Asset Allocation By Age

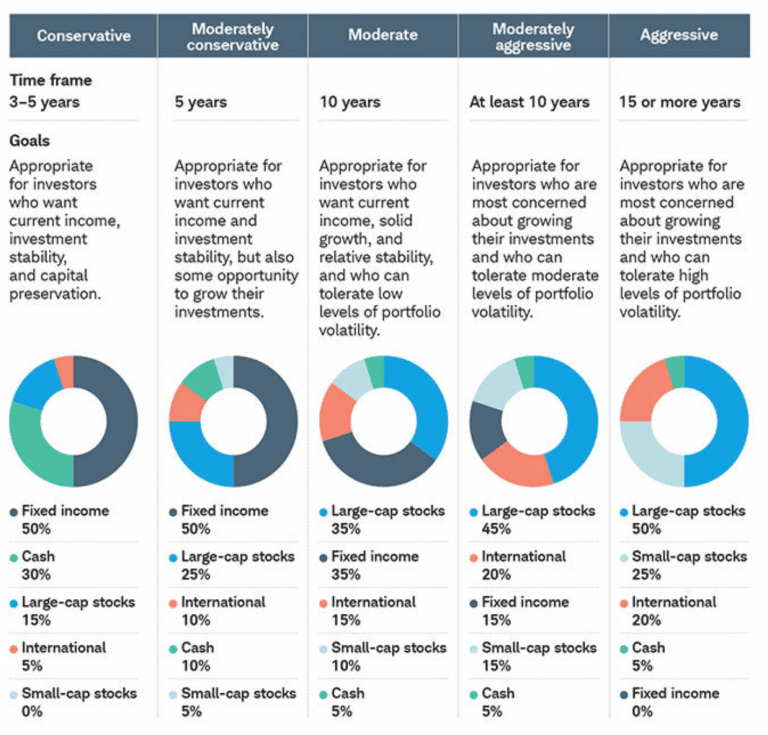

Here’s a look at asset allocation through life’s various stages. Of course, these are general recommendations that can’t take into consideration your specific circumstances or risk profile. Some investors are comfortable with a more aggressive investment approach, while others value stability above all elseor have life situations that call for extra caution, such as a child with disabilities.

A trusted financial advisor can help you figure out your risk profile. Alternatively, many online brokers have risk profile “calculators” and questionnaires that can determine if your investing style is conservative or aggressiveor somewhere in between.

At any age, you should first gather at least six to 12 months’ worth of living expenses in a readily accessible place, such as a savings account, money market account, or liquid CD.

Almost Retirement: Your 50s And 60s

Sample Asset Allocation:

- Stocks: 50% to 60%

- Bonds: 40% to 50%

Since youre getting closer to retirement age, now is not the time to lose focus. If you spent your younger years putting money in the latest hot stocks, you need to be more conservative the closer you get to actually needing your retirement savings.

Switching some of your investments to more stable, low-earning funds like bonds and money markets can be a good choice if you dont want to risk having all your money on the table. Now is also the time to take note of what you have and start thinking about when might be a good time for you to actually retire. Getting professional advice can be a good step to feeling secure in choosing the right time to walk away.

Another approach is to play catch-up by socking more money away. The IRS allows people approaching retirement to put more of their income into investment accounts. Workers who are 50 and older can contribute an additional $6,500 per year to a 401called a catch-up contributionfor 2022. In other words, those aged 50 and over can add a total of $27,000 to their 401 or in 2022. If you have a traditional or Roth IRA, the 2022 contribution limit is $7,000 if you’re aged 50 or older.

Decide Sequence Of Withdrawals And Determine Positioning Accordingly

The preceding steps all relate to setting an asset allocation for your total retirement portfolio. But the reality of positioning your actual portfolio is apt to be messier, complicated by the fact that youre likely holding your assets in various tax silos , each with its own withdrawal rules and tax implications.

The next step, therefore, is to overlay your total asset-allocation plan on your subportfolios. For example, because of impending RMDs, you may want to tee up more liquid assets in your IRA, while steering stocks to your Roth accounts, which dont carry RMDs.

Don’t Miss: Is It Good To Invest In Gold Bars

Retirement Investments: A Beginners Guide

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Advancements in medicine and technology are helping us live longer than ever before. But the prospect of living in retirement for up to 40 years often the same time frame an individual spends working makes saving and planning all the more important.

Yet saving is only one piece of the retirement puzzle. Choosing the right underlying investments and retirement account are critical to getting the most from your savings. Heres how to manage that process.

Retirement: 70s And 80s

- Stocks: 30% to 50%

- Bonds: 50% to 70%

You’re likely retired by nowor will be very soonso it’s time to shift your focus from growth to income. Still, that doesn’t mean you want to cash out all your stocks. Focus on stocks that provide dividend income and add to your bond holdings.

At this stage, you’ll probably collect Social Security retirement benefits, a company pension , and in the year you turn 72, you’ll probably start taking required minimum distributions from your retirement accounts.

Make sure you take those RMDs on timethere’s a 50% penalty on any amount that you should have withdrawn but didn’t. If you have a Roth IRA, you don’t have to take RMDs, so you can leave the account to grow for your heirs if you don’t need the money.

Should you still be working, by the way, you won’t owe RMDs on the 401 you have at the company where you’re employed. And you can still contribute to an IRA if you have eligible earned income that doesn’t exceed the IRS income thresholds.

Recommended Reading: Where To Invest If You Have 100k

Adapt Your Strategy Over Time

Here’s an example of how you might adjust your asset allocation throughout retirement, if you plan to use your portfolio including principal, to support spending, rather than spending only your investment earnings and leaving your nest egg to your heirs.

Retirees who adopted this plan would have seen the following results in their portfolios*:

The key is staying invested–and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments. Why? Over time, equities historically have been an adequate defense against inflation and taxes–even better than bonds and cash.2 However, limit your exposure to stocks based on how much you’ll need from your portfolio soon, because there will be less time to recover from a bad year in the market. The key is determine the right mix for you, based on your age, needs, and time horizon.

1 Social Security Administration, Actuarial Life Table, 2017. The average life expectancy for a person age 65 is 17.89 years for males and 20.45 years for females.

2 Schwab Center for Financial Research.

Dave Ramsey Tsp Allocation

Finance guru Dave Ramsey is one of the most recognizable voices in personal finance. While he is mostly known for helping people pay off debt, he also talks about wealth accumulation.

Like other voices, he recommends a portfolio with 100% equities but recommends a breakdown of 60% C Fund, 20% S Fund, and 20% I Fund.

If you want to research this portfolio further, you should know that the I Fund doesnt invest in what you think it does and may not give you the international exposure you desire.

Don’t Miss: Investing In A Reit Is The Same As Purchasing Property

Income Balanced And Growth Asset Allocation Models

We can divide asset allocation models into three broad groups:

Income Portfolio: 70% to 100% in bonds.

Balanced Portfolio: 40% to 60% in stocks.

Growth Portfolio: 70% to 100% in stocks.

For long-term retirement investors, a growth portfolio is generally recommended. Whatever asset allocation model you choose, you need to decide how to implement it. Next up, well look at three simple asset allocation portfolios that you can use to implement an income, balanced or growth portfolio.

Determine How Much To Invest In Stocks And Other High

The remainder of the portfoliofor which the retiree has a time horizon of more than 10 yearscan go into higher-growth/higher-risk assets . Thats primarily stocks but may also encompass higher-risk asset classes like junk bonds, real estate securities, emerging-markets bonds, and precious-metals equities .

For Paul and Amy, the majority of their portfolio will go into these higher-risk/higher-returning asset classes.

In terms of the complexion of the equity portfolio, Ive generally avoided big style and size bets in my model portfolios while academic data support that certain factors have outperformed over long periods of time, theres no guarantee that will be the case during the 20- to 30-year time horizon of many retirees. If anything, Ive steered the equity components of the portfolios to quality and dividends in an effort to reduce the volatility of the portfolios stock piece for example, my core Bucket portfolio holds its largest equity position in Vanguard Dividend Appreciation VDADX. A minimalist retiree could reasonably use total U.S. and international stock market index funds and call it a day.

Don’t Miss: Mid Cap Companies To Invest In

What Is A 3

A three-fund portfolio is a simpleyet smartway to create a diversified retirement savings plan by focusing on stocks and bonds .

Why that ratio? Over time, stocks have delivered better returns than high-quality bonds and cash. The annualized return for large U.S. stocks dating back to 1928 is around 8.5%, adjusted for inflation. Meanwhile bonds, like 10-year U.S. Treasury notes, for instance, have provided inflation-adjusted annualized returns of 2.3%, according to data compiled by New York University professor Aswath Damodaran.

Each of these far outpace cashs long-term performance, which generally struggles to keep up with inflation. And adding in an international stock fund that includes companies in developed and emerging markets further diversifies your stock holdings while positioning you for growth potentially uncorrelated with the rest of the U.S. stock market.

But theres a catch. While domestic and international stocks generally trend upwards, from time to time stocks fall in value. Owning some bonds along with stocks can be a great way to calm your investing nerves during inevitable dips and bear markets. When stocks are falling, quality bonds typically hold their groundand may even rise in value.

In short, you can get the growth of stocks and the calming protection of bonds with a three-fund approach.

No One Particularly Likes Rules Of Thumb

Financial planners have developed a couple of rules of thumb for different asset allocations over the last 50 years. Theyre a handy mental shortcut for DIY retirement planning, but how good are they?

The investing landscape has changed significantly since the rules were first written down in the 1960s and 70s. Back then, you could get risk-free U.S. government bonds that would pay 10%. These days, the yield on the 10-year U.S. Treasury is 0.71%.

At the same time, the stock market seems to defy gravity. From its low point after the crash of 2008-2009 to its peak in February 2020, the S& P 500 index of U.S. stocks grew 323%. If you had $100,000 in an indexed fund in February 2008 and you didnt panic sell any during the crash, youd have $423,000 in just 10 years.

Life expectancy has also zoomed up by 10 years since the 1970s when the rules first became popular.

You May Like: How Do I Get Into Real Estate Investing

Why The 60/40 Portfolio Is In Trouble

The 60/40 portfolio is designed for moderate risk and moderate returns. This counts on the fact that while the stock market periodically goes down, and the bond market periodically goes down, they rarely go down at the same time a phenomenon that investing pros call having a low correlation.

“For the past two decades, the stock/bond correlation has been consistently negative, and investors have largely been able to rely on their bond investments for protection when equities sell off,” wrote researchers at investment firm AQR earlier this year.

Not so this year. In response to rampant inflation, the Federal Reserve has embarked on the largest six-month increase to interest rates in 41 years. Fear among investors that the Fed’s actions could tip the economy into a recession have sent stock prices down nearly 23% on the year.

Because bond prices and interest rates move in opposite directions, the broad bond market has fallen more than 14% since the year began.

Those stock and bond returns are notable for two reasons:

Asset Allocation Advice For Older Retirees

Your age is just one factor in determining the right mix of investments.

Q: My father recently passed away, and Ive been helping my mom figure out her finances. Mom paid all of the bills over the years, but Dad took care of the investments with the help of a long-time stockbroker. Her home is paid for, and she has about $60,000 in income from pensions and Social Security, so shes fine financially, but Im a little concerned about her investments. She has about $500,000 in her IRA and brokerage account, but she is allocated almost 70% in stocks. Is that too much in stocks for someone in her 80s?

A: Im not sure if its too much to have in stocks or not. As strange as it may sound, ones age isnt always the deciding factor in how much money should be allocated toward long-term investments.

Heres the thing: Your mother has enough income from her pension and Social Security to cover her monthly expenses, so Id bet that shes not spending any money from her investments. She must take required minimum distributions from her IRA, but shes probably just paying the taxes on the distributions and reinvesting the rest.

Also Check: T Rowe Price Investment Management

Best Investments For Retirement Planning

There are countless ways to invest your money to meet your retirement goals. From the simplest index fund to the most convoluted hedge fund, you have endless options.

The following represent the most common investments, although not every one is appropriate for everyone. Again, the greater your financial literacy, the better equipped you are to make your own sound investing decisions.

When in doubt, err on the side of simplicity.

How Broad Inflation Hedges Can Help Your Retirement Portfolio

Inflation hedges are investments whose values go up when higher inflation comes on line. These investments can be further subdivided into two groups: those that aim to reflect inflation broadly, as measured by the Consumer Price Index, and those that reflect higher prices in a smaller basket, such as commodities or real estate.

In the former group, Treasury Inflation-Protected Securities and I Bonds both help the value of their investors’ accounts keep pace with the Consumer Price Index for All Urban Consumers, or CPI-U.

From a practical standpoint, many investors opt for TIPS mutual funds for simplicity and ease of use. Moreover, I Bonds have severe purchase constraints that limit their effectiveness for larger investors who are aiming to build a significant bulwark against inflation.

You May Like: Fisher Investments Wealth Builder Program

Forget Investment Returns And Focus On Income

The real risk of retirement savers is income risk, which includes systematic risks like inflation, market crashes and the loss of pension or social security income. Calculating those kinds of risks and protecting yourself from them takes a more comprehensive approach, like the kind offered by the NewRetirement Planner.

Diversification in retirement isnt just about a defined contribution account and the rates of return. Diversifying your investments to create a retirement paycheck is also important.

How To Find The Right Retirement Portfolio Allocation To Narrower Inflation Hedges

There are a couple of big issues with these types of inflation hedges, which is one reason it’s wise not to go overboard with them. One is that, unlike TIPS, they don’t reflect the broad basket of goods and services that consumers spend money on. Even the broadest-based commodities-tracking funds obviously won’t reflect changes in service categories like healthcare delivery, hair salons, cable TV subscriptions, or gym memberships. REITs reflect inflationary changes in a smaller part of the economy still. Thus, there’s a risk that they won’t defend against the type of inflation you’re experiencing.

Perhaps more important, these investments are quite volatile: If you happen to buy in at the wrong time, as many investors did by racing into commodities following their runup in the mid-2000s, that reduces the inflation-protective benefit that you might derive from them. Of course, the fundamental case for commodities looks better today than it did back then, but commodities have already experienced a significant runup over the past year.

I think it’s reasonable for retirees to forgo commodities altogether.

Don’t Miss: How To Invest In Ripple Cryptocurrency

Allocate Assets To Manage Your Risk

The rule of thumb when it comes to managing your retirement portfolio is that you should be more aggressive earlier. The younger you are, the more time you have to replace any losses that you take from higher-risk assets. Then, as you age, you should shift money into more conservative assets. This will help protect you against risk when you have less time to earn back your money.

By the time you enter retirement itself, you should shift your assets in a generally conservative direction overall. This reflects the fact that you dont intend to work again, so youll have to make up any portfolio losses with future gains and Social Security.

This is generally a wise strategy. The two most common lower-risk assets for a retirement account are:

Bonds are corporate, or sometimes municipal government, debt notes. They generate a return based on the interest payments made by the borrowing entity. Most bonds tend to be relatively secure investment products, since large institutions generally pay their debts .

Certificates of deposit are low-risk, low-return products offered by banks. You make a deposit with the bank and agree not to withdraw it for a minimum period of time. In return they pay you a higher interest rate than normal.

Both bonds and CDs are considered low-risk assets. Bonds give you a better return, but retain some element of risk, while CDs give you a fairly low return but with about as little risk as you can get.