Its Allowed But Only For Certain Strategies

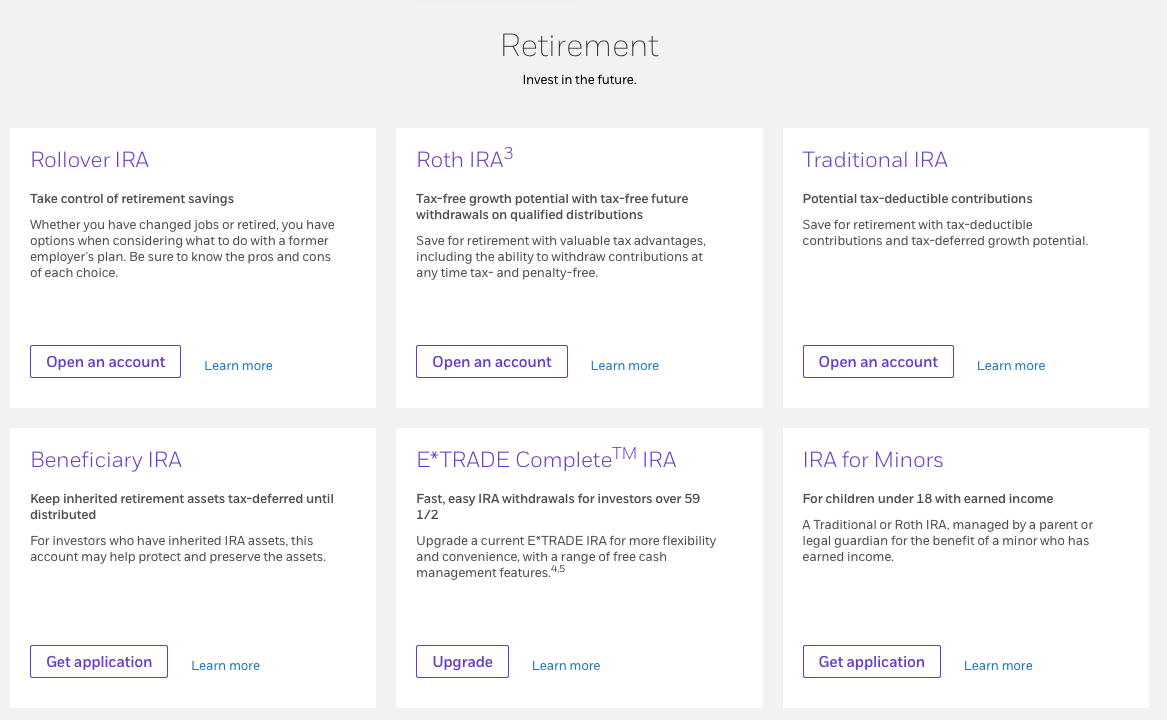

Roth individual retirement accounts are a popular way to build a nest egg. By paying taxes on their contributions today, investors can avoid paying taxes on capital gains in the futurea good move if they think that their taxes are likely to be higher after they retire.

Of course, Roth IRAs still must follow many of the same rules as traditional IRAs, including restrictions on withdrawals and limitations on types of securities and trading strategies. Below, well take a look at the use of options in Roth IRAs and some important considerations for investors to keep in mind.

E*trade Review 202: Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

How Much Do You Need To Open A Roth Ira

It doesnt take a lot to get started with a Roth IRA. But every bank, brokerage and robo-advisor has its own requirements. However, its usually not difficult to find one that will allow you to open an account with no money.

While minimums arent a problem, one of the most important parts is not contributing too much. Investors need to be aware what the annual maximum contribution is and not go over it. For tax year 2022, you can contribute $6,000 to a Roth IRA as long as your income doesnt exceed a certain amount. The maximum amount is tied to inflation and grows over time, so youll need to watch for changes.

One thing you wont have to worry about, however, is having too many Roth IRA accounts. Youre allowed to have as many as you like, but you may not contribute more than the annual maximum. If you have three Roth accounts, you can divide that annual maximum among the accounts in any way you see fit.

The Roth IRA is a powerful retirement tool, and so its important that you pick the Roth IRA provider thats going to give you the best results. Here are the best Roth IRAs to open.

| Provider |

|---|

Read Also: Best Way To Invest In Gold Etf

E*trade Review Desktop Trading Platform

We did not test the E*TRADE Pro desktop platform in this review as it is not available to new customers.

| Trading ideas |

| Data on asset fundamentals |

Research tools can be found on both the E*TRADE and the Power E*TRADE web trading platforms.

While the E*TRADE web trading platform is best for research related to basic investment topics like stocks and ETFs, the Power E*TRADE platform is better suited for researching complex products like options or futures.

This Brokerage Is Right For You If:

Keeping it simple, we think an E*TRADE account may be worthy of additional investigation if one or more of the following statements apply to you.

- Youre looking for a one-stop shop. Only a few select competitors can match E*TRADEs array of account and investment offerings.

- You want more NTF mutual funds. E*TRADE offers more than 2,200 no-load, no-transaction-fee mutual funds, which is a major selling point for fund investors. Buy-and-hold investors could easily create a diversified portfolio using its free funds alone.

- You care about the trading platform. The Power E*TRADE platform as well as E*TRADEs mobile platform both have a lot of bells and whistles compared with many rivals.

- You are a U.S. resident. E*TRADE services are available just to U.S. residents.

You May Like: How Do You Invest In Roth Ira

Read Also: Northwest Commercial Real Estate Investments

When Can You Withdraw From A Roth Ira

With a Roth IRA, you can withdraw your contributions anytime, as long as the account has been open for five years, without penalty. As for the earnings, you have to wait until youre 59 ½ to receive distributions, or you risk paying a 10% penalty in addition to income taxes. There are a couple of exceptions, however, such as if youre using the funds toward the purchase of your first home.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning.

Decide How To Invest Your Funds

Once the funds are deposited into your new IRA, you can allocate the funds within your account.

- Choose the investments that make the most sense for your unique goals and situation.

- Contact us for help creating an investment allocation tailored to your needs.

We are here to help you transfer your IRA. To get started, contact a Wells Fargo retirement professional today.

Recommended Reading: Interest Rates For 30 Year Fixed Investment Property

What To Lookout For Etrade Roth Ira Investment Options

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

The Best Etfs For Roth Iras

What about exchange traded funds , that rapidly ascending rival to mutual funds? Certainly, these pooled asset baskets that trade like individual stocks can be sound investments. They offer diversification and good yields at much lower expense ratios than mutual funds.

The only caveat is that because most are designed to track a particular market index, ETFs tend to be passively managed . As a result, they invest infrequently, so you dont really need the Roths tax-sheltering shell as much.

Still, it wouldnt hurt to have them in your account. Low annual fees and expenseswere talking 0.25% to 0.5%is not the worst idea in the world, when it comes to your rate of return.

Many ETFs are index funds, which aim to match the performance of a benchmark collection of securities, like the S& P 500. There are indexesand index fundsfor nearly every market, asset class, and investment strategy.

As with investing in individual stocks, the ETFs to look for would be those that invest in high-growth or high-income equities.

Recommended Reading: How To Invest In Ecommerce Business

What Is Margin Trading

Margin trading is leveraged investing, or using borrowed money to buy securities. To margin trade, you must opt into a special type of brokerage account called a that gives you access to a line of credit with your brokerage.

With a margin account, youre allowed to take out a loan to buy securities, usually up to half of the amount of the securities you want to buy. This lets you purchase more securities with less of your own cash, which may help you achieve larger gains than you could with just your own money.

The securities in your account act as collateral on the loan, and you will also owe some amount of interest on what you borrow. This, along with the borrowed nature of the funds, makes margin trading inherently riskier than traditional investing.

When you margin trade, youre betting your rate of return will at least exceed your interest rate. If it doesnt, you open yourself up to losses of all the cash you investedand also all of the money you borrowed and the interest you owe on it. That reason alone might make you think twice about using your retirement funds to margin trade, not that you necessarily could anyway.

What Is A Covered Call

A covered call is an options strategy where an investor holding a long position in an asset writes a call option on the same asset to generate income through options premiums. The investors long position is the cover because they can deliver the shares if the call options buyer chooses to exercise the contract.

Also Check: Charles River Investment Management System

Checkbook Equities And Participant Loan

An E-Trade Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, promissory notes, tax liens, private shares as well as process a solo 401k participant loan.

E*trade Offers One Of The Best Sign Up Bonuses In The Industry

E*TRADE offers a very generous bonus structure, starting with a $50 cash credit for opening a new account and depositing at least $5,000. Like most broker bonuses, its a tiered plan, and goes as high as $3,500 in credit.

Both taxable brokerage accounts and retirement accounts are eligible for the bonus. You must fund your new account within 60 days of opening. The bonus will be based on the amount of deposits made from external accounts within 60 days, then paid within seven business days thereafter.

Recommended Reading: Navy Federal Investment Property Loan

Making Trades In An Ira

E*TRADE Securities

Because an IRA is an individual retirement account, many people use them for long-term, buy-and-hold style investing. This makes sense since IRAs let investors take advantage of tax-deferred or tax-free compounding and likely wont be accessed for some time. However, the tax advantages have a related benefit: When you make a trade in an IRA, there are typically no direct tax consequences as there would be in a brokerage account. This makes it possible to take a more active approach to managing an IRA portfolio than many investors realize.

A more active approach might allow you to adjust asset allocations more often, react more closely to market changes, buy or sell individual investments more freely, or pursue potential opportunities when you spot them.

Of course, you should carefully consider the risks and potential downsides of a more active approach, especially with assets that you may be relying on for retirement. Depending on your trade decisions and frequency, you could easily find yourself taking on more risk than with a less active strategy. This is one reason why many investors reserve their more active investing for non-retirement portfolios. Your time horizon is also a big factor, especially if its on the shorter side. If youll be retiring soon, you may not have enough time to recover from trading decisions that go against you.

Can I Buy And Sell Etf On Same Day

Trading ETFs and stocks

There are no restrictions on how often you can buy and sell stocks or ETFs. You can invest as little as $1 with fractional shares, there is no minimum investment and you can execute trades throughout the day, rather than waiting for the NAV to be calculated at the end of the trading day.

Don’t Miss: American Equity Investment Insurance Company

Trading Restrictions For Your Roth Ira

Roth IRAs have certain trading restrictions built in. Thats because these are meant to be long-term retirement accounts, rather than speculative investment vehicles.

Therefore, custodians will not provide what is called full margin in a retirement account, said Shuchman. A account offers the opportunity to borrow money from the custodian to buy more stocks, which creates a lot more risk. In contrast, a retirement account like a Roth IRA has a limited margin basis. That means you cant trade with funds borrowed from the brokerage, but you can use unsettled cash proceedsas long as you meet your brokerages eligibility requirements.

In addition, trading options in a Roth IRA typically require approval from the financial institution. You cant just jump in and start initiating complex options. Youll have to fill out an application and illustrate that you have a strong working knowledge of how options work and that you understand the risk involved.

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

You May Like: The Investment Company Of America Class A

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Also Check: Socially Responsible Investing Robo Advisor

How Do We Review Brokers

NerdWallets comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

Don’t Miss: Can I Invest In Venture Capital

Is E*trade Right For You

E*TRADEs investing tools, educational resources, large selection of no-transaction-fee mutual funds and innovative trading technology will suit all types of investors. Active traders will love the $0 commissions, and beginners will easily get up to speed with the company’s deep educational resources.

For U.S. residents only.

Morgan Stanley Private Bank

As a subsidiary of Morgan Stanley, E*TRADE offers investors access to banking services with Morgan Stanley Private Bank. That includes a checking account with no monthly fees, a premium savings account currently paying 1.40% APY on balances up to $500,000, and a line of credit to borrow against your investments.

Read Also: Ishares Broad Usd Investment Grade Corporate Bond

E*trade Review Web Trading Platform

E*TRADE has a great, user-friendly web trading platform, offering a clear fee report. On the negative side, it cannot be customized.

| Pros |

|---|

| No | No |

There is also a legacy desktop trading platform called E*TRADE Pro. However, E*TRADE doesn’t promote this platform to new clients.

We tested the E*TRADE web platform in this review, as it is the default trading platform. It is available in English and Chinese.

How Does A Roth Ira Work

A Roth IRA is a retirement account where contributions are made with after-tax dollars, and qualified withdrawals in the future are tax-free. IRA is an acronym for individual retirement account. Other types of IRA accounts also have tax benefits, but they may differ from the unique after-tax contributions of Roth-designated retirement accounts.

When you contribute to a Roth IRA, your contributions are not tax-deductible in the current year. While youll pay regular income taxes on those funds in the year you contribute them, they can grow in a Roth IRA account indefinitely, and you wont have to pay taxes on withdrawals during retirement. Youre also allowed to withdraw tax-free for a first-time home purchase.

Don’t Miss: What To Invest In Real Estate