the debit column.Step 3: In the second line of the journal entry, select the owners or partners equity.Step 4: In the credit column, add the purchase amount. Now click Save and Close button.

Is Owners Equity The Same As Owners Contribution

You may have done this when you first set up your bank account. Maybe you needed to transfer some money to open the account, but it came from personal funds. Thats Owners Contribution. Owner Contribution increases equity in your company just as Owner Draw decreases equity in your company.

What is an owners contribution?

Owners contribution is any time you pay for business expenses with personal funds or transfer personal funds to a business bank account. So whenever you transfer money to cover other things from your staff to your business, thats Owners Contribution.

How is owners contribution calculated?

The owners equity is calculated by adding up all the assets of the business and deducting all of its liabilities.

What Does Owner Investment Mean In Quickbooks

With QuickBooks Online, you can record the personal money you use to pay bills or start your own business. Accountants call this a capital investment. These funds come from you as an owner, partner, or other owners.

What does investment by owner mean?

In simple terms, owner equity is defined as the amount of money invested by the business owner minus any money taken by the business owner.

What type of account is owner investment?

Another partnership equity account, owner or member capital, represents the contributed, invested and profitable capital in a business. Carrying a balance on this type of account increases the companys equity. Often, partnerships or sole proprietorship use this type of equity account.

Don’t Miss: Term Sheet For Venture Capital Investment

How Do You Record Investments On A Balance Sheet

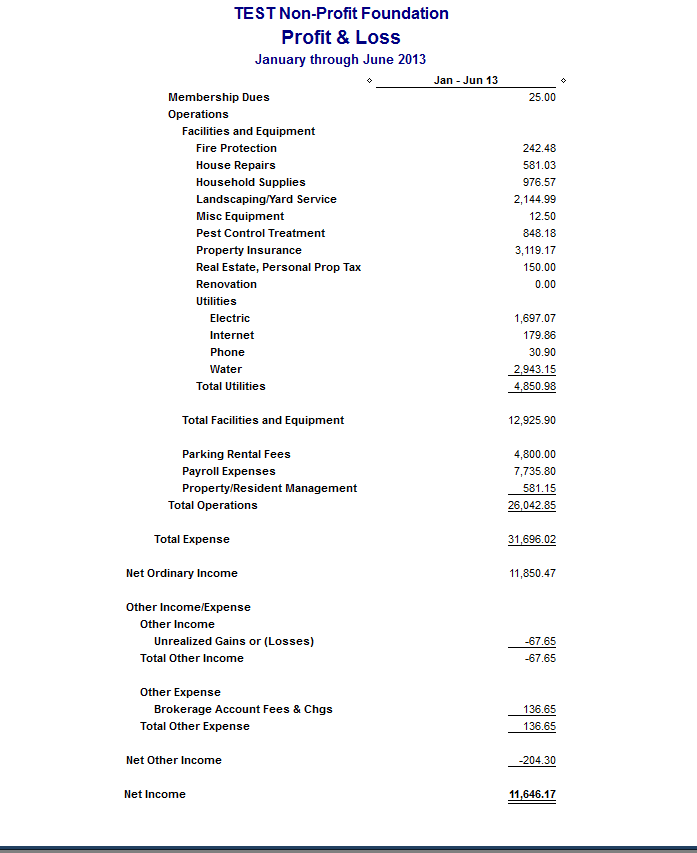

You report the investments listed in the balance sheet at their actual value, not the price you paid for them. If stocks have changed in value since you bought them, report the change as an unrealized gain or loss in the equity section of the owner.

How do you record profit from investments?

The investor records its share of the income of the investee as income from investment in the income statement. For example, if a firm owns 25% of a company with a net income of $ 1 million, the firm reports a return on investment of $ 250,000 under the equity method.

How are investments recorded on the balance sheet?

Investments are shown on a balance sheet in several ways: as common or preferred shares, mutual funds and notes payable. Investments used to generate cash in the current operating period are shown as current assets and are called treasury balances or marketable securities.

What Are The 4 Types Of Financial Assets

a contractual claim for something of value Modern economies have four main types of financial assets: bank deposits, stocks, bonds, and loans.

How many types of financial assets are there?

With land and gold, you can touch and feel the actual physical asset, but with financial assets, you can only touch and feel something that represents the valuable asset. The three financial assets we will discuss in this lesson are money, stocks, and bonds.

What are the four types of financial assets?

Cash, stocks, bonds, mutual funds, and bank deposits are all examples of financial assets. Unlike land, property, commodities, or other tangible physical assets, financial assets do not necessarily have an inherent physical value or even physical form.

You May Like: How To Invest In Otc

A Complete Guide On How To Record Investment Income In Quickbooks

Investment income is the money earned by the increase in the value of an investment. It includes earnings from interests income, stocks, bonds, funds, real estate, collectible items, and other fund receivables. QuickBooks allows you to set up several different types of accounts effortlessly that not only will enable you to classify related transactions but also to allocate investments. This article will guide you on how to record investment income in QuickBooks along with the standard requirements that you need to set up before recording an investment income in QuickBooks. For complete info, follow the entire tutorial until the end.

Need Help Recording an Investment Income in QuickBooks! Call Customer Service Number . for Immediate Assistance

Is Owner Investment The Same As Owner Contribution

Definition: An owners investment, also called an owners investment or contributed capital, is the amount of assets that the owner invests in the company. In other words, it is the amount of money or other assets that the owner contributes to the business either to start it or to keep it going.

What is the owners contribution? A landlords contribution is an inflow of money into a rental property by a landlord. For example: She said that her tax refund was bigger than expected and that she wanted us to use the money to rehabilitate her property.

Also Check: How To Set Up A Real Estate Investment Fund

How Do I Input Transactions For Buying Stocks Or Investing In Mutual Funds

The truth is QB is totally unsuited for investing

use quicken, I have no experience with mint in this area so I am not sure it will work

If this is a company investment account, keep the total asset cost in QB, but track purchase, splits, dividends, return of capital, reverse splits, spin offs, mergers, etc etc in quicken and just make total entries in QB

How To Record Investor Contributions In Quickbooks

When you receive the payment, record that payment to an equity account in the balance sheet to document the ownership of the business. Similar to the way that you would track fixed assets in a balance sheet, you should also have sub accounts for each investor. This allows you to track each investors contribution separately. If you, yourself, contribute money to your business, you should also record it in a similar way. However, as an owner, it would be best to talk to a CPA to ensure its logged in a way that meets financial compliance as well as tax planning best practices.

Also Check: How To Make Money From Gold Investment

Add Accounts For The New Property

First, create two new accounts that will be needed for recording the purchase of a commercial property in QuickBooks.

To create a new account, go to Accounting > Chart of Accounts > New. Or go to the NEW button on the top left and click on Journal Entry. When you begin typing an account name, a green plus will appear, and you can add an account from there.

Create A Journal Entry For Recording The Purchase Of A Fixed Asset

To create the Journal Entry, go to the NEW button on the left top corner to create a Journal Entry.

NOTE: The information below is how a typical Journal Entry will be recorded. As always, check with your accountant to ensure you are recording it correctly for your particular circumstances.

Line 1: Enter the purchase price. Your building is a fixed asset, and your purchase price is typically the book value. To increase an asset, you use the debit column. See the example below.

NOTE: If the purchase price includes land, you will want to separate it out. Buildings can depreciate, but land does not. Check with your accountant for more information.

Line 2: Enter the loan amount. Loan/Notes Payable is a liability account, and it will increase the companys liability, so it is placed in the credit field.

Line 3: Earnest money typically is a check made out of your cash/bank account as a security for the contract, so it should have already been recorded as a separate journal entry with a credit to Checking and a debit to Earnest Money. For recording it here as part of the new purchase, you will utilize Earnest Money with a credit amount.

Line 8 and 9: Security Deposits are often transferred within the transaction because it is common for the leases to transfer with the property. Separating them per unit helps keep them trackable when a deposit needs to be returned to the tenant.

You May Like: Are Shield Annuities A Good Investment

S For Owner Equity Account Setup

After You set up the Owner Account you will need to Set up an owner Equity Account. Owner Equity Account helps you track that how much has been invested following are the steps to create the equity account and the Recording of Owner Investment in quickbooks is done through the Equity account.

For multiple Equity Account for Owner and Partner, you have to set up equity accounts first.

S To Record Owners Investment In Business Journal

Recording the owners investment in quickbooks using Journal entry is also a good way. This way allows you to record the initial capital you invested in your business. It can either be direct cash investment or cash used for buying assets such as inventory or machinery.

Below are the steps for recording the owners investment in quickbooks by using Journal Entry

- From the top menu bar, click on the company and select the make general journal entry option.

- A new window will open with the same layout as a spreadsheet.

- This window consists of five columns which are account, credit, Debit, Customer, and class.

- In the account, in the first row click on the owners equity and select the all-equity account.

- In the next row enter the account in which you will be depositing these funds.

- Now, choose the saving or checking accounts in the debit.

- Enter the same amount as the initial investments in the credit column.

- We hope that you have well learned how to record owner investment in quickbooks step by step setting up an equity account as well as journal entries.

Read Also: Investment Companies In San Antonio

Loans Versus Equity Investments

The first step to tracking investor contributions accurately is to determine if the contribution is a loan or an equity investment. If the contribution is a loan, then theres a repayment point plus interest over time. Weve covered this in other episodes. So for the sake of this episode, we will focus on equity. If an investor is providing you funding and receiving equity, that funding is not expected to be repaid with interest, but the investor would receive a share of the profits.

Setup An Owner Or Partner In Quickbooks

To track the capital that you or your partner has invested in the business, the first thing you need to record is yourself, the owner, or the partner as a supplier in QuickBooks.

- Go to the Expenses.

- Then, select the Suppliers menu and click on the New Supplier.

- Fill the required information and then Save it.

Also Check: Where Can I Invest 100 Dollars

Create An Equity Account To Proceed:

Before you create an equity account, you need to understand how you can divide equity in QuickBooks. A companys equity equals its assets minus its liabilities. Equity is based on two sources. First, is the investment made by the owners and partners, and the other one is profits and losses made in the business. Lets check how to create equity account in QuickBooks-

- Click Charts of Accounts from within the QuickBooks

- Choose New and open Account Type drop-down list to select Equity

- Click Details drop-down list and select from Partners & Owners equity options as the equity is based on different money sources

- Assign a name for this equity account and finally Save and Close

Get Help With Quickbooks Online

The most important part of implementing accounting software is having it set up correctly, to suit the needs of your business. An incorrect setup can lead to inconsistencies between your books and bank recon statements, and this would ultimately affect your tax filing. It is recommended that businesses consult the experts when implementing new software to aid accurate setup and train staff who will be making use of the software most.

Fusion CPA has certified accountants who are experienced in using QuickBooks Online and understand the intricacies of the software setup. We can show you how to add assets in QuickBooks Online and walk you through the process of making use of the software for bookkeeping. Our team of experienced accounting professionals can help you keep your software up-to-date to avoid unwanted issues with the IRS.

______________________________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.

Don’t Miss: How To Invest In Silver Commodity

Is Investment In Subsidiary A Financial Asset Under Ifrs 9

IFRS 9 It deals with someone elses equity instruments, because they are financial assets from your perspective. IFRS 9 DOES NOT deal with your investments in subsidiaries, associates and joint ventures .

What are financial assets under IFRS 9?

Under IFRS 9, a financial asset is initially measured at fair value plus transaction costs, unless it is measured at fair value through profit or loss, in which case the costs of the transaction are eliminated immediately.

Is an investment a financial asset?

Financial assets can be defined as investment assets whose value is derived from a contractual claim of what they represent. These are liquid assets as economic resources or ownership can be converted into something of value, such as cash. These are also called financial instruments or securities.

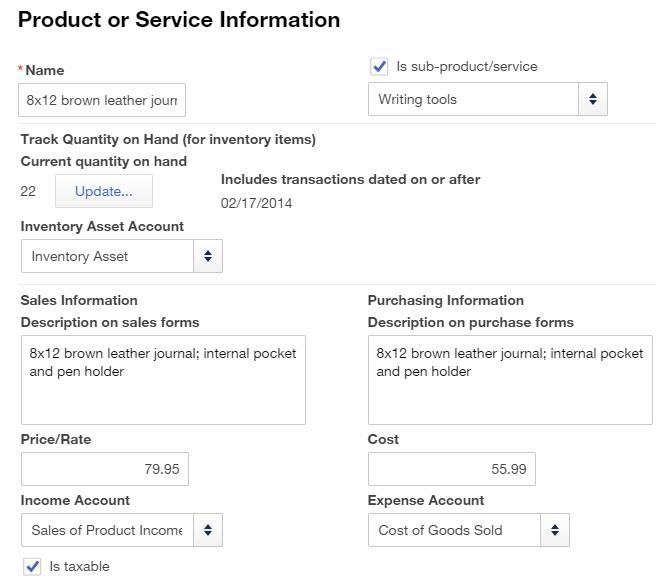

The Importance Of Accurately Recording Fixed Assets

Real estate, land, machinery, vehicles, and IT equipment are examples of fixed assets. A fixed asset in QuickBooks can also be referred to as a tangible asset. As outlined above, you can think of tangible/fixed assets as equipment or property that your business owns and needs to function and generate income. On a balance sheet, they appear as PP& E: property, plant, and equipment.

Accurately recording a fixed asset purchase like in QuickBooks helps you:

- Monitor your finances and the impact of the purchase,

- Accurately file your taxes at the end of the year,

- Give your tax practitioner the information they need for tax planning.

Using our QuickBooks guide to recording a fixed asset in QuickBooks can help you avoid errors when recording these items.

Don’t Miss: How To Invest Without A Social Security Number

How Do You Record An Owners Investment

Here’s how to track adding capital, how to see the total at any time, and how to repay an investment.

Record capital investments in QuickBooks Desktop for Mac

In addition, here’s how you can record owner’s contribution:

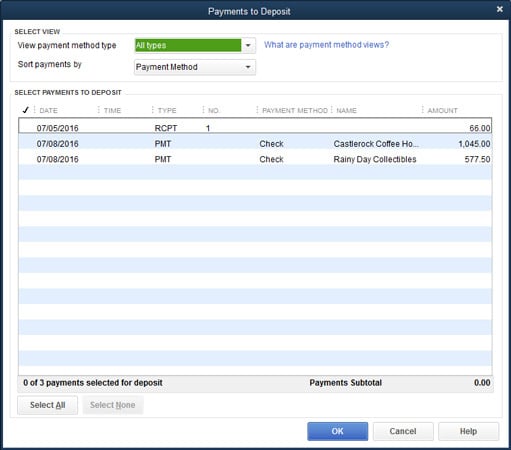

Choose The Payment Procedure And The Deposit Amount

Now once the equity and vendor account has been created in the QuickBooks deposit, the particular capital investment fund in the account should be used to finish the last step of recording investment payment in QuickBooks:

- In the others tab, press + Create icon and then choose Bank Deposit.

- Now access the Account from the drop-down list to select the bank account.

- Add the fund deposit date.

- From the New Deposits, add the investors name mentioned in the Received From area.

- Choose the right account from the drop-down for Accounts and select the Payment Method.

- Enter the amount in the particular Amount field with the right numbers.

- Press Save and Close to finish the procedure.

Just by following the steps given above, you can easily record the change in the value of investments in QuickBooks. This is crucial to determine the business profit or loss percentage. However, those who are new to QuickBooks may fail to do it properly or may face issues while performing the steps.

For those individuals, they can simply connect with our Dancing Numbers team of experts. They can provide a definitive solution to the problems concerning accounting software.

There are certain advantages of recording owner investment in QuickBooks:

Also Check: How To Invest In Healthcare

The Right Way To Record Investment Income In Quickbooks

The income that the business earns from its savings accounts, certificates of deposits, or other investment vehicles is known as the interest income. The financial institution usually sends you a monthly, quarterly, or annual statement that has a separate line item reporting interest earned. The process of how to record Investment Income in QuickBooks comes handy for business users who need to keep a track of the same.

Follow our complete blog to know QuickBooks Investment management or for suggestions and help reach out to QB accountants on 1.800.579.9430.

Is It Important To Set Up An Owner Or Partner In Quickbooks

Yes, it is very much required to record owner or partner investments in QuickBooks. It is required to know how much amount partner or owner has invested in the organization to keep running or start it. Simply go to QuickBooks > > Expenses > > select Suppliers > > click on new suppliers and at last enter all information which is asked and set up is done.

Recommended Reading: Real Estate Investment And Development Company