Select An Online Stockbroker

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the brokers website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically.

» How do you find a broker? Compare options among the best brokers for stock trading

Good Til Cancelled Order

Stays open in the market until cancelled, giving you the benefit of order queue priority. The risk is it could expose you to significant price swings, for example due to overnight international news and market moves. So you could experience a loss. The risk is higher during times of greater market volatility, such as COVID-19.

How Investing In Shares Works

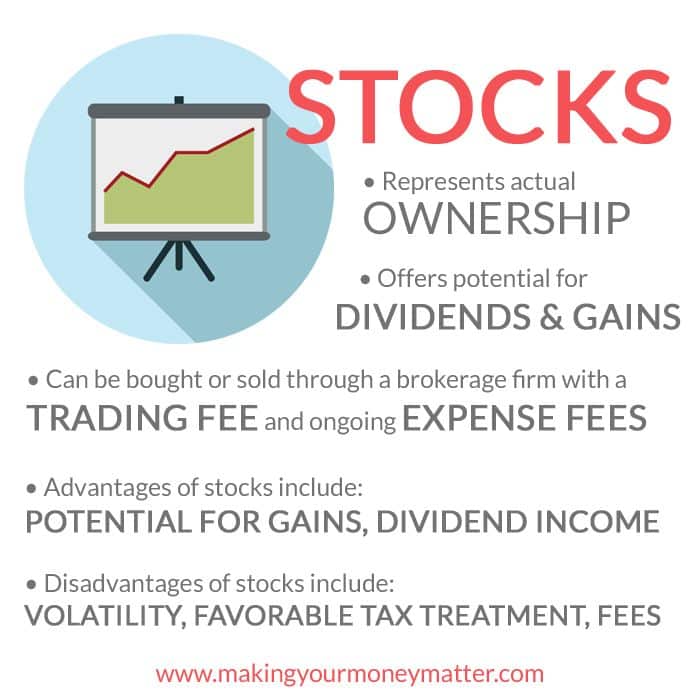

Buying shares makes you a part-owner of a company. As a shareholder, you can get dividends and other benefits.

You can own shares yourself, or pool your money with others through a managed fund .

If you’re new to shares, visit the Australian Securities Exchange education centre for information and online seminars.

Recommended Reading: How To Start Investing In Private Equity

Research Which Stocks Youd Like To Buy

There are thousands of different publicly traded companies offering shares of stock on the market. That makes it daunting to decide which stocks to buy. One way to think about researching the stocks you want to buy is to adopt a well-thought out strategy, like buying growth stocks or buying a portfolio of dividend stocks.

- Growth stocks are shares of companies that are seeing rapid, robust gains in profits or revenue. They tend to be relatively young companies with plenty of room to grow, or companies that are serving markets with lots of room for growth. Whether the shares of a growth stock seem expensive or not, investing in growth stocks assumes that continued rapid growth will deliver strong price gains over time.

- Value stocks are shares of stock that are priced at a discount and stand to see price gains as the market comes to recognize their true value. With value investing, youre looking for shares on sale, with low price-to-earnings and price-to-book ratios. The aim is to buy stocks that are underpriced and hold on to them over the long term.

- Dividend stocks pay out some of their earnings to shareholders in the form of dividends. When you buy dividend stocks, the goal is to achieve a steady stream of income from your investments, whether the prices of your stocks goes up or down. Certain sectors, including utilities and telecommunications, are also more likely to pay dividends.

Is It Worth Buying 10 Shares Of A Stock

Just because you can buy a certain number of shares of a particular stock doesnt mean you have to. Most experts tell beginners that if you want to invest in individual stocks, you should eventually try to have between 10 and 15 different stocks in your portfolio to properly diversify your holdings.

What if you buy 10% of the shares? A: If you are buying individual shares, and you do not know the 10% rule, you are asking for problems. This is what investors who survive in bearish markets know. The rule is very simple. If you have an individual value that is 10% or more of what you paid, sell.

Read Also: Does A Roth Ira Invest In Stocks

Benefits Of Buying Stocks With A Broker

A stockbroker facilitates the purchase and sale of shares and other securities on behalf of customers. Brokers build relationships with their customers to better understand their financial needs and goal. With their training and experience, brokers can offer clients trade advice and suggestions, such as what to invest in and when to buy and sell. However, using a broker can be costly because you pay them a commission every time you buy, sell or trade shares or securities.

Whats A Good Amount Of Shares To Buy

While there is no consensus answer, there is a reasonable range for the ideal number of shares to hold in a portfolio: for U.S. investors, the number is between 20 and 30 shares.

How many shares should a beginner buy?

Most experts tell beginners that if you want to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings.

Is it worth it to buy 10 shares of a stock?

The bottom line is that if you want to invest in the long term, buying 10 shares is now a good idea. Later, when you have more money to invest, buy 10 more shares and 10 more later. However, if you do, I suggest investing in solid companies, and preferably in companies that pay dividends.

Don’t Miss: How To Invest In Darpa

Decide How Many Shares To Buy

You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at once. Consider starting with paper trading, using a stock market simulator, to get your feet wet. With paper trading, you can learn how to buy and sell stock using play money. Or if you’re ready to put real money down, you can start small really small. You could purchase just a single share to get a feel for what its like to own individual stocks and whether you have the fortitude to ride through the rough patches with minimal sleep loss. You can add to your position over time as you master the shareholder swagger.

New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows you to buy a portion of a stock rather than the full share. What that means is you can get into pricey stocks with a much smaller investment. SoFi Active Investing, Robinhood and Charles Schwab are among the brokers that offer fractional shares.

Many brokerages offer a tool that converts dollar amounts to shares, too. This can be helpful if you have a set amount youd like to invest say, $500 and want to know how many shares that amount could buy.

How Much Should I Invest

You dont have to start with a lot of money in order to invest. The great thing about Rule #1 Investing is that you can grow any amount of money into a substantial amount by investing in great companies that will deliver great returns over the long run.

This means you can get started with as little as $500.

If $500 sounds like a lot of money to invest, remember, you have already invested time and energy into learning how to invest so that you can minimize your risk and maximize your reward. You dont have to be afraid of stock investing when you put in the work ahead of time and know what youre doing.

Don’t Miss: Where Can You Find Investment Information Online

Ready To Start Investing In The Stock Market

You’ve got choices. Learn about TD Direct Investing intuitive trading platforms and advanced tools or TD Easy Trade, a simplified easy-to-use app.

The information contained herein has been provided by TD Direct Investing and is for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance.

TD Easy TradeTM is a service of TD Direct Investing, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank.

® The TD logo and other trademarks are the property of The Toronto-Dominion Bank and its subsidiaries.

Review Your Share Positions Regularly

You’re done, you’ve bought the shares, they are yours. Now it is key to monitor your investments.

If you bought the shares with the goal of holding for a longer term, you dont need to check the price movements every day but you might want to check the quarterly or yearly reports and company guidance. This basically means reviewing your investment strategy from time to time.

For short-term buyers, position management could mean setting up a stop-loss price of where to cut losses, and the target price of where you want to sell stocks, while making a profit.

Now that you have mastered the 6 steps of buying shares, take a moment to look at the top 5 brokers we have selected for you.

Also Check: Stock Market Investing Strategies For Beginners

The Problem With Buying Stock Without A Broker

There are serious obstacles that can bar the average person or retail investor from the stock market. For example, transaction fees, hidden fees, and trading fees can eat up all or most of your profit. Also, brokerages, exchanges, and regulators often place severe restrictions on individual traders.

Thus, always research stock purchases carefully before entering the market. A little knowledge can help you avoid high fees and ridiculous restrictions.

Tip: Use National Tax Free Accounts

In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. For example, in the UK, this account is the ISA, the Individual Saving Account, which is exempt from income tax and capital gains tax on the investment returns. In the US, individual retirement accounts offer many benefits.

Recommended Reading: Can You Make Money Investing In Cryptocurrency

Manage Your Investment Portfolio

Depending on your objective, you may want to set specific times to revisit your portfolio, to help ensure youre still in line with your goals. Depending on how involved you want to be, this can be done daily, weekly, monthly or even longer.

To make this step easier on you, some online trading platforms like WebBroker can empower you with real-time market data to help you uncover, evaluate and act on your investment ideas as well as provide tools to help you keep track of them along the way.

Buying Stocks Without A Broker: Why It Might Be A Smart Move For Some Investors

As any good stock broker or experienced investor can tell you, bad brokers are all too common. By bad brokers, we mean those who put their own interests above that of their clients. Keep in mind, however, that most bad brokers do this in a perfectly legal fashion, by catering to their clients whims and weaknesses.

Here are three main practices that bad stock brokers often practice:

- Aiming for stability rather than growth

- Stressing low-risk, low-return, high-fee structured products in client accounts

Additionally, you may have noticed that your broker sometimes uses unfamiliar words and phrases to describe investment concepts. Some of this stock broker jargon is simply shorthand that brokers use among themselves, to refer to familiar situations without having to go into any detail on the underlying concept. However, the concepts that these broker-ese words and phrases represent also serve to further the goals of the brokerage business.

If you find yourself thinking in broker-ese, youll naturally make assumptions that are in tune with the goals of your broker. They may be out of tune with yours.

To do so, of course, you have to pay one commission to sell and another to buy. You may also face some costs from the bid-ask spread. If you make money on the sale and the stock is outside your RRSP or other registered account, youll have to pay capital-gains taxes, which will leave you with less capital to reinvest.

Also Check: Masters Degree In Finance And Investment

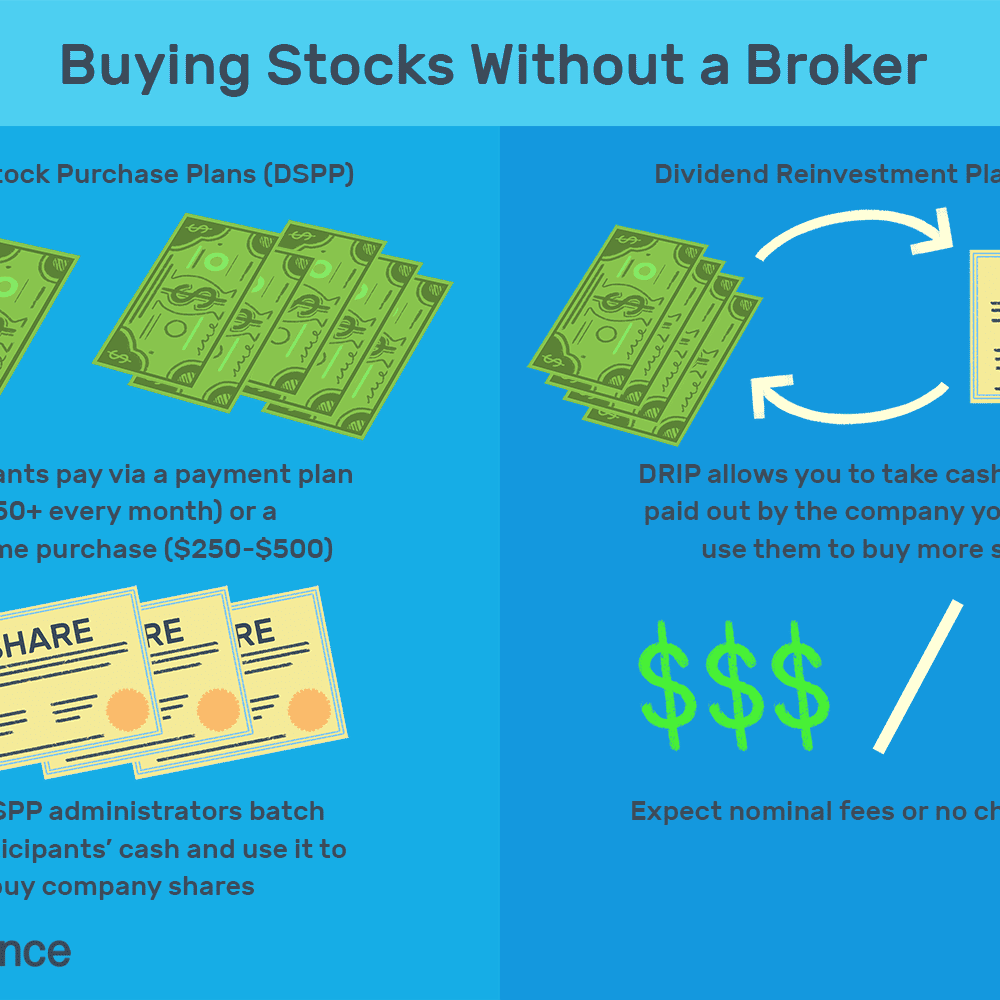

Direct Stock Purchasing Program

A DSPP allows you to purchase stock from a company directly without having to pay commissions to a personal or online broker. Typically, the company youre investing in will take a specified amount regularly from your checking or savings account. You can also make larger

one-time purchases instead of monthly amounts. If your company pays dividends, you also can reinvest your dividends back into the company by purchasing stock. DSPPs are an attractive, low-cost option to individuals who want to purchase stock from companies that they trust while retaining a high degree of self-directedness.

What To Look For When Buying A Stock

Stock picking is hard. So hard in fact that most studies show that even professionals paid to pick stocks will fail to outperform the overall market over the long term. Heres why:

You, person who wants to buy a stock, are super smart But you have to buy that stock from someone. That person might be super smart too, and she has exactly the same information you have She has decided the stock is worth selling at say, $10 dollars a share because its definitely going to go down, and youve decided its worth buying at that price because its definitely going to go up. Whos right? How sure are you that youve synthesized all the available information better than other investors? No offense, but what makes you so darned special?

For this reason, buying a stock is nothing like landing a $1,000 suit for $200 dollars. Through the law of supply and demand, the market has already worked all its special price discounting magic. All of the information the market knows is already baked into a stocks pricerevenue, growth and historical prices.

But, if you understand the risks, there is nothing wrong with devoting a small percentage of your portfolio to one stock there are now mobile apps that allow you to trade stocks commission free.

Recommended Reading: Real Estate Agent Specializing In Investment Properties

What Are Expense Ratios

An expense ratio is a fee charged annually to investors which covers the administrative and operating expenses of exchange-traded funds or mutual funds. This cost is expressed as a percentage and taken out from the amount youve invested, which lowers the amount of returns you receive.

For example, if you purchase a fund with a 0.50% expense ratio, $5 for every $1,000 youve invested. The higher the expense ratio, the more investors will pay in fees and reduce potential returns on their investment. Thats why its important to find ETFs and mutual funds offering the lowest expense ratios, so you can feel confident youre not losing money to large fees.

You May Like: Savings Ira Vs Investment Ira

Investing Through Dividend Reinvestment Plans

Recommended Reading: Beachfront Investment Property For Sale

Tips For Selling Shares

If youre considering selling shares in your company, its important to understand how the process works and to have a plan in place. There are a few different ways to sell shares, but all of them require some type of broker or exchange.

Here are four tips for selling shares without a broker:

How Much Should A Beginner Invest In Stocks

If youre a typical hard worker or a novice investor, you should know that it doesnt take a lot of money to get started, IBD founder William ONeil wrote in How to Make Money with Stocks. You can start with just $ 500 to $ 1,000 and add in as you earn and save more money, he wrote.

How much should you invest in stocks first time?

Theres no minimum to start investing, but you probably need at least $ 200- $ 1,000 to get off to a really good start. If you start with less than $ 1,000, its okay to buy just one stock and add more positions over time.

How much should a beginner investor invest?

A minimum initial investment of $ 1,000 or more may be required. If you dont have a lot of money to invest, remember that many 401 plans offer a selection of mutual funds or indexes with no minimum investment. In addition, index funds are usually cheaper than mutual funds.

You May Like: How To Invest With Fidelity Roth Ira