Guidance On Tenant Occupancy Methodology

As of May 15, 2018, USCIS rescinded its prior guidance on tenant occupancy methodology. That update applies to all USCIS employees with respect to determinations of all Immigrant Petitions by Alien Investors , Petitions by Investors to Remove Conditions on Permanent Resident Status , and Applications for Regional Center Designation Under the Immigrant Investor Program filed on or after that date. USCIS also gives deference to Form I-526 and Form I-829 petitions directly related to projects approved before May 15, 2018, absent material change, fraud or misrepresentation, or legal deficiency of the prior determination.

Previously, on December 20, 2012, USCIS had issued policy guidance defining the criteria to be used in the adjudication of applications and petitions relying on tenant occupancy to establish indirect jobs. In November 2016, USCIS published consolidated policy guidance on immigrant investors in this Policy Manual, including guidance on the tenant occupancy methodology. That guidance provided that investors could map a specific amount of direct, imputed, or subsidized investment to new jobs, or use a facilitation-based approach to demonstrate the project would remove a significant market-based constraint.

Factors To Consider When Selecting A Broker

Products offeredIt is important to consider the type of products offered by the broker. This should go hand in hand with geography. For example the brokerage firm may offer access to top markets like the London Stock Exchange, NYSE and NASDAQ but not Japan and China. When it comes to products, look for a broker that allows you to trade with all US stocks as well as mutual funds, forex and futures among others.

SecurityThis is very important especially when it comes to your funds. One feature to check out is the platforms security. Does it have a valid SSL certificate or not? If you want to know whether a brokers platform is secured with SSL, check the URL. It should start with https and not http. It is also important to consider what investor protection law you are under.

PricingWhat is the brokers minimum balance? Is there a minimum fee charged for every trade? What about withdrawal fees? Does the broker charge any inactivity fee? Learning more about pricing will help you select a broker who is favorable to your budget.

If Im Not A Us Citizen Can I Use Stash

Stash is open to US Citizens and legal residents of the United States with an accompanying green card or certain valid visas.

We accept the following valid visa types: E1, E2, E3, F1, H1B, L1, O1, or TN1.

We cannot accommodate people with visas not mentioned in the above list.

If you are an existing Stash account holder on one of the following visa types , you may continue to use that account. Thereafter you will be unable to open additional accounts due to changes to eligible visa types.

Why does Stash require a Social Security number?

To use Stash you must have a Social Security number. We need this for two reasons:

Can I use Stash if I am a DACA recipient?

Unfortunately, were not able to open accounts for people who are DACA recipients.

This is because a grant of deferred action does not confer legal immigration status in the U.S. and DACA recipients are not considered U.S. citizen or U.S Permanent Residents.

You May Like: How To Invest In Pre Ipo

Special Notice To Non

Each of the investment products and services referred to on this website is intended to be made available to U.S. residents. This website shall not be considered a solicitation or offering for any investment product or service to any person in any jurisdiction where such solicitation or offer would be unlawful. Persons residing outside the United States are invited to visit Vanguard’s Global Investors site for more information about products and services available to them.

The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor of the Vanguard Funds. Your use of this site signifies that you accept our .

How To Open A Trading Account In The Us

To open a U.S. trading account, you need to search for an online, US-based broker that accepts clients from your country of residence. When you have found the one youre comfortable with, read their FAQ page to know all the documents you need to provide and the process involved. Alternatively, you can give them a call.

You will often be required to provide your international passport and current utility bill as proof of your identity and nonresident status, so make sure you have them.

Go to the brokers website and click on the open account link to fill the necessary forms. Some of the forms may need to be signed, so you need to print them out. As a foreigner, you will be required to fill and sign the W-8BEN form. It is a very important form that indicates your foreign residence status, regarding taxations on income.

When youre done with filling and signing the forms, scan them and email or upload them to the broker, along with a scanned copy of your passport and recent utility bill. Then, wait for the broker to review your application and send you an email indicating whether your application is successful or not.

If your application is accepted, you can proceed to deposit into your trading account. You must have already found out the methods of funds transfer supported by your broker: Wire Transfer, PayPal, ACH Transfer, etc. Use the option that suits you.

Once the deposited fund reflects in your trading account, you can start trading.

Also Check: How To Invest In Qualified Opportunity Fund

Engagement In Management Of New Commercial Enterprise

The immigrant investor must be engaged in the management of the new commercial enterprise, either through the exercise of day-to-day managerial responsibility or through policy formulation.

To show that the immigrant investor is or will be engaged in the exercise of day-to-day managerial control or policy formulation, the immigrant investor must submit:

-

A statement of the position title that the immigrant investor has or will have in the new enterprise and a complete description of the positions duties

-

Evidence that the immigrant investor is a corporate officer or a member of the corporate board of directors or

-

If the new enterprise is a partnership, either limited or general, evidence that the immigrant investor is engaged in either direct management or policymaking activities. The immigrant investor is sufficiently engaged in the management of the new commercial enterprise if the investor is a limited partner and the limited partnership agreement provides the investor with certain rights, powers, and duties normally granted to limited partners under the Uniform Limited Partnership Act.

How To Apply For A Social Security Number Card

If you elected on your immigrant visa application form to receive your Social Security Number Card upon admission to the United States as an immigrant, your card will be sent by mail to the U.S. address you designated on your application form and should arrive approximately six weeks following your admission. If you did not elect to receive your Social Security Number Card automatically, you will have to apply to be issued a card following your arrival in the United States. Learn about on the Social Security Administration website.

Don’t Miss: How To Invest In Market

The First Step: File A Petition

To be considered for an E5 immigrant investor visa, an applicant must file Form I-526, Immigrant Petition by Alien Entrepreneur, with U.S. Citizenship and Immigration Services . For more information on qualifying as an immigrant investor and filing the Form I-526 petition, see EB-5 Immigrant Investor, EB-5 Immigrant Investor Process, EB-5 Regional Centers, and Permanent Workers on the USCIS website.

Labor certification is not required for immigrant investors.

The Form I-526 petition must be approved by the USCIS before applying for an immigrant visa at a U.S. Embassy or Consulate outside the United States.

Best Online Brokers For Non

In this article we are going to list the 10 best online brokers for non-US residents. Click to skip ahead and jump to the 5 best online brokers for non-US residents.

Are you a US visa holder or a Non-US resident looking to invest into the US stock market? Finding a broker may seem complicated, but there are actually a few brokers out there that are by far the best brokers for Non-US residents which allow people from many countries to register. If you want to find out who are the best online brokers for non-us residents keep on reading so that you can be a part of the world of Non-US residents online trading soon enough!

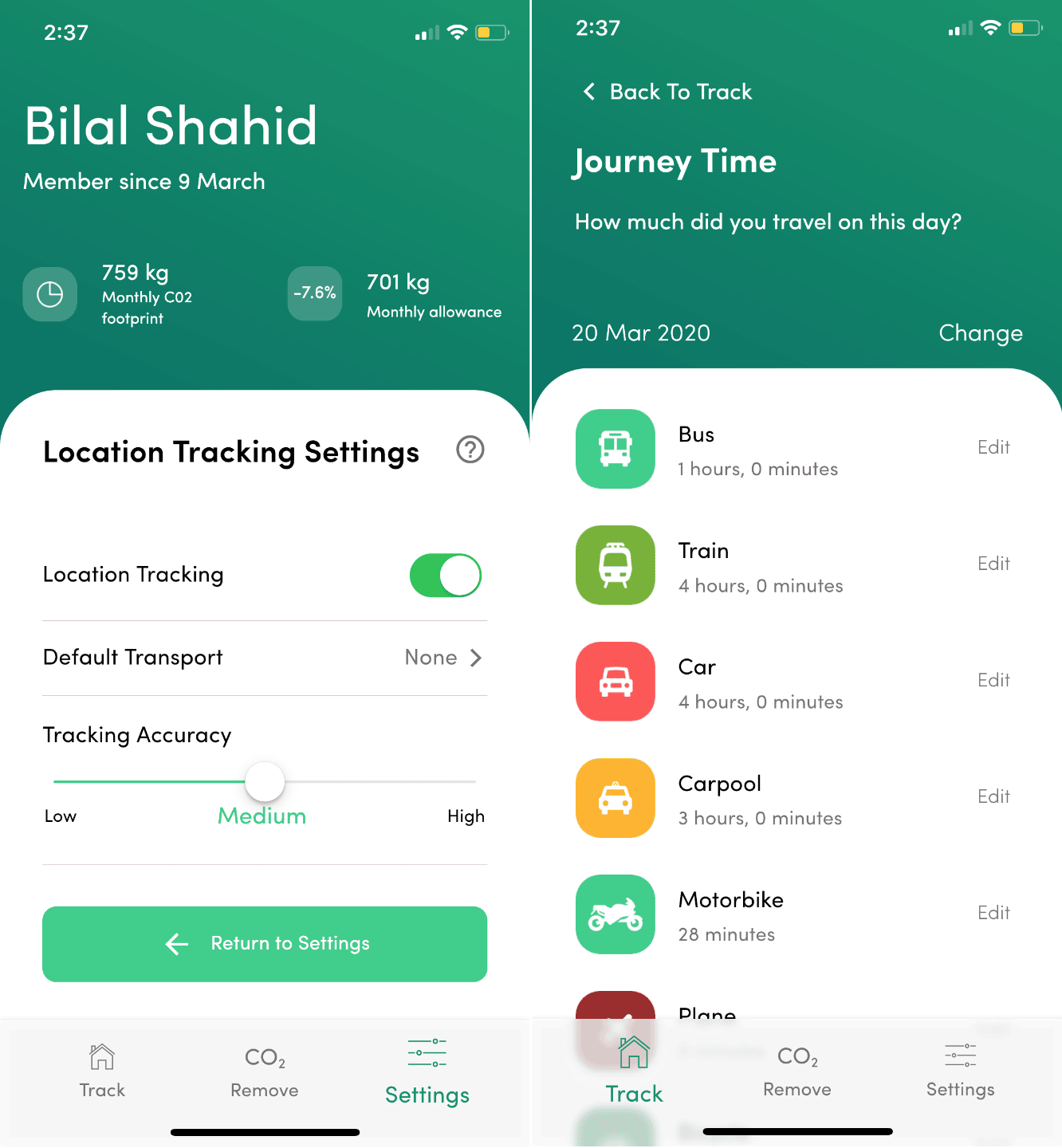

Image: Depositphotos

To participate in online trading, you will need to open an account with an online broker. The right choice for an online broker is essential if you want your trading to be profitable. So, what are online brokers and what can they do for you? An online broker is one which facilitates buying and selling of securities/assets over the Internet. The transactions are mostly done through the broker owned trading platforms. Online brokers began to gain popularity in the mid and late 1990s, facilitated by the development of high-performance computers and faster Internet connections.

Before considering an online broker, you should consider the factors outlined below:

Also Check: Best Investments Of The 1970s

Can I Invest In The Nyse If Im Not A Us National

There is more than one stock exchange in the US. The most well-known securities market are the New York Stock Exchange and the NASDAQ. The NYSE is a physical marketplace while the NASDAQ is a virtual exchange. Different stock exchanges that exist in the US are American Exchange , Boston Stock Exchange , Chicago Stock Exchange and a few others.

Usually, once you open an account with US based brokers, you are allowed to invest or trade in most of the stock exchanges mentioned above through their online trading platform.

Is It Possible For A Non

It depends. Let me draw two scenarios

First, where you hold a green card but live in abroad or when you physically spend more than a few months per year in the USA, then your income tax liability is exactly the same as that of a US citizen. This applied to both short term and long-term capital gains and the qualified dividends .

How to Reduce Taxes

In this circumstance for both of your gain you can enjoy concessionary tax rate which is much lower rates than ordinary income. Its goes as low from 25% to 0% . Depending on ones circumstances, it is often possible for a US taxpayer to reduce ones adjusted gross income to put ones income into the low tax bracket.

This same will be applied on you, even if you are qualified under Substantial Presence Test.

Substantial Presence Test: If yourtotal day of presence in US soil is 183 or greater than you pass the test. To determine your number, you need to add all eligible days you were in U.S. in the current year, 1/3 of the eligible days present in the preceding year, and 1/6 of the eligible days present in the second preceding year.

In second scenario:

Non-US resident

If you are a non-resident alien , then your US investment income is, in principle, taxed at the flat 30%. But this rate may be lower if a tax treaty is in place between the US and the NRAs country.

You May Like: Investment Strategies For Nonprofit Organizations

The Value Of Us Citizenship

Learn the definition and value of becoming a U. Citizenship bestows upon an individual certain entitlements, benefits, and obligations. Citizenship establishes the right of protection by the U. Constitution and the defining law of the land. As a country, the United States is a ps upon a principle that welcomes immigrants from across the globe. The United States seeks and appreciates the contributions of immigrants who take refuge here despite the reason that may have brought them to U. The concept of U.

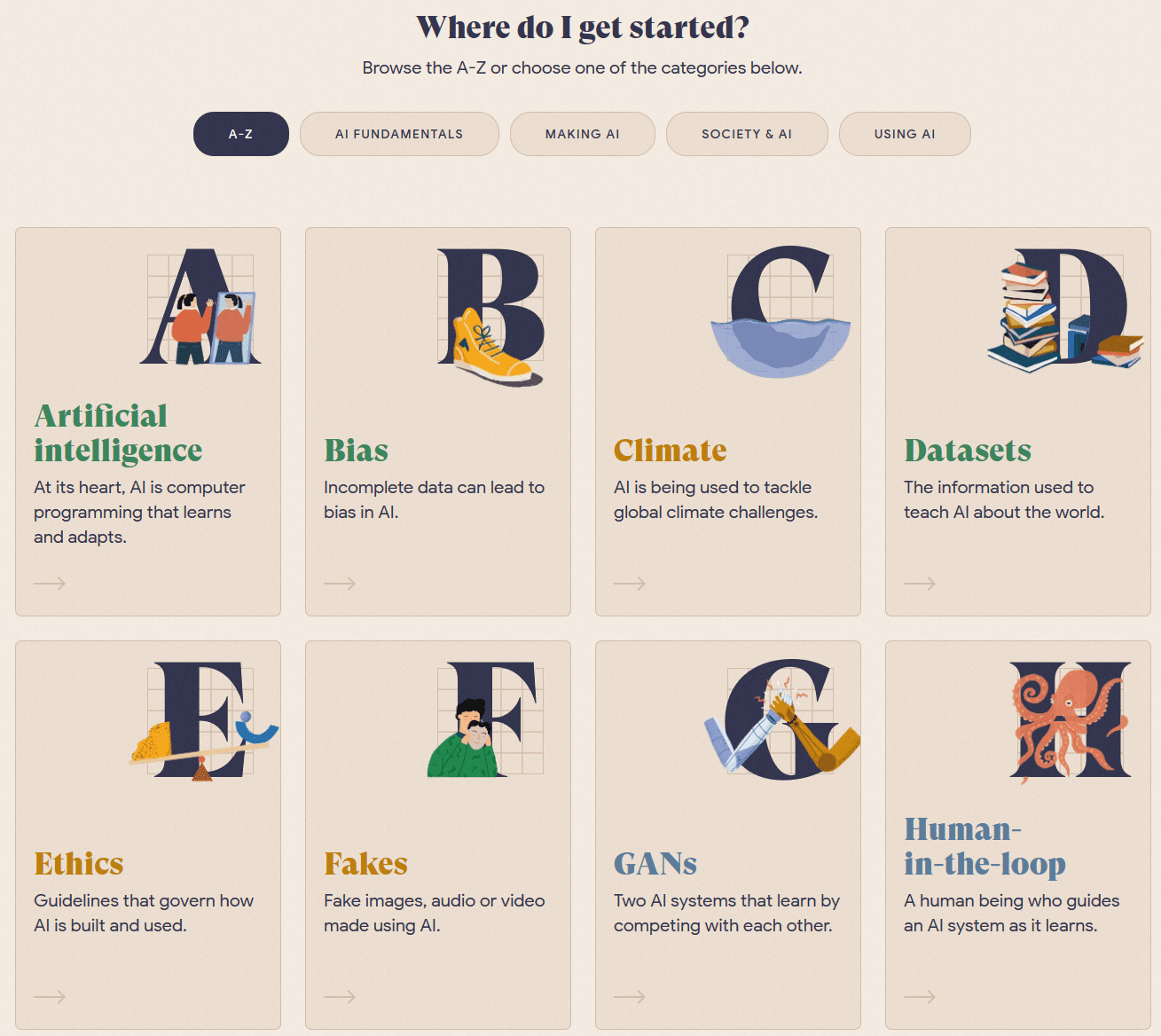

Stay Up To Date And Learn Something New Each Week

Welcome to Stash101, our free financial education platform. Stash101 is not an investment adviser and is distinct from Stash RIA. Nothing here is considered investment advice.

Accounts

Resources

Also Check: Minimum Amount To Invest In Gold

Regular Source Of Income

Losing a significant source of their income is the biggest financial challenge senior citizens face post-retirement. However, an FD investment can help ensure you still have some funds coming in to maintain a comfortable lifestyle during your golden years.

Apart from earning competitive senior citizen interest rates, you have the flexibility to choose the method of interest payout based on your financial needs. At IndusInd Bank, we offer you a regular interest payout facility on a monthly, quarterly, half-yearly, yearly, and maturity basis.

This way, your FD interest acts as a supplementary source of income to help you manage your financial needs with ease.

Local Regulations For Us Stocks Investing

Apart from choosing a broker and opening an account, some other things must be taken into consideration when investing in the US.

You have to inform yourself regarding which type of stocks and accounts you are legally entitled to have, and what are your liabilities from using these services. This also applies to taxes.

Another important aspect are ETFs. Most European Union residents have some restrictions on what ETFs they are allowed to invest. For that reason, if you live in Europe and want to invest on ETFs, prefer EU domiciled ETFs.

Also Check: Real Estate Investing With Little To No Money

Tax Implications Of Us Investments Abroad

There are tax implications for trading U.S. investments if you are not a U.S. citizen. Investors that qualify as non-resident foreign nationals of the U.S for tax purposes are not liable for capital gains tax on the earnings from their investments. This means that the brokerage firm will not withhold any taxes from earnings in an account. However, many other countries require their residents to pay capital gains tax on money earned in foreign markets. Investors may be liable for those taxes in the countries where they are residents or where they pay taxes.

If you are a non-resident foreign national, and you invest in a company that pays dividends, those dividends are usually taxed as income at a flat rate of 30 percent. There are some exceptions to this rule: for example if the investor’s country-of-residence is involved in a treaty with the U.S. that allows for a lower tax rate. Similarly, some investors are eligible for a lower tax rate on their dividend earnings if the earnings are interest-related.

It is important to keep in mind that non-U.S. residents are subject to U.S. estate and gift taxation with respect to certain types of U.S. assets, also at a maximum tax rate of 40% but with an exemption of $60,000, which is only available for transfers at death.

Cost Associated With International Stocks

2 Type of cost incurred

Also Check: Invest With The Best Podcast

Evidence Of Job Creation

To show that a new commercial enterprise will create no fewer than 10 full-time positions for qualifying employees, and except as provided below for regional center-based petitions filed on or after May 14, 2022, an immigrant investor must submit the following evidence:

-

Documentation consisting of photocopies of relevant tax records, Employment Eligibility Verification , or other similar documents for 10 qualifying employees, if such employees have already been hired or

-

A copy of a comprehensive business plan showing that, due to the nature and projected size of the new commercial enterprise, the need for not fewer than 10 qualifying employees will result within the next 2 years and the approximate dates employees will be hired.

The 2-year period is deemed to begin 6 months after adjudication of Form I-526. The business plan filed with the immigrant petition should reasonably demonstrate that the requisite number of jobs will be created by the end of this 2-year period.

Troubled Business

In the case of a troubled business, a comprehensive business plan must accompany the other required evidentiary documents.

Regional Center-Based Petitions Filed before July 1, 2021

-

The areas demographic structure

-

The areas contribution to supply chains of the project and

-

Connectivity with respect to socioeconomic variables in the area .

Regional Center-Based Petitions Filed on or after May 14, 2022