Can You Pull Equity Out Of An Investment Property

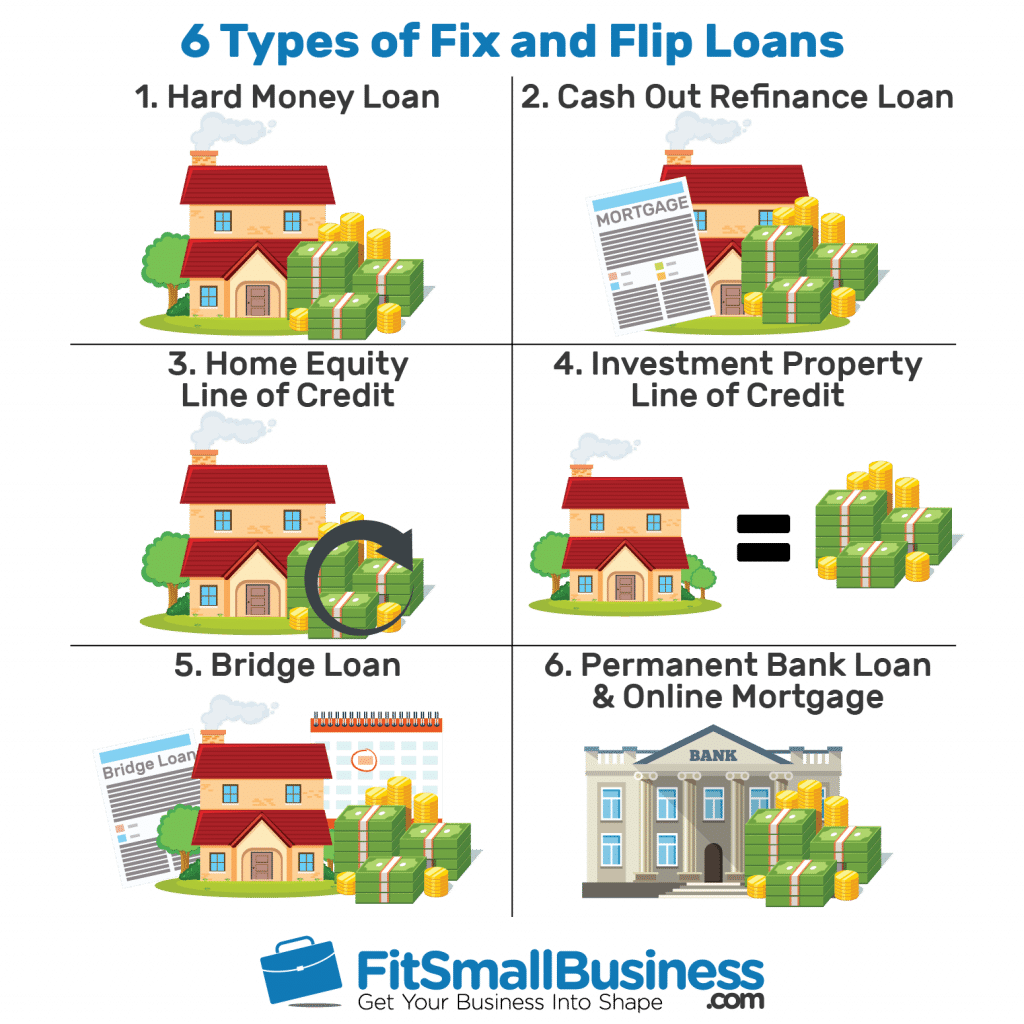

Certainly, you can pull equity out of an investment property, that is, if you have enough equity! Clearly, a cash out refi is one way to proceed, as you borrow cash based on your excess equity. Also, you can harvest equity by selling some of it to other investors. Additionally, a third method is mezzanine financing.

Golden 1 Credit Union: Nmls#669333

National / regional

View details

Why we like it

Golden 1 offers a cost-saving real estate agent program, plus a range of loan types, including jumbos.

Pros

-

Offers a variety of purchase and refinance loans, including jumbo mortgages.

-

Has a preferred real estate agent program that can save a borrower money on closing costs.

-

Offers some flexibility on guidelines for loan qualification.

Cons

-

Does not offer VA or USDA loans.

-

Products available only to California residents.

How Long Do Hard Money Loans Last

You may have a hard moneypersonal loan, a commercial hard money loan, a hard money loans for primary residence, a hard moneyreal estate loan, or hard moneybusiness loans. The typical time span for such loans usually last around 12 months, but the term can extend to 2-5 years. Hard money loan monthly payments must be made. Payments are sometimes of only interest. Or in some cases, payments are interest and some principal, accompanied with a balloon payment required at the end of the term.

Flexible terms with hard money lenders has advantages. Investment property loans, commercial loans, or residential real estate loans can all benefit. You can build your cash reserves, focus on home equity and equity in the property. Whatever the rehab costs need to be addressed to increase the value of the property can be executed with hard loans. Short term hard money loans allow for a real estate investor, like you, to not worry so much as to how youll repay the loan. Youll focus on how youll sell your property at a lucrative purchase price. This allows you the full benefits of hard money lending.

Also Check: Commercial Property Return On Investment

If You Own An Investment Property And Want To Make Improvements To Increase Its Value You Can Use A Cash

As a property owner, you may have gained a significant amount of equity over the past year. A said that homeowners with mortgages gained an average of $60,200 in home equity year over year in the second quarter of 2022. Overall, home equity increased by over 27%.

With such a large increase, you could tap into that equity through a cash-out refinance loan and get a lump sum of money to make renovations or purchase another property.

Waiting Period Of 6 Months After Home Purchase

You can use the proceeds from a cash-out refinance for just about anything. But you wont be able to complete the transaction until youve owned the property for at least six months.

Exceptions apply if you inherited the property or it was legally awarded to you in a divorce or separation. If you do qualify for an exception, then your maximum LTV will be capped at 70% no matter how many units you own.

Read Also: Easiest Way To Invest In Gold

Investment Property Refinance Rates

Mortgage interest rates for a cash-out investment property loan tend to be higher than other loan programs.

Why? Because investment property rates are higher to begin with about 0.5% to 0.75% above primary residence rates on average.

And if you take cash out when refinancing, rates are usually a little higher still. Thats because lenders take on more risk when a homeowner pulls equity out of their property.

The best thing you can do when shopping for this type of loan is get rates from multiple loan officers.

New regulations on investment property mortgages mean rates and fees could vary a lot by lender. So compare at least 3-5 loan offers to find the best deal. You could stand to save thousands on your new loan.

How Soon Can You Get A Cashout Refinance Loan

Many homeowners wonder how long they have to hold their current mortgage before theyre eligible for a cashout refinance.

If you have a conventional, FHA, or VA mortgage, most lenders require a 6month waiting period after closing on the first mortgage before taking out a cashout refinance.

With FHA and VA loan programs, youre also eligible for a Streamline refinance, and youll generally need to wait for 210 days before refinancing. However, these loans do not allow cash back at closing.

A USDA refinance could require a 612 month waiting period, and USDA loans never allow cashout. Read more about refinancing waiting periods.

Also Check: Current Interest Rates For Investment Property Loans

Determine The Lenders Minimum Requirements

Mortgage lenders have different qualifying requirements for cash-out refinancing, and most have a minimum credit score the higher, the better. The other typical requirements include a debt-to-income ratio below a certain percentage and at least 20 percent equity in your home. As you explore your options, take note of the requirements.

Refinancing A Rental Property You Bought With Cash

Delayed financing refers to the practice of buying a home with cash, then reimbursing the purchase with a refinance.

Because there are no loans on an all-cash home purchase, any subsequent refinance is technically a cash-out one.

Normally, the rental property buyer would need to wait six months to get reimbursed per standard cash-out rules. That ties up a lot of cash for a long time not the ideal situation for a savvy investor who wants to put their money to work elsewhere.

So, in mid-2011, Fannie Mae rolled out the delayed financing exception. Home investors may now receive a cash-out refinance just days not months after closing.

Guidelines for delayed financing are as follows.

- The buyer paid cash for the home

- The buyer must document the source of funds for purchase

- Loans or liens opened to buy the home must be paid off with the new loan

- A title search must confirm no financing on the purchased home

Keep all documentation for the home purchase if you plan to use the delayed financing exception. Most importantly, keep a final Closing Disclosure showing your closing date and loan terms.

Don’t Miss: Financial Advisor And Investment Advisor

Finance Other Real Estate Investments

You may want to use your home equity to finance a down payment if you see a real estate investment that you want to buy quickly. As your home grows in value over time, your equity increases in value beyond what you pay on your principal.

Many investors will then parlay this built equity into more profit by using it to put money down on another investment. You might have even bigger goals, such as using the money you get from your refinance to invest in a different type of real estate venture, like a commercial property.

Getting Your Refinanced Funds

Once you get your refinancing approved, its time to get access to your refinanced funds. The cash from refinancing will be the net amount after refinancing fees.

In this example, the property was purchased at $830,000. With a 20% downpayment, your initial mortgage was $664,000. After renovations, the appraised value goes up to $1,081,500 and you qualify for additional financing of $201,020. After deducting refinancing fees, you can take $195,200 out as cash.

STEP 4

You May Like: Northwest Commercial Real Estate Investments

Are You Eligible

A cash-out refinance typically has higher qualification requirements when compared to a conventional mortgage. The following eligibility requirements should be expected:

-

Many lenders will require a minimum credit score between 650 and 700, though it will vary depending on the loan.

-

Cash Reserves: Lenders will want to verify how much money you can access outside of the refinance loan, called your cash reserves. When approving a cash-out refinance for an investment property, lenders may want to see anywhere from two and six percent of the loan amount in a separate asset account.

-

Waiting Period: Anyone wishing to utilize a cash-out refinance will typically need to wait at least six months after buying the property.

-

Equity: Before you can tap into the equity in a property, you must build it up to a certain percentage. Lenders will typically require over 25 percent equity, but the exact requirement will vary.

If you are considering a cash-out refinance for an investment property, the best thing to do is research different lenders. This will give you a better idea of whether or not you are eligible and it will help you identify the best loan terms. Most lenders will want to know the same information about your financial profile, but some may be more willing to work with you regardless.

How Does It Work

You should be aware of a few key terms before deciding if this strategy is right for you.

Cash out refinancing is a type of home loan that allows you to take out more money than what the mortgage owed on the property.

You can take out an equity loan or a cash out refinance.

An equity loan will allow you to borrow the difference between your current mortgage and what its worth . A cash out would involve taking out an entirely new mortgage with an amount higher than what your mortgage currently owes. This would allow you to make money off investment properties in two ways: first, by taking out more money from the deal than what the mortgage owed on the property and second, by selling the property for market value.

When deciding whether or not cash out refinancing is right for your situation, consider three major points:

1) how much cash flow do I need?

2) How much equity am I willing to lose?

3) What are my tax consequences?

You May Like: Does Capital One Invest In Fossil Fuels

How Does A Cash

In general, when you make your scheduled mortgage payments and the housing market improves, your propertys value typically increases and you build equity in that property. With a cash-out refinance on an investment property, you can pull some of that equity out as cash, using it however you see fit. The key difference between a cash-out refinance on your primary residence and a cash-out refinance on an investment property is eligibility requirements are usually more strict for non-primary residences since they tend to carry more risk for the lender.

Advantages Of Cash Out Refi

Cash out refinancing for investment properties is advantageous in several ways:

Read Also: Why Work In Alternative Investments

Grow Your Rental Portfolio With A Cash

Refinancing a loan is a way to replace the current financing of a property with a new loan. For rental property owners, there are two main types of refinance loans: rate and term refinances and cash-out refinances. A rate and term refinance is when you refinance an existing loan in order to change the interest rates and/or terms of the loan. A cash-out refinance is when you replace an existing loan with a new loan for a higher amount, and the difference in cash is yours. Obtaining new financing on a property that is currently not pledged on a loan can also be considered a cash-out refinance.

How To Do Cash Out Refinance To Purchase Investment Property

The following are the basic steps to take when refinancing a rental property to take out a loan:

Collect the Papers That the Lender Requires

- If youre self-employed, youll need proof of income, such as pay stubs or bank records.

- Bring copies of W-2, 1099 forms, or the latest tax returns to prove income and job history.

- Proof of homeowners insurance and coverage for rental properties.

- Copy of the most current title insurance policy you got when you bought the house.

- Extra asset and debt data, including personal and commercial banking and savings accounts, pension and brokerage accounts, as well as existing debt and monthly bills.

Register for a Cash-Out Refinance of Your Rental Property

Although lenders can establish their own regulations for refinancing rental properties, most stick to Fannie Mae and Freddie Macs guidelines.

Based on your banking institution and the present success of your rental property, some lenders may be prepared to work with you on the interests rate and loan fees.

Lock Down the Interest Rate

When your cash-out refinance request for your rental property is accepted, the lender will usually offer a choice of locking in your interest rate.

Interest rate locks can last anywhere from 15 to 60 days, depending on the property and loan kind. Locking the interest rate gives you time to analyze the cash-out refinancing arrangements without worrying about changing interest rates.

Continue With Underwriting

Settle On the Refinance Loan

Don’t Miss: How To Create Investment Website

Whats A Hard Money Loan

Youve heard this term thrown around and so as a borrower, you wonder if this could be a viable option for one of your investments. Whats the hard money loan definition? A hard money loan is in its truest definition, a short-term loan secured by real estate. Theres a key difference between hard loans and loans from traditional lenders. A hard money loan is instead backed by private investors. Hard money lenders issue short term loans. For borrowers looking to get investing quickly can use hard loans to do so. This grants the borrower money in a cash advance loan and an opportunity for an exit strategy. A hard loan is helpful if they are in the middle of selling and purchasing investment properties.

Best For Rehab Loans: Lendingone

LendingOne

Why We Chose It: LendingOne earns our nod for best rehab lender because they are one of the very few commercial lenders that make it easy to get a pre-approval letter, they finance up to 90% loan-to-cost and provide lower rates and fees than their competition.

-

Pre-approval/proof of funds available online within minutes

-

Founded by investors to improve upon traditional lenders limitations

-

$150 charge for each draw

-

Only available for one- to four-unit properties, no commercial

In 2014, Bill Green and Matthew Neisser founded LendingOne in response to their frustrations felt toward the difficult lending environment from rigid bank criteria and the easier, though more expensive, hard money alternatives.

As a direct private real estate lender, LendingOne has become the best rehab lender in the industry because they help investors get what had been missing in the market, such as pre-approval letters and proof of funds, higher leverage, and lower rates and fees.

LendingOne offers fix-and-flip and rehab-to-rent loan products. Down payments range from 10% to 20%. For rehab to rent, they have a 30-year fixed-rate loan as well as 5/1 and 7/1 ARM loans. Their fix-and-flip loans can finance up to 90% of your repair costs. Two years of interest only payments are an option on the fix-and-flip loans too. LendingOne loans on two- to four-unit properties only, including condos and townhouses.

Recommended Reading: Best Way To Buy Silver As An Investment

Read Also: Using Investments To Pay Off Debt

Home Equity Line Of Credit

A HELOC lets you access the equity in your home through a revolving line of credit, which is secured with your home as collateral. Its a popular option because you dont have to go through a refinance, but interest rates can be higher and theyre usually variable. Since you only pay interest on the portion of the credit line you actually use, it can make a great emergency fund. Connect with a lender to learn more about HELOCs.

Lock Your Interest Rate

After you apply for a refinance, the next step is to lock the interest rate for the loan. When you lock the interest rate, the bank guarantees that the rate offered remains available for a certain period. With a rate lock, you dont have to worry about rates going up between the time the offer is submitted and the loan is closed. The typical period for a rate lock is 30 to 60 days.

Read Also: Buying Investment Property For Airbnb

How Much Can I Earn From A Rental Property

The profit you can make from monthly rent payments depends on the area youre in, how good of a deal you get on the home, and how you manage your expenses month-to-month.

That being said, maintaining rental properties are great investments because they can often become passive income when everything lines up perfectlyan up-and-coming neighborhood can command higher rent each year, and if the home doesnt need a ton of maintenance, you might not have to do much work at all throughout the year. Simply sit back, collect the rent checks, and enjoy your new source of income!

Read Also: How Does Robo Investing Work