Why You Might Not Want To Invest In Startups

Startup investing is not for everyone, least of all investors who want low risk and reliable income.

- Startups are super risky. About 90% of all startups fail, due to a lack of product-market fit, marketing problems, team problems or other issues. Theres possibility for total loss, Schryver says. In general, startups are only a good investment if youre prepared to lose 100% of what youre staking. The vast majority of your investing dollars should ideally be in index funds and exchange-traded funds , or even just individual stocks.

- Startups are illiquid investments. If you bought a stock today and changed your mind tomorrow about your choice, you could easily sell it. Startups, on the other hand, are highly illiquid. When you invest in a startup, you should expect that your money will be tied up for at least three to five years, if not more. Although you can have the opportunity to liquidate through secondaries, its not a guarantee, and your investment will likely take years to mature and materialize, says Ammar Amdani, a partner at early stage venture capital firm Adapt Ventures.

- It takes time to see results. Even if a startup succeeds, it still could take years before theres a result from your investment. You have to be patient and have holding power in order to give your portfolio companies time to grow, Amdani says.

Consider The Rest Of Your Portfolio

Remember, your startup business investment is just one portion of your portfolio. And this investment should fit with the rest of your portfolio. Don’t empty your long-term retirement savings to put everything into a single startup. Look at your overall goals and figure out where the startup fits in.

When deciding how to invest in startups, ensure it’s part of your overall portfolio, rather than something that doesn’t make sense with your direction and overall strategy.

How Tech Workers And Their Paper Stock Riches Get Hit

This reset will have implications for the war over talent in the Valley as start-ups facing valuation declines navigate two distinct groups of employees. From a messaging perspective to existing employees, preemptively cutting valuation by a significant amount or going back to the VC market at a lower valuation, is a tough message to send. Telling existing employees the company is worth 50% less is a tough message.

But to attract new employees, start-ups need to issue equity at a price that is fair market value. That’s a tension that start-ups with high valuations will be dealing with, and buying back shares from existing employees through tender offers is one method of stock-based retention at a time when an initial public offering may be farther off. Henrique Dubugras, CEO at Brex, ranked No. 2 on the 2022 CNBC Disruptor 50 list, said it has been buying back shares for employees to the tune of $250 million.

Recommended Reading: Invest In Ripple Company Stock

Jp Morgan Income Fund

JGIAX is a bond fund offered by giant US bank JP Morgan. JGIAX has received 4 stars out of 5 from Morningstar.

As a fixed income fund, JGIAX offers an average return far less impressive than the stock funds we review here. The fund boasts a 5-year average annual return of 2.73%. But investors should remember that this low return is the price that must be paid for investment in lower-risk assets like bonds.

JGIAX is actively-managed, with an asset turnover rate of 54% over the last year. An expense ratio of 0.66% applies. Currently the fund holds 2,369 assets worth almost $11bn. In terms of the ratings of the bonds it holds:

- CCC and lower: 1.7%

Distributions are paid monthly and re-invested automatically. A minimum investment of $1,000 applies, with a minimum for subsequent investments of $50.

Is It Safe To Invest In Mutual Funds

Mutual funds are considered to be low-risk investments, compared to investing in single stocks or other asset classes like commodities or crypto. How much to invest in mutual funds is a key question: it is generally a good idea to diversify one’s total investable wealth among different financial vehicles.

Also Check: Century 21 Homes And Investments

A Generation Of Founders Unfamiliar With Profits

Recruitment and retention is just one wrinkle in the bigger question: Can founders change? Many start-up founders from the current generation and world of declining interest rates and cheap capital, still underappreciate the reversal in conditions and reduced money in the system as a decade of quantitative easing turns to quantitative tightening.

Don’t fight the Fed has been a Wall Street mantra for decades. When the paradigm in liquidity is changing in a sustained way, it should also change the way start-up founders and CEOs are managing their balance sheets. It takes an optimistic, risk-taking individual to be a business founder, but if this lesson hasn’t been internalized since last fall’s downturn began, the time is now, and no recent evidence should be invoked to say the worse is over.

Founders have been in a world for years that has only ever seen hiccups, like a six-month break in bullishness after WeWork’s IPO collapsed, and the brief Covid crash before a VC market that was better than ever before. This time, a longer-term recalibration is the most likely scenario.

Now the outlook for fundraising will focus on quality, it will be concentrated, and it will occur for companies that are already leaders with the market share and revenue to back it up

“Who would have thought profits mattered?” Stanford said.

for our weekly, original newsletter that goes beyond the annual Disruptor 50 list, offering a closer look at list-making companies and their innovative founders.

Should Mutual Funds Invest In Startups

More from: Jeff Schwartz

Jeff Schwartz is William H. Leary Professor of Law, University of Utah S.J. Quinney College of Law. This post is based on a recent article by Professor Schwartz, forthcoming in the North Carolina Law Review.

Contrary to longstanding practice and to their reputation for investing in public companies, mutual funds, including some of the most prominent, are allocating portions of their portfolios to private venture-stage firms, including famous unicorns like Airbnb and Uber. In my forthcoming article, Should Mutual Funds Invest in Startups? A Case Study of Fidelity Magellan Funds Investments in Unicorns and the Regulatory Implications, I analyze whether the securities laws adequately protect mutual-fund investors from the risks that arise when their funds add this unique asset class to fund holdings.

I argue that mutual-fund investments in startups pose several potential concerns for their investors. One is whether investors are aware that this is happening. Since venture investing runs counter to historical practices, mutual-fund investors might not realize that their funds are purchasing these atypical investments. Another concern is liquidity. Investors expect to be able to redeem mutual-fund shares nearly instantly. Since startups are private, however, their shares do not trade on a liquid market, which makes it more difficult for mutual funds to meet their shareholders redemption expectations.

The full article is available here.

Recommended Reading: Solar System Return On Investment

Who Can Form A Mutual Fund

A mutual fund is set up in the form of a trust, which has sponsor, trustees, Asset Management Company and custodian. The trust is established by a sponsor or more than one sponsor who is like promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unitholders.

Can You Make Money Investing In Startups

Yes, you can generate considerable returns on your capital if you get in quickly on a great ideaas early investors in Airbnb, Instagram, and Uber will attest. However, its not easy to make money from startups. For every success story, there are thousands of startups that fail to turn their ideas into a viable business.

Don’t Miss: Crawl Space Encapsulation Return On Investment

Features Of Venture Capital Funds

- The main focus of VCFs is on early-stage investment but sometimes, it can also involve expansion-stage financing.

- Often, equity stakes of the enterprises or companies that are funded by the VCFs are purchased by the VCFs.

- Along with the capital, VCFs also bring with them the knowledge and experts of the investors which will help the company make further advancements.

- Sometimes the VCFs also help in developing new products/services and acquire latest technologies that will help the company to improve efficiency.

- The biggest advantage that VCFs offer is the networking opportunities. With influential and wealthy investors promoting the company, it will in no time, achieve stellar growth.

- VCFs hold the authority to influence the decisions of the enterprises they are investing in.

- To mitigate the risks involved in funding new projects, VCFs invest in a variety of young startups with a belief that at least one firm will achieve massive growth and reward them with a large payout.

How To Invest In Mutual Funds In 2022 With Low Fees

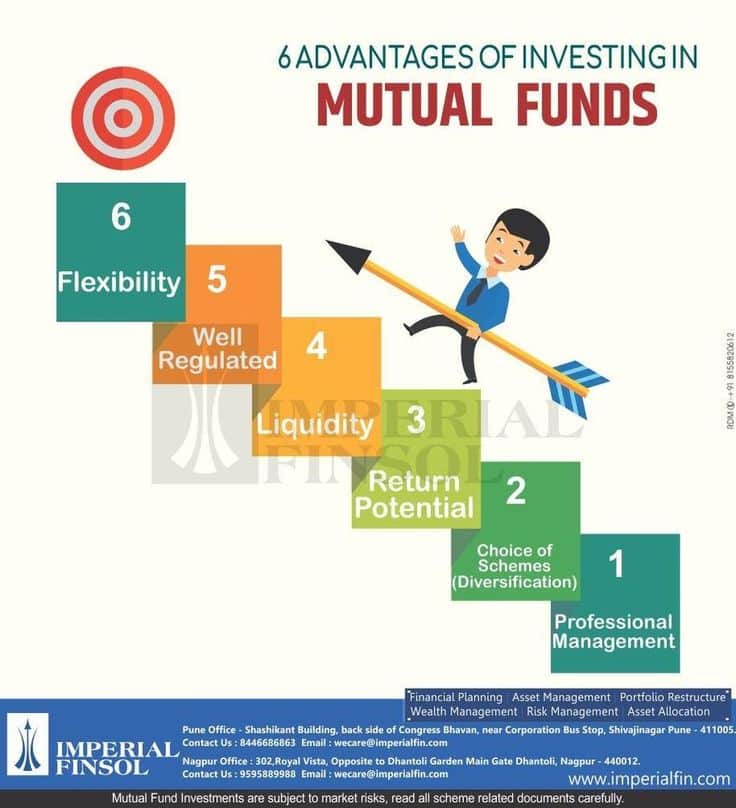

Want to find out how to invest in mutual funds? Mutual funds are an investment vehicle that allow investors to save for the long term as well as benefit from fund manager expertise. Nowadays, Exchange-Traded Funds are considered to be a key competitive alternative to mutual funds.

Below we investigate how to invest in mutual funds online. We also look at the advantages of investing in mutual funds as well as ETFs, and review two brokers which offer ETFs at zero commission.

Recommended Reading: Bitcoin Funds To Invest In

State Street Target Retirement 2060 Fund

This is a target date fund run by State Street, one of the big three US fund providers.

SSDWX aims to provide a low-risk haven for retirement savings. And since its inception in 2014, the fund has averaged a return of 7.51%, with an expense ratio of 0.29%.

In common with other target date funds, the SSDWX portfolio comprises a mix of equities, fixed income assets : 91% equities, 7% fixed income, with 2% is left unassigned.

The fund splits its portfolio between State Street‘s own indices, ETFs and the US Dollar:

- The State Street All Cap Equity ex-US Index Portfolio

- State Street Equity 500 Index II Portfolio

- State Street Small/Mid Cap Equity Index Portfolio 15.13%)

- SPDR Portfolio Treasury ETFs

- SSGA FDS/USA STIF USD

What Is The Value Of Investment Funds In Europe

opening an investment fundhow to start an investment fundinvestment activitiesEuropean funds

- in the 3rd quarter of 2019, the shares issued by investment funds in Europe stood at EUR 12,537 billion

- this represented an increase compared to the 2nd quarter of 2019, up by EUR 446 billion, as revealed by the data gathered by theEuropean Central Bank

- the shares issued by European funds operating as exchange traded funds had a value of EUR 781 billion

- compared to the 2nd quarter of 2019, this marked an increase of EUR 47 billion

- in the case of European money market funds, the total value was of EUR 1,247 billion in the 3rd quarter of 2019

- this also marked an increase compared to the 2nd quarter .

You May Like: How To Invest In The Stock Market Under 18

Research The Mutual Fund Market

With data from Statista.com, we can confirm that the number of mutual funds available globally doubled in the 2010s.

- In 2009, there were 66,400 mutual funds available globally.

131,000 funds to choose from? That’s quite some researching the investor is faced with!

Some investors limit their research to finding out how to invest in mutual funds in the US. That is because the US dominates the mutual fund market, with roughly 7,500 funds accounting for 40% of all global funds under management.

- Investors from other countries may invest in US funds.

- US fund providers operate funds based on assets inside and outside the US.

Brainstorm Possible Ways To Retain Clients & Customers

Making sure your customers are satisfied is one of the ways you can retain them no matter the kind of business you are engaged in. Practicing good customer relationship management helps to keep and increase patronage from your clients and through word of mouth about the kind of services you render they tend to bring in more business for the company.

Poor service delivery on the other hand will make your clients look towards other sources to get their services. As a result of this, most companies end up losing their client and potential new ones. Once you can improve on the quality of your service delivery, then you are in business as your customer wont have any reason to drop your services thereby engage your competitors.

Engaging in good customer relationship practices never fails in helping a business to retain and get new clients. This you can achieve when you keep a proper database of your clientele or buy CRM software to keep up with your clients. This will enable you have the important information you can use to keep in touch with them on important occasions such as birthdays, anniversaries and holidays.

Also Check: Which Cryptocurrency Is Best To Invest In 2020

Niyo Money Provides Goal

People often invest in mutual funds to pursue certain goals, be it a retirement plan, vacation, or emergency reserve. Therefore, startups develop goal-based investment plans, letting investors choose the goals and suggest the most appropriate mutual funds for each goal. Such solutions are capable of generating a personalized plan based on investment preferences and objectives.

Indian startup Niyo Money offers a goal-based mutual fund investment platform for individuals. The startups proprietary software GoalSense suggests the best fitting mutual funds depending on each investors goals, targets, and time budget. Moreover, the startup offers portfolio rebalancing and accommodates asset allocation changes towards the end of the goals time budget to help users maximize income and minimize risks.

Investing In Startups Founded By Women And Multicultural Entrepreneurs

To help close the funding gap for multicultural and women-owned businesses,1 Morgan Stanley Investment Management and the firms Multicultural Client Strategy Group are launching a new fund to invest in startups led by diverse entrepreneurs.

The Next Level Fund will invest primarily in early-stage technology and technology-enabled companies that have women and/or multicultural members among their founding teams. This latest move by Morgan Stanley highlights opportunities with underrepresented business leaders, often targeting underserved markets and communities, and aims to help meet growing investor demand for impactful market solutions to address social justice, gender equality and racial equity.

The fund is part of the Private Credit and Equity strategy within the Investment Management division, which oversees more than $1.4 trillion of assets.2 It will also be backed by three key corporate partners: Hearst, Microsoft and Walmart.

We are pleased to expand our impact-oriented client offerings with the addition of Next Level, and we are proud to partner with like-minded companies that share our commitment to delivering positive social impact through compelling investment opportunities, says David N. Miller, Head of Private Credit and Equity at Morgan Stanley Investment Management. Our differentiated approach can help to increase access to capital for women and multicultural businesses in our target sectors.

This is a Marketing Communication.

Also Check: Pros And Cons Of Investing In Silver

How To Choose An Equity Mutual Fund

To choose an equity mutual fund, investors need to bear in mind the cost that they are willing to pay to own a fund, its performance over a considerable period of time, its risk-adjusted returns and the volatility of the fund. When choosing an equity mutual fund, investors need to shortlist peers to compare the mutual fund performance on key metrics that need to be analyzed before choosing a fund:

How To Find The Most Popular Mutual Funds To Invest In

Nowadays the norm is to invest in mutual funds online.

To track down the most popular mutual funds, simply use a search engine. We recommend searching for ‘most popular mutual funds.’ Alternatively, you could also read our guide on how to invest according to Reddit.

The investor’s research will be much assisted by the fact that there are three recognized leaders in fund provision. All are based in the US:

Don’t Miss: I Want To Start Investing My Money

Investing In Startups Is Not An Easy Process

Investing in startups can be a way to add some growth to your portfolio and give you a chance to see some solid success. However, learning how to invest in startups requires patience. You need to be careful about what you add to your portfolio. It may be a good idea to consult with a financial advisor . Take some time to research the options and do your due diligence. And as always when investing, avoid putting in money you can’t afford to lose.

So You Want to Learn About Investing?

Startup Funding Options In India

08 min read.

Planning to launch your own start-up? Now is the time. India is in its best ever phase of startup ecosystem and the economic environment is favoring the aspiring minds. However, careful planning and futuristic approach are imperative to ensure your startup dont end like the 94% that shut down their shutters within the first year of operation.

Funding is an extremely significant aspect in line with meeting the vision of a business. Funding and fundraising, both are fundamental modern business scenarios that support the growth of a startup. The first round of funding, popularly known as seed funding forms the basis of fundraising. It is followed by series A, B and C rounds of funding. While the seed funding typically refers to the basic, initial round of funding, series A, B, and C differ in the business maturity and the type of investors involved. The series funding helps in the evolvement of a startup to a full-fledged organization by helping it with calculated funds at crucial steps.

Here are a few successful startup funding options in India that will help you support your business with the indispensable finance requirements.

Also Check: Should I Invest In Stocks Or Roth Ira

Recommended Reading: Invest In International Stock Market