Core Positions For A Fidelity Hsa

Opening a Fidelity account automatically establishes a core position which is needed for processing cash transactions such as deposits and withdrawals in and out of your account. Think of it like a wallet that you can access for trading, investing, or withdrawals. A benefit of the core position is that it allows you to earn interest or a yield, depending on which core option you choose.

What are the options for my core position?

When you open a new Fidelity HSA®, we automatically put your uninvested cash into the Fidelity® Government Cash Reserves but you can also choose another cash option. Understanding the differences between your core options can help you make the choice that’s right for you. Below are the HSA core options available to you:

How To Invest With Your Hsa And Why

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Its hard enough to motivate yourself to save for retirement, but saving for your future medical costs? How responsible does a person have to be?

Thankfully, health savings accounts, or HSAs, are tools that make saving for future health-related expenses less painful. These accounts allow you to save money, but they also allow you to invest. With open enrollment coming up, an HSA might be something to consider.

One cool trick is to invest the money in an HSA just like you invest in your IRA, Victor Medina, a certified financial planner and founder of Palante Wealth Advisors in Pennington, New Jersey, said in an email interview.

How Is Fidelity Helping To Protect Your Data

We are implementing new security protocols to add another layer of protection to your accounts. As we complete this transition, when using some third-party websites and apps, you may experience a temporary interruption on those external sites. You will still be able to access all of your account information and activity directly on Fidelity.com or the Fidelity mobile app.

You May Like: How To Invest In Pakistan Stock Market

How We Chose The Best Health Savings Account Providers

To find the best HSAs on the market today, Investopedia compared more than 15 of the top providers to see how they stack up. Criteria we considered included ongoing fees and account management costs, investment options, ease of opening an account, debit card access, and minimum account requirements. The HSA providers who made our ranking tend to stand out due to their lack of fees, their unique or lucrative investment options, or the technology they use.

The Hsa Benefits For Your Clients

Triple tax advantage

- Tax-deferred earnings

It’s the individual investor’s moneyand it stays with them

- Completely portable for individual investorsEven if they move, change employers, or change health plans, their HSA stays with them.

- No “use it or lose it”The account belongs to the individual and does not need to be used each year.

Flexibility and choice

- Use it nowEasy access for current qualified medical expenses

- Save and invest for laterProvides the option to invest some or all of their HSA money for potential growth as a way to prepare for health care costs in retirement

- Option for professional management of assets

Cash management capabilities

- HSA-specific debit card provided to registered account owner for all accounts

Read Also: How To Make Money From Gold Investment

S You Can Take To Protect Your Information

You can help take steps to protect your information and data, including:

- Confirm whether you still actively use all the sites and apps that have your Fidelity username and password.

- Determine whether you want to continue to share your Fidelity access with these sites and apps.

- Read the terms and conditions of sites and apps that have your login credentials, to ensure that you know how your data is used and stored, whether they sell any of your information, and what happens to your data if you leave the service or if the service ceases to exist.

- What is a data aggregator?

Data aggregators are used to collect and exchange data between your accounts and third-party websites and apps. When you provide your login credentials to a third-party app, your data is being retrieved by an aggregator. Once you share your login credentials, they have the same access to your data that you do.

- How will this affect me?

We’re working with third-party sites and apps to make their access more secure when using your data. Depending on which site you use, you may be temporarily unable to access some of your Fidelity data on that site. It does not mean that your Fidelity information has been lost or compromised in any way, and you can still access all your accounts directly on Fidelity.com and on our mobile app.

Best Hsa Accounts For 202: Companies Must Offer Accounts To Individuals

We did not rank the listed companies overall. And, please note: Our list only includes HSA account providers that offer HSAs to individuals, not ones that work exclusively with employers.

The HSA accounts listed below are named in order of their category award wins, with Fidelity at the top since this year it won every category award: widest investment options, low fees, best savings rates, zero investment threshold and access to professional management. Then we list the HSA account providers that won in two categories, then one-category winners and then the rest.

To learn all latest news about HSA accounts, contribution levels for 2023 and changes in the HSA landscape, read our overview story: HSA Contributions Grew In 2023, Despite Rising Prices, Tough Investment Markets. And to understand the issues that sometimes trip up folks who are new to HSAs, read our story on the Top 10 HSA Misconceptions And 2023 HSA Rules.

Read Also: Buy A Home Or Invest In Stock Market

Who Can Contribute To An Hsa

Not everyone is eligible to contribute to an HSA, even if they are enrolled in an HSA-eligible health plan. You can only contribute to an HSA only if:

- You aren’t enrolled in a health plan sponsored by your spouse or parent that is not an HSA-eligible health plan.

- You’re not enrolled in Medicare

- You cannot be claimed as a dependent on someone else’s tax return

Here’s more about what you need to know about the financial advantages of HSAs.

You can deduct your contributions from your taxesHSA contributions are typically made with pre-tax income from your paychecks, similar to the way 401 contributions are set up. If you fund your HSA with after-tax dollars instead, you may be able to take a tax deduction on your personal taxes when you file.

HSA tax deductions can have powerful benefits: For instance, someone in the 22% federal income tax bracket could potentially save nearly 30% in taxes on every dollar contributed to the HSA. That helps increase the amount of money you have for medical spending. But it’s important to keep in mind, contributing via payroll deductions will lead to the most tax savings. Only contributions made with payroll deduction avoid Medicare and Social Security taxes.

HSAs are not subject to required minimum distributions Unlike 401s and traditional IRAs, which require you start minimum withdrawals called RMDs when you turn 72, you’ll never be required to take any funds out of your HSA. This can provide versatility in retirement income planning.

Affinity Federal Credit Union

The Affinity Federal Credit Union HSA account has no minimum deposit requirement and charges no HSA fees. It offers a debit card with the account, but no checking privileges are indicated. The account currently pays 0.25% APY and you can fund it with direct deposits. Its available primarily to residents of New Jersey and Connecticut, but theres a long list of exceptions.

Since most credit unions serve consumers who either live in a specific geographic location or work in a certain industry, its best to check with institutions in your local area.

Learn more:

You May Like: How To Become An Sec Registered Investment Advisor

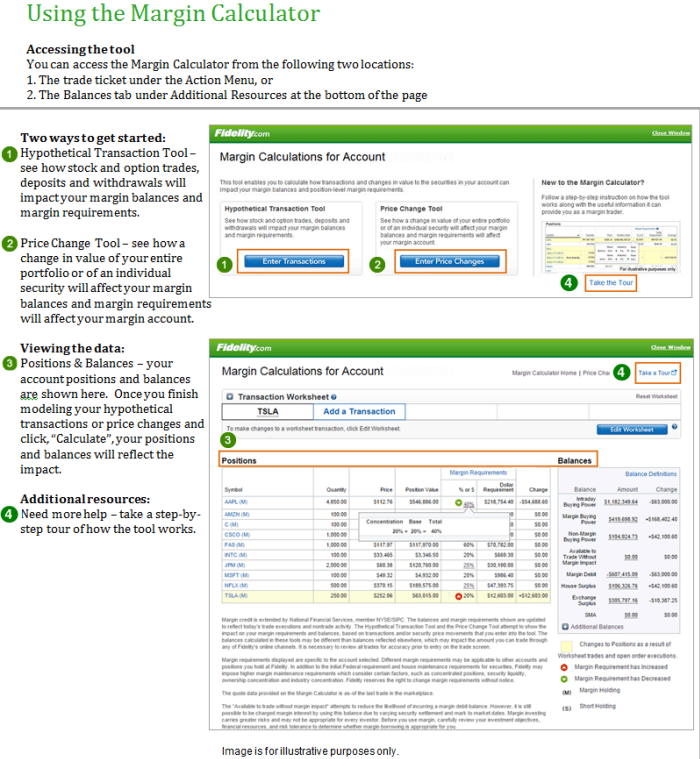

Investing Through An Hsa

Think of your HSA as a home for your medical money. Just like a brokerage account or an IRA, youll need to put money into the account before you buy investments. Then, after you fund the account, you can start investing.

Some HSAs offer tools that help you choose your investments and provide automatic rebalancing, so your portfolio stays within your preferred allocation. Others allow you to select from specific investments, such as stocks, bonds, mutual funds and ETFs.

Whatever method you choose, investing your money through an HSA will likely allow it to grow faster than by saving alone. However, if your HSA is offered through an employer, you may have fewer options for how you can invest your money.

You May Like: Private Equity Investment In Healthcare

How Does An Hsa Work

HSAs work together with an HSA-eligible health plan. If you’re enrolled in this type of health plan, you can make pre-tax contributions to an HSA, allowing you to pay for qualified medical expenses tax-free. This can help create a cash cushion to offset the higher deductibles that HSA-eligible health plans typically have.

If you don’t need the money in your HSA for immediate medical expenses, you can save and invest it until you do. This sets HSAs apart from another popular account, the health care flexible spending account . Unlike an HSA, money held in a health care FSA typically must be spent by the end of the plan year in which it is contributed, cannot be invested, and cannot be carried with you when you leave an employer.

You May Like: Jonathan Harris Alternative Investment Management

How To Open An Hsa

Step 1: Make sure you are eligible to open an HSATo open and contribute to an HSA, you’ll need to be enrolled in an HSA eligible health plan. This health plan does not have to be provided by your employer but it must meet the requirements outlined above. If you aren’t sure whether your plan qualifies, check with your benefits administrator or plan provider.

Step 2: Pick an HSA providerWhile HSAs are all similar in the tax advantages they offer, the specific features available at different providers varies. If you’re interested in investing your HSA, for instance, you may want to go with a provider that requires noor a lowamount of your HSA remain uninvested in cash. You’ll also want to research if potential HSA providers offer low-cost funds or automated investing options, like robo-advisors, that meet your needs. You may also want to compare fees across different providers. Remember too, you can have the flexibility to change your HSA provider even if you are no longer covered by an HSA eligible health plan.

Step 3: Don’t forget to invest your HSAIf you intend to use your HSA to save for long-term medical expenses, don’t forget to set up your investments. As of 2020, over 90% of HSA funds were held in cash,3 suggesting the vast majority of Americans aren’t using this valuable wealth-building tool as well as they could.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Do All Hsas Have Monthly Fees

Some HSA providers offer accounts without an annual or monthly account management fee. However, all providers who let you invest your HSA funds charge investment fees, and often more than one type. For example, you might pay an annual fee to your HSA provider for oversight of the underlying investments in your HSA, but you will also pay expense ratios that vary depending on the investments you choose.

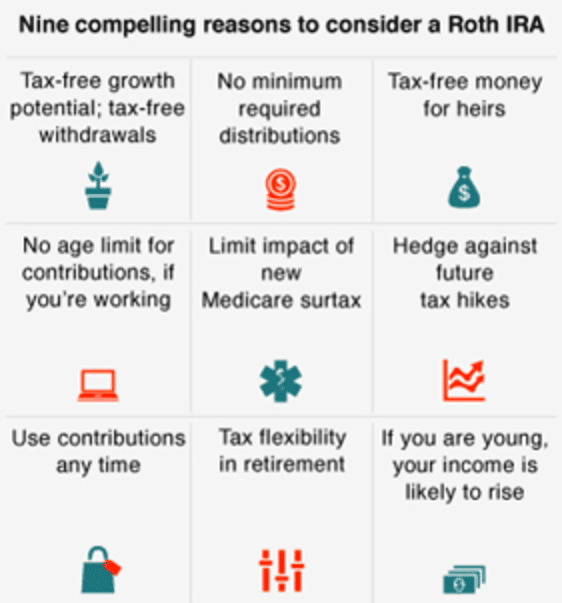

Read Also: Should I Invest In Stocks Or Roth Ira

Find The Best Health Savings Account For You

Not only do HSAs have a lot of benefits, but as you can see from the list above, youll have plenty of options as to the best Health Savings Accounts.

Its becoming more important every year, as health insurance and out-of-pocket medical bills rise. But another under-appreciated factor is the changes that took place with the 2017 Tax Cuts and Jobs Act, which ushered in major shifts in the tax code.

Chief among them is the fact that the standard deduction has nearly doubled. For 2021, the standard deduction is $12,550 for single people and $25,100 for those who are married and filing jointly. With the increase in those thresholds, far fewer people will be able to itemize expenses on their tax returns. That includes medical costs. And thats where HSAs can help.

Not only will you get a tax deduction for your annual contribution to an HSA account, but that will automatically make any expenses paid out of the account tax-free. That will be even better than itemizing the expenses on your tax returnif you even can anymore.

Boosting Your Retirement Savings

An HSA may be the most tax advantaged of all retirement savings plans. In addition, an HSA does not require you to begin taking distributions at age 722, like IRAs and 401s. Not having to pay taxes on withdrawals used for qualified medical expenses can be a big plus for your retirement budget.

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2022 may need approximately $315,000 saved to cover health care expenses in retirement.

If you’ve been fortunate enough to accumulate more money in your HSA than you need to cover current and future retirement health care costs, you can withdraw the money for something other than a qualified medical expense after you reach age 65 without having to pay a penalty. You will, however, owe income tax on the withdrawal.

Read Viewpoints on Fidelity.com: 5 ways HSAs can fortify your retirement

Don’t Miss: Private Equity Investment In Medical Practices

Are Hsa Accounts Worth It

For millennials who are generally healthy and want to save for a future qualified medical expense, an HSA is totally worth it.

Given the tax savings and other advantages, it could be a great way to plan for a healthy and wealthy future. Especially after retirement, the money in your HSA can be used to offset the cost of medical treatments so you can hold onto your hard-earned savings.

Can I Use My Hsa Funds For Non

A word of warning: any payments made from your HSA must be limited to qualified medical expenses.

If funds are disbursed for any other purpose, that payment will be fully taxable and subject to an early withdrawal penalty. For example, if you use your HSA debit card to pay for a prescription, then include other non-medical purchases or take cash back, the payment over and above the cost of the prescription itself will be taxable.

You May Like: Best Credit Card Company To Invest In

Devenir Guided Portfolio Self

Offers low-cost, no-load mutual funds, covering a range of asset classes.

-

HSA Guided Portfolio tool to select investment elections and realign your portfolio

-

Auto-Rebalance feature to keep your portfolioallocation in line with your individual needs

-

Quarterly performance review of mutual funds by Devenir, an SEC registered investment advisor

-

Online access to investment account history, balanceinformation, future elections, trades, and much morethrough HSA Banks Member Website

-

Access to Morningstar® pages, fund fact sheets, and prospectuses

-

A quarterly asset based fee may be charged which is calculated on the amount invested and deducted pro rata from the investment account no commission on investment trades

Note: If you are an existing HSA Bank member, you may have access to a different fund lineup. To view your list of available mutual funds, log into your account and click on “Manage Investments.”

Fidelity Health Savings Funds Designed To Help Investors Save For Health Care Expenses

Transferring hsa funds is pretty simple. Select fdic or fidelity government cash reserves , then click preview order, and submit. switching is free and will not change your ability to access or invest this money. A new request will need to be submitted each time you wish to transfer hsa assets to fidelity.

Recommended Reading: Best Investment Gold Or Silver

You May Like: What’s A Good Stock To Invest In Now

Choosing The Right Hsa For You

As you can see, most HSA providers offer comparable services, making it difficult to choose any particular one. One way to narrow down the choice is to investigate the HSA offered with your employers health plan. It will likely meet your investment needs.

If you’re no longer with your employer and are looking to move your HSA, look at free HSA providers like Fidelity, who also offer investment options.

Among the shortlist above, youre sure to find an HSA provider who can check all of the boxes youre looking for.

Saving For A Possible Medical Emergency

Accidents do happen. And using your HSA as a “rainy day” health care fund to cover a medical emergency is another popular strategy, especially if you’re able to pay routine medical costs from your household cash flow. If a sudden financial need throws a wrench into the household budget, your HSA can help you cover some of your medical costs.

Investing a portion of your account may help you grow your balance faster.

When considering how to invest your HSA savings, you may want to consider one of Fidelity’s Health Savings funds which does not require a specific investing time horizon and provides a conservative asset mix to help protect against down market risk while also participating in the market gains.

Tip: To get started putting your cash to work in your HSA, see the list of Fidelity HSA® Funds to Consider.

You May Like: Etrade Roth Ira Investment Options