Fundrise Returns Vs Other Real Estate Investments

To recap, my four-year average return on my Fundrise investment was 13.3%, net of expenses.

I cant do a valid comparison among other real estate crowdfunding platforms since Im only invested with Fundrise.

But we can look at the Fundrise returns against those provided by real estate exchange-traded funds , which are widely available on market exchanges.

Fundrise Returns Vs The Stock Market

For 2019, the S& P 500 was up 28.88% in 2020, up 16.26%. And 2021 it finished with a 26.89% gain.

Well, but those are crazy returns especially in the middle of a global pandemic. And I dont know that well ever see returns like that again.

When I average out the returns on the S& P 500 index over the past three years and comes to 12.96% per year. Thats almost 5% per year more than my Fundrise investment paid.

So clearly, if I had invested my $5,000 Fundrise investment in the S& P 500, Id have come out ahead. Thats a definite investment opportunity cost.

How Is Fundrise Taxed

Depending on your portfolio, you may receive income from your eREIT or eFund investment .

REIT dividends are categorized either as ordinary dividends or qualified dividends . Ordinary dividends are taxed as ordinary income, while qualified dividends are taxed at the capital gains tax rate. This is reported on tax form 1099-DIV each year.

Income from eFund investments is taxed as ordinary income as well, as the underlying tax structure is a partnership. Any income you receive from your eFund investment will be reported on tax form K-1.

Aside from dividends, if the net asset value of your investment appreciates, youll have to pay capital gains taxes as well. However, you wont pay those taxes until you redeem your shares.

Read Also: Prudential Real Estate Investment Analyst Interview

Fundrise Review 2021 I Invested $1000 Heres What Happened

I set up my account and invested an initial $1,000 into Fundrise back in 2016. I did it just to try it out and invest a few bucks, but I loved it so much I decided to review it.

There are 80+ crowdfunding websites, and the majority of them arent really that good. But, most review sites simply pick the ones with the highest affiliate payout and rank them.

Because of my experience with Fundrise and others, weve created one of the most stringent sets of grading criteria on the web for crowdfunding platforms and we review as many crowdfunding sites as we can.

This strict and well-documented methodology helps us avoid any potential conflicts of interest, and you can see the methodology with the link above. We have 11 overall categories and rank every company based on the information we have and weight the responses based on what we believe is most important.

So, check out the criteria and read the review below about the company and how it stacks up against its competition. You can click on any link below to be taken to that part of the review.

Fundrise Reviews: Is It Good To Invest In Commercial Real Estate

While commercial real estate investments entails some risk, the average return has exceeded the stock market over the last three decades. Historically, this form of investing has been restricted to individuals with sufficient capital to acquire and manage properties. However, real estate crowdfunding platforms such as Fundrise have made commercial real estate accessible to the everyday investor.

Read Also: How Do I Invest In An Ira

Review Of Fundrise Why Invest In Commercial Real Estate

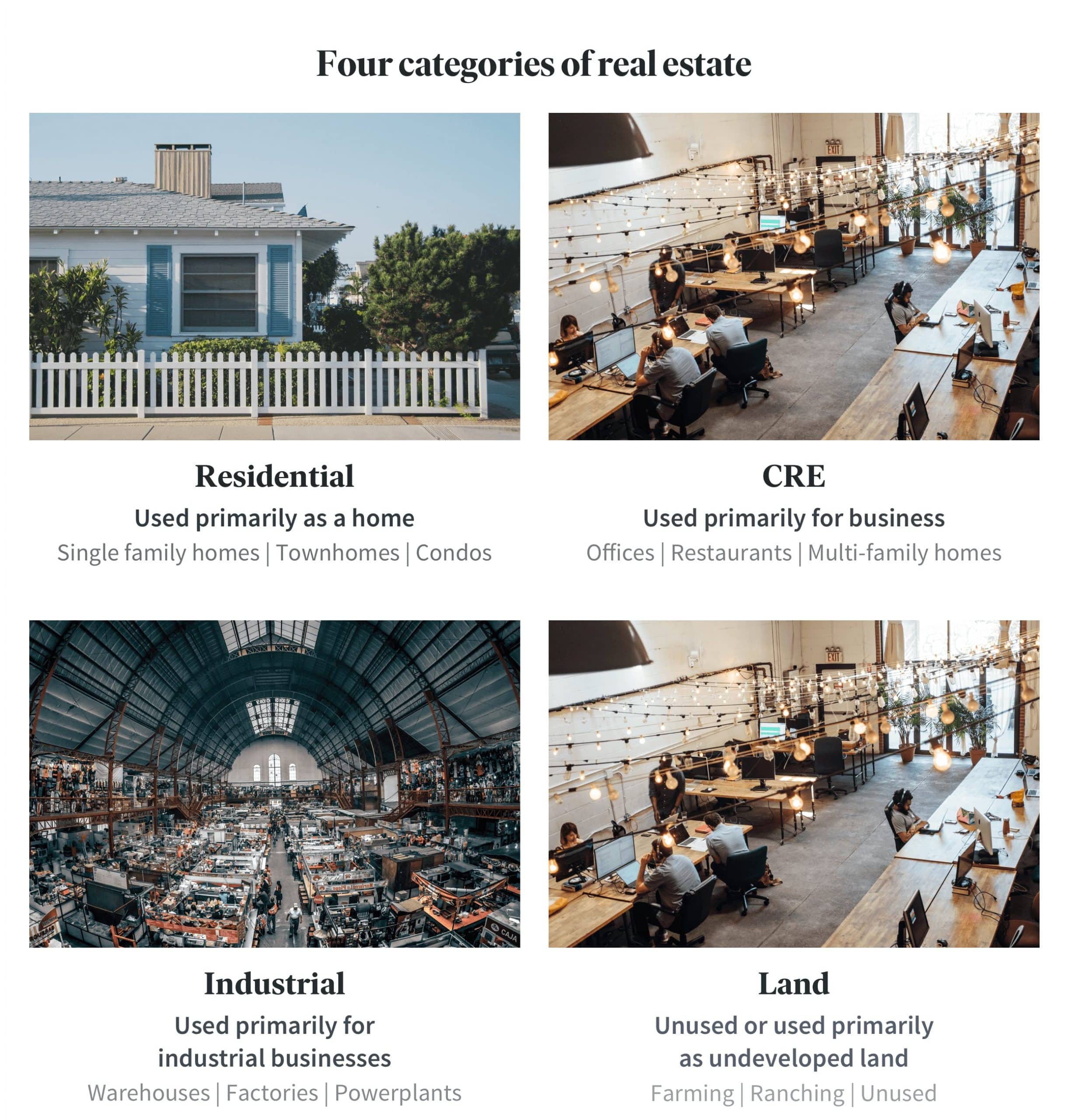

One of the big things we need to cover in this Fundrise Review is why commercial real estate is a great place to invest your money and a great long term investment.

The biggest reason is income. Commercial real estate is bought for the primary purpose of providing income, and thats what it does best. In CRE, even the price of the building is determined entirely on the income it provides, not on what other properties are selling for.

The second biggest reason to have commercial real estate as an investment is because of appreciation. Since price is determined by the income, anything that increases income will increase its value. In real estate, we call this forced appreciation and its a great way to increase the value of your investment.

The Three Biggest Disadvantages Of Fundrise

Read Also: Harsch Investment Properties Las Vegas

Fundrise Reviews: Is It A Scam

So, time for the $1,000,000 question is Fundrise a scam?

No, not technically. You can 100% make money with this program, though its not nearly as simple as they make it seem.

As with most businesses, there is A LOT of work to be done up front & no guarantee of you being successful.

Not to mention the profit margins are typically pretty small.

Dont get me wrong, Im a big proponent of front-loading work now, so that you can reap the rewards later.

But if Im gonna do that, I want the rewards to be HIGH and virtually guaranteed.

Id rather put in that same 3 months of work & build a handful of Digital Rental Properties that each produce $500-$2,000 checks every single month afterward .

And the cool part is that you can do it in a lot less time than 3-months .

Unlike physical real estate, you can do it from anywhere in the world, so its a genuine laptop-lifestyle business.

All you need is an internet connection.

Some of my friends are Digital Landlords that run their 6-figure businesses from:

- Camping trips at national parks

- Beachfront in Hawaii

- On the road in a camper-van

They focus on living an enjoyable life first, and focus on income second. All thanks to this program.

They can take weeks or months off, and money keeps rolling in.

Living happily is the top priority.

If the thought of living perpetually at your dream vacation spot interests you, being a Digital Landlord might be for you!

Making Money With Fundrise

Investors are paid in 2 ways:

1. Quarterly dividendsThis is rent income generated from the rental properties. You’ll typically receive dividend distributions a few weeks after the end of each quarter. You can choose to have them directly deposited into your bank account or automatically reinvested back into Fundrise.

2. Appreciation in share valueYou’ll receive proceeds when a property is sold. Appreciation is only paid at the end of the investment – this can take a few years. While a few years might sound like a long time, in reality, real estate has shown to be an overall good investment.

Is commercial real estate a good investment?

If you want to get into real estate without tying up your money for years at a time, check out Groundfloor. They offer short-term, high-yield investments for just 6 to 12 months.

Recommended Reading: What To Invest In Real Estate

Can You Make Money From Crowdfunding

Yes, there is potential to earn competitive returns in real estate crowdfunding. The platforms we reviewed boast annual returns ranging from 2% to nearly 20%. Still, real estate crowdfunding is considered a risky investment. Just like the stock market, there are no guaranteed returns, and you could lose your entire investment. In additiondepending on the investment and unlike the stock marketyour money may be tied up for years.

What Is An Efund

An eFund is similar to an eREIT but focuses exclusively on residential real estate assets, such as single-family homes, townhomes, and condominiums.

Traditionally, when you wanted to invest in the housing market, the primary opportunity was via publicly traded homebuilders think Toll Brothers or D.R. Horton, both companies you can buy stock in. These companies are subject to double taxation, however, which makes them a less efficient investment than Fundrises eFunds. Double taxation is when a corporation is taxed on its earnings , and shareholders are also taxed on the dividends received from those earnings.

Unlike those residential homebuilders, which are publicly traded and structured as corporations, Fundrises eFunds are structured as partnerships, so theyre not subject to the same double taxation. In other words, you and every other investor in Fundrise are considered partners with Fundrise. So any cash distributions you receive are not considered income and wont be subject to double taxation.

You May Like: Investment Policy Statement Template Cfa

Who Should Choose Fundrise

Fundrise makes sense for people who want to invest in real estate without needing to purchase property or become a landlord. Open an account for as little as $10 and get quick access to real estate funds tailored to different investment goals.

Fundrise warns that investing in real estate is a long-term proposition, meaning you should have at least a five-year time horizon. We agree. However you choose to buy, real estate is a long-term investment that delivers returns in a timespan measured in years or decades.

While some of the platformâs funds give you penalty-free early redemptions if you choose to take out money within five years, most do not. In addition, Fundrise notes that it reserves the right to freeze redemptions during an economic downturn.

Fundrise is designed to meet the needs of smaller, nonaccredited investors. While they also offer options for accredited investors who are prepared to contribute six-figure sums or more, they are not the main focus of the platform.

Note that other real estate crowdfunding platforms like CrowdStreet concentrate on the higher-end market and could be better choices for bigger real estate investments.

Choosing Investments In Fundrise

When I went through the account setup process, they asked me what type of investing goal I was interested in. There were a number of choices, and I chose Supplemental Income. It felt like the most accurate choice: I was looking for another investment to supplement my stocks and bonds portfolio that I could use as income later in life.

The initial $5,000 I invested was split into two sections: Income eREIT and Interval Fund. The Interval Fund still says its ramping up 3 months later, so my assumption is that thats a longer-term play.

I invested $5,000 in August and by November have made about 10% on my money and paid $1.42 in fees.

Interestingly , the difference between the rest of my portfolio and my Fundrise money is that the Fundrise money just slowly goes up. Remember how the chart earlier in this post just shows relatively stable returns?

Its like that. Its not excitingly volatile and all over the place, its just a slow climb upward. I have no idea if thats normal , but thats been my experience so far.

I invested $5,000 and have seen $502 in total returns in three months.

Fundrise breaks your investments down by project, which allows you to see the actual properties as well as the different sectors of their investment strategy that youre partaking in. For example, you can see that 52.9% of mine was put into Core Plus.

Don’t Miss: Private Money For Real Estate Investing

How Does Crowdfunding Work

Real Estate Crowdfunding is simply a way to take the investment capital of a lot of different investors, pool the funds, and buy a real estate asset with those funds.

The investors then receive a distribution of the earnings throughout the holding period of the investment. They also receive their portion of the appreciation upon sale.

In real estate this is generally called syndication, but with the JOBs act and new crowdfunding rules, money can be solicited online and openly. In the past, it had to be done privately and without any open advertising.

Since these offerings are technically securities, not much different than a stock, they are regulated by the SEC. In order to be compliant with the SEC regulations, companies such as Fundrise can use one of two primary ways to raise money.

Can You Get Rich From Fundrise

Fundrise has achieved competitive yields in their industry, making investors significant profits during their history.

The company targets returns between 8-13% per year, offering stable returns that stand to compound well over time if you remain invested in the service.

While not recommended for allocating most of your portfolio to any crowdfunding service, this could serve as an outlet to consider outside of learning how to get rich off stocks or picking stocks for the long-term.

Related:

You May Like: Best Company To Use To Invest In Stocks

How Liquid Is Fundrise

Well, not very.

Thats a big reason why I caution brand new investors: The folks who are in my DMs asking me why it takes three business days to get their money out of their brokerage account are likely not prime candidates for Fundrise, where you cant touch your investment for five years. Its locked up, because its actually being used to buy properties.

Think about it this way. If you bought the house down the street and you gave the bank $50,000 for it upfront and then mortgaged the rest, would you expect to be able to go to the bank and be like, Yo, Id like to withdraw my $50,000. And also, can I cash out some of that appreciation? No. You have a house, not money. Until you sell the house, you dont get the money. Tough luck.

Fundrise isnt THAT illiquid but theyve determined that thats the amount of time they need all funds to remain invested in order for the best results.

The idea of not being able to withdraw for 5 years might feel a little foreign in the age of Robinhood and instant gratification, but Ive heard it described as a way to protect you, the investor.

If you and five friends put money into a pot to buy a house over a five-year period, you wouldnt want one of your friends pulling out their funds after two years. That would hurt your overall investment. Its kinda like that, except way more complex.

Read Also: How To Choose An Investment Broker

How Can You Start In Real Estate Crowdfunding

Crowdfunding platforms connect sponsors and real estate investors. To get started in real estate crowdfunding, research the various crowdfunding sites to find an opportunity that interests youwhether thats an individual property or a fund that owns dozens of properties.

Pay close attention to the platforms vetting process for deals as well as its sponsors. The top platforms employ high levels of due diligence to make sure that sponsorsand any deals offered by the sponsorshave been rigorously evaluated.

Also Check: Buying Your First Real Estate Investment

What Are Fundrise Returns

From the chart above, the annual returns from Fundrise investments are broken down as follows:

When it comes down to it, what matters are the returns you get from the various funds? They claim real estate investing returns of 8 11% per annum.

Two things to note from those returns.

From their disclosures, Performance information is presented net of all management fees and expenses unless marked otherwise. So its a true 8 11% return and not 8 11% less management fees , so its a fair representation of what you will take home at the end of the day.

8% 11% is a pretty wide range but it is well informed.

The low end is based on:

- The weighted average of the annual interest rate of each debt asset plus,

- The annual preferred return for each preferred equity asset plus,

- The base case projected annual return for each equity asset.

Then, it is discounted by ~15% to account for downside scenarios

Then they take off 1% to account for the 0.15% annual advisory fee and 0.85% annual asset management fee.

The high end is based on:

- The weighted average of the annual interest rate of each debt asset plus,

- The annual preferred return for each preferred equity asset plus,

- The base case projected annual return for each equity asset.

Then, it is discounted by ~2.5% to account for downside scenarios

Then they take off 1% to account for the 0.15% annual advisory fee and 0.85% annual asset management fee.

Investors Without Any Margin

By this, I mean you should not use Fundrise if you cant afford to lose your investment. Real estate investing as a whole is inherently risky. Crowdfunding adds even more potential risk as investors on crowdfunding sites typically arent real estate tycoons, and come from more modest means.

Returns are not guaranteed, and since real estate investing depends on so many interconnecting factors, you should be prepared for unexpected short-term drops in the values of your investments.

Also Check: Best Banks For Heloc On Investment Property

How To Make Money With Fundrise

Fundrise is a 100% passive investment.

You simply invest your cash and it is immediately put to work. With Fundrise, you make money in one of two ways: asset appreciation and dividends or distributions.

Your eREITs within Fundrise will pay quarterly dividends or what Fundrise calls distributions. These dividends consist of interest payments from loans and rental payments. The amount of your investment in the entire eREIT determines the amount of your dividend payout.

Investors can expect to receive dividends from Fundrise on a quarterly basis, but it is important to remember that Fundrise does not guarantee these dividends.

It is also important to remember that there is no guarantee of dividends in the stock market either. Fundrise can increase, decrease, or cancel dividends at any time. Just like a publicly-traded company.

We wrote an entire article comparing investing with Fundrise vs the stock market.

In terms of asset appreciation, Fundrise will purchase properties with a high potential to grow in value. Often, this is a property in a booming area where population growth is exceeding the national average.

The goal is to buy property ahead of a major trend and capitalize on the growth of the neighborhood. Once they purchase a property, Fundrise will often renovate the real estate and make improvements to increase the sale price and the value of the property. As a result, investors make money from the sale of the property primarily.