What Is A Good Return On Investment

There is no simple answer to define a good return on an investment. Youll need some additional context on the risk youre accepting with the investment and the amount of time youll need to reap the reward.

Lets say you need a ride to the airport. Its 30 minutes away, and youre running a bit behind schedule. A friend promises to get you there in 15 minutes, but the ride involves driving 100 mph, running red lights, darting in and out of traffic and fearing for your life. Was that return of 15 minutes of your time really worth the white-knuckle ride that came with risks of an accident and injury? Probably not.

Now, think about a real financial example: a 2 percent return. This may not sound impressive, but lets say you earned that 2 percent in a federally-insured, high-yield savings account. In that case, its a very good return since you didnt have to accept any risk whatsoever. If that 2 percent figure came after you spent the past year following Reddit forums to chase the latest meme stock, your return doesnt look so good. You had to accept loads of risk while likely losing loads of sleep during each large valuation swing.

What If I Had Invested For The Last 30 Years

Now, to get to a comparable astronomical amount, we would need to invest for 80 years or so.

Clearly, thats quite unlikely to happen!

But assuming you are in your thirties or forties you can invest at least for the next 20-30 years until you retire and even beyond that.

So lets look at what the return would have been like if someone had invested for the last 30 years.

RELATED CONTENT– 12 Reasons Women Must Invest to Achieve Financial Security

Benefits Of Cleartax Roi Calculator

- The ClearTax ROI Calculator shows you the absolute return and the annualised return on the investment. You may calculate the return on your investment across different holding periods.

- The calculator helps you to pick the right investment based on your financial goals and risk tolerance.

- The calculator helps you select the best mutual funds based on the performance over different periods.

- You can measure the worth of the investment against the benchmark.

- You may measure the profit from the investment against the cost of the investment.

Also Check: How To Angel Invest Without Being Accredited

What Industries Have The Highest Roi

Historically, the average ROI for the S& P 500 has been about 10% per year. Within that, though, there can be considerable variation depending on the industry. For instance, during 2020, many technology companies generated annual returns well above this 10% threshold. Meanwhile, companies in other industries, such as energy companies and utilities, generated much lower ROIs and in some cases faced losses year-over-year. Over time, it is normal for the average ROI of an industry to shift due to factors such as increased competition, technological changes, and shifts in consumer preferences.

What Is Return On Investment

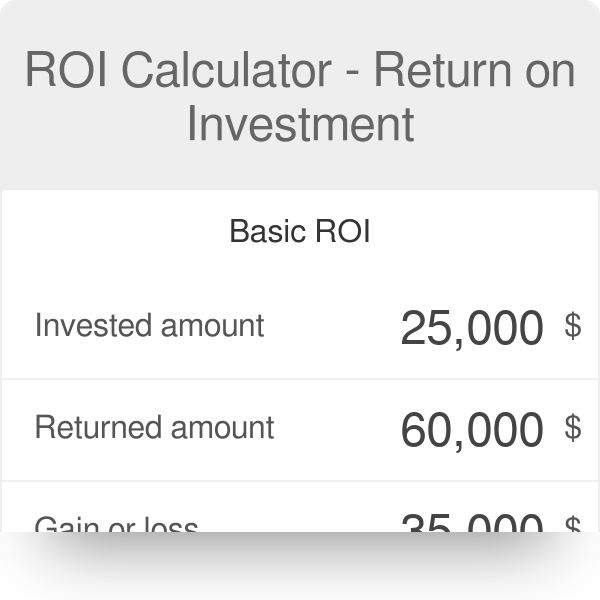

Return on investment is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investments cost.

To calculate ROI, the benefit of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio.

Don’t Miss: Best Real Estate Investment Sites

What Are The Alternatives To Roi

There are similar alternative measurements to ROI that businesses use to varying degrees. These include the following:

- Annualized ROI. This form of ROI considers the length of time a stakeholder has the investment. Here is an example of an annualized return calculation: Annualized ROI = / Initial value of investment) x 100. Likewise, the annual performance rate can be calculated using / P) ^ – 1, where P equals initial investment, G equals gains or losses, and n equals the number of years the investment is held.

- Social ROI . SROI is outcome-based and considers the broader impact of economic, environmental and social value. It translates these outcomes into tangible dollar values. The calculation is SROI = Net present value of benefits / Net present value of investment.

- This helps determine the effectiveness of a marketing campaign strategy or marketing program. A basic calculation is / Marketing cost.

- Social media statistics ROI. This helps determine the effectiveness of a social media campaign and can include how many views or likes are generated. A simple calculation to measure the time, money and resources that went into social media ROI by revenue is x 100.

Learn how we can judge 5G’s near-term impact and ROI and how it affects the economy.

Continue Reading About ROI

Why Is Roi Important In Business

Only smart businesses that spend wisely and monitor ROI closely survive in the long run.

If you arent seeing an optimal ROI on a certain endeavor, stop throwing money at it youre better off scrapping it. Continuing to spend on lost causes is a surefire way to run out of money and run your business into the ground.

Key takeaway: ROI allows you to see the fruits of your investment or the lack thereof, which is important to always have a handle on when running a business.

Don’t Miss: Investment Property Mortgage Low Down Payment

Social Return On Investment

Social return on investment is an approach for measuring the extrafinancial value relative to the resources invested. It is used to evaluate the impact on stakeholders, identify ways to improve performance, and enhance the performance of investments. This approach has had a lot of traction, and in 2008, a network was formed to facilitate the continued evolution of the method. Over 570 practitioners globally are members of the SROI network, to date.12 The SROI method is standardized and provides a consistent quantitative approach. It is used to understand a project’s impact on a business, organization, fund, or its policy. It considers all stakeholders views of impact and puts financial proxy values on all those impacts identified by all the stakeholders that do not typically have market values.

The main aim is to include the values of people that are often excluded from markets in the same terms as used in a market that is money oriented. This gives people a voice in resource allocation decisions. In addition, while it is rather complex in application, it may one day form a base for understanding the overall return on investment for ecological designs and user experience designs.

Linda Berube, in, 2011

What Is A Good Roi

According to conventional wisdom, an annual ROI of approximately 7% or greater is considered a good ROI for an investment in stocks. This is also about the average annual return of the S& P 500, accounting for inflation. Because this is an average, some years your return may be higher some years they may be lower. But overall, performance will smooth out to around this amount.

That said, determining the appropriate ROI for your investment strategy requires careful consideration rather than a simple benchmark. The S& P 500 may not be appropriate for the level of risk youâre willing to take on or the asset class youâre investing in, for instance. To calculate the ROI thatâs good for you, ask yourself the following questions:

- How much risk can I afford to take on?

- What will happen if I lose the money I invest?

- How much profit do I need for this investment to take on the prospect of losing money?

- What else could I do with this money if I donât make this investment?

You May Like: Best Way To Buy Silver As An Investment

The Historical Average Stock Market Return Is 10%

The S& P 500 index comprises about 500 of America’s largest publicly traded companies and is considered the benchmark measure for annual returns. When investors say the market, they mean the S& P 500.

Keep in mind: The markets long-term average of 10% is only the headline rate: That rate is reduced by inflation. Currently, investors can expect to lose purchasing power of 2% to 3% every year due to inflation. Learn more about purchasing power with NerdWallet’s inflation calculator.

The stock market is geared toward long-term investments money you don’t need for at least five years. For shorter time frames, you’ll want to stick to lower-risk options like an online savings account and you’d expect to earn a lower return in exchange for that safety. Here’s our list of the best high-yield online savings accounts.

|

Get up to 12 free stocks when you open and fund an account with Webull. Promotion ends 8/31/2022. |

How To Measure Success

ROI and KPIs get a lot of buzz in the e2.0 world. The HR leader, like many other practitioners, noted that KPIs and ROI metrics were difficult to ascertain. We started to measure the activities through the tools, we called it a dashboard but frankly the measured metrics do not reflect collaboration, but rather activity which is essentially meaningless. After a few months, the leader directed the reporting to focus more on return on experience than ROI. Documented interviews with successful community managers were initially posted on the corporate intranet now the team conducts and posts video testimonials.

One such successful community is the 1,000-member Global Field Service Network. The community is composed of employees from all around the world who have expertise in the organizations power plants. They created a pool of people who travel globally. In the low activity period, they participate in the community and by transferring knowledge.

William R. Croft, Jeffrey R. Seay, in, 2014

Also Check: How To Invest In Real Estate With Little Capital

Learning From The Past

ROI calculations are not intended to be precise methods of measurement, but rather ways to approximate. More accurate projections always help, but some error is generally expected with ROI. Understanding the ROI of any project or marketing campaign helps in identifying successful business practices.

Many companies use ROI to identify methods of marketing and advertising that yield the highest return based on previous successes. This way, ROI becomes not only a measure of past success but also an estimate for the coming months.

Key takeaway: ROI calculations are useful because they help you analyze the progress of your business, and although theyre estimations, they can impact and improve the decisions you make for your company.

How Is Return On Investment Used

ROI is a straightforward method of calculating the return on an investment. It can be used to measure profit or loss on a current investment or to evaluate the potential profit or loss of an investment that you are considering making.

Keep in mind that ROI omits a key factor: the length of time that it took to earn that profit . Obviously, a stock that makes a 10% return in one year is preferable to a stock that makes a 10% return in four years.

For this reason, the formula for annualized return on investment may be a better choice than the basic formula for return on investment.

Recommended Reading: How To Set Up Your Investment Portfolio

Determine The Value Of The Investment

The value of the investment is the amount of money made or promised to businesses and investors after they invest. For example, if a company is seeking investors, they might promise $150 returned for every $100 an investor spends. $150 would be the value of the investment. In other situations, you might not be able to determine the value of the investment until later on. For example, if you purchase $300 in stocks and later sell those stocks for $500, $500 would be the value of the investment.

Roi Measures The Probability Of Gaining Returns From Investments

Return on investment is the key measure of the profit derived from any investment. It is a ratio that compares the gain or loss from an investment relative to its cost. It is useful in evaluating the current or potential return on an investment, whether you are evaluating your stock portfolio’s performance, considering a business investment, or deciding whether to undertake a new project.

In business analysis, ROI and other cash flow measuressuch as internal rate of return and net present valueare key metrics that are used to evaluate and rank the attractiveness of a number of different investment alternatives.

Although ROI is a ratio, it is typically expressed as a percentage rather than as a ratio.

Don’t Miss: Dual Registration Broker Dealer Investment Adviser

Additional Information And Further Calculators

Return on investment is a very popular measure because of its simplicity and usefulness. Now that you know how to calculate ROI, it’s high time you found other applications which will help you make the right choices when investing your money. We are sure that the ROI equation is not the only thing you should be familiar with to make smart financial decisions.

- If you are trying to decide what ROI you will get when investing time and money into building a software tool, check out the build vs. buy calculator.

- If you want to estimate the average yearly gain from your investment, you should use the CAGR calculator.

- If you are involved in a trade, you may also need the profit margin calculator, which lets you calculate every variable in the sales process.

- If you want to find your sale price or, inversely, the cost you bear, you should use .

- If you need to assess the expected profitability of a planned investment project, try the NPV calculator.

- If you want to estimate how much a particular company is worth, use our discounted cash flow calculator

- If you are trying to determine the rate of return on your real estate property purchase, you should check out the cap rate calculator.

- And last but not least, if you want to know how long you have to save to make your dream comes true, use our dream come true calculator.

Challenges To Determining Roi

Calculating ROI is not always clear-cut. Some investments will overlap, making it difficult to determine which investment generated the most profit.

In the case of Samanthas social media ad spending, she may not be able to determine if any single social media platform contributed largely to her returns. She may also have other ongoing investments to thank for her increase in sales, like a monthly email newsletter campaign or word-of-mouth marketing.

Despite the potential difficulty of determining the ROI of a specific investment, the metric is still very useful when trying to ensure you earn more than you spend. Dont worry about complete accuracy when calculating ROI, instead consider how youll be able to measure results each time you make a new investment.

Recommended Reading: Are Mid Cap Stocks A Good Investment

Benchmarking And Adapting To Future Trends Is Key

Returns are measures not only of a ventures performance, but also a measure of one firm to another. Typically this type of analysis is called benchmarking. Key to benchmarking is to identify companies as similar to the subject company as possible. For example, American Airlines benchmarks itself to United, Delta, and other major airlines. Evaluating return metrics for competitors allows for ranking as well as determining industry averages and standards. Obviously, projecting a new ventures performance equal to or better than industry averages will be attractive to investors of all types.

Many new ventures are pursued by founders who are passionate about the business and its product or service. However, passion alone wont attract investors. In the long run, it comes down to money and making money. Turning passion into measurable returns is how one finds the financial investment to realize the dream.

What Is A Good Roi For A Business

As a business owner or investor, you should take a look at your ROI regularly. It gives you an objective look into how the business is doing. Plus, the overall ROI usually shows how well your C-suite or management are performing in their jobs. For each facet of your business, that expected ROI may change depending on the department.

Read Also: Fidelity Rollover Ira Investment Options

What If Your Investment Is Below Its Average

If your investments are falling short of expectations, follow one essential rule: Dont panic. One year, the stock market might be up 14 percent. Two years later, it might be down more than 35 percent . Earning the average means taking the good with the bad, leaving your money invested and reinvesting all distributions even when the index is under-performing.

Stocks, real estate and other higher-risk investments can generate negative returns over short time frames. Over longer periods of time, though, these investments can make up lost ground and generate the higher return on investment that attracted your attention in the first place.

How Do I Find An Investment Rental Property

Now that you understand what an ROI is and how to calculate it, you need to find an investment property that fits all of your wants and needs as an investor. To look for properties in your area, use Mashvisorâs Property Finder tool to explore profitable properties. This tool allows investors to search through properties that match their specific criteria. This could be a certain location, a price point, or a certain type of property.

Once you have located a potential property that you are interested in investing in, you should consider working with a real estate agent when purchasing the property. They can get you the best deal on the property and ensure you are spending your money wisely. To look for real estate agents in your area, use Mashvisorâs Real Estate Agent Directory. You can look through an agentâs real estate portfolio to see which agent you think you would work best with. The Real Estate Agent Directory makes it easy for investors to connect with agents in their area, or any area they are interested in purchasing a property in.

Recommended Reading: Top Real Estate Investment Companies In Usa