Can Private Equity Uphold Your Interests

To win over doctors, a private equity firm may agree to finance projects that the doctors want. For example, Lindstrom said after his group joined Unifeye, Waud agreed to finance the doctors’ plan to open a new $6 million office. Before the deal, the partners would have had to take out a $6 million loan and personally guarantee it, he said.

A private equity firm may even agree to support the selling doctors’ practice philosophy, such as serving low-income patients as long as it has a revenue stream. Luis Benavides, MD, is part of a seven-physician family medicine practice that treats many low-income patients in Laredo, Texas. “There is a lot of poverty here,” he said. This March, the group sold to a large private equity company, whose name Benavides preferred not to reveal.

One reason they made the new arrangement, Benavides said, was to qualify for ACO REACH, a new Medicare payment program that is mostly used in underserved areas and that allows more distribution of shared savings payments. “Our goal has always been better care,” he said. “We want to know how we can best serve our community.”

Benavides acknowledges that he has less independence in the new arrangement, but “I already lost my independence when I went from solo practice to a group,” he said. “The upside of a larger organization is that other people may have better ideas than you have.”

Who Is Participating In The Physician Practice Space

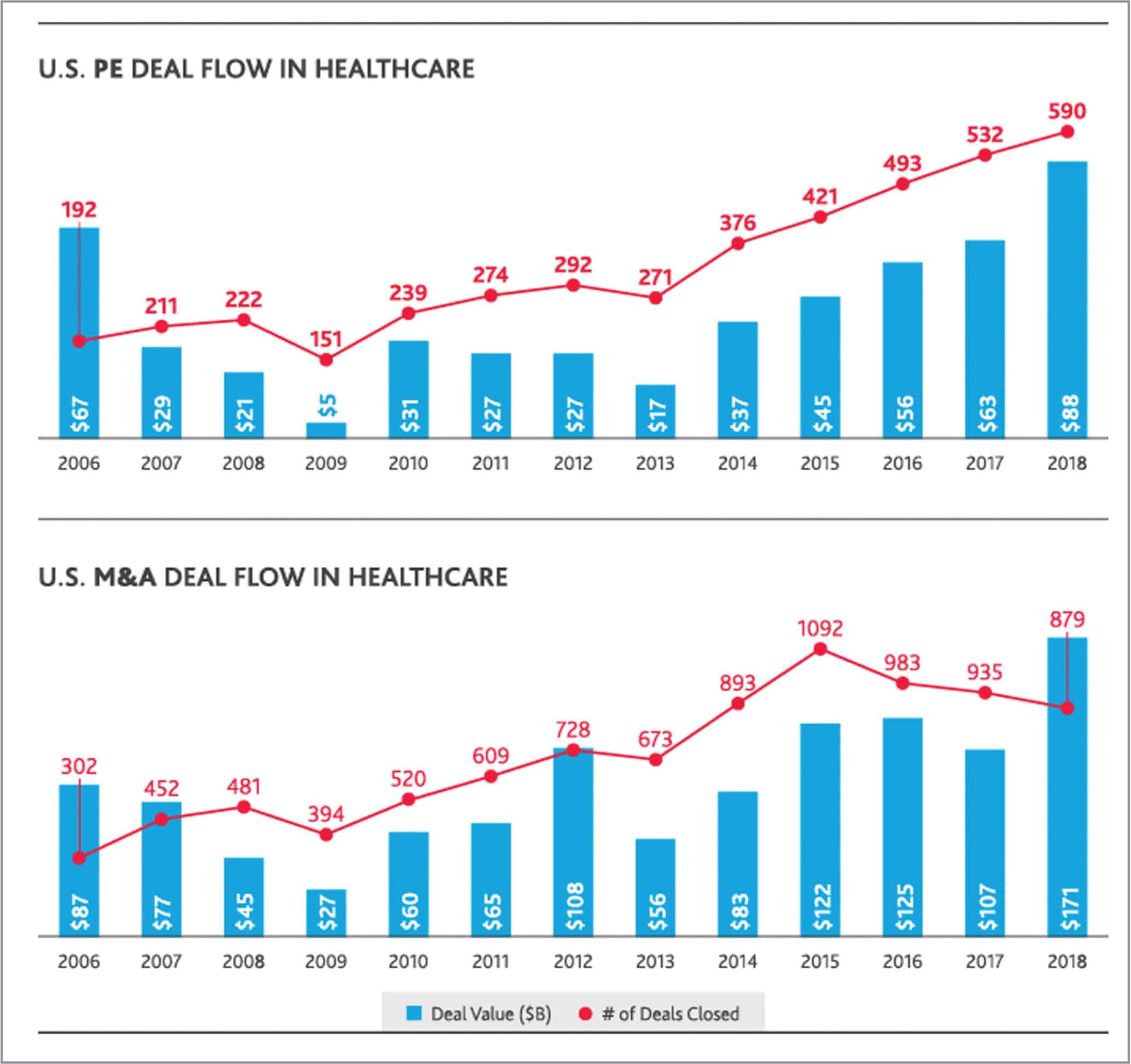

Over the past several years, there have been an increasing number of healthcare private equity firms participating in M& A transactions. Much of this increased interest is driven by the current macroeconomic environment, substantiated by record-low interest rates, a prolonged bull market, and all-time high levels of uninvested capital, or dry powder, spurring a rise in acquisitions in the significantly profitable healthcare services sector.

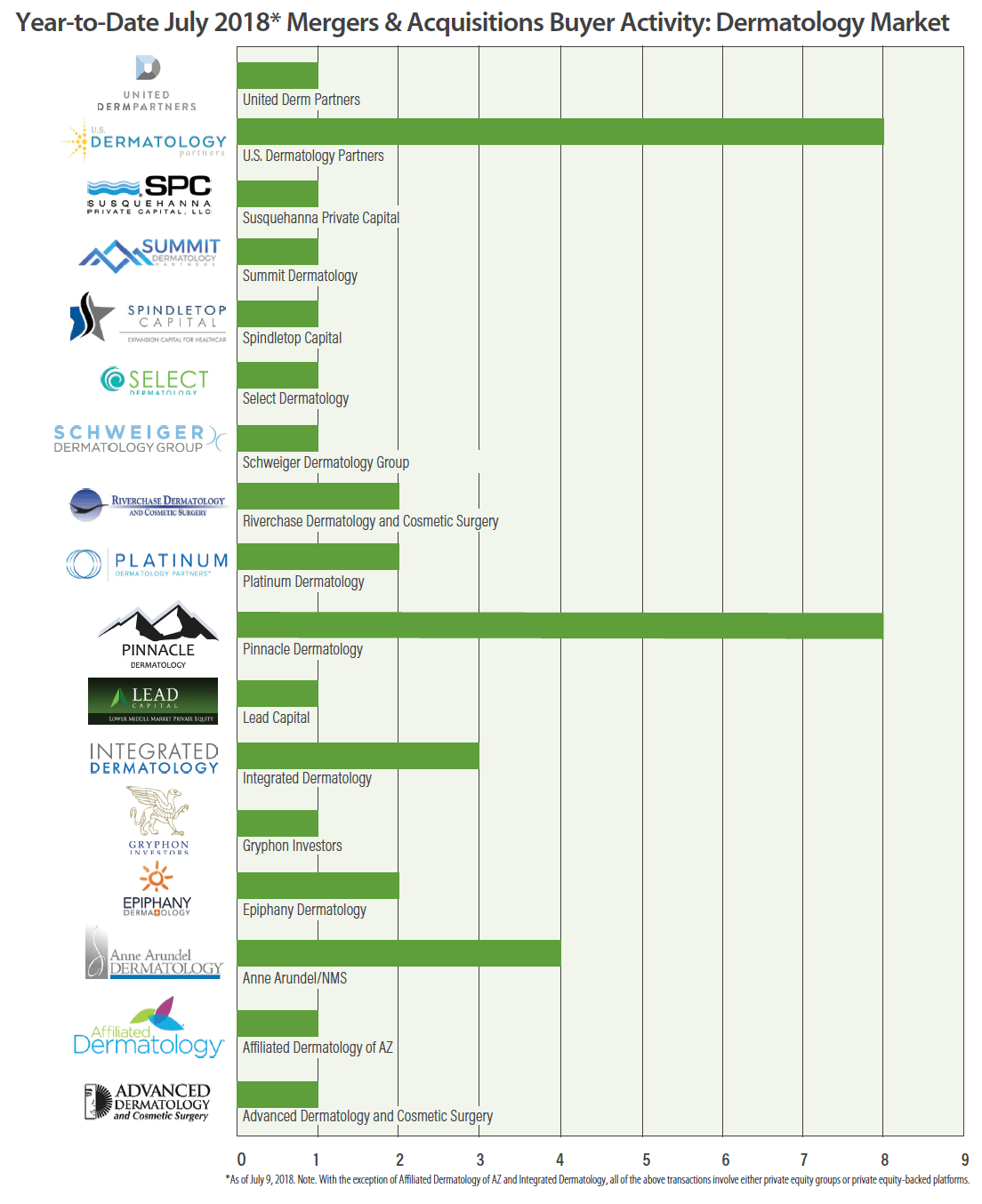

As more healthcare private equity firms compete for similar deals, physicians have reaped the benefits of favorable valuation multiples. These private equity firms are allocating capital across the entire spectrum of healthcare specialties, with certain areas experiencing more prolonged transaction cycles. Dental consolidation in particular has been privy to private equity investment for over 20 years, while dermatology, eye care, and pain management has been consolidating for over 5 years now.

Jeff Haywood & Steve Lesieur

Firm: Spectrum EquityTitle: Managing Directors

Jeff Haywood and Steve LeSieur lead Spectrum Equitys investment activity in healthcare, focusing on high growth Internet-enabled software and information services companies serving all parts of the healthcare market. Steve joined Spectrum in 2005 and currently serves on the following healthcare company boards including GoodRx and Payer Compass and was previously involved with Definitive Healthcare, MedHOK , HealthMEDX , Passport Health Communications and QTC Management . Jeff joined the firm in 2007 and currently serves on the following healthcare company boards including Definitive Healthcare, Payer Compass, RxVantage and Verisys. He also led Spectrums recent investment in PWNHealth and subsequent sale to Everlywell, where he continues as a board observer. Jeff was previously involved with GoodRx , MedHOK , Net Health , and Passport Health Communications .

Spectrum Equity is committed to fostering long-standing partnerships with the founders and entrepreneurs building todays market leading digital health companies. It is incredibly rewarding to support the efforts of management teams addressing the highly complex issues that exist, and are often unique, in healthcare. We believe the ongoing evolution of connected software, data and analytics will continue to have a massive impact on healthcare both in terms of increasing access to care and improving outcomes. Steve LeSieur & Jeff Haywood.

Recommended Reading: Peer To Peer Investment Platforms

Private Equity Investment In Medical Practices Series: Buying Or Selling A Medical Practice The Nda

The first step in most medical practice or health facility sale discussions is the negotiation and execution of a Non-Disclosure Agreement, also commonly referred to as an NDA or Confidentiality Agreement. An NDA is one of the more boilerplate documents in any transaction, but it should be carefully considered, as it can sometimes omit important concepts or overreach in its scope, write attorneys with Krieg DeVault in Lexology.

An NDA controls how the parties will treat the information they obtain from each other, more typically information the practice will provide to others. A broker or private equity buyer is not likely sharing much, if any, sensitive information, so the NDA may practically only cover the information coming from the practice even if it is designed to be mutual and apply to both parties. Confidential information is likely to include payor contracts, employee information such as wages , pending litigation, compliance concerns, 3 to 5 years of historical financial statements, etc. Read more.

Healthcare M& a: The Case For Private Equity Investment In Medical Practices

The business landscape for medical practices and healthcare providers is more complex than ever before. Evolving regulations, increased political attention, and a global pandemic have put the nations spotlight squarely on the healthcare field. And while the public may be focused on providers ability to serve patients sufficiently and efficiently, individuals operating medical practices are left to worry about how they can still remain profitable in this new and challenging world.

Even before COVID-19 turned much of the healthcare space on its head in 2020, providers and independent medical practices were increasingly turning to private equity investment as a way to mitigate these risks. In fact, healthcare saw more than 300 private equity deals in 2019 totaling more than $78 billion the highest values ever recorded, according to findings from Bain and Company. These trends are nothing new, however, as private equity activity in healthcare has been steadily increasing for nearly a decade. Owners of medical practices have been realizing the benefits of selling off a partial or majority stake in their business for some time.

1. Selling a medical practice to a private equity group removes administrative burden and allows physicians to focus on the practice of medicine.

2. Benefits of selling to a private equity group often outweigh the benefits of selling a practice to a hospital or other health system.

Recommended Reading: Cash Out Refinance Investment Property Ltv

Private Equity Is Buying Up Us Healthcare: 4 Things To Know

Private equity firms are purchasing medical practices and hospitals across the nation. Why? Because theres a lot of money in healthcare and theyre expecting large returns, Blue Ridge Public Radio reported Sept. 28.

Here are four things to know:

1. Its made care more efficient, some say. Kenneth Gregg, OD, president and medical director of Eyecarecenter in North Carolina, said after FFL Partners purchased the business, it rapidly added new practices but condensed the human resources, accounting and billing departments. It also brought in new technology and hired more technicians who are paid less than physicians.

2. The goal of the private equity firms is to grow the business and then sell it for a profit. When FFL Partners announced it was selling Eyecarecenter in 2019, it said it grew the parent company, EyeCare Partners, from 63 locations to over 450 in five years. It increased revenues by 65 percent every year.

3. Since 2006, private equity firms have invested $921 billion in U.S. healthcare, according to the American Investment Council. The Medicare Payment Advisory Council says private equity firms own 4 percent of U.S. hospitals and 11 percent of nursing homes.

Why Is Private Equity Participating In Physician Practice Mergers And Acquisitions

Private equity firms historically shied away from investing in single-specialty practices due to the complexity and regulation in the healthcare industry. However, the demonstrable success of early platforms laid the groundwork for sustainable investment in multi-site healthcare service organizations. Founded in 1997, Heartland Dental has grown to over 1,000 dental practices with the support of four separate private equity partners over the last 20 years, the most recent being KKR, one of the worlds largest private equity firms. In the last 5-10 years, there has been a significant uptick in physician practice M& A activity, with interest that has been validated by initial, successful case studies in Dermatology and Eye Care.

Forefront Dermatology is another example of how healthcare private equity can exponentially increase the growth of a physician practice. Founded in 2001, the platform was created through an initial investment from Varsity Healthcare Partners in May 2014. At the time, Forefront operated 40 clinics across 4 states, primarily in the Midwest. In February 2016, after less than two years of ownership, the platform had grown to 80 clinics across 11 states in the Midwestern and Mid-Atlantic regions, allowing Varsity to sell the business to OMERS Private Equity and delivering a second bite of the apple to the physician shareholders. OMERS has further developed and scaled the platform to more than 130 clinics across 16 states.

Read Also: Other Cryptocurrencies To Invest In

Potential Risks Of Private Equity

Like any investment, private equity investments carry risks. Private equity firms invest in strategic assets. Medical groups are financial assets, just like factories or retail chain stores. They are meant to grow in value and be sold. Before you move ahead with agreeing to a private equity investment, understand that the firm you partner with today will not be your partner in the future. The typical investment window for a private equity firm is 35 years. Eventually, the firm will look to sell your practice. You can fall in love with one private equity firm, only to be later sold to another firm or strategic buyer you dislike. You might be eager to secure a private equity investment. However, do not rush into a deal without the appropriate support. These are complex transactions.

Private Equity Sees Ripe Opportunity In Healthcare This Year

Private equity investment in healthcare has ballooned over the past decade, and experts say 2019 is poised to be another robust year, with potential ripe targets in orthopaedics and mental health and addiction treatment.

Private equity deals in healthcare in the U.S. more than doubled over the past 10 years, according to financial data firm Pitchbook. In 2008 there were 325 deals and in 2018 that number swelled to 788, a record number of deals representing more than $100 billion in total value.

One of the largest recent deals was private-equity firm KKRs nearly $10 billion purchase of Envision Healthcare last year, according to Preqin. Envision provides physician services to hospitals and operates hundreds of surgery centers across the country. Another big deal was the public-to-private takeover of athenahealth by Evergreen Coast Capital and Veritas Capital for $5.7 billion in 2018.

It looks as though 2018 was a record year for the industry, and overall the trend in deal-making has been one of strong growth this would suggest that 2019 could be another record year unless we see a change in the underlying conditions, Preqin spokesman William Clarke told Healthcare Dive.

The Envision deal was among the biggest leveraged buyouts ever at more than $4 billion in debt, according to Pitchbook. The practice is criticized in several respects, including that many are financed by loading a company up with mounds of debt.

Recommended Reading: Investing In Gold In South Africa

Private Equity And The Cause For Concern

Proponents of PE argue that the firm provides capital and management expertise to improve quality and clinical standards and billing systems. On the other hand, the short-term focus on revenue, and outsized return on investment and cost cutting measures for efficiency are deemed to be concerns in the prioritization of profits over patient care. Physicians have expressed multiple concerns including the loss of autonomy, the pressure to increase volume and coding intensity, and rely more on physician extenders. Economists have concerns of consolidation and the anticompetitive effects it will have on the healthcare market, which will drive down quality and drive up costs for patients. Additionally, the heavy debt that is placed on the PE acquisition may lead to bankruptcy and affect access to patient care in underserved areas. Finally, the focus on revenue generation may also generate unnecessary procedures and within network referrals which leading to less responsive patterns to patient needs and preferences.

This paper briefly reviews the current evidence on the effect of PE and its three core motifs of consolidation, revenue generation and debt financing through LBOs on patient care. Patient care will be assessed with respect to quality, cost and access in various healthcare settings.

Increased Involvement By Private Equity In Physician Practices

The focus on the health care market by private equity companies is similar to the practice management companies that were popular in the 1990s. Private equity firms hold substantial investment funds, and health care remains an attractive investment vehicle. It is estimated that investors are currently holding $1.8 trillion dollars allocated for health care investments, and health care providers are an attractive target for multiple reasons. Unlike most investment sectors, the health care sector is growing at a quicker rate than the Gross Domestic Product. The health care industry is relatively recession-proof since there is continued demand during economic downturns, and many health care providers do not have access to professional expertise while many medical specialties remain fragmented.9 Certain specialties like oncology, ophthalmology, dermatology, orthopedic, urology, gastroenterology, and radiology are of particular interest to private equity firms primarily because of the opportunity to consolidate practices and generate increased revenues from ancillary services. For example, in the dermatology industry, seventeen private equity-backed dermatology-specific management companies acquired 184 practices during the six-year span of 2012 to 2018, which accounted for an estimated 381 dermatology clinics located in 30 states.10

You May Like: Borrow Against House To Invest

What Is Private Equity

Private equity firms use capital from institutional investors to invest in private companies with potential to return a profit. That potential is realized if private equity firms manage to add value to the company and subsequently sell their stake at a price higher than the purchase, typically within 3 to 7 years. Private equity deals range from tens to hundreds of millions of dollars and are expected to deliver 20% to 30% returns. Private equity firms use several strategies to raise the value of practices, such as reducing costs and improving efficiency by consolidating and internalizing previously outsourced processes like billing. However, in physician practice acquisitions, key private equity tactics also include increasing prices and volume. Private equity firms typically purchase an established group practice and acquire smaller practices to establish regional brands that can exercise greater bargaining power with insurers and medical suppliers. As ownership shifts from physicians to private equity firms, more emphasis might be placed on extracting higher contracted payment rates, lowering overhead, and increasing volume and ancillary revenue streams .

The Private Equity Bet On Healthcare

Susan LadikaMHE Publication

Private equity firms have pulled back some this year, but money has been pouring into the healthcare sector. Will the cash infusion make healthcare more efficient or drive up costs as investors seek returns?

A record amount of private equity flooded into the healthcare sector in 2021. This year, investors seem to be proceeding with a little more caution. Even so, the investment is a major development in how healthcare gets financed and the makeup of the sectors ownership interest. Some are thumbs-up on the healthcare push by private equity firms, arguing that the surge in investment will improve management and operations. Others see the entry of the profit-seeking enterprises as driving up healthcare costs and, especially in the United States, further fracturing an already fragmented healthcare system.

After declining in 2020 as the COVID-19 pandemic swept the world, the total disclosed value of private equity investment in healthcare more than doubled globally last year. It reached $151 billion in 2021 compared with $66 billion in 2020 and $79 billion in pre-pandemic 2019, according to Bain & Company, a Boston management consulting company. At the same time, the number of healthcare deals involving private equity surged from 380 in 2020 to 515 in 2021, Bain reported.

Private equity typically will raise the bar on compliance.

Maximizing return

Ripe for change

Smaller appetite

Also Check: How To Invest In Ada

Is History Going To Repeat Itself

As previously mentioned, the current wave of private equity investing in physician practices is not new. The health care industry witnessed a similar onslaught of suitors in the 1990s when private equity recognized the value of monetizing management services provided to physician practices, and physician practice management companies became the norm in the physician practice world. Companies like Phycor and MedPartners, backed with private equity investments, created single-specialty and multispecialty clinics through rollups using management service companies as the vehicle to bring them together. The visions of both private equity firms and physicians were to create the management company, go public, and prosper from the endeavor. For a period of time, this vision worked. Public PPMs in 1997 raised $2 billion to further acquisition efforts. In 1998, approximately 39 public and 125 private PPMs existed, but eight of the ten largest PPMs had declared bankruptcy by 2002.32

What Is Private Equitys Physician Practice Strategy

Healthcare private equity firms have maintained a platform-based strategy. This strategy is characterized by firms making a large initial investment with a regionally-dominant practice that can be utilized as an anchor, followed by add-on investments in smaller practices to quickly establish multi-state and regional dominance. The thesis is to build scale while recognizing synergies driven by geographic proximity.

Another prevalent strategy for investor groups is to acquire strong, clinically-driven practices across multiple geographies, establishing a brand known for exceptional patient outcomes. Many physicians are worried about the prospect of private equity interfering and affecting patient experience, while dictating to the physician how to practice medicine. The majority of private equity firms are aware of this risk, and instead aim to remain in the background, working to eliminate inefficiencies and drive synergies, while allowing physicians to take leadership roles and remain fully committed to patient care.

Not all private equity firms conduct business the same way, and it is important to be comfortable with the partner that you have entrusted to grow your practice. Advisors have intimate working relationships with all major platforms and healthcare private equity groups, and have relevant insights into the varied growth strategies employed.

You May Like: Best Place To Invest In Penny Stocks