Real Estate Investment Trust : How They Work And How To Invest

James Chen, CMT is an expert trader, investment adviser, and global market strategist. He has authored books on technical analysis and foreign exchange trading published by John Wiley and Sons and served as a guest expert on CNBC, BloombergTV, Forbes, and Reuters among other financial media.

Investopedia / Eliana Rodgers

How To Invest In Private Reits

Investing in private REITs can be a risky, expensive proposition. Minimum purchase amounts can run as high as $25,000 or more, which is why theyâre generally only available to accredited investors.

Private REITs are sold via broker-dealers or may be investment options offered to well-heeled investors by their wealth managers. They are highly illiquid, meaning you may only be able to sell a portion of your holdings at certain times each year, and they may charge high annual management fees in addition to various sales fees.

Because private REITs donât have to register with the SEC, thereâs often little to no data available for tracking the performance or even holdings of private REITs. This makes them particularly risky for investors with limited financial means or risk tolerance.

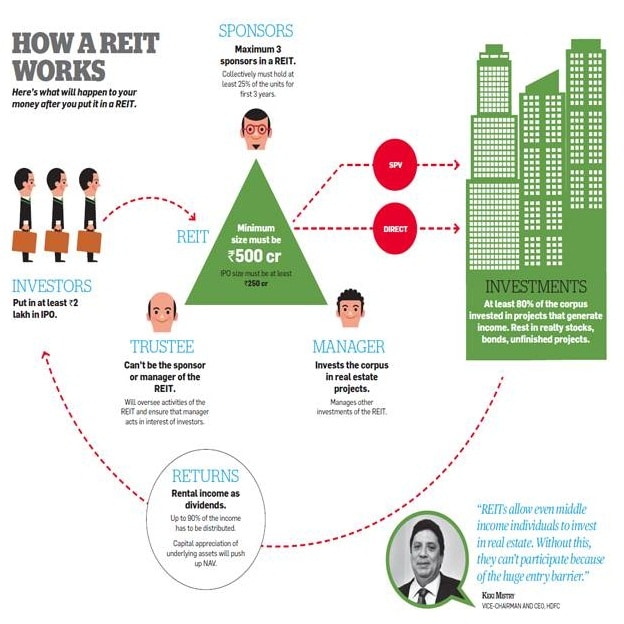

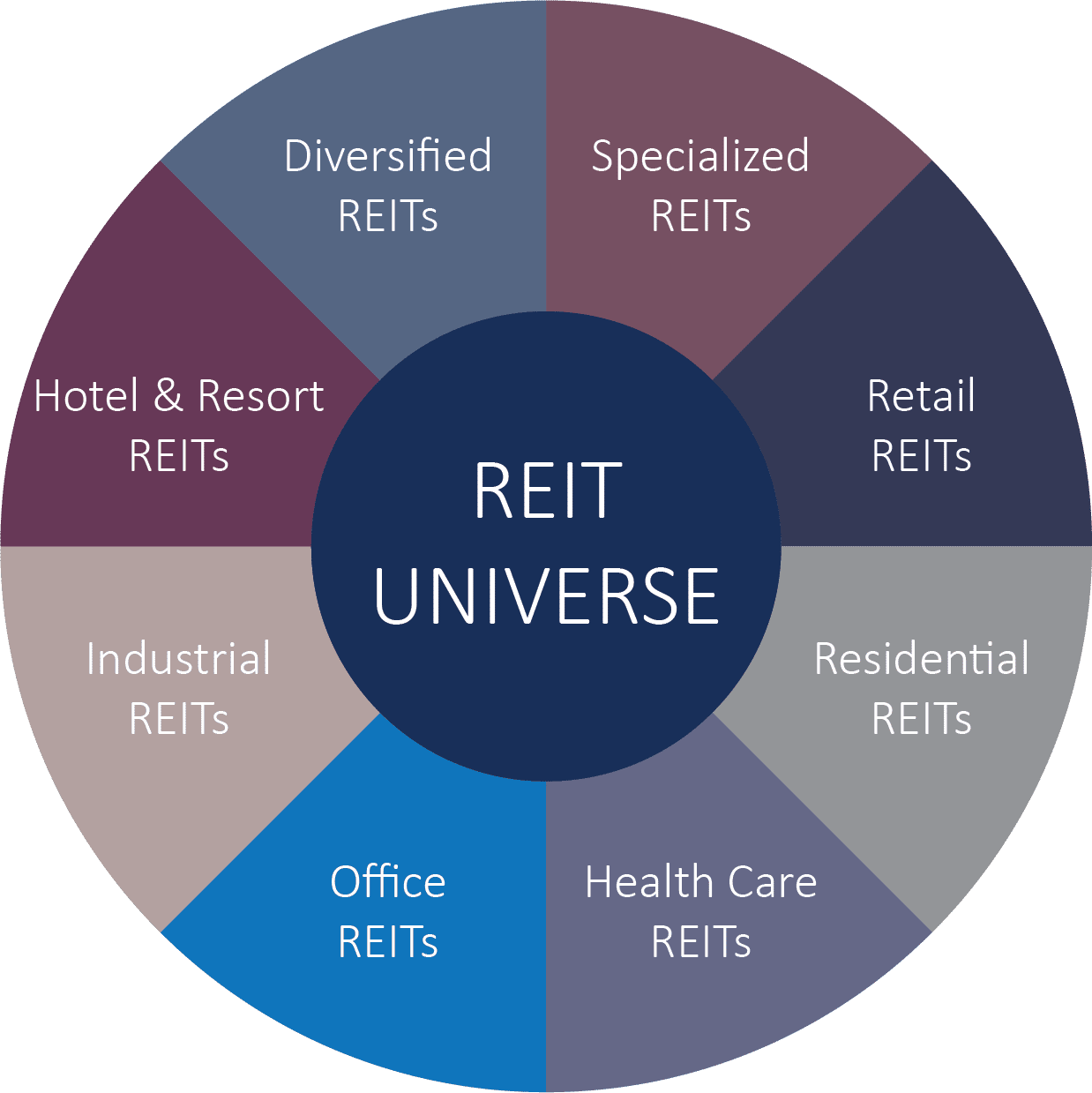

There Are Three General Categories Of Reits: Equity Reits Mortgage Reits And Hybrid Reits

Equity REITs invest in properties and earn income from rent, property sales and dividends. Mortgage REITs, like the name suggests, invest in mortgages and mortgage-backed securities . These types of trusts can earn income through the interest collected on mortgages but because of this, interest rate changes can greatly affect their yield. Lastly, hybrid REITs invest in a combination of mortgages and real estate.

Recommended Reading: Best Gold Bars To Buy For Investment

Real Estate Investing Done Right & For You

A proven, reliable system for investing in properties in key real estate markets across the U.S.

We offer investment partners the opportunity to invest in income producing farms and cash-flowing properties like residential & multi-family with substantial value-add opportunities.

In 2022, RAD Diversified declared an 8% distribution

To improve additional liquidity options for our shareholders. RAD Diversified has kept its entire staff employed while keeping the doors open without taking any government assistance during the COVID-19 pandemic.

$58.6 Million of $75 Million Raised

Since inception, the RADD REIT stock price has had an 122.22% increase. Now is the time to invest in the creation, protection and preservation of your wealth.

$22.22

Current Share Price

Best Reits To Buy In 2022

RECESSION IS NEAR! ARE YOU PREPARED?

Learn how the drop in the US Dollars buying power affects you personally and gain access to an actionable plan to protect your assets with precious metals.

The stock market is a volatile place, and while wealth is often built there, it can also be lost. With valuations across the market climbing to record highs, and some experts suggesting a market crash could be on the horizon, many investors are looking for opportunities elsewhere.

Real estate investments are a hot commodity at the moment. Real estate as an asset class has been a go-to option for many investors throughout history and has stood the test of time. In 1960, the first real estate investment trust , was born. These are publicly traded companies that use funds gathered from investors to purchase real estate , with the proceeds being shared equally among investors.

These funds have grown in popularity in recent years as a low interest-rate environment spurs real estate investments. By investing in these funds, youll be able to own your piece of real estate without having to put up the large investment required to purchase property.

Don’t Miss: Private Lenders For Investment Properties

Real Estate Investment Trusts : What They Are And How To Invest In Them

A REIT , or real estate investment trust, is an entity that holds a portfolio of commercial real estate or real estate loans. Congress created REITs in 1960 to provide all investors, especially retail investors, with access to income-producing commercial real estate. REITs combine the best features of real estate and stock investment.

This guide will walk you through everything you need to know about real estate investing through REITs. Well cover the types of REITs, REIT pros and cons, how to invest in REITs, and what qualifies a company as a REIT.

Caretrust Reit Announces James Callister To Succeed Mark Lamb As Chief Investment Officer

SAN CLEMENTE, Calif., November 28, 2022—-The Board of Directors of CareTrust REIT, Inc. announced today the appointment of James Callister as Chief Investment Officer, to be effective as of December 31, 2022. Mr. Callister will succeed Mark Lamb, who will be leaving the company after a transition period to pursue entrepreneurial opportunities. Mr. Callister currently serves as CareTrusts Executive Vice President.

“On behalf of the Board and all of us at CareTrust, I express our admiration and gratitude for the tremendous impact Mark has had on building the company since the beginning,” said Chief Executive Officer, Dave Sedgwick. “Mark has always been a true partner and friend and we wish him continued success in the future.”

“While I am excited for the next chapter of my career, this was nonetheless a very difficult decision given how much CareTrust means to me,” Mr. Lamb said. “I am proud of what we have accomplished and am highly confident in James and the teams growth prospects going forward. I am pleased to leave the team in very capable hands.”

Accepting the appointment, Mr. Callister said, “I am deeply honored by this opportunity to lead the exceptionally high caliber investment professionals at CareTrust and build on the strong track record of growth.” He continued, “We are driven each day by our mission to match great operators with great opportunities and, as we head into 2023, we are excited to both expand existing relationships and invest in new ones.”

Read Also: What Can I Invest My Ira In

Top Reit #: Uniti Group

- Expected Total Return: 20.6%

- Dividend Yield: 6.6%

Uniti Group focuses on acquiring, constructing, and leasing out communications infrastructure in the United States. In particular, it owns millions of miles of fiber strand along with other communications real estate. In its recent past it has faced challenges due to its largest tenant filing for bankruptcy and renegotiating its lease with Uniti. However, the REIT is now on firmer footing and is pursuing growth opportunities.

Source: Investor Presentation

On August 4th, Uniti Group reported Q2 results. AFFO per share increased 11.3% to $0.44 year-over-year. Net income stood at $0.21 per diluted share, up by 8.3% per diluted share year-over-year. Revenue grew 5.9% to $283.98 million year-over-year. Adjusted EBITDA increased 5.3% to $227.2 million from $215.7 million in the year-ago period. Uniti reported total costs and expenses of $225.7 million, up from $214.0 million in the year-ago period.

Moreover, unrestricted cash and cash equivalents, and undrawn borrowing availability under its revolving credit agreement stood at ~$361.4 million at quarter-end. Meanwhile, the company raised its FY2022 adjusted EBITDA guidance to $887 million to $905 million, and 2022 revenue to $1.12 billion to $1.14 billion.

What Is Thecadre Horizon Fund

The Cadre Horizon Fund provides access to a diversified1 portfolio of commercial real estate in high-performing U.S. markets designed to seize short-term opportunities for long-term growth. The Fundâs investment strategy pairs attractive risk-adjusted returns with downside protectionâan approach tailored specifically for todayâs volatile marketplace.

Cadre seeks to leverage the same diversification strategy that is delivering outsized success in our flagship fund . To date, our high-tech/high-touch market selection process, institutional-quality due diligence, and seasoned asset management have resulted in a phenomenal 27.5%2realized net IRR.

Don’t Miss: How To Invest In Real Estate At 16

How To Invest In Public Reits

Itâs easy to buy listed public REITs, or mutual funds and ETFs that invest in REITs using an online brokerage account. Shares of REIT mutual funds may also be available to purchase in your employer-sponsored retirement account.

Your brokerage offers screener tools to help you evaluate the historical performance, returns and dividends generated by REITs. Researching a REITâs management team is also important. Since a REIT is composed of a managed pool of assets, assessing the managersâ track record is key to understanding if a REIT is a good buy and if its management team is worth its fees.

Publicly traded REITs may have minimum purchases as low as the price of one share. If fractional share investing is available, this minimum may fall to $5 or less, making publicly traded REITs accessible to most any investor. Notably, publicly traded REITs can be bought and sold whenever an exchange is open, making it easy to access the cash value of your investment at almost any time.

Big Trouble In Little Metaverse

Having a figurehead CEO is a double-edged sword. When things are going well, the market rallies around the successful leader. Case in point, was named Times Person of the Year in 2010. Even as recently as 2016, Glassdoor named the Facebook founder the most admired tech CEO.

On the flip side, when the tide turns, it turns fast. After a series of controversies, Zuckerberg took a multi-billion-dollar gamble by renaming his entire company Meta and pivoting its focus to the burgeoning idea of a metaverse. Metas New Horizons platform is rumored to have plateaued at about 200,000 active users, which is underwhelming for a company that still reaches a sizable slice of humanity with its other services.

Part of Metas near-term success hinges on VR headsets being a hot gift this holiday season. Metas cheapest headset is $400, which could be a tough sell in todays economic environment.

Of course, its too early to know whether Zuckerbergs gamble will pay off. As always, all is forgiven once a business unit takes off and becomes profitable.

You May Like: Ways To Finance Investment Property

Advantages Of Investing In Reits

Two primary advantages REITs provide investors relate to liquidity and diversification. Real estate investments have a time-tested favorable risk/return profile with less volatility compared to other assets. However, closing real estate deals typically takes weeks or months, making the asset class extremely illiquid. REITs solve this problem by having their securities traded on major stock exchanges, allowing investors to buy and sell easily.

Real estate investment requires a significant financial commitment, often limiting buyers to a specific market or type of property. Investing in REITs solves this issue by allowing investors to diversify, with many trusts holding a portfolio of different property types, such as condos, retail space, healthcare facilities, or even telecommunication infrastructure.

Microblogging With Macro Expectations

has a complicated history.

The company was launched in the shadow of Facebooks massive growth, and was saddled with expectations that were tough to meet. Although Twitter has an engaged and influential audience, it hasnt managed to monetize them at the level of Metas platforms . The introduction of Twitter Blue in 2021 did not resonate with users at the scale the company hoped, and fleets were essentially written off as a failed experiment.

In addition, Twitter is a magnet for criticism and debate around free speech, in part because of its central place in political discourse.

These issues are directly related to the companys recent sale to Elon Musk. At the time of this article, Twitter finds itself in the midst of a painful, and very public, internal restructuring.

If reports of an exodus of talent and advertising dollars are to be believed, then the future of one of worlds most influential social media platforms could be at risk.

Don’t Miss: How Do I Invest In Nike Stock

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Apartment Investment And Management Company

Apartment Investment and Management Company , known as Aimco, was founded in 1994 and has its headquarters in Denver. The REIT has 32,893 units as of the end of 2019both conventional and “affordable” propertieswhich are owned through low-income housing tax credit partnerships. Apartment Investment and Management Company has a market cap of $750.42 billion and a P/E ratio of 3.95 as of January 2021.

You May Like: Columbia Business School Value Investing

Essex Property Trust Inc

Headquartered in Palo Alto, Calif. Essex Property Trust Inc. focuses primarily on the West Coast, including Southern California, Northern California and the Seattle metropolitan area. It owns 250 complexes, consisting of 60,000 apartments. Founded in 1971, Essex Property Trust Inc. has a market cap of $14.80 billion and a P/E ratio of 24.78. The REIT pays a $8.31 dividend for a yield of 3.64% in January 2021.

Top Reit #: Innovative Industrial Properties

- Expected Total Return: 28.7%

- Dividend Yield: 7.8%

Innovative Industrial Properties, Inc. is a single-use specialty REIT that exclusively focuses on owning properties used for the cultivation and production of marijuana. Because the industry is in the midst of a legal transition, there are constraints on capital available to businesses engaged in the marijuana business.

Related: The Best Marijuana Stocks: List of 100+ Marijuana Industry Companies

The ongoing legalization of cannabis in the US has led to stunning returns and portfolio growth. The $2.8 billion REIT owns 110 properties in 19 states. Amid the cannabis boom over the past few years, as well as its exclusivity in terms of the listing giving the trust access to public markets, Innovate Industrial Properties remains one of the fastest-growing REITs in the world.

Source: Investor Presentation

On March 14th, 2022, Innovative Industrial increased its dividend by 16.7% to a quarterly rate of $1.75. The 16.7% increase compares to the previous quarter. Year-over-year, it implies an increase of 32.5%.

As of May 4th, 100% of IIPRs properties were leased with a weighted-average remaining lease term of approximately 16 years, close to the previous quarter, which is once again very impressive. With its tenants enjoying resilient marijuana demand amid growing consumption, the company collected 99% of its contractual rent due for Q2.

You May Like: I Want To Start Investing In Cryptocurrency

Make Sure You Identify Whether You’re Investing In A Publicly Traded Reit Or A Non

If you’re considering investing in a REIT you, of course, want to make sure you’re putting money into the right one you don’t want to accidentally invest in a non-traded REIT when you really meant to invest in a publicly traded one, and vice versa.

According to Jhangiani, publicly traded REITs will have ticker symbols however, non-traded REITs do not have ticker symbols. This is one simple way of identifying them. You can also search through a directory of REITs using Nareit. You can filter through the list to look at only publicly traded REITs, only non-traded REITS, or both, which can be really handy if you want to do your own research before working with a broker or advisor to invest in non-traded REITs or before investing in a publicly traded REIT on your own.

Public Reits Vs Private Reits

REITs may be either public or private companies, though most real estate investment trusts are publicly owned. Transparency and liquidity separate public and private REITs.

In addition to individual REITs, you can invest in REIT exchange-traded funds and REIT mutual funds, many of which are publicly traded and available for purchase at major brokerages.

You May Like: Find Someone To Invest In My Business

Reits Are Fairly Accessible To Those Who Want To Invest In Them

If you want to invest in publicly traded REITs, you can do so through any brokerage account, like Fidelity or TD Ameritrade. For non-traded REITs, though, you’ll usually need to work with an individual broker or a financial advisor to get invested, but apps like Fundrise, YieldStreet and Elevate Money also allow you to invest in non-traded REIT’s on your own through their platforms.

They each have their own strategy Elevate Money, for example, invests in car washes, gas stations, dollar and convenience stores and quick service restaurants while YieldStreet typically has portfolios made up of commercial, residential and multi-purpose properties. Also, some robo-advisor platforms like SoFi Invest work REITs into their automated investing strategy for users.

How To Invest In Public Non

Buying shares of unlisted public REITs is more challenging. Because they arenât traded on an exchange, it may be more difficult to find public non-traded REITs on your online brokerageâs trading platform. Instead, you may need to purchase them directly from the REIT company itself or a third-party broker-dealer firm. Although anyone may invest, public non-traded REITs typically have a minimum investment requirement of $1,000 to $2,500.

Crowdfunding real estate investing platforms like the DiversyFund, Fundrise and Realty Mogul offer another way to invest in public unlisted REITs. These platforms generally require investors to commit to real estate investments for longer periods of time, however. This can be up to five years or more in many cases.

Read Also: Real Estate Investment Firms San Diego